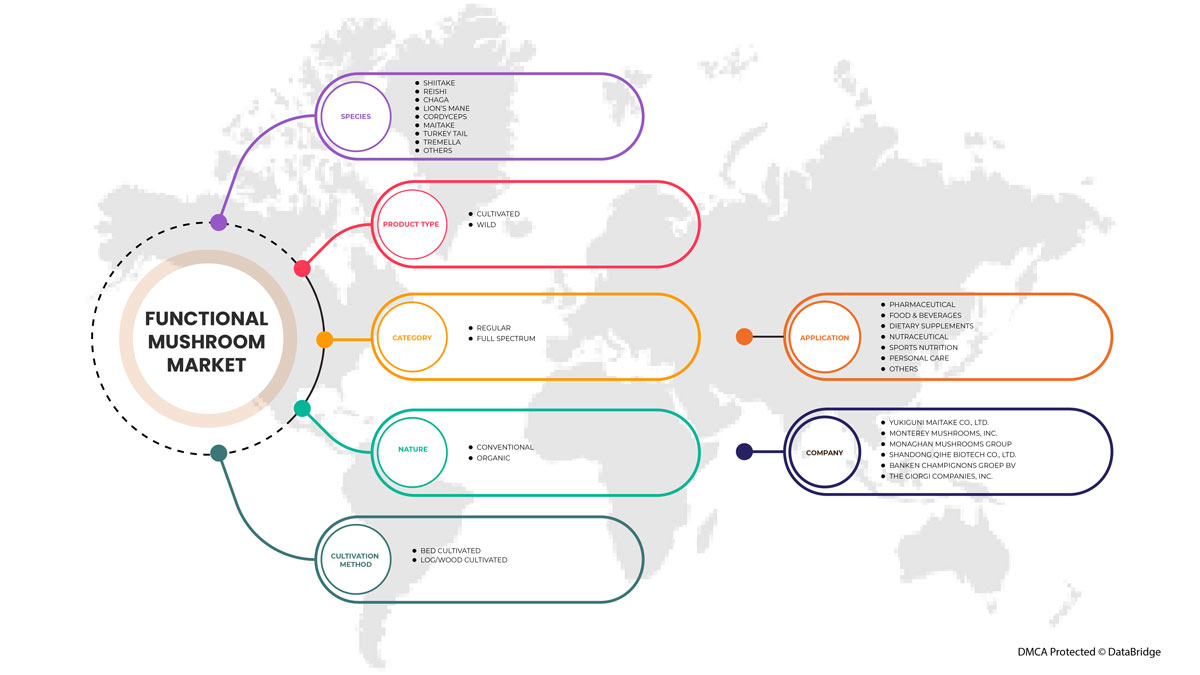

North America Functional Mushroom Market, By Species (Shiitake, Reishi, Chaga, Lion's Mane, Cordyceps, Maitake, Turkey Tail, Tremella, Others), Product Type (Cultivated, Wild), Category (Regular, Full Spectrum), Nature (Conventional, Organic), Cultivation Method (Bed Cultivated, Log/Wood Cultivated), Application (Pharmaceutical, Food & Beverages, Dietary Supplements, Nutraceutical, Sports Nutrition, Personal Care, Others) Industry Trends and Forecast to 2029

North America Functional Mushroom Market Analysis and Insights

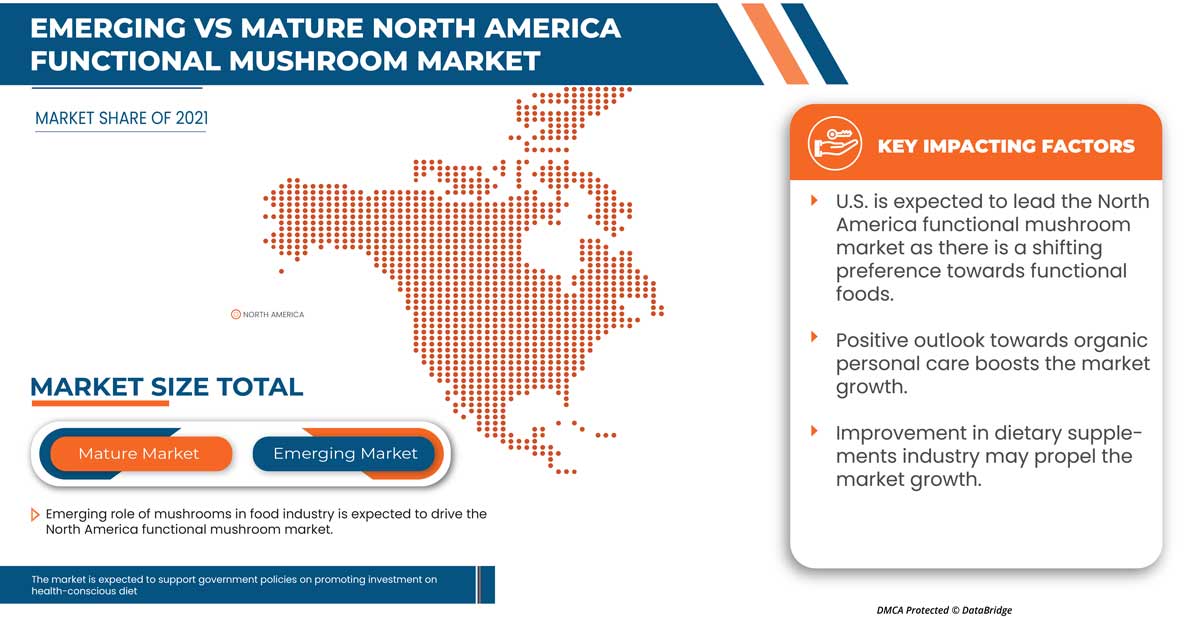

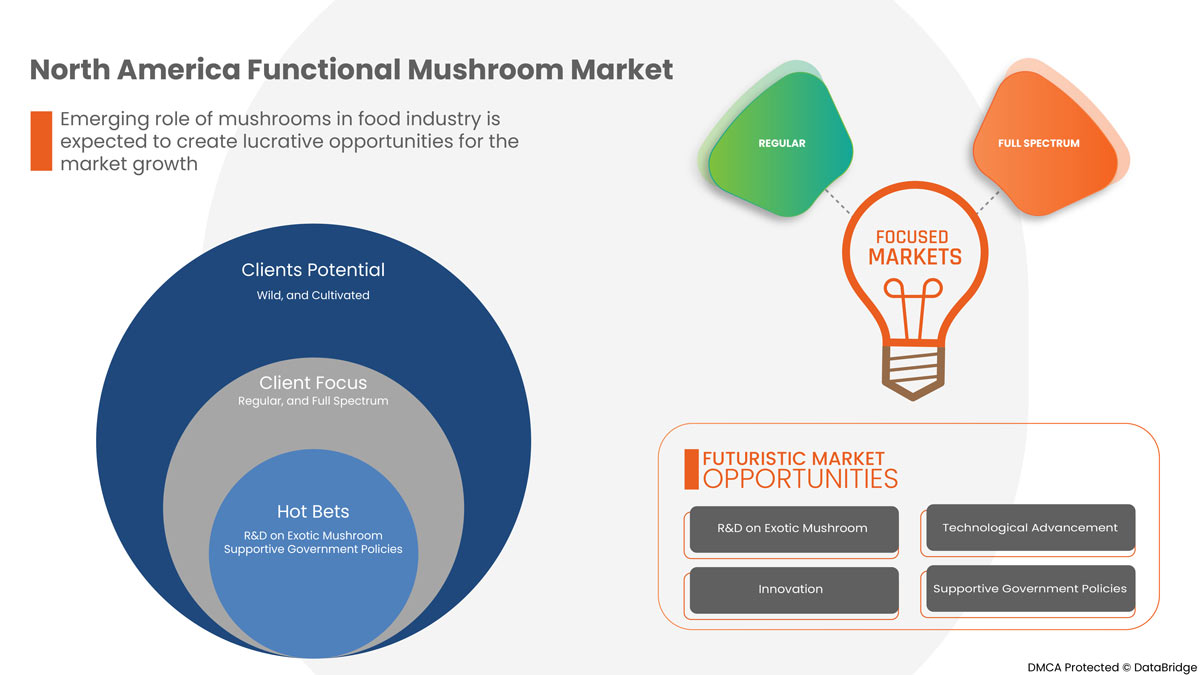

The North America functional mushroom market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.2% in the forecast period of 2022 to 2029 and is expected to reach USD 174,100.93 thousand by 2029. The major factor driving the growth of the North America functional mushroom market is shifting preference towards functional foods, positive outlook towards organic personal care, improvement in the dietary supplements industry, increasing acceptability of mushroom for medicinal properties, and the emerging role of mushrooms in the food industry. The rising alternatives for proteins may hamper the market growth.

The North America functional mushroom market provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousands |

|

Segments Covered |

By Species (Shiitake, Reishi, Chaga, Lion's Mane, Cordyceps, Maitake, Turkey Tail, Tremella, Others), Product Type (Cultivated, Wild), Category (Regular, Full Spectrum), Nature (Conventional, Organic), Cultivation Method (Bed Cultivated, Log/Wood Cultivated), Application (Pharmaceutical, Food & Beverages, Dietary Supplements, Nutraceutical, Sports Nutrition, Personal Care, Others). |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Monterey Mushrooms, Inc., Monaghan Mushrooms Group, Shandong Qihe Biotech Co., Ltd., The Giorgi Companies, Inc., Nammex, Shogun Maitake, Rain Forest Mushrooms, Mushroom King Farm, Farming Fungi, LLC, among others. |

Market Definition

Los hongos funcionales están repletos de antioxidantes y valor nutricional, y tienen muchas propiedades saludables. Estos hongos han sido ampliamente utilizados debido a sus propiedades medicinales y beneficios como superalimentos . Los hongos funcionales ayudan a fortalecer el sistema inmunológico y también se utilizan como una opción dietética baja en calorías y alta en proteínas, lo que es excelente para quienes carecen de proteínas en su dieta, además de proporcionar múltiples vitaminas y minerales esenciales. Los hongos más utilizados con fines medicinales son el shiitake y el reishi, entre otros.

Shiitake

La demanda de shiitake está aumentando en el mercado de hongos funcionales, ya que tiene un sabor rico y sabroso y diversos beneficios para la salud. Los compuestos del shiitake pueden ayudar a combatir el cáncer, reforzar la inmunidad y favorecer la salud cardíaca.

hongo reishi

La demanda de reishi está aumentando en el mercado de hongos funcionales debido a sus propiedades medicinales. También se puede utilizar en el café y el cacao para mejorar el sabor y la salud.

Dinámica del mercado de hongos funcionales en América del Norte

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Cambio en la preferencia del consumidor hacia los alimentos funcionales

Los alimentos funcionales tienen un conjunto específico de nutrientes añadidos, como fibra, probióticos, prebióticos, minerales y otros; además, este tipo de alimentos ayudan a superar las deficiencias nutricionales. Los alimentos funcionales también son útiles para reducir el riesgo de enfermedades crónicas. Las crecientes preocupaciones por la salud debido a un estilo de vida que cambia rápidamente, especialmente en las zonas urbanas, están aumentando en gran medida la preferencia de los consumidores por alimentos saludables y funcionales. Además, en la situación de COVID-19, los consumidores buscan ingredientes alimentarios funcionales que ayuden a aumentar su nivel de inmunidad, por lo que este escenario repercute positivamente en el aumento de la preferencia por los hongos funcionales.

- Perspectiva positiva hacia el cuidado personal orgánico

Los hongos funcionales tienen sus beneficios específicos y todos ellos actúan para equilibrar los niveles de energía, fortalecer la función inmunológica, facilitar la digestión y mejorar el brillo natural de la piel. Los hongos están repletos de polifenoles, polisacáridos, betaglucanos y propiedades antioxidantes. Juntos y por separado, todos estos compuestos ayudan a reforzar el sistema inmunológico. Los hongos también aportan una gran cantidad de fibra dietética, lo que favorece una digestión saludable y aumenta las bacterias intestinales beneficiosas en el sistema digestivo. En cuanto a los beneficios para mejorar la piel, los hongos funcionales tienen una cantidad desbordante de propiedades antioxidantes. Una piel radiante también es el resultado de la salud de todo el cuerpo. Cualquier disfunción en el sistema inmunológico o la digestión se manifestará primero en la piel. Apoyar el bienestar de todo el cuerpo con hongos funcionales suele dar como resultado una tez suave. Los ingredientes de los hongos se abren camino en el cuidado de la piel y los suplementos a medida que perdura la búsqueda del bienestar por parte de los consumidores. Las empresas de belleza y bienestar están aprovechando cada vez más diferentes tipos de hongos, incluidos el reishi, la melena de león, la cola de pavo y el chaga, entre otros.

- Aumento de la aceptabilidad del hongo por sus propiedades medicinales

Los hongos son un componente reconocido de la dieta humana, con propiedades medicinales versátiles. Algunos hongos son populares en todo el mundo por sus propiedades nutricionales y terapéuticas. Los hongos han sido valorados durante mucho tiempo como un alimento altamente medicinal y nutricional por muchas sociedades en todo el mundo. Los hongos se consumen como medicina en los países asiáticos, y se han realizado muchos trabajos de investigación sobre aspectos medicinales. Una gran variedad de hongos se han utilizado tradicionalmente en muchas culturas diferentes para el mantenimiento de la salud y la prevención y el tratamiento de enfermedades a través de sus propiedades inmunomoduladoras y antineoplásicas. En la última década, el interés en el potencial farmacéutico de los hongos ha aumentado rápidamente, y se ha sugerido que muchos hongos son como minifábricas farmacéuticas que producen compuestos con propiedades biológicas milagrosas.

- El papel emergente de los hongos en la industria alimentaria

Los consumidores están cada vez más interesados en productos alimenticios para músculos nutritivos, seguros y saludables con un contenido reducido de sal y grasa que beneficien su bienestar. Por lo tanto, los procesadores de alimentos buscan constantemente ingredientes bioactivos naturales que ofrezcan beneficios para la salud más allá de sus valores nutricionales sin afectar la calidad de los productos. Los hongos se consideran componentes alimenticios saludables de próxima generación. Debido a su bajo contenido de grasa, proteínas de alta calidad, fibra dietética y la presencia de nutracéuticos, son los preferidos idealmente en la formulación de alimentos funcionales bajos en calorías. Existe una tendencia creciente a fortificar los alimentos para músculos con hongos para aprovechar sus bondades en términos de valores nutricionales, bioactivos y terapéuticos. La incorporación de hongos en los alimentos para músculos asume importancia. Los consumidores lo aceptan favorablemente porque su estructura fibrosa imita la textura de los análogos de la carne, ofreciendo un sabor único y un sabor umami.

Oportunidades

- Aumento del gasto en I+D en variantes de hongos exóticos

La demanda de variedades exóticas de hongos ha ido en aumento, impulsada por la creciente tendencia a comer alimentos saludables y naturales. Los hongos ostra, enoki y shiitake son algunos ejemplos de hongos exóticos populares. La demanda de hongos exóticos ha aumentado considerablemente en los últimos años. Se pueden enlatar, secar o envasar congelados, incluido su uso en la industria alimentaria en encurtidos y salsas de hongos.

- Avances tecnológicos e innovaciones en hongos funcionales

Los avances tecnológicos en la industria de los hongos han dado lugar a un aumento de la capacidad de producción, a innovaciones en las tecnologías de cultivo, a mejoras en los productos finales derivados de los hongos y a la utilización de las cualidades naturales de los hongos para obtener beneficios medioambientales. Las tecnologías de cultivo utilizadas en todo el mundo para las especies de hongos están aumentando en las industrias alimentaria, de procesamiento y farmacológica debido al rápido desarrollo del cultivo de hongos.

- Políticas gubernamentales de apoyo para promover la inversión en una alimentación saludable

El consumo de una dieta saludable a lo largo de la vida ayuda a prevenir la malnutrición en todas sus formas, así como una serie de enfermedades no transmisibles (ENT) y afecciones. Sin embargo, el aumento de la producción de alimentos procesados, la rápida urbanización y los cambios en los estilos de vida han modificado los patrones alimentarios. Ahora las personas consumen más alimentos con alto contenido de energía, grasas, azúcares libres y sal/sodio, y muchas personas no comen suficiente fruta, verduras y otras fibras dietéticas, como los cereales integrales. La inversión de los gobiernos, el sector privado y otras partes interesadas pertinentes debería respaldar la capacitación de los productores, manipuladores y procesadores de alimentos para que apliquen medidas nacionales, científicas y basadas en la evidencia que permitan proporcionar alimentos seguros y al mismo tiempo conservar su contenido de nutrientes.

Restricciones/Desafíos

- Fuerte alcance de mercado de otros sustitutos de proteínas

El aumento de la disponibilidad de sustitutos de proteínas está impulsado principalmente por factores como la creciente urbanización, la innovación en tecnología alimentaria, el alto valor nutricional y un aumento de la sostenibilidad ambiental con la producción y el consumo de proteínas alternativas.

- Precios altos de los productos

Los hongos medicinales se están volviendo cada día más populares a medida que los investigadores descubren nuevos beneficios de la psilocibina. Estos beneficios están atrayendo a más consumidores a los productos relacionados con los hongos. La creciente demanda de productos relacionados con los hongos está haciendo subir los precios a un ritmo más alto debido al aumento diario de la demanda en América del Norte. El alto costo de los productos de hongos funcionales está aumentando debido a su alto costo de producción, ya que los hongos para el mercado minorista se recolectan a mano. Los cursos de capacitación para recolectores han contribuido enormemente a los costos laborales. Los costos de cosecha por sí solos representan más del 30% del costo de producción. El requisito de la instalación de almacenamiento en frío moderna y unidades de procesamiento bien equipadas también cuestan más, lo que lleva al aumento de los precios del producto final.

- Implementación de una regulación estricta para la comercialización de productos de hongos funcionales

Estados Unidos tiene una de las normas más estrictas y progresistas en materia de seguridad del consumidor, por lo que, cuando se trata de mantener la salud de sus ciudadanos y de quienes compran alimentos de fabricación estadounidense en todo el mundo, los alimentos son los más examinados. La revista Food Safety Magazine ha nombrado a Estados Unidos como el país con las mejores normas y prácticas de seguridad alimentaria del mundo, justo detrás de Canadá.

Acontecimientos recientes

- En mayo de 2021, Monaghan Group anunció su asociación con Melissa Hemsley. La asociación animará a más personas a crear platos vegetarianos y se ampliará a través de relaciones públicas, redes sociales y actividades digitales. Con este desarrollo, la empresa puede aumentar su base de clientes.

- En octubre de 2017, Monterey Mushrooms, Inc. anunció el lanzamiento de su nueva línea de productos, Let's Blend, hongos finamente picados, para facilitar mucho la experiencia de cocinar. Let's Blend funciona bien con carne molida de res, pollo, cordero, cerdo y pavo. Con este desarrollo, la empresa puede mejorar su cartera de productos.

Alcance del mercado de hongos funcionales en América del Norte

El mercado de hongos funcionales de América del Norte se clasifica en función de la especie, el tipo de producto, la categoría, la naturaleza, el método de cultivo y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Especies

- Shiitake

- hongo reishi

- Chaga

- Melena de león

- Cordyceps

- Maitake

- Cola de pavo

- Tremela

- Otros

Según las especies, el mercado de hongos funcionales de América del Norte se clasifica en shiitake, reishi, chaga, melena de león, cordyceps, maitake, cola de pavo, tremella y otros.

Tipo de producto

- Cultivado

- Salvaje

Según el tipo de producto, el mercado de hongos funcionales de América del Norte se clasifica en cultivados y silvestres.

Categoría

- Regular

- Espectro completo

Según la categoría, el mercado de hongos funcionales de América del Norte se clasifica en regular y de espectro completo.

Naturaleza

- Convencional

- Orgánico

Según la naturaleza, el mercado de hongos funcionales de América del Norte está segmentado en convencional y orgánico.

Método de cultivo

- Cama cultivada

- Tronco/Madera Cultivada

Según el método de cultivo, el mercado de hongos funcionales de América del Norte se segmenta en cultivo en lechos y cultivo en troncos o madera.

Solicitud

- Farmacéutico

- Alimentos y bebidas

- Suplementos dietéticos

- Nutracéutico

- Nutrición deportiva

- Cuidado personal

- Otros

Según la aplicación, el mercado de hongos funcionales de América del Norte está segmentado en productos farmacéuticos, alimentos y bebidas, suplementos dietéticos, nutracéuticos, nutrición deportiva, cuidado personal y otros.

Análisis y perspectivas regionales del mercado de hongos funcionales de América del Norte

El mercado de hongos funcionales de América del Norte está segmentado por país, especie, tipo de producto, categoría, naturaleza, método de cultivo y aplicación.

Algunos países que participan en el mercado de hongos funcionales de América del Norte son Estados Unidos, Canadá y México. Se espera que Estados Unidos domine el mercado de hongos funcionales de América del Norte en términos de participación de mercado e ingresos debido al aumento de las ventas y las ganancias de los actores que operan en el mercado.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos del análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas norteamericanas y sus desafíos afrontados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los hongos funcionales en América del Norte

El panorama competitivo del mercado de hongos funcionales de América del Norte proporciona detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de hongos funcionales de América del Norte.

Algunos de los participantes destacados que operan en el mercado de hongos funcionales de América del Norte son Monterey Mushrooms, Inc., Monaghan Mushrooms Group, Shandong Qihe Biotech Co., Ltd., The Giorgi Companies, Inc., Nammex, Shogun Maitake, Rain Forest Mushrooms, Mushroom King Farm, Farming Fungi, LLC, entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen cuadrículas de posicionamiento de proveedores, análisis de la línea de tiempo del mercado, descripción general y guía del mercado, cuadrículas de posicionamiento de la empresa, análisis de la participación de mercado de la empresa, estándares de medición, América del Norte frente a la región y análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FUNCTIONAL MUSHROOM MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPARATIVE ANALYSIS OF FUNCTIONAL MUSHROOM SPECIES

4.2 FULL SPECTRUM FUNCTIONAL MUSHROOM CULTIVATION METHODS, NORTH AMERICA FUNCTIONAL MUSHROOM MARKET

4.3 MARKETING STRATEGIES ADOPTED BY KEY MARKET PLAYERS OF THE NORTH AMERICA FUNCTIONAL MUSHROOM MARKET

4.4 PRICING ANALYSIS, NORTH AMERICA FUNCTIONAL MUSHROOM MARKET

4.5 SUPPLY CHAIN ANALYSIS, NORTH AMERICA FUNCTIONAL MUSHROOM MARKET

4.6 CHINA PERSPECTIVE

4.6.1 CHINA REGULATORY SCENARIO

4.6.2 RESEARCH AND DEVELOPMENT

4.6.3 OVERVIEW: CONTRACT PARTNERSHIPS AMONG FARMERS

5 REGULATIONS AND LABELLING CLAIMS FOR NORTH AMERICA FUNCTIONAL MUSHROOM MARKET

6 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, REGIONAL SUMMARY

6.1 OVERVIEW

6.2 NORTH AMERICA

6.3 EUROPE

6.4 ASIA-PACIFIC

6.5 SOUTH AMERICA

6.6 MIDDLE EAST AND AFRICA (MEA)

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 SHIFT IN CONSUMER PREFERENCE TOWARD FUNCTIONAL FOODS

7.1.2 POSITIVE OUTLOOK TOWARDS ORGANIC PERSONAL CARE

7.1.3 IMPROVEMENT IN THE DIETARY SUPPLEMENTS INDUSTRY

7.1.4 INCREASE IN ACCEPTABILITY OF MUSHROOM FOR MEDICINAL PROPERTIES

7.1.5 EMERGING ROLE OF MUSHROOMS IN THE FOOD INDUSTRY

7.2 RESTRAINTS

7.2.1 STRONG MARKET REACH OF OTHER PROTEIN SUBSTITUTES

7.2.2 HIGH PRODUCT PRICES

7.3 OPPORTUNITIES

7.3.1 INCREASING R&D SPENDING ON EXOTIC MUSHROOM VARIANTS

7.3.2 TECHNOLOGICAL ADVANCEMENT AND INNOVATIONS ON FUNCTIONAL MUSHROOM

7.3.3 SUPPORTIVE GOVERNMENT POLICIES ON PROMOTING INVESTMENT IN HEALTH-CONSCIOUS DIET

7.4 CHALLENGE

7.4.1 IMPLEMENTATION OF STRICT REGULATION FOR COMMERCIALIZATION OF FUNCTIONAL MUSHROOM PRODUCTS

8 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, BY SPECIES

8.1 OVERVIEW

9 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

10 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, BY CATEGORY

10.1 OVERVIEW

11 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, BY NATURE

11.1 OVERVIEW

12 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, BY CULTIVATION METHOD

12.1 OVERVIEW

13 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, BY APPLICATION

14 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, BY REGION

14.1 NORTH AMERICA

15 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.1.1 PARTNERSHIP & ACQUISITION

15.1.2 EXPANSIONS

15.1.3 NEW PRODUCT DEVELOPMENTS

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 YUKIGUNI MAITAKE CO., LTD.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT UPDATE

17.2 MONTEREY MUSHROOMS, INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT UPDATE

17.3 MONAGHAN MUSHROOMS GROUP

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT UPDATE

17.4 SHANDONG QIHE BIOTECHNOLOGY CO., LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT UPDATE

17.5 BANKEN CHAMPIGNONS GROEP BV

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT UPDATE

17.6 BIOBRITTE AGRO SOLUTIONS PVT LTD

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT UPDATES

17.7 FARMING FUNGI, LLC

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT UPDATE

17.8 LIANFENG (SUIZHOU) FOOD CO., LTD

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT UPDATE

17.9 MAESYFFIN MUSHROOMS

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT UPDATE

17.1 MUSHROOM KING FARM

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT UPDATE

17.11 NAMMEX

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT UPDATE

17.12 OJAS FARMS

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT UPDATES

17.13 RAIN FOREST MUSHROOMS

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT UPDATE

17.14 SHOGUN MAITAKE

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT UPDATE

17.15 SMITHY MUSHROOMS

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT UPDATE

17.16 THE GIORGIO COMPANIES, INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT UPDATE

17.17 VLD FOOD PRODUCTS PVT. LTD.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT UPDATE

17.18 WULING (FUZHOU) BIOTECHNOLOGY CO., LTD.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT UPDATE

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de figuras

FIGURE 1 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: THE PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: SEGMENTATION

FIGURE 13 INCREASING ACCEPTABILITY OF MUSHROOM FOR MEDICINAL PROPERTIES IS DRIVING THE NORTH AMERICA FUNCTIONAL MUSHROOM MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 SHIITAKE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FUNCTIONAL MUSHROOM MARKET IN 2022 & 2029

FIGURE 15 MUSHROOM FARMING STEPS

FIGURE 16 MARKETING STRATEGIES ADOPTED BY MARKET PLAYERS

FIGURE 17 DATA ON THE SPECIFIC SALES PRICES AT DIFFERENT QUANTITIES FOR FULL SPECTRUM MUSHROOM PRODUCTS IN THE 8 PRIMARY SPECIES ACROSS THE GLOBE:

FIGURE 18 SUPPLY CHAIN ANALYSIS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF NORTH AMERICA FUNCTIONAL MUSHROOM MARKET

FIGURE 20 HEART DISEASE DEATH RATE, U.S. (2009-2016)

FIGURE 21 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: BY SPECIES

FIGURE 22 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: BY PRODUCT TYPE, 2020

FIGURE 23 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: BY CATEGORY, 2020

FIGURE 24 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, BY NATURE

FIGURE 25 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: BY CULTIVATION METHOD, 2021

FIGURE 26 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: BY APPLICATION, 2021

FIGURE 27 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: SNAPSHOT (2021)

FIGURE 28 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: BY COUNTRY (2021)

FIGURE 29 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: BY SPECIES (2022-2029)

FIGURE 32 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: COMPANY SHARE 2021, (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.