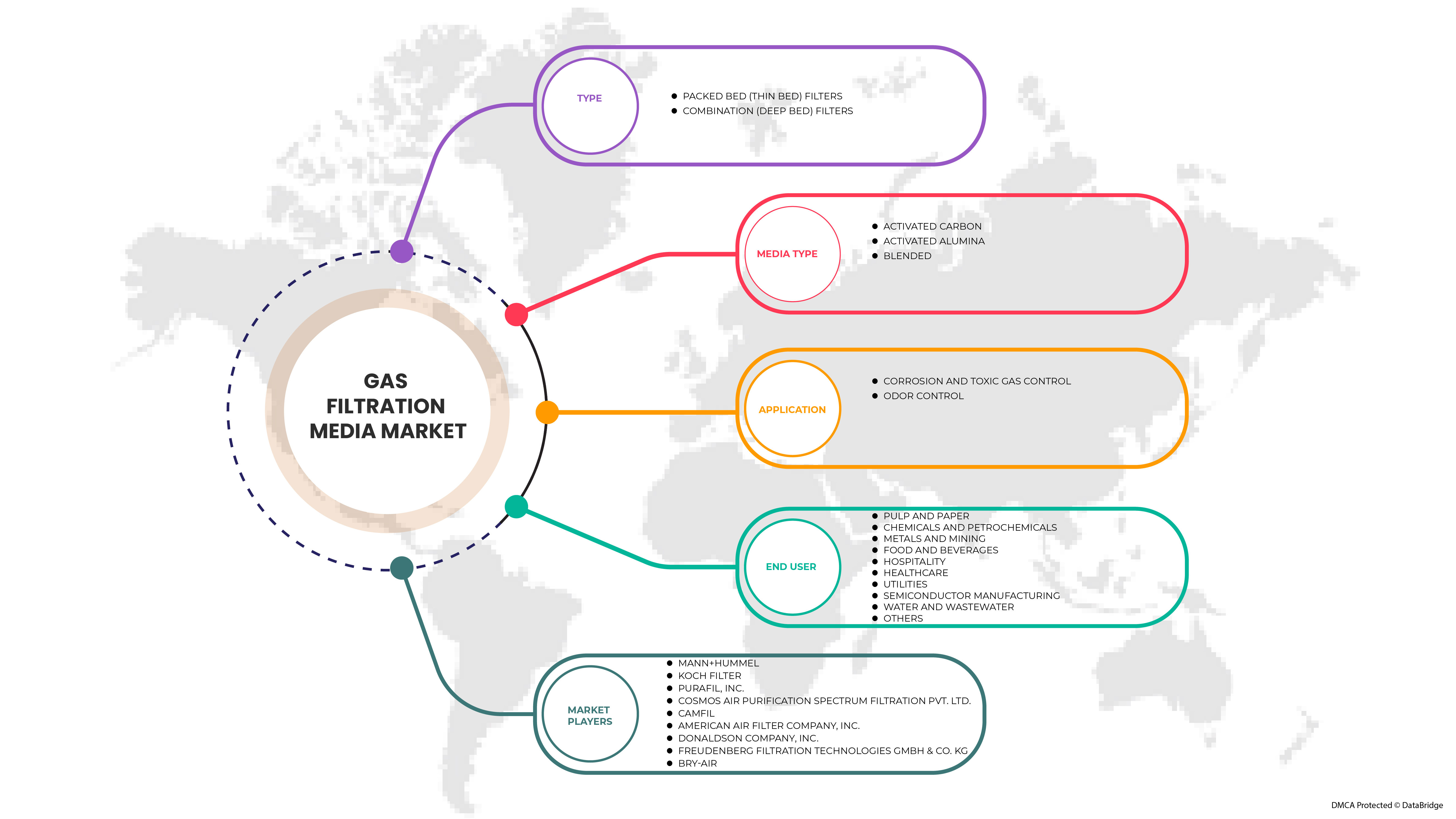

Mercado de medios de filtración de gas de América del Norte , por tipo ( filtros de lecho empacado (lecho delgado) y filtros combinados (lecho profundo) ), tipo de medio ( carbón activado , alúmina activada y mezclado), aplicación (control de corrosión y gases tóxicos y control de olores), usuario final (pulpa y papel, productos químicos y petroquímicos, metales y minería, alimentos y bebidas , hotelería, atención médica, servicios públicos, fabricación de semiconductores , agua y aguas residuales y otros), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de medios de filtración de gas de América del Norte

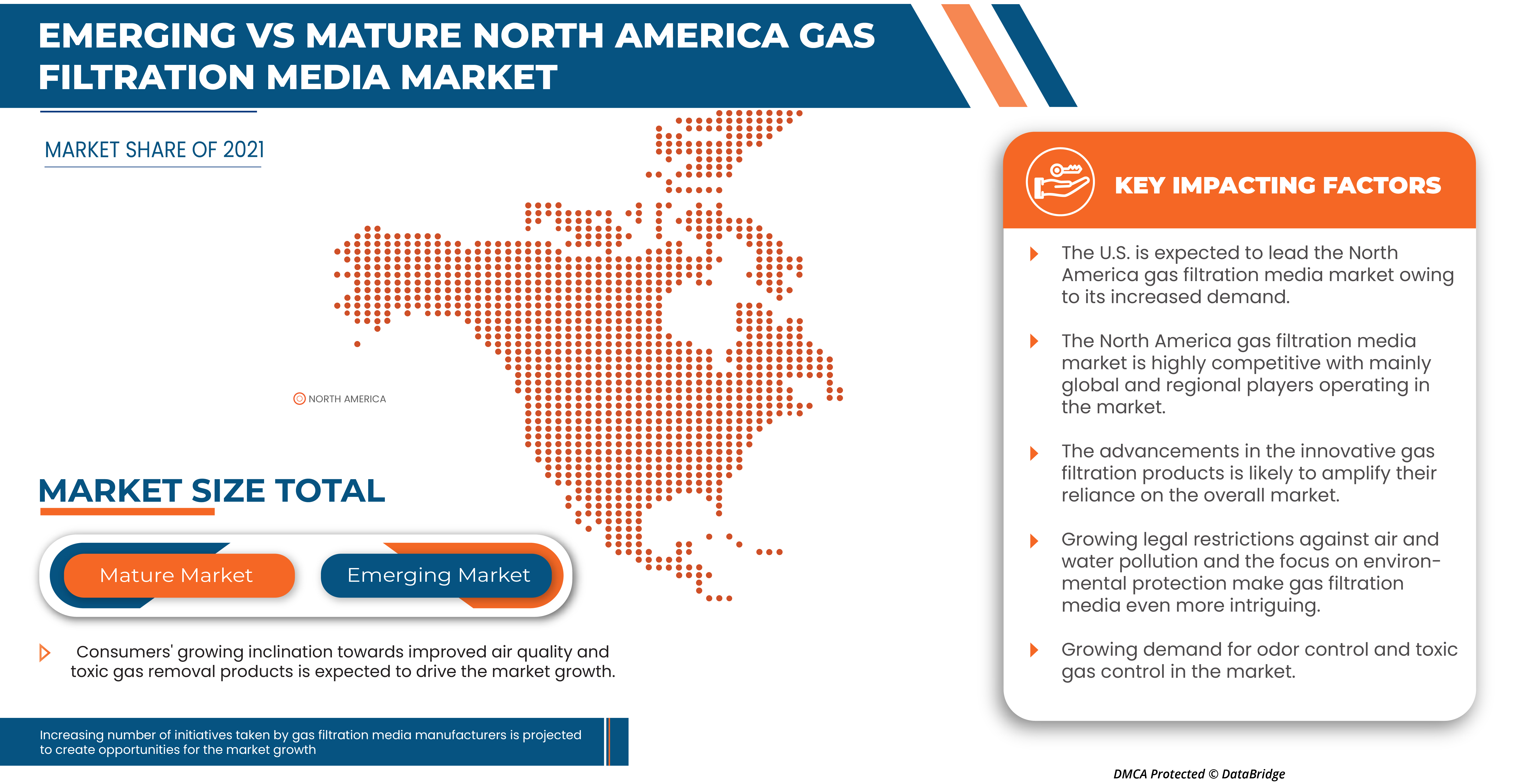

El mercado de medios de filtración de gases de América del Norte está experimentando un crecimiento significativo debido a la cantidad de efectos nocivos asociados con el aire impuro y los gases tóxicos que han aumentado la demanda de medios de filtración de gases en la región. Además, la creciente inclinación de los consumidores, especialmente después de la COVID-19, hacia los productos de filtración de aire para mantenerse saludables y evitar enfermedades. Además, las crecientes restricciones legales contra la contaminación del aire y el agua en la región de América del Norte y el mayor enfoque en la protección del medio ambiente hacen que los medios de filtración de gases sean aún más intrigantes. Por lo tanto, esto ayudará a que el mercado crezca en los próximos años.

Por lo tanto, los fabricantes deben cumplir con las normas y regulaciones cada vez más estrictas que establecen los organismos gubernamentales para vender sus productos en el mercado y garantizar que las demandas de los consumidores impulsen el crecimiento del mercado. Es probable que la falta de conocimientos técnicos en las pequeñas empresas restrinja el crecimiento del mercado en la región.

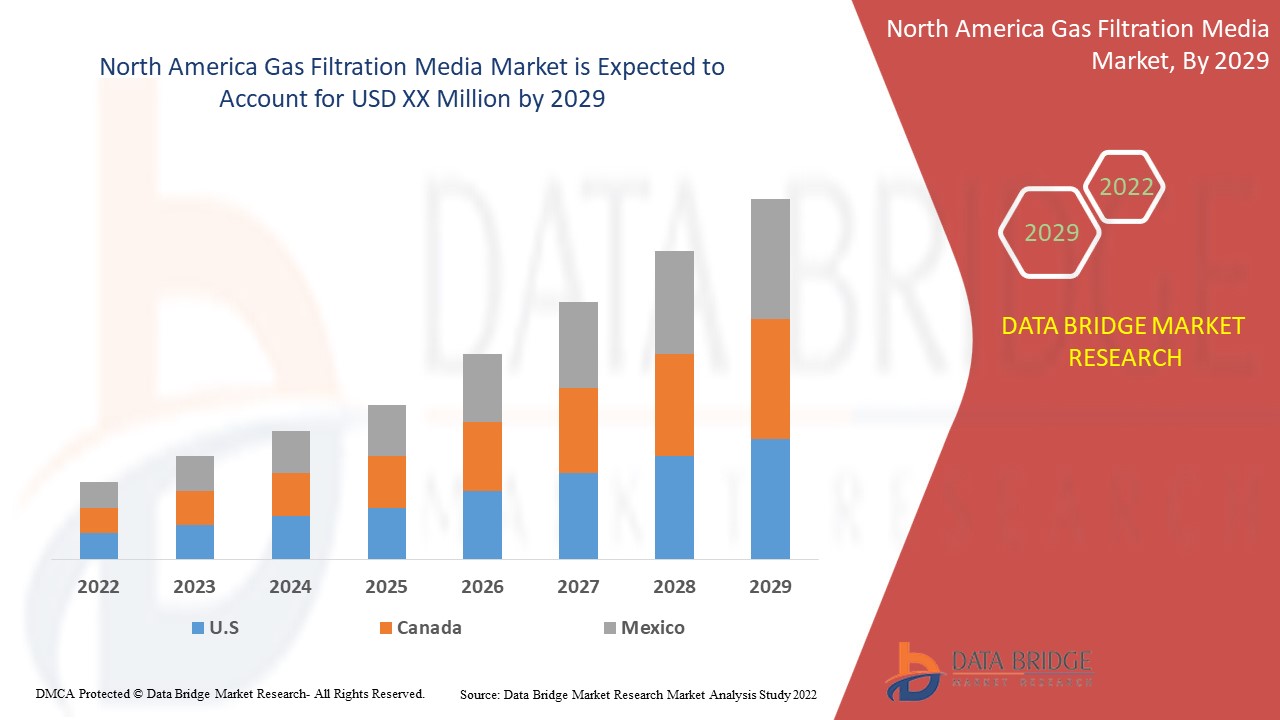

Data Bridge Market Research analiza que el mercado de medios de filtración de gas de América del Norte crecerá a una CAGR del 5,3 % durante el período de pronóstico de 2022 a 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2015) |

|

Unidades cuantitativas |

Ingresos en miles de millones de USD, precios en USD |

|

Segmentos cubiertos |

Por tipo (filtros de lecho empacado (lecho delgado) y filtros combinados (lecho profundo)), tipo de medio (carbón activado, alúmina activada y mezclado), aplicación (control de corrosión y gases tóxicos y control de olores), usuario final (pulpa y papel, productos químicos y petroquímicos, metales y minería, alimentos y bebidas, hotelería, atención médica, servicios públicos, fabricación de semiconductores, agua y aguas residuales, y otros). |

|

Países cubiertos |

Estados Unidos, Canadá y México. |

|

Actores del mercado cubiertos |

Circul-aire Inc., ProMark Associates, Inc., MANN+HUMMEL, Koch Filter, PURAFIL INC., Cosmos Air Purification, Camfil, American Air Filter Company, Inc., Donaldson Company, Inc., Freudenberg Filtration Technologies GmbH & Co. KG, Bry-Air, PureAir Filtration, LLC, MAYAIR MANUFACTURING (M) SDN BHD, Molecular Products Group, Delta Adsorbents, entre otros. |

Definición de mercado

Los medios de filtración en fase gaseosa son aquellos que se utilizan en el proceso de eliminación de contaminantes e impurezas del aire mediante agentes químicos y medios de filtrado especializados. Más específicamente, los permanganatos de sodio o el carbón activado, muy preferidos por una amplia base de consumidores, componen los medios de filtrado en la mayoría de los casos. Por lo general, los materiales absorbentes, también conocidos como sistemas de filtrado en fase gaseosa, se utilizan para absorber contaminantes químicos y eliminarlos del aire interior con precisión. Los lechos empacados y los filtros combinados son los productos más comunes para detener la contaminación del aire. Además, ayudan a eliminar los desechos industriales y los contaminantes gaseosos tóxicos peligrosos que se descargan al medio ambiente, dañando la calidad del aire y poniendo en peligro la salud humana. El filtrado en fase gaseosa es cada vez más importante para aumentar la eficacia de la reducción de gases aberrantes y la regulación de olores en aplicaciones industriales.

Dinámica del mercado de medios de filtración de gas en América del Norte

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Aumentar la conciencia sobre el impacto de la calidad del aire tanto en interiores como en exteriores

En la sociedad, para mantener las actividades humanas, se necesita una enorme cantidad de recursos (como electricidad, agua y alimentos), dada la creciente expansión de la población y el rápido desarrollo de la economía. Como resultado, se han creado diversas formas de contaminación. Debido a su naturaleza generalizada, el daño que causa al medio ambiente y los riesgos para la salud que plantea a las personas, la contaminación del aire es uno de los muchos problemas de contaminación que ha generado una gran preocupación en todo el mundo. Los productos químicos y contaminantes presentes en el aire que lo ensucian pueden tener un impacto negativo en la salud. Las personas son cada vez más conscientes de la importancia de la calidad del aire en interiores y exteriores para evitar estos problemas de salud.

Por ejemplo,

- En mayo de 2021, la Biblioteca Nacional de Medicina publicó un artículo sobre "Conocimiento, percepciones y comportamientos de la calidad del aire exterior entre los niños estadounidenses de 12 a 17 años, 2015-2018". En él se concluía que la conciencia sobre la calidad del aire está aumentando gradualmente.

La sensibilización del público sobre los problemas relacionados con la calidad del aire es esencial para mantener un estilo de vida sostenible en el primer plano de la mente de la gente y también representa una oportunidad para informar e inspirar a la gente a contribuir a la preservación de la naturaleza. Una herramienta importante para generar cambios es la educación.

Por lo tanto, se espera que la creciente conciencia sobre la importancia de la calidad del aire interior y exterior entre las personas impulse el crecimiento del mercado.

- Cambio de tendencia en la calidad del aire

El aire limpio puede reducir el riesgo de cáncer de pulmón, enfermedades cardíacas, accidentes cerebrovasculares y trastornos respiratorios agudos y crónicos como el asma. Los niveles más bajos de contaminación del aire mejoran la salud cardíaca y respiratoria a largo y corto plazo. Las personas son cada vez más conscientes de la importancia del aire puro, lo que se refleja en las tendencias en la calidad del aire. En consecuencia, las personas se sienten atraídas por las tendencias en la calidad del aire.

La contaminación del aire a nivel mundial ha cambiado significativamente como resultado de las medidas de confinamiento adoptadas para contener la epidemia de COVID-19. A nivel mundial, la calidad del aire ha mejorado como resultado del confinamiento estatal relacionado con la pandemia de COVID-19 (SARS-CoV-2) en varios países. La reducción del tráfico vehicular y de la actividad industrial y de construcción contribuyó a una disminución de las emisiones de escape y de otros gases, principalmente de polvo en suspensión. Por lo tanto, este beneficio para la calidad del aire durante el confinamiento hace que las personas sean más conscientes de las tendencias de calidad del aire.

Por ejemplo,

- En junio de 2022, la agencia de protección ambiental de Estados Unidos publicó un informe sobre "Calidad del aire nacional: estado y tendencias de los principales contaminantes del aire". En él se menciona que las emisiones de contaminación del aire todavía tienen un gran impacto en muchos problemas relacionados con la calidad del aire.

Por lo tanto, se espera que esta inclinación cambiante hacia las tendencias de calidad del aire actúe como un motor del crecimiento del mercado.

Oportunidad

-

Las preocupaciones medioambientales conducen a normas más estrictas para garantizar la limpieza del aire y del agua

El gobierno ha implementado regulaciones estrictas para controlar la creciente contaminación ambiental y el calentamiento global. La exposición excesiva al óxido de nitrógeno y al dióxido de azufre puede agravar o provocar el desarrollo de asma y enfermedades respiratorias. Las dos sustancias también ayudan a crear lluvia ácida, que daña el ecosistema al disminuir la liberación de dióxido de carbono (CO2), óxidos de azufre, óxidos de nitrógeno y partículas en suspensión a la atmósfera. Se están introduciendo normas de emisiones automotrices en todo el mundo. Los filtros de fase gaseosa pueden eliminar contaminantes gaseosos y carbonos orgánicos volátiles del aire. La búsqueda de energía más ecológica es otro factor que impulsa el mercado de la filtración. Además, se espera que las crecientes preocupaciones sobre la contaminación ambiental y su efecto tóxico sobre la salud humana impulsen el crecimiento del mercado. Además, la aprobación por parte del gobierno de normas estrictas para la emisión de gases al medio ambiente y la promoción del uso de equipos de filtración en industrias y hogares está impulsando el crecimiento del mercado.

Por ejemplo,

-

En noviembre de 2021, según Auto Express, en los coches de gasolina y diésel producidos en serie, la norma de emisiones Euro 6 busca reducir los niveles de emisiones nocivas de los escapes de los turismos y furgonetas.

-

En enero de 2020, según la Comisión Europea, en respuesta a las crecientes preocupaciones ambientales, incluidas las causadas en parte por las emisiones nocivas de los barcos, la Organización Marítima Internacional (OMI) aplicará un nuevo límite global de azufre en la composición del combustible del 0,5 por ciento desde el 3,5 por ciento actual.

-

En enero de 2022, según la Convención de la Farmacopea de los Estados Unidos, los requisitos incluyen el monitoreo y las mediciones regulares de partículas para garantizar que los lugares con mayor potencial de riesgo cumplan con los estándares de limpieza del aire. La USP 797 establece pautas para prevenir daños a los pacientes por preparaciones estériles compuestas (CSP) contaminadas o fabricadas incorrectamente

Por lo tanto, se anticipa que el uso de medios de filtración de gases para la purificación del aire y la investigación y desarrollos tecnológicos modernos brindarán oportunidades lucrativas para el mercado de medios de filtración de gases de América del Norte.

Restricciones/Desafíos

- Precios fluctuantes

Los altos costos de los productos de filtración se deben a los altos costos de I+D, producción y fabricación. El aumento de la carga de los precios afecta las preferencias de los consumidores, ya que eligen sustitutos para la filtración de aire debido a las dificultades para costear las soluciones de filtración de gases. Los altos precios pueden desafiar a los fabricantes a equilibrar sus costos de I+D, producción, inversiones y otros. Además, los consumidores siempre se decantan por productos con bajos costos y más beneficios. La invasión de Ucrania por parte de Rusia ha contribuido a la perturbación del mercado, y los problemas climáticos y de la cadena de suministro han complicado la entrega en algunos mercados. Los altos precios de las materias primas son un desafío en el mercado de medios de filtración de gases de América del Norte.

Por ejemplo,

- En diciembre de 2021, Freudenberg Performance Materials aumentó los precios de los materiales de alto rendimiento no tejidos para aplicaciones de filtración. Los precios de las aplicaciones de filtración aumentan en dos dígitos según los tipos de productos.

- En abril de 2020, Universal Air Filter (UAF) anunció un aumento de precios para los clientes de todas las categorías. Los precios de la mayoría de los productos UAF aumentaron a nivel mundial entre un 11 y un 15 por ciento, según la complejidad y las especificaciones del producto.

Por lo tanto, los altos precios de los medios de filtración pueden inclinar a los consumidores hacia otros productos, lo que puede afectar al mercado y, por lo tanto, puede desafiar el crecimiento del mercado. Sin embargo, hoy en día, los consumidores son conscientes de la amplia gama de actividades y el efecto de los medios de filtración de gases en el control de gases tóxicos y olores y los compran a pesar de los altos precios.

Impacto posterior a la COVID-19 en el mercado de medios de filtración de gas de América del Norte

Después de la pandemia, la demanda de medios de filtración de gas ha aumentado, ya que no habrá más restricciones de movimiento, por lo que el suministro de productos será fácil. Además, la creciente tendencia a utilizar productos de filtración de aire y agua puede impulsar el crecimiento del mercado.

La mayor demanda de medios de filtración de gases permite a los fabricantes lanzar productos innovadores y multifuncionales, lo que en última instancia aumenta la demanda de medios de filtración de gases y ha ayudado a que el mercado crezca.

Además, la alta demanda de productos de medios de filtración de gases impulsará el crecimiento del mercado. Además, la demanda de productos que puedan purificar el aire y eliminar gases tóxicos después de la pandemia de COVID-19 ha aumentado a medida que los consumidores estaban más preocupados por su salud, lo que resultó en un crecimiento del mercado. Además, se espera que el interés de los consumidores en nuevas tecnologías y productos multiusos impulse el crecimiento del mercado de medios de filtración de gases de América del Norte.

Acontecimientos recientes

- En diciembre de 2021, Camfil anunció sus planes de abrir una nueva planta de fabricación en Texas. La nueva planta producirá una gama completa de productos de filtración de aire.

- En octubre de 2021, Freudenberg Filtration Technologies anunció la apertura de una nueva planta de fabricación en China. La nueva base mundial de I+D y fabricación fabricará filtros purificadores de aire y otros productos.

Alcance del mercado de medios de filtración de gas en América del Norte

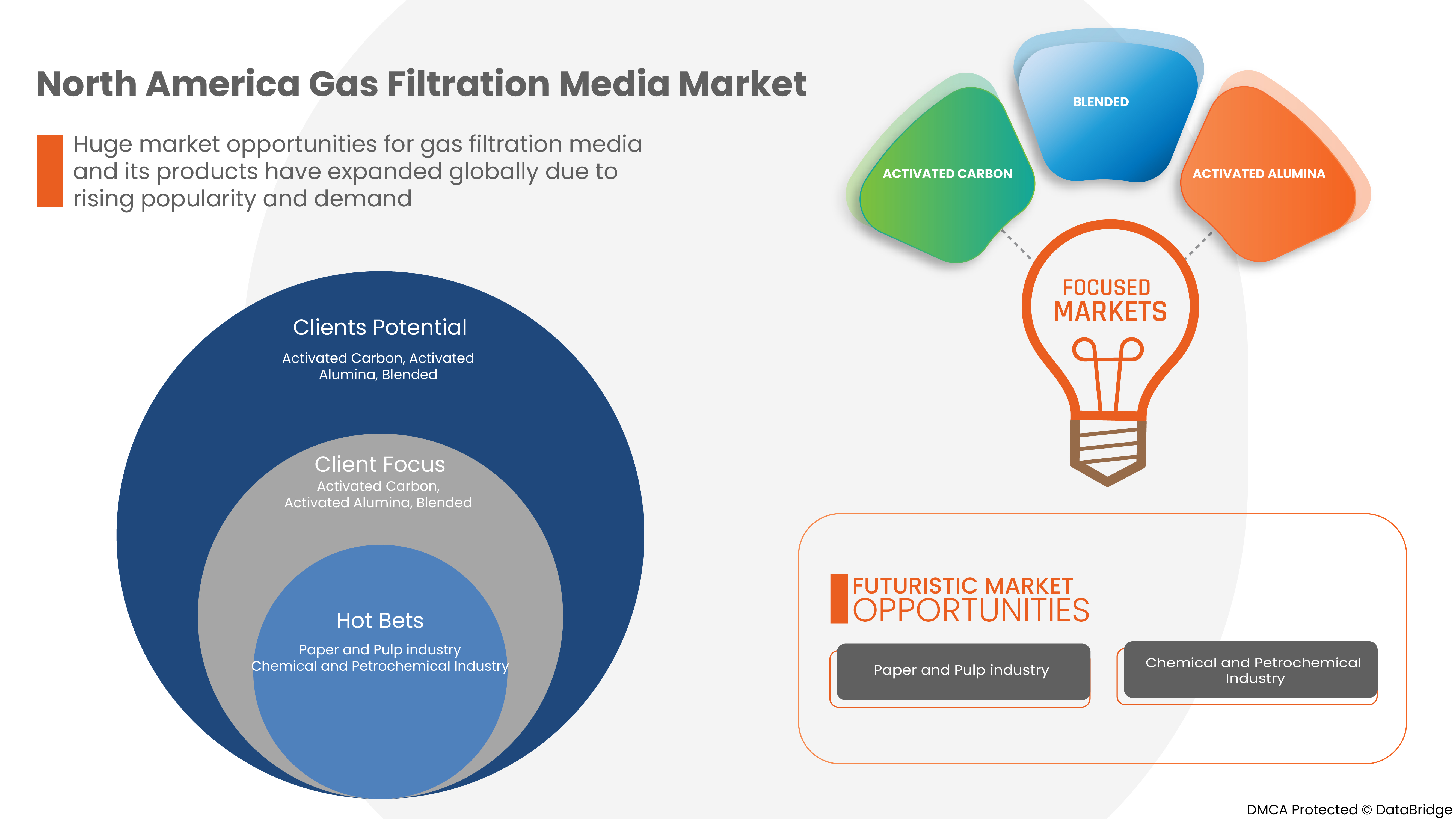

El mercado de medios de filtración de gas de América del Norte está segmentado por tipo, tipo de medio, aplicación y usuario final. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Filtros de lecho empacado (lecho delgado)

- Filtros combinados (de lecho profundo)

Según el tipo, el mercado de medios de filtración de gas de América del Norte está segmentado en filtros de lecho empacado (lecho delgado) y filtros combinados (lecho profundo).

Tipo de medio

- Carbón activado

- Alúmina activada

- Mezclado

Sobre la base del tipo de medio, el mercado de medios de filtración de gas de América del Norte está segmentado en carbón activado, alúmina activada y mezclado.

Solicitud

- Control de corrosión y gases tóxicos

- Control de olores

Sobre la base de la aplicación, el mercado de medios de filtración de gas de América del Norte está segmentado en control de corrosión y gases tóxicos y control de olores.

Usuario final

- Pulpa y papel

- Productos químicos y petroquímicos

- Metales y minería

- Alimentos y bebidas

- Hospitalidad

- Cuidado de la salud

- Utilidades

- Fabricación de semiconductores

- Agua y aguas residuales

- Otros

Sobre la base del usuario final, el mercado de medios de filtración de gas de América del Norte está segmentado en pulpa y papel, productos químicos y petroquímicos, metales y minería, alimentos y bebidas, hotelería, atención médica, servicios públicos, fabricación de semiconductores, agua y aguas residuales, y otros.

Análisis y perspectivas regionales del mercado de medios de filtración de gas de América del Norte

Se analiza el mercado de medios de filtración de gas de América del Norte y se proporcionan información y tendencias del tamaño del mercado según el país, el tipo, el tipo de medio, la aplicación y el usuario final, como se mencionó anteriormente.

Algunos de los países cubiertos en el informe sobre el mercado de filtración de gas de América del Norte son Estados Unidos, Canadá y México.

Se espera que Estados Unidos domine el mercado de medios de filtración de gas de América del Norte en términos de participación de mercado e ingresos. Se estima que mantendrá su dominio durante el período de pronóstico debido a las crecientes preocupaciones sanitarias sobre la calidad del aire y el efecto de los gases tóxicos en la salud humana en la región de América del Norte.

La sección de regiones del informe también proporciona factores individuales que impactan en el mercado y cambios en las regulaciones que afectan las tendencias actuales y futuras del mercado. Los puntos de datos, como las ventas de productos nuevos y de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación, son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para cada país. Además, se consideran la presencia y disponibilidad de marcas norteamericanas y los desafíos que enfrentan debido a la alta competencia de las marcas locales y nacionales y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los medios de filtración de gas en América del Norte

El mercado de medios de filtración de gas de América del Norte proporciona detalles sobre los competidores. Los detalles incluyen una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores solo están relacionados con el enfoque de la empresa en el mercado de medios de filtración de gas de América del Norte.

Algunos de los principales actores que operan en el mercado de medios de filtración de gas de América del Norte son Circul-aire Inc., ProMark Associates, Inc., MANN+HUMMEL, Koch Filter, PURAFIL INC., Cosmos Air Purification, Camfil, American Air Filter Company, Inc., Donaldson Company, Inc., Freudenberg Filtration Technologies GmbH & Co. KG, Bry-Air, PureAir Filtration, LLC, MAYAIR MANUFACTURING (M) SDN BHD, Molecular Products Group, Delta Adsorbents, entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen cuadrículas de posicionamiento de proveedores, análisis de la línea de tiempo del mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de la participación de mercado de la empresa, estándares de medición, América del Norte frente a la región y análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 OVERVIEW OF THE NORTH AMERICA GAS FILTRATION MEDIA MARKET

1.3 LIMITATIONS

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 IMPORT-EXPORT ANALYSIS - NORTH AMERICA GAS FILTRATION MEDIA MARKET

4.4 LIST OF KEY BUYERS_NORTH AMERICA GAS FILTRATION MEDIA MARKET

4.5 PRICE ANALYSIS - NORTH AMERICA GAS FILTRATION MEDIA MARKET

4.6 PRODUCTION CONSUMPTION ANALYSIS- NORTH AMERICA GAS FILTRATION MEDIA MARKET

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.8 VENDOR SELECTION CRITERIA

4.9 RAW MATERIAL PRODUCTION COVERAGE- NORTH AMERICA GAS FILTRATION MEDIA MARKET

5 CLIMATE CHANGE SCENARIO

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING AWARENESS TOWARD THE IMPACT OF BOTH INDOOR AND OUTDOOR AIR QUALITY

7.1.2 SHIFTING INCLINATION TOWARDS AIR QUALITY TRENDS

7.1.3 RISING SPENDING ON FILTRATION OF POISONOUS, CORROSIVE, AND ODOR-PRODUCING GASES IN MANY INDUSTRIES

7.1.4 GROWING HEALTH CONSCIOUSNESS AMONG PEOPLE

7.2 RESTRAINTS

7.2.1 INCREASING DEMAND FOR SUBSTITUTES OF THE GAS FILTERING MEDIA

7.2.2 LIMITED R&D SPENDING

7.3 OPPORTUNITIES

7.3.1 ENVIRONMENT CONCERNS LEADING TO MORE STRINGENT REGULATIONS FOR CLEAN AIR AND WATER

7.3.2 INCREASE IN AWARENESS ABOUT IMPURE AIR QUALITY ON HUMAN HEALTH

7.4 CHALLENGES

7.4.1 FLUCTUATING PRICES

7.4.2 DECREASED ECONOMIC GROWTH IN END USER INDUSTRY

8 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY TYPE

8.1 OVERVIEW

8.2 PACKED BED (THIN BED) FILTERS

8.3 COMBINATION (DEEP BED) FILTERS

9 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY MEDIA TYPE

9.1 OVERVIEW

9.2 ACTIVATED CARBON

9.3 ACTIVATED ALUMINA

9.4 BLENDED

10 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CORROSION AND TOXIC GAS

10.3 ODOR CONTROL

11 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY END USER

11.1 OVERVIEW

11.2 PULP AND PAPER

11.2.1 PACKED BED (THIN BED) FILTERS

11.2.2 COMBINATION (DEEP BED) FILTERS

11.3 CHEMICALS AND PETROCHEMICALS

11.3.1 PACKED BED (THIN BED) FILTERS

11.3.2 COMBINATION (DEEP BED) FILTERS

11.4 METALS AND MINING

11.4.1 PACKED BED (THIN BED) FILTERS

11.4.2 COMBINATION (DEEP BED) FILTERS

11.5 FOOD AND BEVERAGES

11.5.1 PACKED BED (THIN BED) FILTERS

11.5.2 COMBINATION (DEEP BED) FILTERS

11.6 HOSPITALITY

11.6.1 PACKED BED (THIN BED) FILTERS

11.6.2 COMBINATION (DEEP BED) FILTERS

11.7 HEALTHCARE

11.7.1 PACKED BED (THIN BED) FILTERS

11.7.2 COMBINATION (DEEP BED) FILTERS

11.8 UTILITIES

11.8.1 PACKED BED (THIN BED) FILTERS

11.8.2 COMBINATION (DEEP BED) FILTERS

11.9 SEMICONDUCTOR MANUFACTURING

11.9.1 PACKED BED (THIN BED) FILTERS

11.9.2 COMBINATION (DEEP BED) FILTERS

11.1 WATER AND WASTEWATER

11.10.1 PACKED BED (THIN BED) FILTERS

11.10.2 COMBINATION (DEEP BED) FILTERS

11.11 OTHERS

11.11.1 PACKED BED (THIN BED) FILTERS

11.11.2 COMBINATION (DEEP BED) FILTERS

12 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 CAMFIL

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 FREUDENBERG FILTRATION TECHNOLOGIES GMBH & CO. KG (2021)

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 AMERICAN AIR FILTER COMPANY, INC

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 DONALDSON COMPANY, INC. (2021)

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 BRY-AIR

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 AQOZA

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 BIOCONSERVACION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 CIRCUL-AIRE INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 COSMOS AIR PURIFICATION

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 DELTA ADSORBENTS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 GOPANI

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 KOCH FILTER

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 MANN+HUMMEL

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 MAYAIR MANUFACTURING (M) SDN BHD

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 MOLECULAR PRODUCTS GROUP

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 PROMARK ASSOCIATES, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PUREAIR FILTRATION, LLC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 PURAFIL, INC.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 SPECTRUM FILTRATION PVT. LTD.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT OF ACTIVATED CARBON, 2020-2021, IN USD MILLION

TABLE 2 EXPORT OF ACTIVATED CARBON, 2020-2021, IN USD MILLION

TABLE 3 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY MEDIA TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA PULP AND PAPER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CHEMICALS AND PETROCHEMICALS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA METALS AND MINING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA FOOD AND BEVERAGES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA HOSPITALITY IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA HEALTHCARE IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA UTILITIES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SEMICONDUCTOR MANUFACTURING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA WATER AND WASTEWATER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA FILTRATION MEDIA MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY MEDIA TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA PULP AND PAPER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA CHEMICALS AND PETROCHEMICALS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA METALS AND MINING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA FOOD AND BEVERAGES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA HOSPITALITY IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA HEALTHCARE IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA UTILITIES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA SEMICONDUCTOR MANUFACTURING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA WATER AND WASTEWATER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA OTHERS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 U.S. GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 U.S. GAS FILTRATION MEDIA MARKET, BY MEDIA TYPE, 2020-2029 (USD MILLION)

TABLE 34 U.S. GAS FILTRATION MEDIA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 35 U.S. GAS FILTRATION MEDIA MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 36 U.S. PULP AND PAPER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 U.S. CHEMICALS AND PETROCHEMICALS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 U.S. METALS AND MINING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.S. FOOD AND BEVERAGES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 U.S. HOSPITALITY IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.S. HEALTHCARE IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.S. UTILITIES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.S. SEMICONDUCTOR MANUFACTURING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.S. WATER AND WASTEWATER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.S. OTHERS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 CANADA GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 CANADA GAS FILTRATION MEDIA MARKET, BY MEDIA TYPE, 2020-2029 (USD MILLION)

TABLE 48 CANADA GAS FILTRATION MEDIA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 CANADA GAS FILTRATION MEDIA MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 50 CANADA PULP AND PAPER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CANADA CHEMICALS AND PETROCHEMICALS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 CANADA METALS AND MINING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 CANADA FOOD AND BEVERAGES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 CANADA HOSPITALITY IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 CANADA HEALTHCARE IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 CANADA UTILITIES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 CANADA SEMICONDUCTOR MANUFACTURING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 CANADA WATER AND WASTEWATER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CANADA OTHERS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 MEXICO GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 MEXICO GAS FILTRATION MEDIA MARKET, BY MEDIA TYPE, 2020-2029 (USD MILLION)

TABLE 62 MEXICO GAS FILTRATION MEDIA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 MEXICO GAS FILTRATION MEDIA MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 64 MEXICO PULP AND PAPER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 MEXICO CHEMICALS AND PETROCHEMICALS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 MEXICO METALS AND MINING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 MEXICO FOOD AND BEVERAGES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 MEXICO HOSPITALITY IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 MEXICO HEALTHCARE IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO UTILITIES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO SEMICONDUCTOR MANUFACTURING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MEXICO WATER AND WASTEWATER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO OTHERS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA GAS FILTRATION MEDIA MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA GAS FILTRATION MEDIA MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA GAS FILTRATION MEDIA MARKET : DROC ANALYSIS

FIGURE 4 NORTH AMERICA GAS FILTRATION MEDIA MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA GAS FILTRATION MEDIA MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA GAS FILTRATION MEDIA MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA GAS FILTRATION MEDIA MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA GAS FILTRATION MEDIA MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA GAS FILTRATION MEDIA MARKET: SEGMENTATION

FIGURE 10 SHIFTING INCLINATION TOWARD AIR QUALITY TRENDS AMONG PEOPLE IS EXPECTED TO DRIVE THE NORTH AMERICA GAS FILTRATION MEDIA MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 PACKED BEAD (THIN BED) FILTERS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA GAS FILTRATION MEDIA MARKET IN THE FORECAST PERIOD 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA GAS FILTRATION MEDIA MARKET

FIGURE 13 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY TYPE, 2021

FIGURE 14 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY MEDIA TYPE, 2021

FIGURE 15 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY APPLICATION, 2021

FIGURE 16 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY END USER, 2021

FIGURE 17 NORTH AMERICA GAS FILTRATION MEDIA MARKET: SNAPSHOT (2021)

FIGURE 18 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY COUNTRY (2021)

FIGURE 19 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY COUNTRY (2022 & 2029)

FIGURE 20 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY COUNTRY (2021 & 2029)

FIGURE 21 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY TYPE (2022-2029)

FIGURE 22 NORTH AMERICA GAS FILTRATION MEDIA MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.