North America Non Stick Cookware Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

10.06 Billion

USD

14.86 Billion

2025

2033

USD

10.06 Billion

USD

14.86 Billion

2025

2033

| 2026 –2033 | |

| USD 10.06 Billion | |

| USD 14.86 Billion | |

|

|

|

|

Segmentación del mercado de utensilios de cocina antiadherentes en Norteamérica, por producto (sartenes, ollas, utensilios para hornear, ollas a presión, sartenes, parrillas cuadradas, bandejas para horno, hornos holandeses, moldes para pan, sandwicheras, woks, escalfadores de huevos y otros), materia prima (material base y recubrimiento), capa de recubrimiento (capa simple, doble y triple), canal de distribución (supermercados/hipermercados, tiendas de utensilios, comercio electrónico y otros), usuario final (residencial y comercial): tendencias y pronóstico del sector hasta 2033.

¿Cuál es el tamaño y la tasa de crecimiento del mercado de utensilios de cocina antiadherentes de América del Norte?

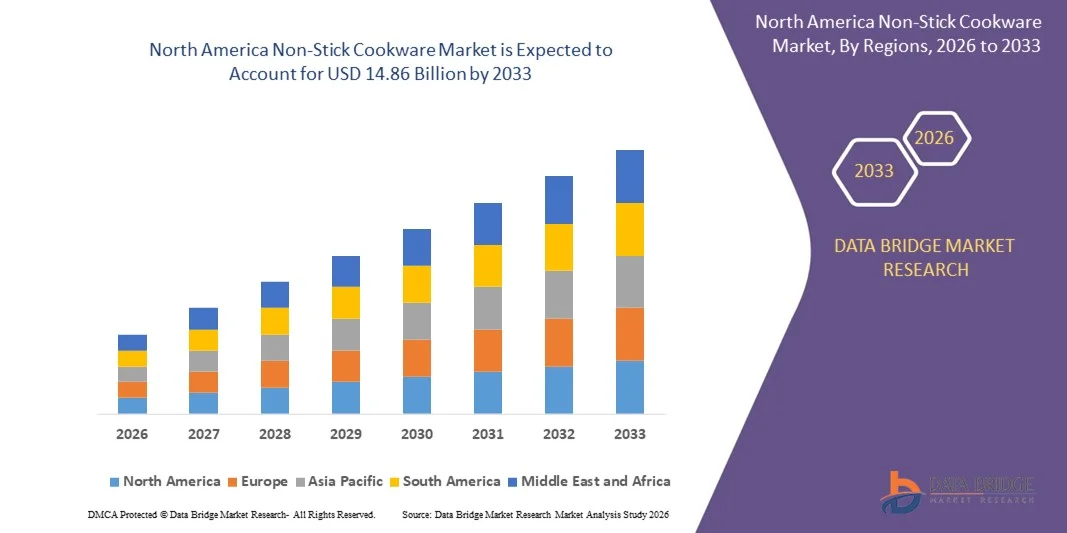

- El tamaño del mercado de utensilios de cocina antiadherentes de América del Norte se valoró en USD 10.06 mil millones en 2025 y se espera que alcance los USD 14.86 mil millones para 2033 , con una CAGR del 5,00% durante el período de pronóstico.

- Se espera que la disponibilidad de numerosos tipos de productos de utensilios de cocina antiadherentes impulse e impulse la demanda del mercado de utensilios de cocina antiadherentes.

- Se espera que la tendencia de ciertos materiales antiadherentes a liberar sustancias químicas tóxicas en los alimentos obstaculice la demanda del mercado de utensilios de cocina antiadherentes.

¿Cuáles son las principales conclusiones del mercado de utensilios de cocina antiadherentes?

- Se espera que la creciente participación de los hombres en la cocina represente una oportunidad para el mercado de utensilios de cocina antiadherentes. La tendencia de estos utensilios a quemarse y rayarse fácilmente si no se les proporciona el cuidado adecuado se prevé que represente un desafío para este mercado.

- Estados Unidos dominó el mercado de utensilios de cocina antiadherentes de América del Norte con una participación estimada en los ingresos del 45,6 % en 2025, respaldado por una alta adopción en los hogares, una fuerte demanda de utensilios de cocina de primera calidad y de marca, y un ecosistema minorista bien desarrollado.

- Se proyecta que México registre la CAGR más rápida del 9,54 % entre 2026 y 2033, respaldada por la expansión de la población de clase media, el aumento de los ingresos disponibles y la creciente adopción de electrodomésticos de cocina modernos.

- El segmento de sartenes dominó el mercado con una participación estimada del 34,6 % en 2025, impulsado por su uso diario generalizado para freír, saltear y cocinar rápidamente en hogares y establecimientos de servicio de comidas.

Alcance del informe y segmentación del mercado de utensilios de cocina antiadherentes

|

Atributos |

Análisis clave del mercado de utensilios de cocina antiadherentes |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

¿Cuál es la tendencia clave en el mercado de utensilios de cocina antiadherentes?

Creciente tendencia hacia utensilios de cocina antiadherentes, ligeros, duraderos y saludables

- El mercado de utensilios de cocina antiadherentes está experimentando una creciente demanda de utensilios de cocina livianos, fáciles de limpiar y de diseño ergonómico, impulsados por los hábitos de cocina modernos y las preferencias de ahorro de tiempo.

- Los fabricantes están desarrollando cada vez más recubrimientos sin PFOA, superficies antiadherentes de cerámica y construcciones multicapa avanzadas para mejorar la durabilidad, la distribución del calor y la seguridad alimentaria.

- El creciente interés de los consumidores por una cocina saludable, un menor uso de aceite y un mantenimiento sin complicaciones está acelerando su adopción en cocinas residenciales y comerciales.

- Por ejemplo, empresas como Tefal, Cuisinart, Tramontina, Le Creuset y Hawkins están ampliando sus carteras de utensilios de cocina antiadherentes premium y ecológicos.

- El creciente uso de utensilios de cocina antiadherentes en hogares urbanos, restaurantes de servicio rápido y cocinas en la nube está impulsando un crecimiento sostenido del mercado.

- A medida que los consumidores priorizan la comodidad, el rendimiento y la seguridad, los utensilios de cocina antiadherentes seguirán siendo fundamentales para las soluciones de cocina modernas.

¿Cuáles son los impulsores clave del mercado de utensilios de cocina antiadherentes?

- Creciente demanda de utensilios de cocina fáciles de usar y de bajo mantenimiento que permitan una cocción más rápida y una limpieza sencilla.

- Por ejemplo, durante 2024-2025, las marcas líderes introdujeron utensilios de cocina antiadherentes con revestimiento cerámico y libres de toxinas para cumplir con las cambiantes regulaciones sanitarias.

- La creciente urbanización, el aumento del ingreso disponible y la expansión de las tendencias de cocina casera y experimentación culinaria están impulsando la adopción de productos.

- Los avances en la tecnología de recubrimiento, la resistencia al rayado y la eficiencia térmica están mejorando la vida útil y el rendimiento del producto.

- La creciente conciencia sobre la cocina sin aceite y la preparación de alimentos más saludables impulsa la demanda en los mercados globales.

- Con el respaldo de los cambios en el estilo de vida y las mejoras de primera calidad en las cocinas, se espera que el mercado de utensilios de cocina antiadherentes sea testigo de un crecimiento constante a largo plazo.

¿Qué factor está obstaculizando el crecimiento del mercado de utensilios de cocina antiadherentes?

- Los mayores costos asociados con recubrimientos premium, materiales multicapa y productos de marca limitan su adopción en regiones sensibles a los precios.

- Durante 2024-2025, las fluctuaciones en los precios de las materias primas y los insumos de recubrimiento aumentaron los costos de fabricación y venta minorista.

- Las preocupaciones sobre la durabilidad del revestimiento, los rayones y la seguridad a largo plazo afectan la confianza del consumidor en productos de baja calidad.

- La falta de conocimiento sobre el uso y el mantenimiento adecuados reduce la vida útil y la satisfacción de los utensilios de cocina.

- La intensa competencia del acero inoxidable, el hierro fundido y las alternativas sin marca de bajo costo crea presión sobre los precios.

- Para superar estos desafíos, los fabricantes se están centrando en la educación del consumidor, la garantía de calidad y la innovación en tecnologías de recubrimiento más seguras.

¿Cómo está segmentado el mercado de utensilios de cocina antiadherentes?

El mercado está segmentado en función del producto, la materia prima, la capa de recubrimiento, el canal de distribución y el usuario final .

- Por producto

Según el producto, el mercado de utensilios de cocina antiadherentes se segmenta en sartenes, ollas, utensilios para hornear, ollas a presión, sartenes, parrillas cuadradas, bandejas para horno, hornos holandeses, moldes para pan, sandwicheras, woks, escalfadores de huevos y otros. El segmento de sartenes dominó el mercado con una participación estimada del 34,6 % en 2025, impulsado por su uso diario generalizado para freír, saltear y cocinar rápidamente en hogares y establecimientos de restauración. Las sartenes antiadherentes ofrecen una rápida distribución del calor, un menor consumo de aceite y una fácil limpieza, lo que las convierte en la opción preferida en las cocinas urbanas.

Se prevé que el segmento de utensilios de repostería crezca a la tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsado por las crecientes tendencias de repostería casera, el aumento del consumo de productos horneados y la creciente influencia del contenido de cocina en línea. La creciente cultura de las cafeterías, las mejoras premium en las cocinas y la demanda de utensilios de cocina especializados, como woks, parrillas y ollas a presión, impulsan aún más la diversificación de productos y el crecimiento del mercado a largo plazo.

- Por materia prima

Según la materia prima, el mercado se segmenta en Material Base y Recubrimiento. El segmento de Material Base dominó el mercado con una participación aproximada del 57,8 % en 2025, ya que materiales como el aluminio, el acero inoxidable y los metales anodizados duros constituyen la base estructural de los utensilios de cocina. Los utensilios de cocina de aluminio, en particular, gozan de una amplia adopción gracias a su ligereza, asequibilidad y excelente conductividad térmica.

Se proyecta que el segmento de recubrimientos crecerá a la tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsado por la creciente concienciación de los consumidores sobre los recubrimientos cerámicos, ecológicos y sin PFOA. Las innovaciones en recubrimientos resistentes a los arañazos, duraderos y libres de toxinas están mejorando la durabilidad y la seguridad. A medida que los consumidores priorizan cada vez más la salud, el rendimiento y la sostenibilidad, las tecnologías de recubrimiento avanzadas se están convirtiendo en un factor clave en la adopción de utensilios de cocina antiadherentes.

- Por capa de recubrimiento

Según la capa de recubrimiento, el mercado de utensilios de cocina antiadherentes se segmenta en monocapa, doble capa y triple capa. El segmento de doble capa dominó el mercado con una participación de alrededor del 41,2 % en 2025, gracias a su equilibrada combinación de durabilidad, rentabilidad y un mejor rendimiento antiadherente en comparación con los recubrimientos monocapa. Los utensilios de cocina de doble capa se utilizan ampliamente en productos domésticos de gama media y cocinas comerciales.

Se espera que el segmento de triple capa registre la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2026 y 2033, impulsado por la creciente demanda de utensilios de cocina premium con mayor resistencia a los arañazos, mayor vida útil y mejor distribución del calor. La creciente preferencia por utensilios de cocina de alto rendimiento en cocinas profesionales y hogares de alta gama está acelerando la adopción de tecnologías de recubrimiento multicapa a nivel mundial.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en supermercados/hipermercados, tiendas de utensilios, comercio electrónico y otros. El segmento de supermercados/hipermercados dominó el mercado con una participación estimada del 46,5 % en 2025, gracias a la sólida visibilidad de la marca, la variedad de productos, las promociones en tienda y la preferencia del consumidor por la inspección física antes de la compra.

Se prevé que el segmento del comercio electrónico crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2026 y 2033, impulsado por una mayor penetración en línea, entregas a domicilio, precios competitivos y comparativas detalladas de productos. La creciente adopción digital, el marketing de influencers y las estrategias directas al consumidor de las marcas de utensilios de cocina están fortaleciendo aún más los canales de venta en línea, especialmente entre los consumidores más jóvenes y urbanos.

- Por el usuario final

Según el usuario final, el mercado de utensilios de cocina antiadherentes se segmenta en Residencial y Comercial. El segmento Residencial dominó el mercado con aproximadamente el 62,9 % de participación en 2025, impulsado por las crecientes tendencias de cocina casera, las familias nucleares, los estilos de vida urbanos y la creciente demanda de utensilios de cocina prácticos y fáciles de mantener. El crecimiento de la cocina saludable y las mejoras premium en las cocinas impulsa aún más la demanda residencial.

Se proyecta que el segmento comercial crecerá a la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2026 y 2033, impulsado por la expansión de restaurantes, hoteles, cocinas en la nube y restaurantes de servicio rápido (QSR). Las necesidades de cocción a gran escala, la eficiencia en el tiempo y la calidad constante de los alimentos están acelerando la adopción de utensilios de cocina antiadherentes duraderos en los establecimientos de servicios de alimentación comerciales.

¿Qué región posee la mayor participación en el mercado de utensilios de cocina antiadherentes?

- Estados Unidos dominó el mercado de utensilios de cocina antiadherentes de América del Norte con una participación estimada en los ingresos del 45,6 % en 2025, respaldado por una alta adopción en los hogares, una fuerte demanda de utensilios de cocina de primera calidad y de marca, y un ecosistema minorista bien desarrollado.

- La creciente tendencia hacia la cocina casera, la preparación de alimentos más saludables y la sustitución de los utensilios de cocina tradicionales por productos sin PFOA y con revestimiento cerámico son factores clave de crecimiento. La expansión del comercio minorista en línea y la sólida fidelidad a la marca refuerzan aún más el liderazgo del mercado.

Análisis del mercado canadiense de utensilios de cocina antiadherentes

Canadá representa un mercado en constante crecimiento, impulsado por la creciente urbanización, la creciente preferencia por utensilios de cocina energéticamente eficientes y fáciles de limpiar, y un creciente comportamiento de los consumidores preocupados por la salud. La demanda de utensilios de cocina antiadherentes, duraderos, ecológicos y compatibles con la inducción está en aumento en cocinas residenciales y establecimientos de restauración. La fuerte penetración en el comercio minorista, la creciente adopción del comercio electrónico y la preferencia por utensilios de cocina de alta calidad impulsan la expansión constante del mercado.

Análisis del mercado de utensilios de cocina antiadherentes en México

Se proyecta que México registrará la tasa de crecimiento anual compuesta (TCAC) más rápida, del 9.54%, entre 2026 y 2033, impulsada por la expansión de la clase media, el aumento de los ingresos disponibles y la creciente adopción de electrodomésticos modernos. El crecimiento de los hogares urbanos, la mejora de la infraestructura comercial y la creciente concienciación sobre los beneficios de los utensilios de cocina antiadherentes impulsan la demanda. La expansión de supermercados, tiendas de utensilios especializados y plataformas en línea acelera aún más la penetración del mercado en todo el país.

¿Cuáles son las principales empresas del mercado de utensilios de cocina antiadherentes?

La industria de utensilios de cocina antiadherentes está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Tramontina USA Inc. (Brasil)

- TEFAL SAS (una filial del Groupe SEB) (Francia)

- Le Creuset (Francia)

- Cuisinart (EE. UU.)

- Swiss Diamond (Suiza)

- Crown Cookware (Canadá)

- Cocinas Hawkins Limited (India)

- Sub Zero Group, Inc. (EE. UU.)

- Compañía John Wright (EE. UU.)

- Newell Brands (EE. UU.)

- SCANPAN USA, INC. (Dinamarca)

- RangeKleen (EE. UU.)

- Gibson Overseas, Inc. (EE. UU.)

- Batería de cocina Moneta (Italia)

- The Vollrath Company, LLC (EE. UU.)

- Batería de cocina Berndes (Alemania)

- ZHEJIANG HANXIN COOKWARE CO., LTD. (Porcelana)

- Utensilios de cocina Co., Ltd. de Zhejiang Zhongxin (China)

¿Cuáles son los desarrollos recientes en el mercado global de cosméticos sin agua?

- En octubre de 2024, el famoso chef Bobby Flay presentó una nueva colección de utensilios de cocina en colaboración con GreenPan, con sede en Nueva York, ampliando las ofertas antiadherentes premium centradas en el rendimiento y la sostenibilidad, reforzando el crecimiento impulsado por la innovación en el mercado de utensilios de cocina.

- En septiembre de 2024, SKB, con sede en California, presentó su gama de utensilios de cocina antiadherentes en el Hotel Pan Pacific Sonargaon, lo que marcó una exhibición estratégica de productos destinada a fortalecer la visibilidad de la marca y la penetración en el mercado regional.

- En agosto de 2024, Paris Hilton lanzó una elegante colección de utensilios de cocina bajo su marca Epoca, con diseños en rosa pastel y fucsia brillante, destacando la creciente influencia de las marcas y la estética de las celebridades en el segmento de utensilios de cocina.

- En abril de 2024, Our Place, con sede en Los Ángeles, presentó Titanium Always Pan Pro, una sartén antiadherente prácticamente indestructible, lo que subraya la creciente demanda de los consumidores de durabilidad, materiales de primera calidad y soluciones de utensilios de cocina de larga duración.

- En enero de 2024, la marca Flavortown de Guy Fieri, con sede en Tennessee, se asoció con Mon Chateau para lanzar tres nuevas líneas de utensilios de cocina, lo que indica una expansión continua de las marcas lideradas por chefs dirigidas tanto a los entusiastas de la cocina casera como a los profesionales.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.