North America Lymphedema Treatment Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

560.25 Million

USD

1,268.05 Million

2024

2032

USD

560.25 Million

USD

1,268.05 Million

2024

2032

| 2025 –2032 | |

| USD 560.25 Million | |

| USD 1,268.05 Million | |

|

|

|

|

Segmentación del mercado de tratamiento del linfedema en América del Norte, por tipo de tratamiento (terapia de compresión, cirugía, farmacoterapia, terapia con láser y otros), tipo (linfedema secundario y linfedema primario), área afectada (extremidad inferior, extremidad superior y genitales), grupo de edad (adulto, geriátrico y pediátrico), vía de administración (oral, inyectable y tópica), usuario final (hospital, clínicas especializadas, centros quirúrgicos ambulatorios y otros), canal de distribución (farmacia, tiendas, licitación directa y otros), tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado de tratamiento del linfedema en América del Norte

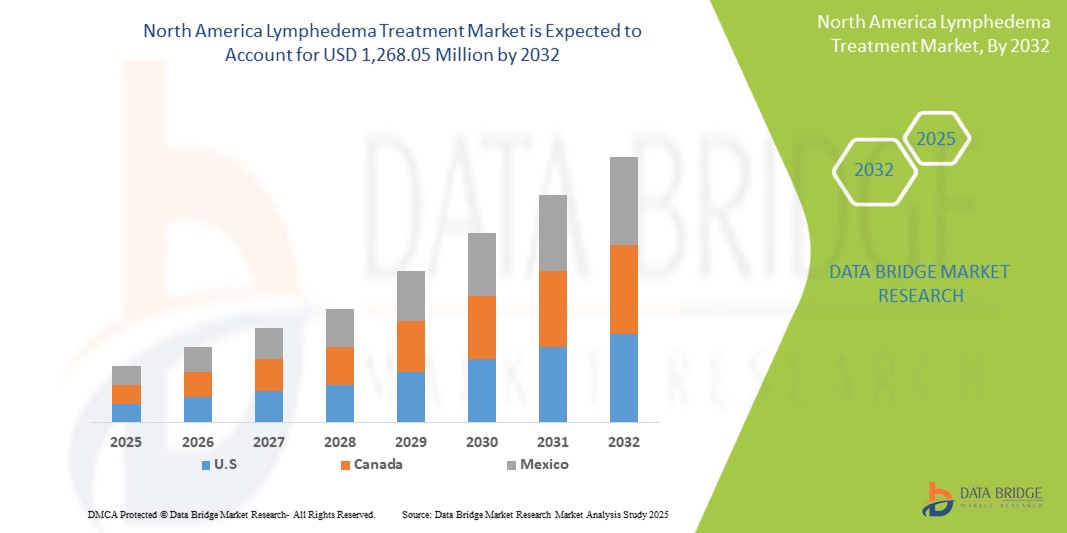

- El tamaño del mercado de tratamiento del linfedema en América del Norte se valoró en USD 560,25 millones en 2024 y se espera que alcance los USD 1.268,05 millones para 2032 , con una CAGR del 11,0 % durante el período de pronóstico.

- El crecimiento del mercado en América del Norte está impulsado en gran medida por la creciente prevalencia regional del linfedema y el linfedema relacionado con el cáncer, junto con importantes avances tecnológicos en las modalidades de diagnóstico por imágenes y enfoques de tratamiento innovadores, lo que conduce a una mejor identificación y gestión de la afección.

- Además, la creciente demanda de pacientes y profesionales clínicos en toda la región de soluciones más efectivas, accesibles e integradas para el manejo de la inflamación crónica y la mejora de la calidad de vida está consolidando las terapias de compresión avanzadas, las técnicas de drenaje linfático y las intervenciones microquirúrgicas como el estándar moderno para el tratamiento del linfedema. Estos factores convergentes están acelerando la adopción de soluciones para el manejo del linfedema en Norteamérica, impulsando así significativamente el crecimiento regional de la industria.

Análisis del mercado de tratamiento del linfedema en América del Norte

- El linfedema, caracterizado por una hinchazón crónica causada por un deterioro del funcionamiento del sistema linfático, es un área de enfoque cada vez más vital en la atención médica moderna de América del Norte debido a su impacto significativo en la calidad de vida del paciente, y a menudo surge como una complicación del tratamiento del cáncer o predisposiciones genéticas.

- La creciente demanda de tratamientos para el linfedema en América del Norte se ve impulsada principalmente por la creciente prevalencia regional del linfedema y el linfedema relacionado con el cáncer, la creciente conciencia entre los profesionales de la salud y los pacientes, y los continuos avances tecnológicos en las modalidades de diagnóstico y terapéuticas.

- Estados Unidos dominó el mercado del linfedema en 2024 y se espera que sea testigo de la mayor tasa de crecimiento durante el período de pronóstico, impulsado por una alta prevalencia de casos de linfedema (particularmente linfedema relacionado con el cáncer), una infraestructura de atención médica avanzada y una fuerte conciencia del consumidor y la adopción temprana de terapias innovadoras.

- Se espera que el segmento de terapia de compresión domine el mercado de tratamiento del linfedema en América del Norte, impulsado por su reputación establecida como el tratamiento de primera línea y más común para controlar la hinchazón, su naturaleza no invasiva y las innovaciones continuas en prendas y dispositivos de compresión que ofrecen mayor comodidad, accesibilidad y eficacia clínica.

Alcance del informe y segmentación del mercado de tratamiento del linfedema en América del Norte

|

Atributos |

Perspectivas clave del mercado del tratamiento del linfedema |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de tratamiento del linfedema en América del Norte

Atención al paciente mejorada mediante IA e integración digital

- Una tendencia significativa y en auge en el mercado norteamericano del linfedema es la creciente integración con la inteligencia artificial (IA) y las plataformas de salud digital, que abarcan la monitorización remota, algoritmos de tratamiento personalizados y soluciones de telesalud. Esta fusión de tecnologías está mejorando significativamente la comodidad del paciente, la adherencia al tratamiento y el manejo integral de su enfermedad crónica.

- Por ejemplo, en noviembre de 2014, según la Sociedad Americana del Cáncer, más de 4 millones de sobrevivientes de cáncer de mama viven en los EE. UU., y se estima que entre el 20 % y el 40 % corren riesgo de desarrollar linfedema después del tratamiento, lo que destaca un segmento crítico de pacientes que impulsa la demanda regional de soluciones para el tratamiento del linfedema a largo plazo.

- La integración de la IA en la atención del linfedema en Norteamérica permite funciones como el análisis de una gran cantidad de datos de pacientes para predecir posibles brotes, optimizar la presión de las prendas de compresión según las respuestas individuales y proporcionar alertas más inteligentes para una intervención temprana. Por ejemplo, se están desarrollando soluciones emergentes basadas en IA en Estados Unidos y Canadá para mejorar la precisión de la detección temprana del linfedema mediante el análisis de imágenes y guiar a los pacientes mediante ejercicios de rehabilitación personalizados. Además, las plataformas digitales con capacidades de comunicación integradas ofrecen a los pacientes la facilidad de realizar consultas virtuales, lo que les permite hablar sobre los síntomas y recibir orientación a distancia de los profesionales sanitarios.

- La integración fluida de los dispositivos de monitoreo de linfedema y las herramientas de autogestión con los ecosistemas de salud digital más amplios de Norteamérica facilita el control centralizado de diversos aspectos de la atención del paciente. A través de una única interfaz, los usuarios pueden gestionar las mediciones de sus extremidades, la adherencia al tratamiento y comunicarse con su equipo de atención, creando una experiencia de gestión de la salud unificada y más proactiva.

Dinámica del mercado del tratamiento del linfedema en América del Norte

Conductor

Necesidad creciente debido a la creciente prevalencia de enfermedades y las capacidades de diagnóstico mejoradas

- La creciente prevalencia del linfedema en América del Norte, en particular el linfedema secundario resultante de tratamientos contra el cáncer, como las terapias para el cáncer de mama, próstata y ginecológico, combinada con los avances acelerados en las tecnologías de diagnóstico y la creciente concientización, es un importante impulsor de la creciente demanda de soluciones para el manejo del linfedema en la región.

- Por ejemplo, en abril de 2020, un artículo publicado por ResearchGate GmbH indicó que la prevalencia combinada de linfedema de brazo era del 27 %, con una heterogeneidad considerable. La incidencia combinada de linfedema de brazo era del 21 %. La evidencia también mostró que un índice de masa corporal (> 25), un problema común en EE. UU. y Canadá, se asociaba con un mayor riesgo de linfedema de brazo.

- A medida que los profesionales de la salud y los pacientes norteamericanos se informan mejor sobre las consecuencias a largo plazo del linfedema no tratado, se pone cada vez más énfasis en la intervención temprana. Las herramientas de diagnóstico avanzadas, como la espectroscopia de bioimpedancia (BIS) y la fluorescencia infrarroja cercana (p. ej., la linfografía ICG), se utilizan cada vez más en clínicas estadounidenses y canadienses, ofreciendo una precisión superior y una detección más temprana que los métodos tradicionales, como la medición de la circunferencia de las extremidades.

- La transición hacia una atención centrada en el paciente y una mejor calidad de vida para las personas con enfermedades crónicas está impulsando la integración del manejo integral del linfedema en el tratamiento poscáncer estándar y las vías de atención de enfermedades crónicas. Esta integración facilita la continuidad de la atención mediante programas de rehabilitación coordinados y terapias de apoyo.

- La disponibilidad de herramientas de salud digital que permiten el diagnóstico temprano, facilitan la planificación personalizada del tratamiento y apoyan la autogestión de los síntomas mediante dispositivos portátiles de compresión avanzados y rutinas de ejercicio guiadas está impulsando significativamente su adopción en entornos de atención clínica y domiciliaria en toda Norteamérica. La tendencia hacia la detección proactiva, combinada con un mayor acceso a productos para el linfedema fáciles de usar y de fácil manejo, está acelerando aún más el crecimiento del mercado en la región.

Restricción/Desafío

Preocupaciones sobre el infradiagnóstico y los altos costos del tratamiento

- La preocupación por el infradiagnóstico generalizado y el diagnóstico erróneo del linfedema en Norteamérica, sumada a la considerable carga financiera que supone el tratamiento a largo plazo, supone un importante reto para una mayor penetración en el mercado y una atención eficaz al paciente. En muchos casos, el linfedema se presenta con síntomas sutiles en sus primeras etapas y a menudo es pasado por alto o mal identificado por los profesionales sanitarios, lo que resulta en un retraso en la intervención, la progresión de la enfermedad y una mayor ansiedad del paciente respecto a las consecuencias para la salud a largo plazo.

- Aunque los datos específicos de costos para Norteamérica varían, los pacientes en EE. UU. reportan con frecuencia altos gastos de bolsillo para el cuidado del linfedema, incluyendo costos asociados con prendas de compresión, terapia de drenaje linfático manual y dispositivos de compresión neumática, que pueden ascender a varios miles de dólares anuales, dependiendo de la gravedad de la enfermedad y la cobertura del seguro. Si bien iniciativas legislativas como la Ley de Tratamiento del Linfedema (promulgada en EE. UU. en 2022) buscan mejorar el reembolso de Medicare por artículos de tratamiento de compresión, los costos del tratamiento de por vida siguen siendo una carga considerable para muchos pacientes, especialmente aquellos sin seguro médico integral.

- Para abordar el desafío del infradiagnóstico en Norteamérica se requiere una mejor formación médica para médicos generales, protocolos de cribado estandarizados en oncología y cuidados posteriores a la cirugía, y campañas de concienciación pública más amplias. Las iniciativas de promoción y educación de organizaciones como la Red de Educación e Investigación Linfática (LE&RN) y la Red Nacional de Linfedema (NLN) son fundamentales para mejorar la detección temprana y los resultados a largo plazo para los pacientes.

- Además, el costo relativamente alto y recurrente de los productos esenciales para el linfedema sigue siendo un obstáculo para la adherencia al tratamiento para muchos, especialmente en comunidades de bajos ingresos o marginadas. Esta dificultad financiera puede desalentar el manejo proactivo y la atención rutinaria, sobre todo en casos donde los pacientes carecen de un seguro médico adecuado o de acceso a clínicas especializadas en linfedema.

- Si bien la concienciación en la región está mejorando, la naturaleza crónica del linfedema y la ausencia de una cura definitiva siguen afectando la motivación de los pacientes y su búsqueda constante de atención médica. Superar estas barreras mediante una mayor capacitación de los profesionales de la salud, mejores mecanismos de reembolso y el desarrollo de soluciones de tratamiento más asequibles y escalables será esencial para impulsar el crecimiento del mercado a largo plazo y mejorar la calidad de vida de los pacientes en Norteamérica.

Alcance del mercado de tratamiento del linfedema en América del Norte

El mercado de tratamiento del linfedema de América del Norte se clasifica en siete segmentos notables que se basan en el tipo de tratamiento, tipo, área afectada, grupo etario, vía de administración, usuario final y canal de distribución.

Por tipo de tratamiento

Según el tipo de tratamiento, el mercado norteamericano del linfedema se segmenta en terapia de compresión, cirugía, farmacoterapia, terapia láser y otros. Se espera que este segmento domine la mayor cuota de mercado en la región (se estima que superará el 70 % en 2025 para el mercado de terapia de compresión, donde el linfedema es una aplicación importante), gracias a su sólida reputación como el tratamiento de referencia para el linfedema y a su naturaleza no invasiva. Esto la hace muy accesible y preferida por una amplia gama de pacientes en Estados Unidos y Canadá. Los pacientes norteamericanos suelen priorizar la terapia de compresión debido a su eficacia comprobada para reducir la inflamación, mejorar la movilidad de las extremidades y aumentar la comodidad diaria. El mercado también se beneficia de la alta demanda de prendas de compresión, mangas y bombas neumáticas, impulsada por las innovaciones continuas en tecnologías de tejidos y diseño de prendas portátiles, que mejoran el cumplimiento terapéutico y la comodidad del paciente.

Se prevé que el segmento de procedimientos quirúrgicos experimente el mayor crecimiento durante el período de pronóstico en Norteamérica, impulsado por los avances en técnicas microquirúrgicas como la anastomosis linfovenosa (LVA) y la transferencia de ganglios linfáticos vascularizados (VLNT). La creciente concienciación de los pacientes sobre estas opciones potencialmente curativas para casos de linfedema avanzado o refractario está incrementando la aceptación del tratamiento quirúrgico. Los centros especializados en cirugía de linfedema en todo Estados Unidos, junto con el aumento de las derivaciones médicas y el apoyo de las aseguradoras para las opciones quirúrgicas, contribuyen aún más a la creciente popularidad de estas intervenciones. Los procedimientos quirúrgicos son especialmente atractivos para los pacientes que buscan una reducción del volumen de las extremidades a largo plazo y una mejor calidad de vida tras un éxito limitado con las terapias conservadoras.

Por tipo

Según el tipo, el mercado norteamericano de tratamiento del linfedema se segmenta en linfedema primario y linfedema secundario. Se prevé que el segmento de linfedema secundario domine la mayor cuota de mercado en la región, con un 79,26 % estimado en 2025, debido a su prevalencia significativamente mayor en EE. UU. y Canadá. Este tipo de linfedema se asocia principalmente con tratamientos oncológicos como la disección de ganglios linfáticos, la mastectomía y la radioterapia, procedimientos comunes en el tratamiento del cáncer de mama, próstata y ginecológico.

Se prevé que el segmento del linfedema primario experimente un crecimiento más rápido durante el período de pronóstico, impulsado por una mayor concienciación y capacidad de diagnóstico para esta afección, a menudo hereditaria y de inicio temprano, junto con los avances en las pruebas genéticas y la atención especializada del linfedema pediátrico. Una mayor comprensión de las mutaciones genéticas asociadas al linfedema primario está permitiendo un diagnóstico más temprano.

Por zona afectada

Según la zona afectada, el mercado norteamericano de tratamiento del linfedema se segmenta en extremidades inferiores, extremidades superiores y genitales. Se prevé que el segmento de extremidades inferiores domine la mayor cuota de mercado en la región, con una estimación del 53,61 % en 2025, debido a la mayor incidencia de linfedema de piernas en Estados Unidos y Canadá. Esto se asocia frecuentemente con afecciones subyacentes como la insuficiencia venosa crónica, la obesidad y tratamientos para cánceres como el de próstata y neoplasias malignas ginecológicas. Los pacientes con linfedema de extremidades inferiores suelen experimentar movilidad reducida y molestias significativas, lo que requiere atención médica temprana.

Se prevé un crecimiento significativo del segmento de extremidades superiores durante el período de pronóstico en Norteamérica, impulsado en gran medida por el creciente número de sobrevivientes de cáncer de mama, especialmente en EE. UU., donde el linfedema posquirúrgico y relacionado con la radiación en el brazo es común tras la disección de ganglios linfáticos axilares. La creciente concienciación entre los profesionales de la salud oncológica y los pacientes sobre los primeros signos del linfedema ha impulsado el desarrollo y la adopción de soluciones personalizadas, como mangas de compresión, guantes y dispositivos de compresión neumática avanzados.

Por grupo de edad

Según el grupo de edad, el mercado de tratamiento del linfedema en Asia-Pacífico se segmenta en adultos, geriátrico y pediátrico. Se prevé que el segmento de adultos siga dominando la mayor cuota de mercado en ingresos en la región APAC. Esto se debe principalmente a la alta incidencia de linfedema secundario relacionado con tratamientos oncológicos, como los de mama, ginecológico y de próstata, cuya prevalencia es cada vez mayor en la población adulta de Asia-Pacífico debido a los cambios en los estilos de vida, los factores ambientales y la mejora en el diagnóstico del cáncer. Además, diversas causas adquiridas, como traumatismos, infecciones (como la filariasis en ciertas zonas endémicas) y otras afecciones médicas, contribuyen a la disfunción linfática en adultos. Los pacientes adultos en APAC constituyen el mayor grupo demográfico que busca tratamiento para el linfedema debido al gran tamaño de este segmento poblacional y al creciente conocimiento de las opciones de tratamiento disponibles. El mercado también se beneficia de una amplia gama de productos y soluciones específicamente diseñados para el tratamiento del linfedema en adultos.

Se prevé que el segmento geriátrico experimente la tasa de crecimiento más rápida en la región Asia-Pacífico durante el período de pronóstico. Este crecimiento acelerado se ve impulsado por el aumento significativo de la población envejecida en Asia-Pacífico, que es inherentemente más susceptible al deterioro linfático relacionado con la edad, lo que resulta en una reducción de la función linfática. La creciente prevalencia de comorbilidades como la insuficiencia venosa crónica, la obesidad y otras enfermedades crónicas relacionadas con la edad también contribuye a la mayor incidencia de linfedema en adultos mayores. A medida que la esperanza de vida continúa aumentando en muchos países de Asia-Pacífico, también aumenta la carga de enfermedades crónicas, incluido el linfedema, en las personas mayores.

Por vía de administración

Según la vía de administración, el mercado de tratamiento del linfedema en Asia-Pacífico se segmenta en oral, inyectable y tópico. Se prevé que el segmento oral ocupe la mayor cuota de mercado, con un 51,84 %, en la región APAC en 2025. Esto se debe a la comodidad del uso en casa de medicamentos de apoyo, como diuréticos para controlar los síntomas de inflamación, antibióticos para prevenir o tratar la celulitis recurrente (una complicación común del linfedema) y diversos antiinflamatorios. También existe un creciente interés e investigación en las nuevas terapias orales destinadas a mejorar la función linfática. Los pacientes en APAC suelen preferir los medicamentos orales debido a su facilidad de autoadministración, lo que promueve una mejor adherencia a los planes de tratamiento fuera del ámbito clínico.

Se prevé que el segmento de inyectables experimente el mayor crecimiento en la región Asia-Pacífico durante el período de pronóstico. Esta rápida expansión se ve impulsada por los continuos esfuerzos de investigación y desarrollo en nuevas terapias biológicas, factores de crecimiento (como el VEGF-C, que estimula la regeneración linfática) y terapias génicas. Estos tratamientos avanzados suelen requerir administración parenteral (inyectable) para estimular eficazmente la regeneración linfática, reducir la inflamación o modular la progresión de la enfermedad.

Por el usuario final

En función del usuario final, el mercado del tratamiento del linfedema se segmenta en hospitales, clínicas especializadas, centros de cirugía ambulatoria (CAA) y otros. Se espera que el segmento hospitalario posea la mayor cuota de mercado. Este predominio se atribuye a la capacidad del hospital para ofrecer una gama completa de opciones de tratamiento para el linfedema, desde terapias conservadoras en etapas tempranas, como el drenaje linfático manual y la terapia compresiva, hasta procedimientos quirúrgicos avanzados, como la anastomosis linfovenosa y la transferencia de ganglios linfáticos vascularizados. Los hospitales también sirven como punto de referencia principal para casos complicados o en etapas avanzadas, que requieren atención multidisciplinaria, que incluye imágenes, diagnóstico e intervención quirúrgica.

Se prevé que el segmento de clínicas especializadas experimente el mayor crecimiento durante el período de pronóstico. Este crecimiento se debe al creciente número de centros de rehabilitación y atención ambulatoria especializados en linfedema, que ofrecen terapias no invasivas y control de enfermedades crónicas. Estas clínicas atienden especialmente a pacientes con linfedema leve a moderado que requieren sesiones de terapia regulares, lo que las convierte en alternativas rentables y convenientes a las visitas hospitalarias. Su auge se ve impulsado por las crecientes campañas de concienciación e iniciativas gubernamentales para el control del edema crónico, especialmente en entornos urbanos.

Por canal de distribución

Según el canal de distribución, el mercado global del tratamiento del linfedema se segmenta en farmacias, tiendas, licitación directa, etc. Se prevé que el segmento de licitación directa domine el mercado. Esto se debe principalmente a la adquisición masiva de dispositivos médicos, como bombas de compresión, prendas y kits quirúrgicos, por parte de hospitales públicos, centros de rehabilitación y organismos gubernamentales de salud. Los canales de licitación directa garantizan procesos de adquisición optimizados, el cumplimiento de las normas regulatorias y precios preferenciales, lo que los convierte en la opción preferida de los grandes compradores institucionales.

Se prevé que el segmento de tiendas físicas, que incluye tanto los canales minoristas como los online, sea el de mayor crecimiento durante el período de pronóstico. Esta rápida expansión se atribuye a un cambio en el comportamiento de los pacientes hacia el tratamiento del linfedema en casa, especialmente tras la COVID-19. La comodidad de las compras online, la creciente penetración del comercio electrónico y la disponibilidad de dispositivos de autogestión, como mangas y vendajes de compresión, han acelerado el crecimiento de este segmento. Además, el auge de los servicios de telesalud ha permitido a los pacientes gestionar el linfedema en fase inicial en casa, aumentando la dependencia de los tratamientos de venta libre y online.

Análisis regional del mercado de tratamiento del linfedema en América del Norte

- Se espera que América del Norte domine el mercado de tratamiento del linfedema de América del Norte con la mayor participación en los ingresos, que a menudo rondará el 53,56 % en 2025, impulsada por una alta prevalencia de casos de linfedema (en particular, linfedema relacionado con el cáncer), una sólida infraestructura de atención médica e inversiones significativas en investigación y desarrollo médico.

- Los proveedores de atención médica y los pacientes de la región valoran enormemente las herramientas de diagnóstico avanzadas disponibles, las opciones de tratamiento integrales y las campañas de concientización crecientes que ofrecen las clínicas y hospitales especializados.

- Esta adopción generalizada se ve respaldada además por los altos ingresos disponibles, la fuerte penetración del seguro de salud y un enfoque proactivo para el manejo de enfermedades crónicas, estableciendo la atención del linfedema como una parte integrada de las vías de atención de los pacientes, tanto para los sobrevivientes de cáncer como para aquellos con otros trastornos linfáticos.

Perspectiva del mercado estadounidense de tratamiento del linfedema

El mercado estadounidense del linfedema captó una importante cuota de ingresos en Norteamérica, representando con frecuencia más del 92,24 % en 2024, impulsado por la rápida adopción de herramientas de diagnóstico avanzadas y la creciente tendencia hacia la atención integral del linfedema. Los profesionales sanitarios y los pacientes priorizan cada vez más la detección temprana y el tratamiento eficaz del linfedema mediante protocolos de tratamiento integrales. El creciente reconocimiento de la afección entre los profesionales clínicos, sumado a la sólida demanda de terapias de compresión especializadas, bombas neumáticas y monitorización digital de la salud, impulsa aún más la industria del linfedema. Asimismo, la creciente integración de políticas de apoyo como la Ley de Tratamiento del Linfedema, junto con los avances tecnológicos en espectroscopia de bioimpedancia (BIS) y plataformas de monitorización remota de pacientes, contribuye significativamente a la expansión del mercado, mejorando el acceso y la adherencia de los pacientes a la atención a largo plazo.

Perspectivas del mercado canadiense de tratamiento del linfedema

El mercado canadiense del linfedema obtuvo una notable participación en los ingresos del 4,53 % en Norteamérica, lo que contribuyó significativamente al crecimiento regional en 2025, impulsado por la adopción gradual de herramientas de diagnóstico avanzadas y el creciente énfasis en la atención integral del linfedema en los sistemas provinciales de salud. Los profesionales de la salud y los pacientes de todo Canadá priorizan cada vez más la detección temprana y el manejo integral del linfedema mediante protocolos de tratamiento coordinados y enfoques de atención multidisciplinarios. La creciente concienciación sobre la enfermedad entre los profesionales clínicos, sumada a la creciente demanda de prendas de compresión especializadas, dispositivos de compresión neumática y nuevas herramientas de salud digital, impulsa constantemente el mercado del linfedema en el país. Además, el apoyo de organizaciones nacionales de defensa, como el Marco Canadiense para el Linfedema, y las iniciativas provinciales que promueven la educación y el acceso de los pacientes, junto con los avances tecnológicos en modalidades de diagnóstico como la espectroscopia de bioimpedancia (BIS) y las plataformas de gestión remota de pacientes, contribuyen a la expansión del mercado. Estos esfuerzos están mejorando el acceso al diagnóstico oportuno y promoviendo la adherencia a las estrategias de atención a largo plazo, lo que en última instancia mejora los resultados para los pacientes canadienses que viven con linfedema.

Cuota de mercado del tratamiento del linfedema en América del Norte

La industria del tratamiento del linfedema está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Tactile Medical (EE. UU.)

- Essity Aktiebolag (publ) (Suecia)

- 3M (EE. UU.)

- Cardinal Health (EE. UU.)

- Lohmann & Rauscher GmbH & Co. KG (Alemania)

- PAUL HARTMANN AG (Alemania)

- medi GmbH & Co. KG (Alemania)

- ConvaTec Inc. (Reino Unido)

- Juzo (Alemania)

- Smith + Nephew (Reino Unido)

- GRUPO SIGVARIS (Suiza)

- Sanyleg Srl (Italia)

- Avet Pharmaceuticals Inc. (EE. UU.)

- ThermoTek Inc. (EE. UU.)

- Huntleigh Healthcare Limited (Reino Unido)

- KOYA MEDICAL (EE. UU.)

- AIROS Medical, Inc. (EE. UU.)

- SISTEMAS DE BIOCOMPRESIÓN (EE. UU.)

- Mego Afek Ltd. (Israel)

- Thusane (Francia)

Últimos avances en el mercado del tratamiento del linfedema en América del Norte

- En marzo de 2025, ConvaTec anunció una colaboración global con la Sociedad de Enfermeras de Heridas, Ostomía y Continencia (WOCN) para mejorar la educación sobre el cuidado de ostomías. La alianza lanza dos programas gratuitos —el Programa de Cuidado Avanzado de Ostomías y el Programa de Asociado en Cuidado de Ostomías (OCA)— para capacitar a más de 750 profesionales de la salud en todo el mundo. La iniciativa busca mejorar los estándares de atención y ampliar el acceso de los pacientes a la atención experta en ostomías.

- En abril de 2025, el Grupo Lohmann & Rauscher (L&R) adquirió Unisurge International Ltd., proveedor líder en el Reino Unido de paquetes de procedimientos personalizados y productos quirúrgicos. Esta adquisición estratégica amplía el acceso de L&R al mercado hospitalario británico. Unisurge operará de forma independiente, conservando su liderazgo y personal, y se beneficiará de la experiencia global de L&R y su compromiso con la innovación médica.

- En febrero de 2025, Tactile Medical amplió el lanzamiento en EE. UU. de su dispositivo de compresión neumática Nimbl para el tratamiento del linfedema de las extremidades inferiores, tras su lanzamiento inicial para afecciones de las extremidades superiores. Nimbl es el dispositivo de compresión neumática (PCD) más pequeño de su tipo, con Bluetooth, diseñado para ofrecer comodidad, portabilidad y una mejor adherencia. Se integra con la aplicación Kylee, optimizando la experiencia del paciente y la autogestión de la atención en casa.

- En octubre de 2024, Tactile Medical lanzó Nimbl, su dispositivo de compresión neumática de última generación para el tratamiento del linfedema de las extremidades superiores. Aprobado por la FDA y los CMS, Nimbl es un 68 % más ligero y un 40 % más pequeño que los modelos anteriores. Diseñado para uso doméstico y comodidad diaria, se integra con la aplicación Kylee para optimizar la monitorización del paciente. Se espera el lanzamiento nacional de una versión para las extremidades inferiores próximamente.

- En julio de 2022, Tactile Medical lanzó las prendas ComfortEase para su sistema Flexitouch Plus, rediseñadas para un mejor ajuste, comodidad y facilidad de uso. Además, la compañía presentó la aplicación móvil Kylee, que permite a los pacientes hacer un seguimiento de los síntomas del linfedema, registrar los tratamientos y acceder a recursos educativos. Ambas innovaciones buscan mejorar la adherencia a la terapia en casa y la participación del paciente en el manejo de las afecciones inflamatorias crónicas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA LYMPHEDEMA TREATMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 INDUSTRY INSIGHTS –

4.3.1 MICRO AND MACROECONOMIC FACTORS

4.3.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.3.3 KEY PRICING STRATEGIES

4.3.4 ANALYSIS AND RECOMMENDATION

4.4 INNOVATION TRACKER & STRATEGIC ANALYSIS

4.4.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.4.1.1 MERGERS & ACQUISITIONS

4.4.1.2 TECHNOLOGY COLLABORATIONS

4.4.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.4.3 STAGE OF DEVELOPMENT

4.4.4 TIMELINES & MILESTONES

4.4.5 INNOVATION STRATEGIES & METHODOLOGIES

4.4.6 RISK ASSESSMENT & MITIGATION

4.4.7 FUTURE OUTLOOK

4.5 PIPELINE ANALYSIS – NORTH AMERICA LYMPHEDEMA TREATMENT MARKET

4.5.1 CLINICAL TRIALS AND PHASE ANALYSIS

4.5.2 DRUG THERAPY PIPELINE

4.5.3 PHASE III CANDIDATES

4.5.4 PHASE II CANDIDATES

4.5.5 PHASE I CANDIDATES

4.5.6 OTHERS (PRE-CLINICAL AND RESEARCH)

4.5.7 CONCLUSION

4.6 EPIDEMIOLOGY–

4.6.1 INCIDENCE OF LYMPHEDEMA (NORTH AMERICA & BY GENDER)

4.6.2 INCIDENCE OF LYMPHEDEMA BY GENDER

4.6.3 TREATMENT RATE

4.6.4 MORTALITY RATE

4.6.5 DRUG ADHERENCE AND THERAPY SWITCH MODEL

4.6.6 PATIENT TREATMENT SUCCESS RATES

4.7 TARIFF

4.7.1 OVERVIEW

4.7.2 TARIFF STRUCTURES

4.7.2.1 North America vs. Regional Tariff Structures

4.7.2.2 United States: Medicare/Medicaid Tariff Policies, CMS Pricing Models

4.7.2.3 European Union: Cross-border Tariff Regulations and Reimbursement Policies

4.7.2.4 Asia-Pacific: Government-imposed Tariffs on Imported Medical Products

4.7.2.5 Emerging Markets: Challenges in Tariff Implementation

4.7.3 PHARMACEUTICAL TARIFFS AND TRADE BARRIERS

4.7.3.1 Import Duties on Prescription Drugs vs. Generics

4.7.3.2 Impact on Drug Affordability and Access

4.7.3.3 Key Trade Agreements Affecting Pharmaceutical Tariffs

4.7.4 IMPACT OF HEALTHCARE TARIFFS ON PROVIDERS AND PATIENTS

4.7.4.1 Cost Burden on Hospitals and Healthcare Facilities

4.7.4.2 Effect on Patient Affordability and Insurance Coverage

4.7.4.3 Tariffs and Their Role in Medical Tourism

4.7.5 TRADE AGREEMENTS AND HEALTHCARE TARIFFS

4.7.5.1 WTO Regulations on Healthcare Tariffs

4.7.5.2 Impact of Trade Wars on the Healthcare Supply Chain

4.7.5.3 Role of Free Trade Agreements (FTAs) in Reducing Tariffs

4.7.6 IMPACT OF TARIFFS ON HEALTHCARE COSTS AND ACCESSIBILITY

4.7.7 IMPORTANCE OF TARIFFS IN THE HEALTHCARE SECTOR

5 REGULATORY FRAMEWORK–

5.1 NORTH AMERICA

5.2 SOUTH AMERICA

5.3 EUROPE

5.4 ASIA-PACIFIC

5.5 MIDDLE EAST & AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN THE NUMBER OF LYMPHEDEMA CASES GLOBALLY

6.1.2 INCREASE IN THE PREVALENCE OF CANCERS

6.1.3 INCREASING NUMBER OF HEALTHCARE FACILITIES

6.1.4 AVAILABILITY AND ADVANCEMENT OF MULTIPLE THERAPEUTIC OPTIONS

6.2 RESTRAINTS

6.2.1 SIGNIFICANT COST BURDEN ASSOCIATED WITH LYMPHEDEMA MANAGEMENT

6.2.2 LACK OF AWARENESS ABOUT THE DISEASE

6.3 OPPORTUNITIES

6.3.1 EXPANDING OPPORTUNITIES FOR DRUG DEVELOPMENT AND REGULATORY APPROVALS

6.3.2 STRATEGIC COLLABORATIONS AND ALLIANCES AMONG INDUSTRY STAKEHOLDERS

6.4 CHALLENGES

6.4.1 ABSENCE OF A DEFINITIVE CURATIVE TREATMENT

6.4.2 RESTRICTIVE AND INCONSISTENT REIMBURSEMENT POLICIES

7 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE

7.1 OVERVIEW

7.2 COMPRESSION THERAPY

7.3 SURGERY

7.4 DRUG THERAPY

7.5 LASER THERAPY

7.6 OTHERS

8 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TYPE

8.1 OVERVIEW

8.2 SECONDARY LYMPHEDEMA

8.3 PRIMARY LYMPHEDEMA

9 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA

9.1 OVERVIEW

9.2 LOWER EXTREMITY

9.3 UPPER EXTREMITY

9.4 GENITALIA

10 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP

10.1 OVERVIEW

10.2 ADULT

10.3 GERIATRIC

10.4 PEDIATRIC

11 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION

11.1 OVERVIEW

11.2 ORAL

11.3 INJECTABLE

11.4 TOPICAL

12 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITAL

12.3 SPECIALTY CLINICS

12.4 AMBULATORY SURGICAL CENTERS

12.5 OTHERS

13 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 PHARMACY STORES

13.3 DIRECT TENDER

13.4 OTHERS

14 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 TACTILE MEDICAL

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 ESSITY AKTIEBOLAG (PUBL)

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 3M

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CARDINAL HEALTH

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 LOHMANN & RAUSCHER GMBH & CO. KG

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 AIROS MEDICAL, INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ARJO

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 AVET PHARMACEUTICALS INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 BAUERFEIND

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BIOCOMPRESSION SYSTEMS

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 CONVATEC INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 ENOVIS CORPORATION

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 HUNTLEIGH HEALTHCARE LIMITED

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 IMPEDIMED LIMITED

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT/NEWS

17.15 JODAS EXPOIM PVT. LTD.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 JUZO

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 KOYA MEDICAL

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 LLC BINNOPHARM GROUP

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 MCKESSON MEDICAL-SURGICAL INC.

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENT

17.2 MEDI GMBH & CO. KG

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 MEDTRONIC

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 MEGO AFEK LTD

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 PAUL HARTMANN AG

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 PERFORMANCE HEALTH

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

17.25 PURETECH HEALTH INC

17.25.1 COMPANY SNAPSHOT

17.25.2 PIPELINE PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 SANYLEG SRL A SOCIO UNICO

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 SIGVARIS GROUP

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 SMITH+NEPHEW

17.28.1 COMPANY SNAPSHOT

17.28.2 REVENUE ANALYSIS

17.28.3 PRODUCT PORTFOLIO

17.28.4 RECENT DEVELOPMENT

17.29 THERMOTEK

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

17.3 THUASNE

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENT

17.31 VIATRIS INC.

17.31.1 COMPANY SNAPSHOT

17.31.2 REVENUE ANALYSIS

17.31.3 PRODUCT PORTFOLIO

17.31.4 RECENT DEVELOPMENT

17.32 WHITE SWAN PHARMACEUTICAL

17.32.1 COMPANY SNAPSHOT

17.32.2 PRODUCT PORTFOLIO

17.32.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 PRODUCTS AND THEIR STAGES IN DEVELOPMENT.

TABLE 2 PHASE-WISE DISTRIBUTION: CLINICAL TRIALS

TABLE 3 PHASE 2 CANDIDATES

TABLE 4 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 6 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY REGION 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA LASER THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA OTHERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA SECONDARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA LOWER EXTREMITY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA UPPER EXTREMITY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA GENITALIA IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA ADULT IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA GERIATRIC IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA PEDIATRIC IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA ORAL IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA INJECTABLE IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA TOPICAL IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA HOSPITAL IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA SPECIALITY CLINICS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA OTHERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA PHARMACY STORES IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA DIRECT TENDER IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA OTHERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 44 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 45 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 57 U.S. LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 U.S. LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 59 U.S. LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 60 U.S. COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 61 U.S. COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 62 U.S. COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 63 U.S. SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 U.S. DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 U.S. LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 U.S. PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 U.S. LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 68 U.S. LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 69 U.S. LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 70 U.S. LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 71 U.S. LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 72 CANADA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 CANADA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 74 CANADA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 75 CANADA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 76 CANADA COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 77 CANADA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 78 CANADA SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 CANADA DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 CANADA LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 CANADA PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 CANADA LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 83 CANADA LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 84 CANADA LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 85 CANADA LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 86 CANADA LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 87 MEXICO LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 MEXICO LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 89 MEXICO LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 90 MEXICO COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 91 MEXICO COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 92 MEXICO COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 93 MEXICO SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 MEXICO DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 MEXICO LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MEXICO PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 MEXICO LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 98 MEXICO LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 99 MEXICO LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 100 MEXICO LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 101 MEXICO LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

Lista de figuras

FIGURE 1 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 FIVE SEGMENTS COMPRISE THE NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE (2024)

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: SEGMENTATION

FIGURE 14 INCREASE IN THE PREVALENCE OF CANCERS IS EXPECTED TO DRIVE THE NORTH AMERICA LYMPHEDEMA TREATMENT MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 THE COMPRESSION THERAPY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LYMPHEDEMA TREATMENT MARKET IN 2025 AND 2032

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF INDONESIA ZEOLITE MARKET

FIGURE 17 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, 2024

FIGURE 18 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 19 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, CAGR (2025-2032)

FIGURE 20 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TYPE, 2024

FIGURE 22 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TYPE, 2025-2032 (USD THOUSAND)

FIGURE 23 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 24 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TYPE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, 2024

FIGURE 26 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, 2025-2032 (USD THOUSAND)

FIGURE 27 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, CAGR (2025-2032)

FIGURE 28 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, LIFELINE CURVE

FIGURE 29 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, 2024

FIGURE 30 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, 2025-2032 (USD THOUSAND)

FIGURE 31 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, CAGR (2025-2032)

FIGURE 32 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 33 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, 2024

FIGURE 34 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, 2025-2032 (USD THOUSAND)

FIGURE 35 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2025-2032)

FIGURE 36 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 37 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY END USER, 2024

FIGURE 38 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 39 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY END USER, CAGR (2025-2032)

FIGURE 40 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 41 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 42 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 43 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 44 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 45 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: SNAPSHOT (2024)

FIGURE 46 North America Lymphedema Treatment Market: COMPANY SHARE 2024 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.