Mercado de sustitutos de grasa de América del Norte, por tipo (basado en carbohidratos, basado en proteínas y basado en grasas), fuente (vegetal y animal), categoría (etiqueta limpia y convencional), forma (líquida y seca), aplicación (panadería, productos lácteos, salsas, sopas y aderezos, alimentos preparados, alimentos procesados, confitería, carne procesada , alimentos funcionales y otros), país (EE. UU., Canadá, México), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado: mercado de sustitutos de grasa en América del Norte

Análisis y perspectivas del mercado: mercado de sustitutos de grasa en América del Norte

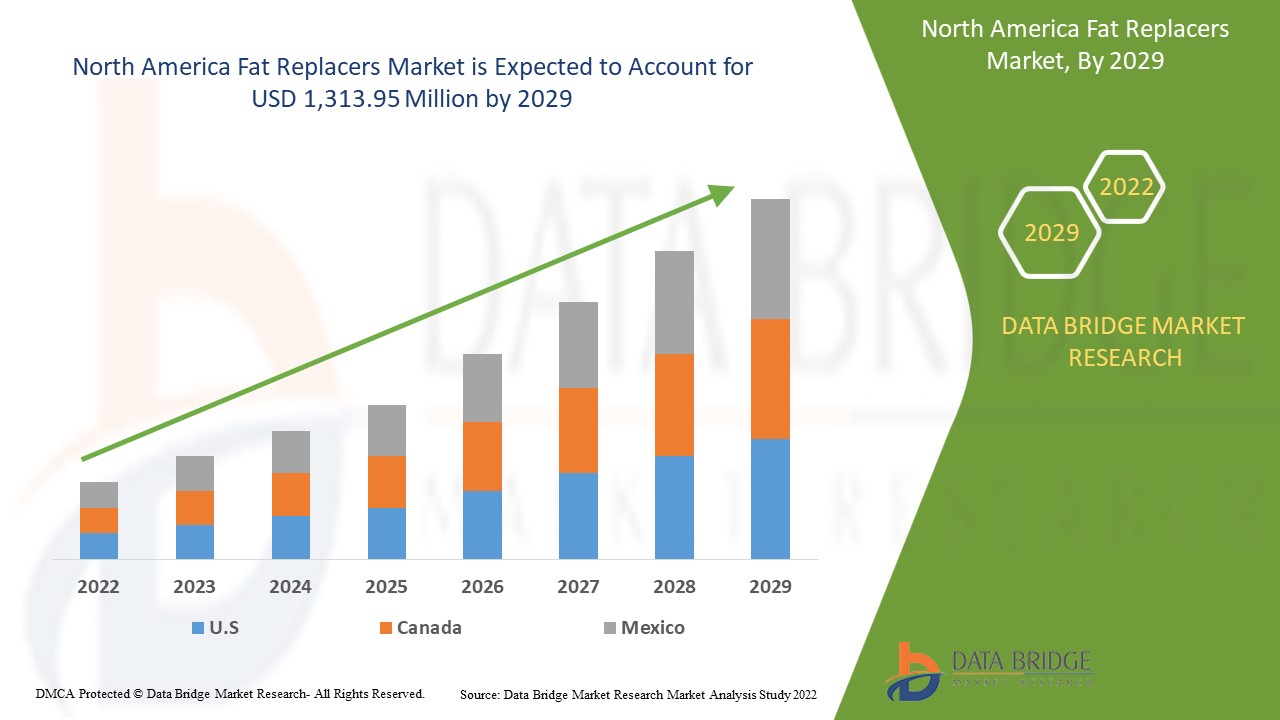

Se espera que el mercado de sustitutos de grasa de América del Norte crezca en el período de pronóstico de 2021 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 6,3% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 1.313,95 millones para 2029. La creciente conciencia entre las personas sobre el consumo excesivo de grasas está impulsando el crecimiento del mercado de sustitutos de grasa de América del Norte.

Los sustitutos de grasa, también conocidos como sustitutos de grasa, son sustancias que reemplazan la totalidad o parte de la grasa de una dieta, manteniendo el mismo sabor, textura y sensación en boca que el alimento original con toda su grasa. La grasa no es una sola sustancia, sino más bien un conjunto de varias sustancias formadas por una molécula de glicerol y tres ácidos grasos separados. Es un componente esencial de una dieta saludable. Contiene los componentes básicos de las prostaglandinas, contiene ácidos grasos esenciales, ayuda a controlar el metabolismo del colesterol, transporta vitaminas liposolubles y carotenoides por todo el cuerpo y ofrece nueve calorías de energía por gramo.

Los sustitutos de grasa son compuestos que se utilizan para reemplazar la grasa en una variedad de alimentos y bebidas. La mayoría de los sustitutos de grasa son versiones reformuladas de componentes alimentarios existentes (almidones, gomas, celulosa y otros).

La grasa se puede encontrar en casi cualquier alimento. Imparte una textura, un sabor y un aroma distintivos al plato en el que está presente. Si bien la grasa es necesaria para la vida, puede ser perjudicial para la salud si se consume en exceso de los requisitos fisiológicos. Las dietas ricas en grasas aumentan el riesgo de enfermedades cardíacas, aumento de peso y varios tipos de cáncer. El uso de sustitutos de grasa en productos alimenticios permite conservar las características de calidad originales de los alimentos al tiempo que evita los riesgos asociados con el consumo de grasas. El mercado de sustitutos de grasa está ganando un crecimiento significativo debido a la creciente conciencia entre las personas sobre el consumo excesivo de grasa, la creciente conciencia de la salud entre las personas. La creciente participación de las personas en programas de control de la pérdida de peso, el aumento de las regulaciones gubernamentales asociadas con el límite del consumo diario de grasa y el creciente uso de sustitutos de grasa en productos de panadería, lácteos y congelados también están impulsando el crecimiento del mercado mundial de sustitutos de grasa. Sin embargo, se espera que el sabor desfavorable en comparación con las grasas y los problemas nutricionales asociados con los sustitutos de grasa frenen el crecimiento del mercado de sustitutos de grasa durante el período de pronóstico. El aumento del consumo de alimentos preparados y la gran cantidad de personas que optan por dietas sin lácteos, así como el aumento de la investigación y el desarrollo de sustitutos de grasa, crearán oportunidades para el mercado en el período de pronóstico. Sin embargo, los altos precios de los productos de reemplazo de grasa y los efectos adversos de estos pueden crear un gran desafío para el mercado.

El informe de mercado de sustitutos de grasa de América del Norte proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado de sustitutos de grasa de América del Norte, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de sustitutos de grasa en América del Norte

Alcance y tamaño del mercado de sustitutos de grasa en América del Norte

El mercado de sustitutos de grasa de América del Norte está segmentado en cinco segmentos notables que se basan en el tipo, la fuente, la categoría, la forma y la aplicación. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- Según el tipo, el mercado mundial de sustitutos de grasa se segmenta en basado en carbohidratos, basado en proteínas y basado en grasas. En 2022, se espera que el segmento basado en carbohidratos domine el mercado de sustitutos de grasa debido a su uso en diversas aplicaciones, como panadería, productos lácteos y otros.

- Según la fuente, el mercado mundial de sustitutos de grasa se segmenta en vegetales y animales. En 2022, se espera que el segmento vegetal domine el mercado, con una creciente población vegana y vegetariana en todo el mundo y un número cada vez mayor de fabricantes de alimentos y bebidas.

- Según la categoría, el mercado mundial de sustitutos de grasa se segmenta en etiqueta limpia y convencional. En 2022, se espera que el segmento de etiqueta limpia domine el mercado de sustitutos de grasa debido al creciente consumo de ingredientes de etiqueta limpia y su uso cada vez mayor en productos de panadería y lácteos.

- En función de la forma, el mercado mundial de sustitutos de grasa se segmenta en líquido y seco. En 2022, se espera que el segmento seco domine el mercado de sustitutos de grasa, ya que los sustitutos de grasa en forma seca ofrecen varios beneficios, como una fácil mezcla durante el proceso de producción, entre otros.

- En función de la aplicación, el mercado global de sustitutos de grasa se segmenta en panadería, productos lácteos, salsas, sopas y aderezos, alimentos preparados, alimentos procesados, confitería, carne procesada, alimentos funcionales y otros. En 2022, se espera que el segmento de panadería domine el mercado de sustitutos de grasa debido a la creciente demanda de bocadillos saludables con contenido reducido de grasa y la creciente conciencia entre las personas sobre el consumo excesivo de grasa.

Análisis a nivel de país del mercado de sustitutos de grasa de América del Norte

Se analiza el mercado de sustitutos de grasa de América del Norte y se proporciona información sobre el tamaño del mercado según el tipo, la fuente, la categoría, la forma y la aplicación como se menciona anteriormente.

Los países incluidos en el informe de mercado de sustitutos de grasa de América del Norte son Estados Unidos, Canadá y México. Estados Unidos lidera el crecimiento del mercado y el segmento basado en carbohidratos domina en este país debido a la creciente demanda de sustitutos de grasa basados en carbohidratos para imitar algunas de las propiedades de las grasas convencionales.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Las crecientes actividades estratégicas de los principales actores para mejorar el conocimiento de los sustitutos de grasa están impulsando el crecimiento del mercado

El mercado de sustitutos de grasa de América del Norte también le proporciona un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2010 a 2019.

Análisis del panorama competitivo y de la cuota de mercado de sustitutos de grasa en América del Norte

El panorama competitivo del mercado de sustitutos de grasa de América del Norte proporciona detalles por competidor. Los detalles incluidos son la descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores solo están relacionados con el enfoque de la empresa en el mercado de sustitutos de grasa de América del Norte.

Algunos de los principales actores que operan en el mercado de sustitutos de grasa de América del Norte son ULRICK&SHORT, Ingredion Incorporated, CP Kelco US, Inc., Tate & Lyle, BENEO, Cargill, Incorporated, Wilmar International Ltd, JELU-WERK J. Ehrler GmbH & Co. KG, Epogee, Grain Processing Corporation, Corbion, Ashland, AVEBE y DuPont, entre otros.

Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Muchos lanzamientos de productos también son iniciados por empresas de todo el mundo, lo que acelera aún más el crecimiento del mercado de sustitutos de grasa en América del Norte.

Por ejemplo,

- En febrero de 2021, Epogee anunció que su tecnología de grasas alternativas, EPG, ahora se utiliza como ingrediente clave en los productos recién lanzados de OWN Your Hunger. Esto ha ayudado a la empresa a ampliar su cartera de productos.

Las colaboraciones, los lanzamientos de productos, las expansiones comerciales, los premios y reconocimientos, las empresas conjuntas y otras estrategias de los actores del mercado están mejorando la presencia de las empresas en el mercado de sustitutos de grasa de América del Norte.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FAT REPLACERS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 NORTH AMERICA FAT REPLACERS MARKET: GROWTH STRATEGIES

4.2 NORTH AMERICA FAT REPLACERS MARKET: INDUSTRIAL INSIGHTS

5 NORTH AMERICA FAT REPLACERS MARKET: REGULATORY FRAMEWORK

5.1 FDA

5.1.1 LABELLING REGULATIONS

5.1.2 OLESTRA

5.1.3 MALTODEXTRINS

5.1.4 ALLERGEN LABELING

5.2 EU

5.2.1 EU ALLERGEN LABELING

5.2.2 EU NUTRITIONAL VALUE

5.2.3 EU HEALTH CLAIM: ‘CARBOHYDRATES CONTRIBUTE TO THE MAINTENANCE OF NORMAL BRAIN FUNCTION’

5.2.4 EU HEALTH CLAIM: ‘CARBOHYDRATE-ELECTROLYTE SOLUTIONS ENHANCE THE ABSORPTION OF WATER DURING PHYSICAL EXERCISE’

5.2.5 EU HEALTH CLAIM: ‘CARBOHYDRATE-ELECTROLYTE SOLUTIONS CAN CONTRIBUTE TO THE MAINTENANCE OF ENDURANCE PERFORMANCE DURING PROLONGED ENDURANCE EXERCISE’

5.2.6 EU HEALTH CLAIM: ‘GLYCEMIC CARBOHYDRATES CONTRIBUTE TO RECOVERY OF NORMAL MUSCLE FUNCTION (CONTRACTION) AFTER STRENUOUS EXERCISE’

5.2.7 EU INFANT NUTRITION REGULATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN AWARENESS AMONG PEOPLE ABOUT EXCESSIVE CONSUMPTION OF FAT

6.1.2 GROWING HEALTH CONSCIOUSNESS AMONG PEOPLE

6.1.3 INCREASE IN PARTICIPATION OF PEOPLE IN WEIGHT LOSS MANAGEMENT PROGRAMS

6.1.4 GROWING GOVERNMENT REGULATIONS ASSOCIATED WITH LIMIT ON DAILY CONSUMPTION OF FAT

6.1.5 GROWING USAGE OF FAT REPLACER IN BAKERY, DAIRY, AND FROZEN PRODUCTS

6.2 RESTRAINTS

6.2.1 UNFAVORABLE TASTE WHEN COMPARED TO FATS

6.2.2 NUTRITION PROBLEMS ASSOCIATED WITH FAT SUBSTITUTES

6.3 OPPORTUNITIES

6.3.1 INCREASE IN CONSUMPTION OF CONVENIENCE FOOD

6.3.2 A LARGE NUMBER OF PEOPLE TURNING TO DAIRY-FREE DIETS

6.3.3 INCREASE IN RESEARCH & DEVELOPMENT OF FAT REPLACER

6.4 CHALLENGES

6.4.1 HIGH PRICES OF FAT REPLACER PRODUCTS

6.4.2 ADVERSE EFFECTS OF FAT REPLACERS

7 IMPACT OF COVID-19 ON THE NORTH AMERICA FAT REPLACERSS MARKET

7.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE NORTH AMERICA FAT REPLACERS MARKET

7.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.3 IMPACT ON PRICE

7.4 IMPACT ON DEMAND

7.5 IMPACT ON SUPPLY CHAIN

7.6 CONCLUSION

8 NORTH AMERICA FAT REPLACERS MARKET, BY TYPE

8.1 OVERVIEW

8.2 CARBOHYDRATE-BASED

8.2.1 STARCH

8.2.2 CELLULOSE

8.2.3 GUM

8.2.4 GELATIN

8.2.5 OTHERS

8.3 PROTEIN-BASED

8.3.1 WHEY PROTEIN

8.3.2 SOY PROTEIN

8.3.3 MILK PROTEIN

8.3.4 EGG PROTEIN

8.3.5 OTHERS

8.4 FAT-BASED

8.4.1 OLESTRA

8.4.2 SALATRIM

8.4.3 CAPRENIN

8.4.4 OTHERS

9 NORTH AMERICA FAT REPLACERS MARKET, BY SOURCE

9.1 OVERVIEW

9.2 PLANT

9.3 ANIMAL

10 NORTH AMERICA FAT REPLACERS MARKET, BY CATEGORY

10.1 OVERVIEW

10.2 CLEAN LABEL

10.3 CONVENTIONAL

11 NORTH AMERICA FAT REPLACERS MARKET, BY FORM

11.1 OVERVIEW

11.2 DRY

11.3 LIQUID

12 NORTH AMERICA FAT REPLACERS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 BAKERY

12.2.1 BAKERY, BY PRODUCT TYPE

12.2.1.1 BREADS & ROLLS

12.2.1.2 CAKES, PASTRIES, & TRUFFLES

12.2.1.3 COOKIES & BISCUIT

12.2.1.4 TART & PIES

12.2.1.5 BROWNIES

12.2.1.6 TORTILLA

12.2.1.7 OTHERS

12.2.2 BAKERY, BY TYPE

12.2.2.1 CARBOHYDRATE-BASED

12.2.2.2 PROTEIN-BASED

12.2.2.3 FAT-BASED

12.3 DAIRY PRODUCTS

12.3.1 DAIRY PRODUCTS, BY PRODUCT TYPE

12.3.1.1 ICE CREAM

12.3.1.2 YOGURT

12.3.1.2.1 FRESH

12.3.1.2.2 FROZEN

12.3.1.3 MILK

12.3.1.3.1 REGULAR PROCESSED MILK

12.3.1.3.2 FLAVORED MILK

12.3.1.4 CHEESE

12.3.1.5 OTHERS

12.3.2 DAIRY PRODUCTS, BY TYPE

12.3.2.1 CARBOHYDRATE-BASED

12.3.2.2 PROTEIN-BASED

12.3.2.3 FAT-BASED

12.4 CONVENIENCE FOOD

12.4.1 CONVENIENCE FOOD, BY PRODUCT TYPE

12.4.1.1 FROZEN FOOD

12.4.1.2 RTE

12.4.1.3 CANNED FOOD

12.4.1.4 NOODLE AND PASTA

12.4.1.5 CEREALS & SNACKS

12.4.1.6 OTHERS

12.4.2 CONVENIENCE FOOD, BY TYPE

12.4.2.1 CARBOHYDRATE-BASED

12.4.2.2 PROTEIN-BASED

12.4.2.3 FAT-BASED

12.5 PROCESSED MEAT

12.5.1 PROCESSED MEAT, BY TYPE

12.5.1.1 CARBOHYDRATE-BASED

12.5.1.2 PROTEIN-BASED

12.5.1.3 FAT-BASED

12.6 CONFECTIONERY

12.6.1 CONFECTIONERY, BY PRODUCT TYPE

12.6.1.1 CHOCOLATE

12.6.1.2 HARD-BOILED SWEETS

12.6.1.3 GUMS & JELLIES

12.6.1.4 CHOCOLATE SYRUPS

12.6.1.5 CARAMELS & TOFFEES

12.6.1.6 MINTS

12.6.1.7 OTHERS

12.6.2 CONFECTIONERY, BY TYPE

12.6.2.1 CARBOHYDRATE-BASED

12.6.2.2 PROTEIN-BASED

12.6.2.3 FAT-BASED

12.7 FUNCTIONAL FOOD

12.7.1 FUNCTIONAL FOOD, BY TYPE

12.7.1.1 CARBOHYDRATE-BASED

12.7.1.2 PROTEIN-BASED

12.7.1.3 FAT-BASED

12.8 SAUCES, SOUPS, & DRESSINGS

12.8.1 SAUCES, SOUPS, & DRESSINGS, BY TYPE

12.8.1.1 CARBOHYDRATE-BASED

12.8.1.2 PROTEIN-BASED

12.8.1.3 FAT-BASED

12.9 BEVERAGES

12.9.1 BEVERAGES, BY TYPE

12.9.1.1 CARBOHYDRATE-BASED

12.9.1.2 PROTEIN-BASED

12.9.1.3 FAT-BASED

12.1 OTHERS

12.10.1 OTHERS, BY TYPE

12.10.1.1 CARBOHYDRATE-BASED

12.10.1.2 PROTEIN-BASED

12.10.1.3 FAT-BASED

13 NORTH AMERICA FAT REPLACERS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA FAT REPLACERS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 CARGILL, INCORPORATED

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 WILMAR INTERNATIONAL LTD

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUS ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 DUPONT

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 INGREDION INCORPORATED

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 ASHLAND

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 CORBION

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 KERRY

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 CP KELCO U.S., INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 AVEBE

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 TATE & LYLE

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 BENEO

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 EPOGEE

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 GRAIN PROCESSING CORPORATION

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 JELU-WERK J. EHRLER GMBH & CO. KG

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 ULRICK&SHORT

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA CARBOHYDRATE-BASED IN FAT REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA CARBOHYDRATE-BASED IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA PROTEIN-BASED IN FAT REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA PROTEIN-BASED IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA FAT-BASED IN FAT REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA FAT-BASED IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA FAT REPLACERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA PLANT IN FAT REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ANIMAL IN FAT REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA FAT REPLACERS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA CLEAN LABEL IN FAT REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA CONVENTIONAL IN FAT REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA FAT REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA DRY IN FAT REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA LIQUID IN FAT REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA FAT REPLACERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA BAKERY IN FAT REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA BAKERY IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA BAKERY IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA DAIRY PRODUCTS IN FAT REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA DAIRY PRODUCTS IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA YOGURT IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA MILK IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA DAIRY PRODUCT IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA CONVENIENCE FOOD IN FAT REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA CONVENIENCE FOOD IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA CONVENIENCE FOOD IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA PROCESSED MEAT IN FAT REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA PROCESSED MEAT IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA CONFECTIONARY IN FAT REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA CONFECTIONERY IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA CONFECTIONERY IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA FUNCTIONAL FOOD IN FAT REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA FUNCTIONAL FOOD IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA SAUCES, SOUPS, & DRESSINGS IN FAT REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA SAUCES, SOUPS, & DRESSINGS IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA BEVERAGES IN FAT REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA BEVERAGES IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN FAT REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA OTHERS IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA FAT REPLACERS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA CARBOHYDRATE-BASED IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA PROTEIN-BASED IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA FAT-BASED IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA REPLACERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA FAT REPLACERS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA FAT REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA FAT REPLACERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA BAKERY IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA BAKERY IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA DAIRY PRODUCTS IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA YOGURT IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA MILK IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA DAIRY PRODUCTS IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA CONVENIENCE FOOD IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA CONVENIENCE FOOD IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA PROCESSED MEAT IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA CONFECTIONERY IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA CONFECTIONERY IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA FUNCTIONAL FOOD IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA SAUCES, SOUPS, & DRESSINGS IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA BEVERAGES IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA OTHERS IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. CARBOHYDRATE-BASED IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. PROTEIN-BASED IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.S. FAT-BASED IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. REPLACERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 71 U.S. FAT REPLACERS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 72 U.S. FAT REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 73 U.S. FAT REPLACERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 U.S. BAKERY IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 U.S. BAKERY IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.S. DAIRY PRODUCTS IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.S. YOGURT IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.S. MILK IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 79 U.S. DAIRY PRODUCTS IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.S. CONVENIENCE FOOD IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.S. CONVENIENCE FOOD IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 U.S. PROCESSED MEAT IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 U.S. CONFECTIONERY IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 U.S. CONFECTIONERY IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.S. FUNCTIONAL FOOD IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 U.S. SAUCES, SOUPS, & DRESSINGS IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 U.S. BEVERAGES IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 U.S. OTHERS IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 CANADA FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 CANADA CARBOHYDRATE-BASED IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 CANADA PROTEIN-BASED IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 CANADA FAT-BASED IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 CANADA REPLACERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 94 CANADA FAT REPLACERS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 95 CANADA FAT REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 96 CANADA FAT REPLACERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 CANADA BAKERY IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 98 CANADA BAKERY IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 CANADA DAIRY PRODUCTS IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 100 CANADA YOGURT IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 CANADA MILK IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 CANADA DAIRY PRODUCTS IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 CANADA CONVENIENCE FOOD IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 CANADA CONVENIENCE FOOD IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 CANADA PROCESSED MEAT IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 CANADA CONFECTIONERY IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 CANADA CONFECTIONERY IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 CANADA FUNCTIONAL FOOD IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 CANADA SAUCES, SOUPS, & DRESSINGS IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 CANADA BEVERAGES IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 CANADA OTHERS IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 MEXICO FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 MEXICO CARBOHYDRATE-BASED IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 MEXICO PROTEIN-BASED IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 MEXICO FAT-BASED IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 MEXICO REPLACERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 117 MEXICO FAT REPLACERS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 118 MEXICO FAT REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 119 MEXICO FAT REPLACERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 120 MEXICO BAKERY IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 121 MEXICO BAKERY IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO DAIRY PRODUCTS IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 123 MEXICO YOGURT IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO MILK IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 MEXICO DAIRY PRODUCTS IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 MEXICO CONVENIENCE FOOD IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 127 MEXICO CONVENIENCE FOOD IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 MEXICO PROCESSED MEAT IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 MEXICO CONFECTIONERY IN FAT REPLACERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 MEXICO CONFECTIONERY IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 MEXICO FUNCTIONAL FOOD IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 MEXICO SAUCES, SOUPS, & DRESSINGS IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 MEXICO BEVERAGES IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 MEXICO OTHERS IN FAT REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA FAT REPLACERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FAT REPLACERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FAT REPLACERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FAT REPLACERS MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA FAT REPLACERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FAT REPLACERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FAT REPLACERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FAT REPLACERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA FAT REPLACERS MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA REGION IS EXPECTED TO DOMINATE THE NORTH AMERICA FAT REPLACERS MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INCREASING AWARENESS AMONG PEOPLE ABOUT EXCESSIVE CONSUMPTION OF FAT IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA FAT REPLACERS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 CARBOHYDRATE-BASED IN PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FAT REPLACERS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF NORTH AMERICA FAT REPLACERS MARKET

FIGURE 14 MAJOR SOURCES OF FAT IN U.S. DIET

FIGURE 15 NORTH AMERICA FAT REPLACERS MARKET: BY TYPE, 2021

FIGURE 16 NORTH AMERICA FAT REPLACERS MARKET: BY SOURCE, 2021

FIGURE 17 NORTH AMERICA FAT REPLACERS MARKET: BY CATEGORY, 2021

FIGURE 18 NORTH AMERICA FAT REPLACERS MARKET, BY FORM, 2021

FIGURE 19 NORTH AMERICA FAT REPLACERS MARKET: BY APPLICATION, 2021

FIGURE 20 NORTH AMERICA FAT REPLACERS MARKET: SNAPSHOT (2021)

FIGURE 21 NORTH AMERICA FAT REPLACERS MARKET: BY COUNTRY (2021)

FIGURE 22 NORTH AMERICA FAT REPLACERS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 NORTH AMERICA FAT REPLACERS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 NORTH AMERICA FAT REPLACERS MARKET: BY TYPE (2022 & 2029)

FIGURE 25 NORTH AMERICA FAT REPLACERS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.