North America Fluorspot And Elispot Assay Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

188.17 Billion

USD

436.78 Billion

2025

2033

USD

188.17 Billion

USD

436.78 Billion

2025

2033

| 2026 –2033 | |

| USD 188.17 Billion | |

| USD 436.78 Billion | |

|

|

|

|

Segmentación del mercado de ensayos ELISpot y FluoroSpot en Norteamérica, por tipo de producto (kits de ensayo, productos complementarios/auxiliares y analizadores), origen (humano, ratón, mono y otros), enfermedades (enfermedades infecciosas, cáncer, enfermedades autoinmunes, alergias y otras), aplicación (aplicación de diagnóstico y aplicaciones de investigación), usuario final (hospitales y laboratorios clínicos, institutos de investigación, empresas biofarmacéuticas y otros), canal de distribución (licitación directa, ventas minoristas y otros) - Tendencias de la industria y pronóstico hasta 2033

Tamaño del mercado de ensayos ELISpot y FluoroSpot en América del Norte

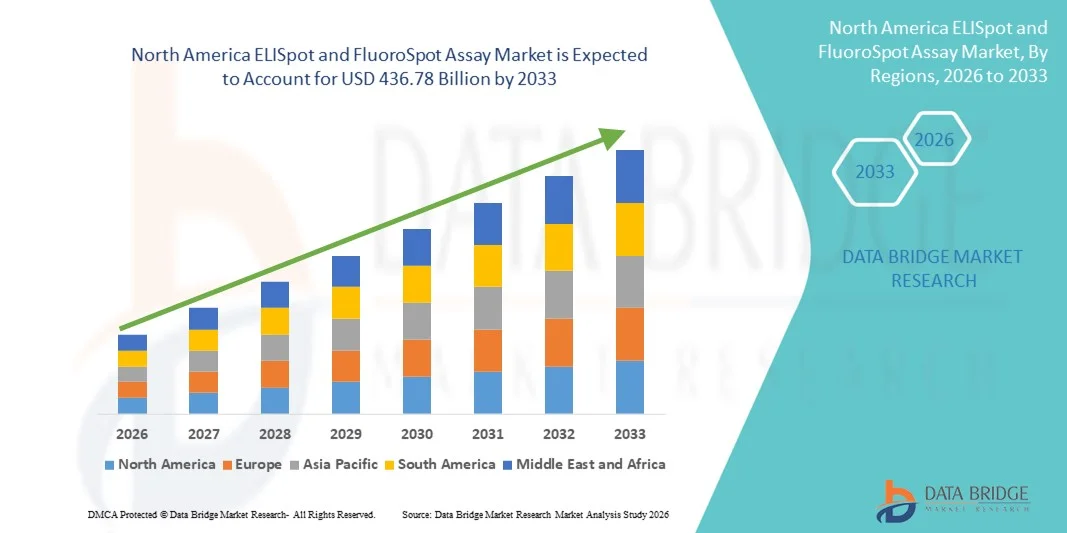

- El tamaño del mercado de ensayos ELISpot y fluorospot de América del Norte se valoró en USD 188.17 mil millones en 2025 y se espera que alcance los USD 436.78 mil millones para 2033 , con una CAGR del 11,10 % durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente adopción de técnicas avanzadas de investigación inmunológica y avances tecnológicos continuos en plataformas de análisis, lo que conduce a una mayor precisión, sensibilidad y rendimiento tanto en la investigación académica como en los entornos de laboratorio clínico.

- Además, la creciente demanda de herramientas de monitorización inmunitaria precisas, reproducibles y de alta sensibilidad para el desarrollo de vacunas, la investigación de enfermedades infecciosas, la inmunoterapia contra el cáncer y el estudio de trastornos autoinmunes está consolidando los ensayos ELISpot y FluoroSpot como las soluciones preferidas para el análisis de la respuesta inmunitaria celular. Estos factores convergentes están acelerando la adopción de las soluciones de ensayo ELISpot y FluoroSpot, impulsando así significativamente el crecimiento general del mercado.

Análisis del mercado de ensayos ELISpot y FluoroSpot en América del Norte

- Los ensayos ELISpot y FluoroSpot, que ofrecen una detección altamente sensible de células secretoras de citocinas a nivel de célula única, son herramientas cada vez más vitales en la investigación inmunológica, el diagnóstico clínico y el desarrollo de fármacos debido a su alta precisión, reproducibilidad y capacidad para analizar múltiples marcadores inmunes simultáneamente.

- La creciente demanda de ensayos ELISpot y FluoroSpot se debe principalmente al rápido crecimiento en el desarrollo de vacunas, la inmunoterapia contra el cáncer, la investigación de enfermedades infecciosas y los estudios de trastornos autoinmunes, junto con la creciente necesidad de un monitoreo inmunológico sólido en entornos preclínicos y clínicos.

- Estados Unidos dominó el mercado de los ensayos ELISpot y FluoroSpot, con la mayor cuota de ingresos, de aproximadamente el 41,3 % en 2025, gracias a una sólida financiación federal para la investigación en ciencias de la vida e inmunología, una alta concentración de empresas biotecnológicas y farmacéuticas líderes, una infraestructura avanzada de investigación clínica y de laboratorio, y la adopción generalizada de los ensayos ELISpot y FluoroSpot en instituciones académicas, hospitales y CRO. El fuerte enfoque del país en el desarrollo de vacunas, la inmunoterapia contra el cáncer y la investigación de enfermedades infecciosas refuerza aún más su liderazgo en el mercado.

- Se prevé que Canadá sea la región con mayor crecimiento en el mercado de ensayos ELISpot y FluoroSpot durante el período de pronóstico, con una tasa de crecimiento anual compuesta (TCAC) del 9,9 %, impulsada por el aumento de las inversiones en biotecnología y ciencias de la vida, la expansión de la investigación clínica y las actividades de las CRO, la creciente prevalencia de enfermedades infecciosas y autoinmunes, y la creciente demanda de herramientas avanzadas de investigación inmunológica y diagnóstica. La financiación gubernamental, la colaboración entre instituciones académicas y empresas biofarmacéuticas, y la mejora de la infraestructura de laboratorio están acelerando aún más el crecimiento del mercado en Canadá.

- El segmento de aplicaciones de investigación dominó con una participación de ingresos del 62,1 % en 2025, impulsado por un uso extensivo en la investigación inmunológica.

Alcance del informe y segmentación del mercado de ensayos ELISpot y FluoroSpot

|

Atributos |

Análisis ELISpot y FluoroSpot: información clave del mercado |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis en profundidad de expertos, epidemiología de pacientes, análisis de la cartera de productos, análisis de precios y marco regulatorio. |

Tendencias del mercado de ensayos ELISpot y FluoroSpot en América del Norte

Creciente adopción de técnicas avanzadas de monitorización inmunitaria celular

- Una tendencia significativa y en auge en el mercado global de ensayos ELISpot y FluoroSpot es la creciente adopción de técnicas avanzadas de monitorización de la respuesta inmunitaria celular en la investigación de enfermedades infecciosas, la oncología y el desarrollo de vacunas. Estos ensayos son reconocidos por su alta sensibilidad para detectar respuestas de células T y B específicas de antígeno a nivel de célula única.

- Por ejemplo, durante la pandemia de COVID-19 (2021-2022), las instituciones de investigación y las compañías farmacéuticas de todo el mundo adoptaron ampliamente los ensayos ELISpot y FluoroSpot para evaluar las respuestas de las células T y la eficacia de las vacunas, lo que respaldó el desarrollo acelerado de vacunas y el monitoreo de la respuesta inmunitaria.

- Los avances tecnológicos, incluidos los ensayos multiparamétricos FluoroSpot, permiten la detección simultánea de múltiples citocinas, lo que mejora significativamente la eficiencia del ensayo y la profundidad de los datos. Esto ha impulsado su adopción en la investigación traslacional y el desarrollo de inmunoterapia.

- El uso creciente de los ensayos ELISpot y FluoroSpot en las pruebas de eficacia de las vacunas, en particular para enfermedades infecciosas como la COVID-19, la tuberculosis, la hepatitis y las infecciones virales emergentes, está fortaleciendo aún más la demanda del mercado mundial en las instituciones de investigación académica y clínica.

- Esta tendencia hacia herramientas de monitoreo inmunológico de alta precisión, reproducibles y escalables está transformando las prácticas de investigación inmunológica a nivel mundial, alentando a los fabricantes de ensayos a expandir las capacidades de fabricación, redes de distribución y soporte técnico en todas las regiones.

- Como resultado, se espera que el mercado global de ensayos ELISpot y FluoroSpot crezca a una CAGR de aproximadamente 9,0%–10,5% durante el período de pronóstico, impulsado por la creciente actividad de investigación y el desarrollo de inmunoterapia en todo el mundo.

Dinámica del mercado de ensayos ELISpot y FluoroSpot en América del Norte

Conductor

La expansión de la investigación en inmunología y la creciente carga de enfermedades infecciosas y crónicas

- La creciente prevalencia de enfermedades infecciosas, cáncer y trastornos autoinmunes a nivel mundial es un importante impulsor de la demanda de los ensayos ELISpot y FluoroSpot. Estos ensayos se utilizan ampliamente para estudiar la respuesta inmunitaria celular tanto en el diagnóstico clínico como en aplicaciones de investigación.

- Por ejemplo, la investigación mundial de vacunas y los ensayos clínicos para enfermedades infecciosas como la COVID-19, el VIH y la tuberculosis han aumentado significativamente la adquisición de kits de ensayo ELISpot y FluoroSpot en América del Norte, Europa y América del Norte entre 2021 y 2024.

- Las iniciativas de investigación respaldadas por el gobierno y las asociaciones público-privadas destinadas a fortalecer la investigación biomédica y la preparación para pandemias están acelerando aún más la adopción de ensayos en institutos académicos y empresas biofarmacéuticas.

- El creciente número de ensayos clínicos globales ha impulsado directamente la demanda de ensayos de monitoreo inmunológico utilizados en evaluaciones de seguridad y eficacia, especialmente en el desarrollo de vacunas contra enfermedades infecciosas y oncológicas.

- Además, la creciente presencia de empresas globales de ciencias de la vida y organizaciones de investigación por contrato (CRO) en todo el mundo está apoyando un crecimiento constante en el consumo de ensayos tanto en aplicaciones de diagnóstico como de investigación.

Restricción/Desafío

Altos costos de ensayo y complejidad técnica

- Uno de los principales desafíos que restringen el crecimiento del mercado es el costo relativamente alto de los kits de ensayo, analizadores y consumibles ELISpot y FluoroSpot, lo que puede limitar su adopción entre pequeños laboratorios y centros de investigación con presupuestos limitados.

- Por ejemplo, en muchos países en desarrollo, la financiación limitada para la investigación y los altos costos de los analizadores FluoroSpot especializados dan como resultado una dependencia continua de las pruebas ELISA convencionales, a pesar de la mayor sensibilidad y calidad de datos que ofrecen los ensayos ELISpot/FluoroSpot.

- La variabilidad en los protocolos de ensayo, los requisitos de preparación de muestras y la interpretación de los resultados también pueden afectar la reproducibilidad, lo que requiere flujos de trabajo estandarizados y experiencia técnica especializada.

- Además, la limitada conciencia y disponibilidad de tecnologías avanzadas de monitoreo inmunológico en regiones remotas o subdesarrolladas continúan restringiendo una penetración más amplia en el mercado.

- Abordar estos desafíos a través de kits de análisis rentables, flujos de trabajo simplificados, programas de capacitación mejorados y expansión de la fabricación regional será fundamental para sostener el crecimiento a largo plazo en el mercado global de análisis ELISpot y FluoroSpot.

Alcance del mercado de ensayos ELISpot y FluoroSpot en América del Norte

El mercado está segmentado según el tipo de producto, la fuente, la enfermedad, la aplicación, el usuario final y el canal de distribución.

- Por tipo de producto

Según el tipo de producto, el mercado de ensayos ELISpot y FluoroSpot se segmenta en kits de ensayo, productos complementarios/auxiliares y analizadores. El segmento de kits de ensayo dominó el mercado con la mayor cuota de ingresos, un 56,8%, en 2025, impulsado por un alto consumo recurrente en entornos clínicos y de investigación. Los kits de ensayo proporcionan reactivos preoptimizados, placas recubiertas y anticuerpos de detección, lo que garantiza resultados consistentes y una alta reproducibilidad. Se utilizan ampliamente en el desarrollo de vacunas, la monitorización de enfermedades infecciosas y la investigación en inmunoterapia. Las empresas farmacéuticas y biofarmacéuticas prefieren los kits de ensayo para la estandarización en múltiples laboratorios. El segmento se beneficia de la fuerte demanda en los mercados emergentes debido al aumento de la financiación para la investigación. También se beneficia de los continuos lanzamientos de productos y la mejora de la sensibilidad de los kits. Muchos laboratorios prefieren los kits para reducir el tiempo de preparación del ensayo y la complejidad operativa. Los kits de ensayo se adoptan ampliamente en la investigación académica e industrial. La presencia de fabricantes líderes a nivel mundial refuerza aún más su dominio. El crecimiento se ve respaldado por el aumento de los perfiles inmunitarios y los estudios de respuesta de células T. Se espera que el segmento mantenga su liderazgo gracias a la continua demanda de ensayos estandarizados.

Se espera que el segmento de analizadores crezca más rápido, registrando una CAGR del 12,9% entre 2026 y 2033. El crecimiento está impulsado por la creciente demanda de recuentos puntuales automatizados y análisis multiplex. Los analizadores mejoran la eficiencia del flujo de trabajo y reducen el error humano en el recuento manual. Apoyan el cribado de alto rendimiento necesario para grandes ensayos clínicos y estudios de vacunas. Los sistemas de imágenes avanzados también permiten un mejor análisis de datos y almacenamiento digital. La adopción de ensayos FluoroSpot, que requieren analizadores sofisticados, impulsa aún más el crecimiento. Las crecientes tendencias de automatización de laboratorios en las economías desarrolladas aceleran la adopción. Además, las crecientes inversiones en investigación inmunooncológica aumentan la demanda de un monitoreo inmunológico preciso. Los analizadores se utilizan cada vez más en laboratorios centralizados para respaldar múltiples proyectos de investigación. Su capacidad para integrarse con los sistemas de información de laboratorio (LIMS) mejora la eficiencia operativa. Las continuas actualizaciones tecnológicas y el reconocimiento de puntos basado en IA contribuyen a un rápido crecimiento.

- Por fuente

Según la fuente, el mercado se segmenta en humanos, ratones, monos y otros. El segmento de origen humano dominó con una participación en los ingresos del 48,3% en 2025, respaldado por un amplio uso clínico. Los ensayos basados en humanos son esenciales para los ensayos de vacunas, el monitoreo de enfermedades infecciosas y la investigación en inmunoterapia. La creciente prevalencia del cáncer, las enfermedades autoinmunes y las enfermedades infecciosas aumenta la demanda de perfiles de respuesta inmunitaria humana. Las compañías farmacéuticas prefieren los ensayos con muestras humanas por su mayor relevancia traslacional en los ensayos clínicos. El segmento se beneficia de una sólida financiación para la investigación clínica y del aumento de las actividades de ensayos clínicos. Además, se ve respaldado por el énfasis regulatorio en los datos relevantes para humanos. Los ensayos humanos se utilizan ampliamente en los laboratorios de diagnóstico para el monitoreo inmunológico. El crecimiento de la medicina personalizada y la inmunoterapia fortalece su adopción. Además, la mejora del acceso a las muestras clínicas impulsa el crecimiento del segmento. La presencia de laboratorios clínicos avanzados en los países desarrollados refuerza aún más su dominio.

Se prevé que el segmento de fuentes de ratón experimente el mayor crecimiento, con una tasa de crecimiento anual compuesta (TCAC) del 11,7 % entre 2026 y 2033. Los modelos murinos se utilizan ampliamente en la investigación inmunológica preclínica y el descubrimiento de fármacos. Proporcionan datos cruciales sobre los mecanismos inmunitarios antes de los ensayos en humanos. Este crecimiento se sustenta en la creciente inversión en estudios preclínicos e investigación con modelos animales. Las instituciones académicas y las CRO recurren a los ensayos con ratones para la evaluación inicial de fármacos. El creciente interés en la inmunología traslacional y la investigación de vacunas impulsa la demanda. Los ensayos con ratones se utilizan para evaluar nuevas terapias y respuestas inmunitarias. Este segmento se beneficia de una intensa actividad investigadora en Norteamérica y Europa. La creciente adopción de modelos murinos modificados genéticamente impulsa aún más su crecimiento.

- Por enfermedad

En función de la enfermedad, el mercado se segmenta en enfermedades infecciosas, cáncer, enfermedades autoinmunes, alergias y otras. El segmento de enfermedades infecciosas dominó con una participación en los ingresos del 34,9% en 2025, debido a la creciente carga mundial de enfermedades. Los ensayos ELISpot son esenciales para detectar respuestas de células T específicas de antígeno. Se utilizan ampliamente para la tuberculosis, el VIH, la hepatitis y las enfermedades infecciosas emergentes. Los programas gubernamentales de detección y las iniciativas de salud pública impulsan su adopción. El desarrollo y el monitoreo de vacunas también contribuyen significativamente. El segmento se beneficia del aumento de la financiación de la investigación para enfermedades infecciosas. La rápida respuesta a brotes y la preparación para pandemias fortalecen aún más la demanda. Los laboratorios de diagnóstico utilizan cada vez más ELISpot para el monitoreo inmunológico. El segmento se ve respaldado por una creciente conciencia del análisis de la respuesta inmune. La presencia de fabricantes líderes de ensayos mejora la disponibilidad del producto. La innovación continua en la sensibilidad de los ensayos mejora la confiabilidad del diagnóstico.

Se prevé que el segmento oncológico experimente el mayor crecimiento, con una tasa de crecimiento anual compuesta (TCAC) del 13,6 % entre 2026 y 2033. Este crecimiento se ve impulsado por el auge de la inmunoterapia y el tratamiento personalizado del cáncer. Los ensayos ELISpot y FluoroSpot se utilizan para evaluar las respuestas inmunitarias específicas de cada tumor. Ayudan a monitorizar la respuesta del paciente a la inmunoterapia y a los tratamientos basados en vacunas. El aumento de los ensayos clínicos oncológicos y la inversión en I+D impulsan un rápido crecimiento. Las empresas biofarmacéuticas utilizan estos ensayos para el descubrimiento de biomarcadores y la elaboración de perfiles inmunitarios. La creciente incidencia del cáncer a nivel mundial impulsa aún más la demanda. El crecimiento también se ve impulsado por un mayor enfoque en la detección temprana y la monitorización del tratamiento.

- Por aplicación

En función de la aplicación, el mercado se segmenta en aplicaciones de diagnóstico y aplicaciones de investigación. El segmento de aplicaciones de investigación dominó con una participación en los ingresos del 62,1 % en 2025, impulsado por su amplio uso en la investigación inmunológica. Las instituciones académicas y las empresas farmacéuticas confían en los ensayos ELISpot y FluoroSpot para el desarrollo de vacunas y la elaboración de perfiles inmunitarios. Este segmento se beneficia de la creciente financiación para la investigación a nivel mundial. Apoya la investigación preclínica y clínica en enfermedades infecciosas, cáncer y trastornos autoinmunes. La necesidad de analizar la respuesta inmunitaria celular impulsa una fuerte demanda. Los laboratorios de investigación prefieren ensayos y kits estandarizados para obtener resultados consistentes. Este segmento se apoya en la colaboración entre universidades y empresas biotecnológicas. También se beneficia del aumento de las publicaciones y la producción científica en inmunología.

Se prevé que el segmento de aplicaciones de diagnóstico experimente el mayor crecimiento, con una tasa de crecimiento anual compuesta (TCAC) del 12,4 % entre 2026 y 2033. Este crecimiento se ve impulsado por el creciente uso en el diagnóstico clínico de enfermedades infecciosas y la monitorización inmunitaria. Los ensayos ELISpot se utilizan cada vez más en laboratorios de diagnóstico para la detección de enfermedades. La mejora de la validación y las aprobaciones regulatorias respaldan su adopción clínica. El auge de la medicina personalizada impulsa la demanda de pruebas de monitorización inmunitaria. La expansión de los laboratorios clínicos en las economías emergentes impulsa el crecimiento. El aumento del gasto sanitario y de la infraestructura de diagnóstico también contribuye.

- Por el usuario final

En función del usuario final, el mercado se segmenta en hospitales y laboratorios clínicos, institutos de investigación, empresas biofarmacéuticas, entre otros. El segmento de institutos de investigación dominó el mercado con una participación en los ingresos del 41,7 % en 2025, gracias a una extensa investigación académica y una sólida financiación. Los institutos de investigación son centros clave para la inmunología y el desarrollo de vacunas, impulsando la demanda de ensayos ELISpot y FluoroSpot. Estos ensayos se utilizan para la elaboración de perfiles de respuesta inmunitaria, estudios de eficacia de vacunas e investigación traslacional. Este segmento cuenta con el apoyo de programas financiados por el gobierno y colaboraciones con empresas biotecnológicas. Los institutos de investigación suelen realizar estudios preclínicos a gran escala que requieren un gran volumen de kits de ensayo. El aumento de la producción de publicaciones y el interés científico en la inmunidad de células T impulsan aún más el crecimiento. Los laboratorios especializados en inmunología de las universidades contribuyen a una demanda sostenida. Estas instituciones prefieren kits estandarizados por su reproducibilidad y consistencia entre laboratorios. Los acuerdos de adquisición a granel también impulsan la participación en los ingresos. El segmento se beneficia de proyectos de investigación y subvenciones a largo plazo. La continua expansión de los departamentos de inmunología impulsa la demanda futura. Los institutos de investigación también actúan como pioneros en la adopción de analizadores avanzados, fortaleciendo su dominio del mercado.

Se prevé que el segmento de las empresas biofarmacéuticas experimente el mayor crecimiento, con una tasa de crecimiento anual compuesta (TCAC) del 13,2 % entre 2026 y 2033, impulsada por el aumento de las inversiones en productos biológicos e inmunoterapias. Las empresas biofarmacéuticas utilizan los ensayos ELISpot y FluoroSpot para el descubrimiento de fármacos, la validación de biomarcadores y la monitorización de ensayos clínicos. El creciente enfoque en la inmunooncología y el desarrollo de vacunas impulsa la demanda. El segmento se beneficia del creciente número de ensayos clínicos y de la aceleración de los procesos de aprobación de fármacos. Las empresas biofarmacéuticas prefieren analizadores de alto rendimiento para una detección rápida y resultados consistentes. A menudo se asocian con CRO para realizar estudios de inmunogenicidad a gran escala. El aumento de fármacos en desarrollo para enfermedades infecciosas y cáncer también impulsa un rápido crecimiento. La necesidad de un perfil inmunológico sólido en la medicina personalizada impulsa su adopción. Las empresas biofarmacéuticas priorizan la estandarización de los ensayos para cumplir con los requisitos regulatorios. El segmento se ve fortalecido por la innovación continua y la automatización en la tecnología de ensayos. El aumento de las colaboraciones con instituciones académicas acelera aún más el crecimiento.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en licitación directa, ventas minoristas y otros. El segmento de licitación directa dominó el mercado con una participación en los ingresos del 52,6% en 2025, impulsado por la adquisición a granel por parte de hospitales, institutos de investigación y organismos gubernamentales. La licitación directa ofrece ventajas en costos mediante contratos a largo plazo y precios competitivos. Las grandes instituciones prefieren este canal por su suministro confiable y calidad constante. Los proyectos de investigación financiados por el gobierno y los programas de salud pública a menudo adquieren mediante licitaciones. Las compras basadas en licitaciones también garantizan el acceso a los kits de ensayo y analizadores más recientes. Este canal respalda grandes ensayos clínicos e iniciativas inmunológicas a nivel nacional. Los principales fabricantes prefieren los contratos de licitación por su demanda predecible y estabilidad de ingresos. Reduce los gastos generales de distribución y mejora la eficiencia de la cadena de suministro. Los hospitales y los grandes laboratorios se benefician de los procesos de adquisición estandarizados. El canal de licitación directa es dominante en regiones desarrolladas con infraestructura de atención médica establecida. También respalda programas de detección de salud pública a gran escala. Se espera que el segmento se mantenga fuerte debido a la continua demanda institucional.

Se espera que el segmento de ventas minoristas crezca más rápido, con una CAGR del 11,3% entre 2026 y 2033, impulsado por la expansión de pequeños laboratorios y CRO que compran kits a través de distribuidores. El crecimiento se sustenta en la creciente demanda de las economías emergentes con una creciente infraestructura de investigación. Los mercados en línea y una logística mejorada facilitan y agilizan las compras minoristas. Las ventas minoristas permiten a las instituciones más pequeñas acceder a kits de análisis avanzados sin largos ciclos de adquisición. Los distribuidores brindan soporte y capacitación localizados, lo que aumenta la adopción. El segmento se beneficia del crecimiento de las instalaciones de investigación privadas y las nuevas empresas biotecnológicas. Las ventas minoristas también facilitan la realización de pedidos flexibles para las necesidades de investigación estacionales. La mayor disponibilidad de kits de análisis en los mercados regionales fortalece este canal. Las ventas minoristas ayudan a la rápida adopción de nuevas tecnologías de análisis. El crecimiento también se sustenta en la creciente demanda de laboratorios de investigación descentralizados y en el punto de atención. Se espera que el segmento se expanda debido a una mayor concienciación y accesibilidad.

Análisis regional del mercado de ensayos ELISpot y FluoroSpot en América del Norte

- América del Norte dominó el mercado de ensayos ELISpot y FluoroSpot en 2025, respaldada por fuertes inversiones en investigación en ciencias biológicas, infraestructura de laboratorio avanzada y una alta adopción de ensayos inmunológicos en entornos de investigación académica, clínica y comercial.

- La región se beneficia de un ecosistema biotecnológico y farmacéutico consolidado, una amplia actividad de ensayos clínicos y un panorama consolidado de CRO. El creciente enfoque en el desarrollo de vacunas, la inmunoterapia contra el cáncer, los trastornos autoinmunes y la investigación de enfermedades infecciosas continúa impulsando la demanda de ensayos ELISpot y FluoroSpot.

- Los marcos de financiación favorables, los avances tecnológicos en la sensibilidad y multiplexación de los ensayos y la adopción temprana de herramientas avanzadas de monitoreo inmunológico fortalecen aún más el crecimiento del mercado regional.

Perspectiva del mercado de ensayos ELISpot y FluoroSpot en EE. UU.

El mercado estadounidense de ensayos ELISpot y FluoroSpot dominó el mercado con la mayor participación en los ingresos, con aproximadamente el 41,3 % en 2025, gracias a una sólida financiación federal para la investigación en ciencias de la vida e inmunología. La alta concentración de empresas biotecnológicas y farmacéuticas líderes, junto con una infraestructura avanzada de investigación clínica y de laboratorio, contribuye significativamente al liderazgo del mercado. La adopción generalizada de los ensayos ELISpot y FluoroSpot en instituciones académicas, hospitales y organizaciones de investigación por contrato (CRO) respalda una demanda sostenida. El fuerte enfoque del país en el desarrollo de vacunas, la inmunoterapia contra el cáncer y la investigación de enfermedades infecciosas impulsa aún más el crecimiento. Los altos volúmenes de ensayos clínicos y la continua innovación de productos aceleran la utilización de los ensayos. Las colaboraciones estratégicas entre institutos de investigación y empresas biofarmacéuticas impulsan el desarrollo tecnológico. La adopción temprana de analizadores automatizados y de alto rendimiento fortalece la posición en el mercado estadounidense.

Análisis del mercado de ensayos ELISpot y FluoroSpot en Canadá

Se prevé que el mercado canadiense de ensayos ELISpot y FluoroSpot sea la región de mayor crecimiento durante el período de pronóstico, con una tasa de crecimiento anual compuesta (TCAC) del 9,9 %. El crecimiento se ve impulsado por el aumento de las inversiones en biotecnología y ciencias de la vida, junto con la expansión de la investigación clínica y las actividades de las CRO. La creciente prevalencia de enfermedades infecciosas y autoinmunes está incrementando la demanda de herramientas avanzadas de investigación inmunológica y diagnóstica. Los programas gubernamentales de financiación y las iniciativas nacionales de investigación están fortaleciendo las capacidades de los laboratorios. La colaboración entre instituciones académicas y empresas biofarmacéuticas está acelerando la adopción de estos ensayos. La mejora de la infraestructura de los laboratorios y el creciente conocimiento de las tecnologías de perfilación inmunitaria impulsan aún más la expansión del mercado. La creciente participación de Canadá en ensayos clínicos globales lo posiciona como un factor clave para el crecimiento en Norteamérica.

Cuota de mercado de los ensayos ELISpot y FluoroSpot en América del Norte

La industria de ensayos ELISpot y FluoroSpot está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Mabtech (Suecia)

- Cellular Technology Limited (EE. UU.)

- BD (EE. UU.)

- Merck KGaA (Alemania)

- Oxford Immunotec (Reino Unido)

- ImmunoSpot (EE. UU.)

- Laboratorios Bio-Rad (EE. UU.)

- Sistemas de I+D (EE. UU.)

- Grupo Tecan (Suiza)

- Agilent Technologies (EE. UU.)

- PerkinElmer (Estados Unidos)

- Lonza (Suiza)

- Thermo Fisher Scientific (EE. UU.)

- Sartorius AG (Alemania)

- Becton Dickinson (EE. UU.)

- Nexcelom Bioscience (EE. UU.)

- ELISpot.com (EE. UU.)

- CTL (Cellular Technology Limited) (EE. UU.)

- Cytiva (EE. UU.)

- AID GmbH (Alemania)

Últimos avances en el mercado de ensayos ELISpot y FluoroSpot en América del Norte

- En marzo de 2023, Medline Industries presentó una nueva línea de muletas ergonómicas diseñadas para una mayor comodidad, estabilidad y facilidad de uso durante la rehabilitación y el apoyo a la movilidad, abordando las necesidades de los usuarios de dispositivos de asistencia a largo plazo.

- En junio de 2023, la empresa de dispositivos médicos Canes and Crutches anunció (mediante un comunicado de prensa) un innovador producto de ayuda a la movilidad como un nuevo dispositivo de movilidad en el mercado global, con el objetivo de ampliar las capacidades de las ayudas de movilidad tradicionales y respaldar una mayor independencia para los usuarios con discapacidades de movilidad.

- En agosto de 2023, Cool Crutches & Walking Sticks en el Reino Unido lanzó el primer programa de reciclaje de ayudas para caminar, en colaboración con la organización benéfica PhysioNet, para renovar y redistribuir ayudas de movilidad usadas, promoviendo la sostenibilidad y una mejor accesibilidad en todo el mundo.

- En julio de 2024, Cardinal Health completó la adquisición de un fabricante de dispositivos médicos, mejorando su cartera de productos de ayuda para la movilidad (incluidos bastones y muletas) y fortaleciendo su presencia en el mercado global de soluciones de movilidad terapéutica.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.