North America Medical Clothing Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

94.30 Billion

USD

179.78 Billion

2021

2029

USD

94.30 Billion

USD

179.78 Billion

2021

2029

| 2022 –2029 | |

| USD 94.30 Billion | |

| USD 179.78 Billion | |

|

|

|

Mercado de ropa médica en América del Norte, por producto (ropa profesional, ropa para pacientes, ropa especializada, ropa de primeros auxilios, vendajes y toallas, otros), uso (reutilizable y desechable), usuario final (hospitales, clínicas especializadas, centros ambulatorios, entornos de atención domiciliaria, laboratorios clínicos y de investigación y otros), canal de distribución (licitación directa, ventas minoristas, distribuidor externo, otros): tendencias de la industria y pronóstico hasta 2029

Análisis y tamaño del mercado

Los proveedores de ropa médica suelen proporcionar uniformes médicos a los hospitales. La ropa de los pacientes también está incluida en el uniforme médico y está compuesta de algodón para mayor comodidad y practicidad. Para ingresar a un hospital, un médico debe vestirse adecuadamente.

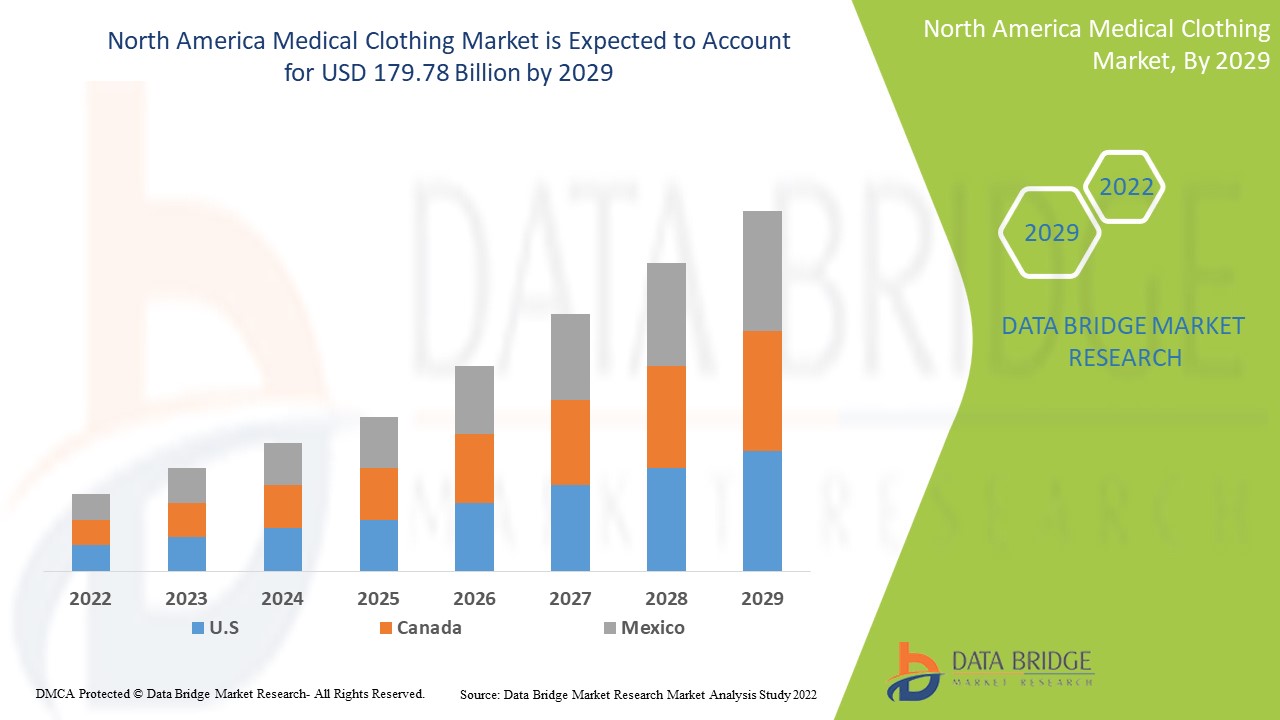

Data Bridge Market Research analiza que el mercado de ropa médica, que fue de USD 94,3 mil millones en 2021, se disparará hasta USD 179,78 mil millones para 2029, y se espera que experimente una CAGR del 8,4% durante el período de pronóstico de 2022 a 2029. Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado curado por el equipo de Data Bridge Market Research también incluye un análisis experto en profundidad, epidemiología del paciente, análisis de la cartera, análisis de precios y marco regulatorio.

Alcance del informe y segmentación del mercado

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2014 - 2019) |

|

Unidades cuantitativas |

Ingresos en miles de millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Producto (ropa profesional, ropa para pacientes, ropa especializada, ropa de primeros auxilios, vendajes y toallas, otros), uso (reutilizable y desechable), usuario final (hospitales, clínicas especializadas, centros ambulatorios, entornos de atención domiciliaria, laboratorios clínicos y de investigación, entre otros), canal de distribución (licitación directa, ventas minoristas, distribuidor externo, otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México en América del Norte |

|

Actores del mercado cubiertos |

Cardinal Health, Inc. (EE. UU.), Mölnlycke Health Care AB (Suecia), 3M (EE. UU.), Smith+Nephew (Reino Unido), Ansell Ltd. (Australia), Superior Group of Companies (EE. UU.), Semperit AG Holding (Austria), Henry Schein, Inc. (EE. UU.), Narang Medical Ltd. (India), Healing Hands (Nueva Jersey), BARCO UNIFORMS (EE. UU.), CHEROKEE UNIFORMS (EE. UU.), Aramark Uniform & Career Apparel (EE. UU.), Carhartt, Inc. (EE. UU.), LynkTrac Technologies LLC (EE. UU.), Owens & Minor, Inc. (EE. UU.), Prestige Medical (California), Landau Uniforms (EE. UU.), Medline Industries, Inc. (EE. UU.) |

|

Oportunidades de mercado |

|

Definición de mercado

Los uniformes médicos son la vestimenta que usan quienes trabajan en hospitales. Los uniformes médicos, enfermeros y trabajadores médicos vienen en varios estilos. Los médicos son proveedores de atención médica que trabajan en hospitales. Deben vestir ropa limpia e higiénica. La vestimenta de un médico debe ser práctica y estar disponible en todo momento.

Dinámica del mercado de ropa médica

Conductores

- Aumento de enfermedades crónicas

La investigación sobre el aumento de este problema de salud crónico, frecuente y costoso está influida por los cambios de comportamiento social y el envejecimiento de la población. Los problemas de salud crónicos aumentarán el número de pacientes que visitan hospitales y clínicas, lo que podría aumentar directamente el mercado de indumentaria médica. Se utilizará indumentaria médica de calidad decente, como guantes, mascarillas y batas, para proporcionar un tratamiento médico bueno e higiénico, lo que hará crecer el mercado y la demanda en el futuro.

- Aumento de la población de personas mayores

La mayor esperanza de vida ha provocado un aumento constante de la población de adultos de 60 años o más. La prevalencia de enfermedades crónicas es máxima en los ancianos, lo que aumenta la demanda de indumentaria médica. En 2050, habrá 1.500 millones de personas mayores en todo el mundo, frente a los 750 millones de 2021. Como resultado, el mercado de indumentaria médica verá un aumento de la demanda en los próximos años.

- Aumenta la incidencia de enfermedades zoonóticas

Las infecciones zoonóticas son aquellas que se propagan espontáneamente de animales a personas y viceversa. Estas enfermedades pueden propagarse directamente a través del contacto directo con personas o animales infectados o a través del consumo de alimentos y agua contaminados que han estado expuestos al patógeno durante su preparación. Más del 75% de las enfermedades infecciosas emergentes en humanos tienen origen animal. En enero de 2020, un coronavirus fue responsable de la epidemia pandémica. Este virus fue etiquetado como una emergencia de salud pública de interés internacional y se cree que proviene de murciélagos o serpientes. Se prevé que la necesidad de ropa médica aumentará a medida que aumenta la prevalencia de enfermedades infecciosas.

Oportunidades

Los wearables médicos están utilizando los últimos avances tecnológicos, incluida la inteligencia artificial, para identificar estados fisiológicos anormales y alertar a las partes adecuadas. El desarrollo de la industria de la indumentaria médica puede beneficiarse de las oportunidades que ofrece la tecnología. Además, durante el período de proyección, habrá más posibilidades de crecimiento del mercado de indumentaria médica debido al creciente número de proveedores de servicios y a la expansión de los mercados.

Restricciones/Desafíos

- Regulaciones gubernamentales rígidas

Los dispositivos médicos incluyen uniformes, guantes, mascarillas y batas, todos los cuales necesitan la aprobación de la FDA. A menudo se fabrican para cumplir con niveles de protección que van desde un riesgo mínimo hasta un riesgo alto, según los peligros involucrados. La autorización de la indumentaria médica está sujeta a una serie de requisitos estrictos, que incluyen resistencia a las infecciones, resistencia a la tracción, resistencia al desgarro y niveles de barrera. La fabricación del producto se encarece debido a estas estrictas regulaciones y permisos, que pueden impedir la expansión del mercado.

Este informe sobre el mercado de ropa médica proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado por categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de ropa médica, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto de la COVID-19 en el mercado de ropa médica

El sector sanitario ha trasladado por completo su atención a la atención al paciente como resultado del creciente número de casos de COVID-19 en diferentes partes del mundo. El objetivo principal es reducir los efectos del virus, y los enérgicos esfuerzos del gobierno para promover la seguridad y la higiene han dado lugar a importantes inversiones en material médico. Por ejemplo, China declaró en abril de 2020 que aumentaría la producción de mascarillas a 116 millones al día, o 12 veces el nivel anterior a la pandemia. El brote del virus COVID-19 ha abierto una serie de oportunidades para los actores y productores del mercado mundial de indumentaria médica. La demanda de guantes, mascarillas y kits de EPI de grado médico ha aumentado recientemente, lo que ha impulsado la industria de la indumentaria médica.

Desarrollo reciente

- En julio de 2020, debido a la creciente necesidad de EPP, Herida Healthcare se asoció con North Tees, Hartlepool Solutions y el NHS para fabricar batas médicas extremadamente estériles.

Alcance del mercado de ropa médica en América del Norte

El mercado de indumentaria médica está segmentado en función del producto, el uso, el canal de distribución y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Producto

- Ropa profesional

- Ropa para pacientes

- Ropa especializada

- Ropa de primeros auxilios

- Envolturas y toallas

- Otros

Uso

- Reutilizable

- Desechable

Usuario final

- Hospitales

- Clínicas de especialidades

- Centros ambulatorios

- Configuración de atención domiciliaria

- Laboratorios de investigación y clínicos

- Otros

Canal de distribución

- Licitación directa

- Ventas al por menor

- Distribuidor externo

- Otros

Análisis y perspectivas regionales del mercado de ropa médica

Se analiza el mercado de ropa médica y se proporcionan información y tendencias del tamaño del mercado por país, producto, uso, canal de distribución y usuario final como se menciona anteriormente.

Los países cubiertos en el informe del mercado de ropa médica son Estados Unidos, Canadá y México en América del Norte.

Estados Unidos domina el mercado y lidera el crecimiento debido a la mayor presencia de actores clave del mercado en la región.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas abajo y aguas arriba, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de la indumentaria médica

El panorama competitivo del mercado de ropa médica proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de ropa médica.

Algunos de los principales actores que operan en el mercado de ropa médica son:

- Cardinal Health, Inc. (Estados Unidos)

- Mölnlycke Health Care AB (Suecia)

- 3M (Estados Unidos)

- Smith+Nephew (Reino Unido)

- Ansell Ltd. (Australia)

- Grupo Superior de Empresas (Estados Unidos)

- Semperit AG Holding (Austria)

- Henry Schein, Inc. (Estados Unidos)

- Narang Medical Ltd. (India)

- Manos sanadoras (Nueva Jersey)

- UNIFORMES BARCO (EE.UU.)

- UNIFORMES CHEROKEE (EE.UU.)

- Uniformes y prendas de trabajo de Aramark (EE. UU.)

- Carhartt, Inc. (Estados Unidos)

- LynkTrac Technologies LLC (Estados Unidos)

- Owens & Minor, Inc. (Estados Unidos)

- Prestigio Médico (CA)

- Uniformes Landau (Estados Unidos)

- Medline Industries, Inc. (Estados Unidos)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA MEDICAL CLOTHING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 REGULATORY

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 PANDEMIC OUTBREAK OF COVID-19

5.1.2 ESCALATION IN NUMBER OF SURGERIES

5.1.3 GROWING DEMAND FOR BETTER QUALITY HEALTHCARE AND HYGIENE

5.1.4 INCREASING GERIATRIC POPULATION

5.1.5 UPSURGE IN INCIDENCES OF CHRONIC DISEASES

5.2 RESTRAINTS

5.2.1 HIGH NUMBER PROBLEMS ASSOCIATED DURING DONNING AND DOFFING OF PPE

5.2.2 POOR COMFORT ABILITY

5.2.3 ALLERGIC REACTIONS ASSOCIATED WITH LATEX AND POWDERED GLOVES

5.3 OPPORTUNITIES

5.3.1 INTRODUCTION OF INNOVATIVE PRODUCT LAUNCHES

5.3.2 PARTNERSHIP AGREEMENT AND ACQUISITION

5.3.3 INCREASING PRODUCTION CAPACITY

5.4 CHALLENGES

5.4.1 STRINGENT REGULATION POLICIES

6 COVID-19 IMPACT ON NORTH AMERICA MEDICAL CLOTHING MARKET

6.1 PRICE IMPACT

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON DEMAND

6.4 STRATEGIC DECISIONS FOR MANUFACTURERS

6.5 CONCLUSION

7 NORTH AMERICA MEDICAL CLOTHING MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 PROFESSIONAL APPAREL

7.2.1 FACE MASKS

7.2.1.1 NON-WOVEN MASK

7.2.1.2 CLOTH MASK

7.2.2 SCRUBS

7.2.2.1 TYPE

7.2.2.1.1 TOPS

7.2.2.1.2 PANTS

7.2.2.1.3 JACKETS

7.2.2.1.4 CAPS

7.2.2.1.5 OTHERS

7.2.2.2 MATERIAL

7.2.2.2.1 WOVEN MEDICAL SCRUBS

7.2.2.2.2 NON-WOVEN MEDICAL SCRUBS

7.2.3 LAB COATS

7.2.3.1 Length

7.2.3.1.1 HIP LENGTH

7.2.3.1.2 KNEE LENGTH

7.2.3.2 TYPE

7.2.3.2.1 FLUID-RESISTANT LAB COAT

7.2.3.2.2 STATIC-RESISTANT LAB COAT

7.2.4 HEADWEAR

7.2.4.1 BOUFFANT CAPS

7.2.4.1.1 COMFORT BOUFFANT CAPS

7.2.4.1.2 PREMIUM BOUFFANT CAPS

7.2.4.1.3 OTHERS

7.2.4.2 BEARD COVERS

7.2.5 SHOE COVERS

7.2.5.1 NON-CONDUCTIVE

7.2.5.2 NON-SKID

7.3 PATIENT APPAREL

7.3.1 TYPE

7.3.1.1 IV GOWN WITH SNAP SLEEVE CLOSURE

7.3.1.2 PLUS SIZE TEAL GOWNS

7.3.1.3 COMPLETE COVERAGE GOWNS

7.3.1.4 PEDIATRIC GOWN

7.3.1.5 OTHERS

7.3.2 MATERIAL

7.3.2.1 REINFORCED TISSUE

7.3.2.2 NON-WOVEN

7.3.2.3 OTHERS

7.4 SPECIALTY APPAREL

7.4.1 ISOLATION GOWNS

7.4.1.1 AAMI ISOLATION GOWN

7.4.1.1.1 LEVEL 1

7.4.1.1.2 LEVEL 4

7.4.1.1.3 LEVEL 3

7.4.1.1.4 LEVEL 2

7.4.1.2 TRI-LAYER SMS GOWN

7.4.1.3 SPUNBOND POLYPROPYLENE GOWN

7.4.1.4 OTHERS

7.4.2 COVERALLS

7.4.2.1 TYPE

7.4.2.1.1 MEDIUM WEIGHT COVERALLS

7.4.2.1.2 HEAVY WEIGHT COVERALLS

7.4.2.2 MATERIAL

7.4.2.2.1 POLYETHYLENE

7.4.2.2.2 SMS MATERIAL

7.4.2.2.3 OTHERS

7.4.3 APRONS

7.4.3.1 COTTON APRON

7.4.3.2 PLASTIC APRON

7.4.3.3 NON-WOVEN APRON

7.4.3.4 OTHERS

7.4.4 OTHERS

7.5 FIRST AID CLOTHING

7.5.1 HEALTHCARE EMERGENCIES

7.5.2 CIVIL PROTECTION

7.6 WRAPS & TOWELS

7.6.1 WASH TOWELS

7.6.2 DOCTOR TOWELS

7.6.3 SURGICAL TOWELS

7.7 OTHERS

8 NORTH AMERICA MEDICAL CLOTHING MARKET, BY USAGE

8.1 OVERVIEW

8.2 DISPOSABLE

8.3 REUSABLE

9 NORTH AMERICA MEDICAL CLOTHING MARKET, BY END USER

9.1 OVERVIEW

9.2 HOSPITALS

9.3 SPECIALTY CLINICS

9.4 AMBULATORY CENTERS

9.5 RESEARCH & CLINICAL LABORATORIES

9.6 HOME CARE SETTINGS

9.7 OTHERS

10 NORTH AMERICA MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT TENDER

10.3 THIRD PARTY DISTRIBUTOR

10.4 RETAIL SALES

10.5 OTHERS

11 NORTH AMERICA MEDICAL CLOTHING MARKET, BY GEOGRAPHY

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA MEDICAL CLOTHING MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT

14 COMPANY PROFILES

14.1 CARDINAL HEALTH

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 MEDLINE INDUSTRIES, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 OWENS & MINOR, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 ARAMARK UNIFORM & CAREER APPAREL (A SUBSIDIARY OF ARAMARK)

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 MÖLNLYCKE HEALTH CARE AB (A SUBSIDIARY OF INVESTOR AB)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 LANDAU UNIFORMS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 3M

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 ABG UNIFORMS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 ANSELL LTD.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 BARCO UNIFORMS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 BBN MEDICAL EQUIPMENT

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 CARHARTT, INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 CHEROKEE UNIFORMS.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 HEALING HANDS

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 HENRY SCHEIN, INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

14.16 LYNKTRAC TECHNOLOGIES LLC

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 NARANG MEDICAL LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 SEMPERIT AG HOLDING

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 SUPERIOR GROUP OF COMPANIES

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

14.2 PRESTIGE MEDICAL.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

LIST OF TABLES

TABLE 1 POPULATION AGES 65 AND ABOVE

TABLE 2 NORTH AMERICA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 3 NORTH AMERICA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (UNITS)

TABLE 4 NORTH AMERICA PROFESSIONAL APPAREL IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 5 NORTH AMERICA PROFESSIONAL APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 6 NORTH AMERICA FACE MASKS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 7 NORTH AMERICA SCRUBS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 8 NORTH AMERICA SCRUBS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 9 NORTH AMERICA LAB COATS IN MEDICAL CLOTHING MARKET, BY LENGTH, 2018-2027 (USD MILLION)

TABLE 10 NORTH AMERICA LAB COATS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 11 NORTH AMERICA HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 12 NORTH AMERICA BOUFFANT CAPS HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 13 NORTH AMERICA SHOE COVERS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 14 NORTH AMERICA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 15 NORTH AMERICA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 16 NORTH AMERICA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 17 NORTH AMERICA SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 18 NORTH AMERICA SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 19 NORTH AMERICA ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 20 NORTH AMERICA AAMI ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 21 NORTH AMERICA COVERALLS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 22 NORTH AMERICA COVERALLS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 23 NORTH AMERICA APRONS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 24 NORTH AMERICA FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 25 NORTH AMERICA FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 26 NORTH AMERICA WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 27 NORTH AMERICA WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 28 NORTH AMERICA OTHERS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 29 NORTH AMERICA MEDICAL CLOTHING MARKET, BY USAGE, 2018-2027 (USD MILLION)

TABLE 30 NORTH AMERICA DISPOSABLE IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 31 NORTH AMERICA REUSABLE IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 32 NORTH AMERICA MEDICAL CLOTHING MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 33 NORTH AMERICA HOSPITALS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 34 NORTH AMERICA SPECIALTY CLINICS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 35 NORTH AMERICA AMBULATORY CENTERS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 36 NORTH AMERICA RESEARCH & CLINICAL LABORATORIES IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 37 NORTH AMERICA HOME CARE SETTINGS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 38 NORTH AMERICA OTHERS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 39 NORTH AMERICA MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 40 NORTH AMERICA DIRECT TENDER IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 41 NORTH AMERICA THIRD PARTY DISTRIBUTOR IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 42 NORTH AMERICA RETAIL SALES IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 43 NORTH AMERICA OTHERS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 44 NORTH AMERICA MEDICAL CLOTHING MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 45 NORTH AMERICA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 46 NORTH AMERICA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (UNITS)

TABLE 47 NORTH AMERICA PROFESSIONAL APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 48 NORTH AMERICA FACE MASKS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 49 NORTH AMERICA SCRUBS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 50 NORTH AMERICA SCRUBS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 51 NORTH AMERICA LAB COATS IN MEDICAL CLOTHING MARKET, BY LENGTH, 2018-2027 (USD MILLION)

TABLE 52 NORTH AMERICA LAB COATS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 53 NORTH AMERICA HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 54 NORTH AMERICA BOUFFANT CAPS HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 55 NORTH AMERICA SHOE COVERS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 56 NORTH AMERICA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 57 NORTH AMERICA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 58 NORTH AMERICA SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 59 NORTH AMERICA ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 60 NORTH AMERICA AAMI ISOLATION IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 61 NORTH AMERICA COVERALLS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 62 NORTH AMERICA COVERALLS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 63 NORTH AMERICA APRONS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 64 NORTH AMERICA FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 65 NORTH AMERICA WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 66 NORTH AMERICA MEDICAL CLOTHING MARKET, BY USAGE, 2018-2027 (USD MILLION)

TABLE 67 NORTH AMERICA MEDICAL CLOTHING MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 68 NORTH AMERICA MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 69 U.S. MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 70 U.S. MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (UNITS)

TABLE 71 U.S. PROFESSIONAL APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 72 U.S. FACE MASKS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 73 U.S. SCRUBS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 74 U.S. SCRUBS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 75 U.S. LAB COATS IN MEDICAL CLOTHING MARKET, BY LENGTH, 2018-2027 (USD MILLION)

TABLE 76 U.S. LAB COATS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 77 U.S. HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 78 U.S. BOUFFANT CAPS HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 79 U.S. SHOE COVERS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 80 U.S. PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 81 U.S. PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 82 U.S. SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 83 U.S. ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 84 U.S. AAMI ISOLATION IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 85 U.S. COVERALLS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 86 U.S. COVERALLS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 87 U.S. APRONS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 88 U.S. FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 89 U.S. WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 90 U.S. MEDICAL CLOTHING MARKET, BY USAGE, 2018-2027 (USD MILLION)

TABLE 91 U.S. MEDICAL CLOTHING MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 92 U.S. MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 93 CANADA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 94 CANADA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (UNITS)

TABLE 95 CANADA PROFESSIONAL APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 96 CANADA FACE MASKS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 97 CANADA SCRUBS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 98 CANADA SCRUBS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 99 CANADA LAB COATS IN MEDICAL CLOTHING MARKET, BY LENGTH, 2018-2027 (USD MILLION)

TABLE 100 CANADA LAB COATS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 101 CANADA HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 102 CANADA BOUFFANT CAPS HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 103 CANADA SHOE COVERS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 104 CANADA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 105 CANADA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 106 CANADA SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 107 CANADA ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 108 CANADA AAMI ISOLATION IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 109 CANADA COVERALLS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 110 CANADA COVERALLS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 111 CANADA APRONS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 112 CANADA FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 113 CANADA WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 114 CANADA MEDICAL CLOTHING MARKET, BY USAGE, 2018-2027 (USD MILLION)

TABLE 115 CANADA MEDICAL CLOTHING MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 116 CANADA MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 117 MEXICO MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 118 MEXICO MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (UNITS)

TABLE 119 MEXICO PROFESSIONAL APPAREL IN MEXICO MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 120 MEXICO FACE MASKS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 121 MEXICO SCRUBS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 122 MEXICO SCRUBS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 123 MEXICO LAB COATS IN MEDICAL CLOTHING MARKET, BY LENGTH, 2018-2027 (USD MILLION)

TABLE 124 MEXICO LAB COATS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 125 MEXICO HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 126 MEXICO BOUFFANT CAPS HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 127 MEXICO SHOE COVERS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 128 MEXICO PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 129 MEXICO PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 130 MEXICO SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 131 MEXICO ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 132 MEXICO AAMI ISOLATION IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 133 MEXICO COVERALLS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 134 MEXICO COVERALLS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 135 MEXICO APRONS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 136 MEXICO FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 137 MEXICO WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 138 MEXICO MEDICAL CLOTHING MARKET, BY USAGE, 2018-2027 (USD MILLION)

TABLE 139 MEXICO MEDICAL CLOTHING MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 140 MEXICO MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

Lista de figuras

LIST OF FIGURES

FIGURE 1 NORTH AMERICA MEDICAL CLOTHING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MEDICAL CLOTHING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MEDICAL CLOTHING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MEDICAL CLOTHING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MEDICAL CLOTHING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MEDICAL CLOTHING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MEDICAL CLOTHING MARKET: MARKET END USER COVERAGE GRID

FIGURE 8 NORTH AMERICA MEDICAL CLOTHING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA MEDICAL CLOTHING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA MEDICAL CLOTHING MARKET: SEGMENTATION

FIGURE 11 PROFESSIONAL APPAREL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MEDICAL CLOTHING MARKET IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF NORTH AMERICA MEDICAL CLOTHING MARKET

FIGURE 13 NORTH AMERICA MEDICAL CLOTHING MARKET: BY PRODUCT, 2019

FIGURE 14 NORTH AMERICA MEDICAL CLOTHING MARKET: BY PRODUCT, 2019-2027 (USD MILLION)

FIGURE 15 NORTH AMERICA MEDICAL CLOTHING MARKET: BY PRODUCT, CAGR (2020-2027)

FIGURE 16 NORTH AMERICA MEDICAL CLOTHING MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 17 NORTH AMERICA MEDICAL CLOTHING MARKET: BY USAGE, 2019

FIGURE 18 NORTH AMERICA MEDICAL CLOTHING MARKET: BY USAGE, 2019-2027 (USD MILLION)

FIGURE 19 NORTH AMERICA MEDICAL CLOTHING MARKET: BY USAGE, CAGR (2020-2027)

FIGURE 20 NORTH AMERICA MEDICAL CLOTHING MARKET: BY USAGE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA MEDICAL CLOTHING MARKET: BY END USER, 2019

FIGURE 22 NORTH AMERICA MEDICAL CLOTHING MARKET: BY END USER, 2019-2027 (USD MILLION)

FIGURE 23 NORTH AMERICA MEDICAL CLOTHING MARKET: BY END USER, CAGR (2020-2027)

FIGURE 24 NORTH AMERICA MEDICAL CLOTHING MARKET: BY END USER, LIFELINE CURVE

FIGURE 25 NORTH AMERICA MEDICAL CLOTHING MARKET: BY DISTRIBUTION CHANNEL, 2019

FIGURE 26 NORTH AMERICA MEDICAL CLOTHING MARKET: BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

FIGURE 27 NORTH AMERICA MEDICAL CLOTHING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2020-2027)

FIGURE 28 NORTH AMERICA MEDICAL CLOTHING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 29 NORTH AMERICA MEDICAL CLOTHING MARKET: SNAPSHOT (2019)

FIGURE 30 NORTH AMERICA MEDICAL CLOTHING MARKET: BY COUNTRY (2019)

FIGURE 31 NORTH AMERICA MEDICAL CLOTHING MARKET: BY COUNTRY (2020 & 2027)

FIGURE 32 NORTH AMERICA MEDICAL CLOTHING MARKET: BY COUNTRY (2020 & 2027)

FIGURE 33 NORTH AMERICA MEDICAL CLOTHING MARKET: BY PRODUCT (2018-2027)

FIGURE 34 NORTH AMERICA MEDICAL CLOTHING MARKET: COMPANY SHARE 2019 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.