North America Epigenetics Diagnostic Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

3.29 Billion

USD

10.82 Billion

2024

2032

USD

3.29 Billion

USD

10.82 Billion

2024

2032

| 2025 –2032 | |

| USD 3.29 Billion | |

| USD 10.82 Billion | |

|

|

|

|

Segmentación del mercado de diagnóstico epigenético de América del Norte, por producto ( reactivos , kits, instrumentos y consumibles, herramientas bioinformáticas y enzimas), tecnología (metilación del ADN, metilación de histonas, estructuras de cromatina, acetilación de histonas, modificación de ARN no codificante grande y microARN), tipo de terapia (inhibidores de la histona desacetilasa [HDAC], inhibidores de la ADN metiltransferasa [DNMT] y otros), aplicación ( oncología , enfermedades cardiovasculares, enfermedades metabólicas , inmunología, enfermedades inflamatorias, enfermedades infecciosas y otras), usuario final (institutos académicos y de investigación, empresas farmacéuticas y biotecnológicas , organizaciones de investigación por contrato [CRO] y otros), canal de distribución (licitación directa y ventas minoristas), tendencias de la industria y pronóstico hasta 2032

Tamaño del mercado de diagnóstico epigenético en América del Norte

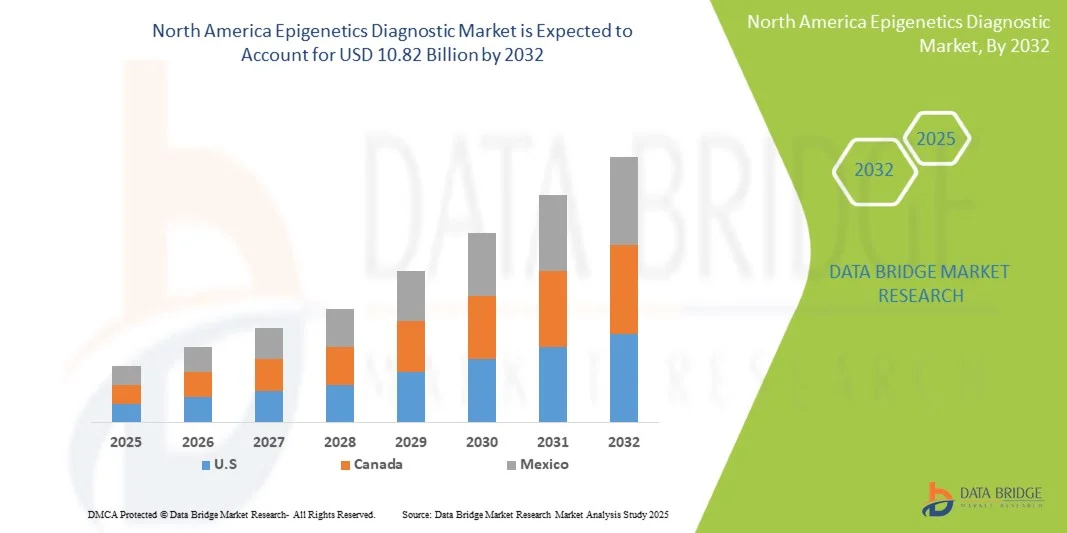

- El tamaño del mercado de diagnóstico de epigenética de América del Norte se valoró en USD 3.29 mil millones en 2024 y se espera que alcance los USD 10.82 mil millones para 2032 , con una CAGR del 16,00% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente adopción de técnicas avanzadas de biología molecular y la integración de tecnologías de secuenciación de próxima generación (NGS), que están mejorando la precisión y la eficiencia de los diagnósticos epigenéticos en la investigación y las aplicaciones clínicas.

- Además, la creciente demanda de detección temprana de enfermedades, medicina personalizada y diagnóstico basado en biomarcadores impulsa la adopción de soluciones de diagnóstico epigenético. Estos factores convergentes aceleran su adopción, impulsando así significativamente el crecimiento del sector.

Análisis del mercado de diagnóstico epigenético en América del Norte

- El mercado de diagnóstico epigenético de América del Norte implica el uso de marcadores y ensayos epigenéticos para detectar, monitorear y controlar enfermedades como el cáncer, los trastornos cardiovasculares y las afecciones neurológicas, ofreciendo soluciones de diagnóstico mínimamente invasivas, precisas y personalizadas.

- La creciente demanda de soluciones de diagnóstico epigenético se ve impulsada principalmente por la creciente prevalencia de enfermedades crónicas, la creciente adopción de la medicina de precisión y la creciente conciencia de la detección temprana de enfermedades entre los proveedores de atención médica y los pacientes.

- Estados Unidos dominó el mercado norteamericano de diagnóstico epigenético, con la mayor participación en ingresos, un 87,3 % en 2024, gracias a una infraestructura sanitaria avanzada, una alta adopción de tecnologías de diagnóstico molecular y una inversión sustancial en investigación clínica e instalaciones de diagnóstico. El país experimentó un crecimiento notable gracias al aumento de la prevalencia del cáncer y las enfermedades crónicas, la creciente demanda de detección temprana y las innovaciones en plataformas de pruebas epigenéticas de alto rendimiento.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de diagnóstico epigenético de América del Norte durante el período de pronóstico, atribuido al aumento de las inversiones en infraestructura de atención médica, la creciente conciencia de la medicina de precisión, la creciente prevalencia de enfermedades relacionadas con el estilo de vida y la expansión de las iniciativas de investigación médica.

- El segmento de oncología dominó el mercado de diagnóstico epigenético de América del Norte con una participación en los ingresos del 46,3 % en 2024. La creciente prevalencia del cáncer, el aumento de las iniciativas de detección temprana y la adopción de biomarcadores epigenéticos impulsan este dominio.

Alcance del informe y segmentación del mercado de diagnóstico epigenético en América del Norte

|

Atributos |

Perspectivas clave del mercado de diagnóstico epigenético en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de diagnóstico epigenético en América del Norte

Avances impulsados por IA y mayor precisión diagnóstica en epigenética

- Una tendencia significativa y en auge en el mercado norteamericano de diagnóstico epigenético es la integración de inteligencia artificial (IA) y algoritmos de aprendizaje automático para mejorar la identificación de biomarcadores y el análisis predictivo. Esta integración está mejorando la precisión diagnóstica, el seguimiento de enfermedades y la planificación personalizada del tratamiento.

- Las empresas líderes están aprovechando la IA para analizar los patrones de metilación del ADN, las modificaciones de las histonas y la accesibilidad de la cromatina, lo que permite la detección temprana de enfermedades complejas como el cáncer y los trastornos cardiovasculares.

- Las plataformas basadas en IA facilitan la interpretación rápida de grandes conjuntos de datos genómicos, lo que reduce el tiempo de análisis y proporciona información más útil para los médicos.

- La integración con sistemas basados en la nube permite la gestión centralizada de los datos epigenéticos de los pacientes, lo que posibilita la consulta remota, la investigación colaborativa y la generación de informes en tiempo real en todas las instituciones sanitarias.

- Los algoritmos de IA pueden aprender continuamente de nuevos datos, mejorando la precisión predictiva a lo largo del tiempo y apoyando el seguimiento longitudinal del paciente para la progresión de la enfermedad y la respuesta terapéutica.

- Además, la IA ayuda a priorizar las poblaciones de pacientes de alto riesgo, sugiriendo estrategias de prueba optimizadas, reduciendo pruebas innecesarias y aumentando la eficiencia general del flujo de trabajo.

- Empresas como Guardant Health, EpigenDx y Exact Sciences están desarrollando activamente ensayos epigenéticos basados en IA para aplicaciones clínicas y de investigación, centrándose en la detección temprana y la medicina personalizada.

- La tendencia hacia diagnósticos más precisos, predictivos y basados en datos está cambiando las expectativas entre los proveedores de atención médica, los institutos de investigación y los pagadores.

- La creciente colaboración entre los desarrolladores de IA y los proveedores de atención médica está acelerando la adopción de diagnósticos epigenéticos basados en IA en la práctica clínica.

- La integración de IA también permite herramientas de visualización e informes integrados, que ayudan a los médicos a interpretar datos epigenéticos complejos de manera eficiente.

Dinámica del mercado de diagnóstico epigenético en América del Norte

Conductor

Creciente demanda de detección temprana, medicina de precisión y atención médica personalizada

- La creciente incidencia del cáncer, los trastornos metabólicos, las enfermedades neurológicas y las afecciones cardiovasculares está impulsando la demanda de diagnósticos epigenéticos precisos.

- La detección temprana de enfermedades a través de biomarcadores epigenéticos permite una intervención oportuna, mejorando significativamente los resultados de los pacientes y las tasas de supervivencia.

- Las iniciativas de medicina personalizada están animando a los proveedores de atención médica a adoptar pruebas epigenéticas para adaptar las terapias en función de los perfiles epigenéticos individuales.

- La financiación gubernamental y las inversiones privadas en investigación genómica y de medicina de precisión apoyan el desarrollo de nuevos ensayos epigenéticos.

- Los hospitales, las clínicas especializadas y las instituciones de investigación están incorporando cada vez más diagnósticos epigenéticos en los flujos de trabajo clínicos estándar para la evaluación y el seguimiento del riesgo de enfermedades.

- Los avances en métodos de pruebas no invasivos, como las biopsias líquidas, están ampliando la aplicación de los diagnósticos epigenéticos en la atención rutinaria de los pacientes.

- Las campañas de concientización y la educación entre los médicos sobre la utilidad clínica de los biomarcadores epigenéticos están impulsando su adopción en el mercado.

- La capacidad de predecir la respuesta del paciente a las terapias y monitorear la recurrencia de la enfermedad aumenta el atractivo de los diagnósticos epigenéticos.

- La integración con plataformas de inteligencia artificial y aprendizaje automático proporciona una precisión de diagnóstico mejorada, algo que los proveedores de atención médica valoran cada vez más.

- La expansión de los programas de investigación colaborativa entre instituciones académicas y empresas de biotecnología está acelerando aún más las innovaciones tecnológicas y el crecimiento del mercado.

Restricción/Desafío

Altos costos, barreras regulatorias y preocupaciones sobre la privacidad de los datos

- El alto costo de las pruebas de diagnóstico epigenético avanzadas sigue siendo una barrera importante, en particular en las regiones en desarrollo o en centros de atención médica más pequeños.

- Los complejos requisitos de laboratorio y la necesidad de personal altamente capacitado restringen su adopción generalizada.

- Los procesos de aprobación regulatoria para nuevos ensayos epigenéticos pueden llevar mucho tiempo, retrasando el lanzamiento del producto y su disponibilidad en el mercado.

- La variabilidad en las políticas de reembolso entre países crea incertidumbres para los proveedores de atención médica y los pacientes.

- Las preocupaciones éticas y de privacidad con respecto al manejo de datos genómicos y epigenéticos pueden limitar la disposición de los pacientes a someterse a pruebas.

- La integración de plataformas basadas en IA requiere una importante infraestructura de TI y medidas de seguridad de datos, lo que plantea desafíos de inversión adicionales.

- La falta de estandarización en los procedimientos de pruebas epigenéticas y bases de datos de referencia puede afectar la confiabilidad de los resultados

- El crecimiento del mercado puede verse obstaculizado por la limitada conciencia entre los médicos sobre la utilidad clínica y la interpretación de datos epigenéticos complejos.

- La necesidad de actualizaciones continuas de software y validación de algoritmos de IA aumenta los costos operativos de los laboratorios.

- Superar estos desafíos requiere la colaboración entre las autoridades reguladoras, los proveedores de atención médica y los actores de la industria para garantizar soluciones de diagnóstico estandarizadas, rentables y seguras.

Alcance del mercado de diagnóstico epigenético en América del Norte

El mercado de diagnóstico epigenético de América del Norte está segmentado según el producto, la tecnología, el tipo de terapia, la aplicación, el usuario final y el canal de distribución.

• Por producto

En cuanto a productos, el mercado norteamericano de diagnóstico epigenético se segmenta en reactivos, kits, instrumentos y consumibles, y herramientas y enzimas bioinformáticas. El segmento de reactivos dominó la mayor cuota de mercado en ingresos, con un 42,8% en 2024. Esto se debe a su papel esencial en la preparación, detección y análisis de muestras en estudios epigenéticos. Los reactivos son altamente fiables, compatibles con múltiples plataformas de ensayo y proporcionan resultados reproducibles, lo que los hace indispensables tanto en la investigación como en el diagnóstico clínico. La creciente adopción de la medicina de precisión y el diagnóstico basado en biomarcadores impulsa aún más la demanda. La investigación académica y las empresas farmacéuticas dependen en gran medida de reactivos de alta calidad para obtener resultados consistentes. Además, los reactivos especializados para la metilación del ADN, la modificación de histonas y el análisis del ARN fortalecen su posición en el mercado. El segmento se beneficia de la innovación continua en la formulación de reactivos y una mayor vida útil. La creciente inversión en investigación epigenética a nivel mundial impulsa el crecimiento del mercado. Los reactivos también facilitan la automatización en laboratorios de alto rendimiento. La pandemia de COVID-19 puso de relieve la importancia de los reactivos de diagnóstico rápidos y precisos, impulsando su conocimiento y adopción. Las colaboraciones estratégicas entre fabricantes de reactivos e institutos de investigación continúan ampliando la disponibilidad. En general, los reactivos siguen siendo la base de los flujos de trabajo de diagnóstico epigenético.

Se prevé que el segmento de instrumentos y consumibles experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 20,3 %, entre 2025 y 2032. Este crecimiento se ve impulsado por la creciente demanda de plataformas de diagnóstico epigenético de alto rendimiento, automatizadas y precisas. Instrumentos como los secuenciadores de nueva generación y las máquinas de PCR en tiempo real mejoran la precisión y la reproducibilidad de los ensayos. El segmento se beneficia de las tendencias hacia dispositivos miniaturizados y portátiles, adecuados para laboratorios descentralizados. Los consumibles como puntas, placas y tubos son fundamentales para la fiabilidad y la eficiencia de los ensayos. Su creciente adopción en hospitales, institutos de investigación y empresas biotecnológicas impulsa la demanda por volumen. La automatización avanzada reduce el error humano y el tiempo de procesamiento. El aumento de las inversiones en medicina personalizada y terapias dirigidas impulsa aún más la adopción. El lanzamiento de nuevos instrumentos con soluciones de software integradas atrae a los usuarios finales que buscan flujos de trabajo optimizados. El desarrollo continuo de consumibles específicos para ensayos mejora el rendimiento. La creciente colaboración entre fabricantes de instrumentos y proveedores de bioinformática también amplía la penetración en el mercado. Las aplicaciones emergentes en la investigación oncológica, cardiovascular y metabólica impulsan aún más el crecimiento.

• Por tecnología

En términos de tecnología, el mercado norteamericano de diagnóstico epigenético se segmenta en metilación de ADN, metilación de histonas, estructuras de cromatina, acetilación de histonas y modificación de ARN no codificante de gran tamaño y microARN. El segmento de metilación de ADN dominó con una participación en los ingresos del 44,5 % en 2024, ya que es un biomarcador clave en el cáncer, las enfermedades cardiovasculares y metabólicas. Su amplia adopción se debe a ensayos rentables y reproducibles, así como a su utilidad clínica validada. La metilación de ADN es crucial para la detección temprana y el pronóstico de enfermedades, lo que facilita la toma de decisiones clínicas. Tanto los laboratorios de investigación como las empresas de diagnóstico utilizan ampliamente el perfil de metilación de ADN. Sus aplicaciones en medicina de precisión y monitorización de terapias epigenéticas aumentan la demanda. Los kits y plataformas de ensayo consolidados ofrecen fiabilidad y facilidad de uso. Las aprobaciones regulatorias para pruebas diagnósticas basadas en biomarcadores de metilación de ADN refuerzan aún más la posición en el mercado. La investigación académica y farmacéutica invierte continuamente en estudios de metilación, lo que mantiene la demanda. Los métodos de detección de metilación de ADN son compatibles con sistemas de alto rendimiento. La integración con herramientas bioinformáticas permite comprender mejor la regulación epigenética. El crecimiento del segmento se ve respaldado por el aumento de la financiación pública y privada en la investigación epigenética.

Se espera que el segmento de metilación de histonas experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 19,6 %, entre 2025 y 2032. Este crecimiento se debe a su papel en la comprensión de la progresión de la enfermedad y la identificación de dianas terapéuticas. El perfil de metilación de histonas se adopta cada vez más en la investigación oncológica y de enfermedades inflamatorias. Las técnicas de detección avanzadas, como ChIP-seq, mejoran la sensibilidad y la precisión. La demanda está aumentando tanto en el sector académico como en el farmacéutico. Se están lanzando nuevos kits de ensayo e instrumentos dirigidos a las modificaciones de histonas. La investigación en remodelación de la cromatina y el desarrollo de terapias epigenéticas impulsa su adopción. Las plataformas automatizadas y de alto rendimiento mejoran la escalabilidad y la eficiencia. Las iniciativas globales para la investigación epigenética apoyan la expansión. Las organizaciones de investigación por contrato externalizan cada vez más los estudios de metilación de histonas. La integración con la biología computacional y la bioinformática fortalece las capacidades analíticas. La metilación de histonas se está volviendo esencial en las aplicaciones de medicina personalizada.

• Por tipo de terapia

Según el tipo de terapia, el mercado norteamericano de diagnóstico epigenético se segmenta en inhibidores de la histona desacetilasa (HDAC), inhibidores de la ADN metiltransferasa (DNMT) y otros. El segmento de inhibidores de HDAC dominó el mercado con una participación en los ingresos del 40,2 % en 2024. Se utilizan ampliamente en el tratamiento del cáncer y la investigación clínica gracias a su capacidad para modular la expresión génica epigenéticamente. Los inhibidores de HDAC cuentan con una sólida cartera de productos clínicos, lo que los ha convertido en una opción popular en hospitales y estudios farmacéuticos. Su relevancia terapéutica en tumores hematológicos y sólidos impulsa la demanda. El segmento se beneficia de la I+D continua en terapias combinadas. Las aprobaciones regulatorias para múltiples inhibidores de HDAC brindan credibilidad en el mercado. La investigación académica que explora las vías de HDAC sustenta su uso constante. Las compañías farmacéuticas invierten en el descubrimiento de fármacos basados en inhibidores de HDAC. Los inhibidores de HDAC se aplican en la investigación de enfermedades inflamatorias y metabólicas. Los procesos de fabricación consolidados y la reproducibilidad de los compuestos impulsan su adopción. La actividad de ensayos clínicos a nivel mundial respalda el crecimiento constante del mercado. La innovación continua en las formulaciones de HDAC garantiza el dominio del segmento.

Se proyecta que el segmento de inhibidores de DNMT registre la CAGR más rápida del 18,9% entre 2025 y 2032. El crecimiento está impulsado por una mayor investigación en terapia epigenética y medicina personalizada. Los inhibidores de DNMT se dirigen a los patrones de metilación del ADN vinculados al cáncer y otras enfermedades crónicas. El aumento de los ensayos clínicos que exploran los inhibidores de DNMT amplía la adopción. Los laboratorios académicos y farmacéuticos implementan cada vez más estudios sobre inhibidores de DNMT. La investigación sobre terapias combinadas mejora su alcance de aplicación. Los mercados emergentes están invirtiendo en la accesibilidad de los inhibidores de DNMT. Los avances tecnológicos en formulación y administración mejoran la eficacia. El conocimiento de los objetivos epigenéticos en enfermedades cardiovasculares y metabólicas impulsa aún más el crecimiento. La continua expansión de la cartera de productos por parte de las compañías farmacéuticas respalda el impulso del mercado. Los inhibidores de DNMT se incorporan cada vez más a las iniciativas de medicina de precisión. La adopción se ve reforzada por la creciente financiación gubernamental y privada.

• Por aplicación

En función de su aplicación, el mercado norteamericano de diagnóstico epigenético se segmenta en oncología, enfermedades cardiovasculares, enfermedades metabólicas, inmunología, enfermedades inflamatorias, enfermedades infecciosas, entre otras. El segmento de oncología dominó el mercado con una participación en los ingresos del 46,3 % en 2024. El aumento de la prevalencia del cáncer, el incremento de las iniciativas de detección temprana y la adopción de biomarcadores epigenéticos impulsan este dominio. Las aplicaciones oncológicas dependen en gran medida de la metilación del ADN, las modificaciones de histonas y el perfilado de ARN no codificante. La utilidad clínica en el pronóstico, la selección de terapias y la monitorización del tratamiento impulsa la demanda. Tanto hospitales como institutos de investigación adoptan ampliamente el diagnóstico epigenético centrado en la oncología. Empresas comerciales desarrollan kits e instrumentos específicos para oncología. La financiación para la investigación oncológica impulsa el crecimiento continuo. La integración con plataformas de alto rendimiento permite el cribado eficiente de grandes cohortes de pacientes. Las herramientas bioinformáticas avanzadas mejoran la información práctica. Las iniciativas gubernamentales que promueven el cribado del cáncer impulsan aún más la adopción. La colaboración entre empresas de diagnóstico y centros oncológicos fortalece su presencia en el mercado.

Se espera que el segmento de enfermedades cardiovasculares experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 19,2 %, entre 2025 y 2032. El crecimiento se ve impulsado por la investigación emergente que vincula los mecanismos epigenéticos con las enfermedades cardíacas. La adopción de herramientas de diagnóstico epigenético para la detección temprana y la estratificación del riesgo está aumentando. Los hospitales y laboratorios de investigación están invirtiendo en la elaboración de perfiles de biomarcadores. Los ensayos de metilación del ADN y modificación de histonas se aplican en la investigación cardiovascular. Los avances tecnológicos en las plataformas de detección mejoran la precisión y el rendimiento. La creciente prevalencia de trastornos cardiovasculares en todo el mundo impulsa el potencial del mercado. Los estudios académicos y la I+D farmacéutica contribuyen a la creciente adopción. La integración con programas de medicina personalizada acelera el crecimiento. La inversión en infraestructura de diagnóstico facilita la accesibilidad. Las campañas de concienciación y las guías clínicas que incorporan la epigenética impulsan aún más la demanda.

• Por el usuario final

En función del usuario final, el mercado norteamericano de diagnóstico epigenético se segmenta en institutos académicos y de investigación, empresas farmacéuticas y biotecnológicas, organizaciones de investigación por contrato (CRO) y otros. El segmento de institutos académicos y de investigación representó la mayor cuota de mercado en ingresos, con un 43,7 % en 2024. Las instituciones realizan una amplia investigación en epigenética, centrándose en el descubrimiento de biomarcadores, los mecanismos de las enfermedades y el desarrollo terapéutico. La disponibilidad de subvenciones y financiación para la investigación fortalece su adopción. La alta inversión en infraestructura de biología molecular respalda ensayos sofisticados. La colaboración con empresas farmacéuticas garantiza el acceso a reactivos, kits e instrumentos. Los resultados de la investigación impulsan la innovación en el diagnóstico epigenético. La integración con plataformas bioinformáticas mejora el análisis y la reproducibilidad. La formación de personal cualificado garantiza el uso óptimo de las herramientas. Las iniciativas globales de investigación en oncología, enfermedades cardiovasculares y metabólicas respaldan el dominio del segmento. Las publicaciones revisadas por pares y las actividades de patentes sustentan la demanda a largo plazo. La continua expansión de los programas de investigación impulsa el consumo de reactivos e instrumentos.

Se espera que el segmento de empresas farmacéuticas y biotecnológicas experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 18,5 %, entre 2025 y 2032. Las empresas se centran en el descubrimiento de fármacos, el desarrollo de terapias epigenéticas y los ensayos clínicos. La creciente inversión en medicina de precisión acelera la adopción. Las colaboraciones con CRO mejoran la escalabilidad y la experiencia. La demanda de reactivos, instrumentos y herramientas bioinformáticas de alta calidad está en aumento. Las tecnologías avanzadas permiten una mejor selección de compuestos y la evaluación de su eficacia. Las líneas de I+D farmacéuticas en oncología y trastornos metabólicos impulsan el crecimiento del mercado. Las aplicaciones emergentes en inmunología y enfermedades infecciosas impulsan la expansión. Las colaboraciones estratégicas con instituciones académicas facilitan la transferencia de conocimiento. Las aprobaciones regulatorias de nuevos diagnósticos impulsan la adopción. La competencia global fomenta la innovación continua.

• Por canal de distribución

Según el canal de distribución, el mercado norteamericano de diagnóstico epigenético se segmenta en licitación directa y ventas minoristas. El segmento de licitación directa dominó el mercado en 2024, representando la mayor participación en los ingresos, con aproximadamente el 48,5 %. Este predominio se debe principalmente a la preferencia de hospitales, instituciones académicas y grandes organizaciones de investigación por adquirir instrumentos y reactivos de diagnóstico de alto valor directamente de fabricantes o distribuidores autorizados. La licitación directa garantiza fiabilidad, ventajas en la compra a granel y un mejor servicio posventa, crucial para las herramientas de diagnóstico epigenético sofisticadas. Los grandes usuarios finales suelen preferir este canal, ya que les permite negociar contratos personalizados, recibir formación técnica y garantizar un suministro ininterrumpido para aplicaciones clínicas y de investigación críticas. Además, la licitación directa ofrece la ventaja de acceder a productos premium, tecnologías avanzadas y servicios integrales de mantenimiento, esenciales para un diagnóstico preciso. Este segmento se beneficia de acuerdos a largo plazo con fabricantes líderes, lo que garantiza una calidad constante del producto y el cumplimiento normativo. Además, la licitación directa facilita una mejor integración de instrumentos, reactivos y herramientas bioinformáticas, lo cual es crucial para optimizar los flujos de trabajo en laboratorios de investigación y clínicos. El alto valor de los productos, como instrumentos, kits y software bioinformático, convierte la licitación directa en el canal predilecto de los compradores institucionales. Además, los fabricantes suelen ofrecer soluciones personalizadas y soporte técnico posterior a la instalación a través de este canal, lo que fomenta la fidelización de los clientes y la repetición de compras.

Se prevé que el segmento de ventas minoristas registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 18,3 %, entre 2025 y 2032. Este crecimiento se debe a la creciente accesibilidad a kits de diagnóstico epigenético, reactivos y consumibles para laboratorios más pequeños, clínicas especializadas e investigadores individuales. Los canales minoristas ofrecen comodidad y ciclos de adquisición más rápidos, lo que permite a los usuarios finales más pequeños adoptar tecnologías de vanguardia sin necesidad de complejos procesos de licitación. La expansión de las plataformas de comercio electrónico y los mercados en línea ha acelerado aún más la adopción de las ventas minoristas, permitiendo a los investigadores y laboratorios clínicos adquirir instrumentos, consumibles y herramientas bioinformáticas directamente con un plazo de entrega mínimo. Además, la creciente tendencia a la medicina personalizada y la demanda de kits de prueba para el hogar o descentralizados contribuyen a la creciente adopción de los canales de ventas minoristas. Los canales minoristas también facilitan una mayor penetración en el mercado de los mercados semiurbanos y regionales, donde la licitación directa puede ser menos accesible. Los fabricantes ofrecen cada vez más soluciones integrales y paquetes promocionales a través del comercio minorista, lo que mejora la asequibilidad y la adopción. Las estrategias de marketing, como los descuentos para nuevos compradores y las opciones de pago flexibles, están impulsando la adopción del comercio minorista. El segmento también se beneficia de una mayor concienciación y formación para clientes minoristas, lo que fomenta el uso de diagnósticos epigenéticos avanzados. Además, los canales de venta minorista contribuyen a generar visibilidad de marca, ampliar el alcance a nuevos usuarios finales y agilizar la recopilación de opiniones para la mejora del producto.

Análisis regional del mercado de diagnóstico epigenético en América del Norte

- Estados Unidos dominó el mercado norteamericano de diagnóstico epigenético, con la mayor participación en ingresos, un 87,3 % en 2024, gracias a una infraestructura sanitaria avanzada, una alta adopción de tecnologías de diagnóstico molecular y una inversión sustancial en investigación clínica e instalaciones de diagnóstico. El país experimentó un crecimiento notable gracias al aumento de la prevalencia del cáncer y las enfermedades crónicas, la creciente demanda de detección temprana y las innovaciones en plataformas de pruebas epigenéticas de alto rendimiento.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de diagnóstico epigenético de América del Norte durante el período de pronóstico, atribuido al aumento de las inversiones en infraestructura de atención médica, la creciente conciencia de la medicina de precisión, la creciente prevalencia de enfermedades relacionadas con el estilo de vida y la expansión de las iniciativas de investigación médica.

- Las fuertes inversiones en investigación clínica, instalaciones de diagnóstico y medicina de precisión están respaldando el crecimiento del mercado.

Perspectiva del mercado de diagnóstico epigenético en América del Norte y EE. UU.

El mercado de diagnóstico epigenético de EE. UU. en Norteamérica captó la mayor participación en ingresos, con un 87,3 %, en 2024, impulsado por la creciente prevalencia del cáncer y otras enfermedades crónicas, la creciente demanda de detección temprana y las innovaciones en plataformas de pruebas epigenéticas de alto rendimiento. La expansión de los laboratorios de diagnóstico, la creciente concienciación sobre la medicina personalizada entre los profesionales sanitarios y las iniciativas gubernamentales para apoyar las herramientas de diagnóstico avanzadas impulsan aún más el crecimiento del mercado.

Perspectiva del mercado de diagnóstico epigenético de Canadá y América del Norte

Se prevé que el mercado de diagnóstico epigenético de Canadá y América del Norte sea el de mayor crecimiento en dicho mercado durante el período de pronóstico, gracias al aumento de la inversión en infraestructura sanitaria, la mayor concienciación sobre la medicina de precisión y la expansión de las iniciativas de investigación médica. El enfoque del país en mejorar el acceso a servicios de diagnóstico avanzados, junto con la colaboración entre el gobierno y el sector privado, está impulsando la adopción de tecnologías de diagnóstico epigenético.

Cuota de mercado de diagnóstico epigenético en América del Norte

La industria del diagnóstico epigenético está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- PerkinElmer (Estados Unidos)

- Diagenode (Bélgica)

- F. Hoffman-La Roche Ltd (Suiza)

- EpiCypher (EE. UU.)

- Promega Corporation (EE. UU.)

- QIAGEN (Alemania)

- PacBio (EE. UU.)

- Epigenomics AG (Alemania)

- Biología de la reacción (EE. UU.)

- Bio-Rad Laboratories, Inc. (EE. UU.)

- Agilent Technologies, Inc. (EE. UU.)

- Merck KGaA (Alemania)

- Illumina, Inc. (EE. UU.)

- ACTIVEMOTIF (EE. UU.)

- Thermo Fisher Scientific, Inc. (EE. UU.)

- EpiGentek Group Inc. (EE. UU.)

- Enzo Life Sciences, Inc. (EE. UU.)

- Epizyme, Inc. (EE. UU.)

Últimos avances en el mercado de diagnóstico epigenético en América del Norte

- En mayo de 2025, un equipo de investigación colaborativo de importantes instituciones académicas estadounidenses publicó un estudio pionero que presenta un modelo de clasificación de metilación del ADN capaz de predecir el origen de órganos y sitios de enfermedades a partir del ADN libre de células (cfDNA). Este modelo, que utiliza aprendizaje automático y conjuntos de datos de metilación armonizados, demostró una alta precisión al distinguir perfiles de metilación específicos de cada tejido, lo que ofrece un gran potencial para el diagnóstico no invasivo en oncología y enfermedades inflamatorias.

- En julio de 2024, la Administración de Alimentos y Medicamentos de EE. UU. (FDA) aprobó una novedosa prueba de biomarcadores epigenéticos para la detección temprana del cáncer colorrectal. Desarrollada por una empresa de biotecnología con sede en California, esta prueba analiza los patrones de metilación del ADN en muestras de sangre, lo que proporciona una opción de detección mínimamente invasiva que mejora el diagnóstico temprano y los resultados del tratamiento.

- En marzo de 2023, una compañía farmacéutica estadounidense anunció el inicio de un ensayo clínico de fase II para un fármaco epigenético dirigido a las enzimas ADN metiltransferasas. El ensayo busca evaluar la eficacia de este novedoso enfoque terapéutico en el tratamiento de pacientes con tumores sólidos avanzados, lo que supone un paso significativo hacia la integración de las terapias epigenéticas en los regímenes de tratamiento del cáncer.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.