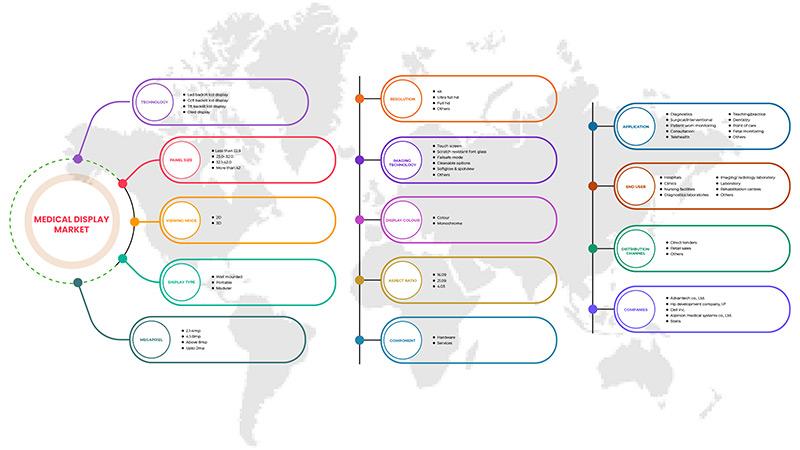

Mercado de pantallas médicas de América del Norte, por tecnología (pantalla LCD con retroiluminación LED, pantalla LCD con retroiluminación CCFL, pantalla LCD TFT y pantalla OLED), tamaño del panel (paneles de menos de 22,9", paneles de 23,0" a 32,0", paneles de 27,0 a 41,9 pulgadas y paneles de más de 42 pulgadas), modo de visualización (2D y 3D), megapíxeles (HASTA 2 MP, 2,1–4 MP, 4,1–8 MP y más de 8 MP), resolución (4K, Ultra Full HD, Full HD y otros), tipo de pantalla (montada en la pared, portátil, modular), tecnología de imágenes (pantalla táctil, vidrio de fuente resistente a rayones, modo a prueba de fallas, opciones de limpieza, Softglow y Spotview y otros), color de la pantalla (color, monocromo), relación de aspecto (16,09, 21,09, 4,03), componente (hardware y servicios), aplicación (consulta, diagnóstico, Cirugía/intervencionismo, telesalud, enseñanza/práctica, monitoreo fetal, odontología, punto de atención, monitoreo en el paciente y otros) Usuario final (hospitales, clínicas, centros de enfermería, laboratorios de diagnóstico, laboratorio de imágenes/radiología, laboratorio, centros de rehabilitación y otros), canal de distribución (licitación directa, ventas minoristas y otros) - Tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de pantallas médicas de América del Norte

Las principales razones del crecimiento del mercado de pantallas médicas es la creciente demanda de tratamientos mínimamente invasivos (MIT) debido a múltiples beneficios, como menos dolor posoperatorio, menos complicaciones operatorias y posoperatorias mayores, estadía hospitalaria más corta, tiempos de recuperación más rápidos, menos cicatrices, menos estrés en el sistema inmunológico, incisiones más pequeñas y, para algunos procedimientos, redujo el tiempo operatorio y también los costos.

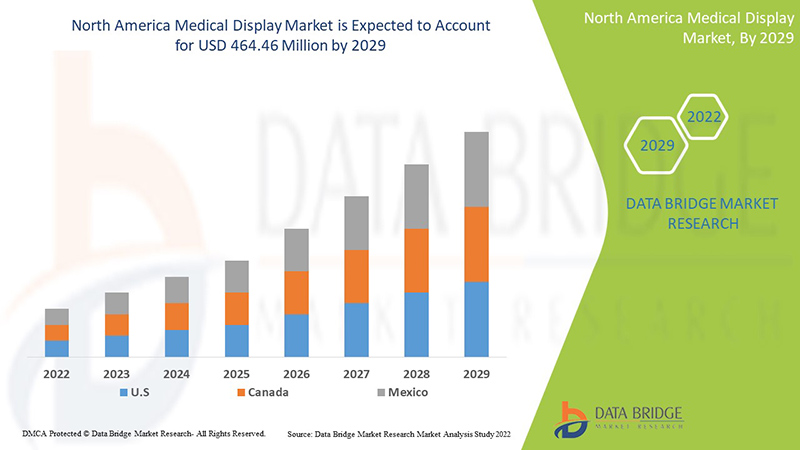

Data Bridge Market Research analiza que se espera que el mercado de pantallas médicas alcance un valor de USD 464,46 millones para 2029, con una CAGR del 6,5 % durante el período de pronóstico. Este informe de mercado también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019-2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por tecnología (pantalla LCD con retroiluminación LED, pantalla LCD con retroiluminación CCFL, pantalla LCD TFT y pantalla OLED), tamaño del panel (paneles de menos de 22,9", paneles de 23,0" a 32,0", paneles de 27,0 a 41,9 pulgadas y paneles de más de 42 pulgadas), modo de visualización (2D y 3D), megapíxeles (HASTA 2 MP, 2,1–4 MP, 4,1–8 MP y más de 8 MP), resolución (4K, Ultra Full HD, Full HD y otros), tipo de pantalla (montada en la pared, portátil, modular), tecnología de imágenes (pantalla táctil, vidrio de fuente resistente a rayones, modo a prueba de fallos, opciones de limpieza, Softglow y Spotview y otros), color de la pantalla (color, monocromo), relación de aspecto (16,09, 21,09, 4,03), componente (hardware y servicios), aplicación (consulta, diagnóstico, cirugía/intervención, Telesalud, Enseñanza/Práctica, Monitoreo Fetal, Odontología, Punto de Atención, Monitoreo Portable del Paciente y Otros) Usuario Final (Hospitales, Clínicas, Centros de Enfermería, Laboratorios de Diagnóstico, Laboratorio de Imágenes/Radiología, Laboratorio, Centros de Rehabilitación y Otros), Canal de Distribución (Licitación Directa, Ventas Minoristas y Otros) |

|

Países cubiertos |

Estados Unidos, Canadá, México |

|

Actores del mercado cubiertos |

Español BenQ, ALPINION MEDICAL SYSTEMS Co., Ltd, Nanjing Jusha Commercial & Trading Co, Ltd, COJE CO., LTD., Axiomtek Co., Ltd., Dell Inc., HP Development Company, LP, Reshin, Onyx Healthcare Inc., Teguar Computers., Shenzhen Beacon Display Technology Co., Ltd., Rein Medical, STERIS., Barco., Hisense., Sony Corporation, Advantech Co., Ltd., LG Electronics., Sharp NEC Display Solutions, Koninklijke Philips NV, EIZO INC., Novanta Inc., FSN Medical Technologies., Quest, Ampronix., Siemens Healthcare GmbH, Panasonic Corporation, entre otros. |

Definición del mercado de pantallas médicas

Una pantalla médica es un monitor que cumple con las altas exigencias de la imagenología médica. Generalmente, viene con tecnologías especiales de mejora de la imagen para garantizar un brillo constante durante la vida útil de la pantalla, imágenes sin ruido, lectura ergonómica y cumplimiento automatizado de las normas DICOM (digital imaging and communications in medicine) y otras normas médicas.

El desarrollo de las tecnologías de imágenes médicas ha hecho que la atención sanitaria avance, proporcionando potentes herramientas de diagnóstico, apoyando la evaluación no invasiva de lesiones y problemas internos y permitiendo detectar enfermedades mucho antes que nunca. Las pantallas médicas son preferidas a las pantallas de consumo cuando se utilizan para imágenes médicas. La razón es sencilla: las pantallas médicas cumplen con los requisitos establecidos de calidad de imagen, normativas médicas y garantía de calidad.

El futuro de los dispositivos médicos de visualización se basa en los avances en inteligencia artificial (IA) y análisis de datos. Los dispositivos médicos están impulsando el tratamiento de enfermedades al permitir a los médicos personalizar la medicina como nunca antes. Estas tecnologías brindan información reveladora sobre pacientes individuales en tiempo real.

Dinámica del mercado de pantallas médicas

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- La tendencia creciente hacia el tratamiento mínimamente invasivo

Las principales razones del crecimiento del mercado de pantallas médicas en América del Norte es la creciente demanda de tratamientos mínimamente invasivos (MIT) debido a múltiples beneficios, como menos dolor posoperatorio, menos complicaciones operatorias y posoperatorias mayores, estadía hospitalaria más corta, tiempos de recuperación más rápidos, menos cicatrices, menos estrés en el sistema inmunológico, incisiones más pequeñas y, para algunos procedimientos, redujo el tiempo operatorio y también los costos.

La cirugía mínimamente invasiva es un método excelente para diagnosticar y tratar una amplia gama de trastornos torácicos que antes requerían esternotomía o toracotomía abierta. La prevalencia de enfermedades crónicas que requieren cirugía ha aumentado en todo el mundo. Debido a las muchas ventajas del tratamiento mínimamente invasivo, muchos pacientes lo prefieren. Además, las cirugías vasculares y endovasculares, las cirugías neurológicas y de columna, la atención de traumatismos ortopédicos y las cirugías cardíacas se realizan en quirófanos híbridos. Esta característica permite a los hospitales realizar operaciones quirúrgicas avanzadas, lo que aumenta la demanda de monitores médicos. Además, el aumento de los costos de la atención médica y la cantidad de laboratorios de patología y radiología impulsan la demanda de monitores médicos.

La cirugía mínimamente invasiva permite a los cirujanos utilizar tecnología moderna y técnicas quirúrgicas avanzadas para operar el cuerpo humano de una manera menos dañina. Se espera que esto impulse la demanda de cirugías mínimamente invasivas.

- Crecimiento de la infraestructura sanitaria

Los gobiernos y las organizaciones sin fines de lucro de varios países se centran principalmente en el desarrollo de infraestructura sanitaria para minimizar la carga de enfermedades y brindar mejores servicios de salud. Además, ha aumentado la adopción de dispositivos médicos, pantallas, monitores y otros dispositivos tecnológicamente avanzados. Es probable que todos estos factores creen oportunidades favorables para el crecimiento del mercado durante el período de pronóstico. Además, las fuertes inversiones de los actores clave en lanzamientos de productos innovadores y funciones actualizadas en los próximos años también pueden impulsar el mercado.

Además, se espera que la creciente demanda de servicios de atención médica rentables, la creciente demanda de soluciones técnicas, la creciente movilidad de la información, el aumento de las iniciativas e incentivos gubernamentales y el aumento de la financiación para pantallas médicas de alta calidad en hospitales y centros de investigación impulsen la presencia de estos centros de atención médica en el mercado. La infraestructura de software médico ha formado la base de los recientes avances en pantallas médicas, bibliotecas médicas digitales y sistemas de información de gestión. Se espera que estos factores impulsen el crecimiento del mercado de pantallas médicas de América del Norte.

Oportunidad

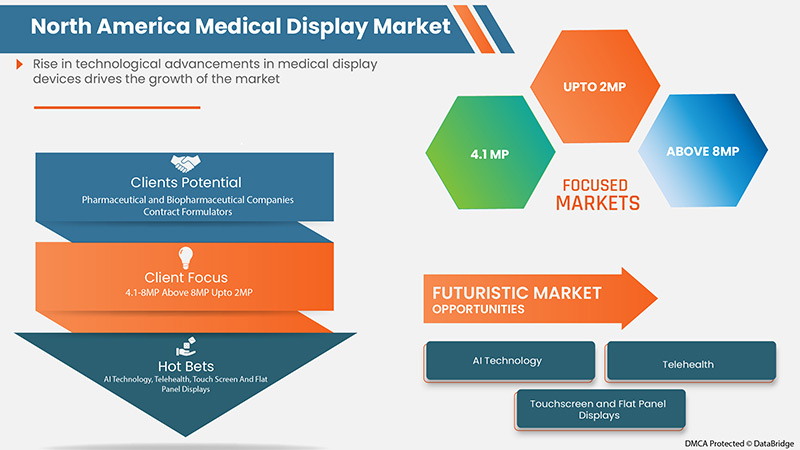

- Avances tecnológicos en los instrumentos de visualización médica

A medida que el mercado se orienta hacia la producción de formas farmacéuticas administrables por vía oral, existe una lucha constante por desarrollar formulaciones adecuadas de nuevas moléculas que permitan la administración oral y, al mismo tiempo, garanticen que el fármaco tenga una biodisponibilidad óptima en los pacientes. Para superar esto, los fabricantes de excipientes farmacéuticos están desarrollando productos más sencillos y reduciendo el tiempo y el coste de desarrollo. El desarrollo de tecnologías de visualización médica ha cambiado la industria de la atención sanitaria, proporcionando herramientas de diagnóstico, telesalud, proporcionando apoyo para tratamientos no invasivos, permitiendo evaluar enfermedades y permitir que se detecten antes.

El lanzamiento de desarrollos tecnológicos en dispositivos de visualización médica está mejorando la eficiencia de la pantalla médica y aumentando la facilidad de uso de los dispositivos de visualización médica. El aumento de las aplicaciones tecnológicas en dispositivos de visualización médica resultaría en menos mano de obra y un diagnóstico y recuperación más rápidos de las enfermedades. En el futuro, la tecnología de inteligencia artificial reemplazará al mercado de pantallas médicas. Se espera que este factor actúe como una oportunidad para el crecimiento del mercado de pantallas médicas de América del Norte en el período de pronóstico.

Restricción/Desafíos

- Altos costos de los dispositivos de visualización médica

El alto costo de los dispositivos de visualización y la alta implementación es el principal factor que restringe el crecimiento del mercado, especialmente en países donde el escenario de reembolso es deficiente. La mayoría de los centros de atención médica en los países en desarrollo, como hospitales y centros de diagnóstico, no pueden permitirse estos dispositivos debido a los altos costos de instalación y mantenimiento y, debido al alto costo de estos equipos médicos y los bajos recursos financieros, los centros de atención médica en los países emergentes son reacios a invertir en nuevos sistemas tecnológicamente avanzados. Estos factores pueden obstaculizar la digitalización en los centros de atención médica e impactar en la adopción de tecnologías avanzadas para el diagnóstico y el análisis.

El avance de la tecnología que conduce al desarrollo de dispositivos de visualización avanzados e innovadores aumenta el costo de los dispositivos. Por lo tanto, se espera que el alto costo de los dispositivos de visualización frene el crecimiento del mercado.

Acontecimientos recientes

- En junio de 2022, EIZO Corporation lanzó RadiForce MX243W, un monitor de 24,1 pulgadas y 2,3 megapíxeles (1920 x 1200 píxeles). El monitor de 24,1 pulgadas y 2,3 megapíxeles (1920 x 1200 píxeles) ha sido diseñado para la monitorización y el diagnóstico cuidadosos de la fisiología completa del sistema del paciente en clínicas y hospitales. El lanzamiento dio como resultado la incorporación de un nuevo dispositivo médico a la cartera y ofreció una pureza de mercado excepcional.

- En mayo de 2021, Barco lanzó la pantalla médica Nio Fusion de 12 MP. El lanzamiento del producto dio como resultado una cartera de productos mejorada y un aumento de las ventas y la expansión de la línea de productos de pantallas médicas en América del Norte y Europa.

Alcance del mercado de pantallas médicas en América del Norte

El mercado de pantallas médicas de América del Norte se clasifica en trece segmentos notables que se basan en la tecnología, el tamaño del panel, el modo de visualización, los megapíxeles, la resolución, el tipo de pantalla, la tecnología de imágenes, el color de la pantalla, la relación de aspecto, el componente, la aplicación, el usuario final y el canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

MERCADO DE PANTALLAS MÉDICAS EN AMÉRICA DEL NORTE, POR TECNOLOGÍA

- PANTALLA LCD RETROILUMINADA POR LED

- PANTALLA LCD CON RETROILUMINACIÓN CCFL

- PANTALLA LCD TFT

- PANTALLA OLED

Sobre la base de la tecnología, el mercado de pantallas médicas está segmentado en pantallas LCD con retroiluminación LED, pantallas LCD con retroiluminación CCFL, pantallas LCD TFT y pantallas OLED.

MERCADO DE PANTALLAS MÉDICAS EN AMÉRICA DEL NORTE, POR TAMAÑO DE PANEL

- PANELES DE MENOS DE 22,9 PULGADAS

- PANELES DE 23,0 A 26,9 PULGADAS

- PANELES DE 27,0 A 41,9 PULGADAS

- PANELES DE MÁS DE 42 PULGADAS

Sobre la base del tamaño del panel, el mercado de pantallas médicas está segmentado en paneles de menos de 22,9 pulgadas, paneles de 23,0 a 32,0 pulgadas, paneles de 27,0 a 41,9 pulgadas y paneles de más de 42 pulgadas.

MERCADO DE EXHIBICIONES MÉDICAS EN AMÉRICA DEL NORTE, POR MODO DE VISUALIZACIÓN

- 2D

- 3D

Según el modo de visualización, el mercado de pantallas médicas se segmenta en 2D y 3D.

MERCADO DE PANTALLAS MÉDICAS EN AMÉRICA DEL NORTE, POR MEGAPÍXELES

- HASTA 2MP

- 2,1–4 MP

- 4,1–8 MP

- MÁS DE 8MP

Sobre la base de megapíxeles, el mercado de pantallas médicas se segmenta en HASTA 2 MP, 2,1–4 MP y 4,1–8 MP y más de 8 MP.

MERCADO DE EXHIBICIONES MÉDICAS EN AMÉRICA DEL NORTE, POR RESOLUCIÓN

- Full HD (alta definición completa)

- ULTRA FULL HD

- 4K

- OTROS

En función de la resolución, el mercado de pantallas médicas se segmenta en Full HD, ultra full HD, 4K y otros.

MERCADO DE EXHIBICIONES MÉDICAS EN AMÉRICA DEL NORTE, POR TIPO DE EXHIBICIÓN

- MONTADO EN LA PARED

- PORTÁTIL

- MODULAR

Según el tipo de pantalla, el mercado de pantallas médicas se segmenta en montaje en pared, portátiles y modulares.

MERCADO DE PANTALLAS MÉDICAS EN AMÉRICA DEL NORTE, POR TECNOLOGÍA DE IMÁGENES

- PANTALLA TÁCTIL

- FUENTE DE VIDRIO RESISTENTE A LOS ARAÑAZOS

- MODO A PRUEBA DE FALLOS

- OPCIONES LIMPIABLES

- RESPLANDOR SUAVE Y VISTA FOCAL

- OTROS

Sobre la base de la tecnología de imágenes, el mercado de pantallas médicas está segmentado en pantalla táctil, vidrio de fuente resistente a rayones, modo a prueba de fallas, opciones de limpieza, brillo suave y vista puntual y otros.

MERCADO DE EXHIBICIONES MÉDICAS EN AMÉRICA DEL NORTE, POR COLOR DE EXHIBICIÓN

- COLOR

- MONOCROMO

Sobre la base del color de la pantalla, el mercado de pantallas médicas se segmenta en color y monocromo.

MERCADO DE EXHIBICIONES MÉDICAS EN AMÉRICA DEL NORTE, POR RELACIÓN DE ASPECTO

- 16:09

- 21:09

- 4:03

Sobre la base de la relación de aspecto, el mercado de pantallas médicas está segmentado en 16:09, 21:09 y 4:03.

MERCADO DE PANTALLAS MÉDICAS EN AMÉRICA DEL NORTE, POR COMPONENTE

- HARDWARE

- SERVICIOS

Según los componentes, el mercado de pantallas médicas se segmenta en hardware y servicios.

- MERCADO DE PANTALLAS MÉDICAS EN AMÉRICA DEL NORTE, POR APLICACIÓN

- DIAGNÓSTICO

- QUIRÚRGICO/INTERVENCIONISTA

- MONITOREO PORTATIL DEL PACIENTE

- CONSULTA

- TELESALUD

- ENSEÑANZA/PRÁCTICA

- ODONTOLOGÍA

- PUNTO DE ATENCIÓN

- MONITOREO FETAL

- OTROS

Sobre la base de la aplicación, el mercado de pantallas médicas se segmenta en consulta, diagnóstico, quirúrgico/intervencionista, telesalud, enseñanza/práctica, monitoreo fetal, odontología, punto de atención, monitoreo por parte del paciente y otros.

MERCADO DE PANTALLAS MÉDICAS EN AMÉRICA DEL NORTE, POR USUARIO FINAL

- HOSPITALES

- POR TECNOLOGÍA

- CLÍNICAS

- CENTROS DE ENFERMERÍA

- LABORATORIOS DE DIAGNÓSTICO

- LABORATORIO DE IMÁGENES/RADIOLOGÍA

- LABORATORIO

- CENTROS DE REHABILITACIÓN

- OTROS

Sobre la base del usuario final, el mercado de pantallas médicas se segmenta en hospitales, clínicas, centros de enfermería, laboratorios de diagnóstico, laboratorios de imágenes/radiología, laboratorios, centros de rehabilitación y otros.

MERCADO DE EXHIBICIONES MÉDICAS EN AMÉRICA DEL NORTE, POR CANAL DE DISTRIBUCIÓN

- LICITACIÓN DIRECTA

- VENTAS AL POR MENOR

- OTROS

Sobre la base del canal de distribución, el mercado de exhibición médica se segmenta en licitación directa, ventas minoristas y otros.

Análisis y perspectivas regionales del mercado de pantallas médicas

Se analiza el mercado de pantallas médicas y se proporciona información sobre el tamaño del mercado, tecnología, tamaño del panel, modo de visualización, megapíxeles, resolución, tipo de pantalla, tecnología de imágenes, color de pantalla, relación de aspecto, componente, aplicación, usuario final y canal de distribución.

Los países cubiertos en este informe de mercado son EE. UU., Canadá y México.

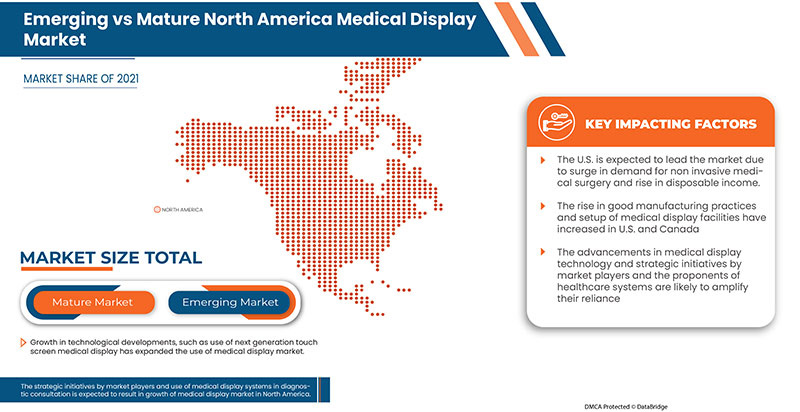

Se espera que América del Norte domine el mercado, ya que es el mercado de dispositivos médicos más grande del mundo. Se espera que Estados Unidos domine el mercado debido al aumento de los ingresos disponibles de la población.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas de América del Norte y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los expositores médicos

El panorama competitivo del mercado de pantallas médicas proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en I+D, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y amplitud de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en el mercado de pantallas médicas.

Algunos de los principales actores que operan en el mercado son BenQ, ALPINION MEDICAL SYSTEMS Co., Ltd, Nanjing Jusha Commercial & Trading Co, Ltd, COJE CO., LTD., Axiomtek Co., Ltd., Dell Inc., HP Development Company, LP, Reshin, Onyx Healthcare Inc., Teguar Computers., Shenzhen Beacon Display Technology Co., Ltd., Rein Medical, STERIS., Barco., Hisense., Sony Corporation, Advantech Co., Ltd., LG Electronics., Sharp NEC Display Solutions, Koninklijke Philips NV, EIZO INC., Novanta Inc., FSN Medical Technologies., Quest, Ampronix., Siemens Healthcare GmbH, Panasonic Corporation, entre otros.

Metodología de investigación: Mercado de pantallas médicas

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen la cuadrícula de posicionamiento de proveedores, el análisis de la línea de tiempo del mercado, la descripción general y la guía del mercado, la cuadrícula de posicionamiento de la empresa, el análisis de la participación de mercado de la empresa, los estándares de medición, América del Norte frente a la región y el análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA MEDICAL DISPLAY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TECHNOLOGYLIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PESTEL

3.2 PORTER'S FIVE FORCES MODEL

3.3 TECHNOLOGICAL LANDSCAPE IN THE NORTH AMERICA MEDICAL DISPLAY MARKET

3.3.1 ORGANIC LIGHT EMITTING DIODE (OLED)

3.3.2 LIGHT EMITTING DIODE (LED), TECHNOLOGY

3.3.3 LIQUID CRYSTAL DISPLAY (LCD)

4 VALUE CHAIN ANALYSIS: NORTH AMERICA MEDICAL DISPLAY MARKET

5 NORTH AMERICA MEDICAL DISPLAY MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE GROWING TREND TOWARDS MINIMALLY INVASIVE TREATMENT

6.1.2 GROWING HEALTHCARE INFRASTRUCTURE

6.1.3 SURGE IN THE NUMBER OF DIAGNOSTIC IMAGING CENTERS

6.2 RESTRAINTS

6.2.1 INCREASE IN USE OF REFURBISHED MEDICAL DISPLAYS

6.2.2 MEDICAL COMMUNITY HAS ATTEMPTED TO TAKE ADVANTAGE

6.2.3 HIGH COSTS OF MEDICAL DISPLAY DEVICES

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN MEDICAL DISPLAY INSTRUMENTS

6.3.3 RISING DISPOSABLE INCOME

6.4 CHALLENGES

6.4.1 LACK OF SKILLED EXPERTISE

6.4.2 STRINGENT REGULATIONS

7 NORTH AMERICA MEDICAL DISPLAY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 LED BACKLIT LCD DISPLAY

7.3 CCFL BACKLIT LCD DISPLAY

7.4 TFT BACKLIT LCD DISPLAY

7.5 OLED DISPLAY

7.5.1 AMOLED

7.5.2 PMOLED

8 NORTH AMERICA MEDICAL DISPLAY MARKET, BY PANEL SIZE

8.1 OVERVIEW

8.2 LESS THAN 22.9

8.2.1 LED BACKLIT LCD DISPLAY

8.2.2 CCFL BACKLIT LCD DISPLAY

8.2.3 TFT BACKLIT LCD DISPLAY

8.2.4 OLED DISPLAY

8.3 23.0- 32.0

8.3.1 LED BACKLIT LCD DISPLAY

8.3.2 CCFL BACKLIT LCD DISPLAY

8.3.3 TFT BACKLIT LCD DISPLAY

8.3.4 OLED DISPLAY

8.4 32.1-42.0

8.4.1 LED BACKLIT LCD DISPLAY

8.4.2 CCFL BACKLIT LCD DISPLAY

8.4.3 TFT BACKLIT LCD DISPLAY

8.4.4 OLED DISPLAY

8.5 MORE THAN 42

8.5.1 LED BACKLIT LCD DISPLAY

8.5.2 CCFL BACKLIT LCD DISPLAY

8.5.3 TFT BACKLIT LCD DISPLAY

8.5.4 OLED DISPLAY

9 NORTH AMERICA MEDICAL DISPLAY MARKET, BY VIEWING MODE

9.1 OVERVIEW

9.2 2D

9.3 3D

10 NORTH AMERICA MEDICAL DISPLAY MARKET, BY MEGAPIXEL

10.1 OVERVIEW

10.2 2.1-4MP

10.3 4.1-8MP

10.4 ABOVE 8MP

10.5 UPTO 2MP

11 NORTH AMERICA MEDICAL DISPLAY MARKET, BY RESOLUTION

11.1 OVERVIEW

11.2 4K

11.3 ULTRA FULL HD

11.4 FULL HD

11.5 OTHERS

12 NORTH AMERICA MEDICAL DISPLAY MARKET, BY DISPLAY TYPE

12.1 OVERVIEW

12.2 WALL MOUNTED

12.3 PORTABLE

12.4 MODULAR

13 NORTH AMERICA MEDICAL DISPLAY MARKET, BY DISPLAY COLOR

13.1 OVERVIEW

13.2 COLOR

13.2.1 LED BACKLIT LCD DISPLAY

13.2.2 CCFL BACKLIT LCD DISPLAY

13.2.3 TFT BACKLIT LCD DISPLAY

13.2.4 OLED DISPLAY

13.3 MONOCHROME

13.3.1 LED BACKLIT LCD DISPLAY

13.3.2 CCFL BACKLIT LCD DISPLAY

13.3.3 TFT BACKLIT LCD DISPLAY

13.3.4 OLED DISPLAY

14 NORTH AMERICA MEDICAL DISPLAY MARKET, BY COMPONENT

14.1 OVERVIEW

14.2 HARDWARE

14.2.1 ACCESSORIES

14.2.2 SENSORS

14.2.3 PANELS

14.2.4 OTHERS

14.3 SERVICES

14.3.1 CONSULTING

14.3.2 INSTALLATION

14.3.3 AFTER-SALE SERVICES

15 NORTH AMERICA MEDICAL DISPLAY MARKET, BY APPLICATION

15.1 OVERVIEW

15.2 DIAGNOSTICS

15.2.1 BY TYPE

15.2.1.1 GENERAL RADIOLOGY

15.2.1.2 MAMMOGRAPHY

15.2.1.3 DIGITAL PATHOLOGY

15.2.1.4 MULTI-MODALITY

15.2.2 BY PANEL SIZE

15.2.2.1 LESS THAN 22.9

15.2.2.2 23.0- 32.0

15.2.2.3 32.1-42.0

15.2.2.4 MORE THAN 42

15.3 SURGICAL/INTERVENTIONAL

15.3.1 BY TYPE

15.3.1.1 CARDIOVASCULAR

15.3.1.2 ONCOLOGY

15.3.1.3 NEUROLOGY

15.3.1.4 OPHTHALMOLOGY

15.3.1.5 OTHERS

15.3.2 BY PANEL SIZE

15.3.2.1 LESS THAN 22.9

15.3.2.2 23.0- 32.0

15.3.2.3 32.1-42.0

15.3.2.4 MORE THAN 42

15.4 PATIENT WORN MONITORING

15.5 CONSULTATION

15.6 TELEHEALTH

15.6.1 BY PANEL SIZE

15.6.1.1 LESS THAN 22.9

15.6.1.2 23.0- 32.0

15.6.1.3 32.1-42.0

15.6.1.4 MORE THAN 42

15.7 TEACHING/PRACTICE

15.7.1 BY PANEL SIZE

15.7.1.1 LESS THAN 22.9

15.7.1.2 23.0- 32.0

15.7.1.3 32.1-42.0

15.7.1.4 MORE THAN 42

15.8 DENTISTRY

15.8.1 BY PANEL SIZE

15.8.1.1 LESS THAN 22.9

15.8.1.2 23.0- 32.0

15.8.1.3 32.1-42.0

15.8.1.4 MORE THAN 42

15.9 POINT OF CARE

15.9.1 BY PANEL SIZE

15.9.1.1 LESS THAN 22.9

15.9.1.2 23.0- 32.0

15.9.1.3 32.1-42.0

15.9.1.4 MORE THAN 42

15.1 FETAL MONITORING

15.10.1 BY PANEL SIZE

15.10.1.1 LESS THAN 22.9

15.10.1.2 23.0- 32.0

15.10.1.3 32.1-42.0

15.10.1.4 MORE THAN 42

15.11 OTHERS

16 NORTH AMERICA MEDICAL DISPLAY MARKET, BY END USER

16.1 OVERVIEW

16.2 HOSPITALS

16.2.1 BY AREA

16.2.1.1 OPERATING ROOM

16.2.1.2 SURGERY UNIT

16.2.1.3 OTHERS

16.2.2 BY TECHNOLOGY

16.2.2.1 LED BACKLIT LCD DISPLAY

16.2.2.2 CCFL BACKLIT LCD DISPLAY

16.2.2.3 TFT BACKLIT LCD DISPLAY

16.2.2.4 OLED DISPLAY

16.2.3 CLINICS

16.2.3.1 LED BACKLIT LCD DISPLAY

16.2.3.2 CCFL BACKLIT LCD DISPLAY

16.2.3.3 TFT BACKLIT LCD DISPLAY

16.2.3.4 OLED DISPLAY

16.2.4 NURSING FACILITIES

16.2.4.1 LED BACKLIT LCD DISPLAY

16.2.4.2 CCFL BACKLIT LCD DISPLAY

16.2.4.3 TFT BACKLIT LCD DISPLAY

16.2.4.4 OLED DISPLAY

16.2.5 DIAGNOSTIC LABORATORIES

16.2.5.1 LED BACKLIT LCD DISPLAY

16.2.5.2 CCFL BACKLIT LCD DISPLAY

16.2.5.3 TFT BACKLIT LCD DISPLAY

16.2.5.4 OLED DISPLAY

16.3 IMAGING/ RADIOLOGY LABORATORY

16.3.1 LABORATORY

16.3.1.1 LED BACKLIT LCD DISPLAY

16.3.1.2 CCFL BACKLIT LCD DISPLAY

16.3.1.3 TFT BACKLIT LCD DISPLAY

16.3.1.4 OLED DISPLAY

16.3.2 REHABILITATION CENTERS

16.3.2.1 LED BACKLIT LCD DISPLAY

16.3.2.2 CCFL BACKLIT LCD DISPLAY

16.3.2.3 TFT BACKLIT LCD DISPLAY

16.3.2.4 OLED DISPLAY

16.4 OTHERS

17 NORTH AMERICA MEDICAL DISPLAY MARKET, BY IMAGING TECHNOLOGY

17.1 OVERVIEW

17.2 TOUCH SCREEN

17.3 SCRATCH RESISTANT FONT GLASS

17.4 FAILSAFE MODE

17.5 CLEANABLE OPTIONS

17.6 SOFTGLOW & SPOTVIEW

17.7 OTHERS

18 NORTH AMERICA MEDICAL DISPLAY MARKET, BY ASPECT RATIO

18.1 OVERVIEW

18.2 12/30/1899 4:09:00 PM

18.3 12/30/1899 9:09:00 PM

18.4 12/30/1899 4:03:00 AM

19 NORTH AMERICA MEDICAL DISPLAY MARKET, BY DISTRIBUTION CHANNEL

19.1 OVERVIEW

19.2 DIRECT TENDERS

19.3 RETAIL SALES

19.4 OTHERS

20 NORTH AMERICA MEDICAL DISPLAY MARKET, BY GEOGRAPHY

20.1 NORTH AMERICA

20.1.1 U.S.

20.1.2 CANADA

20.1.3 MEXICO

21 NORTH AMERICA MEDICAL DISPLAY MARKET: COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

22 SWOT ANALYSIS

23 COMPANY PROFILE

23.1 ADVANTECH CO., LTD

23.1.1 COMPANY SNAPSHOT

23.1.2 REVENUE ANALYSIS

23.1.3 COMPANY SHARE ANALYSIS

23.1.4 PRODUCT PORTFOLIO

23.1.5 RECENT DEVELOPMENTS

23.2 HP DEVELOPMENT COMPANY, L.P

23.2.1 COMPANY SNAPSHOT

23.2.2 REVENUE ANALYSIS

23.2.3 COMPANY SHARE ANALYSIS

23.2.4 PRODUCT PORTFOLIO

23.2.5 RECENT DEVELOPMENT

23.3 DELL INC.

23.3.1 COMPANY SNAPSHOT

23.3.2 REVENUE ANALYSIS

23.3.3 COMPANY SHARE ANALYSIS

23.3.4 PRODUCT PORTFOLIO

23.3.5 RECENT DEVELOPMENTS

23.4 ALPINION MEDICAL SYSTEMS CO., LTD

23.4.1 COMPANY SNAPSHOT

23.4.2 COMPANY SHARE ANALYSIS

23.4.3 PRODUCT PORTFOLIO

23.4.4 RECENT DEVELOPMENTS

23.5 STERIS

23.5.1 COMPANY SNAPSHOT

23.5.2 REVENUE ANALYSIS

23.5.3 COMPANY SHARE ANALYSIS

23.5.4 PRODUCT PORTFOLIO

23.5.5 RECENT DEVELOPMENT

23.6 AMPRONIX

23.6.1 COMPANY SNAPSHOT

23.6.2 PRODUCT PORTFOLIO

23.6.3 RECENT DEVELOPMENT

23.7 AXIOMTEK CO., LTD.

23.7.1 COMPANY SNAPSHOT

23.7.2 REVENUE ANALYSIS

23.7.3 PRODUCT PORTFOLIO

23.7.4 RECENT DEVELOPMENT

23.8 BARCO

23.8.1 COMPANY SNAPSHOT

23.8.2 REVENUE ANALYSIS

23.8.3 PRODUCT PORTFOLIO

23.8.4 RECENT DEVELOPMENTS

23.9 BENQ

23.9.1 COMPANY SNAPSHOT

23.9.2 PRODUCT PORTFOLIO

23.9.3 RECENT DEVELOPMENTS

23.1 COJE CO., LTD.

23.10.1 COMPANY SNAPSHOT

23.10.2 PRODUCT PORTFOLIO

23.10.3 RECENT DEVELOPMENTS

23.11 EIZO INC (2021)

23.11.1 COMPANY SNAPSHOT

23.11.2 REVENUE ANALYSIS

23.11.3 PRODUCT PORTFOLIO

23.11.4 RECENT DEVELOPMENT

23.12 FSN MEDICAL TECHNOLOGIES.

23.12.1 COMPANY SNAPSHOT

23.12.2 PRODUCT PORTFOLIO

23.12.3 RECENT DEVELOPMENT

23.13 HISENSE MEDICAL EQUIPMENT CO, LTD (A SUBSIDIARY OF HISENSE GROUP)

23.13.1 COMPANY SNAPSHOT

23.13.2 REVENUE ANALYSIS

23.13.3 PRODUCT PORTFOLIO

23.13.4 RECENT DEVELOPMENT

23.14 KONINKLIJKE PHILIPS N.V.( 2021)

23.14.1 COMPANY SNAPSHOT

23.14.2 REVENUE ANALYSIS

23.14.3 PRODUCT PORTFOLIO

23.14.4 RECENT DEVELOPMENT

23.15 LG DISPLAY CO., LTD.

23.15.1 COMPANY SNAPSHOT

23.15.2 REVENUE ANALYSIS

23.15.3 PRODUCT PORTFOLIO

23.15.4 RECENT DEVELOPMENT

23.16 NANJING JUSHA COMMERCIAL &TRADING CO,LTD

23.16.1 COMPANY SNAPSHOT

23.16.2 PRODUCT PORTFOLIO

23.16.3 RECENT DEVELOPMENTS

23.17 NOVANTA INC. (2021)

23.17.1 COMPANY SNAPSHOT

23.17.2 REVENUE ANALYSIS

23.17.3 PRODUCT PORTFOLIO

23.17.4 RECENT DEVELOPMENTS

23.18 ONYX HEALTHCARE INC. (SUBSIDIARY OF AAEON TECHNOLOGY INC.)

23.18.1 COMPANY SNAPSHOT

23.18.2 REVENUE ANALYSIS

23.18.3 PRODUCT PORTFOLIO

23.18.4 RECENT DEVELOPMENTS

23.19 PANASONIC HOLDINGS CORPORATION

23.19.1 COMPANY SNAPSHOT

23.19.2 REVENUE ANALYSIS

23.19.3 RECENT DEVELOPMENT

23.2 QUEST MEDICAL, INC. (A SUBSIDIARY OF ATRION CORPORATION)

23.20.1 COMPANY SNAPSHOT

23.20.2 REVENUE ANALYSIS

23.20.3 PRODUCT PORTFOLIO

23.20.4 RECENT DEVELOPMENTS

23.21 REIN MEDICAL GMBH

23.21.1 COMPANY SNAPSHOT

23.21.2 PRODUCT PORTFOLIO

23.21.3 RECENT DEVELOPMENTS

23.22 SHARP NEC DISPLAY SOLUTIONS ( 2021)

23.22.1 COMPANY SNAPSHOT

23.22.2 PRODUCT PORTFOLIO

23.22.3 RECENT DEVELOPMENTS

23.23 SHENZHEN BEACON DISPLAY TECHNOLOGY CO., LTD.

23.23.1 COMPANY SNAPSHOT

23.23.2 PRODUCT PORTFOLIO

23.23.3 RECENT DEVELOPMENT

23.24 SHENZHEN JLD DISPLAY EXPERT CO., LTD

23.24.1 COMPANY SNAPSHOT

23.24.2 PRODUCT PORTFOLIO

23.24.3 RECENT DEVELOPMENTS

23.25 SIEMENS HEALTHCARE GMBH

23.25.1 COMPANY SNAPSHOT

23.25.2 REVENUE ANALYSIS

23.25.3 PRODUCT PORTFOLIO

23.25.4 RECENT DEVELOPMENT

23.26 SONY GROUP CORPORATION

23.26.1 COMPANY SNAPSHOT

23.26.2 REVENUE ANALYSIS

23.26.3 PRODUCT PORTFOLIO

23.26.4 RECENT DEVELOPMENT

23.27 TEGUAR COMPUTERS

23.27.1 COMPANY SNAPSHOT

23.27.2 PRODUCT PORTFOLIO

23.27.3 RECENT DEVELOPMENTS

24 QUESTIONNAIRE

25 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA LED BACKLIT LCD DISPLAY MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA CCFL BACKLIT LCD DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA TFT BACKLIT LCD DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA OLED DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA OLED DISPLAY TYPE IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA LESS THAN 22.9 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA LESS THAN 22.9 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA 23.0- 32.0 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA 23.0- 32.0 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA 32.1-42.0 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA 32.1-40.0 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA MORE THAN 42 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA MORE THAN 42 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA MEDICAL DISPLAY MARKET, BY VIEWING MODE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA 2D IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA 3D IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA MEDICAL DISPLAY MARKET, BY MEGAPIXEL, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA 2.1-4MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA 4.1-8MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA ABOVE 8MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA UPTO 2MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA MEDICAL DISPLAY MARKET, BY RESOLUTION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA 4K IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA ULTRA FULL HD IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA FULL HD IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA MEDICAL DISPLAY MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA WALL MOUNTED IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA PORTABLE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA MODULAR IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA MEDICAL DISPLAY MARKET, BY DISPLAY COLOR, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA COLOR IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA COLOR IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA MONOCHROME IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA MONOCHROME IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA HARDWARE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA HARDWARE IN MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA SERVICES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA SERVICES IN MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA DIAGNOSTICS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA DIAGNOSTICS IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA BY TYPE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA BY PANEL SIZE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA SURGICAL/INTERVENTIONAL IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA SURGICAL/INTERVENTIONAL IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA BY TYPE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA BY PANEL SIZE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA PATIENT WORN MONITORING IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA CONSULTATION IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA TELEHEALTH IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA TELEHEALTH IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA TEACHING/PRACTICE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA TEACHING/PRACTICE IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA DENTISTRY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA DENTISTRY IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA POINT OF CARE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA POINT OF CARE IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA FETAL MONITORING IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA FETAL MONITORING IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA MEDICAL DISPLAY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA HOSPITALS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA HOSPITALS IN MEDICAL DISPLAY MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA BY AREA IN MEDICAL DISPLAY MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA BY TECHNOLOGY IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA CLINICS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA CLINICS IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA NURSING FACILITIES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA NURSING FACILITIES IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA DIAGNOSTIC LABORATORIES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA DIAGNOSTIC LABORATORIES IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA IMAGING/ RADIOLOGY LABORATORY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA LABORATORY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA LABORATORY IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA REHABILITATION CENTERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA REHABILITATION CENTERS IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA MEDICAL DISPLAY MARKET, BY IMAGING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA TOUCH SCREEN IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA SCRATCH RESISTANT FONT GLASS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA FAILSAFE MODE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA CLEANABLE OPTIONS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA SOFTGLOW & SPOTVIEW IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 89 NORTH AMERICA MEDICAL DISPLAY MARKET, BY ASPECT RATIO, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA 16:09 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA 21:09 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA 4:03 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 93 NORTH AMERICA MEDICAL DISPLAY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 NORTH AMERICA DIRECT TENDERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 95 NORTH AMERICA RETAIL SALES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 96 NORTH AMERICA OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA MEDICAL DISPLAYMARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MEDICAL DISPLAYMARKET : DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MEDICAL DISPLAYMARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MEDICAL DISPLAYMARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MEDICAL DISPLAYMARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MEDICAL DISPLAYMARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA MEDICAL DISPLAYMARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA MEDICAL DISPLAYMARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA MEDICAL DISPLAYMARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA MEDICAL DISPLAYMARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA MEDICAL DISPLAY MARKET: SEGMENTATION

FIGURE 12 RISE IN GENERIC DRUG PRODUCTION AND TECHNOLOGICAL FOCUS IN MEDICAL DISPLAYIS DRIVING THE NORTH AMERICA MEDICAL DISPLAYMARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 TECHNOLOGYSEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MEDICAL DISPLAYMARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA MEDICAL DISPLAY MARKET

FIGURE 15 NORTH AMERICA MEDICAL DISPLAY MARKET : BY TECHNOLOGY, 2021

FIGURE 16 NORTH AMERICA MEDICAL DISPLAY MARKET : BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA MEDICAL DISPLAY MARKET : BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA MEDICAL DISPLAY MARKET : BY TECHNOLOGY, LIFELINE CURVE

FIGURE 19 NORTH AMERICA MEDICAL DISPLAY MARKET : BY PANEL SIZE, 2021

FIGURE 20 NORTH AMERICA MEDICAL DISPLAY MARKET : BY PANEL SIZE, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA MEDICAL DISPLAY MARKET : BY PANEL SIZE, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA MEDICAL DISPLAY MARKET : BY PANEL SIZE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA MEDICAL DISPLAY MARKET : BY VIEWING MODE, 2021

FIGURE 24 NORTH AMERICA MEDICAL DISPLAY MARKET : BY VIEWING MODE, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA MEDICAL DISPLAY MARKET : BY VIEWING MODE, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA MEDICAL DISPLAY MARKET : BY VIEWING MODE, LIFELINE CURVE

FIGURE 27 NORTH AMERICA MEDICAL DISPLAY MARKET : BY MEGAPIXEL, 2021

FIGURE 28 NORTH AMERICA MEDICAL DISPLAY MARKET : BY MEGAPIXEL, 2022-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA MEDICAL DISPLAY MARKET : BY MEGAPIXEL, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA MEDICAL DISPLAY MARKET : BY MEGAPIXEL, LIFELINE CURVE

FIGURE 31 NORTH AMERICA MEDICAL DISPLAY MARKET : BY RESOLUTION, 2021

FIGURE 32 NORTH AMERICA MEDICAL DISPLAY MARKET : BY RESOLUTION, 2022-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA MEDICAL DISPLAY MARKET : BY RESOLUTION, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA MEDICAL DISPLAY MARKET : BY RESOLUTION, LIFELINE CURVE

FIGURE 35 NORTH AMERICA MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, 2021

FIGURE 36 NORTH AMERICA MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, 2022-2029 (USD MILLION)

FIGURE 37 NORTH AMERICA MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, CAGR (2022-2029)

FIGURE 38 NORTH AMERICA MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, LIFELINE CURVE

FIGURE 39 NORTH AMERICA MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, 2021

FIGURE 40 NORTH AMERICA MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, 2022-2029 (USD MILLION)

FIGURE 41 NORTH AMERICA MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, CAGR (2022-2029)

FIGURE 42 NORTH AMERICA MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, LIFELINE CURVE

FIGURE 43 NORTH AMERICA MEDICAL DISPLAY MARKET : BY COMPONENT, 2021

FIGURE 44 NORTH AMERICA MEDICAL DISPLAY MARKET : BY COMPONENT, 2022-2029 (USD MILLION)

FIGURE 45 NORTH AMERICA MEDICAL DISPLAY MARKET : BY COMPONENT, CAGR (2022-2029)

FIGURE 46 NORTH AMERICA MEDICAL DISPLAY MARKET : BY COMPONENT, LIFELINE CURVE

FIGURE 47 NORTH AMERICA MEDICAL DISPLAY MARKET: BY APPLICATION, 2021

FIGURE 48 NORTH AMERICA MEDICAL DISPLAY MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 49 NORTH AMERICA MEDICAL DISPLAY MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 50 NORTH AMERICA MEDICAL DISPLAY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 51 NORTH AMERICA MEDICAL DISPLAY MARKET: BY END USER, 2021

FIGURE 52 NORTH AMERICA MEDICAL DISPLAY MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 53 NORTH AMERICA MEDICAL DISPLAY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 54 NORTH AMERICA MEDICAL DISPLAY MARKET: BY END USER, LIFELINE CURVE

FIGURE 55 NORTH AMERICA MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, 2021

FIGURE 56 NORTH AMERICA MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 57 NORTH AMERICA MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, CAGR (2022-2029)

FIGURE 58 NORTH AMERICA MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, LIFELINE CURVE

FIGURE 59 NORTH AMERICA MEDICAL DISPLAY MARKET: BY ASPECT RATIO, 2021

FIGURE 60 NORTH AMERICA MEDICAL DISPLAY MARKET: BY ASPECT RATIO, 2022-2029 (USD MILLION)

FIGURE 61 NORTH AMERICA MEDICAL DISPLAY MARKET: BY ASPECT RATIO, CAGR (2022-2029)

FIGURE 62 NORTH AMERICA MEDICAL DISPLAY MARKET: BY ASPECT RATIO, LIFELINE CURVE

FIGURE 63 NORTH AMERICA MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 64 NORTH AMERICA MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 65 NORTH AMERICA MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 66 NORTH AMERICA MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 67 NORTH AMERICA MEDICAL DISPLAY MARKET: SNAPSHOT (2021)

FIGURE 68 NORTH AMERICA MEDICAL DISPLAY MARKET: BY COUNTRY (2021)

FIGURE 69 NORTH AMERICA MEDICAL DISPLAY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 70 NORTH AMERICA MEDICAL DISPLAY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 71 NORTH AMERICA MEDICAL DISPLAY MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 72 NORTH AMERICA MEDICAL DISPLAY MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.