Mercado de células madre pluripotentes inducidas (iPSC) de América del Norte, por fuente celular (células de la piel y células sanguíneas), tipo (IPSC humanas e IPSC de ratón), producto (instrumentos, consumibles, kits y servicios), aplicaciones (investigación académica, medicina regenerativa, terapia celular, detección toxicológica, descubrimiento y desarrollo de fármacos, modelado de enfermedades, bancos de células madre, bioimpresión 3D y otros), usuario final (empresas biotecnológicas y farmacéuticas, laboratorios de investigación, laboratorios de diagnóstico y otros), canal de distribución (licitación directa y ventas minoristas), país (EE. UU., Canadá, México): tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado: mercado de células madre pluripotentes inducidas (iPSC) en América del Norte

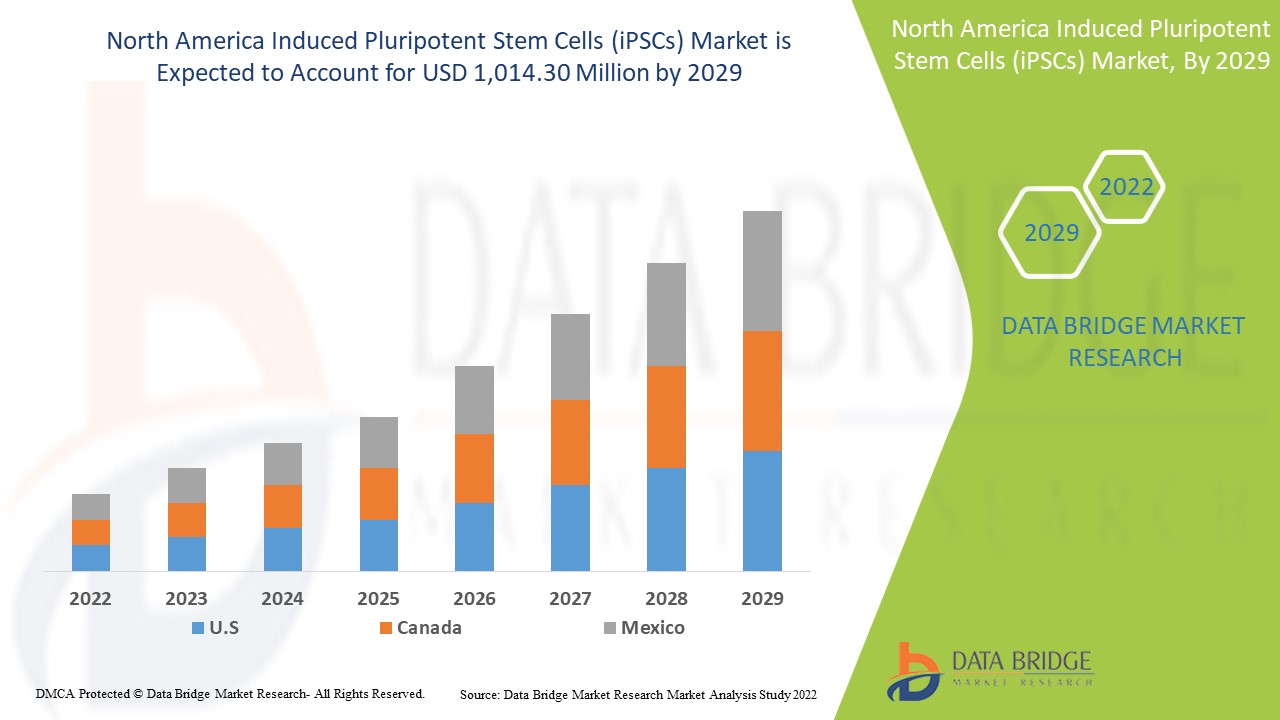

Se espera que el mercado de células madre pluripotentes inducidas (iPSC) de América del Norte gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 9,8% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 1.014,30 millones para 2029. El aumento de las actividades de investigación sobre terapias con células madre actúa como impulsor del crecimiento del mercado de células madre pluripotentes inducidas (iPSC).

Las células madre pluripotentes inducidas son un tipo de células derivadas de los tejidos somáticos adultos y reprogramadas con un conjunto de genes y factores para obtener la naturaleza pluripotente. Se añaden ciertos genes y factores para lograr propiedades definidas de las células madre embrionarias. Las células pluripotentes inducidas son casi idénticas a las células donantes y ayudan en el modelado de enfermedades. Los retrovirus se utilizan comúnmente como vectores para reprogramar las células madre pluripotentes inducidas. Las principales aplicaciones de las células madre pluripotentes inducidas son el modelado de enfermedades, el descubrimiento y desarrollo de fármacos, los estudios de toxicidad y las terapias génicas. Se utilizan ampliamente en tratamientos para enfermedades cardiovasculares, diabetes mellitus y varios tipos de cáncer. Las células madre pluripotentes inducidas humanas muestran las propiedades relevantes de la enfermedad, ya que llevan el genotipo específico de la enfermedad, lo que permite nuevas opciones terapéuticas de forma específica para el paciente.

La creciente adopción de terapias con células madre, el creciente sector de la biotecnología con una mayor inversión y la creciente prevalencia de enfermedades crónicas actúan como impulsores del mercado de células madre pluripotentes inducidas (iPSC). Otros factores que se prevé que impulsen el crecimiento del mercado de células madre pluripotentes inducidas (iPSC) en América del Norte incluyen la amplia gama de aplicaciones clínicas de las células madre pluripotentes inducidas y los avances tecnológicos emergentes de las iPSC.

Sin embargo, factores como el alto costo asociado con las terapias con células madre y la disponibilidad de alternativas para el tratamiento de tumores están obstaculizando el crecimiento del mercado de células madre pluripotentes inducidas (iPSC) en América del Norte. Por otro lado, el creciente número de productos en desarrollo, el mayor interés en la medicina personalizada y el aumento en el gasto en atención médica actúan como una oportunidad para el crecimiento del mercado de células madre pluripotentes inducidas (iPSC) en América del Norte. Las estrictas normas y regulaciones y la inestabilidad genómica de las IPSC son el principal desafío del mercado al que se enfrenta el mercado de células madre pluripotentes inducidas (iPSC) en América del Norte.

El informe de mercado de células madre pluripotentes inducidas (iPSC) proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado de células madre pluripotentes inducidas (iPSC), comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de células madre pluripotentes inducidas (iPSC)

El mercado de células madre pluripotentes inducidas (iPSC) está segmentado en función de la fuente de células, el tipo, el producto, las aplicaciones, los usuarios finales y el canal de distribución. El crecimiento entre segmentos lo ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

El mercado de células madre pluripotentes inducidas (iPSC) de América del Norte se clasifica en seis segmentos notables según la fuente de la célula, el tipo, el producto, las aplicaciones, los usuarios finales y el canal de distribución.

- En función de la fuente de células, el mercado de células madre pluripotentes inducidas (iPSC) de América del Norte se segmenta en células cutáneas y células sanguíneas. En 2022, se espera que el segmento de células cutáneas domine el mercado debido a la amplia disponibilidad de fibroblastos y queratinocitos de la superficie de la piel para la diferenciación de células madre.

- En función del tipo, el mercado de células madre pluripotentes inducidas (iPSC) de América del Norte se segmenta en IPSC humanas e IPSC de ratón. En 2022, se espera que el segmento de IPSC humanas domine el mercado, ya que la fuente de células de pacientes con ciertas enfermedades se puede utilizar específicamente para estudiar la etapa del trastorno.

- En función del producto, el mercado de células madre pluripotentes inducidas (iPSC) de América del Norte se segmenta en instrumentos, consumibles y kits, y servicios. En 2022, se espera que el segmento de consumibles y kits domine el mercado debido a la amplia aplicación de los kits de células madre en el modelado de enfermedades y las pruebas de toxicidad de fármacos.

- En función de la aplicación, el mercado de células madre pluripotentes inducidas (iPSC) de América del Norte se segmenta en investigación académica, medicina regenerativa , terapia celular, detección toxicológica, descubrimiento y desarrollo de fármacos, modelado de enfermedades, bancos de células madre, bioimpresión 3D y otros. En 2022, se espera que el segmento de descubrimiento y desarrollo de fármacos domine el mercado a medida que las células madre se utilicen en la invención terapéutica innovadora para enfermedades crónicas.

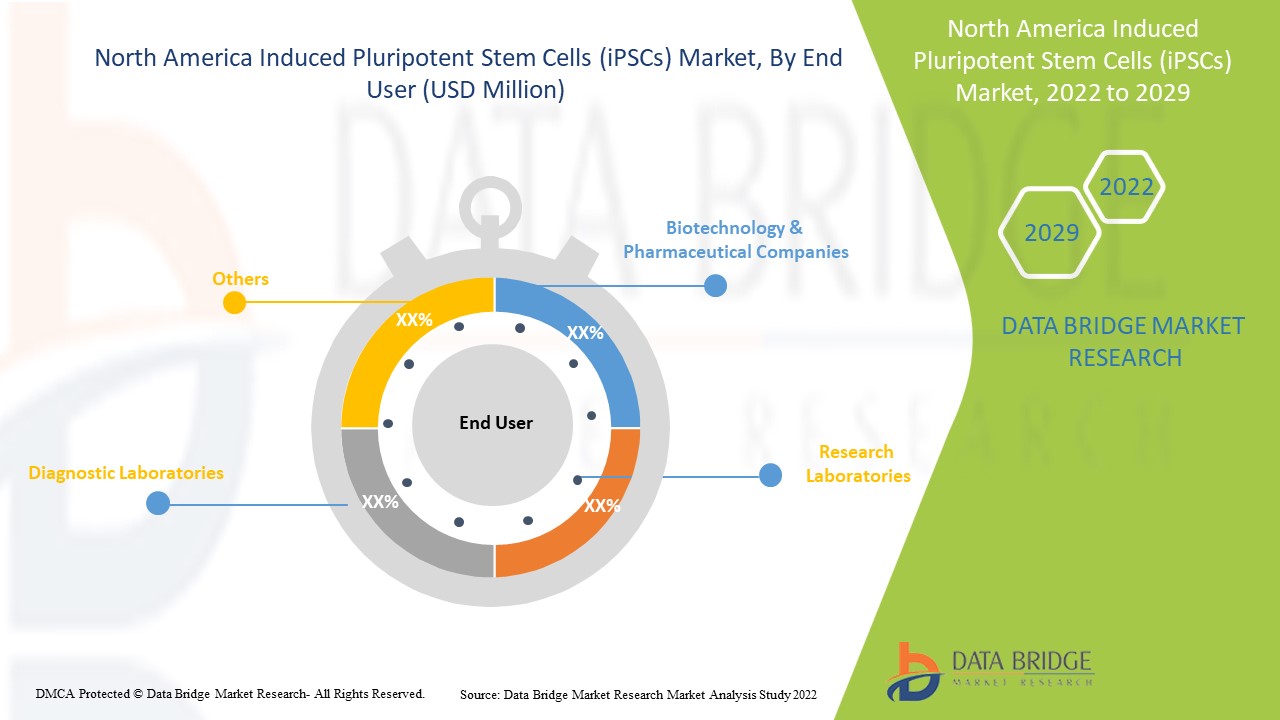

- En función de los usuarios finales, el mercado de células madre pluripotentes inducidas (iPSC) de América del Norte está segmentado en empresas biotecnológicas y farmacéuticas, laboratorios de investigación, laboratorios de diagnóstico y otros. En 2022, se espera que el segmento de empresas biotecnológicas y farmacéuticas domine el mercado debido a la gran cantidad de iniciativas estratégicas adoptadas por actores clave en la región.

- En función del canal de distribución, el mercado de células madre pluripotentes inducidas (iPSC) de América del Norte se segmenta en licitación directa y ventas minoristas. En 2022, se espera que el segmento de licitación directa domine el mercado debido a la gran cantidad de proveedores e instalaciones de transporte gestionadas directamente por los principales fabricantes.

Análisis a nivel de país del mercado de células madre pluripotentes inducidas (iPSC)

Se analiza el mercado de células madre pluripotentes inducidas (iPSC) y se proporciona información sobre el tamaño del mercado por país, fuente de células, tipo, producto, aplicaciones, usuarios finales y canal de distribución como se menciona anteriormente.

Los países cubiertos en el informe del mercado de células madre pluripotentes inducidas (iPSC) son EE. UU., Canadá y México.

Se espera que el segmento de empresas de biotecnología y farmacéuticas en Estados Unidos de la región de América del Norte crezca con la tasa de crecimiento más alta en el período de pronóstico de 2022 a 2029 debido al uso creciente de la tecnología de células madre. El segmento de empresas de biotecnología y farmacéuticas en Canadá es el segundo que domina el mercado debido al aumento de casos de enfermedades crónicas y la alta adopción de fuentes de células madre para mejores terapias. México es el tercero en liderar el crecimiento del mercado y el segmento de empresas de biotecnología y farmacéuticas es dominante en este país debido al creciente número de centros de biotecnología y actividades de investigación.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se considera la presencia y disponibilidad de marcas de América del Norte y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Las crecientes actividades estratégicas de los principales actores del mercado para mejorar el conocimiento sobre el tratamiento con células madre pluripotentes inducidas (iPSC) están impulsando el crecimiento del mercado de células madre pluripotentes inducidas (iPSC).

El mercado de células madre pluripotentes inducidas (iPSC) también le proporciona un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2011 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de las células madre pluripotentes inducidas (iPSC)

El panorama competitivo del mercado de células madre pluripotentes inducidas (iPSC) proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones, la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con el mercado de células madre pluripotentes inducidas (iPSC).

Las principales empresas que se dedican al desarrollo de células madre pluripotentes inducidas (iPSC) son Thermo Fisher Scientific Inc., FUJIFILM Corporation, LumaCyte, Horizon Discovery Ltd., Hopstem Biotechnology LLC., Takara Bio Inc., Cell Applications, Inc., Citius Pharmaceuticals, Inc., Lonza., Evotec SE., Fate Therapeutics, Universal Cells Inc. (An Astellas Company), Axol Bioscience Ltd., R & D Systems, Inc., Charles River Laboratories International, Inc., Corning Incorporated, REPROCELL Inc., Applied StemCell., Merck KGaA, GeneCopoeia, Inc. y otros actores nacionales. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Numerosos contratos y acuerdos son también iniciados por empresas de todo el mundo que están acelerando también el mercado de células madre pluripotentes inducidas (iPSC).

Por ejemplo,

- En febrero de 2021, Thermo Fisher Scientific Inc. anunció que había ganado seis premios en los premios anuales CMO Leadership Awards. Los premios, presentados por Life Science Leader y Outsourced Pharma, reconocen a los principales socios de fabricación por contrato según la evaluación de las empresas biofarmacéuticas y biotecnológicas. Se estima que este reconocimiento fortalecerá la presencia de la empresa en el mercado de América del Norte y conducirá a un aumento del crecimiento de la empresa en los próximos años.

- En junio de 2020, LumaCyte colaboró con Catalent, proveedor norteamericano de tecnologías avanzadas de administración, desarrollo y fabricación de soluciones para medicamentos, productos biológicos, terapias celulares y genéticas y productos de salud para el consumidor. Esta colaboración ayudó a expandir el producto de tecnología de células madre Radiance de la empresa y su aplicación.

La colaboración, el lanzamiento de productos, la expansión comercial, los premios y reconocimientos, las empresas conjuntas y otras estrategias de los actores del mercado están mejorando la presencia de la empresa en el mercado de bombas de infusión veterinaria, lo que también brinda beneficios para el crecimiento de las ganancias de la organización.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CELL SOURCE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 NORTH AMERICA MEDICAL CARTS MARKET: REGULATIONS

5.1 REGULATION IN U.S.

5.2 REGULATION IN CANADA

5.3 REGULATION IN EUROPE

5.4 REGULATION IN INDIA

5.5 REGUALTION IN JAPAN

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 WIDE RANGE OF CLINICAL APPLICATION OF INDUCED PLURIPOTENT STEM CELLS

6.1.2 EMERGING TECHNOLOGICAL ADVANTAGES OF IPSCS

6.1.3 RISING PREVALENCE OF SEVERAL CHRONIC DISEASES

6.1.4 INCREASING ADOPTION OF STEM CELL THERAPY

6.1.5 GROWING BIOTECHNOLOGY SECTOR WITH BETTER INVESTMENT

6.2 RESTRAINT

6.2.1 HIGH COST ASSOCIATED WITH STEM CELL THERAPIES AND LARGE-SCALE APPLICATIONS OF IPSCS

6.2.2 AVAILABILITY OF ALTERNATIVES FOR TUMOR TREATMENT

6.2.3 ADVERSE EFFECTS OF STEM CELL TRANSPLANTS

6.3 OPPORTUNITIES

6.3.1 INCREASING NUMBER OF PIPELINE PRODUCTS

6.3.2 INCREASING INTEREST OF PERSONALIZED MEDICINE

6.3.3 SURGE IN HEALTHCARE EXPENDITURE

6.3.4 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 GENOMIC INSTABILITY OF IPSCS IS THE KEY MARKET CHALLENGE

6.4.2 LACK OF SKILLED PROFESSIONALS

6.4.3 STRINGENT REGULATORY FRAMEWORK

7 IMPACT OF COVID-19 ON THE NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET

7.1 IMPACT ON PRICE

7.2 IMPACT ON DEMAND

7.3 IMPACT ON SUPPLY CHAIN

7.4 STRATEGIC DECISIONS BY MANUFACTURERS

7.5 CONCLUSION

8 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE

8.1 OVERVIEW

8.2 SKIN CELLS

8.2.1 FIBROBLAST

8.2.2 KERATINOCYTES

8.2.3 ADIPOSE DERIVED STEM CELLS

8.2.4 HEPATOCYTES

8.2.5 MELANOCYTES

8.2.6 NEURAL STEM CELLS

8.2.7 OTHERS

8.3 BLOOD CELLS

8.3.1 PERIPHERAL BLOOD

8.3.2 CORD BLOOD ENDOTHELIAL CELLS

8.3.3 CORD BLOOD STEM CELLS

8.3.4 OTHERS

9 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY TYPE

9.1 OVERVIEW

9.2 HUMAN IPSCS

9.3 MOUSE IPSCS

10 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT

10.1 OVERVIEW

10.2 CONSUMABLES & KITS

10.2.1 REPROGRAMMING KITS

10.2.2 MEDIA

10.2.3 TRANSFECTION KITS

10.2.4 CELL IDENTIFICATION KITS

10.2.5 ACCESSORIES

10.2.6 OTHERS

10.3 SERVICES

10.4 INSTRUMENTS

10.4.1 IMAGING SYSTEMS

10.4.2 ELECTROPORATION DEVICE

10.4.3 INCUBATORS

10.4.4 OTHERS

11 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 DRUG DISCOVERY AND DEVELOPMENT

11.3 ACADEMIC RESEARCH

11.4 DISEASE MODELLING

11.5 CELLULAR THERAPY

11.6 REGENERATIVE MEDICINE

11.7 TOXICOLOGY SCREENING

11.8 STEM CELL BANKING

11.9 3D BIOPRINTING

11.1 OTHERS

12 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY END USER

12.1 OVERVIEW

12.2 BIOTECHNOLOGY & PHARMACEUTICAL COMPANIES

12.3 RESEARCH LABORATORIES

12.4 DIAGNOSTIC LABORATORIES

12.5 OTHERS

13 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 RETAIL SALES

14 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 FUJIFILM CORPORATION

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.1.5.1 ACQUISITION

17.2 THERMO FISHER SCIENTIFIC INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.2.5.1 EVENT

17.2.5.2 ACQUISITION

17.3 LONZA.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.3.5.1 EXPANSION

17.4 MERCK KGAA

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.4.5.1 AGREEMENT

17.5 EVOTEC SE.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.5.5.1 AGREEMENT

17.5.5.2 COLLABORATION

17.6 APPLIED STEMCELL.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.6.3.1 PRODUCT LAUNCH

17.7 AXOL BIOSCIENCE LTD.

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.7.3.1 MERGER

17.7.3.2 PRODUCT LAUNCH

17.8 CELL APPLICATIONS, INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.8.3.1 PARTNERSHIP

17.9 CHARLES RIVER LABORATORIES INTERNATIONAL, INC.

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.9.4.1 ACQUISITION

17.1 CITIUS PHARMACEUTICALS, INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.10.3.1 AGREEMENT

17.11 CORNING INCORPORATED

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.11.4.1 AGREEMENT

17.12 FATE THERAPEUTICS

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.12.3.1 CLINICAL TRIAL

17.13 GENECOPOEIA, INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 HOPSTEM BIOTECHNOLOGY LLC.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.14.3.1 PARTNERSHIP

17.15 HORIZON DISCOVERY LTD.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 LUMACYTE

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.16.3.1 COLLABORATION

17.17 R & D SYSTEMS, INC.

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 REPROCELL INC.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.18.3.1 COLLABORATION

17.18.3.2 FACILITY EXPANSION

17.18.3.3 SERVICE LAUNCH

17.19 TAKARA BIO INC.

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENTS

17.19.4.1 NEW FACILITY LAUNCH

17.2 UNIVERSAL CELLS INC. (AN ASTELLAS COMPANY)

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENT

17.20.4.1 ACQUISITION

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 NEW CANCER CASES, AGES 85+, IN THE U.S.

TABLE 2 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SKIN CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SKIN CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BLOOD CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA BLOOD CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA HUMAN IPSCS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA MOUSE IPSCS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA CONSUMABLES & KITS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA CONSUMABLES & KITS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA SERVICES IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA INSTRUMENTS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA INSTRUMENTS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA DRUG DISCOVERY AND DEVELOPMENT IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA ACADEMIC RESEARCH IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA DISEASE MODELLING IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CELLULAR THERAPY IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA REGENERATIVE MEDICINE IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA TOXICOLOGY SCREENING IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA STEM CELL BANKING IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA 3D BIOPRINTING IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA BIOTECHNOLOGY & PHARMACEUTICAL COMPANIES IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA RESEARCH LABORATORIES IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA DIAGNOSTIC LABORATORIES IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA DIRECT TENDER IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA RETAIL SALES IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA SKIN CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA BLOOD CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA INSTRUMENTS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA CONSUMABLES & KITS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 U.S. INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 46 U.S. SKIN CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 47 U.S. BLOOD CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 48 U.S. INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.S. INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 50 U.S. INSTRUMENTS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 U.S. CONSUMABLES & KITS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 52 U.S. INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 U.S. INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 U.S. INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 55 CANADA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 56 CANADA SKIN CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 57 CANADA BLOOD CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 58 CANADA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CANADA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 60 CANADA INSTRUMENTS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 CANADA CONSUMABLES & KITS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 62 CANADA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 CANADA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 CANADA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 MEXICO INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 66 MEXICO SKIN CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 67 MEXICO BLOOD CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 68 MEXICO INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 MEXICO INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 70 MEXICO INSTRUMENTS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 71 MEXICO CONSUMABLES & KITS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 72 MEXICO INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 MEXICO INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 74 MEXICO INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: SEGMENTATION

FIGURE 11 THE WIDE RANGE OF CLINICAL APPLICATION OF INDUCED PLURIPOTENT STEM CELLS (IPSC) ARE EXPECTED TO DRIVE THE NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SKIN CELLS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET

FIGURE 15 PREVALENCE OF CHRONIC DISEASES

FIGURE 16 NUMBER OF PEOPLE WITH DIABETES (MILLION) AMONG AGES 20–79 YEARS

FIGURE 17 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY CELL SOURCE, 2021

FIGURE 18 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY CELL SOURCE, 2020-2029 (USD MILLION)

FIGURE 19 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY CELL SOURCE, CAGR (2022-2029)

FIGURE 20 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY CELL SOURCE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY TYPE, 2021

FIGURE 22 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY TYPE, 2020-2029 (USD MILLION)

FIGURE 23 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 24 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY TYPE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY PRODUCT, 2021

FIGURE 26 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY PRODUCT, 2020-2029 (USD MILLION)

FIGURE 27 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 28 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 29 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY APPLICATION, 2021

FIGURE 30 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 31 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 32 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 33 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY END USER, 2021

FIGURE 34 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 35 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY END USER, CAGR (2022-2029)

FIGURE 36 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY END USER, LIFELINE CURVE

FIGURE 37 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 38 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 39 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 40 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 41 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: SNAPSHOT (2021)

FIGURE 42 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY COUNTRY (2021)

FIGURE 43 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 44 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 45 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY CELL SOURCE (2022-2029)

FIGURE 46 NORTH AMERICA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.