North America Lyophilized Injectable Drugs Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

2.63 Billion

USD

4.09 Billion

2024

2032

USD

2.63 Billion

USD

4.09 Billion

2024

2032

| 2025 –2032 | |

| USD 2.63 Billion | |

| USD 4.09 Billion | |

|

|

|

|

Segmentación del mercado norteamericano de fármacos inyectables liofilizados por envase (viales, jeringas de doble cámara, cartuchos de doble cámara y otros), clase de fármaco (antiinfecciosos, antineoplásicos, diuréticos, inhibidores de la bomba de protones, anestésicos, anticoagulantes, AINE, corticosteroides y otros), forma (polvo y líquido), indicación (oncología, enfermedades autoinmunes, trastornos hormonales, enfermedades respiratorias, trastornos gastrointestinales, trastornos dermatológicos, enfermedades oftálmicas y otras), vía de administración (intravenosa/infusión, intramuscular y otras), usuario final (hospitales, clínicas, atención domiciliaria y otros), canal de distribución (licitación directa, venta minorista y otros): tendencias del sector y previsiones hasta 2032.

Tamaño del mercado de fármacos inyectables liofilizados en América del Norte

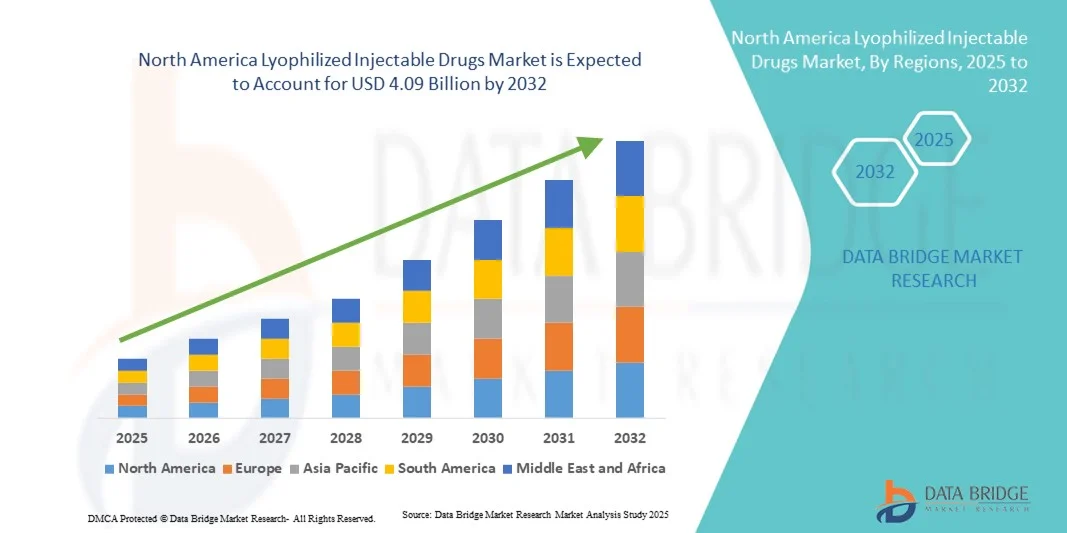

- El tamaño del mercado de medicamentos inyectables liofilizados en Norteamérica se valoró en 2.630 millones de dólares en 2024 y se espera que alcance los 4.090 millones de dólares en 2032 , con una tasa de crecimiento anual compuesta (TCAC) del 5,7% durante el período de pronóstico.

- El crecimiento del mercado se debe principalmente a la creciente demanda de formulaciones estables y de larga duración, y a la creciente prevalencia de enfermedades crónicas e infecciosas , que requieren terapias inyectables eficaces.

- Además, la creciente cartera de productos biológicos y biosimilares, junto con los avances tecnológicos en los procesos de liofilización y los sistemas de envasado, está impulsando la adopción de inyectables liofilizados en los sectores farmacéutico y biotecnológico . Estas tendencias, en conjunto, están impulsando la expansión del mercado en toda Norteamérica.

Análisis del mercado de fármacos inyectables liofilizados en Norteamérica

- Los fármacos inyectables liofilizados, formulados mediante liofilización para mejorar la estabilidad, la solubilidad y la vida útil del producto, son cada vez más importantes en las industrias farmacéutica y biotecnológica para productos biológicos, vacunas y moléculas pequeñas complejas que requieren conservación a largo plazo.

- La creciente demanda de medicamentos inyectables liofilizados se debe principalmente a la mayor prevalencia de enfermedades crónicas e infecciosas, la expansión de la cartera de productos biológicos y biosimilares, y la creciente necesidad de formulaciones termoestables que garanticen la eficacia del medicamento durante el almacenamiento y el transporte.

- Estados Unidos dominó el mercado norteamericano de medicamentos inyectables liofilizados con la mayor cuota de ingresos (80,1%) en 2024, gracias a su avanzada infraestructura de fabricación, sus sólidas capacidades de I+D y la importante presencia de empresas farmacéuticas y biotecnológicas líderes centradas en la producción de inyectables estériles.

- Se prevé que Canadá sea el país de mayor crecimiento en el mercado norteamericano de medicamentos inyectables liofilizados durante el período de pronóstico, impulsado por el aumento de las inversiones en investigación biofarmacéutica y la expansión de las instalaciones de fabricación por contrato.

- El segmento de viales dominó el mercado norteamericano de medicamentos inyectables liofilizados con una cuota de mercado del 43,9% en 2024, impulsado por su uso generalizado en hospitales y laboratorios para el almacenamiento seguro, la fácil manipulación y la compatibilidad con una amplia gama de formulaciones inyectables.

Alcance del informe y segmentación del mercado de fármacos inyectables liofilizados en Norteamérica

|

Atributos |

Información clave del mercado norteamericano de fármacos inyectables liofilizados |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Principales actores del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de datos de valor añadido |

Además de información sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado elaborados por Data Bridge Market Research también incluyen análisis exhaustivos de expertos, epidemiología de pacientes, análisis de proyectos en desarrollo, análisis de precios y marco regulatorio. |

Tendencias del mercado de fármacos inyectables liofilizados en Norteamérica

Adopción creciente de la liofilización automatizada y las tecnologías de un solo uso

- Una tendencia significativa y en auge en el mercado norteamericano de medicamentos inyectables liofilizados es la integración de sistemas de liofilización automatizados y tecnologías de un solo uso, lo que mejora la eficiencia del proceso, la garantía de esterilidad y la rentabilidad en la fabricación farmacéutica.

- Por ejemplo, OPTIMA Packaging Group introdujo líneas de liofilización automatizadas avanzadas que minimizan la manipulación manual y el riesgo de contaminación, mejorando el rendimiento general de la producción y la estabilidad del producto. De manera similar, GEA Group AG ha ampliado sus soluciones de liofilización de un solo uso para optimizar la fabricación de lotes pequeños y a escala clínica.

- La automatización en la liofilización permite la monitorización en tiempo real, el control preciso de la temperatura y la optimización basada en datos, lo que reduce significativamente la variabilidad en los ciclos de secado y mejora la uniformidad del producto en lotes de gran escala. Por ejemplo, SP Scientific implementa sistemas de control de procesos con inteligencia artificial que aprenden de ciclos anteriores para garantizar una calidad de producto constante y la reproducibilidad del ciclo.

- La adopción de sistemas de liofilización automatizados y modulares permite a los fabricantes mejorar la flexibilidad, la escalabilidad y el cumplimiento de las estrictas normas regulatorias, en particular para productos biológicos y vacunas de alto valor que requieren condiciones de liofilización precisas.

- Esta tendencia hacia procesos de liofilización tecnológicamente avanzados, integrados con datos y modulares está transformando el panorama de la fabricación de medicamentos inyectables en toda Norteamérica, impulsando la eficiencia y la fiabilidad en la producción de medicamentos estériles. En consecuencia, empresas como Baxter BioPharma Solutions y Lonza están invirtiendo fuertemente en salas de liofilización automatizadas equipadas con robótica y capacidades de análisis en tiempo real.

- La creciente demanda de formulaciones inyectables de alta calidad, estables y de rápida reconstitución está impulsando la adopción generalizada de tecnologías de liofilización automatizadas y de un solo uso en organizaciones de fabricación por contrato y grandes empresas farmacéuticas.

Dinámica del mercado de fármacos inyectables liofilizados en Norteamérica

Conductor

Expansión de la cartera de productos biológicos y demanda de soluciones de estabilidad a largo plazo

- El creciente interés en los productos biológicos, biosimilares y terapias basadas en péptidos, junto con la creciente prevalencia de enfermedades crónicas, es un factor clave que acelera la demanda de medicamentos inyectables liofilizados en toda Norteamérica.

- Por ejemplo, en febrero de 2024, Pfizer anunció la ampliación de su planta de fabricación de inyectables estériles en Michigan para aumentar la capacidad de liofilización de productos biológicos y fármacos basados en ARNm, lo que refleja la creciente demanda de productos estables y de larga duración.

- Dado que los fármacos biológicos son altamente sensibles a la temperatura y la humedad, la liofilización proporciona una mayor estabilidad, manteniendo la eficacia del producto y prolongando su vida útil, lo que la convierte en el método de formulación preferido para los inyectables.

- Además, el creciente número de aprobaciones de la FDA para medicamentos liofilizados y la expansión de los programas de I+D biofarmacéutica están impulsando el crecimiento del mercado al fomentar la inversión en tecnologías de formulación avanzadas.

- El uso generalizado de inyectables liofilizados en oncología, enfermedades autoinmunes y tratamientos de enfermedades infecciosas subraya su importancia en la terapéutica moderna, al proporcionar una solución fiable para el almacenamiento y la distribución global. Se prevé que la transición hacia los productos biológicos y la medicina de precisión impulse aún más la demanda de medicamentos liofilizados avanzados.

- La creciente colaboración entre las compañías farmacéuticas y las organizaciones de desarrollo y fabricación por contrato (CDMO) especializadas en servicios de liofilización está mejorando aún más la capacidad, la innovación tecnológica y la expansión del mercado en toda la región.

Restricción/Desafío

Altos costos de producción y estrictos requisitos de cumplimiento normativo

- La complejidad y la elevada inversión de capital que requieren los procesos de liofilización, junto con la necesidad de equipos especializados y entornos altamente controlados, supone un reto importante para su adopción generalizada entre los fabricantes pequeños y medianos.

- Por ejemplo, establecer una sala de liofilización que cumpla con las normas requiere inversiones multimillonarias en cámaras de vacío, infraestructura de salas blancas y sistemas de validación, lo que crea barreras financieras para las empresas biotecnológicas emergentes.

- El cumplimiento normativo con los estrictos estándares de calidad de la FDA y la EMA incrementa la carga operativa, ya que cada formulación liofilizada requiere una validación exhaustiva, pruebas de estabilidad y documentación del proceso. Por ejemplo, los retrasos regulatorios o los lotes de validación fallidos pueden afectar significativamente los plazos de producción y la rentabilidad general de las empresas farmacéuticas.

- La alta demanda energética de la liofilización, junto con la experiencia técnica necesaria para optimizar los ciclos de secado, incrementa aún más los costes operativos y limita la escalabilidad para los fabricantes con recursos limitados.

- Además, los ciclos de producción prolongados y los procesos por lotes reducen la productividad en comparación con los inyectables líquidos, lo que conlleva plazos de entrega más largos y mayores gastos de producción que pueden afectar a la competitividad de los precios. Si bien están surgiendo tecnologías de liofilización continua y automatizada, su implementación generalizada sigue siendo gradual debido a los desafíos técnicos y de costos.

- Superar estas limitaciones mediante la optimización de procesos, una mayor automatización y alianzas estratégicas con CDMO que ofrecen capacidades avanzadas de liofilización será esencial para mejorar la eficiencia y reducir los costes de producción a largo plazo.

Alcance del mercado de fármacos inyectables liofilizados en Norteamérica

El mercado está segmentado en función del envase, la clase de fármaco, la forma farmacéutica, la indicación, la vía de administración, el usuario final y el canal de distribución.

- Por embalaje

Según el tipo de envase, el mercado norteamericano de medicamentos inyectables liofilizados se segmenta en viales, jeringas de doble cámara, cartuchos de doble cámara y otros. Los viales dominaron el mercado en 2024 con la mayor cuota de ingresos, gracias a su amplia compatibilidad con diversas formulaciones liofilizadas y a su fabricación rentable. Los viales ofrecen mayor protección contra la humedad y la contaminación, lo que prolonga la vida útil de los inyectables termosensibles, como los productos biológicos y las vacunas. La industria farmacéutica sigue prefiriendo los viales debido a su eficacia demostrada en los procesos de liofilización y a su amplia aceptación en hospitales e instituciones. Además, la extensa disponibilidad de viales de vidrio y polímero ofrece flexibilidad a los fabricantes y centros sanitarios, lo que mantiene el dominio de este segmento en la región.

Se prevé que las jeringas de doble cámara experimenten el mayor crecimiento entre 2025 y 2032. La creciente preferencia por los formatos inyectables listos para usar, tanto por parte de los profesionales sanitarios como de los pacientes, impulsa su adopción. Las jeringas de doble cámara permiten la reconstitución inmediata del fármaco antes de su administración, lo que reduce el tiempo de preparación y los riesgos de contaminación. Estos dispositivos son especialmente adecuados para la atención de urgencias y las terapias biológicas que requieren una administración rápida. Su diseño ergonómico también facilita la autoadministración en entornos de atención domiciliaria, en consonancia con la creciente tendencia hacia sistemas de administración de fármacos personalizados y prácticos en Norteamérica.

- Por clase de fármaco

Según la clase de fármaco, el mercado se segmenta en antiinfecciosos, antineoplásicos, diuréticos, inhibidores de la bomba de protones, anestésicos, anticoagulantes, AINE, corticosteroides y otros. Los fármacos antineoplásicos dominaron el mercado en 2024 debido a la creciente incidencia del cáncer y al papel fundamental de la liofilización en la estabilización de los inyectables oncológicos. Muchos anticuerpos monoclonales y agentes citotóxicos requieren formas liofilizadas para mantener su potencia y prolongar su vida útil. La avanzada infraestructura oncológica de la región y los ensayos clínicos en curso de productos biológicos inyectables para el tratamiento del cáncer refuerzan aún más el liderazgo de este segmento. La creciente demanda de terapias oncológicas dirigidas e inmuno-oncológicas sigue impulsando la necesidad de productos antineoplásicos liofilizados estables en toda Norteamérica.

Se prevé que los fármacos antiinfecciosos experimenten el crecimiento más rápido entre 2025 y 2032. La creciente resistencia antimicrobiana y una mayor concienciación sobre el manejo de infecciones han elevado la demanda de antibióticos inyectables estables y de larga duración. La liofilización mejora la estabilidad de las formulaciones de β-lactámicos, glicopéptidos y macrólidos, lo que garantiza su eficacia en entornos de cuidados intensivos. Además, los frecuentes brotes de enfermedades infecciosas e infecciones nosocomiales han acelerado la transición hacia los antiinfecciosos liofilizados, que ofrecen una mayor vida útil y reducen el desperdicio, lo que fortalece la trayectoria de crecimiento de este segmento.

- Por formulario

Según su presentación, el mercado se divide en polvo y líquido. Las formulaciones en polvo dominaron el mercado en 2024 debido a su superior estabilidad química y física. Estas formulaciones son menos propensas a la degradación y la contaminación microbiana, lo que las hace ideales para productos biológicos, péptidos y vacunas. Los inyectables liofilizados en polvo también reducen la necesidad de transporte refrigerado, disminuyendo así los costos logísticos para los fabricantes farmacéuticos. Su larga vida útil y su rendimiento constante en diversas condiciones ambientales los convierten en la opción preferida para la producción a gran escala y el suministro hospitalario en Norteamérica.

Se prevé que las formulaciones líquidas experimenten el crecimiento más rápido entre 2025 y 2032, impulsadas por la creciente demanda de productos inyectables listos para administrar y precargados. Los fármacos líquidos liofilizados simplifican la administración al minimizar los pasos de preparación y reducir los errores de manipulación. Los avances en el procesamiento aséptico y las tecnologías crioprotectoras han mejorado la estabilidad de los inyectables líquidos, ampliando su aplicabilidad en terapias para enfermedades crónicas. Además, la creciente adopción de formulaciones líquidas en la medicina personalizada y la atención domiciliaria respalda su rápido crecimiento.

- Por indicación

Según la indicación, el mercado se segmenta en oncología, enfermedades autoinmunes, trastornos hormonales, enfermedades respiratorias, trastornos gastrointestinales, trastornos dermatológicos, enfermedades oftalmológicas y otras. La oncología fue la principal indicación en 2024, con la mayor cuota de mercado. El dominio de este segmento se debe a la alta prevalencia del cáncer y a la necesidad de fármacos liofilizados en quimioterapia y formulaciones biológicas. La liofilización garantiza la estabilidad de moléculas complejas como anticuerpos y péptidos, fundamentales para los tratamientos oncológicos modernos. El creciente interés en biosimilares y terapias dirigidas, junto con la sólida cartera de I+D oncológica en EE. UU. y Canadá, sigue respaldando el liderazgo de este segmento en el mercado.

Se prevé que las enfermedades autoinmunes constituyan el segmento de indicación de mayor crecimiento hasta 2032. La creciente incidencia de afecciones como la artritis reumatoide, el lupus y la esclerosis múltiple ha generado una fuerte demanda de medicamentos biológicos inyectables. Los fármacos liofilizados son esenciales para mantener la estabilidad de las proteínas y la eficacia terapéutica en estos tratamientos crónicos. El auge de las formulaciones subcutáneas y los medicamentos biológicos de autoadministración también impulsa la expansión de este segmento. Además, la preferencia de los pacientes por las soluciones de autocuidado y la ampliación de la cobertura de reembolso están favoreciendo la aceleración del mercado en esta categoría.

- Por vía administrativa

Según la vía de administración, el mercado se segmenta en intravenosa/infusión, intramuscular y otras. La administración intravenosa/infusión dominó el mercado en 2024, gracias a su uso generalizado en hospitales para tratamientos oncológicos, antiinfecciosos y de urgencias. Esta vía permite una dosificación precisa y una rápida absorción sistémica, cruciales para los tratamientos en cuidados intensivos. Los inyectables liofilizados se reconstituyen con frecuencia para su uso intravenoso, lo que ofrece un mejor control de la esterilidad y la precisión de la dosis. La presencia de una infraestructura de infusión bien desarrollada y personal de enfermería cualificado en toda Norteamérica contribuye aún más al dominio continuo de este segmento.

Se prevé que la administración intramuscular registre la tasa de crecimiento anual compuesto (TCAC) más rápida entre 2025 y 2032. El aumento en el uso de formulaciones intramusculares para vacunas, terapias hormonales e inyectables de depósito de acción prolongada impulsa este crecimiento. Las presentaciones liofilizadas ofrecen mayor estabilidad y permiten una liberación sostenida, lo que mejora la adherencia al tratamiento. Este segmento también se beneficia del aumento de las iniciativas de vacunación, en particular contra la influenza, el VPH y las enfermedades infecciosas emergentes, lo que convierte a los inyectables intramusculares liofilizados en un foco de creciente interés tanto en la medicina preventiva como en la terapéutica.

- Por usuario final

Según el usuario final, el mercado se segmenta en hospitales, clínicas, atención domiciliaria y otros. Los hospitales dominaron el mercado en 2024, debido a su amplio uso de inyectables liofilizados para oncología, enfermedades infecciosas y cuidados intensivos. Los hospitales gestionan grandes volúmenes de compras mediante sistemas de licitación directa, lo que garantiza un suministro constante para los tratamientos de pacientes hospitalizados. Las formulaciones liofilizadas son las preferidas en este contexto por su mayor vida útil, garantía de esterilidad y gestión de inventario rentable. Además, la integración de sistemas de farmacia automatizados y unidades de preparación estéril mejora la utilización de estos productos en los hospitales de toda Norteamérica.

Se prevé que la atención médica domiciliaria experimente el crecimiento más rápido entre 2025 y 2032. El auge de la autoadministración y el tratamiento en el hogar de enfermedades crónicas impulsa la demanda de inyectables liofilizados, prácticos y fáciles de usar para el paciente. Las jeringas precargadas de doble cámara y los autoinyectores permiten una fácil reconstitución y uso sin supervisión profesional. La ampliación de las políticas de reembolso para los servicios de infusión domiciliaria y el creciente envejecimiento de la población refuerzan aún más esta tendencia, marcando un marcado cambio hacia modelos de atención descentralizados.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en licitación directa, venta minorista y otros. La distribución por licitación directa dominó el mercado en 2024, impulsada por las compras de gran volumen realizadas por hospitales, agencias gubernamentales y sistemas de salud. Este canal garantiza un suministro estable, precios negociados y una calidad de producto uniforme para todos los compradores institucionales. Los fabricantes farmacéuticos prefieren los acuerdos de licitación directa para fortalecer las relaciones con los principales proveedores de atención médica y optimizar la eficiencia logística. Esta tendencia es particularmente marcada en Estados Unidos, donde las organizaciones de compras grupales (GPO, por sus siglas en inglés) facilitan los pedidos centralizados al por mayor de inyectables liofilizados.

Se prevé que las ventas minoristas experimenten el crecimiento más rápido entre 2025 y 2032, impulsadas por la expansión de las redes de farmacias especializadas y el mayor acceso de los pacientes a medicamentos biológicos inyectables. La mejora de la logística de la cadena de frío y las plataformas de farmacia digital permiten la distribución segura de medicamentos liofilizados sensibles a la temperatura. El creciente uso de inyectables para enfermedades crónicas, junto con los programas de apoyo al paciente, impulsa las ventas a través de farmacias físicas y en línea. El crecimiento de este segmento refleja la tendencia generalizada hacia entornos de terapia ambulatoria y autogestionada en toda Norteamérica.

Análisis regional del mercado de fármacos inyectables liofilizados en Norteamérica

- Estados Unidos dominó el mercado norteamericano de medicamentos inyectables liofilizados con la mayor cuota de ingresos (80,1%) en 2024, gracias a su avanzada infraestructura de fabricación, sus sólidas capacidades de I+D y la importante presencia de empresas farmacéuticas y biotecnológicas líderes centradas en la producción de inyectables estériles.

- El liderazgo de la región se apoya en una actividad avanzada de ensayos clínicos, numerosos centros biotecnológicos y grandes organizaciones de desarrollo y fabricación por contrato (CDMO) especializadas en liofilización y llenado aséptico, lo que garantiza una rápida ampliación de la producción desde el laboratorio hasta los volúmenes comerciales.

- Una sólida infraestructura sanitaria y un elevado volumen de compras por parte de hospitales y clínicas especializadas, junto con marcos de reembolso favorables y la compra centralizada por parte de los grandes sistemas de salud, mantienen la demanda de inyectables liofilizados estables y de larga duración.

Perspectivas del mercado estadounidense de fármacos inyectables liofilizados

En 2024, el mercado estadounidense de medicamentos inyectables liofilizados acaparó la mayor cuota de ingresos en Norteamérica, con un 80,1%, impulsado por un ecosistema farmacéutico y biotecnológico consolidado. El dominio del país se debe a la extensa producción de productos biológicos y biosimilares, una sólida infraestructura para la investigación clínica y la presencia de importantes CDMO especializadas en tecnología de liofilización. La creciente demanda de formulaciones inyectables estables para tratamientos oncológicos, autoinmunes e infecciosos sigue impulsando el crecimiento del mercado. Además, las aprobaciones favorables de la FDA, la mayor adopción de terapias personalizadas y los avances en los procesos de llenado estéril y liofilización están fomentando la innovación de productos. La transición hacia sistemas de administración listos para usar y de doble cámara refuerza aún más el liderazgo del mercado estadounidense.

Perspectivas del mercado canadiense de fármacos inyectables liofilizados

Se prevé que el mercado canadiense de medicamentos inyectables liofilizados experimente un crecimiento anual compuesto (CAGR) constante durante el período de pronóstico, impulsado por el aumento del gasto sanitario en el país y el firme compromiso del gobierno con la mejora de la capacidad de producción farmacéutica nacional. La creciente incidencia de enfermedades crónicas como el cáncer y los trastornos autoinmunitarios está impulsando la demanda de medicamentos inyectables biológicos y especializados. Las empresas farmacéuticas canadienses están invirtiendo cada vez más en tecnologías de liofilización e infraestructura de cadena de frío para garantizar la calidad del producto y prolongar su vida útil. Además, la colaboración entre empresas multinacionales y organizaciones de desarrollo y fabricación por contrato (CDMO) locales está mejorando la producción de medicamentos biológicos inyectables estériles. La creciente preferencia por las formulaciones precargadas y reconstituibles también contribuye al crecimiento sostenido del mercado.

Perspectivas del mercado mexicano de medicamentos inyectables liofilizados

Se prevé que el mercado mexicano de medicamentos inyectables liofilizados experimente un crecimiento significativo durante el período de pronóstico, impulsado por la ampliación del acceso a la atención médica y el aumento de la subcontratación farmacéutica. El entorno de fabricación rentable de México y su proximidad a Estados Unidos atraen inversiones de productores farmacéuticos globales que buscan capacidad de producción regional. La creciente prevalencia de enfermedades infecciosas y crónicas incrementa la demanda de medicamentos inyectables estables y fáciles de transportar. Las iniciativas gubernamentales para fortalecer la fabricación nacional de productos biológicos y simplificar los procesos regulatorios estimulan aún más el crecimiento del mercado. Además, la mejora de la infraestructura sanitaria y la expansión de la red de hospitales privados fomentan una mayor adopción de inyectables liofilizados en diversas categorías terapéuticas.

Cuota de mercado de fármacos inyectables liofilizados en Norteamérica

La industria de medicamentos inyectables liofilizados de Norteamérica está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Pfizer Inc. (EE. UU.)

- Merck & Co., Inc. (EE. UU.)

- Johnson & Johnson Services, Inc. (EE. UU.)

- Amgen Inc. (EE. UU.)

- Catalent, Inc. (EE. UU.)

- Thermo Fisher Scientific Inc. (EE. UU.)

- Lonza (Suiza)

- Baxter. (EE. UU.)

- Fresenius Kabi AG (EE. UU.)

- Grifols, SA (España)

- Octapharma USA, Inc. (EE. UU.)

- Emergent BioSolutions Inc. (EE. UU.)

- AbbVie Inc. (EE. UU.)

- Gilead Sciences, Inc. (EE. UU.)

- Novartis AG (Suiza)

- Compañía Bristol-Myers Squibb (EE. UU.)

- Regeneron Pharmaceuticals, Inc. (EE. UU.)

- Compañía Farmacéutica Takeda Limited (Japón)

- Sandoz International GmbH (Alemania)

- Biogen Inc. (EE. UU.)

¿Cuáles son los últimos avances en el mercado norteamericano de fármacos inyectables liofilizados?

- En marzo de 2025, Avenacy anunció el lanzamiento de cinco antibióticos inyectables adicionales en el mercado estadounidense (ampicilina, ampicilina/sulbactam, nafcilina, penicilina G potásica y piperacilina/tazobactam), varios de los cuales se presentan en formato liofilizado/en viales, lo que representa unas ventas combinadas en EE. UU. de aproximadamente 175 millones de dólares durante los 12 meses anteriores. Esta iniciativa refleja el crecimiento del suministro de inyectables genéricos, lo que a su vez impulsa la demanda de envases, fabricación y logística de cadena de frío para inyectables liofilizados en Norteamérica.

- En septiembre de 2024, Amneal Pharmaceuticals y Shilpa Medicare recibieron la aprobación de la FDA estadounidense para BORUZU™ (inyección de bortezomib), la primera formulación de bortezomib (inhibidor del proteasoma) lista para usar, para administración subcutánea o intravenosa, que sustituye al formato anterior de polvo liofilizado que requería reconstitución. Este avance es importante porque ilustra una transición en el mercado norteamericano de los inyectables oncológicos, desde los formatos de polvo liofilizado a formatos precargados o listos para usar más convenientes.

- En abril de 2024, Octapharma USA anunció que la Administración de Alimentos y Medicamentos de los Estados Unidos (FDA) otorgó la exclusividad de medicamento huérfano a wilate (complejo del factor de von Willebrand/factor VIII de coagulación, polvo liofilizado para solución inyectable intravenosa) para la profilaxis de rutina en pacientes (≥ 6 años) con cualquier tipo de enfermedad de von Willebrand (EVW). Esto es significativo porque refleja la continua importancia de las formulaciones inyectables liofilizadas en el ámbito de las bioterapias para enfermedades raras y hemofilia.

- En enero de 2024, Avenacy anunció el lanzamiento comercial de clorhidrato de melfalán inyectable en el mercado estadounidense. Este producto es un equivalente terapéutico genérico de Alkeran y se presenta en un kit de polvo liofilizado (vial de 50 mg de principio activo más 10 ml de diluyente) estable a temperatura ambiente, lo que facilita su transporte y simplifica la logística hospitalaria.

- En enero de 2024, Avenacy también lanzó Bivalirudina para inyección en EE. UU., un vial monodosis de polvo liofilizado (250 mg) que actúa como equivalente genérico de Angiomax para la anticoagulación en intervenciones coronarias percutáneas, incluyendo pacientes con trombocitopenia inducida por heparina. Esto pone de manifiesto la creciente actividad en el mercado de genéricos de productos liofilizados para indicaciones cardiovasculares, un área generalmente menos saturada que la oncología, lo que indica una diversificación de los formatos inyectables liofilizados más allá de los productos biológicos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.