Mercado de sistemas de imágenes hiperespectrales de América del Norte, por producto (cámaras y accesorios), técnicas de escaneo (escaneo espacial, escaneo espectral, escaneo sin escaneo y escaneo espacioespectral), alcance (menos de 400 Nm, 400 Nm a 1700 Nm y más de 1700 Nm), tecnología (escaneo lineal), instantánea (disparo único), escaneo puntual y otros), aplicación (ingeniería civil, vigilancia militar, teledetección, agricultura, minería/mapeo de minerales, monitoreo ambiental, ciencias biológicas y diagnóstico médico, visión artificial y clasificación óptica, procesamiento de alimentos, mineralogía y otras aplicaciones), país (EE. UU., Canadá, México), tendencias de la industria y pronóstico hasta 2028

Análisis y perspectivas del mercado: mercado de sistemas de imágenes hiperespectrales en América del Norte

Análisis y perspectivas del mercado: mercado de sistemas de imágenes hiperespectrales en América del Norte

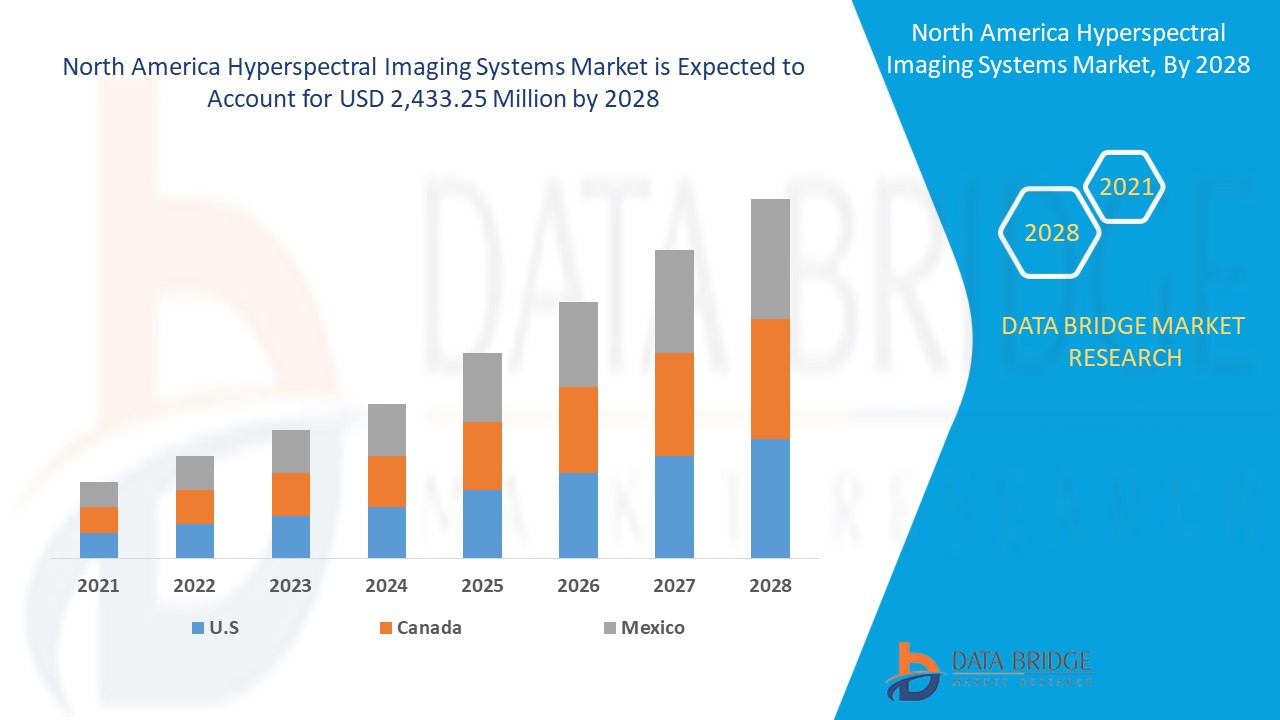

Se espera que el mercado de sistemas de imágenes hiperespectrales de América del Norte gane crecimiento de mercado en el período de pronóstico de 2021 a 2028. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 18,4% en el período de pronóstico de 2021 a 2028 y se espera que alcance los USD 2.433,25 millones para 2028. Una mayor conciencia y adopción de la tecnología de imágenes hiperespectrales para la aplicación e investigación de teledetección aérea es un factor importante para el crecimiento del mercado.

La obtención de imágenes hiperespectrales es una técnica espectroscópica que recopila cientos de imágenes en diferentes longitudes de onda sobre un área espacial lineal. La obtención de imágenes hiperespectrales tiene como objetivo recopilar espectros de cada píxel de la muestra para identificar objetos y procesos. La obtención de imágenes hiperespectrales recopila y procesa información de todo el espectro electromagnético. La obtención de imágenes hiperespectrales ayuda a identificar las propiedades químicas de los materiales y, por lo tanto, se pueden analizar las diferencias en los materiales. Los sistemas HSI se distinguen de los sistemas de imágenes en color y multiespectrales (MSI) en algunas características principales. Es importante destacar que los sistemas en color y MSI obtienen imágenes de la escena en solo tres a diez bandas espectrales, mientras que los sistemas HSI obtienen imágenes en cientos de bandas corregistradas. La tecnología tiene aplicaciones generalizadas en teledetección , industria de clasificación, microscopía, aplicaciones militares y de defensa y agricultura. La tecnología de imágenes hiperespectrales se está volviendo más popular y se ha extendido a la ecología y vigilancia generalizadas , la investigación de manuscritos históricos y otros.

Los factores que impulsan el mercado son el aumento de las inversiones gubernamentales en imágenes hiperespectrales por satélite y el aumento de la utilización de soluciones de imágenes hiperespectrales aerotransportadas. El alto costo asociado con las imágenes hiperespectrales limita el crecimiento del mercado de sistemas de imágenes hiperespectrales de América del Norte. El aprovechamiento de la IA en las imágenes hiperespectrales para el desarrollo tecnológico es un factor que abre oportunidades lucrativas para el mercado. La falta de profesionales capacitados está actuando como un desafío importante para el crecimiento del mercado.

Este informe de mercado de sistemas de imágenes hiperespectrales de América del Norte proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de sistemas de imágenes hiperespectrales en América del Norte

Alcance y tamaño del mercado de sistemas de imágenes hiperespectrales en América del Norte

El mercado de sistemas de imágenes hiperespectrales de América del Norte está segmentado en función del producto, las técnicas de escaneo, el alcance, la tecnología y la aplicación. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- En función del producto, el mercado de sistemas de imágenes hiperespectrales de América del Norte se ha segmentado en cámaras y accesorios. En 2021, se espera que el segmento de cámaras domine el mercado, ya que la cámara es el producto principal del sistema de imágenes hiperespectrales. La mayor conciencia y la creciente presión de los reguladores sobre las organizaciones están aumentando el crecimiento de las cámaras de imágenes hiperespectrales en la región de América del Norte.

- Sobre la base de las técnicas de escaneo, el mercado de sistemas de imágenes hiperespectrales de América del Norte se ha segmentado en escaneo espacial, escaneo espectral, sin escaneo y escaneo espacioespectral. En 2021, se espera que el segmento de escaneo espacial domine el mercado, ya que el escaneo espacial es uno de los principales métodos utilizados para la adquisición de datos hiperespectrales y proporciona una alta resolución espectral en un amplio rango del espectro. El escaneo espacial es la razón del uso del escaneo hiperespectral, que impulsa la adopción en la región de América del Norte.

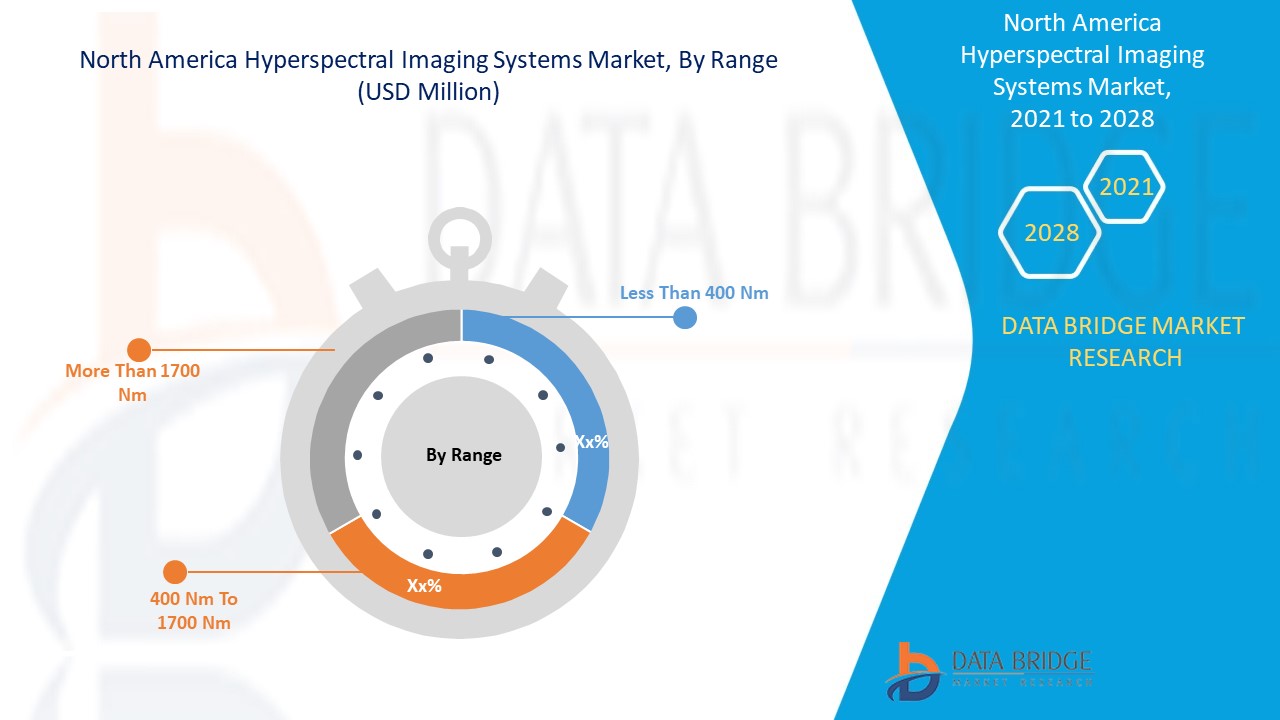

- En función del rango, el mercado de sistemas de imágenes hiperespectrales de América del Norte se ha segmentado en menos de 400 nm, de 400 nm a 1700 nm y más de 1700 nm. En 2021, se espera que el segmento de 400 nm a 1700 nm domine el mercado, ya que el rango es el más utilizado para imágenes hiperespectrales en países como los EE. UU. en aplicaciones como la detección de contaminantes en alimentos, diagnósticos médicos, vigilancia militar, reciclaje de plástico y otros.

- En función de la tecnología, el mercado de sistemas de imágenes hiperespectrales de América del Norte se ha segmentado en pushbroom (escaneo de línea), snapshot (toma única), whiskbroom (escaneo de puntos) y otros. En 2021, se espera que el segmento pushbroom (escaneo de línea) domine el mercado, ya que la tecnología pushbroom es más rápida que cualquier otra, recoge más luz, tiene mejor resolución radiométrica y espacial y es el enfoque de imágenes hiperespectrales más popular y ampliamente adoptado en la región de América del Norte.

- En función de la aplicación, el mercado de sistemas de imágenes hiperespectrales de América del Norte se ha segmentado en teledetección, vigilancia militar, visión artificial y clasificación óptica, ciencias de la vida y diagnósticos médicos, agricultura, procesamiento de alimentos, monitoreo ambiental, minería/mapeo de minerales, mineralogía, ingeniería civil y otras aplicaciones. En 2021, se espera que el segmento de teledetección domine el mercado como imágenes hiperespectrales en muchas aplicaciones como agricultura, exploración minera, monitoreo ambiental y otras para teledetección. Además, una mayor conciencia y adopción de la tecnología de imágenes hiperespectrales para la aplicación e investigación de teledetección aérea contribuye al crecimiento del segmento en la región de América del Norte.

- En función de la velocidad, el mercado de sistemas de imágenes hiperespectrales de América del Norte está segmentado en hasta 20 MHz, de 20 MHz a 40 MHz y más de 40 MHz.

- Sobre la base del número de tomas, el mercado de sistemas de imágenes hiperespectrales de América del Norte se segmenta en una toma y dos tomas.

Análisis a nivel de país del mercado de sistemas de imágenes hiperespectrales de América del Norte

Se analiza el mercado de sistemas de imágenes hiperespectrales de América del Norte y se proporciona información sobre el tamaño del mercado por país, producto, técnicas de escaneo, rango, tecnología y aplicación.

Los países cubiertos en el informe del mercado de sistemas de imágenes hiperespectrales de América del Norte son EE. UU., Canadá y México.

Estados Unidos domina el mercado de sistemas de imágenes hiperespectrales debido a factores como la fuerte presencia de proveedores y la creciente adopción de innovaciones tecnológicas en sistemas de imágenes hiperespectrales. Además, el aumento de la conciencia sobre los beneficios de las imágenes hiperespectrales en aplicaciones comerciales actúa como un impulsor del mercado.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas norteamericanas y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Demanda creciente de sistemas de imágenes hiperespectrales

El mercado de sistemas de imágenes hiperespectrales de América del Norte también le ofrece un análisis detallado del mercado para el crecimiento de cada país en la industria con ventas, ventas de componentes, el impacto del desarrollo tecnológico en sistemas de imágenes hiperespectrales y cambios en los escenarios regulatorios con su apoyo al mercado. Los datos están disponibles para el período histórico de 2010 a 2019.

Análisis del panorama competitivo y de la cuota de mercado de los sistemas de imágenes hiperespectrales en América del Norte

El panorama competitivo del mercado de sistemas de imágenes hiperespectrales de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores solo están relacionados con el enfoque de las empresas en el mercado de sistemas de imágenes hiperespectrales de América del Norte.

Los principales actores cubiertos en el mercado de sistemas de imágenes hiperespectrales de América del Norte son Imec VZW, Corning Incorporated, HORIBA, Ltd, Hamamatsu Photonics KK, Thorlabs, Inc., BaySpec, Inc., Brandywine Photonics LLC, ChemImage Corporation, Cubert GmbH, CytoViva, Inc., Headwall Photonics, Inc., Hinalea Imaging, HyperMed Imaging, Inc., Norsk Electro Optik AS, Photon Etc. Inc, Physical Sciences Inc., Raptor Photonics, Resonon Inc., SPECIM, SPECTRAL IMAGING LTD., STEMMER IMAGING AG, Surface Optics Corporation, Teledyne Digital Imaging Inc. (una subsidiaria de Teledyne Technologies Incorporated), Telops, XIMEA Group y otros. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Numerosas empresas de todo el mundo también están iniciando numerosos desarrollos de productos, lo que también está acelerando el crecimiento del mercado de sistemas de imágenes hiperespectrales de América del Norte.

Por ejemplo,

- En abril de 2021, Headwall Photonics, Inc. anunció la colaboración como miembro del Consejo Asesor de Profesionales Industriales para el proyecto Internet de las cosas para la agricultura de precisión (IoT4Ag) financiado por la NSF. El personal del Centro de Investigación de Ingeniería de la NSF utilizó los sensores hiperespectrales de Headwall integrándolos en sistemas de vehículos aéreos no tripulados (UAV) para crear modelos basados en datos para capturar y analizar la fisiología de las plantas, las propiedades del suelo, la gestión y las variaciones ambientales. Esto mejoró la presencia de la empresa en la comunidad de tecnología agrícola.

- En febrero de 2021, ChemImage Corporation anunció el lanzamiento de una nueva función para VeroVision Mail Screener. La nueva función proporciona la capacidad de detectar el correo de los reclusos, que puede contener metanfetamina pulverizada y ciertos tipos de cannabinoides sintéticos. VeroVision Mail Screener escanea los artículos de correo utilizando tecnología de imágenes hiperespectrales de infrarrojo cercano para detectar drogas ilícitas ocultas y agentes de corte comunes. Con esto, la empresa mejoró la capacidad del usuario para rechazar el correo sospechoso de manera imparcial. El aumento de los escenarios de contrabando en las prisiones ha aumentado la demanda de dicha tecnología.

Las alianzas, las empresas conjuntas y otras estrategias mejoran la participación de mercado de la empresa con una mayor cobertura y presencia. También beneficia a la organización mejorar su oferta de sistemas de imágenes hiperespectrales a través de una gama ampliada de tamaños.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING INVESTMENTS IN SATELLITES INCORPORATED WITH HIS

5.1.2 SURGE IN UTILIZATION OF AIRBORNE HYPERSPECTRAL IMAGING SOLUTIONS

5.1.3 RISE IN USE OF HYPERSPECTRAL IMAGING FOR AGRICULTURE SECTOR

5.1.4 SURGE IN APPLICATIONS OF HSI FOR ENVIRONMENTAL MONITORING

5.1.5 GROW IN INDUSTRIAL APPLICATIONS OF HYPERSPECTRAL IMAGING

5.2 RESTRAINTS

5.2.1 HIGH COMPLEXITY AND DATA STORAGE ISSUES

5.2.2 HIGH COST ASSOCIATED WITH THE USE OF HYPERSPECTRAL IMAGING

5.3 OPPORTUNITIES

5.3.1 SURGING ADVANCEMENTS OF HYPERSPECTRAL IMAGING FOR REMOTE SENSING

5.3.2 RISE IN DEVELOPMENTS TOWARD THE ADOPTION OF PORTABLE HYPERSPECTRAL CAMERAS

5.3.3 INCREASING MEDICAL APPLICATIONS OF HSI

5.3.4 LEVERAGING AI IN HYPERSPECTRAL IMAGING FOR TECHNOLOGICAL DEVELOPMENTS

5.4 CHALLENGES

5.4.1 LACK OF SKILLED PROFESSIONALS

5.4.2 LACK OF LABELLED DATA FOR HSI INCORPORATING AI AND ML ALGORITHMS

6 COVID-19 IMPACT ON HYPERSPECTRAL IMAGING SYSTEMS MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 CAMERAS

7.3 ACCESSORIES

8 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES

8.1 OVERVIEW

8.2 SPATIAL SCANNING

8.3 SPECTRAL SCANNING

8.4 SPATIO-SPECTRAL SCANNING

8.5 NON-SCANNING

9 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE

9.1 OVERVIEW

9.2 NM TO 1700 NM

9.3 MORE THAN 1,700 NM

9.4 LESS THAN 400 NM

10 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 PUSHBROOM (LINE SCANNING)

10.3 WHISKBROOM (POINT SCANNING)

10.4 SNAPSHOT (SINGLE SHOT)

10.5 OTHERS

11 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 REMOTE SENSING

11.2.1 CAMERAS

11.2.2 ACCESSORIES

11.3 MILITARY SURVEILLANCE

11.3.1 CAMERAS

11.3.2 ACCESSORIES

11.4 MACHINE VISION & OPTICAL SORTING

11.4.1 CAMERAS

11.4.2 ACCESSORIES

11.5 LIFE SCIENCES & MEDICAL DIAGNOSTICS

11.5.1 CAMERAS

11.5.2 ACCESSORIES

11.6 AGRICULTURE

11.6.1 CAMERAS

11.6.2 ACCESSORIES

11.7 FOOD PROCESSING

11.7.1 CAMERAS

11.7.2 ACCESSORIES

11.8 ENVIRONMENTAL MONITORING

11.8.1 CAMERAS

11.8.2 ACCESSORIES

11.9 MINING/MINERAL MAPPING

11.9.1 CAMERAS

11.9.2 ACCESSORIES

11.1 MINEROLOGY

11.10.1 CAMERAS

11.10.2 ACCESSORIES

11.11 CIVIL ENGINEERING

11.11.1 CAMERAS

11.11.2 ACCESSORIES

11.12 OTHER APPLICATIONS

11.12.1 CAMERAS

11.12.2 ACCESSORIES

12 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SPEED

12.1 OVERVIEW

12.2 UP TO 20 MHZ

12.3 TO 40 MHZ

12.4 MORE THAN 40 MHZ

13 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY NUMBER OF TAPS

13.1 OVERVIEW

13.2 ONE TAP

13.3 TWO TAP

14 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 IMEC

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 CORNING INCORPORATED

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 HORIBA, LTD

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 HAMAMATSU PHOTONICS K.K.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 THORLABS, INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 BAYSPEC, INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECCENT DEVELOPMENTS

17.7 BRANDYWINE PHOTONICS LLC

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 CHEMIMAGE CORPORATION

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 CUBERT GMBH

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 CYTOVIVA, INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 DIASPECTIVE VISION

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 HEADWALL PHOTONICS, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 HINALEA IMAGING

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 HYPERMED IMAGING, INC.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 INNO-SPEC GMBH

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 LLA INSTRUMENTS GMBH & CO. KG

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 NORSK ELECTRO OPTIK AS

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 PHOTON ETC. INC

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 PHYSICAL SCIENCES INC.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 RAPTOR PHOTONICS

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 RESONON INC.

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 SPECIM, SPECTRAL IMAGING LTD.

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 STEMMER IMAGING AG

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 SURFACE OPTICS CORPORATION

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

17.25 TELEDYNE DIGITAL IMAGING INC. (A SUBSIDIARY OF TELEDYNE TECHNOLOGIES INCORPORATED)

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENTS

17.26 TELOPS

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS

17.27 XIMEA GROUP

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 2 NORTH AMERICA CAMERAS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 NORTH AMERICA ACCESSORIES IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 4 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SANNING TECHNIQUES, 2019-2028 (USD MILLION)

TABLE 5 NORTH AMERICA SPATIAL SCANNING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION ,2019-2028 (USD MILLION)

TABLE 6 NORTH AMERICA SPECTRAL SCANNING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA SPATIOSPECTRAL SCANNING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA NON-SCANNING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 9 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA 400 NM TO 1700 NM IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA MORE THAN 1,700 NM IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 NORTH AMERICA LESS THAN 400 NM IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA PUSHBROOM (LINE SCANNING) IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA WHISKBROOM (POINT SCANNING) IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA SNAPSHOT (SINGLE SHOT) IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA OTHERS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 19 NORTH AMERICA REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 22 NORTH AMERICA MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 23 NORTH AMERICA MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 27 NORTH AMERICA AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 29 NORTH AMERICA FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-202 (USD MILLION)

TABLE 32 NORTH AMERICA ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 33 NORTH AMERICA MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 NORTH AMERICA MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 35 NORTH AMERICA MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 36 NORTH AMERICA MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 37 NORTH AMERICA CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 38 NORTH AMERICA CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 39 NORTH AMERICA OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 40 NORTH AMERICA OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 41 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 42 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 43 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES, 2019-2028 (USD MILLION)

TABLE 44 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2019-2028 (USD MILLION)

TABLE 45 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 46 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 47 NORTH AMERICA REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 48 NORTH AMERICA MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 49 NORTH AMERICA MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 50 NORTH AMERICA LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 51 NORTH AMERICA AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 52 NORTH AMERICA FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 53 NORTH AMERICA ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 54 NORTH AMERICA MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 55 NORTH AMERICA MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 56 NORTH AMERICA CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 57 NORTH AMERICA OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 58 U.S. HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 59 U.S. HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES, 2019-2028 (USD MILLION)

TABLE 60 U.S. HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2019-2028 (USD MILLION)

TABLE 61 U.S. HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 62 U.S. HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 63 U.S. REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 64 U.S. MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 65 U.S. MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 66 U.S. LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 67 U.S. AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 68 U.S. FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 69 U.S. ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 70 U.S. MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 71 U.S. MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 72 U.S. CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 73 U.S. OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 74 CANADA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 75 CANADA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES, 2019-2028 (USD MILLION)

TABLE 76 CANADA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2019-2028 (USD MILLION)

TABLE 77 CANADA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 78 CANADA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 79 CANADA REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 80 CANADA MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 81 CANADA MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 82 CANADA LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 83 CANADA AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 84 CANADA FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 85 CANADA ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 86 CANADA MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 87 CANADA MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 88 CANADA CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 89 CANADA OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 90 MEXICO HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 91 MEXICO HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES, 2019-2028 (USD MILLION)

TABLE 92 MEXICO HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2019-2028 (USD MILLION)

TABLE 93 MEXICO HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 94 MEXICO HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 95 MEXICO REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 96 MEXICO MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 97 MEXICO MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 98 MEXICO LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 99 MEXICO AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 100 MEXICO FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 101 MEXICO ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 102 MEXICO MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 103 MEXICO MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 104 MEXICO CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 105 MEXICO OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: SEGMENTATION

FIGURE 11 INCREASING GOVERNMENT INVESTMENTS IN HYPERSPECTRAL SATELLITE IMAGING TO DRIVE NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 THE CAMERAS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET IN 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET

FIGURE 14 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2020

FIGURE 15 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES, 2020

FIGURE 16 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2020

FIGURE 17 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2020

FIGURE 18 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2020

FIGURE 19 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: SNAPSHOT (2020)

FIGURE 20 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: BY COUNTRY (2020)

FIGURE 21 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: BY COUNTRY (2021 & 2028)

FIGURE 22 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: BY COUNTRY (2020 & 2028)

FIGURE 23 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: BY PRODUCT (2021-2028)

FIGURE 24 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: COMPANY SHARE 2020 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.