North America Greenhouse And Controlled Environment Grow Lights For Agricultural Crops Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

2.24 Billion

USD

5.75 Billion

2024

2032

USD

2.24 Billion

USD

5.75 Billion

2024

2032

| 2025 –2032 | |

| USD 2.24 Billion | |

| USD 5.75 Billion | |

|

|

|

Segmentación del mercado de luces de cultivo en invernaderos y entornos controlados de América del Norte para cultivos agrícolas, por tipo (luces de cultivo LED, luces de cultivo fluorescentes, luces de cultivo de descarga de alta intensidad (HID) y luces de cultivo incandescentes), aplicación (verduras, frutas, flores, hierbas, árboles y otros), tipo de sistema (invernaderos y granjas verticales), tipo de instalación (instalación fija e instalación portátil), espectro (ancho y estrecho), espectro de luz (espectro dual, espectro de luz roja (600-700 NM), espectro de luz azul (400-500 NM), espectro de luz roja lejana (700-850 NM), espectro de luz verde (500-600 NM) y espectro de luz ultravioleta (100-400 NM)), canal de distribución (en línea, comercio electrónico, sitio web de la empresa, venta minorista, mayorista, fuera de línea y otros), usuario final (cultivadores de invernaderos, cultivadores de almacenes, cultivadores residenciales, ganado) Aplicaciones, instituciones de investigación y académicas, y otras) - Tendencias de la industria y pronóstico hasta 2032.

Análisis del mercado de iluminación para cultivos agrícolas en invernaderos y entornos controlados de América del Norte

El mercado norteamericano de luces de cultivo en invernadero y ambiente controlado para cultivos agrícolas ha evolucionado significativamente en las últimas décadas. Inicialmente, se utilizaban ampliamente los métodos de iluminación tradicionales, como las bombillas incandescentes y fluorescentes, pero resultaron menos eficientes para el crecimiento de las plantas. La introducción de la iluminación de descarga de alta intensidad (HID) en la década de 1990 marcó un punto de inflexión, ofreciendo una mejor eficiencia energética y salida de luz. A principios de la década de 2000, comenzó a surgir la tecnología LED, revolucionando el mercado con sus ahorros de energía y espectros de luz personalizables. A medida que la agricultura urbana y las prácticas sostenibles ganaron popularidad, la demanda de luces de cultivo avanzadas aumentó. Las iniciativas gubernamentales y la financiación para la investigación en agricultura impulsaron aún más el crecimiento del mercado.

Tamaño del mercado de iluminación para cultivos agrícolas en invernaderos y entornos controlados de América del Norte

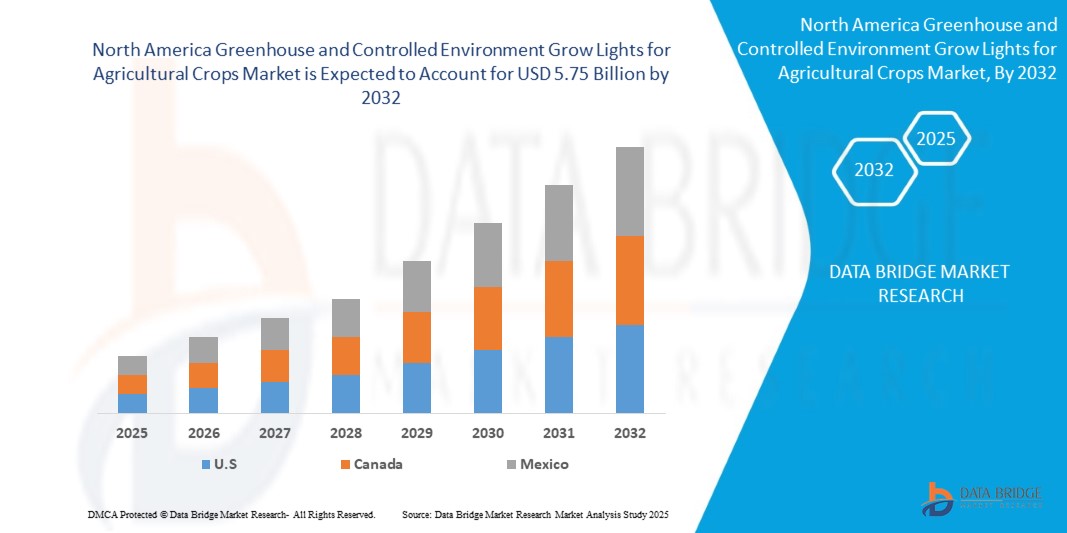

El tamaño del mercado de luces de cultivo en invernaderos y entornos controlados de América del Norte para cultivos agrícolas se valoró en USD 2.24 mil millones en 2024 y se proyecta que alcance los USD 5.75 mil millones para 2032, con una CAGR del 12,51% durante el período de pronóstico de 2025 a 2032.

Alcance del informe y segmentación del mercado

|

Atributos |

Luces de cultivo en invernaderos y entornos controlados para cultivos agrícolas: información clave del mercado |

|

Segmentación |

|

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores clave del mercado |

Signify Holding (Países Bajos), Heliospectra (Suecia), AMS-OSRAM AG (Austria), Cree LED (EE. UU.), Hydrofarm (EE. UU.), SunPlus LED (China), SAVANT TECHNOLOGIES LLC (EE. UU.), Hyperion Grow Lights (filial de Midstream Ltd.) (Reino Unido), MechaTronix Horticulture Lighting (Países Bajos), GrowPackage.com (Canadá), California Lightworks (EE. UU.), Valoya (Finlandia) y Grower's Choice (EE. UU.), entre otros. |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representada geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis de déficit de la cadena de suministro y la demanda. |

Tendencias del mercado de iluminación para cultivos agrícolas en invernaderos y entornos controlados

Demanda creciente de soluciones de iluminación energéticamente eficientes

La creciente demanda de soluciones de iluminación sostenibles y de bajo consumo energético es una tendencia clave que impulsa el mercado de las luces de cultivo en invernaderos y entornos controlados para cultivos agrícolas. Las luces de cultivo avanzadas desempeñan un papel fundamental a la hora de permitir un crecimiento óptimo de las plantas en entornos donde la luz solar natural es limitada o inconsistente. Esta tendencia es especialmente frecuente en sectores como la agricultura de interior, la horticultura y la agricultura urbana, donde los entornos controlados son esenciales para garantizar la producción de cultivos durante todo el año.

Definición del mercado de luces de cultivo en invernaderos y entornos controlados para cultivos agrícolas

El mercado de iluminación para cultivo en invernaderos y entornos controlados de América del Norte se refiere al sector centrado en soluciones de iluminación diseñadas para cultivos agrícolas cultivados en entornos controlados, como invernaderos y granjas de interior. Estas luces simulan la luz solar natural, mejorando el crecimiento de las plantas, la fotosíntesis y los rendimientos. Esto incluye tecnologías como luces LED, fluorescentes y de descarga de alta intensidad. Este mercado está impulsado por la creciente demanda de prácticas agrícolas sostenibles, agricultura urbana y producción de cultivos durante todo el año. También abarca varias aplicaciones, desde la agricultura comercial hasta la investigación y el desarrollo en horticultura.

Dinámica del mercado de iluminación para cultivos agrícolas en invernaderos y entornos controlados

Conductores

- Desarrollo rápido de la tecnología de iluminación LED

El rápido desarrollo de la tecnología de iluminación LED es un factor clave para los invernaderos y los entornos controlados de América del Norte, así como para las luces de crecimiento para el mercado de cultivos agrícolas. La tecnología LED ha avanzado significativamente en los últimos años, ofreciendo una mayor eficiencia energética, una vida útil más prolongada y una mejor calidad de la luz en comparación con las opciones de iluminación tradicionales. Los LED modernos se pueden ajustar con precisión para emitir espectros de luz específicos que optimizan el crecimiento de las plantas, mejoran la fotosíntesis y aumentan los rendimientos. Esta personalización permite un control más preciso de las condiciones de crecimiento, lo que es crucial para maximizar la productividad en entornos controlados.

Por ejemplo,

En junio de 2024, según Grower 2 Grower, la iluminación LED superior Philips GreenPower Force 2.0, lanzada por Signify, ejemplifica el rápido desarrollo de la tecnología LED con una salida de luz de hasta 5150 µmol/s y una eficacia de 3,9 µmol/J. Cuenta con un control dinámico del color multicanal y una lente Quadro Beam avanzada para una uniformidad de luz superior, mejorando el rendimiento de los cultivos y la eficiencia energética. La opción de control inalámbrico o cableado subraya aún más su innovación en la optimización de los sistemas de iluminación de invernaderos.

- La creciente preferencia de los consumidores por los productos frescos

El mercado norteamericano de invernaderos y ambientes controlados para el cultivo de cultivos agrícolas es un factor importante que está aumentando la preferencia de los consumidores por los productos frescos. A medida que los consumidores se vuelven más conscientes de la salud y exigen productos frescos, de origen local y de mayor calidad durante todo el año, los productores se ven obligados a adaptar sus operaciones para satisfacer estas preferencias. Los invernaderos y los ambientes controlados brindan la capacidad de producir verduras, frutas y hierbas frescas independientemente de las limitaciones estacionales o geográficas. Esta creciente demanda de productos frescos de alta calidad ha llevado a un aumento de las inversiones en tecnologías de cultivo avanzadas, incluidos sistemas de iluminación especializados para respaldar la producción continua y óptima de cultivos.

Por ejemplo,

- En 2022, según Signify Holding, la iluminación LED lineal Philips GreenPower muestra rápidos avances en tecnología LED con una eficacia de hasta 3,5 μmol/J y una uniformidad de luz precisa. Esta tecnología garantiza una distribución óptima de la luz vertical y horizontal, lo que mejora el crecimiento y el rendimiento de los cultivos en los invernaderos. La flexibilidad para atenuar y ajustar los niveles de luz resalta aún más el progreso de la iluminación LED para la agricultura. Se ha desarrollado un módulo especial para América del Norte (EE. UU. y Canadá) para cumplir con el estándar UL/CSA.

Oportunidades

- Demanda creciente de alimentos orgánicos

Las ventas de alimentos orgánicos están experimentando un fuerte crecimiento debido a la creciente conciencia de los consumidores sobre la salud, la sostenibilidad ambiental y los efectos nocivos de los productos químicos sintéticos utilizados en la agricultura convencional. Como resultado, la agricultura orgánica se está convirtiendo en una opción más atractiva y sostenible para muchos productores agrícolas, lo que repercute directamente en la demanda de soluciones avanzadas de iluminación para el cultivo. Los alimentos orgánicos vendidos a los consumidores representaron el 56% de la participación a través de supermercados tradicionales, tiendas de clubes y grandes superficies .

Por ejemplo,

- En julio de 2024, según lo informado por el Departamento de Agricultura de EE. UU., el Censo de Agricultura de 2022 reveló que California lideraba la nación en productos agrícolas orgánicos vendidos desde granjas. Las ventas orgánicas se concentraron en gran medida a lo largo de la Costa Oeste, y California generó más de USD 3.7 mil millones en ventas orgánicas, lo que representa casi el 40% de las ventas orgánicas totales del país. Esto fortaleció el dominio de California en el sector orgánico .

Restricción/Desafío

- Requisito de costo inicial inicial

El requisito de un alto costo inicial inicial es una limitación importante para el mercado norteamericano de iluminación de cultivo en invernaderos y ambientes controlados para cultivos agrícolas. Los sistemas avanzados de iluminación de cultivo, en particular los LED de alta calidad y las configuraciones sofisticadas, a menudo requieren una inversión de capital sustancial. Este costo inicial incluye no solo el precio de las luces en sí, sino también la instalación, la integración con los sistemas existentes y las modificaciones de infraestructura potencialmente necesarias. Para los productores pequeños o nuevos, estos costos pueden ser prohibitivos, lo que limita su capacidad para adoptar dichas tecnologías y obstaculiza la expansión del mercado .

Además, la carga financiera que supone invertir en sistemas de iluminación avanzados puede disuadir a los compradores potenciales de pasarse a los métodos de cultivo tradicionales. Los productores pueden dudar en comprometerse a asumir un elevado gasto inicial sin un retorno claro e inmediato de la inversión. Si bien las luces LED para cultivo ofrecen ahorros a largo plazo gracias a un menor consumo de energía y menores costos de mantenimiento, los beneficios financieros a largo plazo no siempre se alinean con las limitaciones presupuestarias a corto plazo que enfrentan muchas empresas agrícolas, en particular en tiempos de incertidumbre económica.

Por ejemplo,

El costo inicial de los productos de invernadero para agricultura en ambiente controlado (CEA) es alto: los componentes clave, como la carpa para eventos ClearSpan, cuestan USD 7085 y el banco rodante para invernadero, USD 1315. El equipo esencial adicional aumenta aún más la carga financiera, lo que resalta la importante inversión necesaria para instalar un sistema CEA. Este alto costo inicial puede disuadir a los posibles adoptantes e impactar la expansión del mercado a pesar de los beneficios a largo plazo.

Este informe de mercado proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Alcance del mercado de luces de cultivo en invernaderos y entornos controlados para cultivos agrícolas

El mercado de iluminación para cultivos agrícolas en invernaderos y ambientes controlados de América del Norte está segmentado en ocho segmentos notables, que se basan en el tipo, la aplicación, el tipo de sistema, el tipo de instalación, el espectro, el espectro de luz, el canal de distribución y el usuario final. El crecimiento entre estos segmentos lo ayudará a analizar los segmentos de crecimiento escaso en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Luces LED para cultivo

- Luces fluorescentes de cultivo

- Lámpara fluorescente T5

- Lámparas fluorescentes compactas (LFC)

- Otros

- Luces de cultivo de descarga de alta intensidad (HID)

- Lámpara de sodio de alta presión (HPS)

- Lámpara de halogenuros metálicos (MH)

- Lámparas de halogenuros metálicos cerámicos

- Bombillas de conversión y balastos conmutables

- Lámparas combinadas MH y HPS

- Luces de cultivo incandescentes

Solicitud

- Verduras

- Frutas

- Flores

- Hierbas

- Árboles

Tipo de sistema

- Casas verdes

- Invernadero de alta tecnología

- Casa verde tradicional

- Granja vertical

- Hidrofónico

- Acuafónico

- Aeropónico

- Sistema de cultivo basado en suelo

Tipo de instalación

- Instalación fija

- Instalación portátil

Espectro

- Amplio

- Angosto

Espectro de luz

- Espectro de luz roja de espectro dual (600–700 Nm)

- Espectro de luz azul (400–500 nm)

- Espectro de luz roja lejana (700–850 nm)

- Espectro de luz verde (500–600 nm)

- Espectro de luz ultravioleta (100–400 Nm)

Canal de distribución

- En línea

- Comercio electrónico

- Sitio web de la empresa

- Minorista

- Al por mayor

- Desconectado

Usuario final

- Cultivadores de invernaderos

- Luces LED para cultivo

- Luces fluorescentes de cultivo

- Lámpara fluorescente T5

- Lámparas fluorescentes compactas (LFC)

- Otros

- Luces de cultivo con descarga de alta intensidad (HID)

- Lámpara de sodio de alta presión (HPS)

- Lámpara de halogenuros metálicos (MH)

- Lámparas de halogenuros metálicos cerámicos

- Bombillas de conversión y balastos conmutables

- Lámparas combinadas MH y HPS

- Luces de cultivo incandescentes

- Cultivadores de almacén

- Luces LED para cultivo

- Luces fluorescentes de cultivo

- Lámpara fluorescente T5

- Lámparas fluorescentes compactas (LFC)

- Otros

- Luces de cultivo con descarga de alta intensidad (HID)

- Lámpara de sodio de alta presión (HPS)

- Lámpara de halogenuros metálicos (MH)

- Lámparas de halogenuros metálicos cerámicos

- Bombillas de conversión y balastos conmutables

- Lámparas combinadas MH y HPS

- Luces de cultivo incandescentes

- Cultivadores residenciales

- Luces LED para cultivo

- Luces fluorescentes de cultivo

- Lámpara fluorescente T5

- Lámparas fluorescentes compactas (LFC)

- Otros

- Luces de cultivo con descarga de alta intensidad (HID)

- Lámpara de sodio de alta presión (HPS)

- Lámpara de halogenuros metálicos (MH)

- Lámparas de halogenuros metálicos cerámicos

- Bombillas de conversión y balastos conmutables

- Lámparas combinadas MH y HPS

- Luces de cultivo incandescentes

- Institución de investigación y académica

- Luces LED para cultivo

- Luces fluorescentes de cultivo

- Lámpara fluorescente T5

- Lámparas fluorescentes compactas (LFC)

- Otros

- Luces de cultivo con descarga de alta intensidad (HID)

- Lámpara de sodio de alta presión (HPS)

- Lámpara de halogenuros metálicos (MH)

- Lámparas de halogenuros metálicos cerámicos

- Bombillas de conversión y balastos conmutables

- Lámparas combinadas MH y HPS

- Luces de cultivo incandescentes

- Aplicaciones para ganado

- Luces LED para cultivo

- Luces fluorescentes de cultivo

- Lámpara fluorescente T5

- Lámparas fluorescentes compactas (LFC)

- Otros

- Luces de cultivo con descarga de alta intensidad (HID)

- Lámpara de sodio de alta presión (HPS)

- Lámpara de halogenuros metálicos (MH)

- Lámparas de halogenuros metálicos cerámicos

- Bombillas de conversión y balastos conmutables

- Lámparas combinadas MH y HPS

- Luces de cultivo incandescentes

- Otros

Análisis regional del mercado de iluminación de cultivo en invernaderos y entornos controlados para cultivos agrícolas

Se analiza el mercado y se proporcionan información y tendencias del tamaño del mercado por país, tipo, aplicación, tipo de sistema, tipo de instalación, espectro, espectro de luz, canal de distribución y usuario final.

Los países cubiertos en el informe del mercado de luces de cultivo en invernadero y ambiente controlado para cultivos agrícolas de América del Norte son EE. UU., Canadá y México.

Se espera que Estados Unidos domine el mercado de invernaderos y luces de cultivo en ambientes controlados para cultivos agrícolas debido a su infraestructura de tecnología agrícola avanzada y sus importantes inversiones en prácticas agrícolas innovadoras, junto con la presencia de actores clave del mercado.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas estadounidenses y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado de iluminación para cultivos agrícolas en invernaderos y entornos controlados

El panorama competitivo del mercado proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Los líderes del mercado de luces de cultivo en invernaderos y entornos controlados para cultivos agrícolas que operan en el mercado son:

- Signify Holding (Países Bajos)

- Heliospectra (Suecia)

- AMS-OSRAM AG (Austria)

- Cree LED (EE. UU.)

- Hydrofarm (Estados Unidos)

- LED SunPlus (China)

- SAVANT TECHNOLOGIES LLC (EE. UU.)

- Hyperion Grow Lights (filial de Midstream Ltd.) (Reino Unido)

- Iluminación para horticultura MechaTronix (Países Bajos)

- GrowPackage.com (Canadá)

- California Lightworks (Estados Unidos)

- Valoya (Finlandia)

- La elección del cultivador (EE. UU.)

Últimos avances en el mercado de iluminación para cultivos agrícolas en invernaderos y entornos controlados

- En agosto de 2024, ams-OSRAM AG estableció un Centro de Desarrollo de China (CDC) para impulsar el crecimiento empresarial regional y la innovación tecnológica. El CDC, que forma parte de la unidad CMOS, Sensores y ASIC (CSA), se centró en el marketing de productos, la ingeniería de soluciones de sistemas, la ingeniería de aplicaciones y la innovación en la cadena de suministro. Esta iniciativa tenía como objetivo aprovechar el dinámico mercado de China para mejorar las experiencias tecnológicas cotidianas y explorar oportunidades en tecnología de tiempo de vuelo, aplicaciones de láser azul y soluciones de proyección láser.

- En mayo de 2024, ams-OSRAM AG recibió tres galardones en los premios alemanes a la innovación de 2024. El OSRAM TRUCKSTAR LED H7 ganó en la categoría “Excelencia en la relación entre empresas: tecnologías automotrices” por su alto brillo y bajo deslumbramiento. El OSRAM NIGHT BREAKER LED W5W fue reconocido en la categoría “Excelencia en la relación entre empresas y consumidores: iluminación” por su luz brillante y de bajo consumo. El OSRAM TYREinflate 4000 recibió una mención especial en “Excelencia en la relación entre empresas y consumidores: artículos de viaje, deportes y actividades al aire libre” por su versatilidad para inflar neumáticos y cargar dispositivos.

- En julio de 2022, Midstream Ltd. adquirió Hyperion Grow Lights para impulsar su sector de horticultura. El acuerdo mejoró el apoyo a los productores de invernadero, integró las operaciones de Hyperion en la red de Midstream y amplió la fabricación de la nueva serie Hyperion Pro.

- En febrero de 2023, las luces LED de cultivo Phantom PHOTOBIO TX y PHOTOBIO T de Hydrofarm ofrecen diseños delgados y de alta eficiencia con espectro S4 para una salud óptima de las plantas. Ideales para invernaderos y entornos interiores, estas luces de primera calidad cuentan con una disipación de calor avanzada y un sombreado mínimo, lo que mejora el rendimiento y la calidad de los cultivos de manera sostenible.

- MechaTronix Horticulture Lighting., lanzó las nuevas luces de cultivo dinámicas COOLSTACK, que utilizan LED Osram OSCONIQ P3737 y ópticas rediseñadas para cultivos en alambres altos. Esta innovación logró una eficacia ultraalta de más de 3,8 µmol por julio, lo que mejoró la propagación y la profundidad de la luz. La empresa fortaleció su compromiso de maximizar los rendimientos y la eficiencia para los productores en la industria de los invernaderos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.