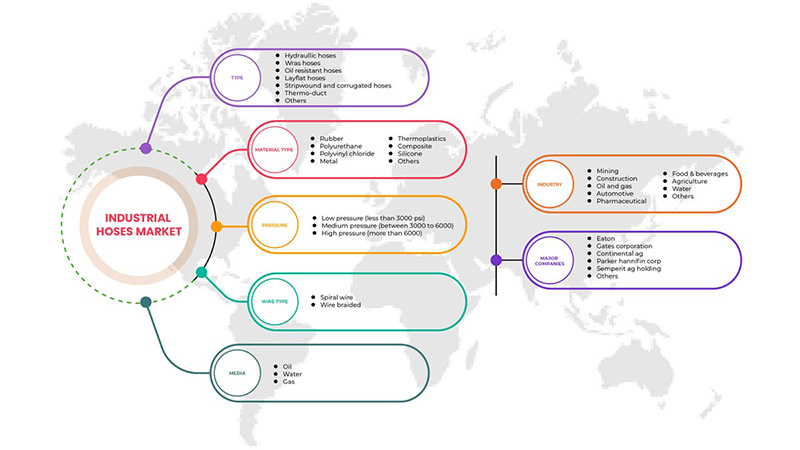

Mercado de mangueras industriales de América del Norte, por tipo (mangueras hidráulicas, mangueras planas, mangueras WRAS, mangueras resistentes al aceite, mangueras enrolladas, mangueras corrugadas, termoconductos y otras), tipo de material ( silicona , poliuretano, cloruro de polivinilo, nitrilo +, elastómeros, metal, termoplásticos, compuestos y otros), medio (petróleo, agua y gas), tipo de cable (alambre trenzado y alambre en espiral), presión (baja presión (menos de 3000 psi), presión media (entre 3000 y 6000) y alta presión (más de 6000)), industria (petróleo y gas, agua, agricultura, alimentos y bebidas, productos farmacéuticos, automoción, minería, construcción y otros) - Tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de mangueras industriales de América del Norte

Las mangueras industriales se utilizan ampliamente en varios sectores industriales por su amplia oferta. Estas mangueras funcionan en entornos adversos que provocan daños como abrasión, rotura y fallos prematuros. Trabajar en estas condiciones hace que sea importante seleccionar correctamente el tipo de manguera necesaria para la aplicación. Para la transferencia de alta presión, las mangueras hidráulicas son las más adecuadas y funcionan con una presión de millones de psi. El sector del petróleo y el gas utiliza mangueras para transferir combustibles y gases y requiere mangueras de alta calidad para cumplir con las especificaciones estándar y la seguridad. El uso de mangueras atiende a una amplia gama de aplicaciones, convirtiéndose así en un elemento esencial para varios sectores industriales.

Para ello, varios actores del mercado están introduciendo nuevos productos y formando asociaciones para expandir sus negocios en el mercado de mangueras industriales de América del Norte.

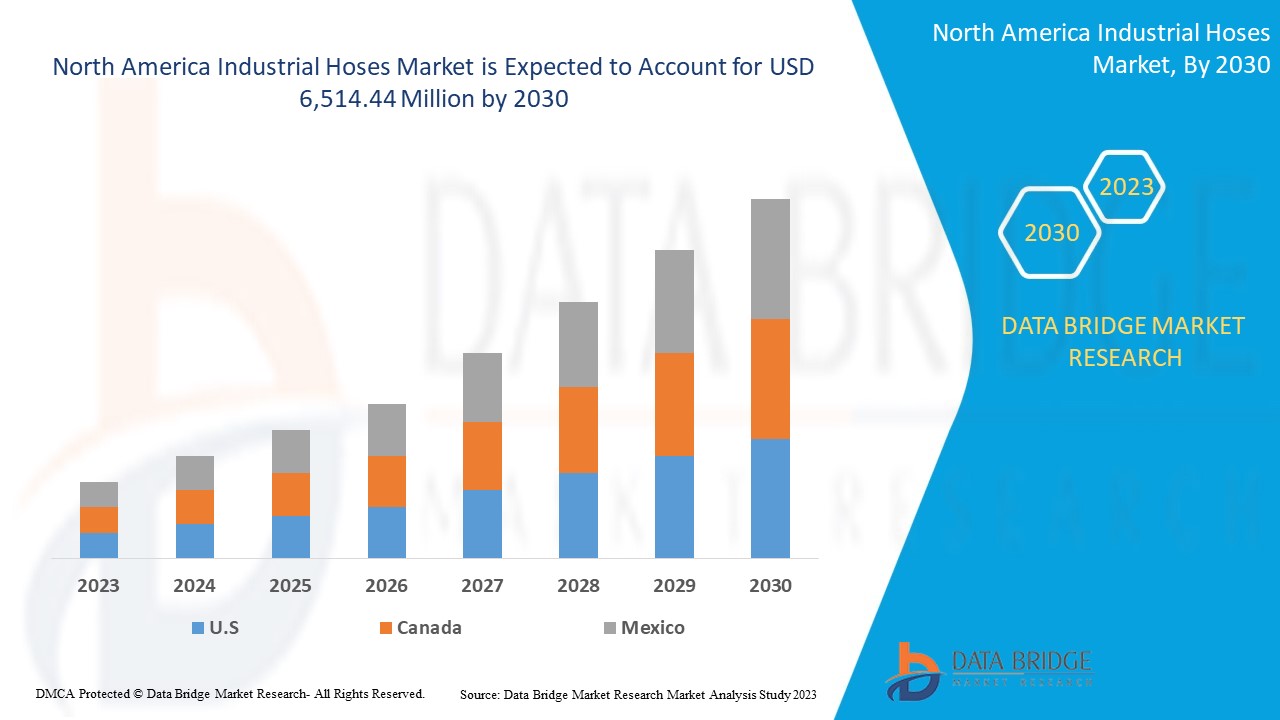

Data Bridge Market Research analiza que se espera que el mercado de mangueras industriales de América del Norte alcance un valor de USD 6.514,44 millones para 2030, con una CAGR del 6,4 % durante el período de pronóstico. Este informe de mercado también cubre de manera integral el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Año histórico |

2021 (Personalizable para 2020-2015) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en millones de metros, precios en USD |

|

Segmentos cubiertos |

Por tipo (mangueras hidráulicas, mangueras planas, mangueras WRAS, mangueras resistentes al aceite, mangueras enrolladas, mangueras corrugadas, termoconductos y otras), tipo de material ( silicona , poliuretano , cloruro de polivinilo, caucho de nitrilo, elastómeros, metal, termoplásticos, compuestos y otros), medio (petróleo, agua y gas), tipo de cable (alambre trenzado y alambre espiral), presión (baja presión (menos de 3000 psi), presión media (entre 3000 y 6000) y alta presión (más de 6000)), industria (petróleo y gas, agua, agricultura, alimentos y bebidas, productos farmacéuticos, automoción, minería, construcción y otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

Eaton, PARKER HANNIFIN CORP, RYCO Hydraulics, Kurt Manufacturing, NORRES Schlauchtechnik GmbH, Transfer Oil SpA, ContiTech AG (una subsidiaria de Continental AG), Kanaflex Corporation Co.,ltd., Pacific Echo, Colex International Limited, Reino Unido, Gates Corporation, Semperit AG Holding, Dixon Valve & Coupling Company, LLC y Titan Fittings |

Definición de mercado

Las mangueras industriales son tubos flexibles reforzados que se utilizan para transferir los diferentes estados de los materiales, como líquidos y gases. La manguera industrial funciona en un amplio rango de presiones, por lo que es adecuada para un conjunto diferente de aplicaciones. Las mangueras industriales están disponibles en diferentes materiales, como poliuretano, termoplásticos y cloruro de polivinilo, entre otros. Cada material ofrece un conjunto diferente de operaciones y se utiliza para transportar varios materiales. Las mangueras industriales están disponibles en formas rígidas y flexibles según la necesidad de las aplicaciones industriales.

Dinámica del mercado de mangueras industriales en América del Norte

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

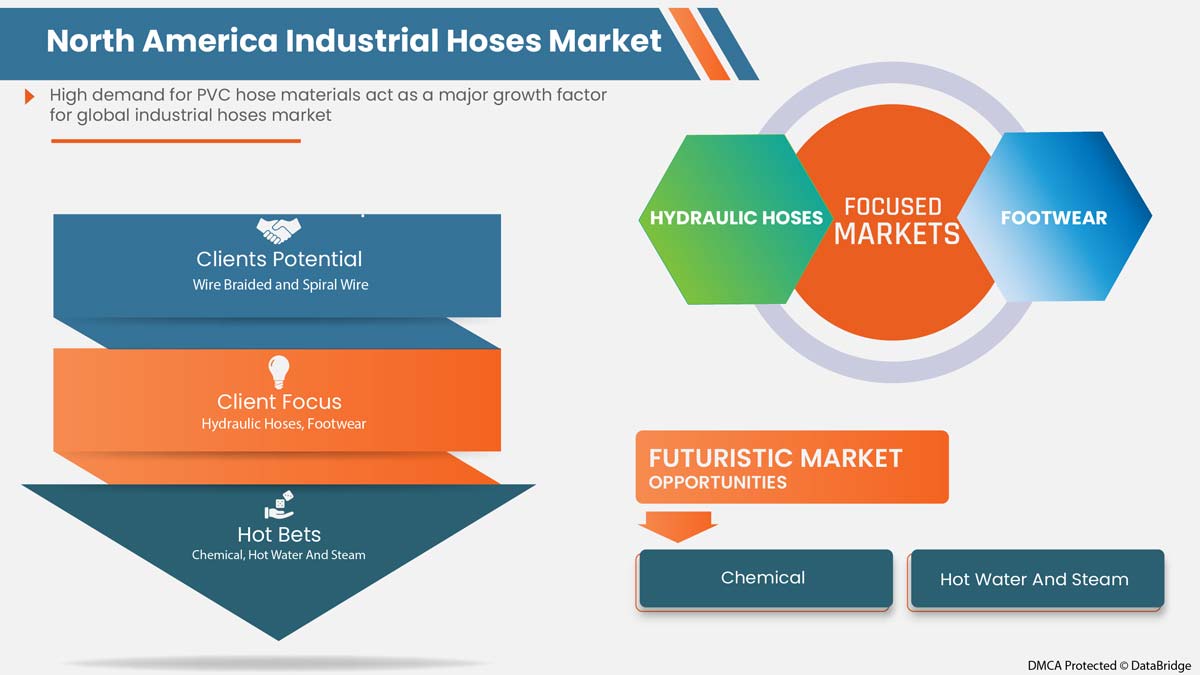

- Alta demanda de materiales para mangueras de PVC

En los últimos días, las mangueras industriales de material de PVC están cobrando importancia en las industrias automotriz, farmacéutica, de infraestructura, de petróleo y gas, de alimentos y bebidas, de minería, de agua, de agricultura y otras para la fabricación y uso de tubos y tuberías para el transporte de aire, agua, productos químicos y fluidos de un extremo a otro.

La demanda aumenta día a día debido a su amplia gama de aplicaciones, como aire, productos abrasivos, aceites minerales, agua, gases técnicos y domésticos, vapor, combustibles y otros. El desarrollo tecnológico está ayudando a que los productos de mangueras industriales complementen el crecimiento del mercado.

- Necesidad creciente de mangueras industriales duraderas en aplicaciones críticas

Las mangueras industriales se utilizan para transportar fluidos, productos químicos, aire, agua, aceite y otros materiales de un lugar a otro. Existe una demanda significativa de mangueras industriales robustas en el mercado para aplicaciones cruciales como alta temperatura, alta presión, reacción química y vacío.

Antes de elegir las mangueras, los clientes deben tener en cuenta una serie de criterios importantes, como la posibilidad de fallos catastróficos, la permeabilidad, la compatibilidad química, la temperatura, el entorno externo, el vacío y otros. Los principales actores del mercado están lanzando productos de vanguardia para usos críticos, lo que está impulsando la demanda de mangueras duraderas en la industria.

Oportunidad

- Creciente adopción de mangueras en el sector automovilístico

Los automóviles están compuestos por estructuras y sistemas internos complejos con varios componentes intactos. La integración de estos sistemas y componentes permite que el automóvil funcione como una máquina eficiente. En los automóviles, las mangueras desempeñan un papel importante, ya que se utilizan como sistema de refrigeración del motor, en un portador de aceite de freno, como portador de combustible, en el aire acondicionado y en otras partes del vehículo. En el diseño de un sistema de refrigeración del motor, se utilizan mangueras de varios tipos para la circulación del refrigerante. Estas mangueras son de diferentes propiedades materiales, ya que algunas están diseñadas para soportar el calor del refrigerante, mientras que otras pueden soportar solo refrigerante frío. Esto aumenta la importancia de las mangueras en los automóviles y el crecimiento del mercado se ve afectado directamente por el crecimiento de la industria automotriz. Como el sector automotriz en la industria de vehículos eléctricos está mostrando un enorme crecimiento a lo largo de los años debido a la creciente demanda de vehículos y vehículos eléctricos, se espera que esto brinde oportunidades lucrativas para el crecimiento del mercado.

Restricción/Desafío

- Limitaciones de las mangueras industriales en diversas aplicaciones

Las mangueras industriales se utilizan ampliamente en diversas industrias para lograr una eficiencia operativa óptima y transferir combustible, productos químicos, materiales a granel y aire, entre otros. Aunque las aplicaciones industriales de las mangueras industriales continúan expandiéndose, los usuarios finales se centran cada vez más en los niveles de eficiencia de las mangueras industriales. Sin embargo, las mangueras industriales plantean diversos desafíos en diversos entornos del sistema, como el rango de temperatura, y esto dificulta el rendimiento y la eficiencia generales del sistema. Se espera que la limitación característica de las mangueras industriales obstaculice el crecimiento del mercado. Muchos usuarios finales y empresas tienden a buscar alternativas a las mangueras debido a sus limitaciones.

Impacto posterior a la COVID-19 en el mercado de mangueras industriales de América del Norte

La industria de las mangueras industriales ha experimentado una disminución gradual de la demanda debido al confinamiento y a las leyes gubernamentales relacionadas con la COVID-19, ya que las instalaciones de fabricación y los servicios se cerraron. Además, la industria también se vio afectada por la interrupción de la cadena de suministro, especialmente de las materias primas utilizadas en el proceso de fabricación de las mangueras industriales. Como la producción de mangueras industriales se desaceleró debido a las restricciones impuestas por los gobiernos de todo el mundo, la producción no satisfizo la demanda en los primeros tres trimestres de 2020. Además, se ha observado una alta demanda/requerimiento de productos de mangueras industriales en los sectores químico, farmacéutico y agrícola y en aplicaciones hidráulicas. La reanudación de la producción de la industria del petróleo y el gas y de la automoción impulsó aún más la creciente demanda de mangueras industriales en todo el mundo. Por lo tanto, esto no solo provocó un aumento de la demanda, sino que también aumentó el coste del producto.

Acontecimientos recientes

- En julio de 2021, NORRES Schlauchtechnik GmbH, fabricante, desarrollador y distribuidor de sistemas de mangueras flexibles, adquirió Baggerman Group ("Baggerman"), fabricante y distribuidor de mangueras, acoplamientos y accesorios industriales. Esta adquisición ayudaría a la empresa a aumentar su presencia en Norteamérica y también a expandir el mercado.

- En septiembre de 2020, la empresa KURIYAMA OF AMERICA desarrolló un nuevo producto llamado Manguera de succión y descarga Tigerflex Tiger Aqua. Esta nueva incorporación no solo mejoraría la cartera de productos de la empresa, sino que también ayudaría a impulsar las ventas generales.

Alcance del mercado de mangueras industriales en América del Norte

El mercado de mangueras industriales de América del Norte está segmentado en seis segmentos notables según el tipo, el tipo de material, el medio, el tipo de cable, la presión y la industria. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento escaso en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

POR TIPO

- Mangueras hidráulicas

- Mangueras WRAS

- Mangueras resistentes al aceite

- Mangueras planas

- Mangueras enrolladas y corrugadas

- Conducto térmico

- Otros

Según el tipo, el mercado está segmentado en mangueras hidráulicas, mangueras WRAS, mangueras resistentes al aceite, mangueras planas, mangueras enrolladas y corrugadas, termoconductos y otras.

POR TIPO DE MATERIAL

- Silicona

- Cloruro de polivinilo

- Poliuretano

- Caucho de nitrilo

- Elastómeros

- Termoplásticos

- Metal

- Compuesto

- Otros

Según el tipo de material, el mercado está segmentado en silicona, poliuretano, cloruro de polivinilo, caucho de nitrilo, elastómeros, metal, termoplásticos, compuestos y otros.

POR MEDIOS DE COMUNICACIÓN

- Aceite

- Agua

- Gas

Según los medios de comunicación, el mercado está segmentado en petróleo, agua y gas.

POR TIPO DE CABLE

- Alambre espiral

- Alambre trenzado

Según el tipo de cable, el mercado está segmentado en cable en espiral y cable trenzado.

POR PRESIÓN

- Baja presión (menos de 3000 psi)

- Presión media (entre 3000 y 6000)

- Alta presión (más de 6000)

En función de la presión, el mercado está segmentado en baja presión (menos de 3000 psi), presión media (entre 3000 a 6000) y alta presión (más de 6000).

POR INDUSTRIA

- Automotor

- Productos farmacéuticos

- Petróleo y gas

- Alimentos y bebidas

- Agua

- Minería

- Agricultura

- Otros

Según la industria, el mercado está segmentado en petróleo y gas, agua, agricultura, alimentos y bebidas, farmacéutico, automotriz, minería y otros.

Análisis y perspectivas regionales del mercado de mangueras industriales de América del Norte

Se analiza el mercado de mangueras industriales de América del Norte y se proporcionan información y tendencias del tamaño del mercado por país, tipo, tipo de material, medio, tipo de cable, presión e industria como se menciona anteriormente.

Los países que se incluyen en este informe de mercado son Estados Unidos, Canadá y México. Estados Unidos domina la región de América del Norte debido a la alta demanda de mangueras industriales. Además, se espera que la alta demanda de materiales para mangueras de PVC actúe como un factor impulsor del crecimiento del mercado.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos afrontados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de las mangueras industriales en América del Norte

El panorama competitivo del mercado de mangueras industriales de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en I+D, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Algunos de los principales actores que operan en el mercado de mangueras industriales de América del Norte son Eaton, PARKER HANNIFIN CORP, RYCO Hydraulics, Kurt Manufacturing, NORRES Schlauchtechnik GmbH, Transfer Oil SpA, ContiTech AG (una subsidiaria de Continental AG), Kanaflex Corporation Co.,ltd., Pacific Echo, Colex International Limited, UK, Gates Corporation, Semperit AG Holding, Dixon Valve & Coupling Company, LLC y Titan Fittings, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA INDUSTRIAL HOSES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPACT OF UKRAINE WAR ON NORTH AMERICA INDUSTRIAL HOSES MARKET

4.1.1 ANALYSIS OF THE IMPACT OF THE UKRAINE WAR ON THE INDUSTRIAL HOSES MARKET

4.1.2 STRATEGIC DECISIONS FROM COUNTRIES AND THEIR EFFECT ON MARKET

4.1.3 IMPACT ON PRICE AND SUPPLY CHAIN

4.1.4 CONCLUSION

4.2 IMPACT OF COVID-19 ON THE NORTH AMERICA INDUSTRIAL HOSES MARKET

4.2.1 ANALYSIS ON THE IMPACT OF COVID-19 ON THE INDUSTRIAL HOSES MARKET

4.2.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

4.2.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

4.2.4 IMPACT ON PRICE

4.2.5 IMPACT ON DEMAND AND SUPPLY CHAIN

4.2.6 CONCLUSION

4.3 PRICING LIST

4.4 REGULATORY STANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 HIGH DEMAND FOR PVC HOSE MATERIALS

5.1.2 INCREASING NEED FOR DURABLE INDUSTRIAL HOSES IN CRITICAL APPLICATIONS

5.1.3 GROWING CONCERN ABOUT WORKPLACE SAFETY AND TESTING PROCEDURES

5.1.4 HIGH ADOPTION OF NON-METAL HOSES

5.2 RESTRAINTS

5.2.1 LIMITATIONS OF INDUSTRIAL HOSES IN VARIOUS APPLICATIONS

5.2.2 ENVIRONMENTAL CONCERNS REGARDING HOSES

5.3 OPPORTUNITIES

5.3.1 GROWING ADOPTION OF HOSES IN AUTOMOBILES SECTORS

5.3.2 GROWING USAGE AND DEMAND OF HOSES IN THE CHEMICAL INDUSTRY

5.3.3 INCREASING PARTNERSHIP AND ACQUISITION AMONG MARKET PLAYERS

5.3.4 RAPID PRODUCT DEVELOPMENT AND LAUNCHES OF INDUSTRIAL HOSES

5.4 CHALLENGE

5.4.1 LOW AWARENESS AMONG END USERS REGARDING HOSES

5.4.2 LACK OF SKILLED PROFESSIONALS FOR FITTING HOSES IN INDUSTRIES

6 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE

6.1 OVERVIEW

6.2 HYDRAULIC HOSES

6.3 LAYFLAT HOSE

6.4 WRAS HOSE

6.5 OIL RESISTANT HOSE

6.6 CORRUGATED HOSE

6.7 STRIPWOUND HOSE

6.8 THERMO-DUCT

6.9 OTHERS

7 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY MATERIAL TYPE

7.1 OVERVIEW

7.2 RUBBER

7.2.1 BY INDUSTRY

7.2.1.1 MINING

7.2.1.2 CONSTRUCTION

7.2.1.3 OIL AND GAS

7.2.1.4 AUTOMOTIVE

7.2.1.5 PHARMACEUTICAL

7.2.1.6 FOOD & BEVERAGES

7.2.1.7 AGRICULTURE

7.2.1.8 WATER

7.2.1.9 OTHERS

7.3 POLYURETHANE

7.3.1 BY WIRE TYPE

7.3.1.1 WIRE BRAIDED

7.3.1.2 SPIRAL WIRE

7.3.2 BY INDUSTRY

7.3.2.1 MINING

7.3.2.2 OIL AND GAS

7.3.2.3 CONSTRUCTION

7.3.2.4 AGRICULTURE

7.3.2.5 PHARMACEUTICAL

7.3.2.6 FOOD & BEVERAGES

7.3.2.7 WATER

7.3.2.8 AUTOMOTIVE

7.3.2.9 OTHERS

7.4 POLYVINYL CHLORIDE

7.4.1 BY WIRE TYPE

7.4.1.1 WIRE BRAIDED

7.4.1.2 SPIRAL WIRE

7.4.2 BY INDUSTRY

7.4.2.1 CONSTRUCTION

7.4.2.2 FOOD & BEVERAGES

7.4.2.3 AGRICULTURE

7.4.2.4 MINING

7.4.2.5 OIL AND GAS

7.4.2.6 PHARMACEUTICAL

7.4.2.7 AUTOMOTIVE

7.4.2.8 WATER

7.4.2.9 OTHERS

7.5 METAL

7.5.1 BY INDUSTRY

7.5.1.1 MINING

7.5.1.2 OIL AND GAS

7.5.1.3 PHARMACEUTICAL

7.5.1.4 CONSTRUCTION

7.5.1.5 FOOD & BEVERAGES

7.5.1.6 WATER

7.5.1.7 AUTOMOTIVE

7.5.1.8 AGRICULTURE

7.5.1.9 OTHERS

7.6 THERMOPLASTICS

7.6.1 BY INDUSTRY

7.6.1.1 OIL AND GAS

7.6.1.2 PHARMACEUTICAL

7.6.1.3 FOOD & BEVERAGES

7.6.1.4 AUTOMOTIVE

7.6.1.5 MINING

7.6.1.6 CONSTRUCTION

7.6.1.7 WATER

7.6.1.8 AGRICULTURE

7.6.1.9 OTHERS

7.7 COMPOSITE

7.7.1 BY INDUSTRY

7.7.1.1 OIL AND GAS

7.7.1.2 WATER

7.7.1.3 PHARMACEUTICAL

7.7.1.4 CONSTRUCTION

7.7.1.5 MINING

7.7.1.6 FOOD & BEVERAGES

7.7.1.7 AGRICULTURE

7.7.1.8 AUTOMOTIVE

7.7.1.9 OTHERS

7.8 SILICONE

7.8.1 BY INDUSTRY

7.8.1.1 AUTOMOTIVE

7.8.1.2 OIL AND GAS

7.8.1.3 MINING

7.8.1.4 CONSTRUCTION

7.8.1.5 FOOD & BEVERAGES

7.8.1.6 PHARMACEUTICAL

7.8.1.7 AGRICULTURE

7.8.1.8 WATER

7.8.1.9 OTHERS

7.9 OTHERS

8 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY MEDIA

8.1 OVERVIEW

8.2 OIL

8.3 WATER

8.4 GAS

9 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY WIRE TYPE

9.1 OVERVIEW

9.2 WIRE BRAIDED

9.3 SPIRAL WIRE

10 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY PRESSURE

10.1 OVERVIEW

10.2 LOW PRESSURE (LESS THAN 3000 PSI)

10.3 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

10.4 HIGH PRESSURE (MORE THAN 6000)

11 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 MINING

11.2.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.2.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.2.3 HIGH PRESSURE (MORE THAN 6000)

11.3 CONSTRUCTION

11.3.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.3.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.3.3 HIGH PRESSURE (MORE THAN 6000)

11.4 OIL AND GAS

11.4.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.4.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.4.3 HIGH PRESSURE (MORE THAN 6000)

11.5 AUTOMOTIVE

11.5.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.5.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.5.3 HIGH PRESSURE (MORE THAN 6000)

11.6 PHARMACEUTICAL

11.6.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.6.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.6.3 HIGH PRESSURE (MORE THAN 6000)

11.7 FOOD & BEVERAGES

11.7.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.7.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.7.3 HIGH PRESSURE (MORE THAN 6000)

11.8 AGRICULTURE

11.8.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.8.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.8.3 HIGH PRESSURE (MORE THAN 6000)

11.9 WATER

11.9.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.9.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.9.3 HIGH PRESSURE (MORE THAN 6000)

11.1 OTHERS

12 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA INDUSTRIAL HOSES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 EATON

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 GATES CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 CONTITECH AG (A SUBSIDIARY OF CONTINENTAL AG)

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 PARKER HANNIFIN CORP

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 SEMPERIT AG HOLDING

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 COLEX INTERNATIONAL LIMITED, UK

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 DIXON VALVE & COUPLING COMPANY, LLC

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 FLEXAUST INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 KANAFLEX CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 KURIYAMA OF AMERICA, INC. (A SUBSIDIARY OF KURIYAMA HOLDINGS CORPORATION)

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 KURT MANUFACTURING

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 NORRES SCHLAUCHTECHNIK GMBH

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 PACIFIC ECHO

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 PIRTEK

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 RYCO HYDRAULICS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 SALEM-REPUBLIC RUBBER COMPANY

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 TITAN FITTINGS

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 TITEFLEX (A SUBSIDIARY OF SMITHS GROUP PLC)

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 TRANSFER OIL S.P.A.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 TRELLEBORG GROUP (A SUBSIDIARY OF TRELLEBORG AB)

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (ASP USD)

TABLE 3 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (MILLION METER)

TABLE 4 NORTH AMERICA HYDRAULIC HOSES IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA LAYFLAT HOSE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA WRAS HOSE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA OIL RESISTANT IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA CORRUGATED HOSE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA STRIPWOUND HOSE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA THERMO-DUCT IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA OTHERS IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA RUBBER IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA RUBBER IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA METAL IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA METAL IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA THERMOPLASTICS IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA THERMOPLASTICS IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA COMPOSITE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA COMPOSITE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA SILICONE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA SILICONE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA OIL IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA WATER IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA GAS IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA WIRE BRAIDED IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA SPIRAL WIRE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA LOW PRESSURE (LESS THAN 3000 PSI) IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA MEDIUM PRESSURE (BETWEEN 3000 TO 6000) IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA HIGH PRESSURE (MORE THAN 6000) IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA MINING IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA MINING IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA OIL & GAS IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA OIL & GAS IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA FOOD & BEVERAGES IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA FOOD & BEVERAGES IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA AGRICULTURE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA AGRICULTURE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA WATER IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA WATER IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA OTHERS IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (ASP USD)

TABLE 62 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (MILLION METER)

TABLE 63 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA RUBBER IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA METAL IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA THERMOPLASTIC IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA COMPOSITE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA SILICONE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA MINING IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA OIL AND GAS IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 81 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA FOOD & BEVERAGES IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 83 NORTH AMERICA AGRICULTURE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA WATER IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 85 U.S. INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 U.S. INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (ASP USD)

TABLE 87 U.S. INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (MILLION METER)

TABLE 88 U.S. INDUSTRIAL HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 89 U.S. POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 90 U.S. POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 91 U.S. RUBBER IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 92 U.S. POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 93 U.S. POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 94 U.S. METAL IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 95 U.S. THERMOPLASTIC IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 96 U.S. COMPOSITE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 97 U.S. SILICONE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 98 U.S. INDUSTRIAL HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 99 U.S. INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 100 U.S. INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 101 U.S. INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 102 U.S. MINING IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 103 U.S. CONSTRUCTION IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 104 U.S. OIL AND GAS IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 105 U.S. AUTOMOTIVE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 106 U.S. PHARMACEUTICAL IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 107 U.S. FOOD & BEVERAGES IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 108 U.S. AGRICULTURE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 109 U.S. WATER IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 110 CANADA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 111 CANADA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (ASP USD)

TABLE 112 CANADA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (MILLION METER)

TABLE 113 CANADA INDUSTRIAL HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 114 CANADA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 115 CANADA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 116 CANADA RUBBER IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 117 CANADA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 118 CANADA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 119 CANADA METAL IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 120 CANADA THERMOPLASTIC IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 121 CANADA COMPOSITE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 122 CANADA SILICONE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 123 CANADA INDUSTRIAL HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 124 CANADA INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 125 CANADA INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 126 CANADA INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 127 CANADA MINING IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 128 CANADA CONSTRUCTION IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 129 CANADA OIL AND GAS IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 130 CANADA AUTOMOTIVE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 131 CANADA PHARMACEUTICAL IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 132 CANADA FOOD & BEVERAGES IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 133 CANADA AGRICULTURE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 134 CANADA WATER IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 135 MEXICO INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 MEXICO INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (ASP USD)

TABLE 137 MEXICO INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (MILLION METER)

TABLE 138 MEXICO INDUSTRIAL HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 139 MEXICO POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 140 MEXICO POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 141 MEXICO RUBBER IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 142 MEXICO POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 143 MEXICO POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 144 MEXICO METAL IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 145 MEXICO THERMOPLASTIC IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 146 MEXICO COMPOSITE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 147 MEXICO SILICONE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 148 MEXICO INDUSTRIAL HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 149 MEXICO INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 150 MEXICO INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 151 MEXICO INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 152 MEXICO MINING IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 153 MEXICO CONSTRUCTION IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 154 MEXICO OIL AND GAS IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 155 MEXICO AUTOMOTIVE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 156 MEXICO PHARMACEUTICAL IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 157 MEXICO FOOD & BEVERAGES IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 158 MEXICO AGRICULTURE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 159 MEXICO WATER IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA INDUSTRIAL HOSES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INDUSTRIAL HOSES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INDUSTRIAL HOSES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INDUSTRIAL HOSES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INDUSTRIAL HOSES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INDUSTRIAL HOSES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INDUSTRIAL HOSES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA INDUSTRIAL HOSES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA INDUSTRIAL HOSES MARKET: SEGMENTATION

FIGURE 10 INCREASED DEMAND IN FOR ROBUST INDUSTRIAL PROCESSES IN CRITICAL APPLICATIONS IS EXPECTED TO DRIVE THE NORTH AMERICA INDUSTRIAL HOSES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 HYDRAULIC HOSES ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INDUSTRIAL HOSES MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA INDUSTRIAL HOSES MARKET

FIGURE 13 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY TYPE, 2022

FIGURE 14 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY MATERIAL TYPE, 2022

FIGURE 15 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY MEDIA, 2022

FIGURE 16 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY WIRE TYPE, 2022

FIGURE 17 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY PRESSURE, 2022

FIGURE 18 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY INDUSTRY, 2022

FIGURE 19 NORTH AMERICA INDUSTRIAL HOSES MARKET: SNAPSHOT (2022)

FIGURE 20 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY COUNTRY (2022)

FIGURE 21 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 22 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 23 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY TYPE (2023-2030)

FIGURE 24 NORTH AMERICA INDUSTRIAL HOSES MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.