North America Hepatitis B Infection Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

2.46 Billion

USD

3.61 Billion

2024

2032

USD

2.46 Billion

USD

3.61 Billion

2024

2032

| 2025 –2032 | |

| USD 2.46 Billion | |

| USD 3.61 Billion | |

|

|

|

|

Segmentación del mercado de la infección por hepatitis B en América del Norte, por tipo (crónica y aguda), por tratamiento (vacuna, antivirales, inmunomoduladores y cirugía): tendencias de la industria y pronóstico hasta 2032

Tamaño del mercado de la infección por hepatitis B en América del Norte

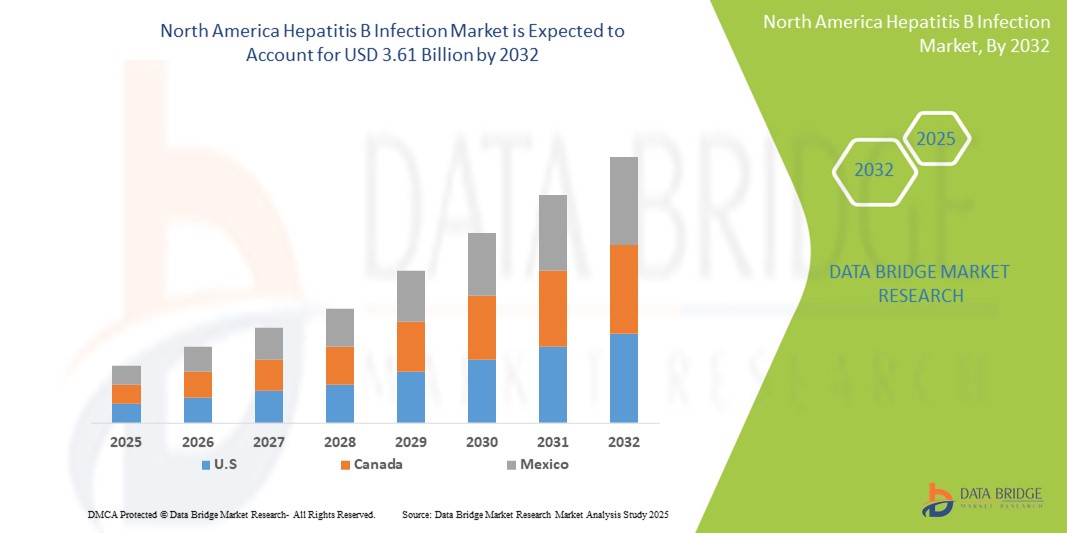

- El tamaño del mercado de infección por hepatitis B en América del Norte se valoró en USD 2.46 mil millones en 2024 y se espera que alcance los USD 3.61 mil millones para 2032 , con una CAGR del 4,90% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente adopción de tecnologías de diagnóstico avanzadas e innovaciones terapéuticas para la hepatitis B, junto con la creciente digitalización e integración de los sistemas de salud electrónicos en toda Europa.

- Además, la creciente demanda de soluciones precisas, accesibles y preventivas por parte de los consumidores y la salud pública está convirtiendo los protocolos de manejo de la hepatitis B en un eje central de las políticas sanitarias. Estos factores convergentes están acelerando la adopción de la vacunación, el cribado y las terapias antivirales, impulsando así significativamente el crecimiento del mercado de la infección por hepatitis B en toda la región.

Análisis del mercado de la infección por hepatitis B en América del Norte

- Los tratamientos y diagnósticos de la hepatitis B son componentes cada vez más vitales de la infraestructura de salud pública de América del Norte, especialmente en entornos hospitalarios y ambulatorios, debido a la creciente conciencia sobre la infección, la mejor accesibilidad a las pruebas y los avances en las terapias antivirales.

- La creciente demanda de un tratamiento eficaz de la hepatitis B se ve impulsada principalmente por los esfuerzos generalizados de inmunización, el aumento de las pruebas de coinfección por VHB y VHD y la creciente carga de enfermedades hepáticas crónicas, en particular entre las poblaciones que envejecen y las comunidades inmigrantes.

- Estados Unidos dominó el mercado norteamericano de la infección por hepatitis B, con la mayor participación en los ingresos, un 57,9 % en 2024. Este país se caracterizó por sólidas políticas de salud pública, la adopción temprana de tecnologías de diagnóstico avanzadas y altas tasas de pruebas de detección del VHB. El país también ha experimentado un crecimiento significativo en la aceptación del tratamiento, especialmente entre los grupos de alto riesgo, impulsado por campañas de concienciación pública, planes de erradicación a nivel estatal y una mayor cobertura de seguros para la atención de la hepatitis.

- Se espera que México sea el país de más rápido crecimiento dentro del mercado de infección por hepatitis B en América del Norte durante el período de pronóstico, apoyado por una creciente urbanización, una mejor cobertura de vacunación, la expansión del financiamiento gubernamental para la eliminación de la hepatitis y un mejor acceso a los servicios de atención médica en áreas urbanas y rurales.

- El segmento de hepatitis B crónica dominó el mercado de infección por hepatitis B de América del Norte con una participación de mercado del 62,4 % en 2024, debido a la naturaleza persistente de la enfermedad, la necesidad de una terapia antiviral a largo plazo y una mejor detección mediante programas de detección específicos y la integración de las pruebas de hepatitis en la atención primaria.

Alcance del informe y segmentación del mercado de la infección por hepatitis B en América del Norte

|

Atributos |

Perspectivas clave del mercado de la infección por hepatitis B en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de la infección por hepatitis B en América del Norte

“ Mayor comodidad mediante atención integrada y acceso a tratamientos avanzados ”

- Una tendencia significativa y en auge en el mercado norteamericano de la infección por hepatitis B es la creciente integración de modelos de atención multidisciplinarios y el acceso a tratamientos avanzados a través de sistemas de salud centralizados. Esta tendencia está mejorando significativamente los resultados y la adherencia al tratamiento de los pacientes al facilitar una comunicación fluida entre médicos generales, hepatólogos e instituciones de salud pública.

- Por ejemplo, varios países de Europa Occidental han implementado planes nacionales de acción contra la hepatitis que permiten a los pacientes recibir diagnóstico temprano, tratamiento antiviral y seguimiento regular bajo un marco coordinado. El modelo de atención integrada de Alemania, por ejemplo, permite una conexión eficiente entre el diagnóstico y el tratamiento, reduciendo así las tasas de progresión de la enfermedad.

- Iniciativas como los registros centralizados de pacientes, los sistemas de historiales médicos digitales y las vías de derivación optimizadas están optimizando el manejo de la infección por hepatitis B al permitir la intervención y el monitoreo oportunos. Estos sistemas permiten a los profesionales de la salud monitorear la función hepática, la respuesta al tratamiento y las coinfecciones, como la hepatitis D, en tiempo real.

- La integración de diagnósticos avanzados con los servicios rutinarios de atención primaria facilita la detección temprana de casos agudos y crónicos. Este enfoque centralizado, combinado con un acceso asequible a terapias antivirales más recientes, mejora tanto la atención individualizada del paciente como la vigilancia de la salud pública en general.

- Esta tendencia hacia una atención de la hepatitis B más ágil, coordinada y con soporte tecnológico está transformando radicalmente las expectativas de los sistemas nacionales de salud. Como resultado, muchos gobiernos europeos están ampliando el acceso a las pruebas de detección de la hepatitis viral, especialmente entre las poblaciones vulnerables y de alto riesgo, como los migrantes, los usuarios de drogas por vía intravenosa y las personas mayores.

- La demanda de modelos de tratamiento de la hepatitis B accesibles, eficientes e integrados está creciendo rápidamente en los sectores de atención médica tanto públicos como privados, a medida que las partes interesadas se centran cada vez más en el control de la enfermedad a largo plazo y la alineación con los objetivos de eliminación de la hepatitis para 2030 de la Organización Mundial de la Salud.

Dinámica del mercado de la infección por hepatitis B en América del Norte

Conductor

Necesidad creciente debido al aumento de la carga de enfermedades y la adopción de atención médica preventiva.

- La creciente prevalencia de infecciones por hepatitis B en toda Europa, junto con una mayor conciencia sobre las enfermedades hepáticas, está impulsando significativamente la demanda de diagnóstico temprano, vacunación y soluciones de tratamiento.

- Por ejemplo, en abril de 2024, GlaxoSmithKline plc (GSK) amplió su suministro de vacunas contra la hepatitis B en Europa mediante una alianza estratégica con los sistemas de salud regionales, con el objetivo de mejorar las tasas de inmunización en poblaciones de alto riesgo. Se espera que estas iniciativas de actores clave del mercado impulsen el crecimiento del mercado norteamericano de la infección por hepatitis B durante el período de pronóstico.

- A medida que las autoridades de salud pública y los consumidores se vuelven más conscientes de las complicaciones a largo plazo asociadas con la hepatitis B crónica (como la cirrosis y el cáncer de hígado), la adopción de estrategias preventivas como la vacunación y la detección temprana continúa aumentando.

- Además, la integración de las pruebas de la hepatitis B en los controles sanitarios rutinarios y la creciente popularidad de las tecnologías de diagnóstico en el punto de atención están haciendo que el tratamiento de la hepatitis B sea más accesible y eficiente en toda Europa.

- La disponibilidad de vacunas eficaces, antivirales orales y el desarrollo de inmunomoduladores avanzados están facilitando un mejor control de la enfermedad. La financiación gubernamental, las políticas de reembolso y los objetivos de eliminación de la hepatitis impulsados por la OMS también están impulsando las tasas de adopción en entornos sanitarios públicos y privados.

Restricción/Desafío

Preocupaciones sobre la accesibilidad al tratamiento y el alto costo de las terapias avanzadas

- A pesar de los avances médicos, el acceso limitado a terapias antivirales avanzadas y moduladores inmunitarios en ciertas partes de América del Norte sigue siendo un desafío, en particular en el este y el sur de América del Norte, donde persisten las disparidades en la atención médica.

- Por ejemplo, estudios publicados a principios de 2024 indicaron que algunos estados miembros de la UE aún enfrentan escasez de vacunas contra la hepatitis B y acceso limitado a nuevos regímenes de tratamiento debido a problemas de adquisición y reembolso.

- Para superar esta brecha se requieren esfuerzos a nivel de políticas para armonizar los estándares de atención de la hepatitis B en todos los países europeos, en particular mediante apoyo financiero a nivel de la UE, negociaciones de precios y aprobaciones regulatorias simplificadas.

- Además, si bien los medicamentos antivirales de primera línea son cada vez más asequibles, las terapias de nueva generación con eficacia mejorada suelen tener un costo más alto, lo que potencialmente limita su adopción entre las poblaciones sin seguro médico o de bajos ingresos.

- La desconfianza pública o la reticencia a vacunarse, especialmente en la Europa pospandémica, es otra barrera que debe abordarse mediante campañas de concienciación y la participación de los profesionales sanitarios.

- Superar estos desafíos a través de una cobertura de seguros ampliada, asociaciones público-privadas y una mayor inversión en infraestructura de atención médica regional será crucial para sostener el crecimiento a largo plazo en el mercado de infección por hepatitis B en América del Norte.

Alcance del mercado de la infección por hepatitis B en América del Norte

El mercado está segmentado según tipo y tratamiento.

• Por tipo

Según el tipo, el mercado norteamericano de la infección por hepatitis B se segmenta en crónica y aguda. El segmento crónico representó la mayor cuota de mercado en ingresos, con un 62,4 % en 2024, debido principalmente a la alta prevalencia de casos crónicos de VHB y a la necesidad de un control de por vida de la enfermedad mediante terapias antivirales y monitoreo.

Se prevé que el segmento agudo sea testigo de la tasa de crecimiento más rápida, con una CAGR del 6,4 % entre 2025 y 2032, impulsada por mejores esfuerzos de detección temprana, iniciativas de salud pública y una creciente conciencia que conduce a un diagnóstico y tratamiento oportunos.

• Por tratamiento

En función del tratamiento, el mercado norteamericano de la infección por hepatitis B se segmenta en vacunas, medicamentos antivirales, inmunomoduladores y cirugía. El segmento de vacunas obtuvo la mayor participación en los ingresos, con un 41,2 % en 2024, gracias a las campañas nacionales de vacunación, el aumento de la inmunización al nacer y una sólida tasa de vacunación entre las poblaciones adultas de alto riesgo.

Se proyecta que el segmento de medicamentos antivirales experimentará la CAGR más rápida del 7,1 % entre 2025 y 2032, impulsada por el creciente grupo de pacientes con VHB crónico, los avances en terapias orales y políticas de reembolso favorables.

Análisis regional del mercado de la infección por hepatitis B en América del Norte

- América del Norte dominó el mercado de infección por hepatitis B con la mayor participación en los ingresos del 33,27 % en 2024, impulsada por una sólida infraestructura de salud pública, programas de vacunación generalizados y una creciente conciencia sobre la transmisión y prevención de la hepatitis B.

- La región se caracteriza por tecnologías de diagnóstico de vanguardia, protocolos de inmunización bien establecidos e iniciativas proactivas de vigilancia de la hepatitis lideradas por el gobierno.

- Esta fuerte adopción de estrategias preventivas y terapéuticas se ve respaldada además por un amplio acceso a la atención médica, una financiación continua de I+D y un esfuerzo centrado en la detección temprana y el tratamiento de la enfermedad, lo que consolida el papel de América del Norte como contribuyente clave al mercado mundial de la infección por hepatitis B.

Perspectiva del mercado de la infección por hepatitis B en EE. UU.

El mercado estadounidense de la infección por hepatitis B dominó el mercado norteamericano con la mayor participación en los ingresos, un 57,9%, en 2024, gracias a su avanzada infraestructura sanitaria, la amplia cobertura de vacunación contra el VHB y la adopción temprana de protocolos de detección y diagnóstico. Las iniciativas gubernamentales, como las directrices de detección universal recomendadas por los CDC, junto con el firme apoyo a las pruebas de coinfección por VHB y VHD, están impulsando el crecimiento del mercado. Además, las campañas de concienciación a gran escala y la innovación del sector privado en terapias antivirales contribuyen a una demanda constante.

Análisis del mercado de la infección por hepatitis B en Canadá

El mercado canadiense de la infección por hepatitis B representó el 25,6 % de los ingresos del mercado norteamericano en 2024. El país se beneficia de un sistema de salud financiado con fondos públicos, programas universales de vacunación infantil y un fuerte énfasis en la detección de inmigrantes y las pruebas maternas. La colaboración continua entre el gobierno y las instituciones de investigación ha mejorado el acceso al diagnóstico y tratamiento de la infección crónica por el VHB, especialmente en comunidades marginadas e indígenas.

Análisis del mercado de la infección por hepatitis B en México

El mercado mexicano de la infección por hepatitis B representó el 16.5% de la cuota de mercado regional en 2024 y se espera que experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 6.9%, durante el período de pronóstico. El crecimiento se sustenta en una mayor inversión gubernamental en la prevención de enfermedades infecciosas, la mejora de los programas de vacunación para bebés y adolescentes, y la expansión del acceso al diagnóstico en zonas rurales. Las alianzas público-privadas y las iniciativas educativas también contribuyen a la concienciación sobre la hepatitis B y a la reducción del estigma, contribuyendo así a una detección temprana y a mejores resultados del tratamiento.

Cuota de mercado de la infección por hepatitis B en América del Norte

La industria de la infección por hepatitis B en América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Gilead Sciences, Inc. (EE. UU.)

- GSK plc (Reino Unido)

- Dynavax Technologies (EE. UU.)

- F. Hoffmann-La Roche Ltd (Suiza)

- Bristol-Myers Squibb Company (EE. UU.)

- Merck & Co., Inc. (EE. UU.)

- Novartis AG (Suiza)

- Arrowhead Pharmaceuticals Inc. (EE. UU.)

- Arbutus Biopharma (Canadá)

- Teva Pharmaceuticals, Inc. (Israel)

- Productos farmacéuticos Zydus (India)

- Aurobindo Pharma (India)

- Lupin Pharmaceuticals, Inc. (India)

Últimos avances en el mercado de la infección por hepatitis B en América del Norte

- En septiembre de 2024, Gilead Sciences y Genesis Therapeutics anunciaron una colaboración estratégica para descubrir y desarrollar nuevas terapias de moléculas pequeñas utilizando la plataforma de IA GEMS de Genesis. Gilead obtuvo los derechos exclusivos para desarrollar y comercializar productos de esta alianza.

- En julio de 2024, Gilead Sciences, Inc. presentó datos de investigación que demuestran la eficacia y seguridad a largo plazo de Biktarvy en diversas poblaciones con VIH, incluyendo personas hispanas/latinas y adultos mayores con comorbilidades. También se destacaron regímenes de dosificación en investigación de una vez al día y semanalmente.

- En febrero de 2024, GSK completó la adquisición de Aiolos Bio, incluyendo el prometedor anticuerpo monoclonal AIO-001 para el asma grave. GSK pagó 1000 millones de dólares por adelantado y hasta 400 millones de dólares en pagos por hitos, ampliando así su cartera de productos biológicos respiratorios.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA HEPATITIS B INFECTION MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 THERAPEUTICS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTAL ANALYSIS

4.2 PORTER FIVE FORCES

5 NORTH AMERICA HEPATITIS B INFECTION MARKET: REGULATIONS

5.1 REGULATORY AUTHORITIES IN THE ASIA-PACIFIC REGION

5.2 NORTH AMERICA REGULATORY SCENARIO

5.3 EUROPE REGULATORY SCENARIO

5.4 MIDDLE EAST AND AFRICA REGULATORY SCENARIO

5.5 SOUTH AMERICA REGULATORY SCENARIO

6 PIPELINE ANALYSIS

7 EPIDEMILIOGY

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 INCREASING PREVALENCE OF HEPATITIS B INFECTIONS

8.1.2 TECHNOLOGICAL ADVANCEMENTS IN DIAGNOSTICS

8.1.3 DEVELOPMENT OF COMBINATION THERAPIES FOR HEPATITIS B

8.1.4 STRATEGIC INITIATIVES BY COMPANIES FOR HEPATITIS B INFECTION

8.2 RESTRAINTS

8.2.1 SIDE EFFECTS AND DRUG RESISTANCE

8.2.2 INSUFFICIENT VACCINE COVERAGE FOR HEPATITIS B INFECTION

8.3 OPPORTUNITY

8.3.1 RISING NEW DRUG RELEASES AND INCREASING NEW DRUG PERMITS FOR HEPATITIS B

8.3.2 GOVERNMENT PROGRAMS TO RAISE AWARENESS OF HEPATITIS B INFECTION

8.3.3 ADVANCED RESEARCH AND DEVELOPMENT FOR CLINICAL TRIALS

8.4 CHALLENGES

8.4.1 THE COST OF HEPATITIS B TREATMENTS IS HIGH

8.4.2 STRINGENT REGULATORY POLICIES AND REGIONAL DISPARITIES IN TREATMENT ACCESS

9 NORTH AMERICA HEPATITIS B INFECTION MARKET, BY TYPE

9.1 OVERVIEW

9.2 CHRONIC

9.3 ACUTE

10 NORTH AMERICA HEPATITIS B INFECTION MARKET, BY TREATMENT

10.1 OVERVIEW

10.2 VACCINE

10.2.1 HOSPITAL PHARMACIES

10.2.2 DRUGS STORES AND RETAIL PHARMACIES

10.2.3 ONLINE PHARMACIES

10.3 ANTIVIRAL DRUGS

10.3.1 TENOFOVIR ALAFENAMIDE FUMARATE (TAF)

10.3.2 TENOFOVIR DISOPROXIL FUMARATE (TDF)

10.3.3 ENTECAVIR

10.3.4 OTHERS

10.4 IMMUNE MODULATOR DRUGS

10.4.1 PEGYLATED INTERFERON

10.4.2 INTERFERON ALPHA

10.5 SURGERY

11 NORTH AMERICA HEPATITIS B INFECTION MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA HEPATITIS B TREATMENT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 GILEAD SCIENCES, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 GLAXOSMITHKLINE PLC

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 DYNAVAX TECHNOLOGIES CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 F. HOFFMAN-LA ROCHE LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 BRISTOL-MYERS SQUIBB COMPANY

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ARROWHEAD PHARMACEUTICALS, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 ARBUTUS BIOPHARMA

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT UPDATES

14.8 AUROBINDO PHARMA

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT UPDATES

14.9 LUPIN PHARMACEUTICALS, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATES

14.1 MERCK & CO., INC.,

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 NOVARTIS AG

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 TEVA PHARMACEUTICAL INDUSTRIES

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 ZYDUS PHARMACEUTICALS, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 REVENUE

14.13.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA CLINICAL TRIAL AND PIPELINE A-LYSIS AS PER THE COMPANY

TABLE 2 DISTRIBUTION OF PRODUCTS OR PROJECTS BY PHASE

TABLE 3 COUNTRY WISE EPIDEMIOLOGY FOR HEPATITIS B

TABLE 4 COST OF HEPATITIS B MEDICATIONS: BRAND VS. GENERIC PRICES

TABLE 5 NORTH AMERICA HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 6 NORTH AMERICA CHRONIC IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 7 NORTH AMERICA ACUTE IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 8 NORTH AMERICA HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 9 NORTH AMERICA VACCINE IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 10 NORTH AMERICA VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 11 NORTH AMERICA ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 12 NORTH AMERICA ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 13 NORTH AMERICA IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 14 NORTH AMERICA IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 15 NORTH AMERICA SURGERY IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 NORTH AMERICA HEPATITIS B INFECTION MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 17 NORTH AMERICA HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 18 NORTH AMERICA HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 19 NORTH AMERICA ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 20 NORTH AMERICA IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 21 NORTH AMERICA VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 22 U.S. HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 23 U.S. HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 24 U.S. ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 25 U.S. IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 26 U.S. VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 27 CANADA HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 28 CANADA HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 29 CANADA ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 30 CANADA IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 31 CANADA VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 32 MEXICO HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 33 MEXICO HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 34 MEXICO ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 35 MEXICO IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 36 MEXICO VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA HEPATITIS B INFECTION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HEPATITIS B INFECTION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HEPATITIS B INFECTION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HEPATITIS B INFECTION MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HEPATITIS B INFECTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HEPATITIS B INFECTION MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA HEPATITIS B INFECTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA HEPATITIS B INFECTION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA HEPATITIS B INFECTION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA HEPATITIS B INFECTION MARKET: SEGMENTATION

FIGURE 11 TWO SEGMENTS COMPRISE THE NORTH AMERICA HEPATITIS B INFECTION MARKET, BY TYPE

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 NORTH AMERICA HEPATITIS B INFECTION MARKET

FIGURE 15 CHRONIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HEPATITIS B INFECTION MARKET IN 2024 & 2031

FIGURE 16 DROC ANALYSIS

FIGURE 17 BURDEN OF HBV INFECTION IN THE GENERAL POPULATION BY WHO REGION, 2019

FIGURE 18 NORTH AMERICA HEPATITIS B INFECTION MARKET: BY TYPE, 2023

FIGURE 19 NORTH AMERICA HEPATITIS B INFECTION MARKET: BY TYPE, 2024-2031 (USD MILLION)

FIGURE 20 NORTH AMERICA HEPATITIS B INFECTION MARKET: BY TYPE, CAGR (2024-2031)

FIGURE 21 NORTH AMERICA HEPATITIS B INFECTION MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA HEPATITIS B INFECTION MARKET: BY TREATMENT, 2023

FIGURE 23 NORTH AMERICA HEPATITIS B INFECTION MARKET: BY TREATMENT, 2024-2031 (USD MILLION)

FIGURE 24 NORTH AMERICA HEPATITIS B INFECTION MARKET: BY TREATMENT, CAGR (2024-2031)

FIGURE 25 NORTH AMERICA HEPATITIS B INFECTION MARKET BY TREATMENT, LIFELINE CURVE

FIGURE 26 NORTH AMERICA HEPATITIS B INFECTION MARKET, SNAPSHOT

FIGURE 27 NORTH AMERICA HEPATITIS B TREATMENT MARKET: COMPANY SHARE 2023 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.