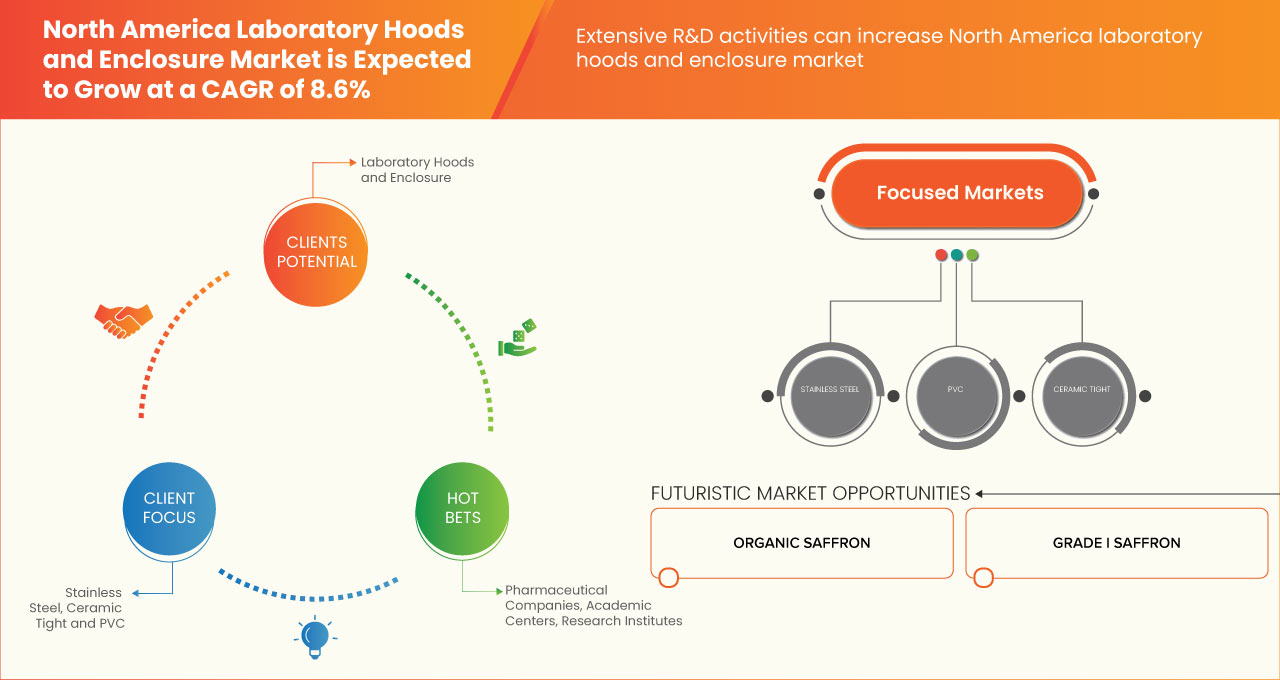

Mercado de campanas y recintos de laboratorio de América del Norte, por materiales ( acero inoxidable , cerámica hermética, PVC y otros), usuario final (compañías farmacéuticas, institutos de investigación, centros académicos y otros): tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de campanas y recintos de laboratorio de América del Norte

El mercado de campanas y recintos de laboratorio se ocupa de productos como campanas de extracción, recintos de equilibrio ventilados (VBE), cabinas de seguridad biológica para la protección del personal, el medio ambiente y los productos de humos o vapores químicos peligrosos durante la experimentación y otras actividades de investigación. Estos productos tienen una gran demanda debido a la creciente conciencia entre las personas sobre la bioseguridad y la bioprotección. Además, la creciente prevalencia de enfermedades infecciosas en todo el mundo ha impulsado aún más la demanda de campanas y recintos de laboratorio. Es probable que la creciente prevalencia de LAI impulse el crecimiento del mercado de campanas y recintos de laboratorio para prevenir la propagación de infecciones mientras se realiza la investigación y el desarrollo de una preparación de muestras en todo el mundo. Los actores clave del mercado están invirtiendo ampliamente en investigación y desarrollo para lanzar nuevos productos y servicios, lo que actúa como una oportunidad para el crecimiento del mercado. Sin embargo, el alto costo de las campanas y recintos de laboratorio y los efectos secundarios ambientales y las limitaciones asociadas con el uso de campanas y recintos de laboratorio actúan como una restricción para su crecimiento en el mercado.

La creciente prevalencia de enfermedades infecciosas exige campanas y recintos de laboratorio avanzados, lo que actúa como impulsor del crecimiento del mercado de campanas y recintos de laboratorio.

Se espera que el mercado de campanas y envolventes de laboratorio gane crecimiento de mercado en el período de pronóstico de 2023 a 2030. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 8,6% en el período de pronóstico de 2023 a 2030 y se espera que alcance los USD 804,00 millones para 2030.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Año histórico |

2021 (Personalizable para 2020-2015) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

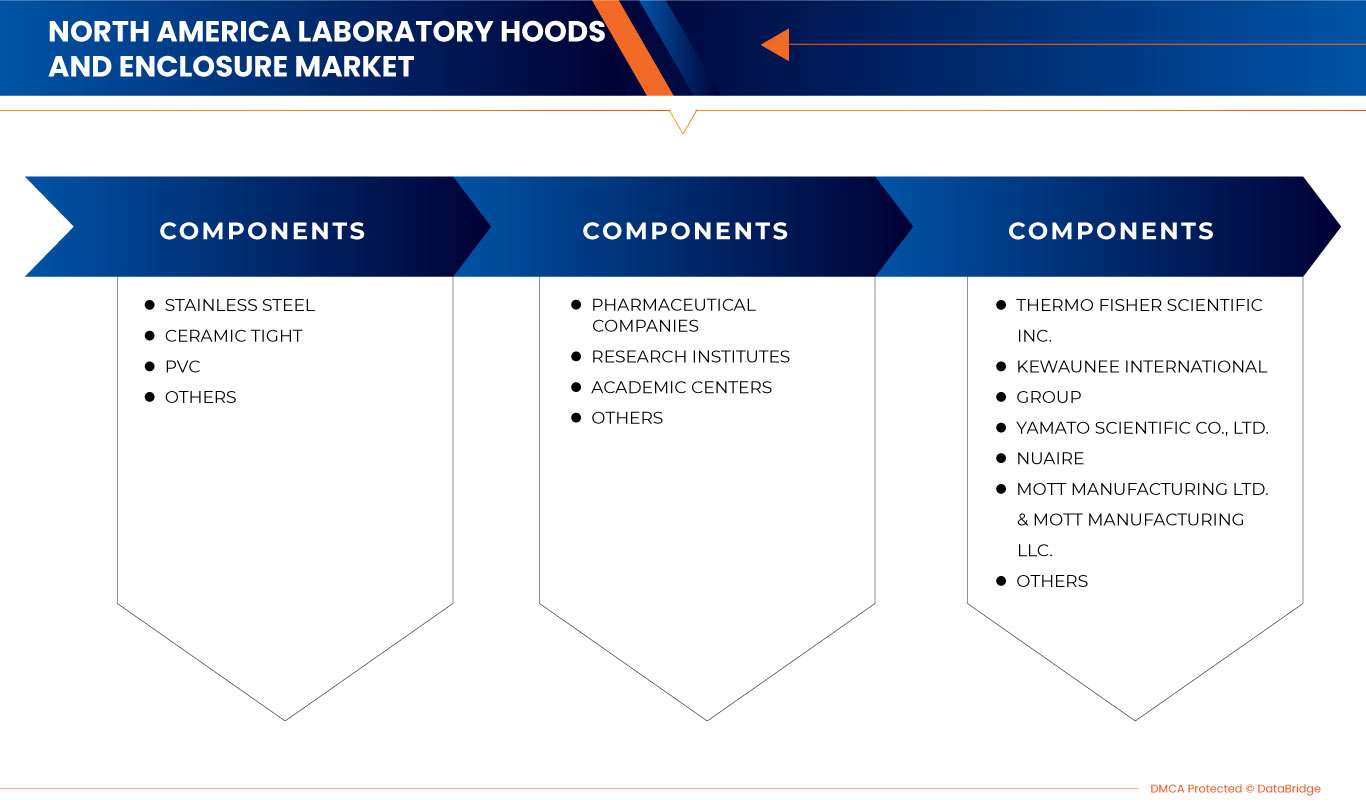

Por materiales (acero inoxidable, cerámica estanca, PVC y otros), usuario final (empresas farmacéuticas, institutos de investigación, centros académicos y otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

Thermo Fisher Scientific Inc., Kewaunee International Group, Yamato Scientific co., ltd., Nuaire, Mott Manufacturing Ltd. y Mott Manufacturing LLC., Labconco, Shimadzu Rika Corporation, AirClean Systems, Inc., Royston Group | Hamilton Lab Solutions, Sheldon Laboratory Systems, Terra Universal. Inc., Bigneat Ltd., Flow Sciences, Inc., Air Science USA LLC., WALDNER Holding SE & Co. KG, Sentry Air Systems, Inc., Liberty Industries, Cleatech, LLC., LOC SCIENTIFIC y Esco Micro Pte. Ltd. |

Definición del mercado de campanas y recintos de laboratorio de América del Norte

Las campanas de extracción son recintos ventilados que eliminan los humos, partículas y vapores volátiles de productos químicos peligrosos del laboratorio, lo que proporciona protección al personal y evita que inhalen o absorban productos químicos peligrosos y otros problemas de salud. La campana de extracción limita la exposición a humos, vapores o polvos peligrosos o nocivos al eliminar de forma segura estas sustancias del entorno de trabajo inmediato. También sirve para proteger la muestra del entorno externo. Los gabinetes de seguridad biológica (o gabinetes de bioseguridad) utilizan filtros HEPA para brindar protección ambiental, del personal y/o del producto. Capturan los humos impuros y recirculan o extraen el aire filtrado para proteger el medio ambiente y al personal mientras se preparan las muestras y se realizan experimentos. Un recinto ventilado es cualquier campana química fabricada en el sitio diseñada principalmente para contener procesos, como equipos de planta piloto o de escalado. Recintos de balanzas ventiladas que se utilizan en laboratorios para pesar partículas tóxicas. Estos dispositivos se instalan con especificaciones diferentes para la velocidad frontal que la campana química de laboratorio estándar y son adecuados para ubicar balanzas sensibles que podrían alterarse si se colocan en una campana química de laboratorio.

Dinámica del mercado de campanas y recintos de laboratorio en América del Norte

CONDUCTORES

AUMENTO DE LAS ENFERMEDADES INFECCIOSAS EN TODO EL MUNDO

El aumento de casos de enfermedades infecciosas es la principal causa de muerte en todo el mundo, especialmente en los países de bajos ingresos. Las enfermedades infecciosas causadas por organismos como virus, parásitos, hongos y bacterias se transmiten directa o indirectamente de una persona a otra.

Los laboratorios clínicos utilizan diferentes métodos para realizar análisis a través de una variedad de pruebas y ensayos necesarios para el diagnóstico y el seguimiento de enfermedades infecciosas.

El aumento de las enfermedades infecciosas aumenta la demanda de laboratorios clínicos. Los laboratorios clínicos brindan distintos tipos de servicios para el diagnóstico y tratamiento de pacientes con enfermedades infecciosas, incluidos hemogramas, pruebas inmunológicas y de alergia y análisis de orina, entre otros.

Diferentes cepas de microorganismos causan enfermedades infecciosas. Se trata de virus, protozoos, hongos y bacterias. Todos estos organismos son de tamaño microscópico. La causa de las enfermedades en los seres humanos son los virus y las bacterias; el parásito que causa la malaria es un ejemplo de protozoo.

Las enfermedades relacionadas con los virus son el VIH/SIDA, el ébola y el MERS; el laboratorio clínico utiliza la técnica de inmunofluorescencia para diagnosticar diferentes tipos de virus en el tejido del cuerpo humano. Los laboratorios desempeñan un papel importante en el diagnóstico de enfermedades infecciosas mediante el uso de técnicas de prueba de enfermedades infecciosas, pruebas de diagnóstico de trasplantes o cualquier otro tipo de prueba clínica. El aumento de las enfermedades infecciosas en todo el mundo está provocando un aumento en el número de laboratorios en todo el mundo, lo que impulsa el crecimiento del mercado mundial de campanas y recintos de laboratorio.

AUMENTO DE LAS PRUEBAS DE DIAGNÓSTICO DEL CÁNCER DE TIROIDES

Los avances permiten ampliar el alcance del desarrollo de nuevos métodos de diagnóstico de enfermedades en el laboratorio clínico. El equipo de investigación y desarrollo participa en la producción de innovaciones más avanzadas en el servicio para mejorar los métodos de diagnóstico clínico. En los EE. UU., hay disponibles más de 4000 métodos diferentes de pruebas de diagnóstico y se realizan cerca de 7000 millones de veces al año.

Los avances tecnológicos en los métodos de diagnóstico clínico han hecho que las pruebas diagnósticas sean más fáciles de usar y más precisas y han dado lugar a informes más precisos y oportunos. También han logrado que las pruebas en el punto de atención permitan una toma de decisiones más rápida por parte de los médicos.

Los avances en el laboratorio tendrán un impacto en los programas de control de infecciones, que se han realizado principalmente en tres áreas principales: identificación y detección de diversos patógenos de enfermedades infecciosas, métodos de genotipificación y pruebas de sensibilidad a los antibióticos. Debido a la implementación de métodos de diagnóstico clínico avanzados, los laboratorios clínicos tienen una mayor capacidad para brindar apoyo en los programas de control de infecciones.

RESTRICCIÓN

FALTA DE PROFESIONALES CALIFICADOS Y CERTIFICADOS

El requerimiento de profesionales capacitados y certificados es una gran restricción para los laboratorios clínicos. La demanda de campanas y recintos de laboratorio aumenta debido al alto crecimiento en el número de personas de 65 años o más que necesitan una prueba de diagnóstico de rutina para su salud, pero el menor número de profesionales capacitados presentes en el centro de laboratorio está obstaculizando el crecimiento del mercado.

El método y el procedimiento de laboratorio tienen ventajas, pero existen ciertas lagunas en la estandarización, la igualación y el conocimiento. Los técnicos se enfrentan a lagunas en la formación técnica relacionadas con los problemas para adoptar métodos avanzados de forma segura y realizar procedimientos de forma eficiente. Existe la necesidad de profesionales altamente cualificados en el laboratorio clínico para las actividades de desarrollo, validación, operación y resolución de problemas de métodos.

El laboratorio es un componente dinámico del complejo sistema de atención sanitaria actual, que proporciona a los pacientes información esencial para el diagnóstico, la prevención, el tratamiento y el control de sus enfermedades y su salud. Los principales factores que inciden en la escasez de profesionales cualificados y certificados son los cambios en la práctica de la ciencia del laboratorio clínico debido al avance de la tecnología y la jubilación de los profesionales cualificados y certificados que envejecen.

El requerimiento de personal capacitado es un gran problema para los laboratorios clínicos, por lo que la falta de profesionales calificados y certificados actúa como un obstáculo para el crecimiento del mercado global de campanas y recintos de laboratorio.

OPORTUNIDAD

APARECIMIENTO DEL COVID-19

La enfermedad por coronavirus (COVID-19) es una enfermedad infecciosa causada por un virus SARS-CoV-2 recientemente descubierto. Las personas afectadas por el virus COVID-19 experimentan una enfermedad respiratoria leve a moderada y se recuperan sin necesidad de tratamiento especial. Sin embargo, la propagación del coronavirus (COVID-19) se ha expandido por todo el mundo en los últimos meses y el número de pacientes ha aumentado enormemente.

Como el COVID-19 es una enfermedad infecciosa, su propagación es infinita; además, no existe un tratamiento específico y aprobado para el COVID-19. Debido a esto, varias organizaciones de salud y organismos gubernamentales están elaborando pautas para controlar su propagación, así como recomendando un tratamiento que se centre en el manejo de los síntomas o complicaciones que desarrolla el virus.

Debido al brote de COVID-19, la demanda de campanas y recintos de laboratorio está aumentando debido a la intensificación de las actividades de investigación para el desarrollo de medicamentos y otros productos biofarmacéuticos, que brindan la máxima seguridad frente a los peligros químicos, así como otras infecciones adquiridas en el laboratorio (LAI) mientras se realizan experimentos en el laboratorio. Por lo tanto, se estima que se anticipa que el mercado mundial de campanas y recintos de laboratorio experimentará un auge en el período de pronóstico.

DESAFÍO

NORMAS Y LEYES REGULADORAS EMERGENTES

Una campana extractora de humos es un recinto ventilado que, por lo general, ventila de forma independiente del sistema de calefacción, ventilación y aire acondicionado (HVAC) del edificio y no se recircula hacia el interior del edificio. Siempre que se trabaje con compuestos tóxicos o compuestos con un punto de ebullición inferior a 120 °C, se deben utilizar campanas extractoras y recintos. Deben utilizarse cuando los materiales utilizados superen los límites de exposición en el laboratorio. Existen diversas normas y leyes reglamentarias establecidas por diferentes organizaciones para proporcionar límites de exposición permisibles con el fin de protegerse de los peligros del laboratorio.

Existen varias agencias gubernamentales que supervisan la bioseguridad en Western, como la Agencia de Salud Pública de Canadá (PHAC) y la Agencia Canadiense de Inspección de Alimentos (CFIA). La PHAC publica la Norma Canadiense de Bioseguridad, que reemplazó las Directrices y Normas de Bioseguridad de Laboratorio y las Normas de Contención de la CFIA para Instalaciones Veterinarias.

Estas pautas, al trabajar en el laboratorio, deben tenerse en cuenta porque son una de las tareas más desafiantes para los participantes. Además, restringen la entrada de nuevos participantes al mercado, ya que estas pautas requieren una gran cantidad de capital, que es muy difícil de mantener para los participantes de nivel medio y bajo, lo que obstaculiza el crecimiento y actúa como un desafío para el mercado global de campanas y gabinetes de laboratorio.

Acontecimientos recientes

- En febrero de 2022, Yamato Scientific Co., ltd. anunció el lanzamiento de un nuevo catálogo de productos. El nuevo catálogo de productos fue diseñado para brindar una descripción general del producto al cliente; esto ayudará a la empresa a generar ingresos.

- En mayo de 2021, Labconco lanzó las cabinas de bioseguridad Axiom recientemente actualizadas con características exclusivas. El lanzamiento de este producto ha generado un flujo de ingresos constante para la empresa

Mercado de campanas y recintos de laboratorio de América del Norte

El mercado de campanas y recintos de laboratorio de América del Norte está segmentado en materiales y usuario final. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Por materiales

- Acero inoxidable

- Cerámica hermética

- CLORURO DE POLIVINILO

- Otros

Sobre la base de los materiales, el mercado de campanas y recintos de laboratorio de América del Norte está segmentado en acero inoxidable, hermético a la cerámica, PVC y otros.

Por el usuario final

- Compañías farmacéuticas

- Institutos de investigación

- Centros académicos

- Otros

Sobre la base del usuario final, el mercado de campanas y recintos de laboratorio de América del Norte está segmentado en compañías farmacéuticas, institutos de investigación, centros académicos y otros.

Análisis y perspectivas regionales del mercado de campanas y envolventes para laboratorio

El mercado de campanas y recintos de laboratorio está segmentado en siete segmentos notables que se basan en los materiales y el usuario final.

Los países cubiertos en este informe de mercado son Estados Unidos, Canadá y México.

Se espera que Estados Unidos domine el mercado debido a los avances tecnológicos en los métodos de diagnóstico clínico que han hecho que las pruebas de diagnóstico sean más fáciles de usar y más precisas.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas de América del Norte y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de las campanas y los gabinetes de laboratorio en América del Norte

El panorama competitivo del mercado de campanas y recintos de laboratorio de América del Norte proporciona detalles de un competidor. Los detalles incluyen una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de campanas y recintos de laboratorio.

Algunos de los principales actores que operan en el mercado de campanas y recintos de laboratorio de América del Norte son Thermo Fisher Scientific Inc., Kewaunee International Group, Yamato Scientific co., ltd., Nuaire, Mott Manufacturing Ltd. y Mott Manufacturing LLC., Labconco, Shimadzu Rika Corporation, AirClean Systems, Inc., Royston Group | Hamilton Lab Solutions, Sheldon Laboratory Systems, Terra Universal. Inc., Bigneat Ltd., Flow Sciences, Inc, Air Science USA LLC., WALDNER Holding SE & Co. KG, Sentry Air Systems, Inc., Liberty Industries, Cleatech, LLC., LOC SCIENTIFIC y Esco Micro Pte. Ltd., entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of NORTH AMERICA LABORATORY HOODS AND ENCLOSURE MARKET

- Currency and pricing

- LIMITATIONs

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- MULTIVARIATE MODELLING

- product LIFELINE CURVE

- DBMR MARKET POSITION GRID

- MARKET end user COVERAGE GRID

- secondary sourcEs

- assumptions

- Pestel's Model_Laboratory Hoods and Enclosure Market

- EXECUTIVE SUMMARY

- Regulations

- Market Overview

- DRIVERS

- RISe in INFECTIOUS DISEASES WORLDWIDE

- ADVANCEMENTs IN CLINICAL DIAGNOSTIC METHODS

- RisE IN Demand for Early and Accurate Disease Diagnosis

- RISE IN PREFERENCE FOR PREVENTIVE HEALTH CHECK-UPS

- INCREASE IN AWARENESS ABOUT DIAGNOSIS AND TREATMENT OF THE DISEASE

- RESTRAINTS

- LACK OF SKILLED AND CERTIFIED PROFESSIONALS

- High cost of Laboratory fume hoods and enclosure

- OPPRTUNITIES

- Emergence of COVID-19

- STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

- RISING AWARENESS OF BIOSAFETY

- Challenges

- EMERGING REGULATORY STANDARDS AND LAWS

- EXPERTISE IN OPERATION

- Impact of COVID 19 Pandemic on the north America Laboratory Hoods and Enclosure Market

- Price Impact

- Impact on Supply Chain

- IMPACT ON DEMAND

- Strategic Decisions by Manufacturers

- CONCLUSION

- north america LABORATORY HOODS AND ENCLOSURE MARKET, BY Product

- overview

- Hoods

- Biological Safety Cabinets

- LAMINAR FLOW CABINETS

- enclosures

- VENTILATED BALANCE ENCLOSURES (VBES)

- OTHERS

- North America LABORATORY HOODS AND ENCLOSURE MARKET, BY Modularity

- overview

- benchtop

- PORTABLE

- North America LABORATORY HOODS AND ENCLOSURE MARKET, BY Material

- overview

- stainless steel

- PVC

- others

- North America LABORATORY HOODS AND ENCLOSURE MARKET, BY End User

- overview

- Pharmaceutical Companies

- RESEARCH INSTITUTES

- Academic Centers

- others

- NORTH AMERICA LABORATORY HOODS AND ENCLOSURE MARKET, by REGION

- overview

- U.S.

- canada

- mexico

- north america Laboratory Hoods and Enclosure Market: COMPANY landscape

- company share analysis: North America

- swot analysis

- company profile

- THERMO FISHER SCIENTIFIC INC.

- COMPANY SNAPSHot

- REVENUE ANALYSIS

- product Portfolio

- RECENT DEVELOPMENTs

- Kewaunee International Group

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- nuiare

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- Terra Universal, Inc.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Air Science USA LLC

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Yamato Scientific co., ltd.

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- Sentry Air Systems, Inc.

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- AirClean Systems, Inc.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Labconco

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Bigneat Ltd.

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- Esco Micro Pte. Ltd.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Flow Science Inc.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Köttermann GmbH

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- LOC SCIENTIFIC

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Mott Manufacturing Ltd. & Mott Manufacturing LLC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Royston Group | Hamilton Lab Solutions

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- Sheldon Laboratory Systems

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- WALDNER Holding GmbH & Co. KG

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- questionnaire

- related reports

Lista de Tablas

TABLE 1 Number of coronavirus (COVID-19) tests performed in the most impacted countries worldwide as of July 27, 2021

TABLE 2 According to the National Laboratory Sales data, cost of hoods are mentioned below,

TABLE 3 North America LABORATORY HOODS AND ENCLOSURE Market, By Product, 2019-2028 (USD MILLION)

TABLE 4 North America hoods in laboratory hoods and enclosure Market, By Product, 2019-2028 (USD MILLION)

TABLE 5 North America LABORATORY HOODS AND ENCLOSURE Market, By Modularity, 2019-2028 (USD MILLION)

TABLE 6 North America LABORATORY HOODS AND ENCLOSURE Market, By Material, 2019-2028 (USD MILLION)

TABLE 7 North America LABORATORY HOODS AND ENCLOSURE Market, By End User, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA LABORATORY HOODS AND ENCLOSURE Market, By COUNTRY, 2019-2028 (USD Million)

TABLE 9 U.S. LABORATORY HOODS AND ENCLOSURE Market, By PRODUCT, 2019-2028 (USD Million)

TABLE 10 U.S. Hoods in Laboratory Hoods and Enclosure Market, By Product, 2019-2028 (USD Million)

TABLE 11 U.S. Laboratory Hoods and Enclosure Market, By Modularity, 2019-2028 (USD Million)

TABLE 12 U.S. Laboratory Hoods and Enclosure Market, By Material, 2019-2028 (USD Million)

TABLE 13 U.S. Laboratory Hoods and Enclosure Market, By End User, 2019-2028 (USD Million)

TABLE 14 Canada Laboratory Hoods and Enclosure Market, By Product, 2019-2028 (USD Million)

TABLE 15 Canada Hoods in Laboratory Hoods and Enclosure Market, By Product, 2019-2028 (USD Million)

TABLE 16 Canada Laboratory Hoods and Enclosure Market, By Modularity, 2019-2028 (USD Million)

TABLE 17 Canada Laboratory Hoods and Enclosure Market, By Material, 2019-2028 (USD Million)

TABLE 18 Canada Laboratory Hoods and Enclosure Market, By End User, 2019-2028 (USD Million)

TABLE 19 mexico LABORATORY HOODS AND ENCLOSURE Market, By PRODUCT, 2019-2028 (USD Million)

TABLE 20 Mexico Hoods in Laboratory Hoods and Enclosure Market, By Product, 2019-2028 (USD Million)

TABLE 21 Mexico Laboratory Hoods and Enclosure Market, By Modularity, 2019-2028 (USD Million)

TABLE 22 Mexico Laboratory Hoods and Enclosure Market, By Material, 2019-2028 (USD Million)

TABLE 23 Mexico Laboratory Hoods and Enclosure Market, By End User, 2019-2028 (USD Million)

Lista de figuras

FIGURE 1 NORTH AMERICA LABORATORY HOODS AND ENCLOSURE MARKET: segmentation

FIGURE 2 NORTH AMERICA laboratory hoods and enclosure MARKET: data triangulation

FIGURE 3 NORTH AMERICA laboratory hoods and enclosure MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA laboratory hoods and enclosure MARKET: north america vs country MARKET ANALYSIS

FIGURE 5 NORTH AMERICA laboratory hoods and enclosure MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA laboratory hoods and enclosure MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA laboratory hoods and enclosure MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA laboratory hoods and enclosure MARKET: MARKET end user COVERAGE GRID

FIGURE 9 NORTH AMERICA laboratory hoods and enclosure MARKET: SEGMENTATION

FIGURE 10 growing prevalence of infectious diseases is expected to drive the NORTH AMERICA laboratory hoods and enclosure MARKET in the forecast period of 2021 to 2028

FIGURE 11 HOODS SEGMENT is expected to account for the largest share of the NORTH AMERICA laboratory hoods and enclosure MARKET in 2021 & 2028

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF North America Laboratory Hoods and Enclosure Market

FIGURE 13 BIOSAFETY CONCEPT AND LEVELS OF BIOSAFETY WITH THEIR RISK INTENSITY

FIGURE 14 NCRST PUBLIC AWARENESS STRATEGY

FIGURE 15 NORTH AMERICA LABORATORY HOODS AND ENCLOSURE MARKET: BY Product, 2020

FIGURE 16 North America LABORATORY HOODS AND ENCLOSURE MARKET: BY Product, 2021-2028 (USD MILLION)

FIGURE 17 North America LABORATORY HOODS AND ENCLOSURE MARKET: BY Product, CAGR (2021-2028)

FIGURE 18 North America LABORATORY HOODS AND ENCLOSURE MARKET: BY Product, LIFELINE CURVE

FIGURE 19 North America LABORATORY HOODS AND ENCLOSURE MARKET : BY Modularity, 2020

FIGURE 20 North America LABORATORY HOODS AND ENCLOSURE MARKET : BY Modularity, 2021-2028 (USD MILLION)

FIGURE 21 North America LABORATORY HOODS AND ENCLOSURE MARKET : BY Modularity, CAGR (2021-2028)

FIGURE 22 North America LABORATORY HOODS AND ENCLOSURE MARKET: BY Modularity, LIFELINE CURVE

FIGURE 23 North America LABORATORY HOODS AND ENCLOSURE MARKET : BY material, 2020

FIGURE 24 North America LABORATORY HOODS AND ENCLOSURE MARKET : BY material, 2021-2028 (USD MILLION)

FIGURE 25 North America LABORATORY HOODS AND ENCLOSURE MARKET : BY material, CAGR (2021-2028)

FIGURE 26 North America LABORATORY HOODS AND ENCLOSURE MARKET: BY material, LIFELINE CURVE

FIGURE 27 NORTH AMERICA LABORATORY HOODS AND ENCLOSURE MARKET: BY End User, 2020

FIGURE 28 North America LABORATORY HOODS AND ENCLOSURE MARKET: BY End User, 2021-2028 (USD MILLION)

FIGURE 29 North America LABORATORY HOODS AND ENCLOSURE MARKET: BY End User, CAGR (2021-2028)

FIGURE 30 North America LABORATORY HOODS AND ENCLOSURE MARKET: BY End User, LIFELINE CURVE

FIGURE 31 NORTH AMERICA laboratory hoods and enclosure MARKET: SNAPSHOT (2020)

FIGURE 32 NORTH AMERICA laboratory hoods and enclosure MARKET: BY COUNTRY (2020)

FIGURE 33 NORTH AMERICA laboratory hoods and enclosure MARKET: BY COUNTRY (2021 & 2028)

FIGURE 34 NORTH AMERICA laboratory hoods and enclosure MARKET: BY COUNTRY (2020 & 2028)

FIGURE 35 NORTH AMERICA laboratory hoods and enclosure MARKET: BY PRODUCT (2021-2028)

FIGURE 36 North America Laboratory Hoods and Enclosure Market: company share 2020 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.