North America Health And Wellness Food Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

341.53 Million

USD

565.24 Million

2024

2032

USD

341.53 Million

USD

565.24 Million

2024

2032

| 2025 –2032 | |

| USD 341.53 Million | |

| USD 565.24 Million | |

|

|

|

|

Mercado de alimentos para la salud y el bienestar en Norteamérica, por tipo (alimentos funcionales, productos de panadería saludables y fortificados, refrigerios saludables, alimentos BFY, bebidas, chocolates y otros), contenido calórico (sin calorías, bajo en calorías y reducido en calorías), naturaleza (sin OGM y OGM), contenido de grasa (sin grasa, bajo en grasa y reducido en grasa), categoría (convencional y orgánico), categoría libre de (sin gluten, sin lácteos, sin soja, sin frutos secos, sin lactosa, sin saborizantes artificiales, sin colorantes artificiales y otros) y canal de distribución (minoristas en tiendas y minoristas sin tiendas): tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado de alimentos para la salud y el bienestar en América del Norte

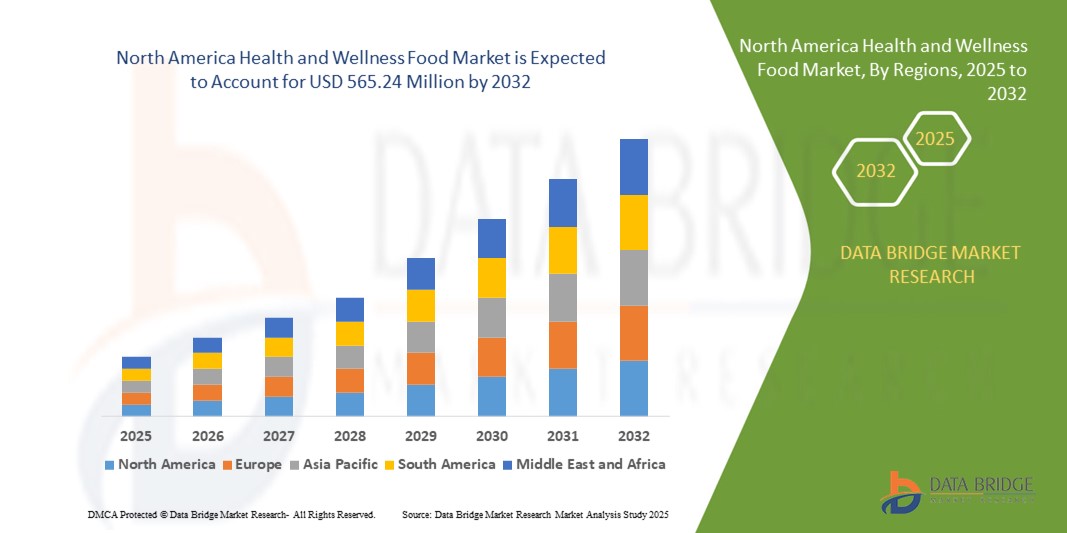

- El tamaño del mercado de alimentos para la salud y el bienestar de América del Norte se valoró en USD 341,53 millones en 2024 y se espera que alcance los USD 565,24 millones para 2032 , con una CAGR del 6,50 % durante el período de pronóstico.

- El crecimiento del mercado está impulsado principalmente por la creciente conciencia de los consumidores sobre los hábitos alimentarios saludables, la creciente demanda de alimentos funcionales y ricos en nutrientes y las crecientes preocupaciones sobre la obesidad y las enfermedades relacionadas con el estilo de vida.

- La creciente adopción de dietas basadas en plantas, productos orgánicos y alimentos sin alérgenos está impulsando aún más la demanda de alimentos saludables y de bienestar en los canales minoristas y de comercio electrónico.

Análisis del mercado de alimentos para la salud y el bienestar en América del Norte

- El mercado de alimentos para la salud y el bienestar en América del Norte está experimentando un sólido crecimiento debido al mayor enfoque de los consumidores en la atención médica preventiva, el fitness y las opciones alimentarias sostenibles.

- La creciente demanda de los millennials y la generación Z de alimentos orgánicos, funcionales y de etiqueta limpia está animando a los fabricantes a innovar con productos ricos en nutrientes y respetuosos con el medio ambiente.

- Estados Unidos domina el mercado de alimentos para la salud y el bienestar de América del Norte con la mayor participación en los ingresos del 65,2 % en 2024, impulsado por una industria alimentaria bien establecida, un alto gasto de los consumidores en productos centrados en la salud y una amplia disponibilidad de alimentos orgánicos y funcionales.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de alimentos de salud y bienestar de América del Norte durante el período de pronóstico, impulsado por una creciente conciencia de la salud, la creciente adopción de dietas orgánicas y basadas en plantas y las iniciativas gubernamentales de apoyo que promueven una alimentación saludable.

- El segmento de alimentos funcionales dominó la mayor participación en los ingresos del mercado con un 22,44 % en 2024, impulsado por la creciente demanda de los consumidores de productos que ofrecen beneficios para la salud más allá de la nutrición básica, como probióticos, vitaminas y alimentos enriquecidos con fibra.

Alcance del informe y segmentación del mercado de alimentos para la salud y el bienestar en América del Norte

|

Atributos |

Perspectivas clave del mercado de alimentos para la salud y el bienestar en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de alimentos para la salud y el bienestar en América del Norte

Aumento de la integración de la IA y el análisis de big data

- El mercado de alimentos para la salud y el bienestar de América del Norte está experimentando una tendencia notable hacia la integración de la inteligencia artificial (IA) y el análisis de big data.

- Estas tecnologías permiten el procesamiento y análisis avanzado de datos, ofreciendo conocimientos más profundos sobre las preferencias de los consumidores, el comportamiento de compra y las necesidades nutricionales.

- Se están utilizando soluciones impulsadas por IA para personalizar las ofertas de productos, como recomendar alimentos saludables personalizados según los requisitos dietéticos individuales o predecir la demanda de productos de bienestar específicos.

- Por ejemplo, las empresas están aprovechando plataformas impulsadas por IA para analizar las tendencias de los consumidores y optimizar el desarrollo de productos, como la formulación de nuevos alimentos funcionales o refrigerios bajos en calorías basados en datos de mercado en tiempo real.

- Esta tendencia mejora la propuesta de valor de los alimentos saludables y de bienestar, haciéndolos más atractivos para los consumidores y minoristas preocupados por la salud.

- Los algoritmos de IA pueden analizar grandes conjuntos de datos, incluidos comentarios de los consumidores, patrones dietéticos y resultados de salud, para mejorar la innovación de productos y las estrategias de marketing.

Dinámica del mercado de alimentos para la salud y el bienestar en América del Norte

Conductor

Creciente demanda de productos alimenticios funcionales y saludables

- La creciente demanda de los consumidores de productos alimenticios centrados en la salud, como alimentos funcionales, opciones orgánicas y bebidas enriquecidas con nutrientes, es un impulsor principal del mercado de alimentos de salud y bienestar de América del Norte.

- Los alimentos saludables y de bienestar mejoran el bienestar del consumidor al ofrecer beneficios como una mejor salud intestinal, apoyo inmunológico y control de peso a través de características como probióticos, contenido bajo en calorías e ingredientes no transgénicos.

- Las iniciativas y regulaciones gubernamentales, particularmente en los EE. UU., que promueven el etiquetado transparente de los alimentos y los estándares nutricionales, están contribuyendo a la adopción generalizada de alimentos saludables y de bienestar.

- La proliferación del comercio electrónico y los avances en la tecnología de la cadena de suministro están permitiendo aún más la expansión del mercado, proporcionando canales de distribución más rápidos y accesibles para productos centrados en la salud.

- Los fabricantes de alimentos ofrecen cada vez más productos de salud y bienestar como opciones estándar o premium para satisfacer las expectativas de los consumidores y mejorar la competitividad del mercado, con Estados Unidos dominando debido a la alta conciencia del consumidor y el ingreso disponible.

Restricción/Desafío

Altos costos de producción y preocupaciones por el cumplimiento normativo

- Los costos sustanciales asociados con la obtención de ingredientes de alta calidad, como materiales orgánicos o no modificados genéticamente, y el desarrollo de productos enfocados en la salud pueden ser una barrera importante para la entrada al mercado, en particular para las empresas más pequeñas en América del Norte.

- La formulación y fabricación de productos especializados, como alimentos sin gluten o bajos en grasas, a menudo implica procesos complejos y costosos.

- Además, el cumplimiento normativo y las preocupaciones sobre la seguridad alimentaria plantean importantes desafíos. Los alimentos saludables y de bienestar están sujetos a estrictas regulaciones en cuanto a etiquetado, declaraciones de propiedades saludables y transparencia de los ingredientes, lo que genera inquietud sobre el cumplimiento de diversas normas en Estados Unidos y Canadá.

- El panorama regulatorio fragmentado en las regiones de América del Norte con respecto a la seguridad alimentaria, el etiquetado de alérgenos y las declaraciones nutricionales complica las operaciones de los fabricantes y minoristas.

- Estos factores pueden frenar la expansión del mercado, en particular en Canadá, el mercado de más rápido crecimiento, donde la sensibilidad a los costos y la conciencia regulatoria están aumentando.

Alcance del mercado de alimentos para la salud y el bienestar en América del Norte

El mercado está segmentado según tipo, contenido calórico, naturaleza, contenido de grasa, categoría, categoría libre y canal de distribución.

- Por tipo

Según el tipo, el mercado norteamericano de alimentos para la salud y el bienestar se segmenta en alimentos funcionales, productos de panadería fortificados y saludables, refrigerios saludables, alimentos saludables (BFY), bebidas, chocolates y otros. El segmento de alimentos funcionales dominó la mayor participación en los ingresos del mercado, con un 22,44 % en 2024, impulsado por la creciente demanda de productos que ofrecen beneficios para la salud más allá de la nutrición básica, como probióticos, vitaminas y alimentos enriquecidos con fibra. Estos productos están dirigidos a consumidores preocupados por su salud que buscan apoyo inmunitario, digestivo y cognitivo.

Se prevé que el segmento de productos de panadería fortificados y saludables experimente el mayor crecimiento entre 2025 y 2032. Este crecimiento se ve impulsado por la creciente preferencia de los consumidores por productos horneados enriquecidos con nutrientes, como aquellos fortificados con fibra, vitaminas y minerales, como alternativas más saludables a los productos de panadería tradicionales. Las innovaciones en formulaciones de etiqueta limpia e ingredientes naturales impulsan aún más su adopción.

- Por contenido calórico

Según el contenido calórico, el mercado norteamericano de alimentos para la salud y el bienestar se segmenta en sin calorías, bajos en calorías y reducidos en calorías. El segmento bajo en calorías dominó el mercado con una participación del 46,68 % en 2024, impulsado por el creciente número de consumidores preocupados por su salud que buscan soluciones para el control de peso sin sacrificar el sabor. Los productos bajos en calorías, como snacks y bebidas, son cada vez más populares entre los millennials y la generación Z.

Se prevé que el segmento sin calorías experimente un crecimiento significativo entre 2025 y 2032, ya que los consumidores optan cada vez más por opciones sin calorías, como aguas con gas y bebidas sin azúcar, para apoyar el control de peso y el bienestar general.

- Por naturaleza

Basándose en la naturaleza, el mercado norteamericano de alimentos para la salud y el bienestar se segmenta en productos sin OMG y con OMG. El segmento sin OMG tuvo la mayor participación de mercado, con un 81,34 % en 2024, impulsado por la creciente concienciación de los consumidores sobre los organismos genéticamente modificados y su preferencia por alimentos naturales y mínimamente procesados. Los productos sin OMG se perciben como más seguros y saludables, lo que impulsa su demanda.

Se espera que el segmento de OGM crezca de manera constante entre 2025 y 2032, ya que permite a los fabricantes maximizar el rendimiento y reducir los costos, atrayendo a los consumidores sensibles a los precios y manteniendo los beneficios nutricionales.

- Por contenido de grasa

Según el contenido de grasa, el mercado norteamericano de alimentos para la salud y el bienestar se segmenta en sin grasa, bajo en grasa y reducido en grasa. El segmento sin grasa dominó con una participación de mercado del 37,94 % en 2024, impulsado por la creciente preferencia de los consumidores por los productos sin grasa para prevenir enfermedades crónicas como la obesidad y los problemas cardiovasculares.

Se anticipa que el segmento bajo en grasas experimentará un sólido crecimiento entre 2025 y 2032, a medida que los consumidores buscan opciones dietéticas equilibradas que mantengan el sabor y reduzcan la ingesta de grasas, respaldadas por innovaciones en snacks bajos en grasas y productos lácteos.

- Por categoría

Según la categoría, el mercado norteamericano de alimentos para la salud y el bienestar se segmenta en convencional y orgánico. El segmento convencional tuvo la mayor participación de mercado, con un 69,00%, en 2024, gracias a su asequibilidad, larga vida útil y amplia disponibilidad en supermercados y tiendas de conveniencia.

Se prevé que el segmento orgánico crezca a su ritmo más rápido entre 2025 y 2032, impulsado por la creciente concienciación de los consumidores sobre los beneficios para la salud y el medio ambiente de los alimentos orgánicos, libres de pesticidas sintéticos y OGM. Este segmento es especialmente popular en Canadá, donde las tendencias de concienciación sobre la salud se están acelerando.

- Por categoría libre de

Según la categoría de alimentos sin gluten, el mercado norteamericano de alimentos para la salud y el bienestar se segmenta en: sin gluten, sin lácteos, sin soya, sin frutos secos, sin lactosa, sin saborizantes artificiales, sin colorantes artificiales, entre otros. El segmento sin gluten mantuvo una cuota de mercado significativa en 2024, impulsado por el aumento de los diagnósticos de celiaquía y la preferencia de los consumidores por productos sin gluten, como las galletas Oreo y los snacks.

Se espera que el segmento sin lácteos experimente el crecimiento más rápido entre 2025 y 2032, impulsado por la creciente intolerancia a la lactosa, el veganismo y la demanda de alternativas de origen vegetal como la leche de avena y los yogures sin lácteos, particularmente en los EE. UU. y Canadá.

- Por canal de distribución

Según el canal de distribución, el mercado norteamericano de alimentos para la salud y el bienestar se segmenta en minoristas con presencia física y minoristas sin presencia física. Los minoristas con presencia física obtuvieron la mayor cuota de mercado en 2024, impulsados por la expansión de supermercados e hipermercados que ofrecen una amplia gama de productos de salud y bienestar, especialmente en EE. UU.

Se prevé que el segmento de minoristas sin tiendas físicas, incluidas las plataformas de comercio electrónico, crezca al ritmo más rápido entre 2025 y 2032. La comodidad de las compras en línea, junto con la creciente confianza de los consumidores en las plataformas digitales para comprar alimentos orgánicos y especiales, está impulsando este crecimiento, especialmente en Canadá.

Análisis regional del mercado de alimentos para la salud y el bienestar en América del Norte

- Estados Unidos domina el mercado de alimentos para la salud y el bienestar de América del Norte con la mayor participación en los ingresos del 65,2 % en 2024, impulsado por una industria alimentaria bien establecida, un alto gasto de los consumidores en productos centrados en la salud y una amplia disponibilidad de alimentos orgánicos y funcionales.

- La creciente conciencia de los beneficios dietéticos, como las opciones sin gluten y bajas en calorías, impulsa la expansión del mercado.

- La tendencia hacia la nutrición personalizada y el aumento de las regulaciones que promueven el etiquetado transparente impulsan aún más el crecimiento del mercado. Los gigantes del comercio minorista y las plataformas de comercio electrónico complementan las ventas tradicionales, creando un ecosistema de productos diverso.

Perspectivas del mercado canadiense de alimentos para la salud y el bienestar

Se espera que Canadá experimente el mayor crecimiento en el mercado norteamericano de alimentos para la salud y el bienestar, impulsado por el creciente interés de los consumidores por dietas saludables y opciones alimentarias sostenibles en entornos urbanos y suburbanos. La creciente demanda de productos orgánicos, sin OMG y sin gluten, como las opciones sin lácteos, fomenta su adopción. La evolución de las normativas de seguridad alimentaria y etiquetado influye en las decisiones de los consumidores, equilibrando los beneficios nutricionales con el cumplimiento normativo.

Cuota de mercado de alimentos para la salud y el bienestar en América del Norte

La industria alimentaria para la salud y el bienestar está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- PepsiCo (EE. UU.)

- Nestlé (Suiza)

- Danone SA (Francia)

- General Mills Inc. (EE. UU.)

- WK Kellogg Co (EE. UU.)

- Abbott (EE. UU.)

- Maspex (Polonia)

- Hu Kitchen (EE. UU.)

- Chobani, LLC (EE. UU.)

- Yakult Honsha Co., Ltd. (Japón)

- Huel Inc. (Reino Unido)

- Stonyfield Farm, Inc. (EE. UU.)

- Kite Hill (EE. UU.)

- So Delicious Dairy Free (EE. UU.)

- Kashi LLC (EE. UU.)

- Proyecto Forager (EE. UU.)

- Chocolates Lake Champlain (EE. UU.)

- Alter Eco (EE. UU.)

- LAVVA (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado de alimentos para la salud y el bienestar de América del Norte?

- En julio de 2025, Tropicale Foods retiró del mercado 14 helados de sus marcas Helados México y La Michoacana debido a alérgenos lácteos no declarados. Si bien la lista de ingredientes incluía "crema", el alérgeno común "leche" no se declaró correctamente, lo que representaba un grave riesgo para las personas con alergia a la leche. El retiro se realizó tras una auditoría interna de etiquetado y se originó por al menos una enfermedad reportada por un consumidor. Este incidente pone de relieve la importancia crucial de un etiquetado preciso y un riguroso control de calidad en la industria alimentaria, especialmente para productos comercializados a consumidores preocupados por su salud y sensibles a las alergias.

- En junio de 2025, Cal-Maine Foods, el mayor productor estadounidense de huevos con cáscara, adquirió Echo Lake Foods, un proveedor con sede en Wisconsin de productos de huevo precocidos congelados y desayunos. Tras considerar un beneficio fiscal de 28 millones de dólares, el precio de compra efectivo fue de 230 millones de dólares. Esta adquisición estratégica permite a Cal-Maine expandirse al segmento de desayunos de valor añadido, ofreciendo productos listos para comer como waffles, omelets y hamburguesas de huevo. Refleja el objetivo general de la compañía de diversificar su cartera, fortalecer las relaciones con los clientes y satisfacer la creciente demanda de opciones de desayuno prácticas y nutritivas en Norteamérica.

- En abril de 2025, la Asociación Americana del Corazón, en colaboración con Deloitte y Research!America, publicó un informe exhaustivo titulado "La salud en EE. UU. y el futuro de los alimentos". Esta iniciativa busca abordar la urgente necesidad de sistemas alimentarios y de salud sostenibles que proporcionen alimentos nutritivos, asequibles y accesibles a todas las comunidades. El informe destaca la creciente colaboración entre las organizaciones sanitarias y los líderes del sector para abordar las enfermedades crónicas, mejorar la seguridad nutricional y promover la salud pública. Exige soluciones integradas que vinculen los sistemas alimentarios con la atención médica para garantizar el bienestar y la equidad a largo plazo en todo Estados Unidos.

- En marzo de 2025, Nestlé USA emitió un retiro voluntario de comidas congeladas seleccionadas de Lean Cuisine® y Stouffer's® debido a la posible presencia de materiales similares a la madera en los productos. Los artículos afectados, producidos entre agosto de 2024 y marzo de 2025, incluyen lotes específicos de ravioles, salteado de camarones y lasaña de pollo. El retiro se produjo tras quejas de consumidores, incluyendo un incidente de atragantamiento. Nestlé enfatizó que se trataba de un caso aislado y está trabajando con la FDA y el USDA para investigar y garantizar la seguridad del producto. Este evento pone de relieve la necesidad constante de un riguroso control de calidad para mantener la confianza del consumidor y el cumplimiento normativo.

- En febrero de 2025, Flowers Foods & Subsidiaries, uno de los mayores productores de productos horneados envasados de EE. UU., completó la adquisición por 795 millones de dólares de Simple Mills, una marca líder de alimentos naturales conocida por sus galletas, bizcochos y mezclas para hornear de etiqueta limpia. Esta estrategia expande la cartera de Flowers al segmento de snacks saludables, en línea con la creciente demanda de productos naturales y saludables. Simple Mills continuará operando de forma independiente bajo la dirección de su fundadora y directora ejecutiva, Katlin Smith, y se beneficiará de la escala y la distribución de Flowers. La adquisición subraya una tendencia más amplia en el sector: las empresas de alimentos tradicionales invierten en marcas orientadas al bienestar.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.