North America Digital Experience Platform Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

10,132.67 Million

USD

38,606.79 Million

2021

2029

USD

10,132.67 Million

USD

38,606.79 Million

2021

2029

| 2022 –2029 | |

| USD 10,132.67 Million | |

| USD 38,606.79 Million | |

|

|

|

|

Mercado de plataformas de experiencia digital de América del Norte, por componente (plataforma, servicios), modelo de implementación (nube, local), tamaño de la organización (pequeña y mediana empresa, gran empresa), aplicación (empresa a cliente, empresa a empresa), vertical (venta minorista, BFSI, viajes y hotelería, TI y telecomunicaciones, atención médica, fabricación, medios y entretenimiento, educación) – Tendencias de la industria y pronóstico hasta 2029

Análisis y tamaño del mercado

El avance del software de gestión de contenido y su combinación con diversas tecnologías como IoT, realidad virtual y gráficos mejorados está ayudando a las empresas a brindar experiencias dinámicas a los clientes. Sectores como BFSI han incorporado DXP para brindar experiencias bancarias personalizadas a sus clientes a través de su aplicación oficial, portales y sitios web, lo que facilita la banca.

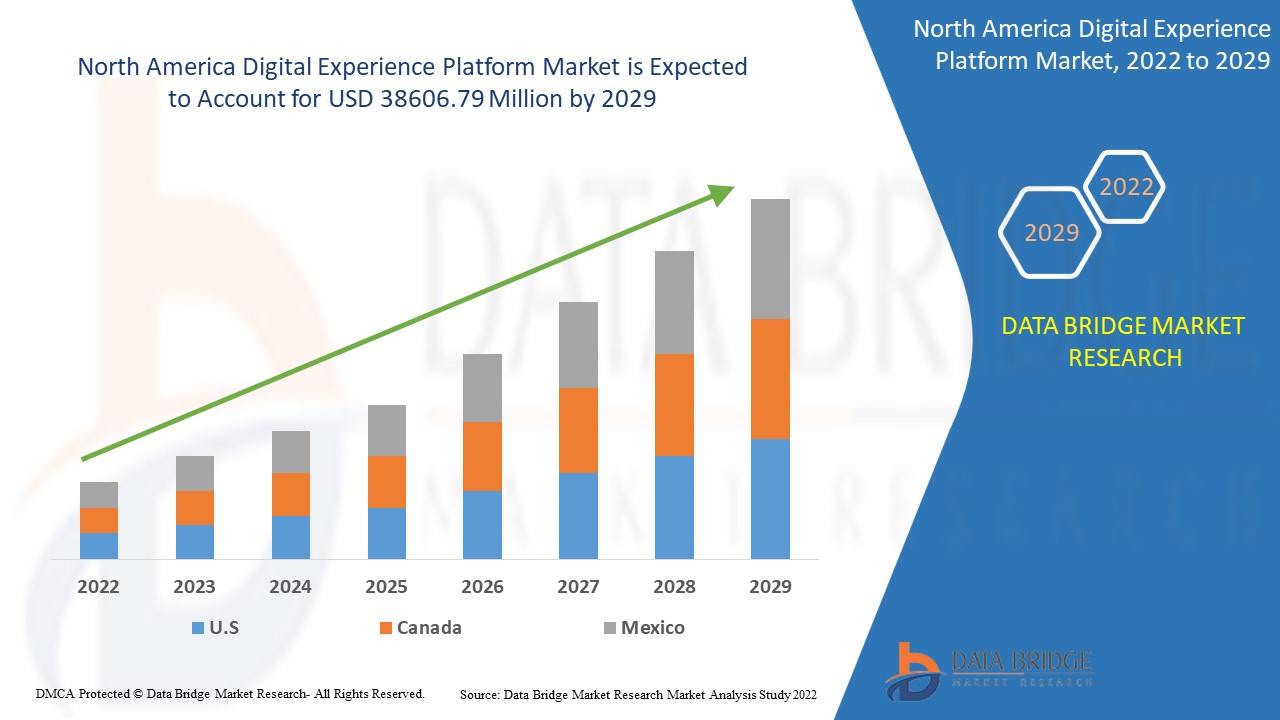

Data Bridge Market Research analiza que el mercado de plataformas de experiencia digital se valoró en USD 10.132,67 millones en 2021 y se espera que alcance el valor de USD 38.606,79 millones para 2029, con una CAGR del 18,2% durante el período de pronóstico de 2022 a 2029.

Definición de mercado

Una plataforma de experiencia digital (DXP) es un conjunto de tecnologías bien integradas y cohesivas que permiten la creación, gestión, entrega y optimización de experiencias digitales contextualizadas en recorridos de clientes con múltiples experiencias. Una DXP puede proporcionar experiencias digitales óptimas a una amplia gama de participantes, incluidos consumidores, socios, empleados, ciudadanos y estudiantes, así como ayudar a garantizar la continuidad durante todo el recorrido de vida del cliente. Proporciona orquestación de presentaciones, que conecta capacidades de varias aplicaciones para crear experiencias digitales fluidas. A través de integraciones basadas en API con tecnologías adyacentes, una DXP se convierte en parte de un ecosistema empresarial digital.

Alcance del informe y segmentación del mercado

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2014 - 2019) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Componente (plataforma, servicios), modelo de implementación (nube, en instalaciones locales), tamaño de la organización (pequeña y mediana empresa, gran empresa), aplicación (empresa a cliente, empresa a empresa), vertical (venta minorista, BFSI, viajes y hotelería, TI y telecomunicaciones, atención médica, fabricación, medios y entretenimiento, educación) |

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

Xandr Inc. (EE. UU.), Verizon (EE. UU.), Kayzen (China), NextRoll, Inc. (EE. UU.), Google (EE. UU.), Adobe (EE. UU.), Magnite, Inc (EE. UU.), MediaMath (EE. UU.), IPONWEB Limited (EE. UU.), VOYAGE GROUP (Japón), Integral Ad Science Inc. (Dinamarca), The Trade Desk (EE. UU.), Connexity (EE. UU.), Centro, Incorporated (EE. UU.), RhythmOne, LLC (EE. UU.) |

|

Oportunidades |

|

Dinámica del mercado de plataformas de experiencia digital

Conductores

- Aumento de la solución basada en la nube en varias empresas

Uno de los principales factores que impulsan el crecimiento del mercado de plataformas de experiencia digital es el aumento de la implementación de soluciones basadas en la nube en diversas empresas. El aumento de las iniciativas de las empresas para ofrecer una interacción y una experiencia de usuario personalizadas, optimizadas e integradas en múltiples canales de marketing, así como la mayor demanda de plataformas para comprender las necesidades inmediatas de los clientes, están impulsando el crecimiento del mercado.

- Aumento de la adopción de plataformas de experiencia digital para llegar a la base de clientes en múltiples niveles

La creciente adopción de plataformas de experiencia digital (DXP) por parte de los especialistas en marketing con el fin de llegar sin problemas a los clientes a través de múltiples dispositivos digitales y promover la venta cruzada y la venta adicional, así como el alto uso debido a los datos precisos obtenidos a través de DXP utilizados para el marketing y la interacción con el cliente, tienen un impacto en el mercado. Además, el uso para reducir la tasa de abandono de clientes, el aumento de la demanda de análisis de big data, la urbanización y la digitalización, y la preferencia por el enfoque omnicanal tienen un impacto positivo en el mercado de plataformas de experiencia digital. Además, el aumento de la demanda de experiencias personalizadas para cada cliente en tiempo real, así como la implementación de tecnologías avanzadas como IA, análisis de datos y computación en la nube, brindarán oportunidades rentables a los participantes del mercado durante el período de pronóstico.

Oportunidad

Se espera que el uso generalizado de quioscos interactivos y de autoservicio para servicios financieros como la banca por Internet y la banca móvil impulse la adopción de plataformas de experiencia digital por parte de bancos, instituciones financieras y empresas financieras no bancarias (NBFC). A medida que la plataforma de experiencia digital elimina los sistemas aislados, muchas organizaciones han comenzado a implementar DXP para mejorar sus estrategias de interacción y compromiso con los clientes a fin de competir con los líderes del mercado.

Restricciones

Por otra parte, se espera que las dificultades para integrar los datos generados por múltiples canales, así como las preocupaciones sobre la falta de claridad en los datos de retorno de la inversión, obstaculicen el crecimiento del mercado. Se espera que los problemas de integración con diversos programas informáticos supongan un desafío para el mercado de plataformas de experiencia digital durante el período de pronóstico.

Este informe de mercado de plataformas de experiencia digital proporciona detalles de nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis de crecimiento estratégico del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de plataformas de experiencia digital, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto de COVID-19 en el mercado de plataformas de experiencia digital

Durante los años de la pandemia de Covid-19, se produjo un aumento inevitable en el campo de las plataformas y tecnologías digitales. Estos pasos allanaron el camino para nuevos modelos de trabajo y vida, lo que dio un impulso significativo a la digitalización de todas las operaciones comerciales. Durante el período de confinamiento, la mayoría de los actores del mercado en todos los campos se centraron en mejorar la experiencia de sus plataformas digitales para sus clientes. La inversión masiva en la gestión de contenido DXP por parte de los proveedores de servicios en línea creó nuevas oportunidades para el desarrollo y el crecimiento del tamaño del mercado de plataformas de experiencia digital. Sin embargo, debido a que el éxito de cualquier servicio de interacción con el cliente depende de la disponibilidad de productos o servicios, Covid-19 tuvo algunos efectos negativos en las plataformas de gestión de la experiencia comercial.

Desarrollo reciente

- Adobe colaboró con ServiceNow, una empresa líder en computación en la nube, para desarrollar una solución pionera en el sector que permitiera integrar datos de experiencia digital con datos de clientes. Los clientes se beneficiarían de flujos de trabajo digitales sin interrupciones y experiencias de cliente personalizadas en todos los puntos de contacto.

- En marzo de 2019, Oracle se asoció con TWINSET, una marca de ropa italiana, para brindarle a la empresa la moderna tecnología de punto de servicio (POS) de Oracle Retail. Esta tecnología ayudaría a mejorar la experiencia del cliente en las tiendas TWINSET al brindar todos los detalles transaccionales al personal de la tienda, lo que les permitiría recomendar el estilo necesario e información sobre la mercancía más reciente, entre otras cosas.

- En enero de 2019, SAP adquirió Qualtrics International, uno de los pioneros mundiales en software de gestión de experiencias. Esta adquisición ayudaría a SAP a acelerar las soluciones CX al combinar datos operativos y de experiencia.

Alcance del mercado de plataformas de experiencia digital en América del Norte

El mercado de plataformas de experiencia digital está segmentado en función de los componentes, el modelo de implementación, el tamaño de la organización, la aplicación y la vertical. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducidos en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Componente

- Plataforma

- Servicios

Tipo de producto

- Software de gestión de identidad de clientes

- Software de monitoreo de transacciones

- Software de informes de transacciones de divisas

- Software de gestión de cumplimiento

- Otros

Tamaño de la organización

- Organización grande

- Pequeña y mediana organización

Despliegue

- En las instalaciones

- Nube

Solicitud

- De empresa a cliente

- De empresa a empresa

Vertical

- Minorista

- BFSI

- Viajes y Hostelería

- TI y telecomunicaciones

- Cuidado de la salud

- Fabricación

- Medios y entretenimiento

- Educación

Análisis y perspectivas regionales del mercado de plataformas de experiencia digital

Se analiza el mercado de la plataforma de experiencia digital y se proporcionan información y tendencias del tamaño del mercado por país, componente, modelo de implementación, tamaño de la organización, aplicación y vertical como se menciona anteriormente.

Los países cubiertos en el informe del mercado de plataformas de experiencia digital son Estados Unidos, Canadá y México.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y la cuota de mercado de las plataformas de experiencia digital

El panorama competitivo del mercado de plataformas de experiencia digital ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de plataformas de experiencia digital.

Algunos de los principales actores que operan en el mercado de plataformas de experiencia digital son:

- Xandr Inc. (Estados Unidos)

- Verizon (Estados Unidos)

- Kayzen (China)

- NextRoll, Inc. (Estados Unidos)

- Google (Estados Unidos)

- Adobe (Estados Unidos)

- Magnite, Inc. (Estados Unidos)

- MediaMath (Estados Unidos)

- IPONWEB Limited (Estados Unidos)

- GRUPO VOYAGE (Japón)

- Integral Ad Science Inc. (Dinamarca)

- El Trade Desk (Estados Unidos)

- Connexity (Estados Unidos).

- Centro, Incorporated (Estados Unidos)

- RhythmOne, LLC (Estados Unidos)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELING

2.1 COMPONENT TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY OPERATING SYSTEMS

5 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: IMPACT ANALYSIS OF COVID-19

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING GROWTH IN DIGITALIZATION

6.1.2 RICH EXPERIENCE WITH TOUCHPOINT OPTIMIZATION

6.1.3 INCREASED CUSTOMER RETENTION THROUGH DXP

6.1.4 GROWTH IN CLOUD TECHNOLOGY AND IOT BASED DEVICES

6.1.5 GROWTH IN BIG DATA ANALYTICS

6.2 RESTRAINTS

6.2.1 LACK OF KNOWLEDGE REGARDING DIGITAL EXPERIENCE PLATFORM

6.2.2 ISSUE WITH CYBER SECURITY

6.2.3 MULTILINGUAL CONTENT AVAILABLE NORTH AMERICALY

6.3 OPPORTUNITIES

6.3.1 INCREASING GROWTH IN ARTIFICIAL INTELLIGENCE TECHNOLOGY

6.3.2 GROWTH IN E-COMMERCE TRANSFORMING THE RETAIL MARKET

6.3.3 IMPLEMENTING BUSINESS INTELLIGENCE IN DXP

6.4 CHALLENGES

6.4.1 COMPLICATIONS INVOLVED IN INTEGRATION OF DIFFERENT PLATFORMS INVOLVED

6.4.2 TRACKING CROSS CHANNEL USER BEHAVIOUR

7 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 PLATFORM

7.3 SERVICES

7.3.1 PROFESSIONAL SERVICES

7.3.2 MANAGED SERVICES

8 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL

8.1 OVERVIEW

8.2 ON PREMISES

8.3 CLOUD

9 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISE

9.3 SMALL & MEDIUM ENTERPRISE

10 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BUSINESS TO CUSTOMER

10.2.1 ON PREMISES

10.2.2 CLOUD

10.3 BUSINESS TO BUSINESS

10.3.1 ON PREMISES

10.3.2 CLOUD

10.4 OTHERS

11 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 RETAIL

11.2.1 PLATFORM

11.2.2 SERVICES

11.3 BFSI

11.3.1 PLATFORM

11.3.2 SERVICES

11.4 IT & TELECOM

11.4.1 PLATFORM

11.4.2 SERVICES

11.5 TRAVEL & HOSPITALITY

11.5.1 PLATFORM

11.5.2 SERVICES

11.6 MEDIA AND ENTERTAINMENT

11.6.1 PLATFORM

11.6.2 SERVICES

11.7 EDUCATION

11.7.1 PLATFORM

11.7.2 SERVICES

11.8 HEALTHCARE

11.8.1 PLATFORM

11.8.2 SERVICES

11.9 MANUFACTURING

11.9.1 PLATFORM

11.9.2 SERVICES

11.1 OTHERS

12 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY GEOGRAPHY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: SWOT ANALYSIS

15 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: DBMR ANALYSIS

16 COMPANY PROFILE

16.1 ADOBE

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 SAP SE

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANLYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 ORACLE

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 SALESFORCE.COM, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 ACCENTURE

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 SERVICE PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ACQUIA, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BLOOMREACH INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CENSHARE AG

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT & SERVICE PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 CROWNPEAK TECHNOLOGY, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 EPISERVER

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 HCL TECHNOLOGIES LIMITED

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 INFOSYS LIMITED

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 SERVICE PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 JAHIA SOLUTIONS GROUP SA

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 KENTICO SOFTWARE

16.14.1 COMPANY SNAPSHOT

16.14.2 SOLUTION PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 LIFERAY INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 OPEN TEXT CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT & SOLUTION PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 SDL PLC

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 SOFTWARE PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 SITECORE

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 SQUIZ

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 WIPRO LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 SERVICE PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

17 CONCLUSION

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

LIST OF TABLES

TABLE 1 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: DIGITAL EXPERIENCE PLATFORM REVIEW BASED ON CUSTOMER FEEDBACK

TABLE 2 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 3 NORTH AMERICA PLATFORM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 4 NORTH AMERICA SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 5 NORTH AMERICA SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 6 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 7 NORTH AMERICA ON PREMISES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 8 NORTH AMERICA CLOUD IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 9 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 10 NORTH AMERICA LARGE ENTERPRISE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 11 NORTH AMERICA SMALL & MEDIUM ENTERPRISE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 12 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 13 NORTH AMERICA BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 NORTH AMERICA BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 15 NORTH AMERICA BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 NORTH AMERICA BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 17 NORTH AMERICA OTHERS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 18 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 19 NORTH AMERICA RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 NORTH AMERICA RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 21 NORTH AMERICA BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 22 NORTH AMERICA BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 23 NORTH AMERICA IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 24 NORTH AMERICA IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 25 NORTH AMERICA TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 26 NORTH AMERICA TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 27 NORTH AMERICA MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 28 NORTH AMERICA MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 29 NORTH AMERICA EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 30 NORTH AMERICA EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 31 NORTH AMERICA HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 32 NORTH AMERICA HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 33 NORTH AMERICA MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 34 NORTH AMERICA MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 36 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 37 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 38 NORTH AMERICA SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 39 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 40 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 41 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 42 NORTH AMERICA BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 43 NORTH AMERICA BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 44 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 45 NORTH AMERICA RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 46 NORTH AMERICA BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 47 NORTH AMERICA IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 48 NORTH AMERICA TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 49 NORTH AMERICA MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 50 NORTH AMERICA EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 51 NORTH AMERICA HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 52 NORTH AMERICA MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 53 U.S. DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 54 U.S. SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 55 U.S. DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 56 U.S. DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 57 U.S. DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 58 U.S. BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 59 U.S. BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 60 U.S. DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 61 U.S. RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 62 U.S. BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 63 U.S. IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 64 U.S. TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 65 U.S. MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 66 U.S. EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 67 U.S. HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 68 U.S. MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 69 CANADA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 70 CANADA SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 71 CANADA DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 72 CANADA DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 73 CANADA DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 74 CANADA BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 75 CANADA BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 76 CANADA DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 77 CANADA RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 78 CANADA BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 79 CANADA IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 80 CANADA TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 81 CANADA MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 82 CANADA EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 83 CANADA HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 84 CANADA MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 85 MEXICO DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 86 MEXICO SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 87 MEXICO DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 88 MEXICO DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 89 MEXICO DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 90 MEXICO BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 91 MEXICO BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 92 MEXICO DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 93 MEXICO RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 94 MEXICO BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 95 MEXICO IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 96 MEXICO TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 97 MEXICO MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 98 MEXICO EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 99 MEXICO HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 100 MEXICO MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

Lista de figuras

LIST OF FIGURES

FIGURE 1 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: MULTIVARIATE MODELING

FIGURE 11 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: SEGMENTATION

FIGURE 12 INCREASED CUSTOMER RETENTION THROUGH DXP IS EXPECTED TO DRIVE NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 13 PLATFORM IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET IN 2020 & 2027

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE AND FASTEST GROWING IN THE NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 15 NORTH AMERICA IS THE FASTEST GROWING MARKET FOR DIGITAL EXPERIENCE PLATFORM MANUFACTURERS IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET

FIGURE 17 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: BY COMPONENT, 2019

FIGURE 18 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: BY DEPLOYMENT MODEL, 2019

FIGURE 19 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: BY ORGANISATION SIZE, 2019

FIGURE 20 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: BY APPLICATION, 2019

FIGURE 21 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: BY VERTICAL, 2019

FIGURE 22 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: SNAPSHOT (2019)

FIGURE 23 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: BY COUNTRY (2019)

FIGURE 24 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: BY COUNTRY (2020 & 2027)

FIGURE 25 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: BY COUNTRY (2019 & 2027)

FIGURE 26 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: BY COMPONENT (2020-2027)

FIGURE 27 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: COMPANY SHARE 2019 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.