Mercado de calderas industriales de América del Norte , por métodos de tubería (calderas pirotubulares, calderas acuotubulares), presión de vapor (calderas de alta presión, calderas de presión media, calderas de baja presión), uso de vapor (calderas de proceso, calderas de servicios públicos, calderas marinas), posición del horno (calderas de encendido externo, calderas de encendido interno), eje de la carcasa (calderas horizontales, calderas verticales), tubos en calderas (calderas multitubulares, calderas individuales), circulación de agua y vapor en calderas (calderas de circulación forzada, calderas de circulación natural), tipo de combustible (calderas de carbón, calderas de fueloil, calderas de gas, calderas de biomasa, otras), tipo de producto (caldera de agua caliente de condensación, caldera de agua caliente de condensación integrada, caldera de vapor de condensación integrada, caldera de vapor de condensación dividida, caldera de vapor calentada eléctricamente). Calderas, Calderas Eléctricas de Agua Caliente, Otras), Potencia de Calderas (10-150 BHP, 151 -300 BHP, 301 - 600 BHP), Industria (Industria Alimentaria, Cervecerías, Lavanderías y Empresas de Limpieza, Construcción, Farmacéutica, Automotriz, Pulpa y Papel, Hospitales, Agricultura, Embalaje, Otras) – Tendencias de la Industria y Pronóstico hasta 2029

Análisis y tamaño del mercado

En todo el mundo se ha observado un aumento de la necesidad de generación de energía debido al rápido aumento de la población. Las calderas industriales se utilizan ampliamente en diversos sectores, como la industria metalúrgica y minera, la química, la refinación y la alimentación, entre otros.

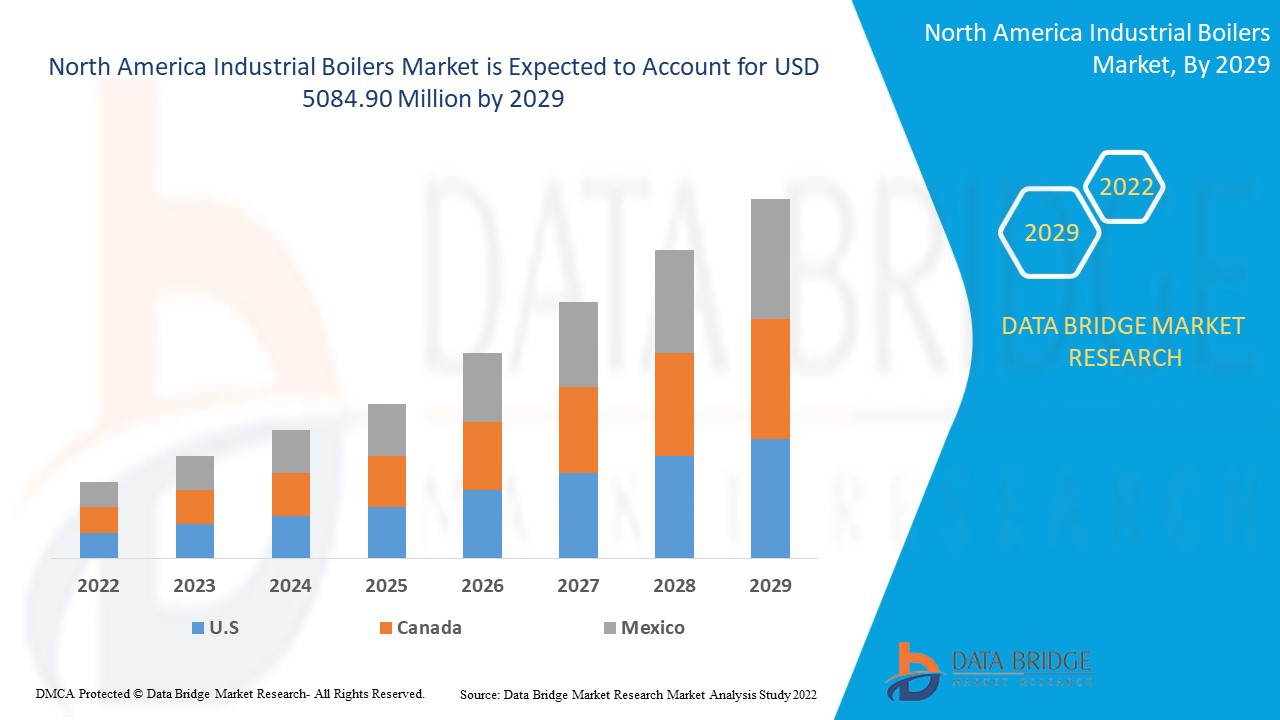

El mercado de calderas industriales de América del Norte se valoró en USD 2962,22 millones en 2021 y se espera que alcance los USD 5084,90 millones para 2029, registrando una CAGR del 5,90% durante el período de pronóstico de 2022-2029. La industria alimentaria representa los segmentos del sector de uso final más grandes en el mercado respectivo debido al consumo de productos de panadería y comidas rápidas. El informe de mercado curado por el equipo de investigación de mercado de Data Bridge incluye un análisis experto en profundidad, análisis de importación / exportación, análisis de precios, análisis de consumo de producción y análisis de pestle.

Definición de mercado

Una caldera industrial es un hervidor de agua a vapor o a alta temperatura que utiliza gas combustible, biomasa, petróleo o carbón como combustible. Las calderas modernas calientan o enfrían el agua que contienen y la distribuyen a los clientes a través de las estructuras de la línea.

Alcance del informe y segmentación del mercado

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Métodos de tuberías (calderas pirotubulares, calderas acuotubulares), presión de vapor (calderas de alta presión, calderas de presión media, calderas de baja presión), uso de vapor (calderas de proceso, calderas de servicios públicos, calderas marinas), posición del horno (calderas de encendido externo, calderas de encendido interno), eje de la carcasa (calderas horizontales, calderas verticales), tubos en calderas (calderas multitubulares, calderas individuales), circulación de agua y vapor en calderas (calderas de circulación forzada, calderas de circulación natural), tipo de combustible (calderas de carbón, calderas de fueloil, calderas de gas, calderas de biomasa, otras), tipo de producto (caldera de agua caliente de condensación, caldera de agua caliente de condensación integrada, caldera de vapor de condensación integrada, caldera de vapor de condensación dividida, caldera de vapor calentada eléctricamente, calderas de agua caliente eléctricas, Otros), Potencia de calderas (10-150 BHP, 151 -300 BHP, 301 - 600 BHP), Industria (Industria alimentaria, Cervecerías, Lavanderías y empresas de limpieza, Construcción, Farmacéutica, Automotriz, Pulpa y papel, Hospitales, Agricultura, Embalaje, Otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México en América del Norte. |

|

Actores del mercado cubiertos |

Babcock & Wilcox Enterprises, Inc. (EE. UU.), John Wood Group PLC (Reino Unido), Bharat Heavy Electricals Limited (India), IHI Corporation (Japón), Mitsubishi Hitachi Power Systems, Ltd. (Europa), Thermax Limited (India), ANDRITZ (Austria), Siemens (Alemania), ALFA LAVAL (Suecia), General Electric Company (EE. UU.), Hurst Boiler & Welding Co, Inc. (EE. UU.), Bryan Steam (EE. UU.), Superior Boiler Works, Inc. (EE. UU.), Vapor Power (EE. UU.), Sofinter Spa (Italia), Cleaver-Brooks, Inc (EE. UU.) y ZOZEN boiler Co., Ltd. (China), entre otros. |

|

Oportunidades de mercado |

|

Dinámica del mercado de calderas industriales en América del Norte

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- Avances tecnológicos

El mercado se verá estimulado por el sólido crecimiento de las instalaciones industriales en línea con los programas de expansión de los gobiernos estatales y federales.

- Regulaciones gubernamentales estrictas

Las estrictas normas gubernamentales destinadas a reducir las emisiones de gases de efecto invernadero, así como un enfoque creciente en la reducción del uso de combustible, impulsarán el mercado.

- Creciente adopción de unidades eficientes

La mayor aceptación de unidades eficientes en la industria química, debido a su funcionamiento seguro, alta eficiencia y bajo mantenimiento, impulsará la adopción de productos, lo que influirá aún más en el crecimiento del mercado.

Oportunidades

Además, la creciente adopción de nueva tecnología de calderas inteligentes en las operaciones de la planta y el desarrollo constante por parte de los proveedores extienden oportunidades rentables a los actores del mercado en el período de pronóstico de 2022 a 2029.

Restricciones/Desafíos

Por otra parte, se espera que el aumento de la inversión inicial obstaculice el crecimiento del mercado. Además, la corrosión, la incapacidad de alcanzar la vida útil requerida y otros problemas tecnológicos requerirán más investigación e inversión en esfuerzos de investigación y desarrollo, lo que se prevé que suponga un desafío para el mercado de las aspiradoras centrales en el período de pronóstico de 2022 a 2029.

Este informe sobre el mercado de calderas industriales de América del Norte proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de calderas industriales de América del Norte, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto de la COVID-19 en el mercado de calderas industriales de América del Norte

El COVID-19 tuvo un impacto negativo en el mercado de calderas industriales. La epidemia de COVID-19 ha provocado que se pospongan varias iniciativas, incluidas la construcción, la reorganización y la renovación de infraestructuras. Una mayor atención del gobierno a la compensación excesiva de los impactos mediante la mejora de las operaciones cuando surjan oportunidades aceleraría el crecimiento de la industria. Por otro lado, las acciones del gobierno para reabrir las principales industrias, instalaciones de fabricación y proyectos de infraestructura respaldarán el crecimiento corporativo.

Acontecimientos recientes

En enero de 2020, Babcock & Wilcox Enterprises, Inc. recibió un nuevo contrato por aproximadamente 5 millones de dólares para la instalación de equipos de calderas de modernización. La innovadora técnica se está utilizando para modernizar los equipos de calderas en las centrales eléctricas de carbón estadounidenses. Este contrato ayudó a la organización a ampliar su presencia en el mercado y su base de clientes en los Estados Unidos.

Alcance y tamaño del mercado de calderas industriales en América del Norte

El mercado de calderas industriales de América del Norte está segmentado en función de los métodos de tuberías, la presión del vapor, el uso del vapor, la posición del horno, el eje de la carcasa, los tubos en las calderas, la circulación del agua y el vapor en las calderas, el tipo de combustible, el tipo de producto, la potencia de la caldera y la industria. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento escaso en las industrias y proporcionará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Métodos de entubado

- Calderas pirotubulares Carrier

- Calderas acuotubulares

Presión de vapor

- Calderas de alta presión

- Calderas de presión media

- Calderas de baja presión

Uso de Steam

- Calderas de proceso

- Calderas de servicio

- Calderas Marinas

Posición del horno

- Calderas de encendido externo

- Calderas de encendido interno

Eje de la concha

- Calderas horizontales

- Calderas verticales

Tubos en calderas

- Calderas multitubulares

- Calderas individuales

Circulación de agua y vapor en calderas

- Calderas de circulación forzada

- Calderas de circulación natural

Tipo de combustible

- Calderas de carbón

- Calderas de gasoil

- Calderas de gas

- Calderas de biomasa

- Otros

Tipo de producto

- Caldera de agua caliente por condensación

- Caldera de agua caliente de condensación integrada

- Caldera de vapor de condensación integrada

- Caldera de vapor de condensación dividida

- Caldera de vapor calentada eléctricamente

- Calderas eléctricas de agua caliente

- Otros

Caballos de fuerza de la caldera

- 10-150 CV

- 151-300 CV

- 301 - 600 CV

Industria

- Industria alimentaria

- Cervecerías

- Empresa de Lavandería y Limpieza

- Construcción

- Farmacéutico

- Automotor

- Pulpa y papel

- Hospitales

- Agricultura

- Embalaje

- Otros

Análisis y perspectivas regionales del mercado de calderas industriales de América del Norte

Se analiza el mercado de calderas industriales de América del Norte y se proporcionan información y tendencias del tamaño del mercado por país, métodos de tubería, presión de vapor, uso de vapor, posición del horno, eje de la carcasa, tubos en calderas, circulación de agua y vapor en calderas, tipo de combustible, tipo de producto, potencia de la caldera e industria como se menciona anteriormente.

Los países cubiertos en el informe del mercado de calderas industriales de América del Norte son Estados Unidos, Canadá y México en América del Norte.

Estados Unidos domina el mercado de calderas industriales de América del Norte debido a su sólida capacidad financiera para aceptar nuevas tecnologías o tecnologías que requieren mayor capital.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas abajo y aguas arriba, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Panorama competitivo y mercado de calderas industriales en América del Norte

El panorama competitivo del mercado de calderas industriales de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de calderas industriales de América del Norte.

Algunos de los principales actores que operan en el mercado de calderas industriales de América del Norte son

- Babcock & Wilcox Enterprises, Inc. (Estados Unidos)

- John Wood Group PLC (Reino Unido)

- Bharat Heavy Electricals Limited (India)

- Corporación IHI (Japón)

- Mitsubishi Hitachi Power Systems, Ltd. (Europa)

- Thermax Limited (India)

- ANDRITZ (Austria)

- Siemens (Germany)

- ALFA LAVAL (Sweden)

- General Electric Company (US)

- Hurst Boiler & Welding Co, Inc. (US)

- Bryan Steam (US)

- Superior Boiler Works, Inc. (US)

- Vapor Power (US)

- Sofinter S.p.a (Italy)

- Cleaver-Brooks, Inc (US)

- ZOZEN boiler Co., Ltd. (China)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INDUSTRIAL BOILERS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TUBING METHODS TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR LOW EMISSION INDUSTRIAL BOILERS

5.1.2 GROWING DEMAND FOR ADVANCED BOILER SOLUTION FROM INDUSTRIAL VERTICALS

5.1.3 RISING DEMAND FROM THE FOOD AND BEVERAGES INDUSTRY

5.1.4 RAPID ADOPTION OF INDUSTRIAL BOILER FROM ASIAN COUNTRIES

5.2 RESTRAINT

5.2.1 HIGH INVESTMENT COST

5.3 OPPORTUNITIES

5.3.1 DIGITALISATION OF THE INDUSTRIAL BOILER FOR IMPROVING EFFICIENCY

5.3.2 GROWING DEMAND FOR THE BIOMASS BOILERS

5.3.3 ADVENT OF PORTABLE, RENTAL AND TEMPORARY INDUSTRIAL BOILERS

5.4 CHALLENGES

5.4.1 TECHNICAL CHALLENGES TO IMPROVE THE PERFORMANCE AND LIFE

5.4.2 UNCERTAINTY AMONGST CUSTOMERS ABOUT INDUSTRIAL BOILER SAFETY AT PLANT

6 IMPACT ANALYSIS OF COVID-19 ON THE MARKET

6.1 IMPACT ON THE MANUFACTURING INDUSTRY AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MARKET PLAYERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND

6.4 CONSLUSION

7 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBING METHODS

7.1 OVERVIEW

7.2 WATER TUBE BOILERS

7.3 FIRE TUBE BOILERS

8 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM PRESSURE

8.1 OVERVIEW

8.2 HIGH PRESSURE BOILERS

8.3 MEDIUM PRESSURE BOILERS

8.4 LOW PRESSURE BOILERS

9 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM USAGE

9.1 OVERVIEW

9.2 PROCESS BOILERS

9.3 UTILITY BOILERS

9.4 MARINE BOILERS

10 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY FURNACE POSITION

10.1 OVERVIEW

10.2 EXTERNALLY FIRED BOILERS

10.3 INTERNALLY FIRED BOILERS

11 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY SHELL AXIS

11.1 OVERVIEW

11.2 HORIZONTAL BOILERS

11.3 VERTICAL BOILERS

12 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBES IN BOILERS

12.1 OVERVIEW

12.2 MULTI TUBE BOILERS

12.3 SINGLE TUBE BOILERS

13 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY WATER AND STEAM CIRCULATION IN BOILERS

13.1 OVERVIEW

13.2 FORCED CIRCULATION BOILERS

13.3 NATURAL CIRCULATION BOILERS

14 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BYFUEL TYPE

14.1 OVERVIEW

14.2 GAS FIRED BOILERS

14.3 COAL FIRED BOILERS

14.4 BIOMASS BOILERS

14.5 OIL FIRED BOILERS

14.6 OTHERS

15 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY PRODUCT TYPE

15.1 OVERVIEW

15.2 CONDENSING HOT WATER BOILER

15.3 INTEGRATED CONDENSING HOT WATER BOILER

15.4 INTEGRATED CONDENSING STEAM BOILER

15.5 SPLIT CONDENSING STEAM BOILER

15.6 ELECTRIC HEATED STEAM BOILER

15.7 ELECTRIC HOT WATER BOILERS

15.8 OTHERS

16 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER

16.1 OVERVIEW

16.2-150 BHP

16.3 -300 BHP

16.4 - 600 BHP

17 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY INDUSTRY

17.1 OVERVIEW

17.2 FOOD INDUSTRY

17.2.1 CONDENSING HOT WATER BOILER

17.2.2 INTEGRATED CONDENSING HOT WATER BOILER

17.2.3 SPLIT CONDENSING STEAM BOILER

17.2.4 INTEGRATED CONDENSING STEAM BOILER

17.2.5 ELECTRIC HEATED STEAM BOILER

17.2.6 ELECTRIC HOT WATER BOILERS

17.2.7 OTHERS

17.3 BREWERIES

17.3.1 CONDENSING HOT WATER BOILER

17.3.2 INTEGRATED CONDENSING HOT WATER BOILER

17.3.3 SPLIT CONDENSING STEAM BOILER

17.3.4 INTEGRATED CONDENSING STEAM BOILER

17.3.5 ELECTRIC HEATED STEAM BOILER

17.3.6 ELECTRIC HOT WATER BOILERS

17.3.7 OTHERS

17.4 LAUNDRIES AND CLEANING FIRM

17.4.1 SPLIT CONDENSING STEAM BOILER

17.4.2 INTEGRATED CONDENSING STEAM BOILER

17.4.3 CONDENSING HOT WATER BOILER

17.4.4 INTEGRATED CONDENSING HOT WATER BOILER

17.4.5 ELECTRIC HEATED STEAM BOILER

17.4.6 ELECTRIC HOT WATER BOILERS

17.4.7 OTHERS

17.5 PHARMACEUTICAL

17.5.1 INTEGRATED CONDENSING HOT WATER BOILER

17.5.2 CONDENSING HOT WATER BOILER

17.5.3 INTEGRATED CONDENSING STEAM BOILER

17.5.4 ELECTRIC HOT WATER BOILERS

17.5.5 ELECTRIC HEATED STEAM BOILER

17.5.6 SPLIT CONDENSING STEAM BOILER

17.5.7 OTHERS

17.6 HOSPITALS

17.6.1 INTEGRATED CONDENSING STEAM BOILER

17.6.2 CONDENSING HOT WATER BOILER

17.6.3 INTEGRATED CONDENSING HOT WATER BOILER

17.6.4 ELECTRIC HOT WATER BOILERS

17.6.5 ELECTRIC HEATED STEAM BOILER

17.6.6 SPLIT CONDENSING STEAM BOILER

17.6.7 OTHERS

17.7 CONSTRUCTION

17.7.1 INTEGRATED CONDENSING STEAM BOILER

17.7.2 CONDENSING HOT WATER BOILER

17.7.3 INTEGRATED CONDENSING HOT WATER BOILER

17.7.4 ELECTRIC HEATED STEAM BOILER

17.7.5 SPLIT CONDENSING STEAM BOILER

17.7.6 ELECTRIC HOT WATER BOILERS

17.7.7 OTHERS

17.8 PULP AND PAPER

17.8.1 CONDENSING HOT WATER BOILER

17.8.2 SPLIT CONDENSING STEAM BOILER

17.8.3 INTEGRATED CONDENSING HOT WATER BOILER

17.8.4 ELECTRIC HOT WATER BOILERS

17.8.5 ELECTRIC HEATED STEAM BOILER

17.8.6 INTEGRATED CONDENSING STEAM BOILER

17.8.7 OTHERS

17.9 AUTOMOTIVE

17.9.1 CONDENSING HOT WATER BOILER

17.9.2 INTEGRATED CONDENSING HOT WATER BOILER

17.9.3 INTEGRATED CONDENSING STEAM BOILER

17.9.4 ELECTRIC HOT WATER BOILERS

17.9.5 ELECTRIC HEATED STEAM BOILER

17.9.6 SPLIT CONDENSING STEAM BOILER

17.9.7 OTHERS

17.1 AGRICULTURE

17.10.1 SPLIT CONDENSING STEAM BOILER

17.10.2 INTEGRATED CONDENSING HOT WATER BOILER

17.10.3 CONDENSING HOT WATER BOILER

17.10.4 INTEGRATED CONDENSING STEAM BOILER

17.10.5 ELECTRIC HEATED STEAM BOILER

17.10.6 ELECTRIC HOT WATER BOILERS

17.10.7 OTHERS

17.11 PACKAGING

17.11.1 ELECTRIC HEATED STEAM BOILER

17.11.2 INTEGRATED CONDENSING STEAM BOILER

17.11.3 SPLIT CONDENSING STEAM BOILER

17.11.4 INTEGRATED CONDENSING HOT WATER BOILER

17.11.5 CONDENSING HOT WATER BOILER

17.11.6 ELECTRIC HOT WATER BOILERS

17.11.7 OTHERS

17.12 OTHERS

18 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY GEOGRAPHY

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

19 NORTH AMERICA INDUSTRIAL BOILERS MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

20 NORTH AMERICA INDUSTRIAL BOILERS MARKET, SWOT

21 COMPANY PROFILE

21.1 GENERAL ELECTRIC

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 COMPANY SHARE ANALYSIS

21.1.4 PRODUCT PORTFOLIO

21.1.5 RECENT DEVELOPMENTS

21.2 MITSUBISHI HITACHI POWER SYSTEMS, LTD.

21.2.1 COMPANY SNAPSHOT

21.2.2 COMPANY PROFILE

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT DEVELOPMENTS

21.3 ANDRITZ

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE ANALYSIS

21.3.3 COMPANY SHARE ANALYSIS

21.3.4 PRODUCT PORTFOLIO

21.3.5 RECENT DEVELOPMENTS

21.4 ALFA LAVAL

21.4.1 COMPANY SNAPSHOT

21.4.2 REVENUE ANALYSIS

21.4.3 COMPANY SHARE ANALYSIS

21.4.4 PRODUCT PORTFOLIO

21.4.5 RECENT DEVELOPMENTS

21.5 IHI CORPORATION

21.5.1 COMPANY SNAPSHOT

21.5.2 REVENUE ANALYSIS

21.5.3 COMPANY SHARE ANALYSIS

21.5.4 PRODUCT PORTFOLIO

21.5.5 RECENT DEVELOPMENTS

21.6 THERMAX LIMITED

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE ANALYSIS

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT DEVELOPMENTS

21.7 AB&CO GROUP

21.7.1 COMPANY SNAPSHOT

21.7.2 PRODUCT PORTFOLIO

21.7.3 RECENT DEVELOPMENT

21.8 BABCOCK & WILCOX ENTERPRISES, INC.

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT DEVELOPMENTS

21.9 BHARAT HEAVY ELECTRICALS LIMITED

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 RECENT DEVELOPMENTS

21.1 BRYAN STEAM

21.10.1 COMPANY SNAPSHOT

21.10.2 PRODUCT PORTFOLIO

21.10.3 RECENT DEVELOPMENTS

21.11 CLEAVER-BROOKS, INC

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.11.3 RECENT DEVELOPMENTS

21.12 DEC

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT DEVELOPMENTS

21.13 HURST BOILER & WELDING CO, INC.

21.13.1 COMPANY SNAPSHOT

21.13.2 PRODUCT PORTFOLIO

21.13.3 RECENT DEVELOPMENTS

21.14 JOHN WOOD GROUP PLC

21.14.1 COMPANY SNAPSHOT

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 RECENT DEVELOPMENTS

21.15 SIEMENS

21.15.1 COMPANY SNAPSHOT

21.15.2 REVENUE ANALYSIS

21.15.3 PRODUCT PORTFOLIO

21.15.4 RECENT DEVELOPMENT

21.16 SOFINTER S.P.A

21.16.1 COMPANY SNAPSHOT

21.16.2 PRODUCT PORTFOLIO

21.16.3 RECENT DEVELOPMENTS

21.17 SUPERIOR BOILER WORKS, INC.

21.17.1 COMPANY SNAPSHOT

21.17.2 PRODUCT PORTFOLIO

21.17.3 RECENT DEVELOPMENTS

21.18 SUZHOU HAILU HEAVY INDUSTRY CO., LTD

21.18.1 COMPANY SNAPSHOT

21.18.2 PRODUCT PORTFOLIO

21.18.3 RECENT DEVELOPMENTS

21.19 VAPOR POWER

21.19.1 COMPANY SNAPSHOT

21.19.2 PRODUCT PORTFOLIO

21.19.3 RECENT DEVELOPMENT

21.2 ZOZEN BOILER CO., LTD.

21.20.1 COMPANY SNAPSHOT

21.20.2 PRODUCT PORTFOLIO

21.20.3 RECENT DEVELOPMENTS

22 QUESTIONNAIRE

23 RELATED REPORTS

Lista de Tablas

LIST OF TABLES

TABLE 1 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 2 NORTH AMERICA WATER TUBE BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 3 NORTH AMERICA FIRE TUBE BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 4 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 5 NORTH AMERICA HIGH PRESSURE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 6 NORTH AMERICA MEDIUM PRESSURE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 7 NORTH AMERICA MEDIUM PRESSURE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 8 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 9 NORTH AMERICA PROCESS BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 10 NORTH AMERICA UTILITY BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 11 NORTH AMERICA MARINE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 12 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 13 NORTH AMERICA EXTERNALLY FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 14 NORTH AMERICA INTERNALLY FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 15 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 16 NORTH AMERICA HORIZONTAL BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 17 NORTH AMERICA VERTICAL BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 18 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 19 NORTH AMERICA MULTI TUBE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 20 NORTH AMERICA SINGLE TUBE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 21 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 22 NORTH AMERICA FORCED CIRCULATION BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 23 NORTH AMERICA NATURAL CIRCULATION BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 24 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 25 NORTH AMERICA GAS FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 26 NORTH AMERICA COAL FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 27 NORTH AMERICA BIOMASS BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 28 NORTH AMERICA OIL FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 30 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 31 NORTH AMERICA CONDENSING HOT WATER BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 32 NORTH AMERICA INTEGRATED CONDENSING HOT WATER BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 33 NORTH AMERICA INTEGRATED CONDENSING STEAM BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 34 NORTH AMERICA SPLIT CONDENSING STEAM BOILERIN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 35 NORTH AMERICA ELECTRIC HEATED STEAM BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 36 NORTH AMERICA ELECTRIC HOT WATER BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 38 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 39 NORTH AMERICA 10-150 BHP IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 40 NORTH AMERICA 151 -300 BHPIN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 41 NORTH AMERICA 301 - 600 BHPIN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 42 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 43 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 44 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 45 NORTH AMERICA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 46 NORTH AMERICA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 47 NORTH AMERICA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 48 NORTH AMERICA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 49 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 50 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 51 NORTH AMERICA HOSPITALS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 52 NORTH AMERICA HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 53 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 54 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 55 NORTH AMERICA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 56 NORTH AMERICA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 57 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 58 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 59 NORTH AMERICA AGRICULTURE IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 60 NORTH AMERICA AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 61 NORTH AMERICA PACKAGING IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 62 NORTH AMERICA PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 63 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 64 NORTH AMERICAINDUSTRIAL BOILERS MARKET,BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 65 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 66 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 67 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 68 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 69 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 70 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 71 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 72 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 73 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 74 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 75 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 76 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 77 NORTH AMERICA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 78 NORTH AMERICA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 79 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 80 NORTH AMERICA HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 81 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 82 NORTH AMERICA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 83 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 84 NORTH AMERICA AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 85 NORTH AMERICA PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 86 U.S. INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 87 U.S. INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 88 U.S. INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 89 U.S. INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 90 U.S. INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 91 U.S. INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 92 U.S. INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 93 U.S. INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 94 U.S. INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 95 U.S. INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 96 U.S. INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 97 U.S. FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 98 U.S. BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 99 U.S. LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 100 U.S. PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 101 U.S. HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 102 U.S. CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 103 U.S. PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 104 U.S. AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 105 U.S. AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 106 U.S. PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 107 CANADA INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 108 CANADA INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 109 CANADA INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 110 CANADA INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 111 CANADA INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 112 CANADA INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 113 CANADA INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 114 CANADA INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 115 CANADA INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 116 CANADA INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 117 CANADA INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 118 CANADA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 119 CANADA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 120 CANADA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 121 CANADA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 122 CANADA HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 123 CANADA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 124 CANADA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 125 CANADA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 126 CANADA AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 127 CANADA PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 128 MEXICO INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 129 MEXICO INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 130 MEXICO INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 131 MEXICO INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 132 MEXICO INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 133 MEXICO INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 134 MEXICO INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 135 MEXICO INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 136 MEXICO INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 137 MEXICO INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 138 MEXICO INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 139 MEXICO FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 140 MEXICO BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 141 MEXICO LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 142 MEXICO PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 143 MEXICO HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 144 MEXICO CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 145 MEXICO PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 146 MEXICO AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 147 MEXICO AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 148 MEXICO PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

Lista de figuras

LIST OF FIGURES

FIGURE 1 NORTH AMERICA INDUSTRIAL BOILERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INDUSTRIAL BOILERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INDUSTRIAL BOILERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INDUSTRIAL BOILERS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INDUSTRIAL BOILERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INDUSTRIAL BOILERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INDUSTRIAL BOILERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA INDUSTRIAL BOILERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA INDUSTRIAL BOILERS MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR LOW EMISSION INDUSTRIAL BOILERS AND GROWING DEMAND FOR ADVANCED BOILER SOLUTION FROM INDUSTRIAL VERTICALS ARE DRIVING THE NORTH AMERICA INDUSTRIAL BOILERS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 11 WATER TUBE BOILERS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA INDUSTRIAL BOILERS MARKET IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINT, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA INDUSTRIAL BOILERS MARKET

FIGURE 13 THERMODYNE MARKET SHARE OF FOOD INDUSTRY BOILERS

FIGURE 14 FUEL LOSS IN BOILER WITH SCALE BUILD UP

FIGURE 15 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY TUBING METHODS, 2019

FIGURE 16 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BYSTEAM PRESSURE, 2019

FIGURE 17 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY STEAM USAGE, 2019

FIGURE 18 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY FURNACE POSITION, 2019

FIGURE 19 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY SHELL AXIS, 2019

FIGURE 20 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY TUBES IN BOILERS, 2019

FIGURE 21 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY WATER AND STEAM CIRCULATION IN BOILERS, 2019

FIGURE 22 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BYFUEL TYPE, 2019

FIGURE 23 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY PRODUCT TYPE, 2019

FIGURE 24 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY BOILER HORSEPOWER, 2019

FIGURE 25 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY INDUSTRY, 2019

FIGURE 26 NORTH AMERICAINDUSTRIAL BOILERS MARKET: SNAPSHOT (2019)

FIGURE 27 NORTH AMERICAINDUSTRIAL BOILERS MARKET: BY COUNTRY(2019)

FIGURE 28 NORTH AMERICAINDUSTRIAL BOILERS MARKET: BY COUNTRY(2020& 2027)

FIGURE 29 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY COUNTRY (2019& 2027)

FIGURE 30 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY TUBING METHODS (2020-2027)

FIGURE 31 NORTH AMERICA INDUSTRIAL BOILERS MARKET: COMPANY SHARE 2019 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.