North America Foundry Chemicals Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

2.68 Billion

USD

3.78 Billion

2025

2033

USD

2.68 Billion

USD

3.78 Billion

2025

2033

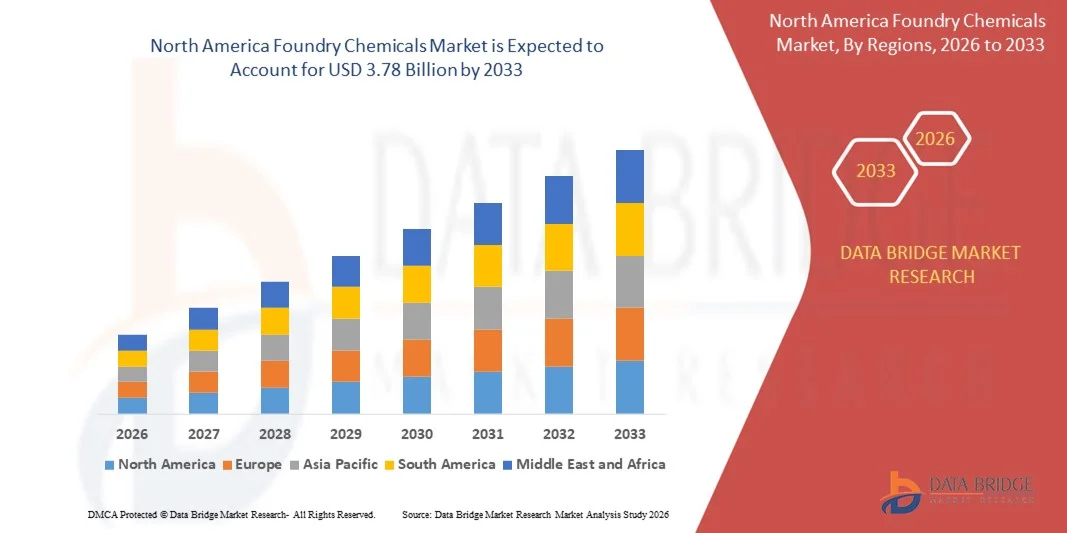

| 2026 –2033 | |

| USD 2.68 Billion | |

| USD 3.78 Billion | |

|

|

|

|

Segmentación del mercado de productos químicos para fundición en Norteamérica, por tipo (benceno, formaldehído, naftaleno, fenol, xileno y otros), tipo de producto (aglutinantes, aditivos, recubrimientos, fundentes y otros), tipo de fundición (ferrosos y no ferrosos), tipo de herramienta de fundición (palas, paletas, elevadores, cribas manuales, alambre de ventilación, apisonadores, hisopos, pasadores y cortadores de bebederos y otros), tipo de proceso de fundición (galvanización térmica y niquelado químico), tipo de sistema de fundición (sistemas de fundición en arena y sistemas de fundición en arena con aglomerante químico), aplicación (hierro fundido, acero, aluminio y otros), canal de distribución (comercio electrónico, tiendas especializadas, distribuidores B2B/terceros y otros) - Tendencias de la industria y pronóstico hasta 2033

Tamaño del mercado de productos químicos para fundición en América del Norte

- El tamaño del mercado de productos químicos de fundición de América del Norte se valoró en USD 2.68 mil millones en 2025 y se espera que alcance los USD 3.78 mil millones para 2033 , con una CAGR del 4,4% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de componentes de metal fundido en los sectores de automoción, construcción, maquinaria industrial e infraestructura, lo que aumenta directamente el consumo de aglutinantes, aditivos, recubrimientos y fundentes utilizados en las operaciones de fundición.

- Además, la modernización continua de las fundiciones, la creciente automatización y el énfasis creciente en mejorar la calidad de la fundición, la productividad y la reducción de defectos están acelerando la adopción de soluciones químicas de fundición avanzadas y de alto rendimiento, lo que respalda la expansión sostenida del mercado.

Análisis del mercado de productos químicos de fundición en América del Norte

- Los productos químicos de fundición, que desempeñan un papel fundamental en la preparación de moldes y núcleos, el tratamiento de metales y el acabado de superficies, son esenciales para lograr precisión dimensional, integridad estructural y calidad constante en fundiciones ferrosas y no ferrosas en diversas aplicaciones industriales.

- La creciente demanda de metales ligeros, las estrictas normas ambientales y de calidad y un enfoque cada vez mayor en prácticas de fabricación sostenibles y de bajas emisiones son factores clave que impulsan la adopción constante de formulaciones químicas de fundición innovadoras y que cumplen con las normas ambientales.

- Estados Unidos dominó el mercado de productos químicos para fundición en 2025, debido a la fuerte demanda de los sectores automotriz, aeroespacial, de maquinaria pesada y de fabricación industrial, junto con la presencia de una base de fundición ferrosa y no ferrosa bien establecida.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de productos químicos para fundición durante el período de pronóstico debido a las crecientes inversiones en la fabricación de automóviles, el desarrollo de infraestructura y la producción de equipos industriales.

- El segmento ferroso dominó el mercado con una cuota de mercado del 62,8 % en 2025, gracias a la producción a gran escala de componentes de hierro fundido y acero para los sectores de la automoción, la construcción y la maquinaria industrial. La alta demanda de componentes duraderos y resistentes sustenta el consumo continuo de productos químicos de fundición en aplicaciones ferrosas. Una infraestructura de fabricación consolidada y un volumen de producción constante refuerzan aún más el dominio del segmento.

Alcance del informe y segmentación del mercado de productos químicos de fundición

|

Atributos |

Perspectivas clave del mercado de productos químicos para fundición |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de productos químicos para fundición en América del Norte

Creciente adopción de formulaciones químicas de fundición ecológicas

- Una tendencia clave en el mercado de productos químicos para fundición es la creciente adopción de formulaciones químicas ecológicas y de bajas emisiones, impulsada por la creciente conciencia ambiental y el endurecimiento de las normas regulatorias en las operaciones de fundición a nivel mundial. Las fundiciones están adoptando gradualmente aglutinantes, aditivos y recubrimientos sostenibles para reducir las emisiones de COV y mejorar la seguridad en el trabajo, manteniendo al mismo tiempo la calidad de la fundición.

- Por ejemplo, empresas como ASK Chemicals y Hüttenes-Albertus suministran sistemas de aglutinantes inorgánicos de bajas emisiones que favorecen procesos de producción más limpios y el cumplimiento normativo. Estas soluciones ayudan a las fundiciones a minimizar el impacto ambiental, a la vez que logran una resistencia del molde y una precisión dimensional constantes.

- Los fabricantes de automóviles e industrias están incentivando a las fundiciones a adoptar soluciones químicas más ecológicas para alinearse con los objetivos de sostenibilidad más amplios en todas las cadenas de suministro. Esto está fortaleciendo la demanda de productos químicos de fundición respetuosos con el medio ambiente que respalden la fundición de gran volumen y de precisión.

- Esta tendencia se ve respaldada por el aumento de las inversiones en tecnologías modernas de fundición que permiten un uso eficiente de los productos químicos y un menor desperdicio de material. Las formulaciones avanzadas ayudan a mejorar la productividad, a la vez que reducen las tasas de reprocesamiento y desperdicio.

- Las fundiciones que producen piezas fundidas de metales no ferrosos y ligeros están adoptando, en particular, productos químicos ecológicos para cumplir con las normas de emisiones y las expectativas de rendimiento. Este cambio refuerza el papel de las formulaciones sostenibles en los entornos de fundición modernos.

- El creciente énfasis en el cumplimiento ambiental, la eficiencia operativa y la optimización de costos a largo plazo está posicionando a los productos químicos de fundición ecológicos como una tendencia central que configura la evolución del mercado.

Dinámica del mercado de productos químicos para fundición en América del Norte

Conductor

Creciente demanda de componentes fundidos en los sectores automotriz e industrial

- La creciente demanda de componentes fundidos en los sectores de la automoción, la construcción y la maquinaria industrial es un factor clave para el mercado de productos químicos para fundición. El aumento de la producción de motores, sistemas de transmisión, piezas estructurales y equipos industriales impulsa directamente el consumo de aglutinantes, recubrimientos y aditivos.

- Por ejemplo, los fabricantes de automóviles dependen cada vez más de componentes de hierro fundido, acero y aluminio de alta calidad, lo que impulsa a las fundiciones a adoptar sistemas químicos avanzados que garantizan resistencia, precisión y acabado superficial. Esta demanda refuerza el uso constante de productos químicos de fundición de alto rendimiento.

- La expansión industrial y los proyectos de desarrollo de infraestructura están incrementando la necesidad de componentes fundidos duraderos y de gran escala. Los productos químicos para fundición desempeñan un papel fundamental para respaldar la producción a gran escala, manteniendo al mismo tiempo los estándares de calidad.

- El crecimiento de los vehículos eléctricos y el uso de materiales ligeros intensifican aún más la demanda de formulaciones químicas especializadas adecuadas para fundiciones de aluminio y metales no ferrosos. Esto impulsa la innovación y la adopción continuas en el mercado.

- A medida que los fabricantes se centran en reducir los defectos y mejorar la productividad, las fundiciones invierten más en soluciones químicas de alto rendimiento. Esta demanda industrial sostenida continúa impulsando el crecimiento del mercado.

Restricción/Desafío

Normativas ambientales estrictas y costos de cumplimiento

- El mercado de productos químicos para fundición se enfrenta a los retos de las estrictas regulaciones ambientales relacionadas con las emisiones, la eliminación de residuos y la manipulación de productos químicos. El cumplimiento de estas regulaciones requiere una inversión significativa en tecnologías más limpias y formulaciones químicas que cumplan con las normativas.

- Por ejemplo, las regulaciones que regulan las emisiones de COV y las sustancias peligrosas obligan a las fundiciones a sustituir los productos químicos convencionales por alternativas avanzadas, a menudo con costes más elevados. Esto incrementa los gastos operativos, especialmente para las fundiciones pequeñas y medianas.

- La transición a productos químicos que cumplen con las normas ambientales también puede requerir modificaciones de procesos y capacitación de los empleados, lo que aumenta la complejidad de la implementación. Estos factores pueden ralentizar la adopción en regiones con costos sensibles.

- El aumento de los precios de las materias primas y la necesidad de un monitoreo continuo incrementan aún más los costos de cumplimiento para los fabricantes de productos químicos y los usuarios finales. Esto genera presión sobre los precios en toda la cadena de suministro.

- Equilibrar el cumplimiento normativo con la rentabilidad sigue siendo un desafío constante para los participantes del mercado. Estas limitaciones siguen influyendo en las decisiones de compra e impactando el ritmo general de expansión del mercado.

Alcance del mercado de productos químicos de fundición en América del Norte

El mercado está segmentado según el tipo, tipo de producto, tipo de fundición, tipo de herramienta de fundición, tipo de proceso de fundición, tipo de sistema de fundición, aplicación y canal de distribución.

- Por tipo

Según el tipo, el mercado de productos químicos para fundición se segmenta en benceno, formaldehído, naftaleno, fenol, xileno y otros. El segmento de fenol dominó el mercado en 2025, impulsado por su amplio uso en resinas fenólicas para la fabricación de moldes y machos en fundiciones ferrosas y no ferrosas. Los productos químicos a base de fenol ofrecen alta estabilidad térmica, gran resistencia de unión y una calidad superficial de fundición uniforme, lo que los convierte en la opción preferida para aplicaciones industriales a gran escala. Su compatibilidad con los procesos de fundición automatizados y su capacidad para soportar altas temperaturas de vertido impulsan aún más su fuerte adopción en las fundiciones de automoción e ingeniería pesada.

Se prevé que el segmento del formaldehído experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente demanda de sistemas aglutinantes rentables con una mayor eficiencia de curado. Las formulaciones a base de formaldehído permiten tiempos de fraguado más rápidos y una mayor productividad, especialmente en entornos de fundición de gran volumen. El aumento de las inversiones en infraestructura y fabricación de maquinaria también está acelerando la adopción de derivados del formaldehído en las fundiciones modernas.

- Por tipo de producto

Según el tipo de producto, el mercado se segmenta en aglutinantes, aditivos, recubrimientos, fundentes y otros. El segmento de aglutinantes dominó el mercado en 2025, ya que desempeñan un papel fundamental en la resistencia del molde, la precisión dimensional y la reducción de defectos durante la fundición. El alto consumo de aglutinantes orgánicos e inorgánicos en los procesos de fundición en arena, especialmente para componentes automotrices e industriales, continúa impulsando el liderazgo en ingresos. Su capacidad para mejorar la colapsabilidad y el acabado superficial refuerza su uso generalizado en diferentes tipos de fundición.

Se proyecta que el segmento de recubrimientos crecerá al ritmo más rápido durante el período de pronóstico, impulsado por un mayor enfoque en la mejora de la calidad de la superficie de la fundición y la reducción de los defectos de penetración del metal. Los recubrimientos refractarios avanzados ayudan a mejorar el aislamiento térmico y prolongan la vida útil del molde, lo que contribuye a una mayor eficiencia. La creciente adopción de la fundición de precisión y las aleaciones de alto rendimiento impulsa aún más la demanda de recubrimientos especializados para fundición.

- Por tipo de fundición

Según el tipo de fundición, el mercado se segmenta en ferrosos y no ferrosos. El segmento de fundición ferrosa mantuvo una participación dominante del 62,8 % en 2025, gracias a la producción a gran escala de componentes de hierro fundido y acero para los sectores de la automoción, la construcción y la maquinaria industrial. La alta demanda de componentes duraderos y resistentes sustenta el consumo continuo de productos químicos de fundición en aplicaciones ferrosas. Una infraestructura de fabricación consolidada y un volumen de producción constante refuerzan aún más el dominio del segmento.

Se prevé que el segmento de metales no ferrosos registre el mayor crecimiento entre 2026 y 2033, impulsado por el creciente uso de aluminio y otros metales ligeros en las industrias automotriz y aeroespacial. El creciente énfasis en la eficiencia del combustible y la reducción de emisiones impulsa una mayor producción de fundición de metales no ferrosos. Esta tendencia impulsa directamente la demanda de productos químicos especializados adaptados a las necesidades de la fundición de metales no ferrosos.

- Por tipo de herramienta de fundición

Según el tipo de herramienta de fundición, el mercado incluye palas, paletas, elevadores, cribas manuales, alambre de ventilación, apisonadores, hisopos, pasadores y cortadores de bebedero, entre otros. El segmento de apisonadores dominó el mercado en 2025, ya que son esenciales para lograr una compactación uniforme de la arena y la integridad del molde, tanto en fundiciones manuales como semiautomatizadas. Su uso constante en fundiciones pequeñas y grandes garantiza una demanda constante de sistemas químicos compatibles. Su papel en la minimización de defectos de fundición impulsa su adopción continua.

Se prevé que el segmento de alambres de ventilación crezca al ritmo más rápido durante el período de pronóstico, impulsado por una mayor atención a la evacuación de gases y la prevención de defectos en diseños de moldes complejos. Las prácticas avanzadas de ventilación mejoran la calidad de la fundición y reducen las tasas de desperdicio, lo que fomenta un uso más amplio. El crecimiento de las piezas fundidas de precisión y alto valor acelera aún más esta tendencia.

- Por tipo de proceso de fundición

Según el tipo de proceso de fundición, el mercado se segmenta en galvanización térmica y niquelado químico. El segmento de galvanización térmica dominó el mercado en 2025, gracias a su amplio uso para la protección contra la corrosión en fundiciones estructurales e industriales. El proceso requiere formulaciones químicas consistentes para garantizar la uniformidad y durabilidad del recubrimiento. La alta demanda en proyectos de construcción e infraestructura refuerza el liderazgo del segmento.

Se prevé que el segmento del niquelado químico experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente demanda de componentes fundidos de alta precisión, resistentes al desgaste y a la corrosión. Su capacidad para proporcionar un espesor de recubrimiento uniforme mejora el rendimiento en aplicaciones automotrices y de ingeniería. La creciente adopción de tecnologías avanzadas de tratamiento de superficies impulsa aún más el crecimiento.

- Por tipo de sistema de fundición

Según el tipo de sistema de fundición, el mercado se segmenta en sistemas de fundición en arena y sistemas de fundición en arena con aglomerante químico. El segmento de sistemas de fundición en arena dominó el mercado en 2025 gracias a su rentabilidad, flexibilidad e idoneidad para una amplia gama de tamaños y metales de fundición. El alto consumo de productos químicos relacionados con la arena en las operaciones de fundición tradicionales sustenta una fuerte demanda. Su adopción generalizada en las regiones manufactureras en desarrollo refuerza su cuota de mercado.

Se proyecta que el segmento de sistemas de fundición en arena con aglomerante químico crecerá a un ritmo acelerado, impulsado por la demanda de mayor precisión dimensional y un mejor acabado superficial. Estos sistemas reducen la necesidad de retrabajo y mecanizado, lo que mejora la eficiencia operativa. La creciente automatización en las fundiciones acelera la adopción de sistemas con aglomerante químico.

- Por aplicación

Según su aplicación, el mercado se segmenta en hierro fundido, acero, aluminio y otros. El segmento de hierro fundido dominó el mercado en 2025, gracias a su amplio uso en componentes automotrices, tuberías y piezas de maquinaria. Los altos volúmenes de producción y las cadenas de suministro consolidadas se traducen en un consumo constante de productos químicos para fundición. Su rentabilidad y resistencia mecánica sustentan la demanda a largo plazo.

Se espera que el segmento del aluminio experimente el mayor crecimiento durante el período de pronóstico, impulsado por la creciente adopción de materiales ligeros en las industrias automotriz y de transporte. La fundición de aluminio requiere formulaciones químicas especializadas para garantizar la calidad y el rendimiento. El aumento de la producción de vehículos eléctricos impulsa aún más la demanda en este segmento.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en comercio electrónico, tiendas especializadas, distribuidores B2B/terceros, entre otros. El segmento de distribuidores B2B/terceros dominó el mercado en 2025, ya que las fundiciones dependen de redes de proveedores consolidadas para la adquisición a granel y el soporte técnico. Los contratos a largo plazo y una logística fiable garantizan un suministro constante de productos químicos críticos. Este canal sigue siendo fundamental para las operaciones industriales a gran escala.

Se prevé que el segmento del comercio electrónico crezca a su ritmo más rápido entre 2026 y 2033, impulsado por la creciente digitalización de las compras industriales. Las plataformas en línea ofrecen mayor visibilidad de los productos, pedidos más rápidos y mayor transparencia de precios. Las fundiciones pequeñas y medianas adoptan cada vez más este canal para un abastecimiento eficiente.

Análisis regional del mercado de productos químicos de fundición en América del Norte

- Estados Unidos dominó el mercado de productos químicos para fundición con la mayor participación en los ingresos en 2025, impulsado por la fuerte demanda de los sectores automotriz, aeroespacial, de maquinaria pesada y de fabricación industrial, junto con la presencia de una base de fundición ferrosa y no ferrosa bien establecida.

- Los estrictos estándares de calidad, las regulaciones de seguridad en el lugar de trabajo y los requisitos de cumplimiento ambiental alientan la adopción de productos químicos de fundición de alto rendimiento y bajas emisiones en los EE. UU. La fuerte presencia de los principales fabricantes de productos químicos, las inversiones continuas en I+D y la creciente automatización dentro de las fundiciones refuerzan aún más la posición de liderazgo del país en el mercado regional.

- El creciente enfoque en la optimización de la productividad, la reducción de defectos y la fundición de metales livianos, junto con la modernización de la antigua infraestructura de fundición, garantiza que EE. UU. mantenga su papel dominante durante todo el período de pronóstico.

Perspectivas del mercado de productos químicos de fundición de Canadá

Se proyecta que Canadá registrará la tasa de crecimiento anual compuesta (TCAC) más rápida en el mercado norteamericano de productos químicos para fundición entre 2026 y 2033, impulsada por las crecientes inversiones en la fabricación de automóviles, el desarrollo de infraestructura y la producción de equipos industriales. La creciente adopción de fundiciones de aluminio y no ferrosos, sumada a la creciente demanda de sistemas aglutinantes avanzados y productos químicos respetuosos con el medio ambiente, está acelerando el crecimiento del mercado. La colaboración entre fundiciones nacionales y proveedores químicos globales, junto con un enfoque en la eficiencia y las prácticas de fabricación sostenibles, posiciona a Canadá como el mercado de mayor crecimiento de la región.

Perspectiva del mercado de productos químicos para fundición en México

Se prevé que México experimente un crecimiento sostenido entre 2026 y 2033, impulsado por la expansión de las actividades de manufactura automotriz e industrial y el aumento de la inversión extranjera directa en operaciones de fundición. El apoyo gubernamental al desarrollo industrial, el aumento de la producción de componentes fundidos para los mercados de exportación y la adopción gradual de productos químicos modernos para fundición contribuyen a una expansión constante del mercado. La mayor presencia de proveedores regionales y la mejora del acceso a soluciones químicas avanzadas respaldan un crecimiento sostenido durante el período de pronóstico.

Cuota de mercado de productos químicos para fundición en América del Norte

La industria de productos químicos para fundición está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Cerámicas y refractarios de alto rendimiento de Saint-Gobain (PCR) (Francia)

- Carpenter Brothers, Inc. (EE. UU.)

- Compax Industrial Systems Pvt. Ltd. (India)

- CS Additive GmbH (Alemania)

- CAGroup (una subsidiaria de AMC Group) (EE. UU.)

- Mancuso Chemicals Limited (Canadá)

- Ceraflux India Pvt. Ltd. (India)

- Forcee Polymers (P) Ltd. (India)

- DuPont (EE. UU.)

- John Winter (Reino Unido)

- Georgia-Pacific Chemicals (EE. UU.)

- Ultraseal India Pvt. Ltd. (India)

- Hüttenes-Albertus (Alemania)

- Vesubio (Reino Unido)

- Ashland Global Holdings Inc. (Alemania)

- Imerys (Francia)

- Industrias Shandong Crownchem Co., Ltd (China)

- Cavenaghi SpA (Italia)

Últimos avances en el mercado de productos químicos para fundición en América del Norte

- En junio de 2024, Clariant consolidó su posición en el mercado de productos químicos para fundición con su participación en Metal China 2024, celebrada en Shanghái, donde presentó soluciones químicas avanzadas y sostenibles. Se espera que este desarrollo influya en el mercado al mejorar la eficiencia del proceso de fundición, optimizar el rendimiento de la fundición y apoyar los objetivos de sostenibilidad en los centros de fabricación a gran escala. El fuerte enfoque de Clariant en la innovación y las formulaciones de última generación probablemente acelerará la adopción de productos químicos especializados para fundición tanto en el mercado nacional como en el internacional.

- En enero de 2024, Loramendi generó un fuerte impulso en el mercado indio de productos químicos para fundición al anunciar el próximo lanzamiento de una solución de vanguardia diseñada para redefinir los parámetros operativos. Se prevé que este desarrollo impulse la demanda de productos químicos avanzados para fundición, compatibles con sistemas de fundición de alta automatización y precisión. Esta innovación impulsa el crecimiento del mercado al fomentar la modernización de las operaciones de fundición y aumentar la confianza en formulaciones químicas de alto rendimiento en India.

- En septiembre de 2023, Hüttenes-Albertus introdujo una nueva tecnología de aglutinante inorgánico de bajas emisiones, cuyo objetivo es reducir las emisiones de COV y mantener una alta calidad de fundición. Se espera que este desarrollo tenga un impacto positivo en el mercado, apoyando el cumplimiento normativo, mejorando la seguridad laboral y fortaleciendo las prácticas de fundición centradas en la sostenibilidad. Esta innovación impulsa la demanda de productos químicos de fundición respetuosos con el medio ambiente en aplicaciones de fundición automotriz e industrial.

- En enero de 2021, ASK Chemicals, filial de Ashland, lanzó un sistema de aglutinante de poliuretano autopolimerizable respetuoso con el medio ambiente que mejoró los resultados de fundición y aumentó la productividad. Este desarrollo fortaleció la posición de la empresa en el mercado al abordar la creciente necesidad de sistemas de aglutinantes sostenibles y de alto rendimiento. El lanzamiento contribuyó al crecimiento de las ventas a largo plazo, reforzando la confianza de los clientes y fomentando la adopción de tecnologías químicas avanzadas.

- En noviembre de 2020, Vesuvius amplió su presencia en el mercado con su participación en la feria comercial ANKIROS 2020 en Estambul, donde presentó una amplia cartera de soluciones para la metalurgia y la fundición. Este desarrollo impulsó el crecimiento del mercado al aumentar la visibilidad de los productos, ampliar la base de clientes de la empresa y fortalecer la colaboración con operadores globales de fundición. La participación en la feria contribuyó a un crecimiento constante de las ventas y reforzó la posición competitiva de Vesuvius en el mercado de productos químicos para fundición.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.