North America Hydrophobic Coatings Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

96.18 Million

USD

156.80 Million

2025

2033

USD

96.18 Million

USD

156.80 Million

2025

2033

| 2026 –2033 | |

| USD 96.18 Million | |

| USD 156.80 Million | |

|

|

|

|

Segmentación del mercado de recubrimientos hidrófobos en Norteamérica, por producto (polisiloxanos, fluoropolímeros, fluoroalquilsilanos, dióxido de titanio y otros), tipo de sustrato (metal, vidrio, polímero, cerámica, hormigón y textiles), capa de recubrimiento (monocapa y multicapa), método de aplicación (recubrimiento por inmersión, cepillado, recubrimiento con rodillo, pulverización y otros), función (anticorrosión, antimicrobiano, antiincrustante, antihielo/humectante, autolimpiante y otros), grado (grado alimentario, grado industrial y otros), canal de distribución (presencial y en línea), usuario final (automotriz, electrónica, construcción, naval, textil, salud, aeroespacial, petróleo y gas, alimentos y bebidas, y otros) - Tendencias y pronóstico de la industria hasta 2033

Tamaño del mercado de recubrimientos hidrofóbicos en América del Norte

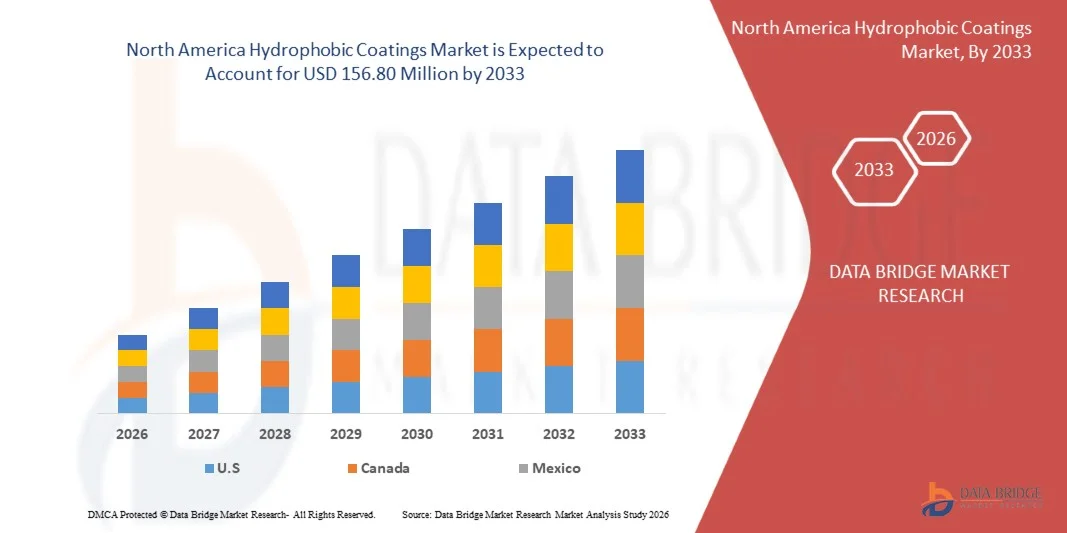

- El tamaño del mercado de recubrimientos hidrofóbicos de América del Norte se valoró en USD 96,18 millones en 2025 y se espera que alcance los USD 156,80 millones para 2033 , con una CAGR del 6,3% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de recubrimientos protectores en industrias como la automotriz, la electrónica, la construcción y la aeroespacial, donde las superficies requieren repelencia al agua, resistencia a la corrosión y mayor durabilidad.

- Además, la creciente atención de los consumidores y la industria a la sostenibilidad, la higiene y las superficies de bajo mantenimiento está impulsando la adopción de recubrimientos hidrófobos avanzados, estableciéndolos como soluciones esenciales para aplicaciones de alto rendimiento y respetuosas con el medio ambiente. Estos factores convergentes están acelerando la adopción de recubrimientos hidrófobos, impulsando así significativamente el crecimiento del mercado.

Análisis del mercado de recubrimientos hidrofóbicos en América del Norte

- Los recubrimientos hidrófobos, que brindan repelencia al agua, autolimpieza, propiedades anticorrosivas y antimicrobianas, son cada vez más importantes para mejorar la longevidad, la seguridad y la funcionalidad de las superficies en múltiples aplicaciones industriales y comerciales.

- La creciente demanda de recubrimientos hidrófobos se debe principalmente a los avances tecnológicos en materiales de recubrimiento, los crecientes requisitos de cumplimiento normativo y ambiental y la creciente necesidad de tratamientos de superficies multifuncionales, de bajo mantenimiento y alto rendimiento.

- Estados Unidos dominó el mercado de recubrimientos hidrofóbicos de América del Norte en 2025, debido a la creciente adopción de recubrimientos resistentes a la corrosión y al agua en los sectores automotriz, electrónico, aeroespacial y de la construcción.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de recubrimientos hidrofóbicos de América del Norte durante el período de pronóstico debido a la creciente modernización industrial, la expansión de la fabricación de automóviles y productos electrónicos y la creciente adopción de recubrimientos protectores multifuncionales.

- El segmento de los polisiloxanos dominó el mercado con una cuota de mercado superior al 40 % en 2025, gracias a sus excelentes propiedades hidrófugas, resistencia química y adaptabilidad a diversos sustratos. Estos recubrimientos son ampliamente utilizados en aplicaciones de automoción, electrónica y construcción por su durabilidad a largo plazo y su capacidad para mantener la estética de las superficies. Los polisiloxanos también ofrecen una fácil aplicación y compatibilidad con múltiples métodos de recubrimiento, lo que mejora la eficiencia operativa. Su versatilidad para formar capas delgadas y transparentes sin alterar la apariencia del sustrato refuerza su preferencia en el mercado. Las cadenas de suministro consolidadas del segmento y su amplia adopción industrial consolidan aún más su dominio.

Alcance del informe y segmentación del mercado de recubrimientos hidrofóbicos en América del Norte

|

Atributos |

Perspectivas clave del mercado de recubrimientos hidrofóbicos |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de recubrimientos hidrofóbicos en América del Norte

Uso creciente de recubrimientos autolimpiantes y multifuncionales

- Una tendencia significativa en el mercado norteamericano de recubrimientos hidrofóbicos es la creciente aplicación de recubrimientos autolimpiantes y multifuncionales en diversas industrias, impulsada por la necesidad de superficies resistentes al agua, al polvo y a los contaminantes, a la vez que mejoran la durabilidad del producto. Estos recubrimientos están mejorando el rendimiento en sectores como la automoción, la electrónica y la construcción, al reducir los requisitos de mantenimiento y prolongar la vida útil de los activos.

- Por ejemplo, empresas como P2i y 3M ofrecen recubrimientos hidrófobos avanzados para electrónica de consumo y dispositivos médicos que evitan la entrada de agua y la contaminación de las superficies. Estas soluciones mejoran la durabilidad del dispositivo y la comodidad del usuario en entornos expuestos a la humedad y a las partículas.

- La adopción de recubrimientos hidrofóbicos en el sector automotriz se está acelerando, ya que los recubrimientos aplicados a parabrisas, sensores y paneles de carrocería mejoran la visibilidad, la seguridad y la resistencia a la corrosión. Esto posiciona a estos recubrimientos como esenciales para el rendimiento de los vehículos modernos y la protección de los pasajeros.

- En dispositivos electrónicos y wearables, se utilizan recubrimientos hidrofóbicos para proteger los componentes sensibles del agua y el sudor. Esta tendencia permite a los fabricantes ofrecer productos fiables y duraderos que satisfacen las crecientes expectativas de los consumidores de dispositivos robustos.

- El sector de la construcción y los materiales de construcción incorpora cada vez más recubrimientos hidrófobos en superficies de vidrio, hormigón y metal para prevenir daños por agua y manchas. Esto está generando una preferencia por recubrimientos que ofrecen protección a largo plazo y conservan la estética.

- Las industrias dedicadas a la energía y la infraestructura están aplicando recubrimientos hidrofóbicos a turbinas, tuberías y paneles solares para mejorar la eficiencia y reducir los costos de mantenimiento. La creciente incorporación de estos recubrimientos está impulsando el crecimiento del mercado y posicionándolos como factores clave para la longevidad operativa.

Dinámica del mercado de recubrimientos hidrofóbicos en América del Norte

Conductor

Creciente demanda de recubrimientos resistentes a la corrosión y al agua en industrias clave

- La creciente necesidad de superficies resistentes a la corrosión y al agua en equipos automotrices, electrónicos e industriales impulsa el mercado norteamericano de recubrimientos hidrofóbicos. Estos recubrimientos protegen activos de alto valor de la degradación ambiental, prolongando su vida útil y reduciendo los costos de reparación.

- Por ejemplo, PPG Industries suministra recubrimientos hidrófobos especializados para aplicaciones automotrices y aeroespaciales que mejoran la resistencia a la corrosión en condiciones extremas. Estos recubrimientos permiten a los fabricantes ofrecer productos más seguros y duraderos, además de cumplir con las estrictas normas regulatorias.

- La industria electrónica recurre cada vez más a recubrimientos hidrofóbicos para prevenir fallos provocados por la humedad en dispositivos sensibles como smartphones, wearables y equipos médicos. Esta adopción está impulsando la innovación en nanorrecubrimientos y tratamientos de protección de superficies.

- La maquinaria industrial y los equipos pesados se benefician de los recubrimientos hidrofóbicos que reducen la oxidación y el desgaste superficial, mejorando así el tiempo de funcionamiento y la productividad de los equipos. Esto impulsa su adopción en sectores donde la continuidad operativa es crucial.

- El sector de las energías renovables está aprovechando los recubrimientos hidrofóbicos para turbinas eólicas, paneles solares y equipos hidroeléctricos con el fin de mejorar la eficiencia y minimizar los daños causados por el agua. La demanda continua de recubrimientos resilientes impulsa la expansión del mercado y los posiciona como esenciales para la protección de activos.

Restricción/Desafío

“Alto costo y aplicación compleja de recubrimientos avanzados”

- El mercado norteamericano de recubrimientos hidrofóbicos se enfrenta a desafíos debido al alto costo de las formulaciones avanzadas y a los complejos procesos de aplicación necesarios para un rendimiento óptimo. Estos factores limitan su adopción, especialmente en segmentos sensibles a los precios y en industrias de pequeña escala.

- Por ejemplo, empresas como P2i utilizan técnicas de deposición de vapor de precisión para aplicar nanorrecubrimientos en componentes electrónicos, lo que requiere equipo especializado y personal cualificado. La complejidad de estos procesos incrementa los gastos de producción y limita su implementación a gran escala.

- Lograr un espesor de recubrimiento uniforme y adhesión en diversas superficies requiere un riguroso control del proceso, lo que eleva aún más los costos operativos y extiende los plazos de producción.

- La dependencia de productos químicos de alta pureza y nanomateriales aumenta la sensibilidad de la cadena de suministro y afecta la estabilidad de los costos, lo que crea desafíos para mantener precios competitivos.

- Escalar los recubrimientos hidrofóbicos para aplicaciones industriales y de consumo, garantizando al mismo tiempo una calidad constante, sigue siendo una limitación clave. Estos desafíos, en conjunto, obligan a los fabricantes a invertir en estrategias de optimización de procesos y reducción de costes para satisfacer la creciente demanda y mantener los estándares de rendimiento.

Alcance del mercado de recubrimientos hidrofóbicos en América del Norte

El mercado está segmentado según el producto, el tipo de sustrato, la capa de recubrimiento, el método de aplicación, la función, el grado, el canal de distribución y el usuario final.

• Por producto

En cuanto a productos, el mercado norteamericano de recubrimientos hidrófobos se segmenta en polisiloxanos, fluoropolímeros, fluoroalquilsilanos, dióxido de titanio y otros. El segmento de los polisiloxanos dominó el mercado con la mayor participación en los ingresos, superior al 40% en 2025, gracias a sus excelentes propiedades hidrófugas, resistencia química y adaptabilidad a diversos sustratos. Estos recubrimientos son ampliamente utilizados en aplicaciones de automoción, electrónica y construcción por su durabilidad a largo plazo y su capacidad para mantener la estética de las superficies. Los polisiloxanos también ofrecen fácil aplicación y compatibilidad con múltiples métodos de recubrimiento, lo que mejora la eficiencia operativa. Su versatilidad para formar capas delgadas y transparentes sin alterar la apariencia del sustrato refuerza su preferencia en el mercado. Las cadenas de suministro consolidadas y la amplia adopción industrial del segmento consolidan aún más su dominio.

Se prevé que el segmento de fluoropolímeros experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente demanda en aplicaciones avanzadas de electrónica, aeroespacial y marina. Por ejemplo, Chemours ha ampliado su cartera de recubrimientos hidrófobos a base de teflón para satisfacer los requisitos industriales de superficies de alto rendimiento y resistentes a la corrosión. Los fluoropolímeros ofrecen una inercia química y estabilidad térmica superiores, lo que los hace ideales para entornos hostiles. Sus propiedades de baja energía superficial les confieren una eficaz capacidad antiincrustante y de autolimpieza. El aumento de la inversión en I+D para recubrimientos de fluoropolímeros de nueva generación también impulsa su rápida adopción. El segmento se beneficia de la creciente preferencia por recubrimientos protectores de alta gama y larga duración en diversas industrias.

• Por tipo de sustrato

Según el tipo de sustrato, el mercado norteamericano de recubrimientos hidrófobos se segmenta en metal, vidrio, polímero, cerámica, hormigón y textiles. El segmento de sustratos metálicos dominó el mercado en 2025, debido a su amplio uso en las industrias automotriz, aeroespacial y de la construcción, que requieren superficies resistentes a la corrosión e hidrófugas. Los sustratos metálicos se benefician de una mayor durabilidad y rendimiento al recubrirse con capas hidrófobas, lo que prolonga la vida útil de los componentes críticos. Las normas y regulaciones industriales favorecen aún más los recubrimientos metálicos para aplicaciones de protección. Su compatibilidad con diversos métodos de recubrimiento y su capacidad para mantener la integridad estructural impulsan su adopción continua. La consolidada presencia industrial del segmento contribuye a su liderazgo sostenido en el mercado.

Se prevé que el segmento de sustratos de vidrio experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente adopción de ventanas inteligentes, paneles solares y electrónica de consumo. Por ejemplo, PPG Industries ha desarrollado recubrimientos hidrófobos avanzados para vidrio arquitectónico que mejoran la repelencia al agua y las propiedades de autolimpieza. Estos recubrimientos mejoran la visibilidad y reducen los costos de mantenimiento en edificios residenciales y comerciales. Los sustratos de vidrio recubiertos con capas hidrófobas también ofrecen beneficios antiincrustantes para parabrisas de automóviles. El aumento de la urbanización y las tendencias de construcción inteligente impulsan la demanda de superficies de vidrio tratadas. El segmento crece rápidamente gracias a los avances tecnológicos y a la creciente concienciación sobre soluciones de eficiencia energética.

• Por capa de recubrimiento

En función de la capa de recubrimiento, el mercado norteamericano de recubrimientos hidrófobos se segmenta en monocapa y multicapa. El segmento monocapa dominó el mercado en 2025, impulsado por su rentabilidad, facilidad de aplicación e idoneidad para la implementación industrial a gran escala. Los recubrimientos monocapa se utilizan ampliamente en aplicaciones de automoción, electrónica y construcción para la protección de superficies sin alterar significativamente las dimensiones del sustrato. Su simplicidad garantiza un rendimiento constante y un tiempo de inactividad mínimo en la producción. Este segmento se beneficia de prácticas de fabricación consolidadas y de la compatibilidad con los métodos de recubrimiento convencionales. Las soluciones monocapa también ofrecen una hidrofobicidad fiable a la vez que reducen el desperdicio de material. Su versatilidad en diversas aplicaciones contribuye a su dominio del mercado.

Se prevé que el segmento multicapa experimente su mayor crecimiento entre 2026 y 2033, impulsado por la creciente demanda de recubrimientos multifuncionales y de alto rendimiento. Por ejemplo, AkzoNobel ha introducido recubrimientos hidrófobos multicapa para aplicaciones marinas que combinan funciones anticorrosivas, antiincrustantes y autolimpiables. Los sistemas multicapa mejoran la durabilidad, la resistencia térmica y el rendimiento de las superficies en entornos exigentes. El segmento cobra impulso en los sectores aeroespacial, electrónico y de maquinaria industrial, donde la protección avanzada es esencial. El aumento de la inversión en I+D para recubrimientos multifuncionales acelera su adopción. Las soluciones multicapa satisfacen la demanda de tratamientos de superficies de ingeniería de alta gama.

• Por método de aplicación

Según el método de aplicación, el mercado norteamericano de recubrimientos hidrofóbicos se segmenta en recubrimiento por inmersión, brocha, rodillo y pulverización, entre otros. El segmento de pulverización dominó el mercado en 2025, impulsado por su eficiencia para recubrir geometrías complejas y grandes superficies de forma uniforme. La pulverización ofrece un control preciso del espesor del recubrimiento y reduce el desperdicio de material, lo que la hace ideal para aplicaciones de automoción y construcción. La adopción y mecanización a escala industrial mejora el rendimiento y garantiza una calidad constante. Los métodos de pulverización también permiten la compatibilidad con múltiples sustratos y formulaciones de recubrimiento. La consolidada presencia del segmento en procesos comerciales e industriales contribuye a su liderazgo en el mercado.

Se prevé que el segmento de recubrimiento por inmersión experimente su mayor crecimiento entre 2026 y 2033, impulsado por su creciente uso en la fabricación a pequeña escala y aplicaciones industriales especializadas. Por ejemplo, DuPont ha aprovechado las técnicas de recubrimiento por inmersión para aplicar capas hidrofóbicas a componentes electrónicos y mejorar su resistencia a la humedad. El recubrimiento por inmersión garantiza una cobertura uniforme y una fuerte adhesión en superficies complejas o con formas irregulares. Este método está ganando popularidad en aplicaciones textiles, electrónicas y sanitarias por su precisión y eficiencia. La creciente demanda de procesos de recubrimiento rentables y escalables impulsa el crecimiento. El recubrimiento por inmersión también facilita recubrimientos multifuncionales, lo que acelera su adopción.

• Por función

En función de su función, el mercado norteamericano de recubrimientos hidrófobos se segmenta en anticorrosión, antimicrobianos, antiincrustantes, antihielo/humectantes, autolimpiantes, entre otros. El segmento anticorrosión dominó el mercado en 2025, impulsado por su amplio uso industrial en los sectores automotriz, marítimo, de petróleo y gas, y de la construcción, que requieren protección a largo plazo contra la oxidación y la degradación. Los recubrimientos anticorrosión prolongan la vida útil de los componentes y reducen los costos de mantenimiento, lo que los hace cruciales en infraestructura y maquinaria industrial. Estos recubrimientos son preferidos debido a su rendimiento comprobado, cumplimiento normativo y compatibilidad con diversos sustratos. Las soluciones anticorrosión también se integran bien con otras capas funcionales, mejorando la protección general de la superficie. La consolidada relevancia industrial del segmento refuerza su dominio del mercado.

Se prevé que el segmento de autolimpieza experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente adopción en vidrio arquitectónico, paneles solares y electrónica de consumo. Por ejemplo, Saint-Gobain ha desarrollado recubrimientos hidrófobos autolimpiables para fachadas de edificios con el fin de reducir el mantenimiento y el consumo de agua. Estos recubrimientos aprovechan sus propiedades superhidrófobas para repeler la suciedad y los contaminantes de forma natural. La rápida urbanización y las tendencias de construcción inteligente impulsan la demanda de superficies de bajo mantenimiento. El segmento también se beneficia de una mayor concienciación sobre la sostenibilidad y la eficiencia de los recursos. Los avances tecnológicos en nanorrecubrimientos aceleran aún más el crecimiento del mercado.

• Por grado

Según el grado, el mercado norteamericano de recubrimientos hidrofóbicos se segmenta en grado alimentario, grado industrial y otros. El segmento de grado industrial dominó el mercado en 2025, impulsado por amplias aplicaciones en las industrias automotriz, aeroespacial, de la construcción y electrónica, que requieren recubrimientos protectores de alto rendimiento. Los recubrimientos hidrofóbicos de grado industrial ofrecen durabilidad, estabilidad térmica y resistencia química en condiciones de operación adversas. Estos recubrimientos son ampliamente preferidos debido a su cumplimiento con los estándares industriales y sus beneficios operativos a largo plazo. La sólida presencia del segmento en centros de fabricación y sus robustas cadenas de suministro respaldan su continuo dominio. Los recubrimientos de grado industrial también permiten la integración con capas multifuncionales, lo que mejora su utilidad.

Se prevé que el segmento de grado alimenticio experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente demanda de superficies higiénicas e hidrófugas en la industria de alimentos y bebidas. Por ejemplo, PPG ha desarrollado recubrimientos hidrófobos de grado alimenticio para prevenir el crecimiento bacteriano y facilitar la limpieza de los equipos de procesamiento. Estos recubrimientos cumplen con las normativas de seguridad y garantizan la calidad del producto. La creciente concienciación sobre el control de la contaminación y las normas de higiene en el procesamiento de alimentos impulsa su adopción. El segmento crece a medida que los fabricantes priorizan la eficiencia y la seguridad. Los recubrimientos de grado alimenticio también prolongan la vida útil de los equipos y minimizan los esfuerzos de limpieza.

• Por canal de distribución

Según el canal de distribución, el mercado norteamericano de recubrimientos hidrofóbicos se segmenta en presencial y en línea. El segmento presencial dominó el mercado en 2025, impulsado por cadenas de suministro consolidadas, prácticas de adquisición industrial y la disponibilidad de soporte técnico para productos de recubrimiento. Los compradores industriales suelen preferir los canales presenciales para pedidos al por mayor, consultas y soluciones personalizadas. La distribución presencial permite la evaluación práctica del producto y garantiza el cumplimiento de los estándares de calidad. Este segmento se beneficia de las sólidas relaciones entre fabricantes, distribuidores y usuarios finales en los sectores automotriz, aeroespacial y de la construcción. Los canales presenciales siguen siendo una vía principal para los recubrimientos hidrofóbicos gracias a la confianza y la accesibilidad.

Se prevé que el segmento online experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente adopción del comercio electrónico, los mercados B2B y las plataformas de compras digitales. Por ejemplo, Alibaba ha facilitado la venta online de recubrimientos hidrofóbicos especiales para aplicaciones industriales y a pequeña escala. Los canales online ofrecen comodidad, mayor alcance y una visión comparativa de los productos a los compradores. El aumento de la digitalización y las compras remotas impulsan la adopción entre las pymes y los compradores globales. El segmento crece a medida que los fabricantes amplían su visibilidad online y sus iniciativas de venta directa al consumidor. La distribución online permite una penetración más rápida en el mercado y el acceso a aplicaciones nicho.

• Por el usuario final

En función del usuario final, el mercado norteamericano de recubrimientos hidrofóbicos se segmenta en los sectores automotriz, electrónico, construcción, marítimo, textil, salud, aeroespacial, petróleo y gas, alimentos y bebidas, entre otros. El segmento automotriz dominó el mercado en 2025, impulsado por la creciente demanda de recubrimientos protectores para vehículos que mejoran la resistencia a la corrosión, la repelencia al agua y la longevidad de las superficies. Los recubrimientos hidrofóbicos mejoran la estética del vehículo, reducen el mantenimiento y promueven prácticas de fabricación sostenibles. Los fabricantes de automóviles integran cada vez más recubrimientos en los procesos de producción de componentes de alto valor. La sólida base industrial del segmento y su adopción en vehículos de pasajeros, comerciales y eléctricos refuerzan su dominio. La fuerte preferencia de los consumidores por los vehículos de bajo mantenimiento refuerza aún más este segmento.

Se prevé que el segmento de la electrónica experimente su mayor crecimiento entre 2026 y 2033, impulsado por la creciente adopción de smartphones, wearables y electrónica industrial que requieren superficies resistentes a la humedad y autolimpiables. Por ejemplo, Samsung ha incorporado recubrimientos hidrofóbicos en dispositivos móviles para mejorar la resistencia al agua y la fiabilidad. El segmento se beneficia de las tendencias de miniaturización, la adopción del IoT y los componentes electrónicos de alto valor que requieren durabilidad a largo plazo. La mayor concienciación de los consumidores sobre la protección de los dispositivos impulsa una rápida adopción. Los recubrimientos electrónicos también favorecen la eficiencia energética y la ausencia de mantenimiento en dispositivos. El segmento crece a medida que los fabricantes priorizan la innovación y la diferenciación de productos.

Análisis regional del mercado de recubrimientos hidrofóbicos en América del Norte

- Estados Unidos dominó el mercado de recubrimientos hidrofóbicos de América del Norte con la mayor participación en los ingresos en 2025, impulsado por la creciente adopción de recubrimientos resistentes a la corrosión y al agua en los sectores automotriz, electrónico, aeroespacial y de la construcción.

- La creciente aplicación de recubrimientos multifuncionales y autolimpiables, la creciente modernización industrial y la rápida adopción en proyectos de infraestructura y fabricación de alto valor respaldan una demanda sostenida del mercado en aplicaciones comerciales, residenciales e industriales.

- La sólida presencia de empresas como PPG Industries, Sherwin-Williams y AkzoNobel, las continuas inversiones en I+D para nanorrecubrimientos avanzados y las alianzas estratégicas con fabricantes de equipos originales (OEM) refuerzan el liderazgo de EE. UU. en el mercado regional. Se espera que el creciente enfoque en la durabilidad, la eficiencia operativa y las iniciativas de sostenibilidad mantengan el liderazgo del país durante el período de pronóstico.

Perspectiva del mercado de recubrimientos hidrofóbicos de Canadá y América del Norte

Se proyecta que Canadá registrará la tasa de crecimiento anual compuesta (TCAC) más rápida en el mercado norteamericano de recubrimientos hidrofóbicos entre 2026 y 2033, impulsada por la creciente modernización industrial, la expansión de la fabricación de automóviles y productos electrónicos, y la creciente adopción de recubrimientos protectores multifuncionales. Por ejemplo, empresas como Sherwin-Williams y Axalta ofrecen recubrimientos hidrofóbicos avanzados para equipos industriales, materiales de construcción y componentes automotrices, mientras que la creciente demanda de recubrimientos resistentes a la corrosión y al agua en condiciones climáticas adversas acelera el crecimiento del mercado. La expansión de las cadenas de suministro industriales, la integración con plataformas de fabricación inteligente y las sólidas tasas de adopción de tecnología mejoran la accesibilidad de los productos, y el mayor enfoque en recubrimientos sostenibles y protección de superficies de alto rendimiento posiciona a Canadá como el mercado de mayor crecimiento de la región.

Perspectiva del mercado de recubrimientos hidrofóbicos en México y América del Norte

Se prevé un crecimiento sostenido en México entre 2026 y 2033, impulsado por el aumento de la construcción industrial y comercial, la expansión de los sectores automotriz y electrónico, y la creciente concienciación sobre los recubrimientos protectores. Empresas como PPG Industries y AkzoNobel fortalecen la oferta nacional mediante la localización de tecnología, la personalización de productos y las alianzas con fabricantes industriales. Por otro lado, la urbanización, la expansión industrial y la inversión extranjera en proyectos de infraestructura impulsan la adopción constante de recubrimientos hidrofóbicos. La conformidad con los estándares de rendimiento norteamericanos, el aumento de la aplicación en entornos con riesgo de agua y corrosión, y la adopción gradual en centros industriales emergentes contribuyen a un crecimiento estable del mercado durante el período de pronóstico.

Cuota de mercado de recubrimientos hidrofóbicos en América del Norte

La industria de recubrimientos hidrofóbicos está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Nanofilm (EE. UU.)

- BASF SE (Alemania)

- AccuCoat Inc. (EE. UU.)

- NeverWet, LLC (EE. UU.)

- Arkema (Francia)

- COTEC GmbH (Alemania)

- P2i Ltd. (Reino Unido)

- PPG Industries, Inc. (EE. UU.)

- 3M (EE. UU.)

- Artekya Teknoloji (Turquía)

- The Sherwin-Williams Company (EE. UU.)

- Laboratorio de nanotecnología avanzada (EE. UU.)

- AkzoNobel NV (Países Bajos)

- Aculon Inc. (EE. UU.)

- UltraTech International, Inc. (EE. UU.)

- Nukote Coating Systems International (EE. UU.)

- Cytonix, LLC (EE. UU.)

Últimos avances en el mercado de recubrimientos hidrofóbicos en América del Norte

- En junio de 2024, NEI Corporation presentó NANOMYTE AM-100EC, un recubrimiento antimicrobiano de última generación diseñado para ofrecer una protección superior contra microorganismos dañinos. Este innovador producto ofrece funcionalidad antimicrobiana y fácil limpieza, lo que lo hace ideal para aplicaciones en entornos de atención médica, procesamiento de alimentos e higiene pública. El recubrimiento AM-100EC está diseñado para soportar rigurosos protocolos de limpieza, manteniendo su eficacia, respondiendo a la creciente demanda del mercado de superficies seguras y centradas en la higiene. Este lanzamiento fortalece la posición de NEI en el mercado norteamericano de recubrimientos hidrófobos al ampliar la oferta de recubrimientos antimicrobianos y multifuncionales, lo que refleja la creciente importancia de la seguridad pública y el cumplimiento normativo.

- En marzo de 2024, Mitsui Chemicals, Inc., en colaboración con la empresa alemana CADIS Engineering GmbH, presentó una impresora digital diseñada para mejorar las pantallas automotrices con recubrimiento hidrófobo avanzado a través de su filial COTEC GmbH. Esta innovación facilita la deposición precisa de recubrimientos hidrófobos en superficies electrónicas automotrices, mejorando la repelencia al agua, la antiincrustación y la durabilidad. Se espera que este desarrollo acelere la adopción de recubrimientos hidrófobos en la electrónica automotriz, un segmento en rápido crecimiento, al permitir aplicaciones más eficientes y de alto rendimiento. También refuerza la tendencia del mercado hacia la integración de recubrimientos avanzados con la fabricación digital y las tecnologías de vehículos inteligentes.

- En febrero de 2024, el Instituto Leibniz de Ciencia y Tecnología del Plasma (INP) en Greifswald, Alemania, desarrolló un novedoso método para producir recubrimientos de polímeros de organosilicio ultrahidrofóbicos. Este enfoque ofrece una alternativa ecológica a los compuestos perfluorados y polifluorados (PFAS), ampliamente utilizados, pero sometidos a un creciente escrutinio regulatorio. Al reducir la dependencia de los PFAS, esta innovación aborda las preocupaciones de sostenibilidad en el mercado norteamericano de recubrimientos hidrofóbicos, promoviendo soluciones más seguras y respetuosas con el medio ambiente. Este desarrollo impulsa el crecimiento del mercado en industrias que priorizan los recubrimientos ecológicos y posiciona a los polímeros de organosilicio como una solución clave de alto rendimiento y cumplimiento normativo.

- En julio de 2023, BASF Automotive OEM Coatings alcanzó el 100 % de utilización de energía renovable en sus plantas de China, un paso significativo hacia la transformación de la compañía hacia cero emisiones netas. Mediante una combinación de Compras Directas de Energía Renovable, certificados internacionales de energía renovable y otras estrategias, se proyecta que la iniciativa reduzca las emisiones de carbono en aproximadamente 19 000 toneladas para finales de 2023. Este hito subraya el compromiso de BASF con la sostenibilidad y resuena con el mercado norteamericano de recubrimientos hidrofóbicos, destacando la creciente expectativa de soluciones ambientalmente responsables y bajas en carbono. La iniciativa fortalece el posicionamiento competitivo de BASF al alinear su oferta de productos con las tendencias globales de sostenibilidad.

- En septiembre de 2022, BASF Coatings inauguró un centro de investigación de vanguardia para recubrimientos electroforéticos por inmersión en Münster-Hiltrup, Alemania, centrado en mejorar las tecnologías de recubrimientos hidrofóbicos. Las instalaciones priorizan la seguridad, la eficiencia y la simulación de procesos específicos para cada cliente, impulsando la tecnología de recubrimiento electrónico CathoGuard 800 de la compañía. Conocida por proteger las superficies automotrices contra la corrosión con un bajo contenido de solventes y una reducción de aguas residuales, esta innovación ofrece un alto rendimiento y beneficios ambientales. El centro de investigación consolida el liderazgo de BASF en el mercado de recubrimientos hidrofóbicos para automoción, permitiendo el desarrollo de soluciones avanzadas y ecológicas que cumplen con los estándares cambiantes de la industria y las expectativas de los clientes.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.