North America Eclinical Solutions Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

3.62 Billion

USD

10.71 Billion

2024

2032

USD

3.62 Billion

USD

10.71 Billion

2024

2032

| 2025 –2032 | |

| USD 3.62 Billion | |

| USD 10.71 Billion | |

|

|

|

|

Segmentación del mercado de soluciones clínicas electrónicas en Norteamérica, por producto (sistemas de captura electrónica de datos y gestión de datos de ensayos clínicos, sistemas de gestión de ensayos clínicos, plataformas de análisis clínico, registros médicos de coordinación de atención [CCMR], gestión de aleatorización y suministro de ensayos , plataformas de integración de datos clínicos, soluciones de evaluación electrónica de resultados clínicos, soluciones de seguridad, sistemas de archivos maestros de ensayos electrónicos, soluciones de gestión de información regulatoria y otros), modo de entrega (soluciones alojadas en la web (bajo demanda), soluciones empresariales con licencia (locales) y soluciones basadas en la nube (SAAS)), fase de ensayo clínico (fase I, fase II, fase III y fase IV), tamaño de la organización (pequeña, mediana y grande), dispositivo de usuario (ordenador de escritorio, tableta, dispositivo PDA portátil, teléfono inteligente y otros), usuario final (empresas farmacéuticas y biofarmacéuticas , organizaciones de investigación por contrato, empresas de servicios de consultoría, fabricantes de dispositivos médicos, hospitales e institutos de investigación académica): tendencias de la industria y pronóstico hasta 2032

Tamaño del mercado de soluciones clínicas electrónicas en América del Norte

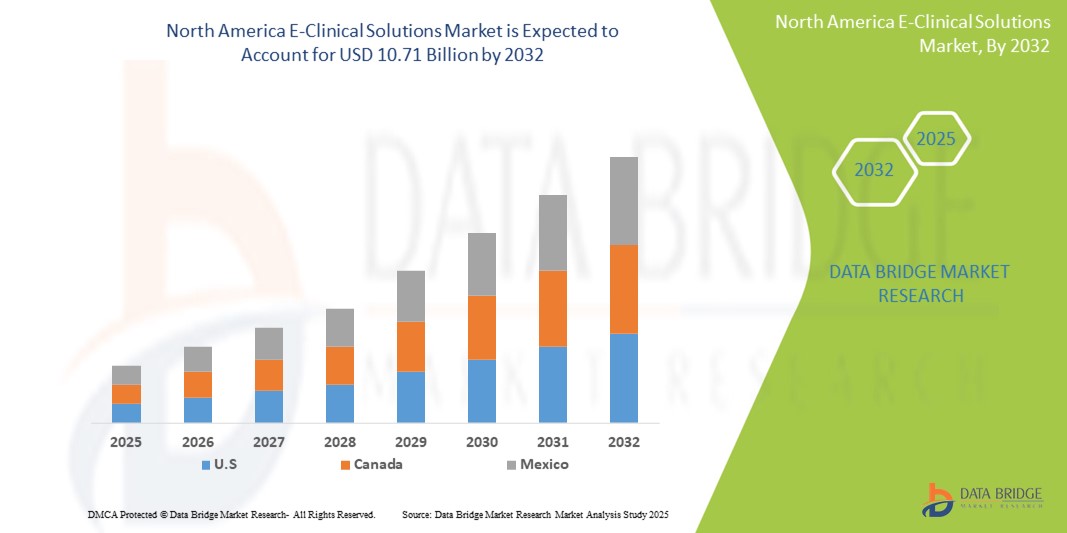

- El tamaño del mercado de soluciones clínicas electrónicas de América del Norte se valoró en USD 3.62 mil millones en 2024 y se espera que alcance los USD 10.71 mil millones para 2032 , con una CAGR del 14,50% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente adopción de soluciones de atención médica digital, sistemas de captura electrónica de datos (EDC) y plataformas clínicas basadas en la nube, que están agilizando los ensayos clínicos y acelerando la toma de decisiones basada en datos.

- Además, la creciente demanda de soluciones seguras, eficientes e integradas para la gestión de datos de pacientes, la monitorización de ensayos clínicos y el cumplimiento normativo está impulsando la adopción de soluciones clínicas electrónicas. La integración de herramientas de análisis avanzado, inteligencia artificial y generación de informes en tiempo real está mejorando significativamente la eficiencia de los ensayos clínicos y reduciendo los costes operativos, impulsando así el crecimiento del mercado de soluciones clínicas electrónicas.

Análisis del mercado de soluciones clínicas electrónicas en América del Norte

- Las soluciones clínicas electrónicas, que abarcan sistemas electrónicos para la gestión de ensayos clínicos, la captura de datos y la monitorización remota, son cada vez más vitales en la atención médica moderna y la investigación farmacéutica debido a su capacidad para mejorar la eficiencia operativa, garantizar la integridad de los datos y agilizar el cumplimiento normativo.

- La creciente demanda de soluciones clínicas electrónicas se ve impulsada principalmente por la creciente adopción de tecnologías digitales en ensayos clínicos, la creciente necesidad de monitoreo de datos en tiempo real y el creciente enfoque en reducir los plazos de desarrollo de medicamentos.

- Estados Unidos dominó el mercado de soluciones clínicas electrónicas de América del Norte con la mayor participación en los ingresos del 82,8 % en 2024, caracterizado por una infraestructura de atención médica avanzada, una alta adopción digital en ensayos clínicos y una fuerte presencia de importantes empresas farmacéuticas y biotecnológicas, con un crecimiento sustancial impulsado por plataformas basadas en la nube, captura electrónica de datos (EDC) y soluciones de monitoreo remoto.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de soluciones clínicas electrónicas de América del Norte durante el período de pronóstico, debido a la creciente inversión en ensayos clínicos descentralizados e híbridos, la creciente adopción de plataformas clínicas electrónicas basadas en la nube y la expansión de iniciativas de investigación farmacéutica y biotecnológica, lo que respalda la rápida expansión del mercado.

- El segmento de grandes organizaciones dominó el mercado de soluciones clínicas electrónicas de América del Norte con una participación en los ingresos del 52,3 % en 2024, impulsado por extensas líneas de ensayos clínicos, presupuestos sustanciales para soluciones digitales y la necesidad de gestionar ensayos de gran volumen en varios países de manera eficiente.

Alcance del informe y segmentación del mercado de soluciones clínicas electrónicas

|

Atributos |

Perspectivas clave del mercado de soluciones clínicas electrónicas |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de soluciones clínicas electrónicas en América del Norte

Creciente adopción de plataformas de ensayos clínicos digitales

- Una tendencia significativa y en auge en el mercado norteamericano de soluciones clínicas electrónicas es la creciente adopción de plataformas digitales para la gestión de ensayos clínicos, la captura electrónica de datos (EDC) y las soluciones de monitorización remota. Esta tendencia está mejorando significativamente la eficiencia operativa, la precisión de los datos y el cumplimiento normativo en la investigación farmacéutica y biotecnológica.

- Por ejemplo, las principales CRO y compañías farmacéuticas están implementando cada vez más plataformas clínicas electrónicas basadas en la nube que permiten la monitorización centralizada de ensayos multicéntricos, lo que facilita la toma de decisiones en tiempo real y una agregación de datos más rápida. Estas plataformas agilizan el reclutamiento de pacientes, la gestión de centros y el cumplimiento del protocolo, reduciendo así los retrasos en los ensayos.

- La integración de E-Clinical Solutions con herramientas analíticas y sistemas de resultados informados electrónicamente por los pacientes (ePRO) permite una mejor supervisión del progreso del ensayo, la identificación de riesgos y la optimización de los flujos de trabajo clínicos, mejorando así tanto la calidad del ensayo como la seguridad del paciente.

- El monitoreo remoto y las plataformas habilitadas para dispositivos móviles brindan a los equipos de estudio mayor flexibilidad y accesibilidad, lo que permite a las partes interesadas realizar un seguimiento de las métricas del ensayo, revisar los datos y garantizar el cumplimiento sin estar físicamente presentes en los sitios del ensayo.

- La tendencia hacia plataformas clínicas electrónicas centralizadas, basadas en la nube y totalmente integradas está redefiniendo las expectativas de eficiencia, precisión y escalabilidad en la investigación clínica. En consecuencia, empresas como Medidata Solutions, Oracle Health Sciences y Veeva Systems están optimizando sus plataformas para ofrecer soluciones integrales de gestión de ensayos, diseños de ensayos adaptativos y capacidades de análisis en tiempo real.

- La demanda de soluciones clínicas electrónicas está creciendo rápidamente en los sectores farmacéutico y biotecnológico, ya que las organizaciones priorizan cada vez más plazos de desarrollo de fármacos más rápidos, eficiencias de costos y captura de datos de alta calidad.

Dinámica del mercado de soluciones clínicas electrónicas en América del Norte

Conductor

Creciente necesidad debido a la creciente demanda de ensayos clínicos digitalizados

- El mercado norteamericano de soluciones clínicas electrónicas está experimentando un crecimiento significativo debido a la creciente complejidad de los ensayos clínicos, que requieren una gestión fluida de volúmenes masivos de datos de pacientes, ensayos y normativas. La creciente adopción de tecnologías digitales permite a las organizaciones optimizar el diseño de ensayos, mejorar la eficiencia operativa y optimizar los resultados de los pacientes.

- Por ejemplo, en abril de 2024, las principales empresas del sector actualizaron sus plataformas para incluir análisis avanzados en tiempo real, captura automatizada de datos y funcionalidades de monitorización remota, lo que permitió operaciones de ensayos clínicos más rápidas, precisas y conformes. Se espera que estos avances tecnológicos aceleren la adopción de soluciones clínicas electrónicas durante el período de pronóstico.

- El enfoque creciente en el cumplimiento normativo, la integridad de los datos y los informes optimizados está impulsando aún más la demanda, ya que las plataformas E-Clinical facilitan la gestión de ensayos de extremo a extremo, incluida la captura electrónica de datos, la gestión de archivos maestros de ensayos y la evaluación de resultados clínicos.

- Además, el auge de los ensayos clínicos descentralizados y virtuales está generando una fuerte demanda de soluciones clínicas electrónicas basadas en la nube, escalables y accesibles desde dispositivos móviles. Estas soluciones mejoran la colaboración entre equipos de investigación distribuidos geográficamente y permiten la toma de decisiones en tiempo real, reduciendo los plazos de los ensayos y los costes operativos.

- Funciones avanzadas, como el análisis predictivo, la validación de datos con IA y la integración fluida con las historias clínicas electrónicas (HCE) y otros sistemas informáticos sanitarios, ayudan a los patrocinadores y a las CRO a mejorar el reclutamiento de pacientes, garantizar el cumplimiento del protocolo y optimizar la precisión de los ensayos. La combinación de estos beneficios está impulsando una mayor adopción en organizaciones farmacéuticas, biotecnológicas y de investigación por contrato.

Restricción/Desafío

Preocupaciones sobre la seguridad de los datos, el cumplimiento normativo y los altos costos de implementación

- La creciente dependencia de las plataformas digitales para datos confidenciales de pacientes y ensayos genera inquietudes con respecto a la ciberseguridad, las violaciones de datos y el posible acceso no autorizado.

- Garantizar el cumplimiento de los estrictos requisitos reglamentarios, como FDA 21 CFR Parte 11, HIPAA y GDPR, requiere un cifrado sólido, protocolos de autenticación seguros y un monitoreo continuo.

- Los altos costos iniciales de las plataformas clínicas electrónicas avanzadas, incluidas las licencias de software, la infraestructura de TI y la capacitación de los empleados, pueden representar una barrera para las organizaciones más pequeñas o los centros de investigación con presupuestos limitados, lo que potencialmente desacelera la penetración en el mercado.

- Los desafíos de interoperabilidad con los sistemas heredados existentes, así como las dificultades para integrar datos de múltiples fuentes de diversos sitios de prueba, pueden limitar la eficiencia operativa y obstaculizar una adopción fluida.

- Para abordar estos desafíos es necesario implementar medidas sólidas de ciberseguridad, marcos de cumplimiento estandarizados, modelos de implementación rentables e interfaces fáciles de usar.

- Superar con éxito estos obstáculos permitirá a las organizaciones de investigación realizar ensayos clínicos más eficientes, precisos y rentables, sustentando así el crecimiento a largo plazo en el mercado de soluciones clínicas electrónicas.

Alcance del mercado de soluciones clínicas electrónicas en América del Norte

El mercado está segmentado en función del producto, el modo de entrega, la fase del ensayo clínico, el tamaño de la organización, el dispositivo del usuario y el usuario final.

- Por producto

En cuanto a productos, el mercado norteamericano de soluciones clínicas electrónicas se segmenta en sistemas de captura electrónica de datos y gestión de datos de ensayos clínicos, sistemas de gestión de ensayos clínicos, plataformas de análisis clínico, registros médicos de coordinación de atención (CCMR), gestión de aleatorización y suministro de ensayos, plataformas de integración de datos clínicos, soluciones de evaluación electrónica de resultados clínicos, soluciones de seguridad, sistemas de archivo maestro de ensayos electrónicos, soluciones de gestión de información regulatoria, entre otros. El segmento de sistemas de captura electrónica de datos y gestión de datos de ensayos clínicos dominó el mercado con la mayor participación en los ingresos, con un 36,5 %, en 2024, gracias a su papel fundamental en la captura, validación y gestión eficiente de datos de ensayos clínicos en múltiples centros, lo que garantiza información en tiempo real, mejora la precisión de los datos y mantiene el cumplimiento normativo. Su adopción por parte de las empresas farmacéuticas y biotecnológicas, junto con la capacidad de integración con otros sistemas clínicos, refuerza su dominio.

Se prevé que el segmento de Plataformas de Análisis Clínico registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 12,1 %, entre 2025 y 2032. Este crecimiento se ve impulsado por la creciente demanda de información procesable a partir de conjuntos de datos clínicos complejos, lo que permite el modelado predictivo, la generación de informes en tiempo real y la visualización avanzada. Las plataformas de análisis mejoran la eficiencia operativa y aceleran la toma de decisiones para los ensayos clínicos en curso. El aumento de las inversiones en análisis basados en IA, el enfoque regulatorio en los resultados basados en datos y la integración con sistemas de captura electrónica de datos impulsan aún más su adopción. Las empresas biotecnológicas medianas y las grandes organizaciones farmacéuticas están adoptando rápidamente estas plataformas para mejorar la eficiencia de los ensayos clínicos, optimizar la asignación de recursos y reducir el tiempo de comercialización. La innovación continua en las funcionalidades del software, sumada a la creciente concienciación sobre la información obtenida a partir de datos clínicos, respalda el crecimiento sostenido de este segmento.

- Por modo de entrega

Según el modo de entrega, el mercado norteamericano de soluciones clínicas electrónicas se segmenta en soluciones alojadas en web (bajo demanda), soluciones empresariales con licencia (locales) y soluciones en la nube (SAAS). El segmento de soluciones alojadas en web (bajo demanda) dominó el mercado con una participación en los ingresos del 41,8 % en 2024, gracias a su facilidad de implementación, mínimos requisitos de infraestructura y rentabilidad, lo que permite a las organizaciones escalar rápidamente sus operaciones, garantizando al mismo tiempo el acceso centralizado a los datos y la monitorización en tiempo real. Su flexibilidad para gestionar ensayos clínicos multicéntricos y su integración fluida con plataformas de terceros refuerzan su dominio.

Se prevé que el segmento de soluciones basadas en la nube (SAAS) experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 13,4 %, entre 2025 y 2032. El crecimiento se ve impulsado por la adopción de infraestructuras en la nube seguras y escalables que respaldan los ensayos clínicos globales. Las soluciones en la nube ofrecen acceso a datos en tiempo real, copias de seguridad automatizadas, sólidas medidas de seguridad y una colaboración optimizada entre equipos multifuncionales. La creciente demanda de ensayos descentralizados, la rentabilidad y la fácil integración con herramientas de análisis e informes impulsan aún más su adopción. Tanto las organizaciones grandes como las medianas están implementando cada vez más plataformas basadas en la nube para una implementación más rápida y un mejor cumplimiento normativo. La comodidad, la flexibilidad y la escalabilidad que ofrecen las soluciones basadas en la nube las posicionan como el modo de prestación de servicios de mayor crecimiento en el mercado.

- Por fase de ensayo clínico

Según la fase de los ensayos clínicos, el mercado norteamericano de soluciones e-clínicas se segmenta en Fase I, Fase II, Fase III y Fase IV. El segmento de Fase III dominó el mercado con la mayor participación en ingresos, un 39,2%, en 2024. Esto se atribuye a la escala y complejidad de los ensayos de Fase III, que involucran grandes poblaciones de pacientes, múltiples centros de estudio y amplios requisitos de gestión de datos. Las soluciones e-clínicas desempeñan un papel fundamental para garantizar la precisión de la captura de datos, mantener el cumplimiento normativo y permitir una monitorización fluida de los ensayos en curso. El alto riesgo y el escrutinio regulatorio asociados a los estudios de Fase III impulsan una fuerte adopción de estas soluciones, ya que ayudan a reducir errores, agilizar las operaciones y proporcionar información en tiempo real a los patrocinadores de los ensayos. Su integración con análisis clínicos, captura electrónica de datos y sistemas de generación de informes consolida aún más su posición como la solución más utilizada durante esta fase.

Se espera que el segmento de Fase II registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 11,7 %, entre 2025 y 2032. El crecimiento en este segmento se ve impulsado por el aumento de ensayos clínicos en fase intermedia y la creciente necesidad de soluciones integradas que optimicen el reclutamiento de pacientes, agilicen la recopilación de datos y agilicen la toma de decisiones. Las soluciones clínicas electrónicas para ensayos de Fase II permiten a los patrocinadores analizar rápidamente los datos emergentes de seguridad y eficacia, reducir los retrasos y mejorar el diseño de los ensayos. Las inversiones de empresas biotecnológicas, junto con la adopción de la monitorización en tiempo real y los enfoques basados en el riesgo, impulsan aún más el crecimiento. La capacidad de mejorar la eficiencia operativa y garantizar el cumplimiento normativo hace que las soluciones de Fase II sean muy atractivas y posicionan a este segmento como el de mayor crecimiento dentro de las fases de ensayos clínicos.

- Por tamaño de la organización

Según el tamaño de las organizaciones, el mercado norteamericano de soluciones clínicas electrónicas se segmenta en pequeñas, medianas y grandes. El segmento de las grandes organizaciones dominó el mercado con una participación en los ingresos del 52,3 % en 2024, impulsado por una extensa cartera de proyectos de ensayos clínicos, presupuestos sustanciales para soluciones digitales y la necesidad de gestionar eficientemente ensayos clínicos de gran volumen en varios países. Las grandes organizaciones utilizan las soluciones clínicas electrónicas para optimizar las operaciones clínicas, mantener el cumplimiento normativo y facilitar la coordinación eficaz entre múltiples equipos funcionales. Su uso de plataformas avanzadas para la integración, la generación de informes y la monitorización de datos garantiza una mayor adopción y refuerza el dominio de este segmento.

Se prevé que el segmento de pequeñas y medianas empresas experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 10,8 %, entre 2025 y 2032. Este crecimiento se sustenta en la creciente externalización de actividades clínicas, la adopción de plataformas rentables basadas en la nube y la escalabilidad que ofrecen las modernas soluciones clínicas electrónicas. Las pequeñas y medianas empresas utilizan cada vez más estas plataformas para gestionar eficientemente los ensayos clínicos sin grandes inversiones en infraestructura de TI. La flexibilidad para escalar las soluciones según el tamaño del ensayo, la mayor seguridad de los datos y la integración con herramientas de análisis aceleran aún más la adopción. Además, el auge de las startups biotecnológicas y la creciente concienciación sobre el cumplimiento normativo contribuyen a una rápida expansión, convirtiendo a este segmento en el de mayor crecimiento entre las organizaciones.

- Por dispositivo del usuario

En función del dispositivo de usuario, el mercado norteamericano de soluciones clínicas electrónicas se segmenta en computadoras de escritorio, tabletas, dispositivos PDA portátiles, teléfonos inteligentes y otros. El segmento de computadoras de escritorio dominó el mercado con la mayor participación en ingresos, con un 47,5 % en 2024. Este predominio se debe principalmente a la preferencia de los investigadores clínicos por las computadoras de escritorio debido a su capacidad para gestionar análisis complejos, la entrada avanzada de datos y las interfaces integrales que facilitan los ensayos clínicos a gran escala. Las computadoras de escritorio ofrecen una gran potencia de procesamiento, mayor espacio de pantalla para la multitarea y una integración fluida con las sofisticadas plataformas de soluciones clínicas electrónicas. También permiten la gestión eficiente de datos de ensayos multicéntricos, la elaboración de informes regulatorios y herramientas de visualización avanzadas. La fiabilidad, la estabilidad y la facilidad de uso de las computadoras de escritorio para las operaciones clínicas refuerzan aún más su liderazgo en el mercado.

Se prevé que el segmento de teléfonos inteligentes experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 12,5 %, entre 2025 y 2032. Este rápido crecimiento se ve impulsado por la creciente adopción de dispositivos móviles para la monitorización en tiempo real, la entrada remota de datos y la participación en ensayos clínicos descentralizados. Los teléfonos inteligentes permiten al personal clínico introducir, revisar y compartir datos de ensayos en cualquier momento y lugar, lo que mejora la productividad y la colaboración. La integración con plataformas en la nube, herramientas de análisis móvil y aplicaciones intuitivas mejora la comodidad y la eficiencia. La creciente penetración de los teléfonos inteligentes entre el personal clínico, combinada con soluciones móviles rentables y flujos de trabajo optimizados para ensayos, convierte a este segmento en la opción de dispositivo de usuario de mayor crecimiento.

- Por el usuario final

En función del usuario final, el mercado norteamericano de soluciones e-clínicas se segmenta en compañías farmacéuticas y biofarmacéuticas, organizaciones de investigación por contrato, empresas de servicios de consultoría, fabricantes de dispositivos médicos, hospitales e institutos de investigación académica. El segmento de compañías farmacéuticas y biofarmacéuticas dominó el mercado con una participación en los ingresos del 44,6 % en 2024. Esto se debe principalmente a sus extensas carteras de ensayos clínicos, operaciones en múltiples centros y requisitos de estudios de alto volumen que requieren soluciones e-clínicas avanzadas para una gestión eficiente, cumplimiento normativo y análisis en tiempo real. La adopción de plataformas integradas permite un diseño de ensayos optimizado, una mayor integridad de los datos y una toma de decisiones más rápida. La capacidad de gestionar ensayos complejos y garantizar el cumplimiento de las regulaciones globales refuerza el dominio de este segmento.

Se prevé que el segmento de las organizaciones de investigación por contrato (CRO) experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 12,8 %, entre 2025 y 2032. El crecimiento en este segmento se debe a la creciente externalización de ensayos clínicos y a la dependencia de las empresas biotecnológicas de las CRO para obtener soluciones clínicas electrónicas flexibles y escalables. Las CRO aprovechan estas plataformas para la gestión global de ensayos, la monitorización remota, la generación de informes basados en riesgos y una mayor eficiencia operativa. La adopción de soluciones avanzadas permite una ejecución de ensayos rentable, plazos más rápidos y el cumplimiento de las normas regulatorias. El aumento de la externalización de ensayos clínicos, junto con la necesidad de datos de alta calidad y una gestión eficiente de los ensayos, posiciona a las CRO como el segmento de usuarios finales de mayor crecimiento.

Análisis regional del mercado de soluciones clínicas electrónicas en América del Norte

- América del Norte dominó el mercado de soluciones clínicas electrónicas con la mayor participación en los ingresos en 2024, impulsada por la creciente adopción de tecnologías digitales en ensayos clínicos, una mayor demanda de gestión eficiente de ensayos y una amplia integración de plataformas basadas en la nube.

- Las organizaciones de la región valoran mucho la conveniencia, la escalabilidad y el análisis en tiempo real que ofrecen las plataformas de E-Clinical Solutions, lo que permite una captura de datos optimizada, una gestión centralizada de ensayos y un mejor cumplimiento normativo.

- Esta adopción generalizada está respaldada además por una infraestructura de atención médica avanzada, una alta alfabetización digital entre los profesionales de investigación y el creciente énfasis en los ensayos clínicos descentralizados e híbridos, lo que establece a E-Clinical Solutions como una herramienta esencial para las organizaciones de investigación farmacéutica, biotecnológica y por contrato.

Perspectiva del mercado de soluciones clínicas electrónicas de EE. UU.

El mercado estadounidense de soluciones clínicas electrónicas captó la mayor participación en los ingresos, con un 82,8 %, en 2024 en Norteamérica, impulsado por una infraestructura sanitaria avanzada, una alta adopción digital en ensayos clínicos y una sólida presencia de importantes compañías farmacéuticas y biotecnológicas. Este rápido crecimiento se debe a plataformas en la nube, captura electrónica de datos (EDC) y soluciones de monitorización remota, que permiten operaciones de ensayos clínicos eficientes, rentables y conformes con las normativas. Además, el mercado estadounidense se beneficia de marcos regulatorios favorables, importantes inversiones en I+D e innovaciones continuas en análisis clínicos y plataformas de gestión de ensayos.

Análisis del mercado de soluciones clínicas electrónicas de Canadá

Se prevé que el mercado canadiense de soluciones clínicas electrónicas sea el de mayor crecimiento durante el período de pronóstico, impulsado por el aumento de la inversión en ensayos clínicos descentralizados e híbridos, la creciente adopción de plataformas clínicas electrónicas en la nube y la expansión de las iniciativas de investigación farmacéutica y biotecnológica. Se prevé que estos factores impulsen una rápida expansión del mercado, facilitando una mayor eficiencia operativa, una mayor participación del paciente y una gestión de datos más precisa en los estudios clínicos.

Cuota de mercado de soluciones clínicas electrónicas en América del Norte

La industria de soluciones clínicas electrónicas está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Oracle (EE. UU.)

- Signant Health (EE. UU.)

- Parexel International (MA) Corporation (EE. UU.)

- Dassault Systèmes (Francia)

- Clario (EE. UU.)

- Mednet (EE. UU.)

- OpenClinica, LLC (EE. UU.)

- 4G Clinical (EE. UU.)

- Veeva Systems (EE. UU.)

- Saama (EE. UU.)

- Castor (Países Bajos)

- Medrio (Estados Unidos)

- ArisGlobal (EE. UU.)

- Merative (EE. UU.)

- Advarra (EE. UU.)

- eClinical Solutions, LLC (EE. UU.)

- Y-Prime, LLC. (EE. UU.)

- RealTime Software Solutions LLC (EE. UU.)

- Datatrack International (Reino Unido)

- IQVIA Inc (EE. UU.)

Últimos avances en el mercado de soluciones clínicas electrónicas en América del Norte

- En abril de 2025, eClinical Solutions anunció el lanzamiento de su último producto, destinado a reducir la duración de los ciclos de ensayos clínicos para las empresas biofarmacéuticas. Esta nueva oferta está diseñada para optimizar los procesos de gestión de datos y mejorar la eficiencia operativa, respondiendo a la creciente demanda de ensayos clínicos más rápidos y rentables en la industria.

- En mayo de 2025, RealTime eClinical Solutions amplió su división de Servicios Profesionales para acelerar la adopción de soluciones eClinical en centros de investigación clínica, centros médicos académicos, patrocinadores y organizaciones de investigación por contrato. Esta iniciativa busca brindar soporte y capacitación integrales, facilitando la integración fluida de las plataformas eClinical en los flujos de trabajo de investigación existentes.

- En junio de 2025, eClinical Solutions lideró los debates de la industria sobre la modernización de los ensayos clínicos en la conferencia 2025 de la Drug Information Association (DIA). La empresa destacó el papel de la inteligencia artificial y las estrategias basadas en el riesgo en la transformación de las metodologías de los ensayos clínicos, enfatizando la necesidad de innovación para abordar los desafíos actuales en el panorama de la investigación clínica.

- En septiembre de 2024, RealTime eClinical Solutions fue reconocido como proveedor preferente por nueve de las 10 principales redes de centros globales. Este reconocimiento subraya la creciente influencia de la empresa y la amplia adopción de su paquete integrado de productos eClinical entre las principales organizaciones de investigación clínica.

- En noviembre de 2024, RealTime eClinical Solutions anunció la expansión de su oferta de Servicios Profesionales para acelerar la adopción de soluciones eClinical en centros de investigación clínica, centros médicos académicos, patrocinadores y organizaciones de investigación por contrato. Esta iniciativa busca brindar soporte y capacitación integrales, facilitando la integración fluida de las plataformas eClinical en los flujos de trabajo de investigación existentes.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.