Mercado de tubos termorretráctiles de América del Norte, por tipo (pared simple y pared doble), tipo de producto (carretes, longitud precortada y otros), voltaje (bajo, medio y alto), relación de contracción (2:01, 3:01, 4:01, 6:01 y otros), material (poliolefina, perfluoroalcoxi alcanos (PFA), politetrafluoroetileno (PTFE), etileno tetrafluoroetileno (ETFE), etileno propileno fluorado (FEP), polieteretercetona (PEEK) y otros), usuario final (servicios públicos, TI y telecomunicaciones, automoción, electrónica, aeroespacial, atención médica, petróleo y gas, marina, alimentos y bebidas, construcción, química y otros) Tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de tubos termorretráctiles de América del Norte

El aumento de la capacidad de generación de energía en todo el mundo impulsa el mercado de tubos termorretráctiles en América del Norte. Sin embargo, la modernización de las líneas de transmisión y las subestaciones a lo largo de los corredores existentes es una forma rentable de aumentar la capacidad de transmisión. Las líneas existentes se pueden reconducir para aumentar la capacidad de transmisión (utilizando materiales como conductores compuestos que pueden transportar corrientes más altas). Estos materiales están disponibles actualmente, pero no se utilizan ampliamente porque es difícil sacar las líneas de servicio para reconducir nuevos materiales. Además, cuando las condiciones climáticas son favorables, todas las líneas aéreas pueden transportar una corriente superior a su capacidad nominal y una capacidad nominal en tiempo real que pudiera ajustarse continuamente aumentaría la capacidad disponible.

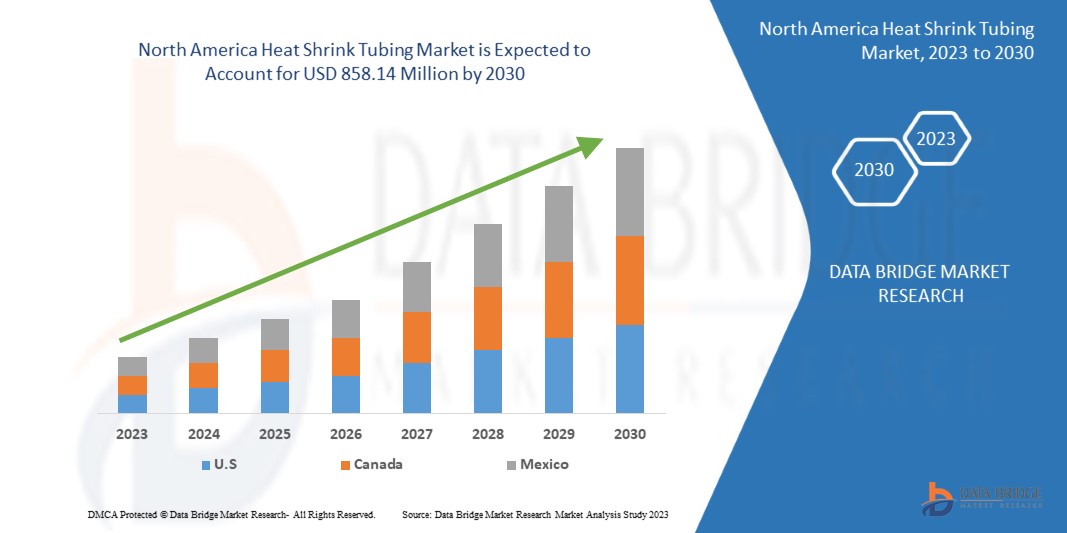

Data Bridge Market Research analiza que se espera que el mercado de tubos termorretráctiles de América del Norte crezca a una CAGR del 6,2% en el período de pronóstico de 2023 a 2030 y se espera que alcance los USD 858,14 millones para 2030. El informe del mercado de tubos termorretráctiles de América del Norte también cubre de manera integral el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable 2015-2020) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Tipo (pared simple y pared doble), tipo de producto (carretes, longitud precortada y otros), voltaje (bajo, medio y alto), relación de contracción (2:01, 3:01, 4:01, 6:01 y otros), material (poliolefina, perfluoroalcoxi alcanos (PFA), politetrafluoroetileno (PTFE), etileno tetrafluoroetileno (ETFE), etileno propileno fluorado (FEP), polieteretercetona (PEEK) y otros), usuario final (servicios públicos, TI y telecomunicaciones, automoción, electrónica, aeroespacial, atención médica, petróleo y gas, marina, alimentos y bebidas, construcción, química y otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

ABB (Suiza), Sumitomo Electric Industries, Ltd. (Japón), TE Connectivity (Suiza), Thermosleeve USA (EE. UU.), Techflex, Inc. (EE. UU.), Dasheng Group (China), Shenzhen Woer Heat - Shrinkable Material Co., Ltd. (China), Huizhou Guanghai Electronic Insulation Materials Co., Ltd. (China), Panduit (EE. UU.), HellermannTyton (Alemania), Alpha Wire (EE. UU.), 3M (EE. UU.), SHAWCOR (Canadá), Zeus Industrial Products, Inc. (EE. UU.), Molex (EE. UU.), PEXCO (EE. UU.), Prysmain Group (Italia), GREMCO GmbH (Alemania), Qualtek Electronics Corp. (EE. UU.), Hilltop (Reino Unido), Dunbar Products, LLC. (EE. UU.), cygia y Changyuan Electronics (Dongguan) Co., Ltd. (China), entre otros. |

Definición de mercado

Los tubos termorretráctiles se utilizan para aislar cables, lo que proporciona resistencia a la abrasión y protección ambiental para los conductores de cables sólidos trenzados con conexiones, uniones y terminales en trabajos eléctricos. En general, un tubo con una temperatura de contracción más baja se encogerá más rápido. Cuando los tubos termorretráctiles se envuelven alrededor de conjuntos de cables y componentes eléctricos, se colapsan radialmente para adaptarse a los contornos del equipo, formando una capa protectora.

Además, estos tubos utilizan diversos materiales, como perfluoroalcoxi alcanos (PFA), politetrafluoroetileno (PTFE), etileno propileno fluorado (FEP) y otros, para fabricar tubos termorretráctiles. Los tubos termorretráctiles con diferentes materiales tienen diferentes características de protección contra la abrasión, el bajo impacto, los cortes, la humedad y el polvo al cubrir cables individuales o envolver conjuntos completos. Además, el material se decide en función del uso final, como la electrónica, la automoción, la industria aeroespacial y otros. Los fabricantes de plástico comienzan por extruir un tubo termoplástico para crear tubos termorretráctiles. Los materiales de los tubos termorretráctiles varían según la aplicación prevista.

Dinámica del mercado de tubos termorretráctiles en América del Norte

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- El papel del gobierno en el apoyo y la expansión de los sistemas de transmisión y distribución en el mercado de tubos termorretráctiles en toda la región

El papel de la transmisión y distribución de energía eléctrica (T&D) juega un papel importante en la conexión entre las centrales generadoras y los clientes. Las crecientes cargas y el estrés creado por el envejecimiento de los equipos y el aumento del riesgo de apagones generalizados son algunos de los factores que contribuyen a generar la necesidad de tubos termorretráctiles. El suministro de electricidad que sea confiable y rentable es fundamental en la sociedad actual. La transmisión y distribución (T&D) de los EE. UU. se compone de numerosos impulsores económicos, estructuras organizativas, tecnologías y formas de supervisión regulatoria. Los gobiernos federales y municipales y las cooperativas estatales y de propiedad de los clientes son parte de estos sistemas. Sin embargo, alrededor del 80 por ciento de las transacciones de energía ocurren en líneas propiedad de empresas de servicios públicos reguladas (IOU) propiedad de inversores. Estas empresas de servicios públicos totalmente integradas son dueñas tanto de las plantas generadoras como de los sistemas de transmisión y distribución que entregan la energía a sus clientes. Este fue uno de los modelos dominantes en el pasado, pero la desregulación en algunos estados ha transformado la industria. La transmisión, la generación y la distribución pueden ser manejadas por diferentes entidades en áreas desreguladas.

- Aumento de la capacidad de generación de energía en todo el mundo

Para crear tubos termorretráctiles se utiliza un proceso de dos pasos. El primer paso es la extrusión estándar seguida de un proceso secundario que hace que el tubo sea termorretráctil. Aunque los detalles de este proceso secundario se mantienen confidenciales, se utiliza calor y fuerza para expandir el diámetro del tubo. Mientras aún está expandido, el tubo se enfría a temperatura ambiente. Si el tubo es rígido, se encogerá hasta su tamaño original. La modernización de las líneas de transmisión y las subestaciones a lo largo de los corredores existentes es una forma rentable de aumentar la capacidad de transmisión. Las líneas existentes se pueden reconducir para aumentar la capacidad de transmisión (utilizando materiales como conductores compuestos que pueden transportar corrientes más altas).

Oportunidad

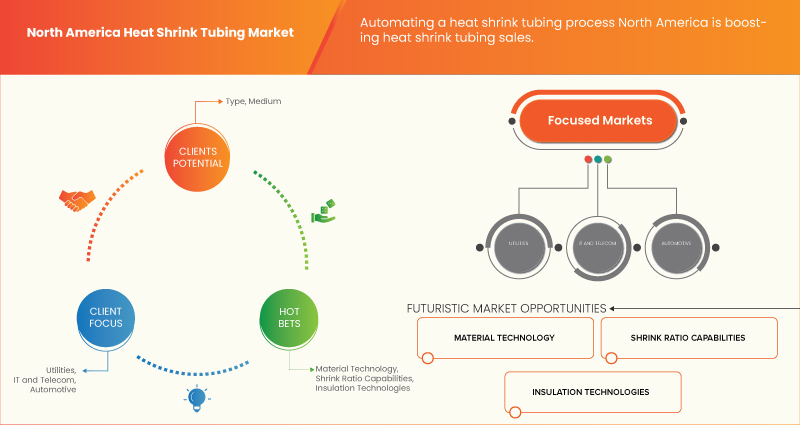

- Amplia adopción de tubos termorretráctiles en diversas industrias

Los productos de tubos termorretráctiles están hechos de materiales de fórmula única que se han mejorado mediante reticulación por radiación, una tecnología con un diseño de producto que proporciona una instalación repetible, confiable y de encogimiento a medida compatible con muchos procesos de fabricación. Estos productos están en servicio en todo el mundo en aplicaciones automotrices, de telecomunicaciones, distribución de energía, aeroespacial, de defensa, industriales y comerciales. La aplicación de tubos en la protección de cables debajo del capó, mangueras, tuberías de freno, aire acondicionado, grupos de inyección diésel, conectores, empalmes en línea, mazos de cables, terminales de anillo, vástagos de cinturones de seguridad, resortes de gas, antenas y otros están mejorando aún más las capacidades de aplicación en la industria automotriz. Los productos de tubos están hechos de materiales de fórmula única que se han mejorado mediante reticulación por radiación, una tecnología. Los productos fáciles de usar brindan soluciones probadas y rentables en varias aplicaciones automotrices, desde sellar y proteger empalmes eléctricos hasta brindar protección mecánica para sistemas de gestión de fluidos en entornos hostiles.

Restricciones/Desafíos

- Reglamento gubernamental sobre emisión de gases tóxicos

La importancia ambiental de la rápida industrialización ha provocado que innumerables lugares con recursos hídricos, terrestres y aéreos se hayan contaminado con materiales tóxicos y otros contaminantes, lo que supone una amenaza para la salud de los seres humanos y los ecosistemas. El uso más extensivo e intensivo de materiales y energía ha creado presiones acumulativas sobre la calidad de los ecosistemas locales, regionales y de América del Norte. Antes de que se hiciera un esfuerzo concertado para limitar el impacto de la contaminación, la gestión ambiental no iba más allá de la tolerancia del laissez-faire, atenuada por la eliminación de desechos para evitar molestias locales perturbadoras concebidas en una perspectiva de corto plazo. La necesidad de remediación se reconocía excepcionalmente en casos en que se determinaba que el daño era inaceptable. A medida que se intensificaba el ritmo de la actividad industrial y crecía la comprensión de los efectos acumulativos, un paradigma de control de la contaminación se convirtió en el método dominante de gestión ambiental.

- Aumento de los precios de las materias primas para la fabricación de tubos

Las fluctuaciones de precios afectan a los cables, alambres y productos y materiales de conectividad que se compran o afectan las perspectivas de las proyecciones presupuestarias en materia de adquisiciones, finanzas, gestión de la cadena de suministro o desarrollo de productos. Gracias a la creciente producción industrial y a las agresivas iniciativas de energía sostenible, China es el mayor consumidor de cobre del mundo. Europa, Estados Unidos y China están llevando a cabo agresivas iniciativas de energía renovable para sostener economías más ecológicas y la alta conductividad térmica y eléctrica del cobre les ayudará a lograrlo. Los mayores países productores de cobre, como Chile, Perú, China y Estados Unidos, están luchando por satisfacer la alta demanda de países que cumplan con su iniciativa económica ecológica, lo que contribuye a que el precio del cobre se dispare. También se especula que, a medida que el dólar estadounidense se debilite frente a otras monedas de América del Norte, habrá más oportunidades para que los usuarios de otras monedas aumenten su poder adquisitivo con el cobre y otras materias primas.

Acontecimientos recientes

- En abril de 2023, TE Connectivity anunció el nuevo tubo EV Single Wall (EVSW) diseñado específicamente para aplicaciones de alto voltaje y que aísla y protege de manera segura los componentes y cables conductores. Este producto es un tubo de pared simple cuyo objetivo principal es brindar aislamiento eléctrico y protección para los componentes de alto voltaje en vehículos eléctricos. Esto ayudará a la empresa a diversificar su cartera de productos y a enfrentar los desafíos únicos de las aplicaciones de vehículos eléctricos.

- En febrero de 2023, Molex publicó un informe de miniaturización en el que se expusieron los conocimientos y las innovaciones de los expertos en ingeniería de diseño de productos y conectividad de vanguardia. Gracias a esta miniaturización, la empresa ha aumentado la eficacia de los productos y también su seguridad. Este desarrollo mejoró la línea de productos de la empresa y tuvo un impacto positivo en el crecimiento del mercado de tubos termorretráctiles de América del Norte.

Alcance del mercado de tubos termorretráctiles en América del Norte

El mercado de tubos termorretráctiles de América del Norte se divide en seis segmentos importantes según el tipo, el tipo de producto, el material, el voltaje, la relación de contracción y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Pared simple

- Doble pared

Según el tipo, el mercado de tubos termorretráctiles de América del Norte está segmentado en pared simple y pared doble.

Tipo de producto

- Carretes

- Longitudes precortadas

- Otros

Según el tipo de producto, el mercado de tubos termorretráctiles de América del Norte está segmentado en carretes, longitudes precortadas y otros.

Voltaje

- Bajo

- Medio

- Alto

Sobre la base del voltaje, el mercado de tubos termorretráctiles de América del Norte está segmentado en bajo, medio y alto.

Relación de contracción

- 2:01

- 3:01

- 4:01

- 6:01

- Otros

Sobre la base de la relación de contracción, el mercado de tubos termorretráctiles de América del Norte está segmentado en 2:01, 3:01, 4:01, 6:01 y otros.

Material

- Poliolefina

- Per Fluoroalkoxy Alkane (PFA)

- Poly Tetra Fluoro Ethylene (PTFE)

- Ethylene Tetra Fluoro Ethylene (ETFE)

- Fluorinated Ethylene Propylene (FEP)

- Polyether Ether Ketone (PEEK)

- Others

On the basis of material, the North America heat shrink tubing market is segmented into polyolefin, per fluoroalkoxy alkane (PFA), poly tetra fluoro ethylene (PTFE), ethylene tetra fluoro ethylene (ETFE), fluorinated ethylene propylene (FEP), polyether ether ketone (PEEK), and others.

End User

- Utilities

- IT and Telecommunication

- Automotive

- Electronics

- Aerospace

- Healthcare

- Oil and Gas

- Marine

- Food and Beverages

- Construction

- Chemical

- Others

On the basis of application, the North America heat shrink tubing market is segmented into utilities, it and telecommunication, automotive, electronics, aerospace, healthcare, oil and gas, marine, food and beverages, construction, chemical, and others.

North America Heat Shrink Tubing Market Regional Analysis/Insights

The North America heat shrink tubing market is analysed, and market size insights and trends are provided by type, product type, voltage, shrink ratio, material, and end user as referenced above.

The countries covered in the North America heat shrink tubing market report are U.S., Canada, and Mexico.

The U.S. dominates in the North America region owing to the region's advanced software sector.

The region section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and North America Heat Shrink Tubing Market Share Analysis

North America heat shrink tubing market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the North America heat shrink tubing market.

Algunos de los principales actores que operan en el mercado de tubos termorretráctiles de América del Norte son ABB (Suiza), Sumitomo Electric Industries, Ltd. (Japón), TE Connectivity (Suiza), Thermosleeve USA (EE. UU.), Techflex, Inc. (EE. UU.), Dasheng Group (China), Shenzhen Woer Heat - Shrinkable Material Co., Ltd. (China), Huizhou Guanghai Electronic Insulation Materials Co., Ltd. (China), Panduit (EE. UU.), HellermannTyton (Alemania), Alpha Wire (EE. UU.), 3M (EE. UU.), SHAWCOR (Canadá), Zeus Industrial Products, Inc. (EE. UU.), Molex (EE. UU.), PEXCO (EE. UU.), Prysmain Group (Italia), GREMCO GmbH (Alemania), Qualtek Electronics Corp. (EE. UU.), Hilltop (Reino Unido), Dunbar Products, LLC. (EE. UU.), cygia y Changyuan Electronics (Dongguan) Co., Ltd. (China), entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA HEAT SHRINK TUBING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ROLE OF THE GOVERNMENT IN SUPPORTING AND EXPANSION OF TRANSMISSION & DISTRIBUTION SYSTEMS IN THE HEAT SHRINK TUBING MARKET ACROSS THE REGION

5.1.2 INCREASE IN THE CAPACITY FOR POWER GENERATION ACROSS THE GLOBE

5.1.3 RISING USAGE OF PRODUCTS WITH ADVANCED INFRASTRUCTURE AND TECHNOLOGY

5.1.4 INCREASING PENETRATION OF ELECTRIC VEHICLES

5.2 RESTRAINTS

5.2.1 GOVERNMENT REGULATION ON THE EMISSION OF TOXIC GASES

5.2.2 PRODUCTION CHALLENGES IN THE LEAST DEVELOPED COUNTRIES

5.2.3 INVOLVEMENT OF PLASTIC HAS A DIRECT IMPACT ON THE COST AS WELL AS THE ENVIRONMENT

5.3 OPPORTUNITIES

5.3.1 WIDE ADOPTION OF HEAT SHRINK TUBES IN VARIOUS INDUSTRIES

5.3.2 EASY PRODUCTION OF THE HEAT-SHRINKABLE TUBING

5.3.3 AUTOMATING A HEAT SHRINK TUBING PROCESS

5.4 CHALLENGES

5.4.1 RISING PRICES OF RAW MATERIALS FOR TUBING

5.4.2 POOR INSTALLATION OF HEAT-SHRINK TUBES

5.4.3 AVAILABILITY OF ALTERNATIVE AND INEXPENSIVE PRODUCTS IN THE MARKET

6 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY TYPE

6.1 OVERVIEW

6.2 SINGLE WALL

6.3 DUAL WALL

7 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SPOOLS

7.3 PRE-CUT LENGTH

7.4 OTHERS

8 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY VOLTAGE

8.1 OVERVIEW

8.2 LOW

8.3 MEDIUM

8.4 HIGH

9 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 POLYOLEFIN

9.3 PERFLUOROALKOXY ALKANES (PFA)

9.4 POLYTETRAFLUOROETHYLENE (PTFE)

9.5 FLUORINATED ETHYLENE PROPYLENE (FEP)

9.6 ETHYLENE TETRAFLUOROETHYLENE (ETFE)

9.7 POLYETHER ETHER KETONE (PEEK)

9.8 OTHERS

10 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO

10.1 OVERVIEW

10.2 12/30/1899 2:01:00 AM

10.3 12/30/1899 3:01:00 AM

10.4 12/30/1899 4:01:00 AM

10.5 12/30/1899 6:01:00 AM

10.6 OTHERS

11 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY END-USER

11.1 OVERVIEW

11.2 UTILITIES

11.3 IT AND TELECOMMUNICATION

11.4 AUTOMOTIVE

11.5 ELECTRONICS

11.5.1 COMMERCIAL/INDUSTRIAL

11.5.2 CONSUMER PRODUCT

11.6 AEROSPACE

11.7 HEALTHCARE

11.8 OIL AND GAS

11.9 MARINE

11.1 FOOD AND BEVERAGES

11.11 CONSTRUCTION

11.11.1 COMMERCIAL

11.11.2 RESIDENTIAL

11.12 CHEMICAL

11.13 OTHERS

12 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA HEAT SHRINK TUBING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 TE CONNECTIVITY

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 SUMITOMO ELECTRIC INDUSTRIES, LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 MOLEX

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 ABB

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 PRYSMIAN GROUP

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 3M

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 ALPHA WIRE

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 CHANGYUAN ELECTRONICS (DONGGUAN) CO., LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 DASHENG GROUP

15.9.1 COMPANY SNAPSHOT

15.9.2 COMPANY PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 DUNBAR PRODUCTS, LLC.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 GREMCO GMBH

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 HELLERMANNTYTON

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 HILLTOP

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 HUIZHOU GUANGHAI ELECTRONIC INSULATION MATERIALS CO., LTD.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 PANDUIT

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 PEXCO

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 QUALTEK ELECTRONICS CORP

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 SHAWCOR

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 SHENZHEN WOER HEAT - SHRINKABLE MATERIAL CO., LTD.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 TECHFLEX, INC.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 THERMOSLEEVE USA

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 ZEUS INDUSTRIAL PRODUCTS, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA SINGLE WALL IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA DUAL WALL IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA SPOOLS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA PRE-CUT LENGTH IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA LOW IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA MEDIUM IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA HIGH IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA POLYOLEFIN IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA PERFLUOROALKOXY ALKANES (PFA) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA POLYTETRAFLUOROETHYLENE (PTFE) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA FLUORINATED ETHYLENE PROPYLENE (FEP) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA ETHYLENE TETRAFLUOROETHYLENE (ETFE) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA POLYETHERETHERKETONE (PEEK) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA 2:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA 3:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA 4:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA 6:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA UTILITIES IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA IT AND TELECOMMUNICATION IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA AUTOMOTIVE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA AEROSPACE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA HEALTHCARE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA OIL AND GAS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA MARINE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA FOOD AND BEVERAGES IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA CHEMICAL IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.S. HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.S. HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 52 U.S. HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 53 U.S. HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 54 U.S. HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 55 U.S. HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 56 U.S. ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 U.S. CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 CANADA HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 CANADA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 60 CANADA HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 61 CANADA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 62 CANADA HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 63 CANADA HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 64 CANADA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 CANADA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 MEXICO HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 MEXICO HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 68 MEXICO HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 69 MEXICO HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 70 MEXICO HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 71 MEXICO HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 72 MEXICO ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 MEXICO CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA HEAT SHRINK TUBING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HEAT SHRINK TUBING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HEAT SHRINK TUBING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HEAT SHRINK TUBING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HEAT SHRINK TUBING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HEAT SHRINK TUBING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA HEAT SHRINK TUBING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA HEAT SHRINK TUBING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA HEAT SHRINK TUBING MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA HEAT SHRINK TUBING MARKET: TYPE TIMELINE CURVE

FIGURE 11 NORTH AMERICA HEAT SHRINK TUBING MARKET: MARKET END-USER COVERAGE GRID

FIGURE 12 NORTH AMERICA HEAT SHRINK TUBING MARKET: SEGMENTATION

FIGURE 13 INCREASE IN THE CAPACITY FOR POWER GENERATION ACROSS THE GLOBE IS EXPECTED TO DRIVE THE NORTH AMERICA HEAT SHRINK TUBING MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 THE SINGLE WALL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HEAT SHRINK TUBING MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA HEAT SHRINK TUBING MARKET

FIGURE 16 GOVERNMENT INITIATIVES TO ENHANCE POWER TRANSMISSION

FIGURE 17 GENERATION OF RENEWABLE ELECTRICITY

FIGURE 18 ELECTRICITY GENERATION IN VARIOUS COUNTRIES

FIGURE 19 NORTH AMERICA SALES VOLUME OF ELECTRIC VEHICLES

FIGURE 20 MANUFACTURING PROCESS FOR HEAT SHRINK TUBING

FIGURE 21 SILVER PRICING (SEPTEMBER 2022 TO MARCH 2023)

FIGURE 22 ALTERNATIVES FOR HEAT SHRINK TUBING

FIGURE 23 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY TYPE, 2022

FIGURE 24 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY PRODUCT TYPE, 2022

FIGURE 25 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY VOLTAGE, 2022

FIGURE 26 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY MATERIAL, 2022

FIGURE 27 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY SHRINK RATIO, 2022

FIGURE 28 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY END-USER, 2022

FIGURE 29 NORTH AMERICA HEAT SHRINK TUBING MARKET: SNAPSHOT (2022)

FIGURE 30 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY COUNTRY (2022)

FIGURE 31 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 32 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 33 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY TYPE (2023-2030)

FIGURE 34 NORTH AMERICA HEAT SHRINK TUBING MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.