North America Gene Synthesis Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.35 Billion

USD

7.28 Billion

2024

2032

USD

1.35 Billion

USD

7.28 Billion

2024

2032

| 2025 –2032 | |

| USD 1.35 Billion | |

| USD 7.28 Billion | |

|

|

|

|

Segmentación del mercado de síntesis de genes en Norteamérica por componente (sintetizador, consumibles y software y servicios), tipo de gen (gen estándar, gen de expresión, gen complejo y otros), tipo de síntesis de genes (síntesis de bibliotecas de genes y síntesis de genes a medida), aplicación ( biología sintética , ingeniería genética, diseño de vacunas , anticuerpos terapéuticos y otros), método (síntesis en fase sólida, basada en chips, síntesis de ADN y síntesis enzimática basada en PCR), usuario final (instituciones académicas y de investigación, laboratorios de diagnóstico, empresas biotecnológicas y farmacéuticas y otros) y canal de distribución (licitación directa, distribución en línea y distribución a través de terceros). Tendencias del sector y previsiones hasta 2032.

Tamaño del mercado de síntesis de genes en América del Norte

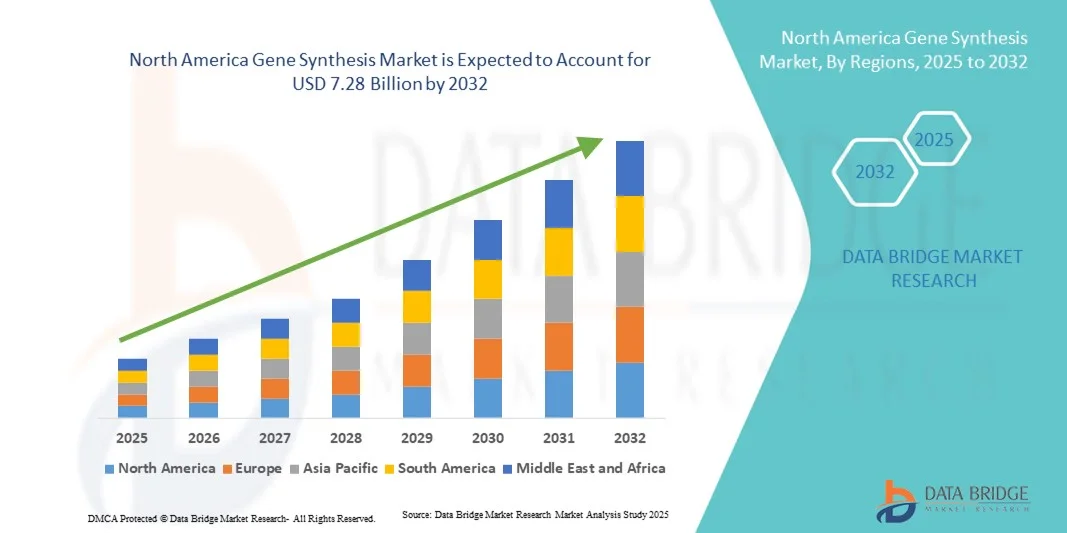

- El tamaño del mercado de síntesis de genes en América del Norte se valoró en 1.350 millones de dólares en 2024 y se espera que alcance los 7.280 millones de dólares en 2032 , con una tasa de crecimiento anual compuesta (TCAC) del 23,40% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a los rápidos avances en biología sintética, tecnologías de secuenciación de ADN y automatización, que en conjunto han mejorado la velocidad, la precisión y la rentabilidad de la síntesis de genes. Este progreso ha permitido a los investigadores diseñar y producir construcciones genéticas complejas para aplicaciones en los sectores farmacéutico, biotecnológico y de investigación agrícola .

- Además, la creciente demanda de genes personalizados para el desarrollo de vacunas, la medicina personalizada y la investigación en terapia génica está acelerando la adopción global de soluciones de síntesis genética. Estos factores convergentes impulsan significativamente el crecimiento del mercado de síntesis genética, consolidándolo como un elemento clave para la innovación en genómica, diagnóstico molecular y biología sintética.

Análisis del mercado de síntesis de genes en Norteamérica

- El mercado de la síntesis de genes ha experimentado una expansión significativa, impulsada principalmente por la creciente demanda de genes sintéticos en los sectores de biotecnología, farmacéutico y de investigación académica. Los continuos avances en la tecnología de síntesis de ADN, la automatización y la bioinformática han reducido los costes de producción y los tiempos de entrega, lo que permite una innovación más rápida en el desarrollo de vacunas, terapias génicas y productos biológicos.

- El crecimiento del mercado se ve impulsado aún más por la rápida adopción de la biología sintética y la medicina de precisión, así como por la creciente necesidad de secuencias genéticas personalizadas en el descubrimiento de fármacos, la biotecnología agrícola y el diagnóstico.

- Estados Unidos dominó el mercado de la síntesis de genes con la mayor cuota de ingresos (41,6%) en 2024, impulsado por fuertes inversiones en I+D, una sólida presencia de actores clave como Thermo Fisher Scientific, Twist Bioscience y GenScript, y aplicaciones generalizadas en investigación genómica, fabricación biofarmacéutica y medicina personalizada.

- Se prevé que Canadá sea el país de mayor crecimiento en el mercado de síntesis de genes durante el período de pronóstico, con una tasa de crecimiento anual compuesto (TCAC) esperada, impulsada por el aumento de la financiación para la investigación en biotecnología, el auge de las empresas emergentes de biología sintética y la expansión de las colaboraciones con empresas biotecnológicas internacionales líderes.

- El segmento de síntesis de genes a medida dominó el mercado en 2024 con una cuota del 52,8%, impulsado por la creciente necesidad de secuencias de ADN personalizadas en investigación, diseño de vacunas y descubrimiento de fármacos.

Alcance del informe y segmentación del mercado de síntesis de genes

|

Atributos |

Información clave del mercado de la síntesis de genes |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Principales actores del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de datos de valor añadido |

Además de los datos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado elaborados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, epidemiología de pacientes, análisis de proyectos en desarrollo, análisis de precios y marco regulatorio. |

Tendencias del mercado de síntesis de genes en América del Norte

Avances mediante la integración de IA y automatización

- Una tendencia significativa y en auge en el mercado norteamericano de síntesis de genes es la integración de la inteligencia artificial (IA) y las tecnologías de automatización avanzada para mejorar la eficiencia, la precisión y la escalabilidad de los procesos de síntesis de ADN. Esta convergencia está transformando los flujos de trabajo tradicionales de laboratorio, permitiendo una construcción de genes más rápida, menores tasas de error y una mayor flexibilidad de diseño.

- Por ejemplo, empresas como Twist Bioscience y Thermo Fisher Scientific están implementando algoritmos basados en IA para optimizar el diseño de secuencias genéticas, predecir las tasas de éxito de la síntesis y minimizar los costes. Estas tecnologías permiten a los científicos diseñar secuencias complejas rápidamente y personalizarlas para diversas aplicaciones en biología sintética, terapéutica y diagnóstico.

- Las plataformas de automatización basadas en IA también ayudan en la corrección de errores y la validación de la calidad, lo que garantiza construcciones genéticas de alta fidelidad. Esta automatización reduce la intervención manual y la variabilidad, mejorando así la reproducibilidad y el rendimiento en la investigación y las aplicaciones industriales.

- La integración de la automatización permite la monitorización en tiempo real y la retroalimentación durante la síntesis, minimizando los retrasos y mejorando la precisión. Esto también facilita la fabricación de ADN a medida a gran escala para empresas farmacéuticas y biotecnológicas dedicadas a la ingeniería genética y el desarrollo de vacunas.

- La integración de la robótica con el análisis basado en IA está impulsando a los laboratorios hacia la automatización completa de los procesos de síntesis genética. Por ejemplo, varias empresas biotecnológicas están empleando sistemas automatizados de manipulación de líquidos que se conectan directamente con plataformas de IA para predecir la eficiencia de las reacciones y optimizar las condiciones para cada secuencia genética.

- Esta tendencia hacia la síntesis inteligente, automatizada y de alto rendimiento está transformando las expectativas en todo el sector biotecnológico. En consecuencia, empresas como GenScript, Twist Bioscience e Integrated DNA Technologies (IDT) están ampliando sus plataformas de síntesis genética basadas en IA para ofrecer tiempos de respuesta más rápidos y soluciones rentables para la investigación y el uso terapéutico.

- La demanda de síntesis genética integrada con IA y automatización está aumentando rápidamente en instituciones de investigación, compañías farmacéuticas y organizaciones de fabricación por contrato (CMO), ya que buscan mejorar la productividad y acelerar la innovación en las ciencias de la vida.

Dinámica del mercado de síntesis de genes en América del Norte

Conductor

Creciente demanda de biología sintética y medicina personalizada

- La creciente aplicación de la biología sintética y la medicina personalizada impulsa significativamente el crecimiento del mercado de la síntesis genética. La síntesis genética permite la creación de secuencias genéticas personalizadas para su uso en el desarrollo de fármacos, la producción de vacunas y la investigación genómica.

- Por ejemplo, en marzo de 2024, Twist Bioscience Corporation anunció avances en su capacidad de fabricación de ADN sintético para satisfacer la creciente demanda mundial de investigación genética y producción de productos biológicos. Se espera que estos avances aceleren la expansión del mercado.

- La creciente prevalencia de trastornos genéticos y cáncer está impulsando la investigación en terapias personalizadas, donde se diseñan genes sintéticos para abordar las necesidades individuales de cada paciente.

- Además, la creciente adopción de genes sintéticos en la biotecnología industrial —para la producción de enzimas, la generación de biocombustibles y las mejoras agrícolas— está contribuyendo aún más al crecimiento del mercado.

- La conveniencia de la síntesis genética rápida, precisa y rentable permite a los investigadores prescindir de los métodos de clonación tradicionales, acelerando así los plazos de desarrollo e innovación de productos. El auge de la investigación en CRISPR y terapia celular también incrementa la demanda de genes sintéticos de alta calidad.

- Además, el crecimiento de la I+D biofarmacéutica, respaldado por iniciativas gubernamentales e inversiones privadas, está fomentando un entorno propicio para la expansión del mercado de síntesis de genes.

Restricción/Desafío

Altos costos y complejidades técnicas en los procesos de síntesis de genes

- A pesar de los avances tecnológicos, el elevado coste asociado a la síntesis de genes sigue siendo un desafío clave, especialmente para los pequeños laboratorios e instituciones académicas. Las secuencias genéticas complejas y la necesidad de una alta precisión contribuyen a los elevados costes de producción.

- Además, los desafíos técnicos, como los errores de secuencia, las dificultades para sintetizar fragmentos largos de ADN y la formación de estructuras secundarias, siguen obstaculizando la eficiencia.

- Por ejemplo, las secuencias largas o repetitivas suelen requerir múltiples pasos de síntesis y ensamblaje, lo que aumenta tanto el tiempo como el coste.

- Las empresas se están centrando en superar estas limitaciones mediante químicas de síntesis innovadoras, métodos mejorados de corrección de errores y automatización para reducir los costes operativos.

- Además, las complejidades regulatorias relacionadas con el uso de genes sintéticos en aplicaciones terapéuticas y agrícolas pueden retrasar la comercialización y aumentar los costos de cumplimiento.

- Garantizar la bioseguridad y las normas éticas en la investigación en biología sintética sigue siendo una preocupación creciente.

- Abordar estos desafíos mediante avances en las tecnologías de síntesis, economías de escala y marcos regulatorios favorables será fundamental para el crecimiento sostenido del mercado de síntesis de genes.

Alcance del mercado de síntesis de genes en América del Norte

El mercado está segmentado en función del componente, el tipo de gen, el tipo de síntesis genética, la aplicación, el método, el usuario final y el canal de distribución.

- Por componente

Según sus componentes, el mercado de síntesis genética se segmenta en sintetizadores, consumibles y software y servicios. El segmento de consumibles dominó el mercado con la mayor cuota de ingresos (46,5 %) en 2024, impulsado principalmente por la demanda continua y recurrente de materiales esenciales como reactivos, cebadores, nucleótidos y enzimas utilizados en diversos procesos de síntesis y amplificación. Los consumibles son fundamentales en cada etapa de la construcción y las pruebas genéticas, lo que los hace indispensables en laboratorios académicos, clínicos e industriales. El creciente número de proyectos de investigación genética, la expansión de las aplicaciones de la biología sintética y el mayor enfoque en la medicina de precisión han impulsado significativamente la demanda. Además, el aumento de las pruebas diagnósticas y los ensayos de terapia génica incrementan aún más el consumo de reactivos de síntesis, lo que contribuye al dominio de este segmento en el mercado.

Se prevé que el segmento de software y servicios experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 19,8 %, entre 2025 y 2032. Este crecimiento se debe al aumento en la utilización de herramientas bioinformáticas y plataformas de diseño en la nube que facilitan el análisis preciso de secuencias, la optimización y la minimización de errores. El auge de los algoritmos basados en inteligencia artificial para el diseño automatizado de genes y la gestión de la síntesis ha acelerado la adopción de estos servicios en instituciones de investigación y farmacéuticas. Se espera que la creciente externalización de servicios de síntesis de genes por parte de laboratorios más pequeños con infraestructura limitada y la integración de plataformas digitales para la gestión de datos impulsen aún más la expansión de este segmento durante el período de pronóstico.

- Por tipo de gen

Según el tipo de gen, el mercado de síntesis genética se segmenta en genes estándar, genes de expresión, genes complejos y otros. El segmento de genes estándar dominó el mercado con una cuota del 41,3 % en 2024, debido a su amplio uso en la investigación básica en biología molecular, la producción de proteínas recombinantes y los estudios de modificación genética. Los genes estándar son rentables, fiables e idóneos para sistemas de clonación y expresión, lo que los convierte en la opción preferida en laboratorios de investigación tanto académicos como industriales. El auge de los proyectos de biología sintética y la financiación académica para experimentos de clonación genética ha consolidado el liderazgo de este segmento. Además, la creciente demanda de genes estándar para el desarrollo de diagnósticos y terapias sigue impulsando la expansión del mercado a nivel mundial.

Se prevé que el segmento de genes complejos registre la tasa de crecimiento anual compuesto (TCAC) más rápida, del 20,4 %, entre 2025 y 2032, gracias a los avances en las tecnologías de síntesis que permiten la creación eficiente de secuencias de ADN grandes, ricas en GC o repetitivas. Los genes complejos desempeñan un papel fundamental en los productos biológicos de última generación, el desarrollo de vacunas y la ingeniería metabólica. La creciente adopción de plataformas de síntesis de alta fidelidad y métodos de corrección de errores ha posibilitado la construcción de secuencias intrincadas con mayor precisión. Se espera que el aumento de las aplicaciones en el diseño de circuitos genéticos y las terapias de precisión impulse aún más el crecimiento de este segmento.

- Por tipo de síntesis genética

Según el tipo de síntesis genética, el mercado se divide en síntesis de bibliotecas genéticas y síntesis genética a medida. Este último segmento dominó el mercado en 2024 con una cuota del 52,8%, impulsado por la creciente necesidad de secuencias de ADN personalizadas para la investigación, el diseño de vacunas y el descubrimiento de fármacos. La síntesis a medida ofrece flexibilidad para diseñar secuencias genéticas específicas optimizadas para diversos organismos y sistemas de expresión proteica. La creciente tendencia hacia la medicina de precisión, el aumento de las colaboraciones académicas y las innovaciones en tecnologías de optimización de codones han impulsado la demanda. La facilidad para externalizar la síntesis a medida a proveedores de servicios especializados también ha contribuido a su posición de liderazgo en el mercado.

Se prevé que el segmento de síntesis de bibliotecas genéticas experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 18,7 %, entre 2025 y 2032, impulsada por la creciente adopción de técnicas de cribado de alto rendimiento e ingeniería de proteínas. Las bibliotecas genéticas permiten el estudio simultáneo de múltiples variantes genéticas, lo que acelera el descubrimiento de fármacos y la investigación en genómica funcional. Los avances en automatización y síntesis en microarrays han facilitado la creación de grandes bibliotecas de forma eficiente y rentable. Se espera que el aumento de la investigación en optimización de enzimas e innovaciones en biología sintética contribuya aún más al sólido crecimiento de este segmento.

- Mediante solicitud

Según su aplicación, el mercado de la síntesis de genes se segmenta en biología sintética, ingeniería genética, diseño de vacunas, anticuerpos terapéuticos y otros. El segmento de biología sintética dominó el mercado con la mayor cuota (39,6%) en 2024, impulsado por el aumento de las inversiones en el desarrollo de organismos modificados genéticamente, rutas metabólicas y circuitos biológicos. La biología sintética depende en gran medida de la síntesis de genes para diseñar y ensamblar nuevos sistemas biológicos con aplicaciones industriales, farmacéuticas y agrícolas. Los gobiernos y las entidades privadas financian considerablemente la investigación en biología sintética, especialmente para la producción sostenible de biomateriales y el desarrollo de biocombustibles. La versatilidad de las aplicaciones de la biología sintética y su integración en la bioeconomía circular siguen reforzando su liderazgo.

Se prevé que el segmento de diseño de vacunas registre la tasa de crecimiento anual compuesto (TCAC) más rápida, del 21,3 %, entre 2025 y 2032, impulsada por la creciente demanda de plataformas de desarrollo rápido de vacunas y tecnologías de genes sintéticos que permiten una respuesta ágil ante enfermedades infecciosas emergentes. Tras el éxito de las vacunas de ADN y ARNm, muchas compañías farmacéuticas están invirtiendo en herramientas de genes sintéticos para desarrollar vacunas de última generación. La continua evolución de los patógenos y el énfasis mundial en la preparación para pandemias siguen estimulando la demanda en este segmento. Además, las iniciativas gubernamentales que promueven la I+D de vacunas y las colaboraciones entre empresas biotecnológicas y organismos de salud pública están acelerando la innovación en este campo. La integración del modelado basado en IA y la síntesis automatizada de genes está mejorando aún más la precisión del diseño de vacunas y reduciendo los plazos de desarrollo.

- Por método

Según el método empleado, el mercado de la síntesis de genes se segmenta en síntesis en fase sólida, síntesis en chips, síntesis de ADN y síntesis enzimática basada en PCR. El segmento de síntesis en fase sólida ostentó la mayor cuota de mercado en 2024, con un 44,8%, gracias a su precisión, fiabilidad y escalabilidad para la producción de largas secuencias de ADN. Esta técnica minimiza los riesgos de contaminación y permite la síntesis automatizada y en paralelo, lo que la hace idónea para operaciones de alto rendimiento en entornos farmacéuticos y de investigación. La continua innovación en la química de oligonucleótidos y los sistemas de purificación ha mejorado el rendimiento y la precisión. Su amplia aplicabilidad en diagnóstico, terapéutica y biotecnología industrial consolida su posición de liderazgo en el mercado.

Se prevé que el segmento de síntesis basada en chips experimente el mayor crecimiento anual compuesto (CAGR) del 20,9 % entre 2025 y 2032, gracias a su capacidad para producir simultáneamente miles de oligonucleótidos a menor costo y mayor velocidad. La miniaturización de este método facilita aplicaciones en el almacenamiento de datos de ADN, el diagnóstico molecular y la genómica de alto rendimiento. La creciente demanda de plataformas de síntesis rápidas y rentables en investigación y bioinformática refuerza aún más las perspectivas de este segmento. Además, los avances en las tecnologías de síntesis basadas en microarrays y semiconductores están mejorando la escalabilidad y la precisión en la producción de oligonucleótidos. Las colaboraciones estratégicas entre empresas biotecnológicas y desarrolladores de tecnología impulsan aún más la innovación y aceleran la adopción global de soluciones de síntesis basadas en chips.

- Por usuario final

Según el usuario final, el mercado de síntesis de genes se segmenta en instituciones académicas y de investigación, laboratorios de diagnóstico, empresas biotecnológicas y farmacéuticas, y otros. El segmento de empresas biotecnológicas y farmacéuticas dominó el mercado en 2024 con una cuota del 47,2%, impulsado por sus extensas actividades de I+D en productos biológicos, vacunas y medicina personalizada. Estas empresas utilizan ADN sintético para la validación de dianas terapéuticas, la terapia génica y el desarrollo de anticuerpos. El aumento de las inversiones en genómica, la expansión de las líneas de desarrollo biofarmacéutico y las alianzas con proveedores de servicios de síntesis han impulsado aún más su adopción. La integración de la automatización y las herramientas de optimización de secuencias basadas en IA está mejorando la productividad, lo que consolida el dominio del segmento.

Se prevé que el segmento de instituciones académicas y de investigación registre la tasa de crecimiento anual compuesto (TCAC) más rápida, del 19,4 %, entre 2025 y 2032, impulsada por el aumento de la financiación gubernamental para proyectos de genómica, el crecimiento de los programas de biología molecular y el acceso a servicios de síntesis genética de bajo coste. El creciente interés por la formación y la investigación colaborativa en biología sintética e ingeniería genética ha fomentado la adopción de tecnologías de síntesis en universidades y organizaciones de investigación de todo el mundo. El aumento de las colaboraciones entre el ámbito académico y las empresas biotecnológicas para el desarrollo de genes personalizados y estudios funcionales está acelerando aún más la demanda. Además, se espera que la creación de infraestructuras de investigación avanzadas y centros regionales de innovación genómica mejore la utilización de herramientas de síntesis genética en el ámbito académico.

- Por canal de distribución

Según el canal de distribución, el mercado de síntesis de genes se segmenta en licitación directa, distribución en línea y distribución a través de terceros. El segmento de licitación directa representó la mayor cuota de mercado, con un 49,5 % en 2024, dado que la mayoría de los grandes laboratorios, hospitales y empresas biofarmacéuticas prefieren contratos de adquisición a largo plazo para garantizar un suministro constante y la calidad. Las licitaciones directas facilitan relaciones transparentes con los proveedores, reducen costes mediante compras al por mayor y aseguran el cumplimiento de los plazos de investigación. El creciente uso de sistemas de compras centralizados en proyectos gubernamentales e institucionales sigue consolidando el dominio de este segmento.

Se estima que el segmento de distribución en línea crecerá a la tasa de crecimiento anual compuesta (TCAC) más rápida, del 18,9 %, entre 2025 y 2032, impulsado por la rápida digitalización de los canales de adquisición y la creciente adopción de plataformas de comercio electrónico para suministros de laboratorio. Los sistemas en línea ofrecen comodidad, un procesamiento de pedidos más rápido y seguimiento de entregas en tiempo real. Las empresas emergentes y los pequeños centros de investigación prefieren las plataformas en línea debido al fácil acceso a una amplia gama de productos y a sus precios competitivos, lo que la convierte en una de las áreas de mayor crecimiento del mercado. El surgimiento de mercados electrónicos especializados en biotecnología que ofrecen kits de síntesis personalizados y servicios de entrega por suscripción está impulsando aún más su adopción. Además, las medidas de seguridad de datos mejoradas y la integración de sistemas de recomendación basados en inteligencia artificial están optimizando la eficiencia de las compras y la experiencia del usuario en todos los canales de distribución en línea.

Análisis regional del mercado de síntesis de genes en Norteamérica

- El mercado de síntesis de genes en Norteamérica representó una parte significativa del mercado mundial en 2024.

- Impulsado por una infraestructura biotecnológica avanzada, una elevada inversión en I+D y una fuerte adopción de la biología sintética en la investigación farmacéutica y académica.

- El crecimiento del mercado en la región se ve respaldado además por la presencia de actores líderes y las iniciativas gubernamentales para promover la investigación y la innovación genética.

Perspectivas del mercado estadounidense de síntesis de genes

En 2024, el mercado estadounidense de síntesis genética dominó el sector con la mayor cuota de ingresos (41,6%), impulsado por fuertes inversiones en I+D, la sólida presencia de actores clave como Thermo Fisher Scientific, Twist Bioscience y GenScript, y sus amplias aplicaciones en investigación genómica, fabricación biofarmacéutica y medicina personalizada. Los avances tecnológicos en la síntesis automatizada de ADN y la creciente colaboración entre instituciones académicas y empresas biotecnológicas han impulsado aún más el crecimiento del mercado en el país.

Perspectivas del mercado de síntesis de genes en Canadá

Se prevé que Canadá sea el mercado de síntesis genética de mayor crecimiento en el sector durante el período de pronóstico, impulsado por el aumento de la financiación para la investigación en biotecnología, el auge de las empresas emergentes de biología sintética y la expansión de las colaboraciones con empresas biotecnológicas internacionales líderes. El incremento de las inversiones en innovación en ciencias de la vida y la demanda de servicios personalizados de síntesis genética acelerarán el crecimiento del mercado canadiense y fortalecerán su posición regional.

Cuota de mercado de síntesis de genes en Norteamérica

La industria de la síntesis de genes está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

• Thermo Fisher Scientific Inc. (EE. UU.)

• Twist Bioscience Corporation (EE. UU.)

• GenScript Biotech Corporation (China)

• Integrated DNA Technologies, Inc. (EE. UU.)

• Boster Biological Technology (EE. UU.)

• ProteoGenix (Francia)

• OriGene Technologies, Inc. (EE. UU.)

• Bio Basic Inc. (Canadá)

• ATUM (EE. UU.)

• Eurofins Genomics (Alemania)

• Bioneer Corporation (Corea del Sur)

• Synbio Technologies (EE. UU.)

• SGI-DNA (EE. UU.)

• BlueHeron Biotech (EE. UU.)

• Evonetix Ltd. (Reino Unido)

• DNA2.0 (EE. UU.)

• Theragen Bio (Corea del Sur)

• Genewiz (EE. UU.)

• Takara Bio Inc. (Japón)

• Codex DNA (EE. UU.)

Últimos avances en el mercado de síntesis de genes en Norteamérica

- En mayo de 2023, GenScript Biotech Corporation lanzó su servicio GenTitan Gene Fragments, que utiliza una plataforma basada en chips para la generación de fragmentos de ADN sintético de alto rendimiento, lo que permite una investigación y un desarrollo más rápidos para los sectores biotecnológico y farmacéutico.

- En noviembre de 2023, Twist Bioscience Corporation presentó su servicio Express Genes, que ofrece síntesis génica rápida (≈ 5–7 días hábiles) mediante su plataforma basada en chips de silicio, reduciendo así el tiempo de entrega de construcciones génicas personalizadas en aplicaciones de investigación y biofarmacéuticas.

- En junio de 2024, GenScript (la empresa) lanzó su servicio FLASH Gene, que ofrece síntesis de genes a partir de secuencias (S2P) con un plazo de entrega de cuatro días hábiles y una tarifa plana, con el objetivo de acelerar la innovación en el descubrimiento de fármacos de anticuerpos, la I+D de vacunas y las terapias celulares y génicas.

- En marzo de 2025, Syngoi Technologies y Ribbon Bio GmbH anunciaron una colaboración estratégica para producir ADN sintético de alta pureza a escala de gramos para terapias génicas, combinando las capacidades de fabricación de ADN a gran escala de Syngoi y la plataforma de síntesis génica basada en algoritmos de Ribbon Bio.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.