Mercado de adhesivos flocados de América del Norte, por producto (poliuretano, acrílico, epoxi y otros), fuente (a base de solvente y a base de agua), sustrato (textil, plástico, metal, vidrio, madera y otros), aplicación (automotriz, textiles técnicos y prendas de vestir, impresión, papel y embalaje y otros), país (EE. UU., Canadá, México), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado: mercado de adhesivos flocados en América del Norte

Análisis y perspectivas del mercado: mercado de adhesivos flocados en América del Norte

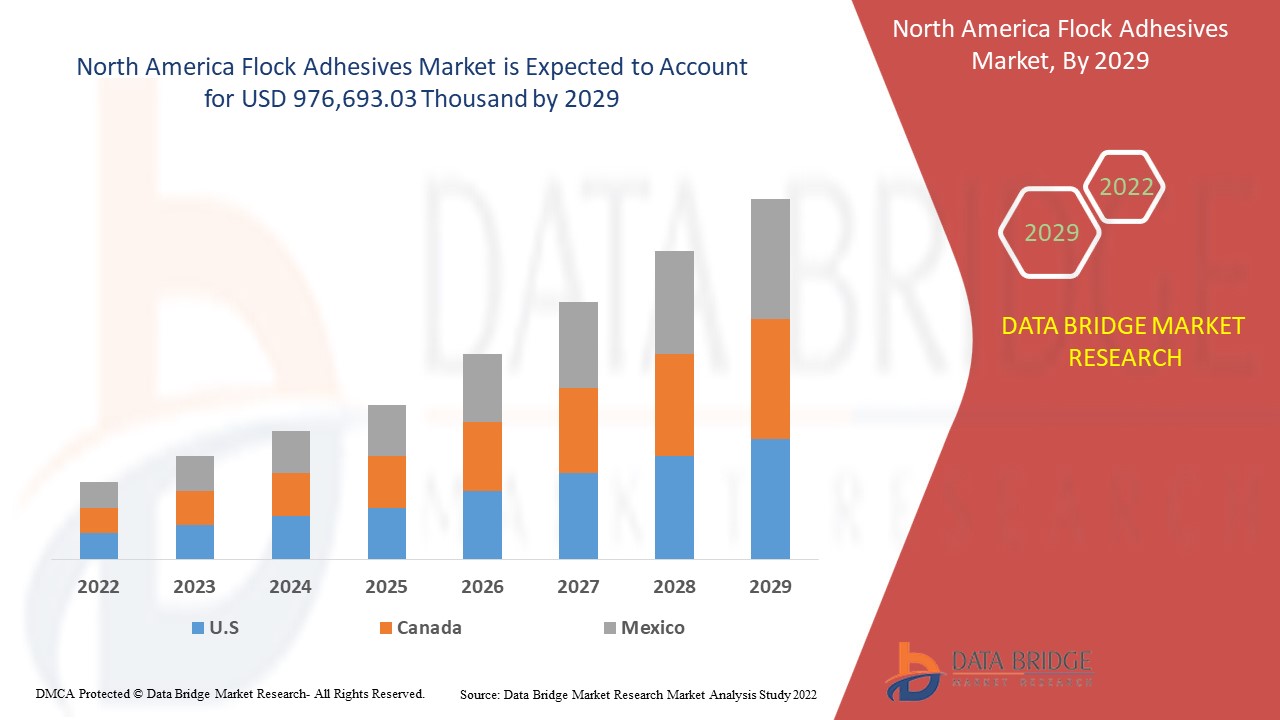

Se espera que el mercado de adhesivos flocados de América del Norte gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo a una CAGR del 5,0% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 976.693,03 mil para 2029. Se espera que la tendencia creciente de vehículos livianos y con bajas emisiones de carbono y las perspectivas positivas hacia los adhesivos flocados en los sectores automotriz y textil impulsen el mercado.

Los adhesivos flocados son materiales aglutinantes que se utilizan para unir diversos sustratos , como caucho, plástico y metal. El flocado adhesivo se produce cuando las partículas de fibra se incorporan electrostáticamente a la capa adhesiva. La mayoría de los flocados utilizan fibras naturales o sintéticas finamente picadas. El exterior flocado le da a la superficie propiedades decorativas y funcionales.

La creciente adopción de adhesivos flocados en la fabricación de aislamiento térmico y el cambio en las preferencias de los consumidores por el nivel de calidad del interior del automóvil son algunos de los determinantes clave que pueden favorecer el crecimiento del mercado de adhesivos flocados de América del Norte durante el período de pronóstico.

Sin embargo, la volatilidad de los precios de las materias primas y la reacción de las diferentes estructuras de composición pueden actuar como restricciones importantes en la tasa de crecimiento del mercado de adhesivos flocados de América del Norte. Además, las estrictas regulaciones asociadas con el proceso de aprobación de la comercialización pueden desafiar el crecimiento del mercado durante el período de pronóstico.

El aumento en la utilización de adhesivos flocados en los sectores de impresión y embalaje puede crear oportunidades lucrativas para el mercado.

Este informe sobre el mercado de adhesivos flocados de América del Norte proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de nuevos segmentos de ingresos, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen de analistas; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de adhesivos flocados en América del Norte

Alcance y tamaño del mercado de adhesivos flocados en América del Norte

El mercado de adhesivos flocados de América del Norte está segmentado en cuatro segmentos notables según la fuente, el sustrato, el producto y la aplicación. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- Según la fuente, el mercado de adhesivos flocados de América del Norte se segmenta en adhesivos a base de solvente y a base de agua. En 2022, se proyecta que el segmento a base de agua domine la región de América del Norte, ya que consiste en una baja temperatura de fusión que ayuda a mantener la suavidad de cualquier producto y aumenta su demanda en el mercado.

- En función del sustrato, el mercado de adhesivos flocados de América del Norte se segmenta en textiles, plásticos, metales, vidrios, maderas y otros. En 2022, se prevé que el segmento de plásticos domine la región de América del Norte, ya que el plástico tiene una alta capacidad de resistencia que ayuda a mantener el equilibrio de temperatura de cualquier producto y, por lo tanto, aumenta su demanda en el mercado.

- En función del producto, el mercado de adhesivos flocados de América del Norte se segmenta en poliuretano, acrílico, epoxi y otros. En 2022, se proyecta que el segmento acrílico domine la región de América del Norte, ya que el acrílico tiene una buena conductividad térmica y, por lo tanto, aumenta su demanda en el mercado.

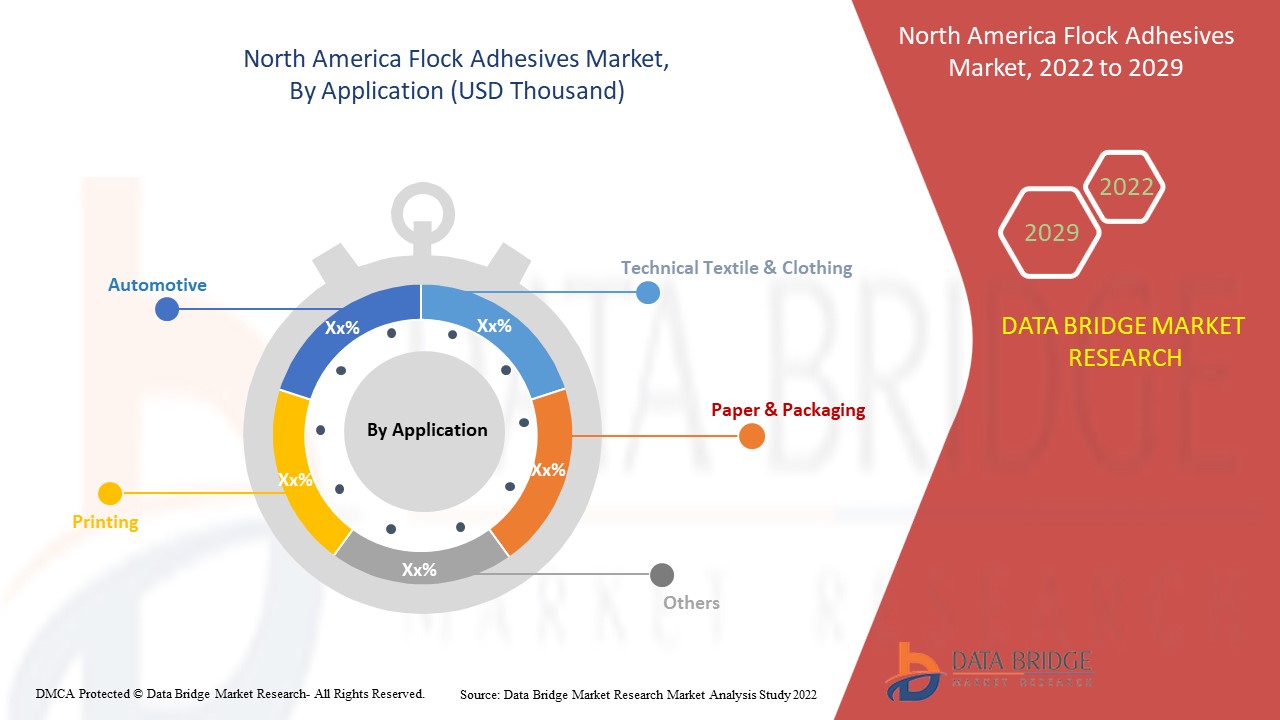

- En función de la aplicación, el mercado de adhesivos flocados de América del Norte se segmenta en automoción, textiles y prendas de vestir técnicas, impresión, papel y embalaje, entre otros. En 2022, se prevé que el segmento de la automoción domine la región, ya que los adhesivos flocados son muy ligeros y se utilizan para fabricar interiores de automóviles, lo que aumenta su demanda en el mercado.

Análisis a nivel de país del mercado de adhesivos flocados de América del Norte

El mercado de adhesivos flocados de América del Norte está segmentado en cuatro segmentos notables según la fuente, el sustrato, el producto y la aplicación.

Los países cubiertos en el mercado de adhesivos flocados de América del Norte son EE. UU., Canadá y México.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas norteamericanas y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Tendencia creciente de vehículos ligeros y con bajas emisiones de carbono

Los materiales ligeros utilizados en la fabricación de automóviles ofrecen grandes oportunidades de reducción de peso y otros beneficios cuando se utilizan en acero estructural y hierro fundido en aplicaciones automotrices. Los vehículos eléctricos tienen el impacto más significativo en la reducción de las emisiones de gases de efecto invernadero en la mayoría de los países, y los vehículos de gasolina ligeros logran reducciones significativas. Una reducción del 10% en el peso del vehículo puede mejorar el consumo de combustible en un 6% y un 8%.

Los materiales avanzados para la fabricación de vehículos eléctricos son esenciales para impulsar el mercado automotriz y, al mismo tiempo, mantener la seguridad y el rendimiento. Los materiales livianos ofrecen un gran potencial para aumentar la eficiencia del vehículo, ya que los objetos más livianos requieren menos energía para acelerar que los más pesados. Reemplazar las piezas de hierro fundido y de acero tradicionales por materiales livianos como acero de alta resistencia y aleaciones de magnesio puede reducir el peso de la carrocería y el chasis del vehículo hasta en un 50%, lo que reduce el consumo de combustible.

- En conclusión, los vehículos ligeros están fabricados principalmente de aluminio o acero ligero especial y emiten menos gases contaminantes que otros vehículos. Por este motivo, se espera que la creciente tendencia de vehículos ligeros y con bajas emisiones de carbono actúe como un factor impulsor de la demanda del mercado de adhesivos flocados en América del Norte.

El mercado de adhesivos flocados de América del Norte también le proporciona un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2012 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de adhesivos flocados en América del Norte

El panorama competitivo del mercado de adhesivos flocados de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de ensayos clínicos, el análisis de la marca, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque del mercado de adhesivos flocados de América del Norte.

Algunos de los principales actores del mercado de adhesivos flocados en América del Norte son Sika AG, CHT Group, NYATEX, Arkema, HB Fuller Company, Dow, PARKER HANNIFIN CORP, Henkel AG & Co. KGaA, Stahl Holdings BV, Avient Corporation, Kissel + Wolf GmbH, entre otros actores nacionales. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Las empresas también inician numerosos contratos y acuerdos, lo que acelera el mercado de adhesivos flocados en América del Norte.

Por ejemplo,

- En febrero de 2021, PARKER HANNIFIN CORP participó en la Fluid Power Expo 2021, que se celebró de forma virtual. La empresa participó en el evento para presentar sus productos a posibles clientes. Esto ha ayudado a la empresa a ampliar su base de consumidores.

- En agosto de 2021, Arkema adquirió el negocio Performance Adhesives de Ashland, empresa líder en adhesivos de alto rendimiento para aplicaciones industriales en EE. UU. Esto ha ayudado a la empresa a ampliar su cartera de productos en términos de adhesivos y soluciones.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FLOCK ADHESIVES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 THE PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 REGIONAL SUMMARY

5.1 NORTH AMERICA

5.2 NORTH AMERICA

5.3 ASIA-PACIFIC

5.4 EUROPE

5.5 SOUTH AMERICA

5.6 MIDDLE EAST AND AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING TREND OF LIGHTWEIGHT AND LOW CARBON-EMITTING VEHICLES

6.1.2 POSITIVE OUTLOOK TOWARDS FLOCK ADHESIVES IN AUTOMOTIVE AND TEXTILE SECTORS

6.1.3 RISING ADOPTION OF FLOCK ADHESIVES TO MANUFACTURE THERMAL INSULATION

6.1.4 SHIFTING CONSUMER PREFERENCE TOWARDS QUALITY LEVEL OF AUTOMOTIVE INTERIOR

6.2 RESTRAINTS

6.2.1 VOLATILITY IN RAW MATERIAL PRICES

6.2.2 REACTION OF DIFFERENT COMPOSITION STRUCTURE

6.2.3 RESTRICTED SUPPLY OF RAW MATERIALS FOR PRODUCING FLOCK ADHESIVES

6.3 OPPORTUNITIES

6.3.1 INCREASING R&D ACTIVITIES INVESTMENTS FOR THE DEVELOPMENT OF NEW PRODUCTS

6.3.2 UPSURGE IN UTILIZATION OF FLOCK ADHESIVES IN PRINTING AND PACKAGING SECTORS

6.3.3 FLAME RETARDING AND HIGH WASHABILITY QUALITIES BASED FLOCK ADHESIVES PRODUCTS CREATES LUCRATIVE OPPORTUNITIES

6.4 CHALLENGES

6.4.1 STRINGENT REGULATIONS ASSOCIATED WITH THE COMMERCIALIZATION APPROVAL PROCESS

6.4.2 LACK OF AWARENESS REGARDING FLOCK ADHESIVES IN SEVERAL EMERGING ECONOMIES

7 IMPACT OF COVID 19 IMPACT ON THE NORTH AMERICA FLOCK ADHESIVES MARKET

7.1 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA FLOCK ADHESIVES MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE NORTH AMERICA FLOCK ADHESIVES MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 IMPACT ON PRICE

7.5 IMPACT ON DEMAND

7.6 IMPACT ON SUPPLY CHAIN

7.7 CONCLUSION

8 NORTH AMERICA FLOCK ADHESIVES MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 ACRYLIC

8.3 POLYURETHANE

8.4 EPOXY

8.5 OTHERS

9 NORTH AMERICA FLOCK ADHESIVES MARKET, SOURCE

9.1 OVERVIEW

9.2 WATER-BORNE

9.3 SOLVENT-BORNE

10 NORTH AMERICA FLOCK ADHESIVES MARKET, BY SUBSTRATE

10.1 OVERVIEW

10.2 PLASTIC

10.3 METAL

10.4 TEXTILE

10.5 WOOD

10.6 GLASS

10.7 OTHERS

11 NORTH AMERICA FLOCK ADHESIVES MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 AUTOMOTIVE

11.2.1 ACRYLIC

11.2.2 POLYURETHANE

11.2.3 EPOXY

11.2.4 OTHERS

11.3 TECHNICAL TEXTILE & CLOTHING

11.3.1 ACRYLIC

11.3.2 POLYURETHANE

11.3.3 EPOXY

11.3.4 OTHERS

11.4 PAPER & PACKAGING

11.4.1 ACRYLIC

11.4.2 POLYURETHANE

11.4.3 EPOXY

11.4.4 OTHERS

11.5 PRINTING

11.5.1 ACRYLIC

11.5.2 POLYURETHANE

11.5.3 EPOXY

11.5.4 OTHERS

11.6 OTHERS

11.6.1 ACRYLIC

11.6.2 POLYURETHANE

11.6.3 EPOXY

11.6.4 OTHERS

12 NORTH AMERICA FLOCK ADHESIVE MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA FLOCK ADHESIVES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 DOW

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATE

15.2 SIKA AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 HENKEL AG & CO. KGAA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATE

15.4 PARKER HANNIFIN CORP

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT UPDATE

15.5 ARKEMA

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT UPDATES

15.6 AVIENT CORPORATION

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATE

15.7 H.B. FULLER COMPANY

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 CHT GROUP

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATES

15.9 KISSEL + WOLF GMBH

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATE

15.1 NANPAO RESINS CHEMICAL GROUP

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATE

15.11 NYATEX

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT UPDATE

15.12 STAHL HOLDINGS B.V

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT UPDATE

15.13 SWISSFLOCK AG

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT UPDATE

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 EXPORT DATA OF GLUES, PREPARED, AND OTHER PREPARED ADHESIVES, N.E.S., HS 350699 (USD THOUSAND)

TABLE 2 IMPORT DATA OF GLUES, PREPARED, AND OTHER PREPARED ADHESIVES, N.E.S., HS 350699 (USD THOUSAND)

TABLE 3 NORTH AMERICA FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 4 NORTH AMERICA FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 5 NORTH AMERICA ACRYLIC IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA ACRYLIC IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (TONS)

TABLE 7 NORTH AMERICA POLYURETHANE IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA POLYURETHANE IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (TONS)

TABLE 9 NORTH AMERICA EPOXY IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA EPOXY IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (TONS)

TABLE 11 NORTH AMERICA OTHERS IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA OTHERS IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (TONS)

TABLE 13 NORTH AMERICA FLOCK ADHESIVES MARKET, BY SOURCE, 2022-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA WATER-BORNE IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA SOLVENT-BORNE IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA FLOCK ADHESIVES MARKET, BY SUBSTRATE, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA PLASTIC IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA METAL IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA TEXTILE IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA WOOD IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA GLASS IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA OTHERS IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA FLOCK ADHESIVES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA AUTOMOTIVE IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA AUTOMOTIVE IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA TECHNICAL TEXTILE & CLOTHING IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA TECHNICAL TEXTILE & CLOTHING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA PAPER & PACKAGING IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA PAPER & PACKAGING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA PRINTING IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA PRINTING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA OTHERS IN FLOCK ADHESIVES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA OTHERS IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA FLOCK ADHESIVES MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA FLOCK ADHESIVES MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 36 NORTH AMERICA FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 38 NORTH AMERICA FLOCK ADHESIVES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA FLOCK ADHESIVES MARKET, BY SUBSTRATE, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA FLOCK ADHESIVES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA AUTOMOTIVE IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA TECHNICAL TEXTILE & CLOTHING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA PAPER & PACKAGING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA PRINTING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA OTHERS IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 46 U.S. FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 47 US FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 48 US FLOCK ADHESIVES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 49 US FLOCK ADHESIVES MARKET, BY SUBSTRATE, 2020-2029 (USD THOUSAND)

TABLE 50 US FLOCK ADHESIVES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 51 US AUTOMOTIVE IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 52 US TECHNICAL TEXTILE & CLOTHING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 53 US PAPER & PACKAGING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 54 US PRINTING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 55 US OTHERS IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 56 CANADA FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 57 CANADA FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 58 CANADA FLOCK ADHESIVES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 59 CANADA FLOCK ADHESIVES MARKET, BY SUBSTRATE, 2020-2029 (USD THOUSAND)

TABLE 60 CANADA FLOCK ADHESIVES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 CANADA AUTOMOTIVE IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 62 CANADA TECHNICAL TEXTILE & CLOTHING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 63 CANADA PAPER & PACKAGING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 64 CANADA PRINTING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 65 CANADA OTHERS IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 66 MEXICO FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 67 MEXICO FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 68 MEXICO FLOCK ADHESIVES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 69 MEXICO FLOCK ADHESIVES MARKET, BY SUBSTRATE, 2020-2029 (USD THOUSAND)

TABLE 70 MEXICO FLOCK ADHESIVES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 71 MEXICO AUTOMOTIVE IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 72 MEXICO TECHNICAL TEXTILE & CLOTHING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 73 MEXICO PAPER & PACKAGING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 74 MEXICO PRINTING IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 75 MEXICO OTHERS IN FLOCK ADHESIVES MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

Lista de figuras

FIGURE 1 NORTH AMERICA FLOCK ADHESIVES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FLOCK ADHESIVES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FLOCK ADHESIVES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FLOCK ADHESIVES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FLOCK ADHESIVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FLOCK ADHESIVES MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 NORTH AMERICA FLOCK ADHESIVES MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA FLOCK ADHESIVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA FLOCK ADHESIVES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA FLOCK ADHESIVES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA FLOCK ADHESIVES MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA FLOCK ADHESIVES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA FLOCK ADHESIVES MARKET: SEGMENTATION

FIGURE 14 A POSITIVE OUTLOOK TOWARDS FLOCK ADHESIVES IN THE AUTOMOTIVE AND TEXTILE SECTORS IS EXPECTED TO DRIVE THE NORTH AMERICA FLOCK ADHESIVES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 ACRYLIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FLOCK ADHESIVES MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA FLOCK ADHESIVES MARKET

FIGURE 17 PERCENTAGE OF LIGHTWEIGHT MATERIALS PRESENT IN TYPICAL VEHICLES (APPROXIMATE VALUE)

FIGURE 18 NORTH AMERICA FLOCK ADHESIVES MARKET, BY PRODUCT, 2021

FIGURE 19 NORTH AMERICA FLOCK ADHESIVES MARKET, BY SOURCE, 2021

FIGURE 20 NORTH AMERICA FLOCK ADHESIVES MARKET, BY SUBSTRATE, 2021

FIGURE 21 NORTH AMERICA FLOCK ADHESIVES MARKET, BY APPLICATION, 2021

FIGURE 22 NORTH AMERICA FLOCK ADHESIVES MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA FLOCK ADHESIVES MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA FLOCK ADHESIVES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA FLOCK ADHESIVES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA FLOCK ADHESIVES MARKET: BY PRODUCT (2022-2029)

FIGURE 27 NORTH AMERICA FLOCK ADHESIVES MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.