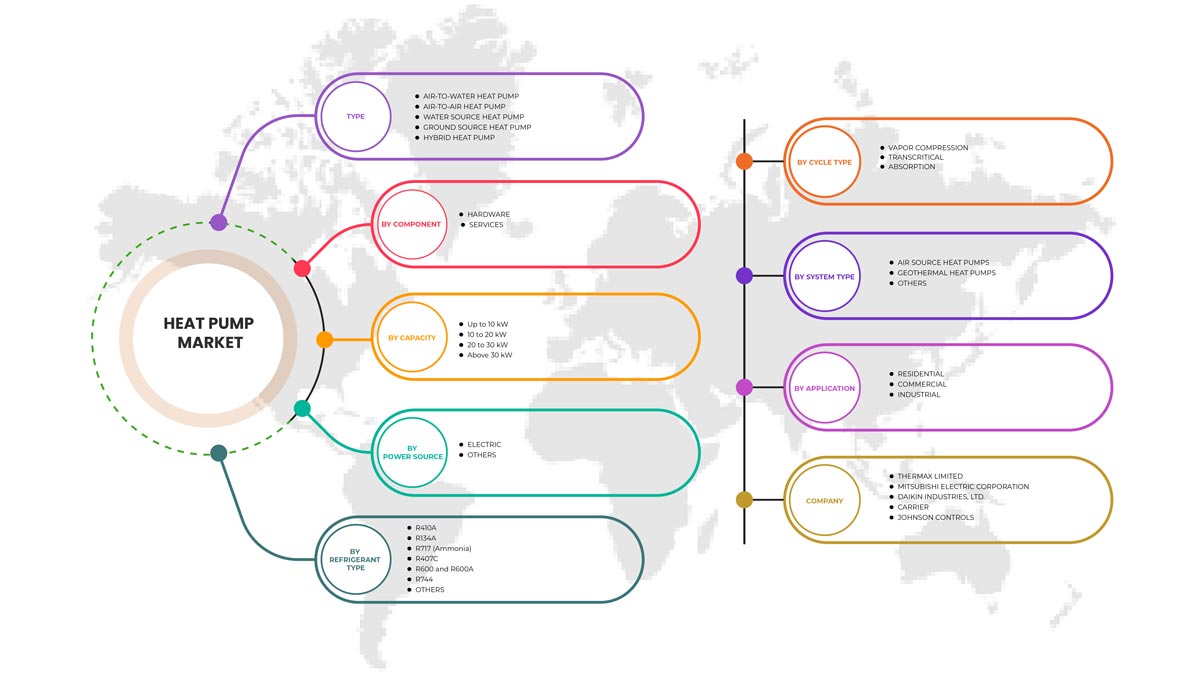

Mercado de bombas de calor de América del Norte, por tipo (bomba de calor aire-agua, bomba de calor aire-aire, bomba de calor de fuente de agua, bomba de calor de fuente terrestre y bomba de calor híbrida ), componente (hardware y servicios), capacidad (hasta 10 kW, 10 a 20 kW, 20 a 30 kW y más de 30 kW), fuente de energía (eléctrica y otras), tipo de refrigerante (R410A, R134A, R717 ( amoníaco ), R407C, R600 y R600A, R744 y otros), tipo de ciclo (compresión de vapor, transcrítico y absorción), tipo de sistema (bombas de calor de fuente de aire, bombas de calor geotérmicas y otras), aplicación (residencial, comercial, industrial), tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de bombas de calor de América del Norte

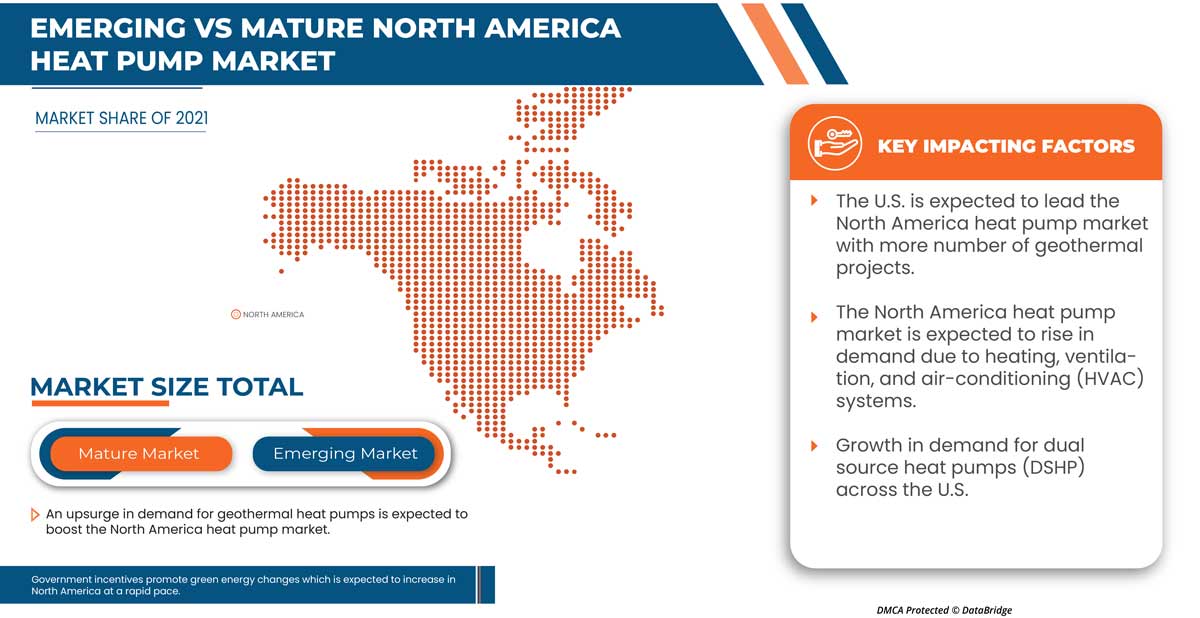

El mercado de bombas de calor de América del Norte ha experimentado un crecimiento debido a la creciente demanda de sistemas de calefacción, ventilación y aire acondicionado (HVAC). Se puede utilizar para numerosas aplicaciones residenciales, comerciales e industriales en diversas industrias, como la fabricación general, la química y el petróleo, la alimentación y las bebidas, los servicios públicos, los textiles y el cuero, los productos de madera, el metal y otros. La reciente pandemia ha disminuido ligeramente el crecimiento en todos los sectores, pero estos sistemas tienen un enorme potencial para mejorar las capacidades industriales, ya que son el futuro. El mercado de bombas de calor de América del Norte se encuentra en una fase de rápido crecimiento debido a la creciente demanda de bombas de calor de doble fuente (DSHP) en los EE. UU.

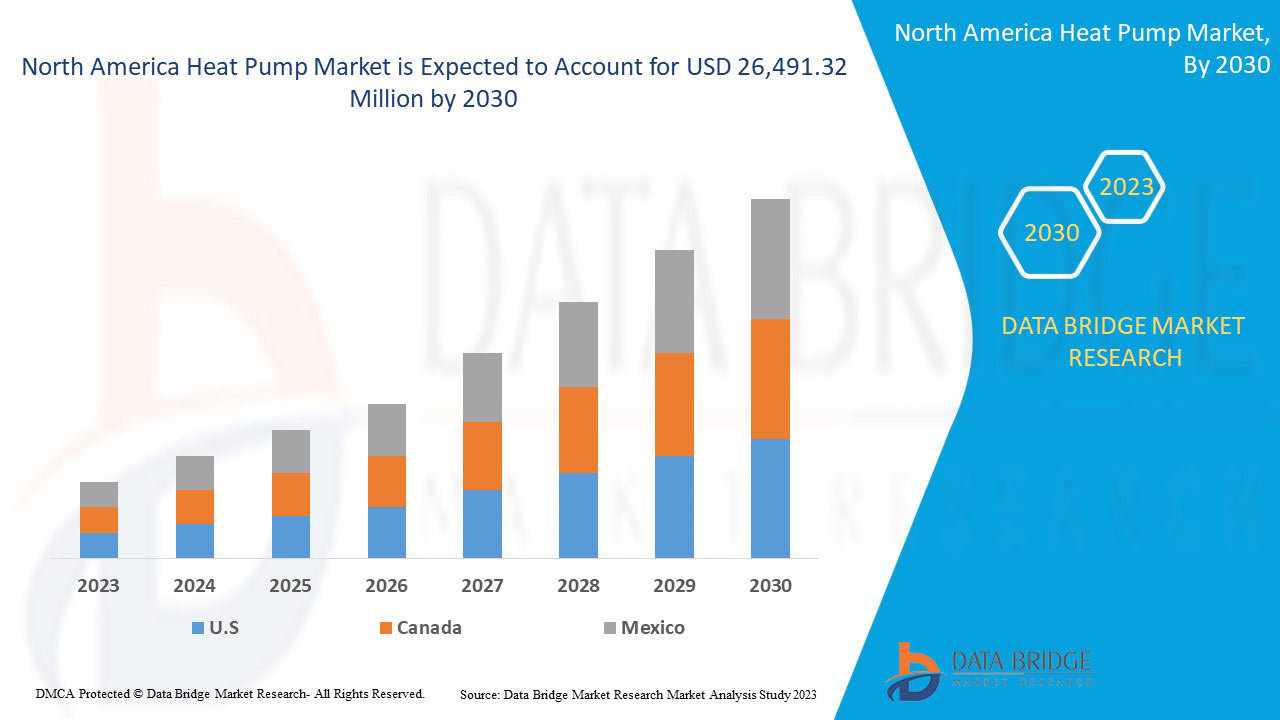

Data Bridge Market Research analiza que se espera que el mercado de bombas de calor alcance un valor de USD 26.491,32 millones para 2030, con una CAGR del 8,9 % durante el período de pronóstico. La "bomba de calor aire-agua" es el segmento de sistema más grande en el mercado de bombas de calor. El informe del mercado de bombas de calor de América del Norte también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020 - 2015) |

|

Unidades cuantitativas |

Precios en USD en millones |

|

Segmentos cubiertos |

Por tipo (bomba de calor aire-agua, bomba de calor aire-aire, bomba de calor de fuente de agua, bomba de calor de fuente terrestre y bomba de calor híbrida ), componente (hardware y servicios), capacidad (hasta 10 kW, 10 a 20 kW, 20 a 30 kW y más de 30 kW), fuente de energía (eléctrica y otras), tipo de refrigerante (R410A, R134A, R717 ( amoníaco ), R407C, R600 y R600A, R744 y otros), tipo de ciclo (compresión de vapor, transcrítico y absorción), tipo de sistema (bombas de calor de fuente de aire, bombas de calor geotérmicas y otras), aplicación (residencial, comercial, industrial). |

|

Países cubiertos |

Estados Unidos, Canadá y México. |

|

Actores del mercado cubiertos |

Danfoss Industries Pvt. Ltd., Trane Technologies plc, NIBE Industrier AB, Midea Group, VIVRECO group, Robert Bosch GmbH, American Standard Heating and Air Conditioning (Marca de Trane Technologies plc), Lennox International Inc., Rheem Manufacturing Company, Goodman (Una marca de Daikin Comfort Technologies North America, Inc.), Thermax Limited., Mitsubishi Electric Corporation, DAIKIN INDUSTRIES, Ltd., Carrier., Johnson Controls, RUUD (Marca de Rheem Manufacturing Company), BRYANT (Marca de Carrier.), entre otros. |

Definición de mercado

Las bombas de calor ofrecen una alternativa energéticamente eficiente a los hornos y los acondicionadores de aire para todos los climas. Al igual que su refrigerador, las bombas de calor utilizan electricidad para transferir calor de un espacio frío a un espacio cálido, lo que hace que el espacio frío sea más fresco y el espacio cálido más cálido. Las bombas de calor trasladan el calor del exterior frío a su casa cálida durante la temporada de calefacción. Las bombas de calor trasladan el calor de su casa al exterior durante la temporada de refrigeración. Debido a que transfieren calor en lugar de generarlo, las bombas de calor pueden proporcionar de manera eficiente temperaturas agradables para su hogar.

Dinámica del mercado de bombas de calor en América del Norte

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Aumento de la demanda de sistemas de calefacción, ventilación y aire acondicionado (HVAC)

Los sistemas de calefacción, ventilación y aire acondicionado (HVAC) desempeñan un papel importante en los sistemas y tecnologías de ventilación avanzados adoptados para mejorar la calidad del aire y equilibrar el exceso de humedad y diversos tipos de contaminación. La adopción de modelos matemáticos, tecnología de simulación por ordenador y otras técnicas implica la integración de componentes mecánicos y una interfaz de usuario digital para facilitar su funcionamiento. Por tanto, este tipo de sistema y tecnología son interdependientes. Por tanto, el desarrollo de sistemas avanzados de HVAC depende del uso adecuado y correcto de los componentes relacionados con las bombas de calor.

- Crece la demanda de bombas de calor de doble fuente (DSHP) en Estados Unidos

Además, las bombas de calor de doble fuente extraen energía de fuentes naturales como el sol y el suelo. Están disponibles en múltiples diseños. Las bombas de calor de aire con energía solar están disponibles principalmente en países desarrollados como Estados Unidos, Canadá y México. Este tipo de bomba de calor de doble fuente es más eficiente durante el clima más frío porque hay menos calor que la bomba de calor debe extraer del aire exterior. Esta característica proporcionará instalaciones de respuesta dinámica que aumentarán su uso.

Restricción/Desafío

- Complejidades en la modernización de bombas de calor

Los sistemas de bombas de calor modernos incluyen el aumento de las complejidades relacionadas con la modernización de las bombas de calor. Las bombas de calor de fuente de aire se encuentran inherentemente en una etapa crítica debido al cambio de tecnología en el proceso de fabricación y la calidad del producto final. Estas bombas de calor están asociadas con equipos cruciales para que se puedan utilizar fuentes energéticamente eficientes para generar calor.

Oportunidad

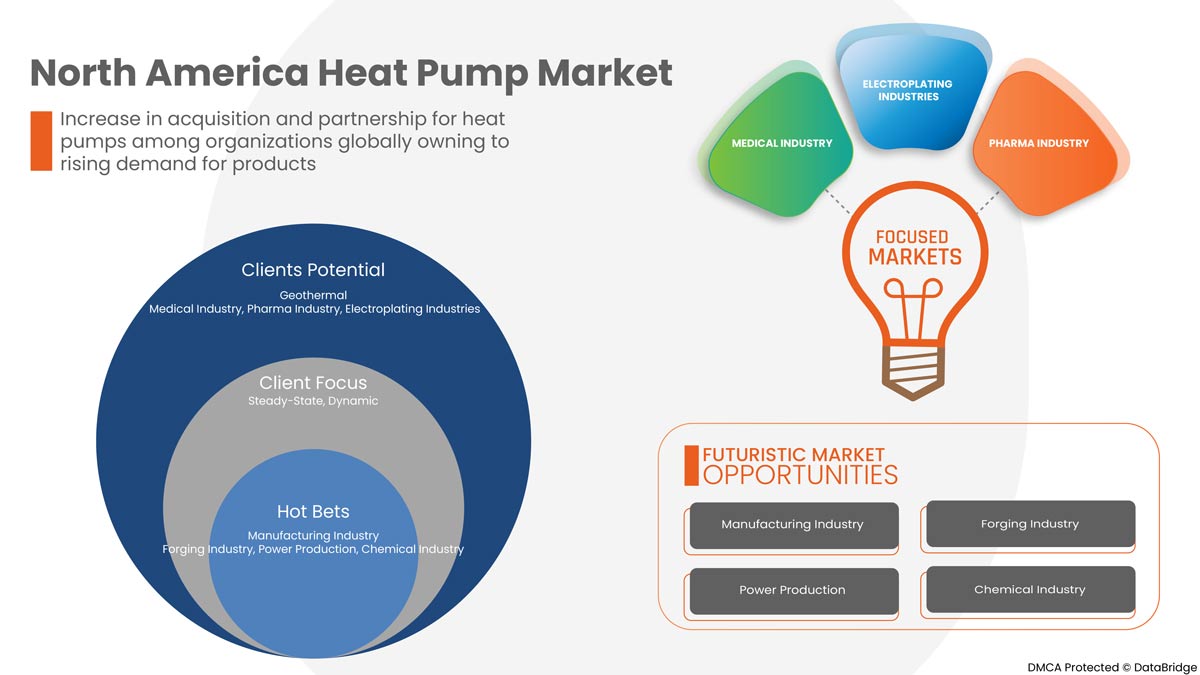

- Cambio en la preferencia del consumidor hacia la solución sostenible para uso residencial y comercial

Además, la cantidad de electricidad que requieren las bombas de calor geotérmicas ecológicas es significativamente menor, lo que afecta la eficiencia de funcionamiento de las bombas de calor. El avance principal en las bombas de calor es el compresor, un aspecto que cambia las reglas del juego. A medida que el mundo se centra en reducir las emisiones de gases de efecto invernadero, las bombas de calor son soluciones fácilmente disponibles para satisfacer la demanda de calefacción sostenible de espacios y agua. Esto ha mejorado la precisión y las características de funcionamiento de las bombas de calor.

Impacto posterior a la COVID-19 en el mercado de bombas de calor de América del Norte

La COVID-19 afectó significativamente al mercado de bombas de calor, ya que casi todos los países optaron por cerrar todas las instalaciones de producción, excepto las que producen bienes esenciales. El gobierno tomó algunas medidas estrictas, como el cierre de la producción y venta de bienes no esenciales, el bloqueo del comercio internacional y muchas más para evitar la propagación de la COVID-19. Las únicas empresas que se enfrentan a esta pandemia son los servicios esenciales a los que se les permite abrir y ejecutar los procesos.

Los fabricantes están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de investigación y desarrollo para mejorar la tecnología en el mercado de bombas de calor. Las empresas aportarán soluciones avanzadas y precisas al mercado. Además, las iniciativas gubernamentales para impulsar el comercio internacional han propiciado el crecimiento del mercado.

Acontecimientos recientes

- En abril de 2021, Thermax Limited firmó un acuerdo con Power Roll para desarrollar el mercado de películas solares en la India. Las empresas acordaron desarrollar instrumentos de energía solar. El objetivo principal de las empresas era contribuir a una solución ecológica. Las empresas podrán ampliar su cartera de productos y atraer una nueva base de clientes.

- En abril de 2022, DAIKIN INDUSTRIES, Ltd anunció la adquisición de DUPLOMATIC MS SPA, que se decidió para comenzar a fabricar equipos relacionados con la hidráulica. La adquisición ayudará a diversificar la cartera de productos y a tener un negocio en una amplia gama de campos. Las empresas dieron el paso para ampliar su cartera de productos y aumentar el margen de beneficio y la plantilla de la empresa.

Alcance del mercado de bombas de calor en América del Norte

El mercado de bombas de calor de América del Norte está segmentado en función del tipo, componente, capacidad, fuente de energía, tipo de refrigerante, tipo de ciclo, tipo de sistema y aplicación. El crecimiento entre estos segmentos le ayudará a analizar segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Por tipo

- Bomba de calor aire-agua

- Bomba de calor aire-aire

- Bomba de calor con fuente de agua

- Bomba de calor geotérmica

- Bomba de calor híbrida

Según el tipo, el mercado de bombas de calor de América del Norte está segmentado en bomba de calor aire-agua, bomba de calor aire-aire, bomba de calor de fuente de agua, bomba de calor de fuente terrestre y bomba de calor híbrida.

Por componente

- Hardware

- Servicios

Sobre la base de los componentes, el mercado de bombas de calor de América del Norte se ha segmentado en hardware y servicios.

Por capacidad

- Hasta 10 kW

- De 10 a 20 kW

- De 20 a 30 kW

- Más de 30 kW

Sobre la base de la capacidad, el mercado de bombas de calor de América del Norte se ha segmentado en hasta 10 kW, de 10 a 20 kW, de 20 a 30 kW y más de 30 kW.

Por fuente de energía

- Eléctrico

- Otros

Sobre la base de la fuente de energía, el mercado de bombas de calor de América del Norte se ha segmentado en eléctrico y otros.

Por tipo de refrigerante

- R410A

- R134A

- R717 (Amoniaco)

- R407C

- R600 y R600A

- R744

- Otros

Sobre la base del tipo de refrigerante, el mercado de bombas de calor de América del Norte se ha segmentado en R410A, R134A, R717 (amoníaco), R407C, R600 y R600A, R744 y otros.

Por tipo de ciclo

- Compresión de vapor

- Transcrítico

- Absorción

Sobre la base del tipo de ciclo, el mercado de bombas de calor de América del Norte se ha segmentado en compresión de vapor, transcrítico y absorción.

Por tipo de sistema

- Bombas de calor de fuente de aire

- Bombas de calor geotérmicas

- Otros

Según el tipo de sistema, el mercado de bombas de calor de América del Norte se ha segmentado en bombas de calor de fuente de aire, bombas de calor geotérmicas y otras.

Por aplicación

- Residencial

- Comercial

- Industrial

Sobre la base de la aplicación, el mercado de bombas de calor de América del Norte se ha segmentado en residencial, comercial e industrial.

Análisis y perspectivas regionales del mercado de bombas de calor de América del Norte

Se analiza el mercado de bombas de calor de América del Norte y se proporcionan información y tendencias del tamaño del mercado por país, tipo, componente, capacidad, fuente de energía, tipo de refrigerante, tipo de ciclo, tipo de sistema y aplicación, como se menciona anteriormente.

Algunos de los países incluidos en el informe sobre el mercado de bombas de calor de América del Norte son Estados Unidos, Canadá y México. Se espera que Estados Unidos domine el mercado de bombas de calor de América del Norte, ya que está a la vanguardia del desarrollo tecnológico y el desarrollo sostenible en la región.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas norteamericanas y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles internos y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de bombas de calor en América del Norte

El panorama competitivo del mercado de bombas de calor de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de bombas de calor de América del Norte.

Algunos de los principales actores que operan en el mercado de bombas de calor de América del Norte son Danfoss Industries Pvt. Ltd., Trane Technologies plc, NIBE Industrier AB, Midea Group, VIVRECO group, Robert Bosch GmbH, American Standard Heating and Air Conditioning (marca de Trane Technologies plc), Lennox International Inc., Rheem Manufacturing Company, Goodman (una marca de Daikin Comfort Technologies North America, Inc.), Thermax Limited., Mitsubishi Electric Corporation, DAIKIN INDUSTRIES, Ltd., Carrier., Johnson Controls, RUUD (marca de Rheem Manufacturing Company), BRYANT (marca de Carrier.), entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA HEAT PUMP MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 AIR-TO-WATER HEAT PUMP WILL REPLACE FURNACE IN NORTH AMERICA

4.1.1 GOVERNMENT POLICIES

4.1.1.1 U.S.

4.1.1.2 CANADA

4.2 EUROPEAN METHOD OF AIR TO WATER (USING A RADIATOR) FOR THE NORTH AMERICA HEAT PUMP MARKET

4.2.1 AIR-SOURCE HEAT PUMPS ADVANCED TECHNOLOGIES

4.3 HEAT PUMP VS FURNACE

4.4 PORTER’S FIVE FORCES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR HEATING, VENTILATION, AND AIR-CONDITIONING (HVAC) SYSTEMS

5.1.2 GROW IN DEMAND FOR DUAL SOURCE HEAT PUMPS (DSHP) ACROSS THE U.S

5.1.3 UPSURGE IN DEMAND FOR GEOTHERMAL HEAT PUMPS

5.2 RESTRAINTS

5.2.1 HIGH INSTALLATION COST OF ENERGY-EFFICIENCY HEAT PUMPS

5.2.2 LACK OF AWARENESS REGARDING THE BENEFITS OF HEAT-PUMPS IN DEVELOPED COUNTRIES

5.3 OPPORTUNITIES

5.3.1 SHIFT IN CONSUMER PREFERENCE TOWARD THE SUSTAINABLE SOLUTION FOR RESIDENTIAL AND COMMERCIAL USE

5.3.2 INCREASING INVESTMENT IN GREEN BUILDING INFRASTRUCTURE AND TECHNICAL ADVANCEMENT

5.4 CHALLENGE

5.4.1 COMPLEXITIES IN HEAT PUMPS RETROFITS

6 NORTH AMERICA HEAT PUMP MARKET, BY TYPE

6.1 OVERVIEW

6.2 AIR-TO-WATER HEAT PUMP

6.3 AIR-TO-AIR HEAT PUMP

6.4 WATER SOURCE HEAT PUMP

6.5 GROUND SOURCE HEAT PUMP

6.6 HYBRID HEAT PUMP

7 NORTH AMERICA HEAT PUMP MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 HARDWARE

7.2.1 COMPRESSOR

7.2.2 HEAT EXCHANGERS

7.2.3 SENSORS

7.2.4 RECEIVER

7.2.5 REVERSING VALVE

7.2.6 OTHERS

7.3 SERVICES

7.3.1 INSTALLATION COST

7.3.1.1 NEW

7.3.1.2 RETROFIT

7.3.2 MAINTENANCE COST

8 NORTH AMERICA HEAT PUMP MARKET, BY CAPACITY

8.1 OVERVIEW

8.2 UP TO 10 KW

8.3 10 TO 20 KW

8.4 20 TO 30 KW

8.5 ABOVE 30 KW

9 NORTH AMERICA HEAT PUMP MARKET, BY POWER SOURCE

9.1 OVERVIEW

9.2 ELECTRIC

9.3 OTHERS

10 NORTH AMERICA HEAT PUMP MARKET, BY REFRIGERANT TYPE

10.1 OVERVIEW

10.2 R410A

10.3 R134A

10.4 R717 (AMMONIA)

10.5 R407C

10.6 R600 AND R600A

10.7 R744

10.8 OTHERS

11 NORTH AMERICA HEAT PUMP MARKET, BY CYCLE TYPE

11.1 OVERVIEW

11.2 VAPOR COMPRESSION

11.3 TRANSCRITICAL

11.4 ABSORPTION

12 NORTH AMERICA HEAT PUMP MARKET, BY SYSTEM TYPE

12.1 OVERVIEW

12.2 AIR SOURCE HEAT PUMPS

12.2.1 DUCTED SPLIT AND PACKAGED TYPE

12.2.2 DUCTLESS MINISPLIT

12.2.3 PORTABLE WINDOW

12.3 GEOTHERMAL HEAT PUMPS

12.3.1 HORIZONTAL

12.3.2 VERTICAL

12.4 OTHERS

13 NORTH AMERICA HEAT PUMP MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 RESIDENTIAL

13.2.1 SINGLE HOME

13.2.2 MULTI HOME

13.3 COMMERCIAL

13.3.1 OFFICES

13.3.2 HOSPITALITY

13.3.3 HEALTHCARE

13.3.4 RETAIL

13.3.5 LOGISTICS & TRANSPORTATION

13.3.6 EDUCATION

13.3.7 OTHERS

13.4 INDUSTRIAL

13.4.1 GENERAL MANUFACTURING

13.4.2 CHEMICAL AND PETROLEUM

13.4.3 FOOD AND BEVERAGES

13.4.4 UTILITIES

13.4.5 TEXTILE AND LEATHER

13.4.6 WOOD PRODUCTS

13.4.7 METAL

13.4.8 OTHERS

14 NORTH AMERICA HEAT PUMP MARKET, BY COUNTRY

14.1 U.S.

14.2 CANADA

14.3 MEXICO

15 COMPANY LANDSCAPE: NORTH AMERICA HEAT PUMP MARKET

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 TRANE TECHNOLOGIES PLC

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCTS PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 JOHNSON CONTROLS

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 CARRIER

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 MIDEA GROUP

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCTS PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 LENNOX INTERNATIONAL INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 AMERICAN STANDARD HEATING AND AIR CONDITIONING

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 BRYANT (BRAND OF CARRIER)

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 DAIKIN INDUSTRIES, LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 DANFOSS INDUSTRIES PVT. LTD.

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCTS PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 GOODMAN (BRAND OF DAIKIN INDUSTRIES, LTD.)

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 MITSUBISHI ELECTRIC CORPORATION

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 NIBE INDUSTRIER AB

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCTS PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 RHEEM MANUFACTURING COMPANY

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 ROBERT BOSCH GMBH

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 RUUD (BRAND OF RHEEM MANUFACTURING COMPANY)

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 THERMAX LIMITED.

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENTS

17.17 VIVRECO GROUP

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 PRICE OF HEAT PUMP BASED ON TYPE, CAPACITY, AND EFFICIENCY RATING

TABLE 2 NORTH AMERICA HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA HEAT PUMP MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA HARDWARE IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA SERVICES IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA INSTALLATION COST IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA HEAT PUMP MARKET, BY CAPACITY, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA HEAT PUMP MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA HEAT PUMP MARKET, BY REFRIGERANT TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA HEAT PUMP MARKET, BY CYCLE TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA HEAT PUMP MARKET, BY SYSTEM TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA AIR SOURCE HEAT PUMPS IN HEAT PUMP MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA GEOTHERMAL HEAT PUMPS IN HEAT PUMP MARKET, BY LOOP, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA HEAT PUMP MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA RESIDENTIAL IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA COMMERCIAL IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA INDUSTRIAL IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA HEAT PUMP MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 19 U.S. HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 U.S. HEAT PUMP MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 21 U.S. HARDWARE IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 U.S. SERVICES IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 U.S. INSTALLATION COST IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 U.S. HEAT PUMP MARKET, BY CAPACITY, 2021-2030 (USD MILLION)

TABLE 25 U.S. HEAT PUMP MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 26 U.S. HEAT PUMP MARKET, BY REFRIGERANT TYPE, 2021-2030 (USD MILLION)

TABLE 27 U.S. HEAT PUMP MARKET, BY CYCLE TYPE, 2021-2030 (USD MILLION)

TABLE 28 U.S. HEAT PUMP MARKET, BY SYSTEM TYPE, 2021-2030 (USD MILLION)

TABLE 29 U.S. AIR SOURCE HEAT PUMPS IN HEAT PUMP MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 30 U.S. GEOTHERMAL HEAT PUMPS IN HEAT PUMP MARKET, BY LOOP, 2021-2030 (USD MILLION)

TABLE 31 U.S. HEAT PUMP MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 32 U.S. RESIDENTIAL IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 U.S. COMMERCIAL IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 U.S. INDUSTRIAL IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 CANADA HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 CANADA HEAT PUMP MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 37 CANADA HARDWARE IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 CANADA SERVICES IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 CANADA INSTALLATION COST IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 CANADA HEAT PUMP MARKET, BY CAPACITY, 2021-2030 (USD MILLION)

TABLE 41 CANADA HEAT PUMP MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 42 CANADA HEAT PUMP MARKET, BY REFRIGERANT TYPE, 2021-2030 (USD MILLION)

TABLE 43 CANADA HEAT PUMP MARKET, BY CYCLE TYPE, 2021-2030 (USD MILLION)

TABLE 44 CANADA HEAT PUMP MARKET, BY SYSTEM TYPE, 2021-2030 (USD MILLION)

TABLE 45 CANADA AIR SOURCE HEAT PUMPS IN HEAT PUMP MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 46 CANADA GEOTHERMAL HEAT PUMPS IN HEAT PUMP MARKET, BY LOOP, 2021-2030 (USD MILLION)

TABLE 47 CANADA HEAT PUMP MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 48 CANADA RESIDENTIAL IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 CANADA COMMERCIAL IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 CANADA INDUSTRIAL IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 MEXICO HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 MEXICO HEAT PUMP MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 53 MEXICO HARDWARE IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 MEXICO SERVICES IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 MEXICO INSTALLATION COST IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 MEXICO HEAT PUMP MARKET, BY CAPACITY, 2021-2030 (USD MILLION)

TABLE 57 MEXICO HEAT PUMP MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 58 MEXICO HEAT PUMP MARKET, BY REFRIGERANT TYPE, 2021-2030 (USD MILLION)

TABLE 59 MEXICO HEAT PUMP MARKET, BY CYCLE TYPE, 2021-2030 (USD MILLION)

TABLE 60 MEXICO HEAT PUMP MARKET, BY SYSTEM TYPE, 2021-2030 (USD MILLION)

TABLE 61 MEXICO AIR SOURCE HEAT PUMPS IN HEAT PUMP MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 62 MEXICO GEOTHERMAL HEAT PUMPS IN HEAT PUMP MARKET, BY LOOP, 2021-2030 (USD MILLION)

TABLE 63 MEXICO HEAT PUMP MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 64 MEXICO RESIDENTIAL IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 MEXICO COMMERCIAL IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 MEXICO INDUSTRIAL IN HEAT PUMP MARKET, BY TYPE, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA HEAT PUMP MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HEAT PUMP MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HEAT PUMP MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HEAT PUMP MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HEAT PUMP MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HEAT PUMP MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA HEAT PUMP MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA HEAT PUMP MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA HEAT PUMP MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA HEAT PUMP MARKET: SEGMENTATION

FIGURE 11 UPSURGE IN DEMAND FOR GEOTHERMAL HEAT PUMPS IS EXPECTED TO DRIVE THE NORTH AMERICA HEAT PUMP MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 AIR-TO-WATER HEAT PUMP COMPONENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HEAT PUMP MARKET IN 2023 & 2030

FIGURE 13 PORTER’S FIVE FORCES

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF THE NORTH AMERICA HEAT PUMP MARKET

FIGURE 15 NORTH AMERICA HEAT PUMP MARKET: BY TYPE, 2022

FIGURE 16 NORTH AMERICA HEAT PUMP MARKET: BY COMPONENT, 2022

FIGURE 17 NORTH AMERICA HEAT PUMP MARKET: BY CAPACITY, 2022

FIGURE 18 NORTH AMERICA HEAT PUMP MARKET: BY POWER SOURCE, 2022

FIGURE 19 NORTH AMERICA HEAT PUMP MARKET: BY REFRIGERANT TYPE,2022

FIGURE 20 NORTH AMERICA HEAT PUMP MARKET: BY CYCLE TYPE, 2022

FIGURE 21 NORTH AMERICA HEAT PUMP MARKET: BY SYSTEM TYPE, 2022

FIGURE 22 NORTH AMERICA HEAT PUMP MARKET: BY APPLICATION, 2022

FIGURE 23 NORTH AMERICA HEAT PUMP MARKET: SNAPSHOT (2022)

FIGURE 24 NORTH AMERICA HEAT PUMP MARKET: BY COUNTRY (2022)

FIGURE 25 NORTH AMERICA HEAT PUMP MARKET: BY COUNTRY (2023 & 2030)

FIGURE 26 NORTH AMERICA HEAT PUMP MARKET: BY COUNTRY (2022 & 2030)

FIGURE 27 NORTH AMERICA HEAT PUMP MARKET: BY TYPE (2023-2030)

FIGURE 28 NORTH AMERICA HEAT PUMP MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.