North America Multifocal Iols Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

372.97 Million

USD

650.47 Million

2024

2032

USD

372.97 Million

USD

650.47 Million

2024

2032

| 2025 –2032 | |

| USD 372.97 Million | |

| USD 650.47 Million | |

|

|

|

|

Segmentación del mercado de LIO multifocales en Norteamérica, por tipo (lente blanda y lente rígida permeable al gas [RGP o dura]), diseño (lentes de visión simultánea y lentes multifocales segmentadas), empaque (paquete de 6, paquete de 30 y otros), tipo de producto (LIO multifocales difractivas, LIO multifocales híbridas y LIO multifocales refractivas), marca (Technis Symphony, Zeiss Trifocal y otras), tamaño de la incisión (1,8 mm, 2,2 mm y otras), dependencia pupilar (dependiente e independiente), potencia (baja y alta potencia), material (acrílico hidrofóbico, silicio y colámero, Lehfilcon-A, Somofilcon A y otros), ajustabilidad (reducción de luz y sin reducción), rango de precios (lente premium y lente estándar), flexibilidad (LIO plegables y LIO rígidas), grupo de edad (mayores de 51 años, 41-50 años y menores de 40 años), género (femenino y masculino), aplicación (trastornos de la visión, cataratas, trastornos de la córnea y otros), usuario final (hospitales, clínicas oftalmológicas , institutos de investigación ocular, centros de cirugía ambulatoria y otros), canal de distribución (licitación directa, ventas minoristas y otros): tendencias de la industria y pronóstico hasta 2032

Tamaño del mercado de LIO multifocales en América del Norte

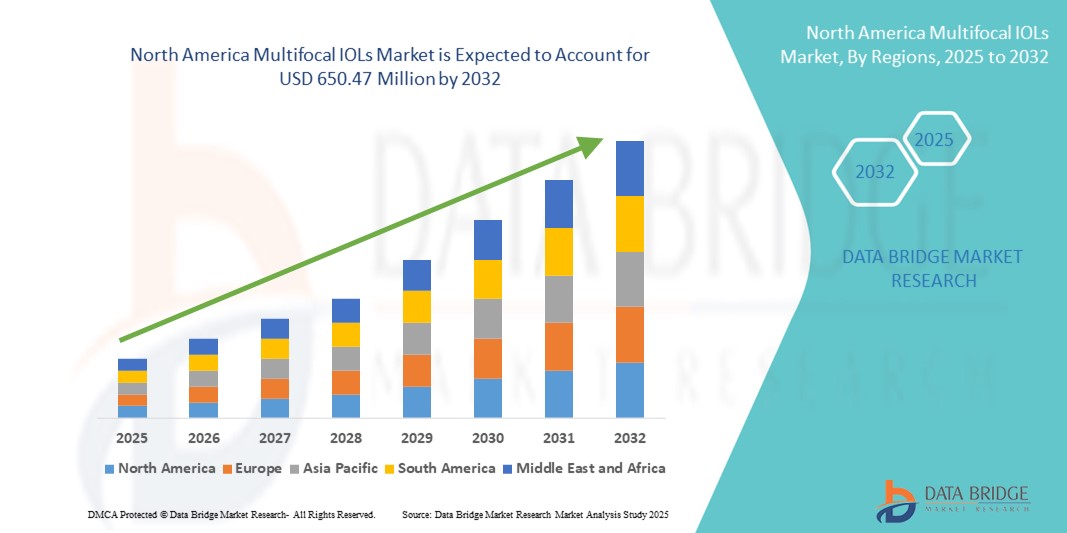

- El tamaño del mercado de LIO multifocales de América del Norte se valoró en USD 372,97 millones en 2024 y se espera que alcance los USD 650,47 millones para 2032 , con una CAGR del 7,20 % durante el período de pronóstico.

- El mercado norteamericano de lentes intraoculares (LIO) multifocales está experimentando un sólido crecimiento, impulsado por el creciente conocimiento de las soluciones oftálmicas avanzadas y la creciente prevalencia de afecciones visuales relacionadas con la edad, como las cataratas y la presbicia. El diagnóstico temprano, junto con el acceso a atención quirúrgica de alta calidad, permite una corrección visual oportuna y específica en toda la región, especialmente en EE. UU. y Canadá.

- Los avances tecnológicos en cirugía oftálmica, como la cirugía de cataratas asistida por láser de femtosegundo (FLACS) y los sistemas guiados por imagen, contribuyen significativamente a la mejora de los resultados quirúrgicos y a la creciente aceptación de las LIO multifocales. Estas innovaciones mejoran la satisfacción del paciente al reducir la dependencia de las gafas después de la cirugía.

Análisis del mercado de LIO multifocales en América del Norte

- Las lentes intraoculares (LIO) multifocales, diseñadas para corregir la presbicia y las cataratas al permitir una visión nítida a múltiples distancias, están experimentando una fuerte adopción en Norteamérica, impulsada por el envejecimiento de la población, el aumento del volumen de cirugías de cataratas y la creciente demanda de independencia de gafas entre los adultos mayores. Las mejoras tecnológicas en la precisión quirúrgica y los materiales de las lentes también están fomentando un uso más amplio en las consultas oftalmológicas.

- La creciente preferencia por las LIO premium en lugar de las lentes monofocales tradicionales en Norteamérica se debe en gran medida a una mayor concienciación de los pacientes, la disponibilidad de tecnologías avanzadas para lentes, como la óptica difractiva y las lentes de profundidad de foco extendida (EDOF), y el aumento de los ingresos disponibles. Además, la cobertura favorable de los seguros para los procedimientos estándar de cataratas anima a los pacientes a optar por LIO multifocales para obtener mejores resultados visuales.

- Estados Unidos dominó el mercado norteamericano de LIO multifocales, representando la mayor participación en los ingresos, con un 35,2 % en 2024. Este dominio se atribuye a su consolidada infraestructura de atención oftalmológica, el alto volumen de cirugías de cataratas y la rápida integración de tecnologías de lentes intraoculares de alta gama en centros de cirugía ambulatoria y hospitales. Además, la presencia de importantes fabricantes de LIO, los sólidos sistemas de reembolso y la creciente demanda de soluciones posoperatorias sin gafas impulsan una expansión constante del mercado.

- Se proyecta que Canadá registre la CAGR más rápida del 11,8 % en el mercado de LIO multifocales de América del Norte durante el período de pronóstico, respaldado por el envejecimiento creciente de su población, un mejor acceso a los servicios de atención oftalmológica y un mayor financiamiento público y privado para los procedimientos de corrección de la visión.

- Las lentes sin reducción dominaron el mercado de LIO multifocales de Asia-Pacífico con una participación de mercado del 66,4 % en 2024, impulsadas por su preferencia clínica generalizada, simplicidad en el diseño y rentabilidad, lo que las convierte en una opción estándar en los procedimientos de LIO multifocales en Asia-Pacífico.

Alcance del informe y segmentación del mercado de LIO multifocales en América del Norte

|

Atributos |

Perspectivas clave del mercado de LIO multifocales en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de LIO multifocales en América del Norte

Crecientes avances terapéuticos y creciente investigación clínica

- Una tendencia significativa y en aceleración en el mercado de LIO multifocales de América del Norte es el enfoque creciente en las innovaciones terapéuticas y la investigación clínica, en particular abordando discapacidades visuales complejas a través de diseños de LIO mejorados e integración neurosensorial.

- Por ejemplo, varias empresas de dispositivos médicos e institutos de investigación de Norteamérica están invirtiendo en lentes intraoculares multifocales de última generación que incorporan óptica difractiva mejorada, mecanismos de profundidad de foco extendida (EDOF) y tecnologías de ajuste de la luz. Estos avances buscan ofrecer una visión más nítida con menos efectos secundarios, como halos o deslumbramientos, comunes en las lentes multifocales más antiguas.

- La creciente adopción de modelos personalizados de atención oftalmológica en clínicas especializadas y centros quirúrgicos está permitiendo mejores resultados visuales. Estos modelos utilizan diagnósticos preoperatorios avanzados, como la aberrometría de frente de onda y la biometría ocular, para optimizar la selección de lentes según la anatomía ocular individual y las necesidades de estilo de vida.

- Las asociaciones entre empresas de tecnología médica, hospitales universitarios y programas respaldados por el gobierno también están ayudando a ampliar el acceso a lentes intraoculares de primera calidad al mejorar las estructuras de reembolso, agilizar las regulaciones de importación e impulsar la capacitación de los médicos.

- A medida que América del Norte continúa priorizando la atención ocular de precisión y los resultados de salud basados en el valor, el mercado de LIO multifocales está preparado para un crecimiento sostenido, impulsado por la innovación, la precisión quirúrgica mejorada y una creciente demanda de visión sin anteojos entre las poblaciones que envejecen.

Dinámica del mercado de LIO multifocales en América del Norte

Conductor

Necesidad creciente debido al aumento de las tasas de diagnóstico y los avances en la investigación genética

- La creciente prevalencia de los procedimientos con lentes intraoculares (LIO) multifocales en Norteamérica, respaldada por una mayor concienciación y los avances en las capacidades de diagnóstico, está impulsando significativamente el crecimiento del mercado. La región está experimentando un aumento en los casos de cataratas y presbicia, especialmente entre la población de edad avanzada, lo que genera una creciente demanda de intervenciones quirúrgicas tempranas. La adopción generalizada de exámenes oculares de rutina y la disponibilidad de clínicas oftalmológicas especializadas están permitiendo la detección temprana y el tratamiento oportuno de las deficiencias visuales, lo que impulsa aún más la expansión del mercado.

- Por ejemplo, en abril de 2024, Anavex Life Sciences informó avances positivos en su ensayo clínico de fase III para Anavex 2-73 (blarcamesina), una pequeña molécula destinada al tratamiento de la discapacidad visual mediante la activación del receptor sigma-1. Se prevé que este y otros avances en fase avanzada impulsen el mercado norteamericano de LIO multifocales durante el período de pronóstico.

- El creciente interés en las terapias modificadoras de la enfermedad y los diseños de LIO de última generación está impulsando un cambio de la corrección sintomática estándar hacia soluciones más personalizadas y curativas, incluidas las lentes ajustables por luz y las lentes de profundidad de enfoque extendida (EDOF).

- La Agencia de Medicamentos de Asia y el Pacífico (EMA) continúa desempeñando un papel fundamental al ofrecer incentivos para medicamentos huérfanos, revisiones aceleradas y subvenciones de I+D a empresas que innovan en el ámbito del tratamiento oftálmico y de enfermedades raras.

- Las colaboraciones entre empresas biotecnológicas, instituciones académicas y fundaciones de salud visual también están fomentando un sólido ecosistema de investigación en Asia-Pacífico. Estas alianzas están ayudando a ampliar los registros de pacientes, las iniciativas de concienciación y la participación en ensayos clínicos, pasos cruciales para mejorar el acceso y las estrategias de atención a largo plazo.

Restricción/Desafío

Infraestructura limitada y variabilidad en la adopción clínica

- El alto costo del tratamiento asociado con las LIO multifocales avanzadas (incluidos los implantes de lentes premium, las terapias genéticas y los diagnósticos personalizados) representa una barrera sustancial para su adopción generalizada, especialmente en el este de América del Norte y las áreas rurales con fondos limitados para la atención médica.

- Incluso cuando se les concede el estatus de medicamento huérfano, estas terapias suelen implicar ciclos de desarrollo largos y costosos con requisitos de fabricación sofisticados, lo que las hace menos asequibles para los sistemas nacionales de salud con presupuestos limitados.

- Además, la atención multidisciplinaria especializada, que incluye oftalmólogos, optometristas, asesores genéticos y terapeutas de rehabilitación, suele concentrarse en los centros urbanos. Esta disparidad geográfica obliga a los pacientes y sus familias a recorrer largas distancias o a soportar largos tiempos de espera para obtener servicios especializados.

- Otro desafío es la falta de protocolos estandarizados para la adaptación y el manejo de LIO multifocales avanzadas. Debido a la escasez de datos clínicos y a la familiaridad de los médicos, especialmente en centros con bajo volumen de pacientes, la adopción de soluciones innovadoras sigue siendo inconsistente.

- Para superar estos desafíos, las reformas políticas, el aumento de la financiación gubernamental, la colaboración en investigación transfronteriza y el establecimiento de centros de oftalmología dedicados en América del Norte serán esenciales para ampliar el acceso y lograr un crecimiento sostenible en el mercado de LIO multifocales de América del Norte.

Alcance del mercado de LIO multifocales en América del Norte

El mercado está segmentado según tipo, diseño, embalaje, tipo de producto, marca, tamaño de la incisión, dependencia de la pupila, potencia, material, capacidad de ajuste, rango de precio, flexibilidad, grupo de edad, género, aplicación, usuario final y canal de distribución.

- Por tipo

Según el tipo, el mercado de LIO multifocales se segmenta en lentes blandas y lentes rígidas permeables al gas (RGP o duras). El segmento de lentes blandas dominó el mercado con la mayor participación en los ingresos, con un 68,3 % en 2024, gracias a su alta comodidad, amplia adopción y facilidad de uso.

Se espera que el segmento de lentes rígidas permeables al gas crezca a la CAGR más rápida del 7,5 % entre 2025 y 2032, debido a la creciente demanda de una corrección de la visión más nítida y de materiales para lentes de larga duración.

- A propósito

Según su diseño, el mercado de LIO multifocales se segmenta en lentes de visión simultánea y lentes multifocales segmentadas. Las lentes de visión simultánea lideraron el segmento con una participación del 61,9 % en 2024, favorecidas por su capacidad para proporcionar visión a múltiples distancias simultáneamente.

Se espera que el segmento de lentes multifocales segmentadas experimente la CAGR más alta del 6,9 % durante 2025-2032, debido a una mayor personalización e idoneidad para pacientes con cataratas.

- Por embalaje

En cuanto al empaque, el mercado de LIO multifocales se segmenta en paquetes de 6, 30 y otros. El segmento de paquetes de 6 tuvo la mayor participación de mercado, con un 47,6 % en 2024, gracias a su asequibilidad y a su uso frecuente para necesidades a corto plazo.

Se proyecta que el segmento Pack de 30 crecerá a la CAGR más rápida del 8,1 % entre 2025 y 2032, ya que apoya el uso a largo plazo y las compras al por mayor por parte de las clínicas.

- Por tipo de producto

Según el tipo de producto, el mercado de LIO multifocales se segmenta en LIO multifocales difractivas, LIO multifocales híbridas y LIO multifocales refractivas. El segmento de LIO multifocales difractivas lideró el mercado con una participación del 42,8 % en 2024, gracias a sus consistentes resultados visuales y su amplio uso clínico.

Se espera que las LIO multifocales híbridas crezcan a la CAGR más rápida del 9,3 % entre 2025 y 2032, impulsadas por la innovación y la combinación de los beneficios de las tecnologías difractivas y refractivas.

- Por marca

Según la marca, el mercado de LIO multifocales se segmenta en Technis Symphony, Zeiss Trifocal y otras. Zeiss Trifocal obtuvo la mayor participación, con un 35,1 %, en 2024, gracias a la sólida confianza en la marca, el diseño innovador de sus lentes y su amplia disponibilidad.

Se prevé que el segmento Technis Symphony crezca a la CAGR más alta del 7,8 % entre 2025 y 2032, debido a la creciente preferencia en las cirugías de lentes premium.

- Por el tamaño de la incisión

Sobre la base del tamaño de la incisión, el mercado de LIO multifocales está segmentado en 1,8 MM, 2,2 MM y otros. 2,2 MM tuvo la participación de mercado dominante del 54,6 % en 2024, ya que equilibra la facilidad de inserción y el control quirúrgico.

Se espera que el segmento de 1,8 MM sea testigo de la CAGR más rápida del 8,5 % entre 2025 y 2032, debido a un cambio creciente hacia cirugías de cataratas con microincisión.

- Por dependencia del alumno

En función de la dependencia pupilar, el mercado de LIO multifocales se segmenta en dependientes e independientes. Las lentes de pupila independiente dominaron el mercado con una cuota de mercado del 63,2 % en 2024, valoradas por su eficacia en condiciones de luz variables.

Se proyecta que el segmento de alumnos dependientes crecerá a una CAGR del 6,7 % entre 2025 y 2032, a medida que las mejoras de los productos reduzcan sus limitaciones en cuanto a las condiciones de luz.

- Por poder

En función de la potencia, el mercado de LIO multifocales se segmenta en baja y alta potencia. Las lentes de baja potencia representaron la mayor participación, con un 58,9 % en 2024, ideales para pacientes con necesidades mínimas de corrección refractiva.

Se espera que los lentes de alta potencia crezcan a la CAGR más rápida del 7,6 % entre 2025 y 2032, debido a la creciente demanda en casos de uso posquirúrgico y de alta prescripción.

- Por material

Según el material, el mercado de LIO multifocales se segmenta en acrílico hidrofóbico, silicio y colámero, Lehfilcon-A, Somofilcon A y otros. El segmento de acrílico hidrofóbico tuvo la mayor participación de mercado, con un 49,5 %, en 2024, gracias a su biocompatibilidad superior, alta claridad óptica y menor riesgo de opacificación de la cápsula posterior (OCP), lo que lo convierte en la opción preferida para implantes a largo plazo.

Se proyecta que el segmento Somofilcon A experimentará la CAGR más rápida del 8,8 % entre 2025 y 2032, respaldado por su mayor permeabilidad al oxígeno y comodidad, particularmente adecuado para aplicaciones intraoculares basadas en lentes de contacto blandas.

- Por ajustabilidad

En función de su ajustabilidad, el mercado de LIO multifocales se segmenta en lentes con y sin reducción de luz. El segmento de lentes sin reducción dominó el mercado con una participación del 66,4 % en 2024, gracias a su amplia adopción, transmisión de luz uniforme y facilidad de fabricación, que satisfacen las necesidades estándar de corrección de cataratas.

Se espera que el segmento de lentes con reducción de luz crezca a la CAGR más rápida del 9,1 % entre 2025 y 2032, impulsado por innovaciones en materiales fotoadaptativos que brindan ajustes visuales dinámicos en diferentes condiciones de iluminación, mejorando la comodidad y los resultados del paciente.

- Por rango de precio

Según el rango de precios, el mercado de LIO multifocales se segmenta en lentes premium y lentes estándar. El segmento de lentes premium captó la mayor participación en los ingresos, con un 59,7 %, en 2024, impulsado por la creciente demanda de las personas mayores que buscan resultados visuales avanzados y el aumento de los ingresos disponibles, lo que permite a los pacientes optar por intervenciones quirúrgicas premium.

Se proyecta que el segmento de lentes estándar crecerá a la CAGR más rápida del 8,4 % entre 2025 y 2032, debido al creciente acceso a los sistemas de salud públicos y una mayor asequibilidad, particularmente en las economías emergentes.

- Por flexibilidad

En función de su flexibilidad, el mercado se segmenta en LIO plegables y LIO rígidas. El segmento de LIO plegables lideró el mercado con una cuota de mercado del 73,5 % en 2024, gracias a su dominio en las cirugías de cataratas con microincisión, que permiten una recuperación más rápida y reducen las complicaciones postoperatorias.

Se prevé que el segmento de LIO rígidas crezca a una CAGR del 5,9 % entre 2025 y 2032, sostenido por su uso limitado en procedimientos oftálmicos específicos donde se requiere una mayor rigidez estructural.

- Por grupo de edad

Según el grupo de edad, el mercado de LIO multifocales se segmenta en mayores de 51 años, de 41 a 50 años y menores de 40 años. El segmento de mayores de 51 años registró la mayor participación, con un 67,2 %, en 2024, debido a una mayor prevalencia de afecciones visuales relacionadas con la edad, como cataratas y presbicia, en la población de edad avanzada.

Se espera que el segmento de 41 a 50 años crezca a la CAGR más rápida del 7,2 % entre 2025 y 2032, atribuido al aumento de la intervención temprana a través de procedimientos electivos de corrección de la visión y la creciente adopción de tecnologías de lentes de primera calidad en este grupo de edad.

- Por género

En función del género, el mercado de LIO multifocales se segmenta en mujeres y hombres. El segmento femenino dominó el mercado con una participación del 53,8 % en 2024, debido a la mayor esperanza de vida y al aumento de la demanda de atención médica para exámenes oculares rutinarios y cuidado de la vista.

Se espera que el segmento masculino crezca a la CAGR más rápida del 6,9 % durante el período de pronóstico, respaldado por una mayor conciencia y una mayor participación en la corrección electiva de la visión entre los grupos demográficos masculinos que envejecen.

- Por aplicación

Según su aplicación, el mercado de LIO multifocales se segmenta en trastornos visuales, cataratas, trastornos corneales y otros. El segmento de cataratas tuvo la mayor participación de mercado, con un 64,9 % en 2024, ya que las LIO multifocales se utilizan principalmente después de la cirugía de cataratas para restaurar la visión a múltiples distancias, eliminando así la necesidad de gafas.

Se proyecta que el segmento de trastornos de la córnea crecerá a la CAGR más rápida del 8,7 % entre 2025 y 2032, impulsado por un número creciente de procedimientos correctivos de la córnea e innovaciones en lentes diseñadas para irregularidades de la córnea .

- Por el usuario final

Según el usuario final, el mercado de LIO multifocales se segmenta en hospitales, clínicas oftalmológicas, institutos de investigación oftalmológica, centros de cirugía ambulatoria, entre otros. El segmento Hospitalario dominó el mercado con una participación del 45,6 % en 2024, gracias a una infraestructura quirúrgica integral y un mayor volumen de procedimientos de implante de LIO.

Se espera que el segmento de clínicas de oftalmología crezca a la CAGR más rápida del 9,2 % entre 2025 y 2032, debido a la creciente preferencia por la atención ambulatoria especializada y las crecientes inversiones en salas quirúrgicas basadas en clínicas.

- Por canal de distribución

Según el canal de distribución, el mercado de LIO multifocales se segmenta en licitación directa, venta minorista y otros. El segmento de licitación directa tuvo la mayor participación, con un 48,1 %, en 2024, impulsado por la adquisición centralizada de LIO a través de hospitales públicos e instituciones financiadas por el gobierno.

Se espera que el segmento de ventas minoristas crezca a la CAGR más rápida del 10,3 % entre 2025 y 2032, impulsado por el surgimiento de minoristas ópticos en línea, una mayor conciencia de los pacientes y un acceso creciente a recetas de lentes y opciones de personalización.

Análisis regional del mercado de LIO multifocales en América del Norte

- América del Norte dominó el mercado global de lentes intraoculares (LIO) multifocales con la mayor participación en los ingresos del 30,3 % en 2024, impulsada por la infraestructura de atención médica oftálmica avanzada de la región, la creciente prevalencia de presbicia y cataratas, y la rápida adopción de tecnologías de lentes premium.

- Los marcos regulatorios sólidos, las políticas de reembolso generalizadas y la alta concienciación de los pacientes están impulsando el crecimiento en los sectores de atención médica tanto públicos como privados.

- El aumento de la financiación gubernamental para la salud visual, junto con las iniciativas público-privadas para reducir los retrasos en la cirugía de cataratas tras la COVID-19, está impulsando el uso de LIO multifocales avanzadas. Además, Norteamérica alberga a varios fabricantes líderes de dispositivos oftálmicos y centros de I+D, lo que facilita la innovación continua de productos y la evaluación clínica.

Perspectiva del mercado de LIO multifocales en América del Norte y EE. UU.

El mercado estadounidense de LIO multifocales representó la mayor participación en Norteamérica, con un 36,1 % en 2024, gracias a la amplia adopción de tecnologías de lentes premium, el alto volumen de cirugías de cataratas y la red de centros de cirugía ambulatoria de vanguardia. La presencia de importantes compañías de dispositivos oftálmicos, los sólidos procesos de aprobación de la FDA y la creciente preferencia por procedimientos que mejoran el estilo de vida impulsan una expansión constante del mercado. Además, la creciente concienciación sobre la corrección de la presbicia y el reembolso favorable para LIO avanzadas refuerzan aún más el liderazgo del mercado estadounidense.

Perspectiva del mercado de LIO multifocales de Canadá y América del Norte

Se prevé que el mercado canadiense de LIO multifocales registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 11,6 %, entre 2025 y 2032, impulsada por el envejecimiento de la población, la mejora del acceso a la atención oftalmológica y la creciente preferencia por la independencia de las gafas después de la cirugía. El mercado canadiense se beneficia de tiempos de espera quirúrgicos más cortos, una mayor cobertura de seguros privados para lentes premium y una creciente red de clínicas oftalmológicas ambulatorias. Las iniciativas gubernamentales para mejorar la eficiencia de la cirugía de cataratas y los programas de cribado digital también están impulsando la adopción generalizada de LIO multifocales.

Perspectiva del mercado de LIO multifocales en México y Norteamérica

El mercado mexicano de LIO multifocales muestra un crecimiento constante, impulsado por la expansión de la atención médica pública, el aumento de la capacitación en cirugía oftalmológica y la creciente demanda de tecnologías avanzadas de corrección visual. El crecimiento se concentra particularmente en los centros urbanos, donde hospitales privados y clínicas especializadas están adoptando implantes de lentes de alta calidad para satisfacer las expectativas de los pacientes. El turismo médico transfronterizo y las colaboraciones con fabricantes internacionales están mejorando aún más la disponibilidad y asequibilidad de los productos para los pacientes locales.

Cuota de mercado de LIO multifocales en América del Norte

La industria de LIO multifocales de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Johnson & Johnson y sus filiales (EE. UU.)

- Hoya Medical Singapore Pte. Ltd. (Singapur)

- Grupo Zeiss (Alemania)

- Alcon Inc. (Suiza)

- Grupo Rayner (Reino Unido)

- Lenstec, Inc. (EE. UU.)

- Aurolab (India)

- Excelente Hi-Care Pvt Ltd (India)

- Sav-Iol SA (Suiza)

- Vsy Biotechnology GmbH (Alemania)

- Hanita Lenses Ltd. (Israel)

- Grupo de atención (India)

- Iolart (India)

- Omni Lens Pvt. Ltd. (India)

- Ophtec BV (Países Bajos)

Últimos avances en el mercado de LIO multifocales en América del Norte

- En febrero de 2025, Taysha Gene Therapies anunció resultados provisionales positivos de la Parte A de su ensayo clínico de Fase I/II que evaluaba TSHA - 102 , una terapia génica en investigación para el síndrome de Rett. Los resultados no mostraron efectos adversos graves y mostraron mejoras clínicas dependientes de la dosis, lo que allanó el camino para un estudio fundamental de la Parte B. La compañía está trabajando actualmente con organismos reguladores globales para iniciar ensayos de expansión en población pediátrica y validar aún más su enfoque de terapia génica de una sola aplicación para abordar las mutaciones de MECP2.

- En junio de 2024, el Grupo ZEISS promueve activamente la salud ocular durante el Mes de la Concientización sobre las Cataratas mediante campañas educativas y exámenes oculares gratuitos. Sus iniciativas buscan concienciar sobre la prevención y el tratamiento de las cataratas, enfatizando la importancia de la detección temprana y las soluciones quirúrgicas modernas. ZEISS colabora con profesionales de la salud locales para mejorar el acceso a una atención oftalmológica de calidad y apoyar a las comunidades en el manejo y la prevención de la discapacidad visual.

- En diciembre de 2024, Pfizer Inc. anunció la exitosa adquisición de Seagen Inc., una empresa norteamericana de biotecnología reconocida por descubrir, desarrollar y comercializar medicamentos innovadores contra el cáncer. Pfizer adquirió todas las acciones ordinarias en circulación de Seagen por 229 USD por acción en efectivo, lo que totalizó... En marzo de 2023, el Grupo ZEISS diseñó e innovó su portafolio de LIO y OVD para satisfacer tanto las necesidades de los pacientes como las preferencias de los cirujanos. Combinando innovación y precisión, ofrece una amplia selección de consumibles e implantes para cataratas, diseñados para cirugías de cataratas monofocales, tóricas y refractivas.

- En abril de 2024, Alcon, líder en el cuidado ocular dedicado a ayudar a las personas a ver con claridad, presentó aproximadamente 100 presentaciones de datos, respaldadas por la compañía y dirigidas por investigadores, que demostraban sus últimas iniciativas innovadoras para optimizar los resultados de los pacientes en la Reunión Anual de la Sociedad Americana de Cataratas y Cirugía Refractiva (ASCRS) de 2024, celebrada del 5 al 8 de abril en Boston. Además, la compañía organiza múltiples simposios entre pares y demostraciones en su stand de sus dispositivos e implantes líderes en la industria, incluyendo la cartera de lentes intraoculares (LIO) Clareon, el planificador quirúrgico SMARTCataract basado en la nube, Hydrus Microstent y más.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.