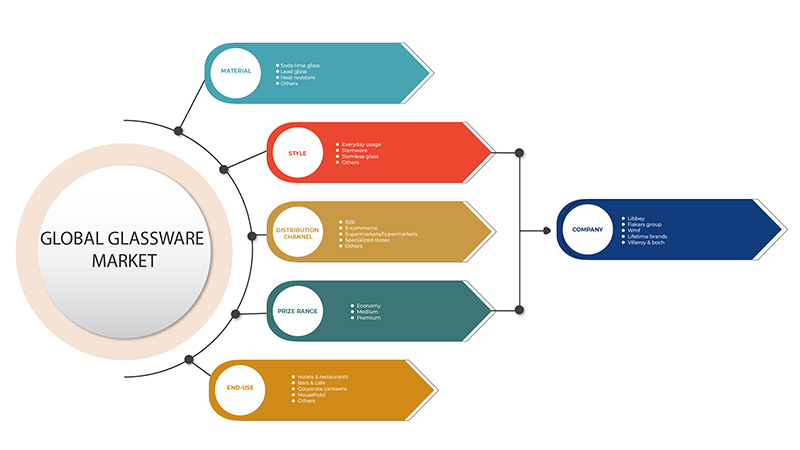

Mercado de cristalería de América del Norte, por material (vidrio sodocálcico, vidrio con plomo, resistente al calor y otros), estilo (vidrio sin tallo, copas, uso diario y otros), canal de distribución (B2B, tiendas especializadas, supermercados/hipermercados, comercio electrónico y otros), rango de precios (medio, premium y económico), uso final (hoteles y restaurantes, bares y cafeterías, hogar, comedores corporativos y otros), tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado

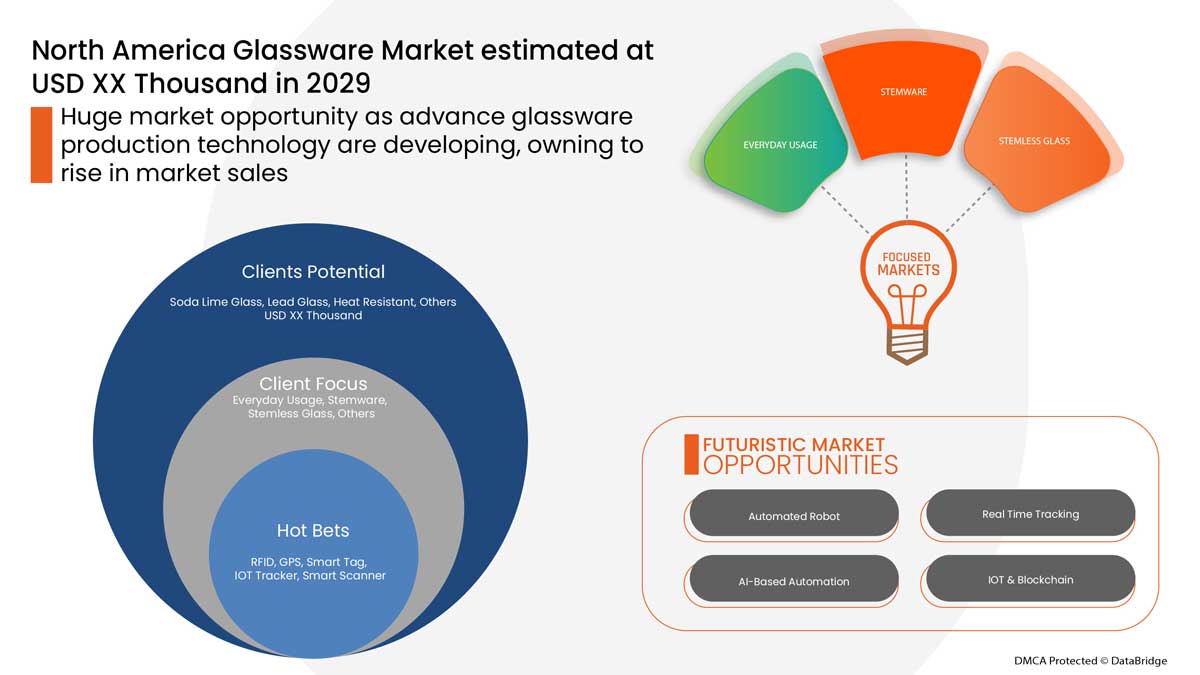

Se espera que los crecientes niveles de inversión en la industria hotelera y de la restauración actúen como un motor para el crecimiento del mercado de cristalería en el período de pronóstico. Se espera que los cambios en el estilo de vida de los consumidores actúen como un motor para el crecimiento del mercado de cristalería en el período de pronóstico de 2022 a 2029. Se espera que los avances en las tecnologías de producción de cristalería traigan oportunidades de crecimiento para el mercado de cristalería en el futuro.

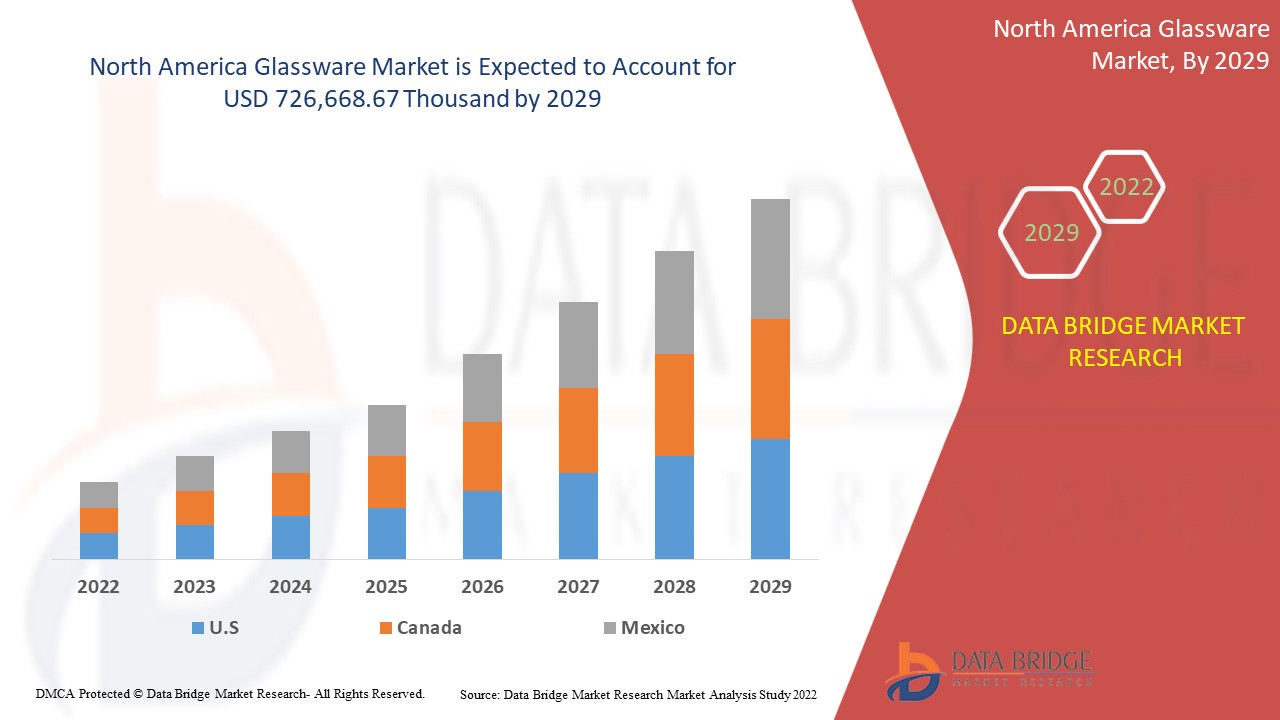

Data Bridge Market Research analiza que se espera que el mercado de cristalería alcance un valor de USD 726.668,67 mil para 2029, con una CAGR del 4,9% durante el período de pronóstico. La "cal sódica" representa el segmento de material más destacado, ya que este tipo de vidrio proporciona superficies resistentes a los arañazos. El informe del mercado de cristalería también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 |

|

Unidades cuantitativas |

Ingresos en miles de USD, volumen en unidades, precios en USD |

|

Segmentos cubiertos |

Por material (vidrio sodocálcico, vidrio al plomo, resistente al calor y otros), estilo (vidrio sin tallo, vidrio con copas, uso diario y otros), canal de distribución (B2B, tiendas especializadas, supermercados/hipermercados, comercio electrónico y otros), rango de precios (medio, premium y económico), uso final (hoteles y restaurantes, bares y cafeterías, hogar, comedores corporativos y otros) |

|

Países cubiertos |

Estados Unidos, Canadá, México |

|

Actores del mercado cubiertos |

Hrastnik1860, Oneida, NoritakeU.S., Ocean Glass Public Company Limited, Lenox Corporation, Treo.in, Libbey Inc, Fiskars Group, WMF (una subsidiaria de Groupe SEB), Lifetime Brands, Inc, Villeroy & Boch, Bormioli Rocco SpA, Wonderchef Home Appliances Pvt. Ltd., The Zrike Company, Inc, Shandong Hikingpac Co., Ltd., Addresshome, Stölzle Lausitz GmbH, Eagle Glass Deco (P.) Ltd., Degrenne, Cello World, MYBOROSIL, Jiangsu Rongtai Glass Products Co., Ltd., Cumbria Crystal, Garbo Glassware, entre otras. |

Definición de mercado

El vidrio es un material frágil y rígido, generalmente transparente o translúcido. Puede estar hecho de una mezcla de arena, soda, cal u otros minerales. El método más común para formar el vidrio consiste en calentar las materias primas hasta que se convierten en líquido fundido y luego enfriar rápidamente la mezcla para hacer vidrio templado. Las variedades de vidrio se pueden clasificar en función de sus cualidades mecánicas y térmicas para identificar qué aplicaciones son las más adecuadas.

Vidrio sódico-cálcico: El vidrio sódico-cálcico es la forma más común de vidrio utilizada para cristales de ventanas y recipientes de vidrio, como botellas y frascos para bebidas, alimentos y ciertos artículos básicos.

Vidrio con plomo: El vidrio con plomo es un vidrio con un alto porcentaje de óxido de plomo con una claridad y brillo excepcionales.

Resistente al calor: el vidrio resistente al calor está diseñado para soportar el estrés térmico y se utiliza comúnmente en cocinas y aplicaciones industriales.

Dinámica del mercado de cristalería

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

- Crecientes niveles de inversión en el sector hotelero y de restauración

El turismo ha mejorado el negocio del sector hotelero y de la restauración en todo el mundo y ha proporcionado un gran alcance para la industria hotelera. La industria ha florecido principalmente a través del turismo y debido a los diversos paisajes, creencias y sociedades en diferentes países, lo que proporcionó un gran atractivo para los turistas de diferentes regiones. Los sectores de la hostelería y la restauración de muchas naciones se han expandido gradualmente durante las últimas dos décadas, y se prevé un desarrollo en los próximos años, junto con un aumento en la demanda de varios tipos de artículos de cristalería.

- Cambios en el estilo de vida de los consumidores

La vida de los consumidores está en constante evolución. Los hábitos y valores de los consumidores se ven influidos por las tendencias existentes y nuevas, así como por la mezcla demográfica en constante cambio, las convulsiones culturales a nivel mundial y los rápidos avances tecnológicos. Las empresas pueden aprovechar las nuevas posibilidades adquiriendo un conocimiento profundo de las preferencias de los clientes en función de los cambios de comportamiento y creencias. En los últimos tiempos, los consumidores de todas las generaciones se están centrando más en los productos de marca en muchas áreas de su vida diaria.

- La creciente popularidad de la alta cocina en todo el mundo

Un restaurante de alta cocina es un establecimiento de especialidades o de cocina variada que da prioridad a la calidad de los ingredientes, la presentación y el servicio impecable. La categoría está creciendo a un ritmo respetable del 15%, lo que ha fomentado la llegada de restaurantes premium con estrellas Michelin y otros competidores locales. Por lo tanto, la creciente demanda de restaurantes de alta cocina delicada se logra principalmente mediante el funcionamiento exitoso de diferentes tipos de marcas de productos de cristalería en hoteles y restaurantes.

- Disponibilidad de productos de calidad económica.

El vidrio es uno de los materiales más complejos y adaptables, y se utiliza en casi todas las industrias. El uso extensivo del vidrio contribuye a la creación de un aspecto muy moderno y de alta tecnología tanto en estructuras residenciales como comerciales. El vidrio viene en una variedad de formas y tamaños para adaptarse a una variedad de aplicaciones y se utiliza en una variedad de aplicaciones arquitectónicas, como puertas, ventanas y mamparas. El vidrio ha recorrido un largo camino desde sus humildes comienzos como panel de ventana hasta convertirse en un sofisticado componente estructural en la actualidad.

- Creciente demanda de vajillas de acero y papel

El papel y el plástico se utilizan cada vez más para fabricar platos y vasos desechables, debido a su excelente rendimiento medioambiental y a la creciente demanda de comercio electrónico y servicios de entrega. Los consumidores, las marcas y los minoristas tienen grandes expectativas en cuanto a los productos reciclables hechos de papel. La tasa de reciclaje de materiales a base de papel es de alrededor del 85 por ciento, y la cadena de valor del papel mejora día a día. Para alcanzar objetivos de reciclaje aún más altos y, al mismo tiempo, ampliar la utilidad de los envases a base de papel, es fundamental, para empezar, la fase de diseño, teniendo en cuenta tanto el propósito previsto como el final de la vida útil.

Impacto del COVID-19 en el mercado de cristalería

La COVID-19 ha tenido un gran impacto en el mercado de cristalería, ya que casi todos los países han optado por cerrar todas las instalaciones de producción, excepto las que se dedican a la producción de bienes esenciales. El gobierno ha tomado algunas medidas estrictas, como el cierre de la producción y la venta de bienes no esenciales, el bloqueo del comercio internacional y muchas más para evitar la propagación de la COVID-19. Las únicas empresas que están lidiando con esta situación de pandemia son los servicios esenciales a los que se les permite abrir y ejecutar los procesos.

El crecimiento del mercado de cristalería está aumentando debido a las políticas gubernamentales para impulsar el comercio internacional después de la COVID-19. Además, la apertura del confinamiento está impulsando la industria hotelera, que está aumentando la demanda de cristalería en el mercado. Sin embargo, factores como la congestión asociada a las rutas comerciales y las restricciones comerciales entre algunas naciones están frenando el crecimiento del mercado. El cierre de las instalaciones de producción durante la situación de pandemia ha tenido un impacto significativo en el mercado.

Los fabricantes están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de investigación y desarrollo para mejorar la tecnología involucrada en la cristalería. Con esto, las empresas traerán soluciones avanzadas y precisas al mercado. Además, las iniciativas gubernamentales para impulsar el comercio internacional han llevado al crecimiento del mercado.

Acontecimientos recientes

- En octubre de 2020, Libbey Inc. anunció la confirmación de un plan de reorganización y esperaba completar su reestructuración supervisada por el tribunal y emerger con un balance más sólido en las próximas semanas. La empresa hizo este anuncio para tener éxito en el entorno operativo comercial actual.

- En octubre de 2021, Lenox Corporation adquirió Oneida Consumer LLC con su marca de productos de mesa, que incluye vajillas, cubertería y cubiertos. La colaboración se llevó a cabo para comercializar una cartera líder de marcas y productos innovadores con un conocimiento inigualable por parte de los clientes en una amplia gama de canales minoristas.

Alcance del mercado de cristalería en América del Norte

El mercado de cristalería está segmentado en función del material, el estilo, el canal de distribución, el rango de precios y el uso final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducidos en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Por material

- Vidrio de cal sódica

- Vidrio con plomo

- Resistente al calor

- Otros

Según el material, el mercado de cristalería se segmenta en vidrio sódico-cálcico, vidrio con plomo, resistente al calor y otros.

Por estilo

- Vaso sin tallo

- Copas de vino

- Uso cotidiano

- Otros

Según el estilo, el mercado de cristalería se ha segmentado en vidrio sin tallo, vidrio con copas, uso diario y otros.

Por canal de distribución

- B2B

- Tiendas especializadas

- Supermercados/Hipermercados

- Comercio electrónico

- Otros

Según el canal de distribución, el mercado de cristalería se ha segmentado en B2B, tiendas especializadas, supermercados/hipermercados, comercio electrónico y otros.

Por rango de precio

- Medio

- De primera calidad

- Economía

Según el rango de precios, el mercado de cristalería se ha segmentado en mediano, premium y económico.

Por uso final

- Hoteles y restaurantes

- Bares y cafeterías

- Familiar

- Comedores corporativos

- Otros

Según el uso final, el mercado de cristalería se ha segmentado en hoteles y restaurantes, bares y cafeterías, hogares, comedores corporativos y otros.

Análisis y perspectivas regionales del mercado de cristalería

Se analiza el mercado de cristalería y se proporcionan información y tendencias del tamaño del mercado por país, material, estilo, canal de distribución, rango de precios y uso final como se mencionó anteriormente.

Los países cubiertos en el informe del mercado de cristalería son Estados Unidos, Canadá y México.

Estados Unidos domina el mercado de cristalería de América del Norte. Es probable que Estados Unidos sea el mercado de cristalería de América del Norte de más rápido crecimiento. El creciente desarrollo de la infraestructura, el comercio y la industria en países emergentes como Estados Unidos se atribuyen al dominio del mercado. Con el creciente desarrollo en los países, el número de restaurantes y bares está aumentando, lo que impulsará la demanda de productos de cristalería en la región de América del Norte.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de cristalería

El panorama competitivo del mercado de cristalería proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de cristalería.

Algunos de los principales actores que operan en el mercado de cristalería son Hrastnik1860, Oneida, Noritake China, Ocean Glass Public Company Limited, Lenox Corporatio, Treo.in, Libbey Inc, Fiskars Group, WMF (una subsidiaria de Groupe SEB), Lifetime Brands, Inc, Villeroy & Boch, Bormioli Rocco SpA, Wonderchef Home Appliances Pvt. Ltd., The Zrike Company, Inc, Shandong Hikingpac Co., Ltd., Addresshome, Stölzle Lausitz GmbH, Eagle Glass Deco (P.) Ltd., Degrenne. Cello World, MYBOROSIL, Jiangsu Rongtai Glass Products Co., Ltd., Cumbria Crystal, Garbo Glassware.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA GLASSWARE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL TIME LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S MODEL

4.2 CONSUMER BEHAVIOUR PATTERN

4.3 FACTORS INFLUENCING BUYING DECISION

4.3.1 PSYCHOLOGICAL FACTORS

4.3.2 SOCIAL FACTORS

4.3.3 CULTURAL FACTORS

4.3.4 PERSONAL FACTORS

4.3.5 ECONOMIC FACTORS

4.4 KEY TRENDS

4.4.1 BOROSILICATE GLASSWARE IS A GAME-CHANGER

4.4.2 OMNI-CHANNEL STRATEGY USAGE IS ENCOURAGING THE GROWTH OF THE GLASSWARE MARKET

4.4.3 BEVERAGE INDUSTRY TO REGISTER SIGNIFICANT GROWTH

4.4.4 INCREASE IN TABLEWARE PRODUCTS

4.5 PRICING ANALYSIS

4.6 PRODUCT ADOPTION SCENARIO

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING LEVELS OF INVESTMENT IN THE HOTEL AND CATERING INDUSTRY

5.1.2 CHANGES IN LIFESTYLE OF THE CONSUMERS

5.1.3 RISING POPULARITY OF FINE DINING ACROSS THE GLOBE

5.1.4 INCREASING DEMAND FOR PREMIUM DECORATIVE GLASSWARE PRODUCTS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF CHEAP QUALITY PRODUCTS

5.2.2 RISING DEMAND FOR STEEL AND PAPER BASE DRINKWARE

5.2.3 DIFFICULTY IN MAINTAINING THE GLASSWARE PRODUCTS

5.3 OPPORTUNITIES

5.3.1 ADVANCEMENTS IN GLASSWARE PRODUCTION TECHNOLOGIES

5.3.2 RISING DEMAND FOR GLASSWARE PRODUCTS FOR CLINICAL USE IN HOSPITALS AND FORENSIC LABORATORIES

5.4 CHALLENGES

5.4.1 COMPLEXITY IN MANUFACTURING GLASSWARE PRODUCTS

5.4.2 RISING DIFFICULTY IN RECYCLING GLASSWARE PRODUCTS

6 NORTH AMERICA GLASSWARE MARKET, BY MATERIAL

6.1 OVERVIEW

6.2 SODA LIME GLASS

6.3 LEAD GLASS

6.4 HEAT RESISTANT

6.5 OTHERS

7 NORTH AMERICA GLASSWARE MARKET, BY STYLE

7.1 OVERVIEW

7.2 STEMWARE

7.2.1 RED WINE GLASS

7.2.1.1 BORDEAUX

7.2.1.2 CABERNET

7.2.1.3 ZINFANDEL

7.2.1.4 BURGUNDY

7.2.1.5 PINOT NOIR

7.2.1.6 ROSE

7.2.2 WHITE WINE GLASS

7.2.2.1 SPARKLING

7.2.2.2 CHARDONNAY

7.2.2.3 VIOGNIER

7.2.2.4 SWEET WINE

7.2.2.5 VINTAGE

7.3 STEMLESS GLASS

7.3.1 LIQUOR GLASS

7.3.2 BEER GLASS

7.4 EVERYDAY USAGE

7.5 OTHERS

8 NORTH AMERICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 B2B

8.3 SPECIALIZED STORES

8.4 SUPERMARKETS/HYPERMARKETS

8.5 E-COMMERCE

8.6 OTHERS

9 NORTH AMERICA GLASSWARE MARKET, BY PRICE RANGE

9.1 OVERVIEW

9.2 MEDIUM

9.3 PREMIUM

9.4 ECONOMY

10 NORTH AMERICA GLASSWARE MARKET, BY END-USE

10.1 OVERVIEW

10.2 HOTELS & RESTAURANTS

10.3 BARS & CAFE

10.4 HOUSEHOLD

10.5 CORPORATE CANTEENS

10.6 OTHERS

11 NORTH AMERICA GLASSWARE MARKET, BY GEOGRAPHY

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA GLASSWARE MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LIBBEY, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATE

14.2 FISKARS GROUP

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT UPDATE

14.3 WMF (A SUBSIDIARY OF GROUPE SEB)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATE

14.4 LIFETIME BRANDS, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT UPDATE

14.5 VILLEROY & BOCH

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT UPDATES

14.6 ADDRESSHOME

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 BORMIOLI ROCCO S.P.A.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 CELLO WORLD

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATE

14.9 CUMBRIA CRYSTAL

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 DEGRENNE

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

14.11 EAGLE GLASS DECO (P.) LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATE

14.12 GARBO GLASSWARE

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 HRASTNIK1860

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 JIANGSU RONGTAI GLASS PRODUCTS CO., LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATES

14.15 LENOX CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATE

14.16 MYBOROSIL

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT UPDATE

14.17 NORITAKECHINA

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT UPDATE

14.18 OCEAN GLASS PUBLIC COMPANY LIMITED

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT UPDATE

14.19 ONEIDA

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATE

14.2 SHANDONG HIKINGPAC CO., LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATE

14.21 STÖLZLE LAUSITZ GMBH

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT UPDATES

14.22 TREO.IN

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT UPDATE

14.23 THE ZRIKE COMPANY, INC.

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT UPDATE

14.24 WONDERCHEF HOME APPLIANCES PVT. LTD

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 TYPE OF REUSABLE CUPS CONSUMERS WOULD PREFER FOR DRINKWARE IN U.S, 2015

TABLE 2 NORTH AMERICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 3 NORTH AMERICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 4 NORTH AMERICA SODA LIME GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA SODA LIME GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 6 NORTH AMERICA LEAD GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA LEAD GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 8 NORTH AMERICA HEAT RESISTANT IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA HEAT RESISTANT IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 10 NORTH AMERICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 12 NORTH AMERICA GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA STEMWARE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA STEMLESS GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA EVERYDAY USAGE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA B2B IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA SPECIALIZED STORES IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA SUPERMARKETS/HYPERMARKETS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA E-COMMERCE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA MEDIUM IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA PREMIUM IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA ECONOMY IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA HOTELS & RESTAURANTS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA BARS & CAFÉ IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA HOUSEHOLD IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA CORPORATE CANTEENS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA GLASSWARE MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA GLASSWARE MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 39 NORTH AMERICA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 41 NORTH AMERICA GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL , 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 49 U.S. GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 50 U.S. GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 51 U.S. GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 52 U.S. STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 U.S. RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 U.S. WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE 2020-2029 (USD THOUSAND)

TABLE 55 U.S. STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 U.S. GLASSWARE MARKET, BY DISTRIBUTION CHANNEL , 2020-2029 (USD THOUSAND)

TABLE 57 U.S. GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 58 U.S. GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 59 CANADA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 60 CANADA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 61 CANADA GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 62 CANADA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 CANADA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 CANADA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE 2020-2029 (USD THOUSAND)

TABLE 65 CANADA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 CANADA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL , 2020-2029 (USD THOUSAND)

TABLE 67 CANADA GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 68 CANADA GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 69 MEXICO GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 70 MEXICO GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 71 MEXICO GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 72 MEXICO STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 MEXICO RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 74 MEXICO WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE 2020-2029 (USD THOUSAND)

TABLE 75 MEXICO STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 MEXICO GLASSWARE MARKET, BY DISTRIBUTION CHANNEL , 2020-2029 (USD THOUSAND)

TABLE 77 MEXICO GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 78 MEXICO GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

Lista de figuras

FIGURE 1 NORTH AMERICA GLASSWARE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA GLASSWARE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA GLASSWARE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA GLASSWARE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA GLASSWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA GLASSWARE MARKET: MATERIAL TIME LINE CURVE

FIGURE 7 NORTH AMERICA GLASSWARE MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA GLASSWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA GLASSWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA GLASSWARE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA GLASSWARE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA GLASSWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA GLASSWARE MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE NORTH AMERICA GLASSWARE MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 RISING POPULARITY OF FINE DINING ACROSS THE GLOBE IS DRIVING THE NORTH AMERICA GLASSWARE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 SODA LIME GLASS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA GLASSWARE MARKET IN 2022 & 2029

FIGURE 17 FACTOR INFLUENCING PURCHASE OF PRODUCT

FIGURE 18 PRICE RANGE COMPARISON OF KEY PLAYERS BY STEMLESS GLASSES

FIGURE 19 PRICE RANGE COMPARISON OF KEY PLAYERS BY STEMWARE GLASSES

FIGURE 20 PRICE RANGE COMPARISON OF KEY PLAYERS BY EVERYDAY USAGE GLASSES

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA GLASSWARE MARKET

FIGURE 22 NORTH AMERICA LUXURY HOTEL COUNT, IN LUXURY CLASS, 2002-2018 (APPROXIMATE)

FIGURE 23 NORTH AMERICA GLASSWARE MARKET, BY MATERIAL, 2021

FIGURE 24 NORTH AMERICA GLASSWARE MARKET, BY STYLE, 2021

FIGURE 25 NORTH AMERICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 NORTH AMERICA GLASSWARE MARKET, BY PRICE RANGE, 2021

FIGURE 27 NORTH AMERICA GLASSWARE MARKET, BY END-USE, 2021

FIGURE 28 NORTH AMERICA GLASSWARE MARKET: SNAPSHOT (2021)

FIGURE 29 NORTH AMERICA GLASSWARE MARKET: BY COUNTRY (2021)

FIGURE 30 NORTH AMERICA GLASSWARE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 NORTH AMERICA GLASSWARE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 NORTH AMERICA GLASSWARE MARKET: BY MATERIAL (2022-2029)

FIGURE 33 NORTH AMERICA GLASSWARE MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.