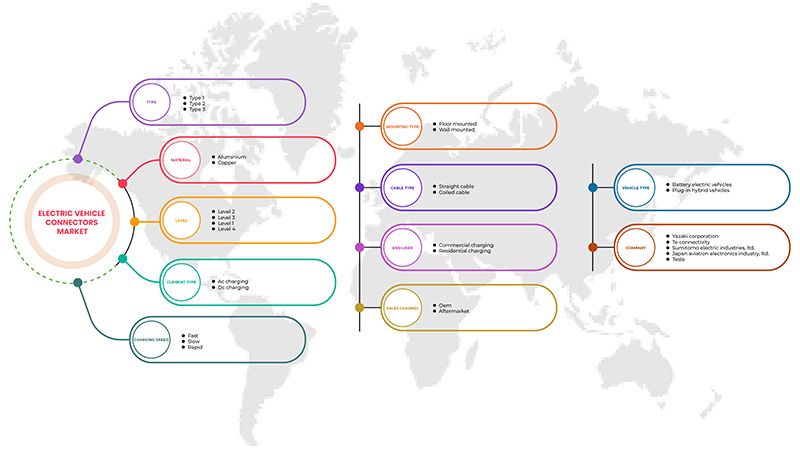

Mercado de conectores para vehículos eléctricos de América del Norte, por tipo (tipo 1, tipo 2 y tipo 3), material (cobre y aluminio), tipo de corriente (carga de CA y carga de CC), velocidad de carga (lenta, rápida y veloz), tipo de montaje (montado en la pared y montado en el piso), tipo de cable (cable recto y cables en espiral), nivel (nivel 1, nivel 2, nivel 3 y nivel 4), usuario final (comercial y residencial), canal de ventas (OEM y posventa), tipo de vehículo ( vehículos eléctricos de batería y vehículos híbridos enchufables ) : tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado de conectores para vehículos eléctricos en América del Norte

La electrificación requiere un nuevo enfoque del diseño automotriz y pone de relieve la importancia de los conectores automotrices de alta calidad para dar vida a las innovaciones. Los conectores garantizan que la energía se distribuya de manera confiable en cada sistema eléctrico, desde la batería hasta el tren motriz, pasando por la física del tablero y otros equipos especializados. También ayudan en caso de fallas, permitiendo que los sistemas operativos sigan funcionando en caso de una falla singular del sistema. La estación de carga de vehículos eléctricos puede funcionar con corriente alterna o continua. La fuente de energía se utiliza para clasificar los tipos de conectores de carga de vehículos eléctricos.

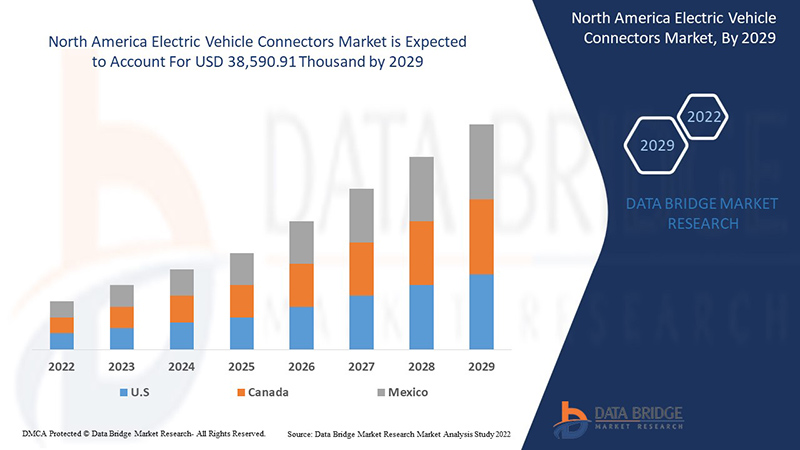

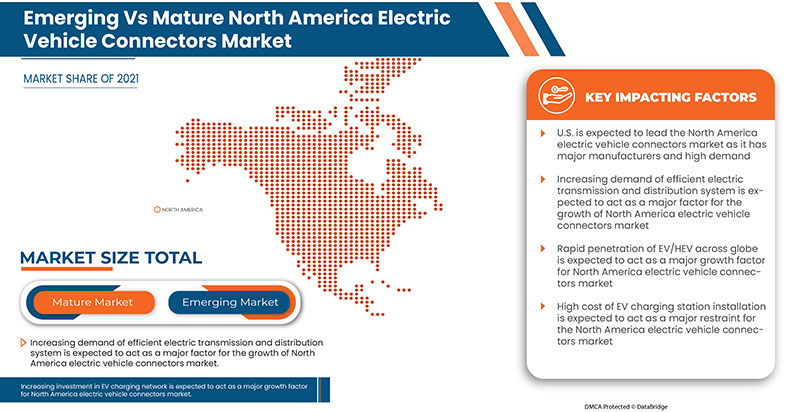

Data Bridge Market Research analiza que se espera que el mercado de conectores para vehículos eléctricos de América del Norte alcance un valor de USD 38 590,91 mil para 2029, con una CAGR del 18,8 % durante el período de pronóstico. El informe del mercado de conectores para vehículos eléctricos de América del Norte también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019-2014) |

|

Unidades cuantitativas |

Ingresos en miles de USD, precios en USD |

|

Segmentos cubiertos |

Por tipo (Tipo 1, Tipo 2 y Tipo 3), Material (Cobre y Aluminio), Tipo de Corriente (Carga CA y Carga CC), Velocidad de Carga (Lenta, Rápida y Rápida), Tipo de Montaje (Montado en Pared y Montado en Piso), Tipo de Cable (Cable Recto y Cables Enrollados), Nivel (Nivel 1, Nivel 2, Nivel 3 y Nivel 4), Usuario Final (Comercial y Residencial), Canal de Ventas (OEM y Posventa), Tipo de Vehículo (Vehículos Eléctricos de Batería y Vehículos Híbridos enchufables) |

|

Países cubiertos |

Estados Unidos, Canadá y México. |

|

Actores del mercado cubiertos |

YAZAKI Corporation, TE Connectivity, Sumitomo Electric Industries, Ltd., HUBER+SUHNER, Tesla, REMA Lipprandt GmbH Co. KG, Sumitomo Electric Industries, Ltd., BESEN INTERNATIONAL GROUP CO., LTD., HARTING Technology Group, Weidmüller, BizLink Group, Japan Aviation Electronics Industry, Ltd., ITT Inc., entre otros. |

Definición de mercado

Un conector es un elemento que se utiliza para proporcionar energía eléctrica al paquete de baterías desde la estación de carga. El paquete de baterías recibe electricidad de la estación de carga a través de un conector de carga. Un conector de carga se parece a un cable de carga utilizado para cargar un teléfono móvil en muchos aspectos. Un cable de carga de teléfono móvil cuenta con un conector de pared y un conector lateral del teléfono. De manera similar, el conector de carga del paquete de baterías de un vehículo eléctrico tiene un conector lateral del vehículo y un conector de enchufe del cargador. La gran mayoría de las estaciones de carga de vehículos eléctricos en todo el mundo son del tipo de red a vehículo (G2V), que permite una única dirección de transferencia de carga.

Dinámica del mercado de conectores para vehículos eléctricos en América del Norte

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

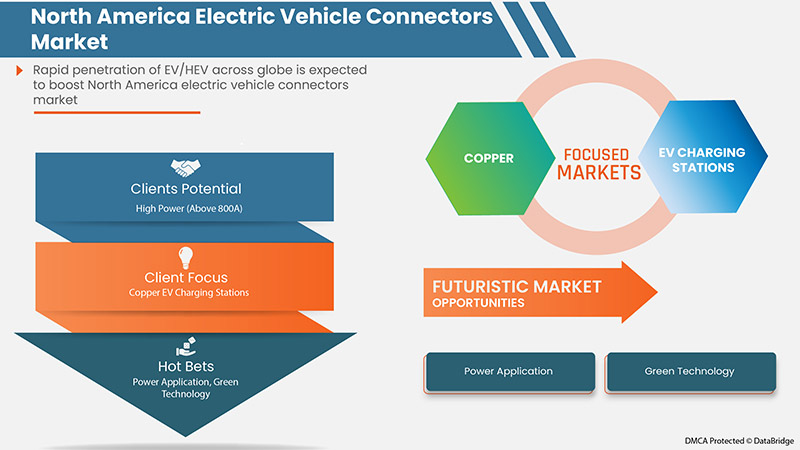

- Penetración rápida de vehículos eléctricos y híbridos

La industria de vehículos eléctricos ha mostrado un enorme crecimiento a lo largo de los años debido a la creciente demanda de vehículos eléctricos en casi todas las regiones. Además, los principales actores del mercado de vehículos eléctricos, como Tesla, BMW Group, Nissan Motor Corporation, Toyota Motor Corporation, Volkswagen AG, General Motors, Daimler AG, Energica Motor Company SPA, BYD Company Motors y Ford Motors Company, se están centrando en expandir sus operaciones comerciales en países emergentes como China, India y otros. La rápida penetración de EV/HEV a nivel mundial está impulsando el mercado de conectores para vehículos eléctricos de América del Norte, ya que los conectores EV actúan como un acoplador EV con un polo de carga de la estación necesaria para la transmisión de energía. Los conectores ayudan a establecer la conexión de la batería de un EV con el punto de carga de la estación.

- Aumentan las inversiones en redes de recarga por parte de los actores clave

La creación de una red de carga pública accesible será esencial para lograr una adopción generalizada de los vehículos eléctricos. La carga pública es vital para los consumidores de vehículos eléctricos que viven en complejos de varias unidades o que no tienen una entrada privada. Además, los propietarios de vehículos eléctricos necesitarán cargar sus vehículos a lo largo de las carreteras y las entradas para conducir distancias más largas y cargarlos en el camino. Se espera que las futuras mejoras previstas en las baterías y el aumento de la inversión en redes de carga por parte de los actores clave actúen como impulsores del mercado de conectores para vehículos eléctricos de América del Norte. Además de las iniciativas gubernamentales y las subsidiarias para instalar estaciones de carga para vehículos eléctricos, los actores clave en el mercado de vehículos eléctricos (VE) también están invirtiendo fuertemente en la construcción de una red de carga en regiones donde las ventas son altas.

- Avance y desarrollo en conectores para vehículos eléctricos

El desarrollo y avance de los conectores para vehículos eléctricos está aumentando a un ritmo rápido. Esto se debe básicamente a la satisfacción de las demandas actuales de carga de alta velocidad de vehículos eléctricos y la capacidad de cargar desde ambas fuentes de electricidad, CA y CC, para los propietarios de vehículos eléctricos. Se espera que el rápido avance y desarrollo del conector para vehículos eléctricos impulse el crecimiento del mercado de conectores para vehículos eléctricos.

Oportunidades

-

Demanda creciente de soluciones V2X

A medida que el mercado de vehículos eléctricos se expande, aumenta la demanda de soluciones de conectores de carga de vehículo a todo (V2X). A medida que la adopción de vehículos eléctricos continúa creciendo, los conectores potentes que pueden soportar la carga de vehículos eléctricos desempeñarán un papel clave tanto en el desarrollo del futuro panorama automotriz como en la red eléctrica y los sistemas de energía residencial. Por lo tanto, se espera que la creciente demanda de soluciones V2X aumente las aplicaciones y el uso de conectores de vehículos eléctricos en los sectores de vehículos eléctricos y sus afines, lo que brinda una oportunidad para el mercado de conectores de vehículos eléctricos de América del Norte.

Restricciones/Desafíos

- Altos costos asociados con los conectores EV

La importancia de los conectores está aumentando a medida que los vehículos eléctricos y híbridos se utilizan cada vez más en las carreteras de todo el mundo. Son un componente importante en los vehículos eléctricos y en su carga, ya que los vehículos eléctricos se recargan con electricidad. Sin embargo, el alto coste asociado a los conectores para vehículos eléctricos es un factor limitante importante para el crecimiento del mercado de conectores para vehículos eléctricos en América del Norte.

Impacto de la COVID-19 en el mercado de conectores para vehículos eléctricos de América del Norte

La COVID-19 ha tenido un gran impacto en diversas industrias, ya que casi todos los países han optado por cerrar todas las instalaciones, excepto las que se dedican al segmento de bienes esenciales. El gobierno ha tomado algunas medidas estrictas, como el cierre de instalaciones y la venta de bienes no esenciales, el bloqueo del comercio internacional y muchas más, para evitar la propagación de la COVID-19. Las únicas empresas que están lidiando con esta situación de pandemia son los servicios esenciales a los que se les permite abrir y ejecutar los procesos.

El COVID-19 afectó fuertemente al transporte público. Durante el distanciamiento social, se pidió a los viajeros que evitaran viajar a menos que fuera completamente necesario. Además, el comportamiento de las personas ciertamente ha cambiado durante la pandemia, lo que ha llevado a una disminución en la venta de vehículos automotores. La pandemia provocó una gran caída en las ventas de vehículos eléctricos, ya que el bloqueo prevaleció en la mayoría de las regiones y, a su vez, disminuyó la venta de estaciones de carga y, por lo tanto, la venta de conectores EV. El bloqueo llevó a los fabricantes y consumidores a detener completamente los procesos durante unos meses. La demanda de conectores para vehículos eléctricos enfrentó una caída drástica debido al cierre de varias industrias automotrices, de transporte y electrónica. Sin embargo, las cosas se están normalizando día a día. El crecimiento de los conectores EV ahora está obsoleto y crece a un ritmo rápido.

Los fabricantes están tomando diversas decisiones estratégicas para satisfacer la creciente demanda en el período de COVID-19. Los actores participaron en actividades estratégicas como asociaciones, colaboraciones, adquisiciones y otras para mejorar la tecnología involucrada en el mercado de conectores para vehículos eléctricos de América del Norte. Las empresas traerán soluciones avanzadas y precisas al mercado. Además, las iniciativas gubernamentales para impulsar la adopción de vehículos eléctricos y mejorar la infraestructura de vehículos eléctricos en todos los países han llevado al crecimiento del mercado.

Desarrollo reciente

- En junio de 2022, Robert Bosch GmbH anunció la adquisición del Grupo MoTeC. Esta adquisición permitirá a la empresa ampliar su oferta de productos en tecnología automotriz y aumentar su alcance en el mercado.

- En abril de 2021, NINGBO DEGSON ELECTRICAL CO., LTD anunció que la empresa había participado en la Feria de Electrónica de Múnich en el Nuevo Centro Internacional de Exposiciones de Shanghái. La empresa ha exhibido varios productos para diversos sectores y aplicaciones en este evento. A través de esto, la empresa ha aumentado su alcance en el mercado al mostrar las capacidades de sus productos y los avances técnicos.

Alcance del mercado de conectores para vehículos eléctricos en América del Norte

El mercado de conectores para vehículos eléctricos de América del Norte está segmentado en función del tipo, el material, el tipo de corriente, la velocidad de carga, el tipo de montaje, el tipo de cable, el nivel, el usuario final, el canal de venta y el tipo de vehículo. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Por tipo

- Tipo 1

- Tipo 2

- Tipo 3

Según el tipo, el mercado de conectores para vehículos eléctricos de América del Norte está segmentado en Tipo 1, Tipo 2 y Tipo 3.

Por material

- Aluminio

- Cobre

Según el material, el mercado de conectores para vehículos eléctricos de América del Norte está segmentado en aluminio y cobre.

Por nivel

- Nivel 1

- Nivel 2

- Nivel 3

- Nivel 4

Sobre la base del nivel, el mercado de conectores para vehículos eléctricos de América del Norte está segmentado en nivel 1, nivel 2, nivel 3 y nivel 4.

Por tipo actual

- Carga de CA

- Carga de CC

Sobre la base del tipo actual, el mercado de conectores para vehículos eléctricos de América del Norte está segmentado en carga de CA y carga de CC.

Por velocidad de carga

- Lento

- Rápido

- Rápido

Sobre la base de la velocidad de carga, el mercado de conectores para vehículos eléctricos de América del Norte se segmenta en lento, rápido y veloz.

Por tipo de montaje

- Montado en la pared

- Montado en el suelo

Según el tipo de montaje, el mercado de conectores para vehículos eléctricos de América del Norte está segmentado en montaje en pared y montaje en piso.

Por tipo de cable

- Cable recto

- Cable enrollado

Según el tipo de cable, el mercado de conectores para vehículos eléctricos de América del Norte está segmentado en cable recto y cable enrollado.

Por el usuario final

- Carga residencial

- Carga comercial

Sobre la base del usuario final, el mercado de conectores para vehículos eléctricos de América del Norte está segmentado en carga residencial y carga comercial.

Por canal de venta

- Fabricante de equipos originales (OEM)

- Mercado de accesorios

Sobre la base del canal de ventas, el mercado de conectores para vehículos eléctricos de América del Norte está segmentado en OEM y mercado de accesorios.

Por tipo de vehículo

- Vehículos híbridos enchufables

- Vehículos eléctricos de batería

Según el tipo de vehículo, el mercado de conectores para vehículos eléctricos de América del Norte está segmentado en vehículos híbridos enchufables y vehículos eléctricos de batería.

Análisis y perspectivas regionales del mercado de conectores para vehículos eléctricos de América del Norte

Se analiza el mercado de conectores para vehículos eléctricos de América del Norte y se proporcionan información y tendencias del tamaño del mercado por país, tipo, material, tipo de corriente, velocidad de carga, tipo de montaje, tipo de cable, nivel, usuario final, canal de ventas y tipo de vehículo, como se menciona anteriormente.

Los países cubiertos en el informe del mercado de conectores de vehículos eléctricos son EE. UU., Canadá y México.

Estados Unidos domina el mercado de conectores para vehículos eléctricos de América del Norte y es probable que sea el de más rápido crecimiento en dicho mercado, ya que tiene una enorme presencia de importantes proveedores de conectores para vehículos eléctricos, lo que puede aumentar el crecimiento del mercado en la región de América del Norte.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos afrontados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de conectores para vehículos eléctricos en América del Norte

El panorama competitivo del mercado de conectores para vehículos eléctricos proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de conectores para vehículos eléctricos de América del Norte.

Algunos de los principales actores que operan en el mercado de conectores para vehículos eléctricos de América del Norte son YAZAKI Corporation, TE Connectivity, Sumitomo Electric Industries, Ltd., HUBER+SUHNER, Tesla, REMA Lipprandt GmbH Co. KG, Sumitomo Electric Industries, Ltd., BESEN INTERNATIONAL GROUP CO., LTD., HARTING Technology Group, Weidmüller, BizLink Group, Japan Aviation Electronics Industry, Ltd., ITT Inc., entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: DROC ANALYSIS

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MARKET END-USER COVERAGE GRID

2.1 MULTIVARIATE MODELLING

2.11 TYPE LIFELINE CURVE

2.12 CHALLENGE MATRIX

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CHARGING SOFTWARE

4.2 RENEWABLE CHARGING

4.3 TECHNOLOGY & INNOVATION LANDSCAPE

4.4 ELECTRIC VEHICLE CONNECTORS INDUSTRIAL STANDARDS

5 REGIONAL REASONING

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RAPID PENETRATION OF EV & HEV

6.1.2 INCREASING INVESTMENT IN CHARGING NETWORK BY KEY PLAYERS

6.1.3 ADVANCEMENT AND DEVELOPMENT IN ELECTRIC VEHICLE CONNECTORS

6.1.4 RISING IMPORTANCE OF EV CONNECTORS

6.2 RESTRAINTS

6.2.1 HIGH COST ASSOCIATED WITH EV CONNECTORS

6.2.2 VOLATILITY IN GEOPOLITICAL SCENARIO

6.3 OPPORTUNITIES

6.3.1 INITIATIVES BY GOVERNMENTS FOR CHARGING INFRASTRUCTURE

6.3.2 INCREASING DEMAND FOR V2X SOLUTIONS

6.3.3 INCREASING PARTNERSHIP AND ACQUISITION AMONG MARKET PLAYERS

6.4 CHALLENGES

6.4.1 FLUCTUATIONS IN THE PRICE OF RAW MATERIALS

6.4.2 INDUCTIVE CHARGING FOR EVS

6.4.3 STRINGENT EV CONNECTOR STANDARDS

7 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE

7.1 OVERVIEW

7.2 TYPE 2

7.2.1 CCS

7.2.2 CHADEMO

7.2.3 GB/T

7.2.4 TESLA

7.3 TYPE 1

7.4 TYPE 3

8 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 COPPER

8.3 ALUMINIUM

9 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY LEVEL

9.1 OVERVIEW

9.2 LEVEL 2

9.3 LEVEL 3

9.4 LEVEL 1

9.5 LEVEL 4

10 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CURRENT TYPE

10.1 OVERVIEW

10.2 AC CHARGING

10.3 DC CHARGING

11 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CHARGING SPEED

11.1 OVERVIEW

11.2 FAST

11.3 SLOW

11.4 RAPID

12 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY MOUNTING TYPE

12.1 OVERVIEW

12.2 FLOOR MOUNTED

12.3 WALL MOUNTED

13 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CABLE TYPE

13.1 OVERVIEW

13.2 STRAIGHT CABLE

13.3 COILED CABLE

14 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY END USER

14.1 OVERVIEW

14.2 COMMERCIAL CHARGING

14.3 RESIDENTIAL CHARGING

15 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY SALES CHANNEL

15.1 OVERVIEW

15.2 OEM

15.3 AFTERMARKET

16 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY VEHICLE TYPE

16.1 OVERVIEW

16.2 BATTERY ELECTRIC VEHICLES

16.3 PLUG-IN HYBRID VEHICLES

17 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: SWOT ANALYSIS

20 COMPANY PROFILE

20.1 YAZAKI CORPORATION

20.1.1 COMPANY SNAPSHOT

20.1.2 COMPANY SHARE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENTS

20.2 TE CONNECTIVITY

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENTS

20.3 SUMITOMO ELECTRIC INDUSTRIES, LTD.

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 COMPANY SHARE ANALYSIS

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENTS

20.4 JAPAN AVIATION ELECTRONICS INDUSTRY, LTD.

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 COMPANY SHARE ANALYSIS

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENTS

20.5 TESLA

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENTS

20.6 APTIV (2021)

20.6.1 COMPANY SNAPSHOT

20.6.2 REVENUE ANALYSIS

20.6.3 COMPANY SHARE ANALYSIS

20.6.4 SOLUTION PORTFOLIO

20.6.5 RECENT DEVELOPMENTS

20.7 BESEN INTERNATIONAL GROUP CO., LTD.

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENTS

20.8 BIZLINK GROUP

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENTS

20.9 FUJIKURA LTD. (2021)

20.9.1 COMPANY SNAPSHOT

20.9.2 REVENUE ANALYSIS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT DEVELOPMENT

20.1 HARTING TECHNOLOGY GROUP

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENTS

20.11 HUBER+SUHNER

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENTS

20.12 ITT INC.

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENTS

20.13 JUICEPOINT

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENTS

20.14 LEVITON MANUFACTURING CO., INC.

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENTS

20.15 MATERION CORPORATION

20.15.1 COMPANY SNAPSHOT

20.15.2 REVENUE ANALYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT DEVELOPMENTS

20.16 NINGBO DEGSON ELECTRICAL CO.,LTD

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 RECENT DEVELOPMENTS

20.17 PHOENIX CONTACT

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENTS

20.18 REMA LIPPRANDT GMBH CO. KG

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 RECENT DEVELOPMENTS

20.19 ROBERT BOSCH GMBH (2021)

20.19.1 COMPANY SNAPSHOT

20.19.2 REVENUE ANALYSIS

20.19.3 PRODUCT PORTFOLIO

20.19.4 RECENT DEVELOPMENTS

20.2 SHANGHAI MIDA EV POWER CO., LTD.

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENTS

20.21 WEIDMULLER

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 RECENT DEVELOPMENTS

20.22 ZHENGZHOU SAICHUAN ELECTRONIC TECHNOLOGY CO., LTD.

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENTS

21 QUESTIONNAIRE

22 RELATED REPORTS

Lista de Tablas

TABLE 1 DIFFERENT TYPES OF CONNECTORS USED ACROSS DIFFERENT COUNTRIES/REGIONS.

TABLE 2 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 3 NORTH AMERICA TYPE 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 4 NORTH AMERICA TYPE 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA TYPE 1 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA TYPE 3 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA COPPER IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA ALUMINIUM IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY LEVEL, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA LEVEL 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA LEVEL 3 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA LEVEL 1 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA LEVEL 4 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CURRENT TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA AC CHARGING IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA DC CHARGING IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CHARGING SPEED, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA FAST IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA SLOW IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA RAPID IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY MOUNTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA FLOOR MOUNTED IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA WALL MOUNTED IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CABLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA STRAIGHT CABLE IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA COILED CABLE IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA COMMERCIAL CHARGING IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA RESIDENTIAL CHARGING IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA OEM IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA AFTERMARKET IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA BATTERY ELECTRIC VEHICLES IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA TYPE 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY LEVEL, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CURRENT TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CHARGING SPEED, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY MOUNTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CABLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 U.S. TYPE 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 51 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY LEVEL, 2020-2029 (USD THOUSAND)

TABLE 52 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY CURRENT TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY CHARGING SPEED, 2020-2029 (USD THOUSAND)

TABLE 54 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY MOUNTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY CABLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 57 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 58 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 CANADA TYPE 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 62 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY LEVEL, 2020-2029 (USD THOUSAND)

TABLE 63 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY CURRENT TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY CHARGING SPEED, 2020-2029 (USD THOUSAND)

TABLE 65 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY MOUNTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY CABLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 68 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 69 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 MEXICO TYPE 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 72 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 73 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY LEVEL, 2020-2029 (USD THOUSAND)

TABLE 74 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY CURRENT TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY CHARGING SPEED, 2020-2029 (USD THOUSAND)

TABLE 76 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY MOUNTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY CABLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 79 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 80 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

Lista de figuras

FIGURE 1 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 4 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 5 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 6 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: DBMR MARKET POSITION GRID

FIGURE 7 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: VENDOR SHARE ANALYSIS

FIGURE 8 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: SEGMENTATION

FIGURE 10 INCREASING INVESTMENT IN CHARGING NETWORKS BY KEY PLAYERS IS EXPECTED TO BE A KEY DRIVER FOR THE NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET GROWTH IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 11 TYPE 2 IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET IN 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET

FIGURE 13 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY TYPE,2021

FIGURE 14 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY MATERIAL, 2021

FIGURE 15 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY LEVEL, 2021

FIGURE 16 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY CURRENT TYPE, 2021

FIGURE 17 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY CHARGING SPEED, 2021

FIGURE 18 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY MOUNTING TYPE, 2021

FIGURE 19 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY CABLE TYPE, 2021

FIGURE 20 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY END USER, 2021

FIGURE 21 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY SALES CHANNEL, 2021

FIGURE 22 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY VEHICLE TYPE, 2021

FIGURE 23 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: SNAPSHOT (2021)

FIGURE 24 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY COUNTRY (2021)

FIGURE 25 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY TYPE (2022-2029)

FIGURE 28 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.