Mercado de tapones para los oídos en América del Norte, por estilo de fijación (con cordón, sin cordón), ajuste (estándar, personalizado), material (PVC, silicona, poliuretano, caucho, otros), aplicación (industrial, doméstica, entretenimiento, atención médica, otros), precio (menos de US$ 10, US$ 11 – US$ 50, US$ 51 – US$ 100, más de US$ 100), país (EE. UU., Canadá, México), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado : mercado de tapones para los oídos en América del Norte

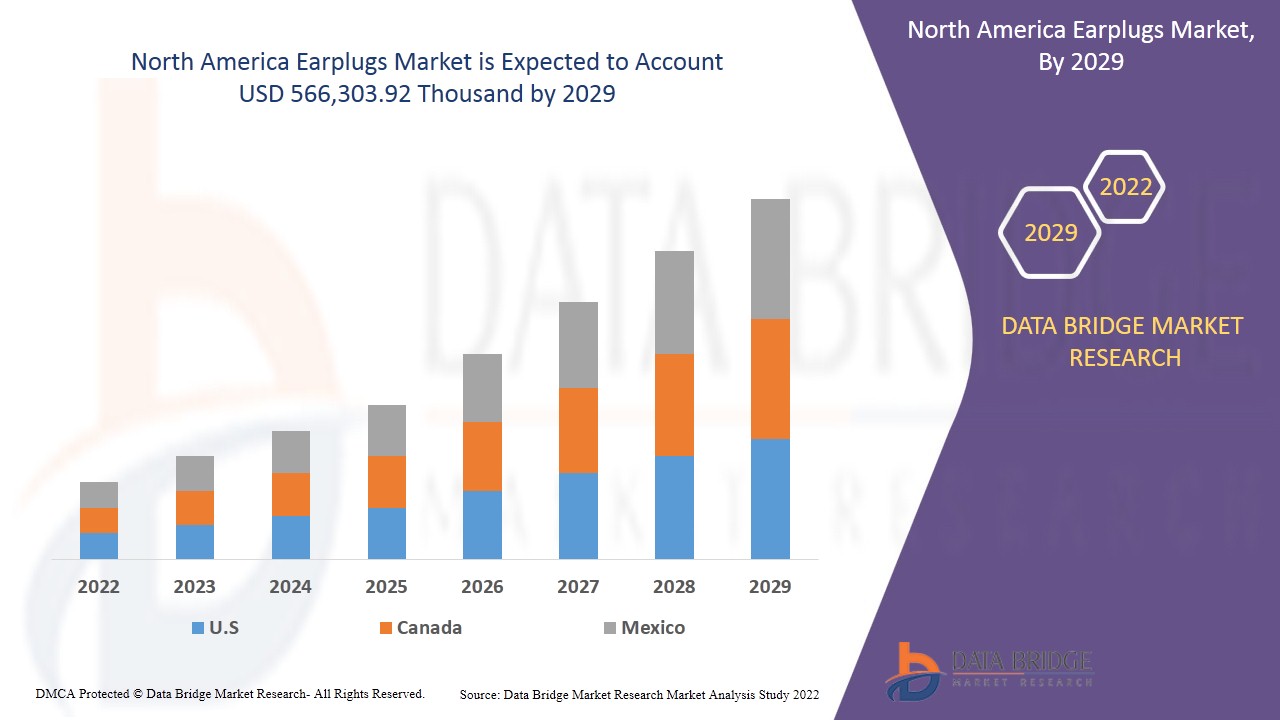

Se espera que el mercado de tapones para los oídos de América del Norte gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 7,8% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 566.303,92 mil para 2029. Se espera que el aumento en el requisito de un proceso de toma de decisiones rápidas en biotecnología impulse significativamente el crecimiento del mercado.

Un tapón para los oídos es un dispositivo que se inserta en el oído para proteger los oídos del usuario de ruidos fuertes, la entrada de agua , el polvo o el exceso de aire. Como reduce el volumen del sonido, los tapones para los oídos se utilizan a menudo para ayudar a prevenir la pérdida de audición y el tinnitus.

Los tapones para los oídos moldeados /moldeables se pueden insertar en el canal auditivo. Están disponibles como desechables o reutilizables y se pueden encontrar en la mayoría de las farmacias y supermercados. Existen principalmente cuatro tipos de tapones para los oídos para la protección auditiva: tapones para los oídos de espuma, fabricados principalmente con cloruro de polivinilo ( PVC ) o poliuretano (PU) (espuma viscoelástica), tapones para los oídos de cera, tapones para los oídos de silicona con brida y tapones para los oídos moldeados a medida. Además, hay disponibles tapones para los oídos diseñados a medida que se pueden confeccionar visitando a su otorrinolaringólogo u otro profesional de la salud auditiva.

El uso creciente de tapones para los oídos en las actividades de construcción y minería de América del Norte es el principal factor impulsor del mercado. La disponibilidad de sustitutos de productos en la industria puede resultar un desafío, sin embargo, la creciente demanda de dispositivos de reducción de ruido (NRR) o cancelación de ruido resulta ser una oportunidad. La limitación es la falta de conocimiento sobre el uso y la importancia de los tapones para los oídos. También los desafíos a los que se enfrenta debido al impacto de Covid-19 en la cadena de suministro de las materias primas son los factores limitantes.

El informe de mercado de tapones para los oídos proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado de tapones para los oídos, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de tapones para los oídos

El mercado de tapones para los oídos de América del Norte está segmentado en cinco segmentos notables, a saber, estilo de fijación, material, ajuste, aplicación y precio.

- En función del estilo de sujeción, el mercado de tapones para los oídos de América del Norte se clasifica en sin cordón y con cordón. En 2022, se espera que los tapones sin cordón ocupen el segmento más alto debido a su fácil aplicación y precio más económico.

- En función del ajuste, el mercado de tapones para los oídos de América del Norte se clasifica en estándar y personalizado. En 2022, se espera que los estándar ocupen el segmento más alto, ya que están disponibles a un precio muy bajo en comparación con los personalizados.

- En función del material, el mercado de tapones para los oídos de América del Norte se clasifica en PVC, silicona, poliuretano, caucho y otros. En 2022, se espera que el PVC ocupe el segmento más alto debido a la mayor demanda de tapones para los oídos más económicos a base de espuma en el mercado.

- En función de la aplicación, el mercado de tapones para los oídos de América del Norte se clasifica en industrial, doméstico, de entretenimiento, sanitario y otros. En 2022, se espera que el segmento industrial ocupe el mayor lugar debido a los estándares de seguridad auditiva más estrictos y a las regulaciones de los organismos reguladores.

- En función del precio, el mercado de tapones para los oídos de América del Norte se clasifica en menos de 10 dólares estadounidenses, de 11 a 50 dólares estadounidenses, de 51 a 100 dólares estadounidenses y más de 100 dólares estadounidenses. En 2022, menos de 10 dólares estadounidenses ocupará el segmento más alto, ya que los consumidores prefieren la protección auditiva de bajo precio a otras.

Análisis del mercado de tapones para los oídos a nivel de país

El mercado de tapones para los oídos de América del Norte está segmentado en cinco segmentos notables, a saber, estilo de fijación, material, ajuste, aplicación y precio.

Los países incluidos en el informe sobre el mercado de tapones para los oídos son Estados Unidos, Canadá y México. Estados Unidos domina la región de América del Norte debido al aumento de la conciencia sobre los equipos de protección personal y las iniciativas gubernamentales para la protección contra el ruido.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se considera la presencia y disponibilidad de marcas de América del Norte y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

La creciente adopción de tapones para los oídos en aplicaciones de música y sueño para aumentar la demanda de productos está impulsando el crecimiento del mercado de tapones para los oídos.

El mercado de tapones para los oídos también le proporciona un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2012 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de los tapones para los oídos

El panorama competitivo del mercado de tapones para los oídos proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la profundidad de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en relación con el mercado de tapones para los oídos.

Algunos de los principales actores que operan en el mercado de tapones para los oídos de América del Norte son EARGASM, Decibullz LLC., Tapones para los oídos Wavy Ocean, EAROS, Inc., Vibes, QuietOn, Moldex-Metric, Honeywell International Inc., Etymotic, Magid Glove & Safety Manufacturing Company LLC, HEAROS, 3M, Liberty Glove & Safety, uvex group, Speedo International Limited y McKeon Products, Inc., entre otros.

Numerosos nuevos desarrollos de productos, ampliaciones de negocios, contratos y acuerdos son también iniciados por empresas de todo el mundo que también están acelerando el mercado de tapones para los oídos.

Por ejemplo,

- En marzo de 2021, Honeywell International Inc. presentó un nuevo dispensador de tapones para los oídos con protección antimicrobiana. Este lanzamiento de producto ayudará a la empresa a diversificar su cartera de productos y ofrecer una amplia gama de productos que pueden atraer a los clientes y acelerar las ventas.

- En julio de 2021, Magid Glove & Safety Manufacturing Company LLC se asoció con becarios de Chicago para crear un fondo para nuevos profesionales de la seguridad. Esto ayudará a la empresa a aumentar su capacidad de inversión y desarrollar nuevos productos y servicios que puedan diversificar la cartera de productos y atraer nuevos clientes.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA EARPLUGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TYPE TIMELINE CURVE

2.1 MARKET APPLICATION GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT AND EXPORT SCENARIO

4.2 RAW MATERIAL PRODUCTION COVERAGE

4.2.1 SILICON

4.2.2 PVC

4.2.3 POLYURETHANE

4.3 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.4 PORTER'S FIVE FORCES ANALYSIS

4.5 VENDOR SELECTION CRITERIA

4.6 PESTEL ANALYSIS

4.7 REGULATION COVERAGE

4.7.1 PRODUCT CODES

4.7.2 CERTIFIED STANDARDS

4.7.2.1 ANSI S12.6-2016

4.7.2.2 EN 352

4.7.3 SAFETY STANDARDS

4.7.3.1 MATERIAL HANDLING AND STORAGE

4.7.3.2 TRANSPORT & PRECAUTIONS

4.7.3.2.1 227.105 - PROTECTION OF EMPLOYEES:

4.7.3.2.2 227.107 - HEARING CONSERVATION PROGRAM.

4.7.3.3 HAZARD IDENTIFICATION

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS:

5.2 INDUSTRY RESPONSE:

5.3 GOVERNMENT’S ROLE:

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW:

6.2 LOGISTIC COST SCENERIO:

6.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS:

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING USE OF EARPLUGS IN CONSTRUCTION AND MINING ACTIVITIES

7.1.2 INCREASING ADOPTION OF EARPLUGS IN MUSIC AND SLEEPING APPLICATIONS

7.1.3 GROWING ACCEPTANCE OF MOLDED EARPLUGS WITH THE USE OF DIFFERENT MATERIAL

7.1.4 GROWING PREVALENCE OF HEARING LOSS

7.2 RESTRAINTS

7.2.1 LACK OF KNOWLEDGE REGARDING THE USE AND IMPORTANCE OF EARPLUGS

7.2.2 HIGHER COST OF CUSTOMIZED EARPLUGS

7.3 OPPORTUNITIES

7.3.1 GOVERNMENT REGULATIONS ON INDUSTRIAL WORKERS AND MILITARY PERSONNEL

7.3.2 INCREASING TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS FOR EARPLUGS

7.3.3 RISING DEMAND FOR NOISE REDUCTION RATING (NRR) OR NOISE CANCELLATION DEVICES

7.3.4 INCREASE IN USAGE OF EARPLUGS IN MANUFACTURING INDUSTRY

7.4 CHALLENGES

7.4.1 AVAILABILITY OF PRODUCT SUBSTITUTES IN THE INDUSTRY

7.4.2 CONTINUED USE LEADING TO INFECTIONS

8 IMPACT OF COVID-19 ON THE NORTH AMERICA EARPLUGS MARKET

8.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

8.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

8.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

8.4 IMPACT ON PRICE

8.5 IMPACT ON DEMAND

8.6 IMPACT ON SUPPLY CHAIN

8.7 CONCLUSION

9 NORTH AMERICA EARPLUGS MARKET, BY ATTACHMENT STYLE

9.1 OVERVIEW

9.2 UNCORDED

9.2.1 DISPOSABLE

9.2.2 REUSABLE

9.3 CORDED

9.3.1 DISPOSABLE

9.3.2 REUSABLE

10 NORTH AMERICA EARPLUGS MARKET, BY FITTING

10.1 OVERVIEW

10.2 STANDARD

10.3 CUSTOMIZED

11 NORTH AMERICA EARPLUGS MARKET, BY MATERIAL

11.1 OVERVIEW

11.2 PVC

11.3 SILICON

11.4 POLYURETHANE

11.5 RUBBER

11.6 OTHERS

12 NORTH AMERICA EARPLUGS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 INDUSTRIAL

12.3 HOUSEHOLD

12.3.1 SLEEP

12.3.2 CONCENTRATION

12.3.3 NOISE SENSITIVITY

12.3.4 DIY

12.3.5 PARENTING

12.3.6 TRAVEL

12.4 ENTERTAINMENT

12.4.1 MUSIC

12.4.2 RECREATIONAL

12.4.3 MOTOR SPORTS

12.5 HEALTHCARE

12.6 OTHERS

13 NORTH AMERICA EARPLUGS MARKET, BY PRICE

13.1 OVERVIEW

13.2 UNDER US$ 10

13.3 US$ 11- US$ 50

13.4 US$ 51- US$ 100

13.5 ABOVE US$ 100

14 NORTH AMERICA EARPLUGS MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA EARPLUGS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY SHARE ANALYSIS

17.1 HONEYWELL INTERNATIONAL INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 3M

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 SPEEDO INTERNATIONAL LIMITED

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 MOLDEX-METRIC

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 HEAROS

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 BLOX

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.7 DECIBULLZ LLC.

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 EARGASM

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 EARJOBS

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLI

17.1 EAROS, INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 EAR LABS AB

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 ETYMOTIC

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 HAPPY EARS

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 LIBERTY GLOVE & SAFETY

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 MAGID GLOVE & SAFETY MANUFACTURING COMPANY LLC

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 MCKEON PRODUCTS, INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 OHROPAX

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 QUIETON

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 UVEX GROUP

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 VIBES

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 WAVY OCEAN EARPLUGS

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA EARPLUGS MARKET, BY ATTACHMENT STYLE, 2022-2029 (USD THOUSAND)

TABLE 2 NORTH AMERICA EARPLUGS MARKET, BY ATTACHMENT STYLE, 2022-2029 (THOUSAND PAIRS)

TABLE 3 NORTH AMERICA UNCORDED IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 4 NORTH AMERICA UNCORDED IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 5 NORTH AMERICA UNCORDED IN EARPLUGS MARKET, BY TYPE, 2022-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA UNCORDED IN EARPLUGS MARKET, BY TYPE, 2022-2029 (THOUSAND PAIRS)

TABLE 7 NORTH AMERICA CORDED IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA CORDED IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 9 NORTH AMERICA UNCORDED IN EARPLUGS MARKET, BY TYPE, 2022-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA UNCORDED IN EARPLUGS MARKET, BY TYPE, 2022-2029 (THOUSAND PAIRS)

TABLE 11 NORTH AMERICA EARPLUGS MARKET, BY FITTING, 2022-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA EARPLUGS MARKET, BY FITTING, 2022-2029 (THOUSAND PAIRS)

TABLE 13 NORTH AMERICA STANDARD IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA STANDARD IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 15 NORTH AMERICA CUSTOMIZED IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA CUSTOMIZED IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 17 NORTH AMERICA EARPLUGS MARKET, BY MATERIAL, 2022-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA EARPLUGS MARKET, BY MATERIAL, 2022-2029 (THOUSAND PAIRS)

TABLE 19 NORTH AMERICA PVC IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA PVC IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 21 NORTH AMERICA SILICON IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA SILICON IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 23 NORTH AMERICA POLYURETHANE IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA POLYURETHANE IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 25 NORTH AMERICA RUBBER IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA RUBBER IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 27 NORTH AMERICA OTHERS IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA OTHERS IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 29 NORTH AMERICA EARPLUGS MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA EARPLUGS MARKET, BY APPLICATION, 2022-2029 (THOUSAND PAIRS)

TABLE 31 NORTH AMERICA INDUSTRIAL IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA INDUSTRIAL IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 33 NORTH AMERICA HOUSEHOLD IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA HOUSEHOLD IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 35 NORTH AMERICA HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2022-2029 (THOUSAND PAIRS)

TABLE 37 NORTH AMERICA ENTERTAINMENT IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA ENTERTAINMENT IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 39 NORTH AMERICA ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2022-2029 (THOUSAND PAIRS)

TABLE 41 NORTH AMERICA HEALTHCARE IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA HEALTHCARE IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 43 NORTH AMERICA OTHERS IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA OTHERS IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 45 NORTH AMERICA EARPLUGS MARKET, BY PRICE, 2022-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA EARPLUGS MARKET, BY PRICE, 2022-2029 (THOUSAND PAIRS)

TABLE 47 NORTH AMERICA UNDER US$ 10 IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA UNDER US$ 10 IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 49 NORTH AMERICA US$ 11- US$ 50 IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 50 NORTH AMERICA US$ 11- US$ 50 IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 51 NORTH AMERICA US$ 51- US$ 100 IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 52 NORTH AMERICA US$ 51- US$ 100 IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 53 NORTH AMERICA ABOVE US$ 100 IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 54 NORTH AMERICA ABOVE US$ 100 IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 55 NORTH AMERICA EARPLUGS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 56 NORTH AMERICA EARPLUGS MARKET, BY COUNTRY, 2020-2029 (THOUSAND PAIRS)

TABLE 57 NORTH AMERICA EARPLUGS MARKET, BY ATTACHMENT STYLE, 2020-2029 (USD THOUSAND)

TABLE 58 NORTH AMERICA EARPLUGS MARKET, BY ATTACHMENT STYLE, 2020-2029 (THOUSAND PAIRS)

TABLE 59 NORTH AMERICA UNCORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 NORTH AMERICA UNCORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (THOUSAND PAIRS)

TABLE 61 NORTH AMERICA CORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 NORTH AMERICA CORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (THOUSAND PAIRS)

TABLE 63 NORTH AMERICA EARPLUGS MARKET, BY FITTING, 2020-2029 (USD THOUSAND)

TABLE 64 NORTH AMERICA EARPLUGS MARKET, BY FITTING, 2020-2029 (THOUSAND PAIRS)

TABLE 65 NORTH AMERICA EARPLUGS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 66 NORTH AMERICA EARPLUGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND PAIRS)

TABLE 67 NORTH AMERICA EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 68 NORTH AMERICA EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 69 NORTH AMERICA HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 NORTH AMERICA HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 71 NORTH AMERICA ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 72 NORTH AMERICA ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 73 NORTH AMERICA EARPLUGS MARKET, BY PRICE, 2020-2029 (USD THOUSAND)

TABLE 74 NORTH AMERICA EARPLUGS MARKET, BY PRICE, 2020-2029 (THOUSAND PAIRS)

TABLE 75 U.S. EARPLUGS MARKET, BY ATTACHMENT STYLE, 2020-2029 (USD THOUSAND)

TABLE 76 U.S. EARPLUGS MARKET, BY ATTACHMENT STYLE, 2020-2029 (THOUSAND PAIRS)

TABLE 77 U.S. UNCORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 U.S. UNCORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (THOUSAND PAIRS)

TABLE 79 U.S. CORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 U.S. CORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (THOUSAND PAIRS)

TABLE 81 U.S. EARPLUGS MARKET, BY FITTING, 2020-2029 (USD THOUSAND)

TABLE 82 U.S. EARPLUGS MARKET, BY FITTING, 2020-2029 (THOUSAND PAIRS)

TABLE 83 U.S. EARPLUGS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 84 U.S. EARPLUGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND PAIRS)

TABLE 85 U.S. EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 86 U.S. EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 87 U.S. HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 88 U.S. HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 89 U.S. ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 90 U.S. ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 91 U.S. EARPLUGS MARKET, BY PRICE, 2020-2029 (USD THOUSAND)

TABLE 92 U.S. EARPLUGS MARKET, BY PRICE, 2020-2029 (THOUSAND PAIRS)

TABLE 93 CANADA EARPLUGS MARKET, BY ATTACHMENT STYLE, 2020-2029 (USD THOUSAND)

TABLE 94 CANADA EARPLUGS MARKET, BY ATTACHMENT STYLE, 2020-2029 (THOUSAND PAIRS)

TABLE 95 CANADA UNCORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 CANADA UNCORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (THOUSAND PAIRS)

TABLE 97 CANADA CORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 CANADA CORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (THOUSAND PAIRS)

TABLE 99 CANADA EARPLUGS MARKET, BY FITTING, 2020-2029 (USD THOUSAND)

TABLE 100 CANADA EARPLUGS MARKET, BY FITTING, 2020-2029 (THOUSAND PAIRS)

TABLE 101 CANADA EARPLUGS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 102 CANADA EARPLUGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND PAIRS)

TABLE 103 CANADA EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 104 CANADA EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 105 CANADA HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 106 CANADA HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 107 CANADA ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 108 CANADA ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 109 CANADA EARPLUGS MARKET, BY PRICE, 2020-2029 (USD THOUSAND)

TABLE 110 CANADA EARPLUGS MARKET, BY PRICE, 2020-2029 (THOUSAND PAIRS)

TABLE 111 MEXICO EARPLUGS MARKET, BY ATTACHMENT STYLE, 2020-2029 (USD THOUSAND)

TABLE 112 MEXICO EARPLUGS MARKET, BY ATTACHMENT STYLE, 2020-2029 (THOUSAND PAIRS)

TABLE 113 MEXICO UNCORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 MEXICO UNCORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (THOUSAND PAIRS)

TABLE 115 MEXICO CORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 116 MEXICO CORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (THOUSAND PAIRS)

TABLE 117 MEXICO EARPLUGS MARKET, BY FITTING, 2020-2029 (USD THOUSAND)

TABLE 118 MEXICO EARPLUGS MARKET, BY FITTING, 2020-2029 (THOUSAND PAIRS)

TABLE 119 MEXICO EARPLUGS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 120 MEXICO EARPLUGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND PAIRS)

TABLE 121 MEXICO EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 122 MEXICO EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 123 MEXICO HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 124 MEXICO HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 125 MEXICO ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 126 MEXICO ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 127 MEXICO EARPLUGS MARKET, BY PRICE, 2020-2029 (USD THOUSAND)

TABLE 128 MEXICO EARPLUGS MARKET, BY PRICE, 2020-2029 (THOUSAND PAIRS)

Lista de figuras

FIGURE 1 NORTH AMERICA EARPLUGS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA EARPLUGS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA EARPLUGS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA EARPLUGS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA EARPLUGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA EARPLUGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA EARPLUGS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA EARPLUGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA EARPLUGS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA EARPLUGS MARKET: SEGMENTATION

FIGURE 11 GROWING USE OF EARPLUGS IN CONSTRUCTION AND MINING ACTIVITIES IS EXPECTED TO BOOST NORTH AMERICA EARPLUGS MARKET IN THE FORECAST PERIOD

FIGURE 12 UNCORDED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA EARPLUGS MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE NORTH AMERICA EARPLUGS MARKET IN THE FORECAST PERIOD

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA EARPLUGS MARKET

FIGURE 15 EXPECTED GROWTH IN INFRASTRUCTURE CONSTRUCTION FROM 2020-2030 (IN %)

FIGURE 16 MUSIC INDUSTRY REVENUE WORLDWIDE FROM 2012 TO 2023 (IN BILLION U.S. DOLLARS)

FIGURE 17 ESTIMATED GROWTH RATES PERCENTS OF WORLD MANUFACTURING OUTPUT (Q3 2021 VS. Q3 2020)

FIGURE 18 USER PREFERENCES FOR HEARING PROTECTION (%)

FIGURE 19 NORTH AMERICA EARPLUGS MARKET, BY ATTACHMENT STYLE, 2021

FIGURE 20 NORTH AMERICA EARPLUGS MARKET, BY FITTING, 2021

FIGURE 21 NORTH AMERICA EARPLUGS MARKET, BY MATERIAL, 2021

FIGURE 22 NORTH AMERICA EARPLUGS MARKET, BY APPLICATION, 2021

FIGURE 23 NORTH AMERICA EARPLUGS MARKET, BY PRICE, 2021

FIGURE 24 NORTH AMERICA EARPLUGS MARKET: SNAPSHOT (2022)

FIGURE 25 NORTH AMERICA EARPLUGS MARKET: BY COUNTRY (2022)

FIGURE 26 NORTH AMERICA EARPLUGS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 NORTH AMERICA EARPLUGS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 NORTH AMERICA EARPLUGS MARKET: BY ATTACHMENT STYLE (2022-2029)

FIGURE 29 NORTH AMERICA EARPLUGS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.