Mercado de inyección de metotrexato en América del Norte, por producto ( sin conservantes , con conservantes), tipo (solución inyectable, solución autoinyectable), disponibilidad (25 mg/ml, 50 mg/2 ml), forma farmacéutica (solución, polvo), aplicación (cáncer, enfermedades autoinmunes, embarazo), grupo de edad (adultos, geriátricos, pediátricos), vía de administración (intramuscular, intravenosa, intraarterial, intratecal), usuario final (hospitales, clínicas, atención médica domiciliaria, otros), canal de distribución (farmacia hospitalaria, farmacia minorista, farmacia en línea, otros), tendencias de la industria y pronóstico hasta 2029.

Definición y perspectivas del mercado

La inyección de metotrexato se emplea sola o con otros medicamentos para tratar diversos tipos de cáncer, como el de mama, de cabeza y cuello, de pulmón, de sangre , de huesos, de ganglios linfáticos y de útero.

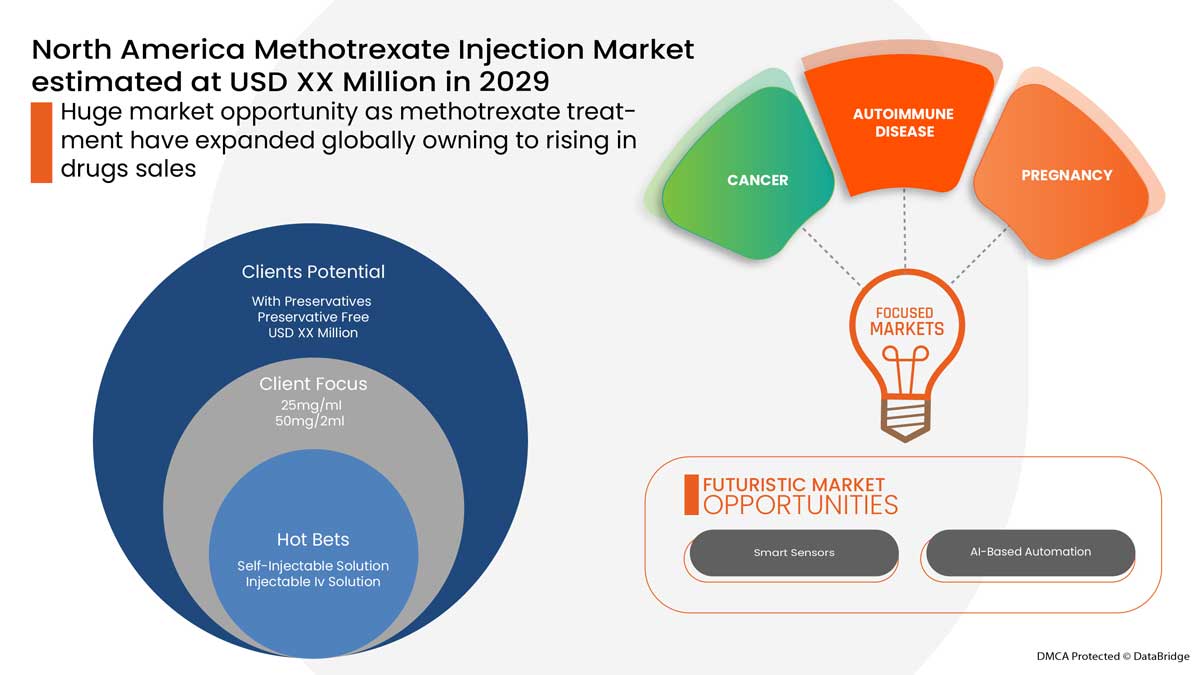

Se espera que la alta prevalencia de enfermedades autoinmunes, el aumento del número de pacientes con enfermedades inflamatorias y el aumento del gasto sanitario impulsen el crecimiento del mercado de inyecciones de metotrexato en América del Norte. Sin embargo, se espera que la presencia de alternativas para el tratamiento del cáncer actúe como un factor restrictivo para el crecimiento del mercado.

El metotrexato es una terapia contra el cáncer que impide que las células cancerosas se repliquen. Esto ayuda a evitar que se multipliquen y se propaguen por todo el cuerpo. Es posible que transcurran hasta 12 semanas desde que se haya ajustado la dosis de metotrexato al nivel máximo antes de que experimente algún beneficio. La creciente carga de enfermedades autoinmunes y el creciente gasto en atención médica han acelerado la necesidad de inyecciones de metotrexato, lo que ha impulsado el crecimiento del mercado.

Sin embargo, los efectos secundarios y las complicaciones con el uso de metotrexato obstaculizan el crecimiento del mercado de inyección de metotrexato en América del Norte en el período de pronóstico.

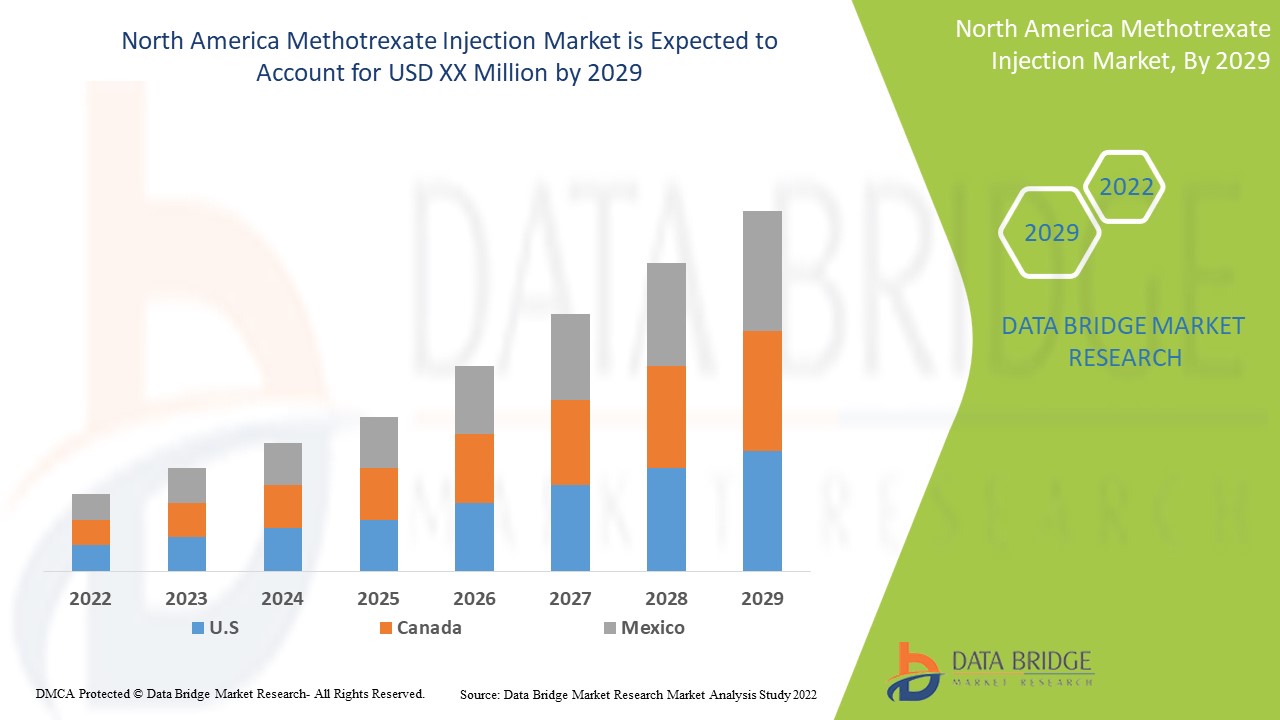

El mercado de inyección de metotrexato de América del Norte es favorable y tiene como objetivo reducir la progresión de la enfermedad. Data Bridge Market Research analiza que el mercado de inyección de metotrexato de América del Norte crecerá a una CAGR del 6,0 % durante el período de pronóstico de 2022 a 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por producto (sin conservantes, con conservantes), tipo (solución inyectable, solución autoinyectable), disponibilidad (25 mg/ml, 50 mg/2 ml), forma farmacéutica (solución, polvo), aplicación (cáncer, enfermedades autoinmunes, embarazo), grupo de edad (adultos, geriátricos, pediátricos), vía de administración (intramuscular, intravenosa, intraarterial, intratecal), usuario final (hospitales, clínicas, atención médica domiciliaria, otros), canal de distribución (farmacia hospitalaria, farmacia minorista, farmacia en línea, otros) |

|

Países cubiertos |

Estados Unidos, Canadá, México |

|

Actores del mercado cubiertos |

Pfizer Inc., Antares Pharma, Inc., Fresenius Kabi USA, Medexus Pharmaceuticals, Inc., Viatris Inc., Sandoz AG (una subsidiaria de Novartis AG), Teva Pharmaceuticals USA, Inc., Accord BioPharma, Hikma Pharmaceuticals PLC, Cumberland Pharmaceuticals Inc., PV Pharma, entre otros. |

Dinámica del mercado de inyección de metotrexato

Conductores

- Aumento de la prevalencia del cáncer

El aumento de la población de pacientes con cáncer de mama, cáncer de pulmón, cáncer de cabeza y cuello y cáncer de sangre está impulsando el crecimiento del mercado de inyección de metotrexato en América del Norte. El cáncer de mama es el cáncer invasivo más recurrente en mujeres y es la segunda causa principal de muerte en mujeres después del cáncer de pulmón. La Sociedad Estadounidense del Cáncer estima que 41.760 mujeres tienen cáncer de mama. El cáncer de mama comienza siendo bastante pequeño, por lo que se siente. A medida que continúa el crecimiento, el tumor se extiende a la mama y otras partes del cuerpo. Produce problemas de salud graves y puede causar la muerte. El 80% de las muertes por cáncer de pulmón se deben al tabaquismo y la exposición al tabaco. El cáncer de pulmón existe como la principal causa de muerte, con un estimado de 1,8 millones de muertes.

- Iniciativas gubernamentales para concienciar sobre el cáncer de pulmón y de mama

Las iniciativas gubernamentales se refieren a declaraciones o programas que son necesarios para resolver el problema. El gobierno crea conciencia o ofrece mejores iniciativas de salud y seguridad para tratar el cáncer de mama en mujeres y el cáncer de pulmón. Promueve asociaciones entre organizaciones de atención médica, instalaciones y fabricantes para hacer necesaria la terapia y el tratamiento del cáncer de mama en mujeres y el cáncer de pulmón.

Las iniciativas llevadas a cabo por el gobierno se traducirán en seguridad para el paciente, ahorro de costes y un menor impacto en la atención quirúrgica. Además, los hospitales y las organizaciones sanitarias se beneficiarán de la aplicación de los protocolos mediante la colaboración con las organizaciones gubernamentales para el suministro y la distribución. El gobierno ya ha empezado a financiar este tipo de trabajos de forma limitada, pero cree que es necesario hacer más. Por tanto, se espera que esta característica complemente el crecimiento del mercado de inyección de metotrexato en América del Norte.

Oportunidad

- Iniciativas estratégicas de los actores del mercado

El aumento de la incidencia de diversos tipos de cáncer y de nódulos tiroideos malignos en las regiones y el aumento de la población geriátrica han creado una mayor demanda de procedimientos de diagnóstico para el tratamiento oportuno de los pacientes. El objetivo principal es mejorar la gestión sanitaria y el diagnóstico para lograr un rendimiento de calidad antes de llegar a las etapas críticas de la enfermedad. Los principales actores del mercado se centran en satisfacer las demandas de los profesionales sanitarios y gastan una cantidad considerable en mejores productos.

Los principales actores participan en la elaboración de las estrategias y su implementación, como la adquisición y el lanzamiento del producto.

Restricciones/Desafíos

La investigación y el desarrollo son requisitos previos para modificar los productos de naturaleza avanzada. A medida que aumenta la demanda de procedimientos de diagnóstico del cáncer, las empresas están invirtiendo más en investigación y desarrollo para ofrecer las mejores opciones de diagnóstico para obtener resultados convenientes para los pacientes.

Los laboratorios de investigación están invirtiendo más en productos y procedimientos debido al aumento de casos de cáncer y a la necesidad de un diagnóstico temprano para salvar la vida del paciente. La investigación y el desarrollo han mejorado la personalización del diagnóstico, ya que las células y los tejidos humanos no son todos iguales.

El aumento del consumo de tabaco y el crecimiento de la población han provocado un aumento de los casos de cáncer en todo el mundo. Por ello, también se está incrementando la demanda de investigación y desarrollo en las industrias farmacéuticas para el diagnóstico de esta enfermedad. Por lo tanto, se prevé que el aumento de las actividades de investigación y desarrollo suponga una mayor oportunidad para el mercado de inyección de metotrexato de América del Norte.

Además, el uso de metotrexato en todo el mundo está aumentando rápidamente, con el crecimiento de la población envejecida y varias enfermedades cancerígenas que se pueden prevenir mediante un diagnóstico temprano. Al mismo tiempo, los actores de los fabricantes de inyecciones de metotrexato en el mercado tienen que seguir ciertas regulaciones para obtener la aprobación de las autoridades superiores para lanzar el producto al mercado. Estas estrictas pautas deben cumplirse, y esta es una de las tareas más difíciles entre todos los pasos. La aprobación previa a la comercialización de varios dispositivos médicos varía de un país a otro. La Administración de Alimentos y Medicamentos (FDA) regula la FDA de EE. UU.

El informe de mercado de inyección de metotrexato de América del Norte proporciona detalles de nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de inyección de metotrexato de América del Norte, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Acontecimientos recientes

- En marzo de 2022, Viatris Inc. y Kindeva Drug Delivery LP anunciaron que Mylan Pharmaceuticals Inc., una subsidiaria de Viatris, había recibido la aprobación de la Administración de Alimentos y Medicamentos de los Estados Unidos (FDA) para su Solicitud Abreviada de Nuevo Medicamento (ANDA) para Breyna (Aerosol para inhalación de dihidrato de fumarato de budesonida y formoterol), la primera versión genérica aprobada de Symbicort de AstraZeneca.

- En enero de 2022, Cumberland Pharmaceuticals Inc., una empresa farmacéutica especializada, celebró y cerró un acuerdo definitivo para adquirir SANCUSO, un medicamento de apoyo para oncología aprobado por la FDA, de Kyowa Kirin, Inc., la filial estadounidense de Kyowa Kirin Co., Ltd., una empresa farmacéutica especializada global con sede en Japón centrada en el descubrimiento y la distribución de medicamentos novedosos. Esto ha ayudado a la empresa a expandir su negocio.

Mercado de inyección de metotrexato en América del Norte

El mercado de inyección de metotrexato de América del Norte se clasifica en nueve segmentos notables según el producto, el tipo, la disponibilidad, la forma de dosificación, la aplicación, el grupo de edad, la vía de administración, el usuario final y el canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- Por producto

- Con conservantes

- Sin conservantes

Según el producto, el mercado de inyecciones de metotrexato de América del Norte está segmentado en con conservantes y sin conservantes.

- Por tipo

- Solución autoinyectable

- Solución intravenosa inyectable

Según el tipo, el mercado de inyección de metotrexato de América del Norte está segmentado en solución autoinyectable y solución intravenosa inyectable.

- Disponibilidad

- 25 mg/ml

- 50 mg/2 ml

Según la disponibilidad, el mercado de inyecciones de metotrexato de América del Norte está segmentado en 25 MG/ML y 50 MG/2ML.

- Forma de dosificación

- Solución

- Polvo

Según la dosis, el mercado de inyección de metotrexato de América del Norte está segmentado en solución y polvo.

- Solicitud

- Cáncer

- Enfermedades autoinmunes

- Embarazo

Según la aplicación, el mercado de inyecciones de metotrexato de América del Norte está segmentado en cáncer, enfermedades autoinmunes y embarazo.

- Grupo de edad

- Pediatría

- Adultos

- Geriátrico

Según el grupo de edad, el mercado de inyecciones de metotrexato de América del Norte está segmentado en pediatría, adultos y geriatría.

- Vía de administración

- Intramuscular

- Intravenoso

- Intraarterial

- Intratecal

Según la vía de administración, el mercado de inyección de metotrexato de América del Norte está segmentado en intramuscular, intravenosa, intraarterial e intratecal.

- Usuario final

- Hospitales

- Clínicas

- Atención médica domiciliaria

- Otros

Según el usuario final, el mercado de inyección de metotrexato de América del Norte está segmentado en hospitales, clínicas, atención médica domiciliaria y otros.

- Canal de distribución

- Farmacias hospitalarias

- Farmacia minorista

- Farmacia en línea

- Otros

Según el canal de distribución, el mercado de inyecciones de metotrexato de América del Norte está segmentado en farmacias hospitalarias, farmacias minoristas, farmacias en línea y otras.

Análisis y perspectivas regionales del mercado de inyección de metotrexato en América del Norte

Se analiza el mercado de inyección de metotrexato de América del Norte y se proporcionan información y tendencias del tamaño del mercado por país, producto, tipo, disponibilidad, forma de dosificación, aplicación, grupo de edad, vía de administración, canal de distribución y usuario final como se menciona anteriormente.

Los países cubiertos en el informe del mercado de inyección de metotrexato de América del Norte son EE. UU., Canadá y México.

Estados Unidos domina el mercado de inyecciones de metotrexato en América del Norte debido a la presencia de un gran número de fabricantes y al aumento de iniciativas y organizaciones gubernamentales dentro de la región.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de las inyecciones de metotrexato

El panorama competitivo del mercado de inyección de metotrexato en América del Norte proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de la aplicación. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de inyección de metotrexato.

Algunos de los principales actores en el mercado son Pfizer Inc., Antares Pharma, Inc., Fresenius Kabi USA, Medexus Pharmaceuticals, Inc., Viatris Inc., Sandoz AG (una subsidiaria de Novartis AG), Teva Pharmaceuticals USA, Inc., Accord BioPharma, Hikma Pharmaceuticals PLC, Cumberland Pharmaceuticals Inc., PV Pharma, entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen la cuadrícula de posicionamiento de proveedores, el análisis de la línea de tiempo del mercado, la descripción general y la guía del mercado, la cuadrícula de posicionamiento de la empresa, el análisis de la participación de mercado de la empresa, los estándares de medición, el análisis global frente al regional y el análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA METHOTREXATE INJECTION MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION OVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTERS FIVE FORCES

4.3 PRICING DYNAMICS

4.4 INDUSTRIAL INSIGHTS:

4.5 CONCLUSION:

5 NORTH AMERICA METHOTREXATE INJECTION MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED PREVALENCE OF CANCER

6.1.2 GOVERNMENT INITIATIVES TO SPREAD AWARENESS ABOUT LUNG AND BREAST CANCER

6.1.3 RISE IN NUMBER OF PATIENTS WITH INFLAMMATORY DISEASES

6.2 RESTRAINTS

6.2.1 RISE IN COST OF METHOTREXATE

6.2.2 SIDE EFFECTS AND COMPLICATIONS WITH USE OF METHOTREXATE

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.2 RISE IN HEALTHCARE EXPENDITURE AND DISPOSABLE INCOME

6.3.3 INCREASE IN RESEARCH AND DEVELOPMENT ACTIVITIES

6.4 CHALLENGES

6.4.1 STRINGENT RULES AND REGULATIONS

6.4.2 PRODUCT RECALLS

6.4.3 RISE IN COMPETITION BETWEEN MARKET PLAYERS

7 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 WITHOUT PRESERVATIVES

7.3 WITH PRESERVATIVES

8 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY TYPE

8.1 OVERVIEW

8.2 INJECTABLE SOLUTION

8.3 SELF-INJECTABLE SOLUTION

9 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY AVAILABILITY

9.1 OVERVIEW

9.2 25MG/ML

9.3 50MG/2ML

10 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY DOSAGE FORM

10.1 OVERVIEW

10.2 SOLUTION

10.3 POWDER

11 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 CANCER

11.2.1 BREAST CANCER

11.2.2 LUNG CANCER

11.2.3 HEAD AND NECK CANCER

11.2.4 BLOOD CANCER

11.2.5 GESTATIONAL TROPHOBLASTIC TUMORS

11.2.6 OSTEOSARCOMA

11.2.7 OTHERS

11.3 AUTOIMMUNE DISEASES

11.3.1 RHEUMATOID ARTHRITIS

11.3.2 PSORIASIS

11.3.3 LUPUS

11.3.4 LOCALIZED SCLERODERMA

11.3.5 SARCOIDOSIS

11.3.6 VASCULITIS

11.3.7 JUVENILE DERMATOMYOSITIS

11.3.8 OTHERS

11.4 PREGNANCY

12 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY AGE GROUP

12.1 OVERVIEW

12.2 ADULTS

12.3 GERIATRIC

12.4 PEDIATRICS

13 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY ROUTE OF ADMINISTRATION

13.1 OVERVIEW

13.2 INTRAMUSCULAR

13.3 INTRAVENOUS

13.4 INTRA-ARTERIAL

13.5 INTRATHECAL

14 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 CLINICS

14.4 HOME HEALTHCARE

14.5 OTHERS

15 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 HOSPITAL PHARMACY

15.3 RETAIL PHARMACY

15.4 ONLINE PHARMACY

15.5 OTHERS

16 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY COUNTRY

16.1 U.S.

16.2 CANADA

16.3 MEXICO

17 NORTH AMERICA METHOTREXATE INJECTION MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 PFIZER INC.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT DEVELOPMENT

19.2 ANTARES PHARMA

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 PRODUCT PORTFOLIO

19.2.4 RECENT DEVELOPMENT

19.3 FRESENIUS KABI USA (A SUBSIDIARY OF FRESENIUS SE & CO. KGAA)

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT DEVELOPMENT

19.4 MEDEXUS PHARMACEUTICALS, INC.

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 PRODUCT PORTFOLIO

19.4.4 RECENT DEVELOPMENT

19.5 VIATRIS INC.

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT DEVELOPMENT

19.6 ACCORD HEALTHCARE

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENT

19.7 CUMBERLAND PHARMACEUTICALS INC.

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENTS

19.8 HIKMA PHARMACEUTICALS PLC

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENTS

19.9 PV PHARMA

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 SANDOZ INTERNATIONAL GMBH (A SUBSIDIARY OF NOVARTIS AG)

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 PRODUCT PORTFOLIO

19.10.4 RECENT DEVELOPMENT

19.11 TEVA PHARMACEUTICAL INDUSTRIES LTD.

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY AVAILABILITY, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CANCER IN METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA AUTOIMMUNE DISEASES IN METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA METHOTREXATE INJECTION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 13 U.S. METHOTREXATE INJECTION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 14 U.S. METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 U.S. METHOTREXATE INJECTION MARKET, BY AVAILABILITY, 2020-2029 (USD MILLION)

TABLE 16 U.S. METHOTREXATE INJECTION MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 17 U.S. METHOTREXATE INJECTION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 U.S. CANCER IN METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 U.S. AUTOIMMUNE DISEASES IN METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 U.S. METHOTREXATE INJECTION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 21 U.S. METHOTREXATE INJECTION MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 22 U.S. METHOTREXATE INJECTION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 U.S. METHOTREXATE INJECTION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 24 CANADA METHOTREXATE INJECTION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 25 CANADA METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 CANADA METHOTREXATE INJECTION MARKET, BY AVAILABILITY, 2020-2029 (USD MILLION)

TABLE 27 CANADA METHOTREXATE INJECTION MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 28 CANADA METHOTREXATE INJECTION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 29 CANADA CANCER IN METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 CANADA AUTOIMMUNE DISEASES IN METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 CANADA METHOTREXATE INJECTION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 32 CANADA METHOTREXATE INJECTION MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 33 CANADA METHOTREXATE INJECTION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 CANADA METHOTREXATE INJECTION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 MEXICO METHOTREXATE INJECTION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 36 MEXICO METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 MEXICO METHOTREXATE INJECTION MARKET, BY AVAILABILITY, 2020-2029 (USD MILLION)

TABLE 38 MEXICO METHOTREXATE INJECTION MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 39 MEXICO METHOTREXATE INJECTION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 MEXICO CANCER IN METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 MEXICO AUTOIMMUNE DISEASES IN METHOTREXATE INJECTION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 MEXICO METHOTREXATE INJECTION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 43 MEXICO METHOTREXATE INJECTION MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 44 MEXICO METHOTREXATE INJECTION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 MEXICO METHOTREXATE INJECTION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA METHOTREXATE INJECTION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA METHOTREXATE INJECTION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA METHOTREXATE INJECTION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA METHOTREXATE INJECTION MARKET: REGIONAL VS COUNTRY ANALYSIS

FIGURE 5 NORTH AMERICA METHOTREXATE INJECTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA METHOTREXATE INJECTION MARKET : INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA METHOTREXATE INJECTION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA METHOTREXATE INJECTION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA METHOTREXATE INJECTION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA METHOTREXATE INJECTION MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVALENCE OF CANCERS AUTOIMMUNE DISEASES IS EXPECTED TO DRIVE THE NORTH AMERICA METHOTREXATE INJECTION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 WITHOUT PRESERVATIVES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA METHOTREXATE INJECTION MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA METHOTREXATE INJECTION MARKET

FIGURE 14 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY PRODUCT, 2021

FIGURE 15 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 18 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY TYPE, 2021

FIGURE 19 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY AVAILABILITY, 2021

FIGURE 23 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY AVAILABILITY, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY AVAILABILITY, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY AVAILABILITY, LIFELINE CURVE

FIGURE 26 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY DOSAGE FORM, 2021

FIGURE 27 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY DOSAGE FORM, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY DOSAGE FORM, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY DOSAGE FORM, LIFELINE CURVE

FIGURE 30 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY APPLICATION, 2021

FIGURE 31 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 34 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY AGE GROUP, 2021

FIGURE 35 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 37 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 38 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY ROUTE OF ADMINISTRATION, 2021

FIGURE 39 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

FIGURE 40 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 41 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 42 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY END USER, 2021

FIGURE 43 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 44 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY END USER, CAGR (2022-2029)

FIGURE 45 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY END USER, LIFELINE CURVE

FIGURE 46 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 47 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 48 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 49 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 50 NORTH AMERICA METHOTREXATE INJECTION MARKET: SNAPSHOT (2021)

FIGURE 51 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY COUNTRY (2021)

FIGURE 52 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 53 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 54 NORTH AMERICA METHOTREXATE INJECTION MARKET: BY PRODUCT (2022-2029)

FIGURE 55 NORTH AMERICA METHOTREXATE INJECTION MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.