Mercado de química medicinal para el descubrimiento de fármacos en América del Norte, por proceso ( selección de objetivos , validación de objetivos, identificación de hit-to-lead, optimización de leads y validación de candidatos), diseño (variación basada en fragmentos, diseño de fármacos basado en la estructura, síntesis orientada a la diversidad, quimiogenómica, productos naturales y otros), tipo de fármaco (moléculas pequeñas y productos biológicos), área terapéutica ( oncología , neurología, enfermedades infecciosas y del sistema inmunológico , enfermedades cardiovasculares, enfermedades del sistema digestivo y otras), usuario final (organización de investigación por contrato, empresas farmacéuticas y de biotecnología , institutos académicos y de investigación y otros), país (EE. UU., Canadá, México) Tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado : mercado de química medicinal para el descubrimiento de fármacos en América del Norte

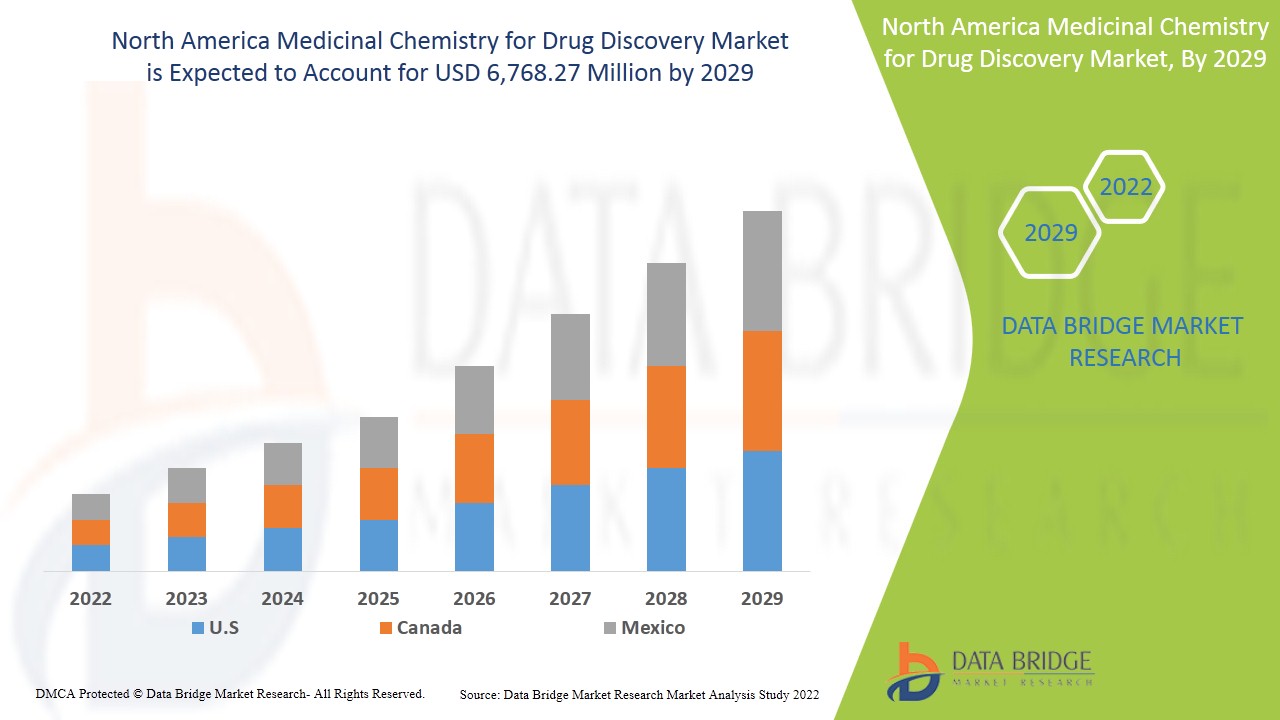

Se espera que el mercado de química medicinal para el descubrimiento de fármacos de América del Norte gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 14,0% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 6.768,27 millones para 2029. La creciente demanda de medicamentos especializados y el aumento de las enfermedades relacionadas con el estilo de vida son los principales impulsores que impulsaron la demanda del mercado en el período de pronóstico.

La química medicinal para el descubrimiento de fármacos comprende características tales como la creciente necesidad de fármacos seguros y eficaces que repercutirán en el lanzamiento de nuevos productos por parte de los fabricantes al mercado, lo que aumentará su demanda, así como el aumento de la inversión en investigación y desarrollo para el descubrimiento y desarrollo de nuevas moléculas de fármacos que conducen al crecimiento del mercado. Actualmente se están llevando a cabo varios estudios de investigación que se espera que brinden varias otras oportunidades en el mercado de la química medicinal para el descubrimiento de fármacos. Sin embargo, se espera que el aumento del costo de los fármacos formulados y las estrictas regulaciones limiten el crecimiento del mercado en el período de pronóstico.

El informe de mercado de química medicinal para el descubrimiento de fármacos proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado , aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado mundial de la química medicinal para el descubrimiento de fármacos

El mercado de la química medicinal para el descubrimiento de fármacos está segmentado en función del proceso, el diseño, el tipo de fármaco, el área terapéutica y el usuario final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

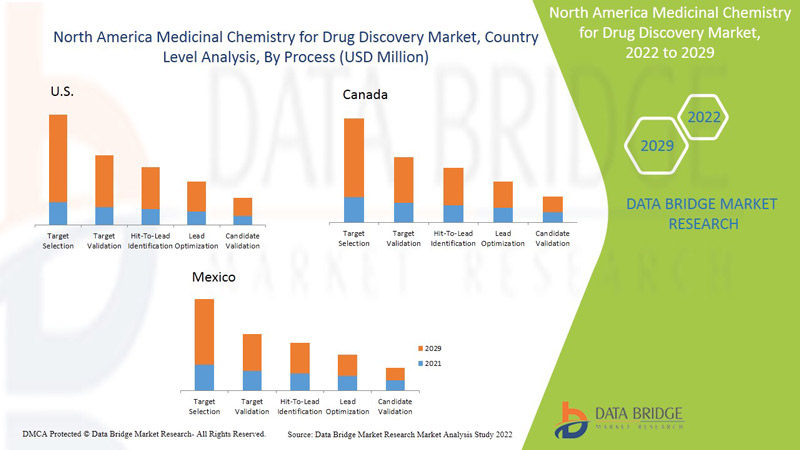

- En función del proceso, el mercado de química medicinal para el descubrimiento de fármacos de América del Norte se segmenta en selección de objetivos, validación de objetivos, identificación de resultados, optimización de resultados y validación de candidatos. En 2022, se espera que el segmento de selección de objetivos domine el mercado, ya que mejora la eficiencia y la eficacia del proceso de investigación y desarrollo.

- Sobre la base del diseño, el mercado de química medicinal para el descubrimiento de fármacos de América del Norte se segmenta en variación basada en fragmentos, diseño de fármacos basado en la estructura, síntesis orientada a la diversidad, quimiogenómica, productos naturales y otros. En 2022, se espera que el segmento de variación basada en fragmentos domine el mercado, ya que se utiliza ampliamente en instituciones biotecnológicas, farmacéuticas y académicas para identificar una gran cantidad de compuestos en ensayos clínicos y fármacos que es necesario lanzar.

- En función del tipo de fármaco, el mercado de química medicinal para el descubrimiento de fármacos de América del Norte se segmenta en moléculas pequeñas y productos biológicos . En 2022, se espera que el segmento de moléculas pequeñas domine el mercado, ya que estas moléculas presentan mayor especificidad, potencia y larga duración de acción.

- En función del área terapéutica, el mercado de química medicinal para el descubrimiento de fármacos de América del Norte se segmenta en oncología, enfermedades infecciosas y del sistema inmunológico, neurología, enfermedades cardiovasculares, enfermedades del sistema digestivo y otras. En 2022, se espera que el segmento de oncología domine el mercado debido a la creciente prevalencia del cáncer y al aumento de la investigación y el desarrollo para el descubrimiento de moléculas terapéuticas avanzadas.

- En función del usuario final, el mercado de química medicinal para el descubrimiento de fármacos de América del Norte se segmenta en organizaciones de investigación por contrato, institutos académicos y de investigación, empresas farmacéuticas y de biotecnología, entre otros. En 2022, se espera que las organizaciones de investigación por contrato dominen el mercado debido al creciente número de CRO y al aumento de la inversión en investigación y desarrollo farmacéutico para impulsar los servicios de las CRO.

Análisis a nivel de país del mercado de química medicinal para el descubrimiento de fármacos

Se analiza el mercado de química medicinal para el descubrimiento de fármacos y se proporciona información sobre el tamaño del mercado en función del proceso, el diseño, el tipo de fármaco, el área terapéutica y el usuario final.

Los países cubiertos en el informe del mercado de química medicinal para el descubrimiento de fármacos son Estados Unidos, Canadá y México.

Estados Unidos es líder en el mercado de descubrimiento de fármacos en química medicinal de América del Norte debido al aumento de las iniciativas de investigación sobre enfermedades raras y medicamentos huérfanos y al aumento de los gastos de atención médica. Canadá está creciendo en el mercado de descubrimiento de fármacos en química medicinal de América del Norte debido al aumento de los ensayos clínicos y la investigación y el desarrollo para diversas enfermedades crónicas. México está creciendo en el mercado de descubrimiento de fármacos en química medicinal de América del Norte debido a la creciente conciencia sobre el desarrollo de tratamientos para enfermedades crónicas.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Los avances tecnológicos y el aumento de las iniciativas de investigación sobre medicamentos raros y huérfanos están impulsando el crecimiento del mercado de la química medicinal para el descubrimiento de fármacos

El mercado de química medicinal para el descubrimiento de fármacos también le proporciona un análisis de mercado detallado para cada país, el crecimiento de la industria de química medicinal para el descubrimiento de fármacos con las ventas de química medicinal para el descubrimiento de fármacos, el impacto del avance en la tecnología de química medicinal para el descubrimiento de fármacos y los cambios en los escenarios regulatorios con su apoyo al mercado de química medicinal para el descubrimiento de fármacos. Los datos están disponibles para el período histórico de 2011 a 2020.

Análisis de la cuota de mercado de la química medicinal para el descubrimiento de fármacos y panorama competitivo

El panorama competitivo del mercado de química medicinal para el descubrimiento de fármacos proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y amplitud de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con el mercado de química medicinal para el descubrimiento de fármacos.

Algunas de las principales empresas que se dedican al mercado de la química medicinal para el descubrimiento de fármacos son Eurofins Scientific, Covance Inc. (ahora parte del Grupo LabCorp), WuXi Apptec, Charles River, Evotec SE, Piramal Pharma Solutions, Pfizer, Inc., Certara, USA, Sygnature Discovery Limited, Malvern Panalytical Ltd (empresa matriz Spectris PLC), Jubilant Biosys Ltd. (una empresa limitada de Jubilant Pharmova), Taros Chemicals GmbH & Co. KG, Genscript Biotech Corporation, Nereid Therapeutics Inc., BioBlocks, Inc., Charnwood Molecular LTD, Domainex, Aurigene Pharmaceutical Services Ltd. (una subsidiaria de Dr. Reddy's Laboratories Ltd.), Selvita, Nanosyn, Drug Discovery Alliances Inc., entre otras.

Varios actores del mercado proporcionan las últimas tecnologías de química medicinal para el descubrimiento de fármacos, lo que también está acelerando el mercado de la química medicinal para el descubrimiento de fármacos.

Por ejemplo,

- En febrero de 2021, Selvita lanzó su nueva plataforma de análisis fenotípico basado en células para el descubrimiento de fármacos. La plataforma lanzada se utiliza para probar nuevos compuestos con potencial terapéutico en el tratamiento de múltiples enfermedades, incluidas enfermedades fibróticas y enfermedades neuroinflamatorias, entre otras. La plataforma lanzada permitió a la empresa generar más ingresos a partir de su cartera de servicios de descubrimiento de fármacos.

- En agosto de 2020, Piramal Pharma Solutions colaboró con Epirium Bio en un programa exclusivo de desarrollo y fabricación integrados de medicamentos huérfanos. Este programa de integración abarca el desarrollo de fórmulas, las sustancias farmacológicas y la fabricación de productos farmacéuticos. Esta colaboración mejoró la cartera existente de la empresa en química medicinal para el descubrimiento de fármacos.

La colaboración, el lanzamiento de productos, la expansión comercial, los premios y reconocimientos, las empresas conjuntas y otras estrategias de los actores del mercado están mejorando el mercado de la empresa en la química medicinal para el descubrimiento de fármacos, lo que también proporciona el beneficio para que la organización mejore su oferta para la bronquiectasia.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 PROCESS LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 POTERS FIVE FORCES

5 NORTH AMERICA MEDICINAL CHEMISTRY IN DRUG DISCOVERY MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN R&D FOR DISCOVERY AND DEVELOPMENT OF NOVEL DRUG MOLECULES

6.1.2 RISE IN CHRONIC DISEASES

6.1.3 INITIATIVES FOR RESEARCH ON RARE DISEASES AND ORPHAN DRUGS

6.1.4 GROWTH IN BIOLOGICS

6.1.5 COLLABORATIONS AMONG RESEARCHERS AND PHARMACEUTICAL INDUSTRIES

6.2 RESTRAINTS

6.2.1 RISE IN COST OF FORMULATED DRUG

6.2.2 TECHNICAL RISKS IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY

6.2.3 BIOETHICAL ISSUES IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENTS IN BIOCHEMICAL, TRANSLATIONAL, AND MOLECULAR STUDIES

6.3.2 RISE IN HEALTHCARE EXPENDITURE

6.3.3 USE OF ARTIFICIAL INTELLIGENCE IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY

6.4 CHALLENGES

6.4.1 BIOLOGICS NEED SPECIALIST TESTING SERVICES

6.4.2 STRINGENT REGULATIONS

7 IMPACT OF COVID-19 ON NORTH AMERICA MEDICINAL CHEMISTRY IN DRUG DISCOVERY MARKET

7.1 IMPACT ON PRICE

7.2 IMPACT ON DEMAND

7.3 IMPACT ON SUPPLY CHAIN

7.4 STRATEGIC DECISIONS BY MANUFACTURERS

7.5 CONCLUSION

8 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS

8.1 OVERVIEW

8.2 TARGET SELECTION

8.3 TARGET VALIDATION

8.4 HIT-TO-LEAD IDENTIFICATION

8.5 LEAD OPTIMIZATION

8.6 CANDIDATE VALIDATION

9 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN

9.1 OVERVIEW

9.2 FRAGMENT-BASED VARIATION

9.3 STRUCTURE BASED DRUG DESIGN

9.4 DIVERSITY ORIENTED SYNTHESIS

9.5 CHEMOGENOMICS

9.6 NATURAL PRODUCTS

9.7 OTHERS

10 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE

10.1 OVERVIEW

10.2 SMALL MOLECULES

10.3 BIOLOGICS

11 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA

11.1 OVERVIEW

11.2 ONCOLOGY

11.3 NEUROLOGY

11.4 INFECTIOUS AND IMMUNE SYSTEM DISEASES

11.5 CARDIOVASCULAR DISEASES

11.6 DIGESTIVE SYSTEM DISEASES

11.7 OTHERS

12 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER

12.1 OVERVIEW

12.2 CONTRACT RESEARCH ORGANIZATION

12.3 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

12.4 ACADEMIC AND RESEARCH INSTITUTES

12.5 OTHERS

13 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY COUNTRY

13.1 OVERVIEW

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 EUROFINS SCIENTIFIC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 SERVICE PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 LABCORP DRUG DEVELOPMENT

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 SERVICE PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 CHARLES RIVER

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 SERVICE PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 WUXI APPTEC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 SERVICE PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 EVOTEC SE

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 SERVICE PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 THERMO FISHER SCIENTIFIC INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 SERVICE PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.6.4.1 ACQUISITION

16.7 AURIGENE PHARMACEUTICAL SERVICES (A SUBSIDIARY OF DR. REDDY'S LABORATORIES)

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 SERVICE PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 BIOBLOCKS INC

16.8.1 COMPANY SNAPSHOT

16.8.2 SERVICE PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 CERTARA INC

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 SERVICE PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 DRUG DISCOVERY ALLIANCES

16.10.1 COMPANY SNAPSHOT

16.10.2 SERVICE PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 GENSCRIPT BIOTECH

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 SERVICE PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 JUBILANT BIOSYS

16.12.1 COMPANY SNAPSHOT

16.12.2 SERVICE PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 NANOSYN

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 NEREID THERAPEUTICS

16.14.1 COMPANY SNAPSHOT

16.14.2 SERVICE PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 PFIZER INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 SERVICE PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 SELVITA

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 SERVICE PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.16.4.1 ACQUISITION

16.17 SPECTRIS PLC

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 SERVICE PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 SYGNATURE DISCOVERY

16.18.1 COMPANY SNAPSHOT

16.18.2 SERVICE PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 7 U.S. MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 8 U.S. MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN 2020-2029 (USD MILLION)

TABLE 9 U.S. MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 10 U.S. MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 11 U.S. MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 12 CANADA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 13 CANADA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 14 CANADA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 15 CANADA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 16 CANADA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 17 MEXICO MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 18 MEXICO MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 19 MEXICO MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 20 MEXICO MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 21 MEXICO MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: DROC ANALYSIS

FIGURE 4 MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: END USER COVERAGE GRID

FIGURE 8 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: SEGMENTATION

FIGURE 11 GROWTH IN BIOLOGICS DISCOVERY AND COLLABORATION AMONG RESEARCHERS AND PHARMACEUTICAL INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PROCESS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET

FIGURE 14 ESTIMATED NEW CANCER CASES IN 2021, IN THE U.S.

FIGURE 15 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS, 2021

FIGURE 16 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS, 2020-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS, LIFELINE CURVE

FIGURE 19 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DESIGN, 2021

FIGURE 20 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DESIGN, 2020-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DESIGN, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DESIGN, LIFELINE CURVE

FIGURE 23 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DRUG TYPE, 2021

FIGURE 24 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DRUG TYPE, 2020-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DRUG TYPE, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 27 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY THERAPEUTIC AREA, 2021

FIGURE 28 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY THERAPEUTIC AREA, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY THERAPEUTIC AREA, LIFELINE CURVE

FIGURE 31 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY END USER, 2021

FIGURE 32 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: SNAPSHOT (2021)

FIGURE 36 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY COUNTRY (2021)

FIGURE 37 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS (2022-2029)

FIGURE 40 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.