Mercado de aplicaciones de dieta y nutrición en América del Norte, por tipo (aplicación de seguimiento de la nutrición, aplicación de seguimiento de la actividad, aplicaciones de plataformas sociales, aplicaciones de apuestas y otras), productos (teléfonos inteligentes, dispositivos portátiles, tabletas), género (mujeres, hombres), edad (adultos, adolescentes, ancianos), plataforma (Android, IOS, Windows y otros), usuario final (centros de fitness, industrias de atención médica, entornos de atención domiciliaria y otros), país (EE. UU., Canadá y México), tendencias del mercado y pronóstico hasta 2028.

Análisis y perspectivas del mercado: mercado de aplicaciones de nutrición y dietas en América del Norte

Análisis y perspectivas del mercado: mercado de aplicaciones de nutrición y dietas en América del Norte

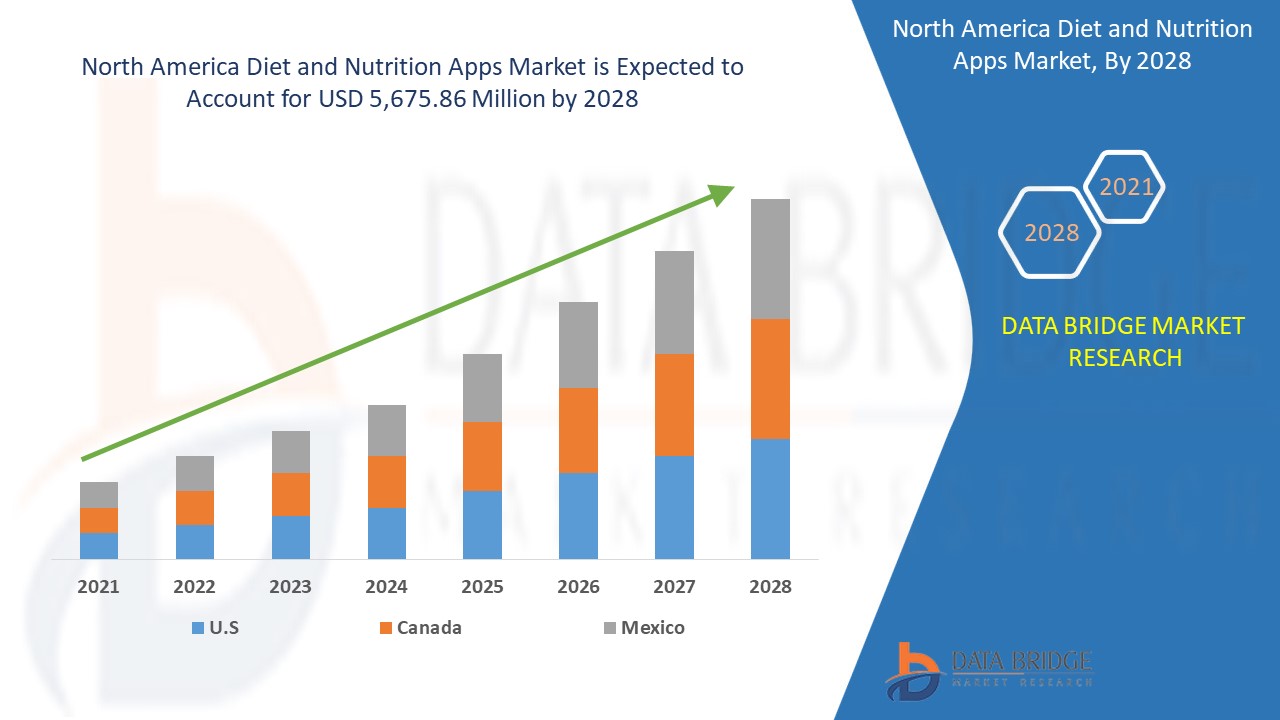

Se espera que el mercado de aplicaciones de dieta y nutrición de América del Norte crezca en el período de pronóstico de 2021 a 2028. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 30,6% en el período de pronóstico de 2021 a 2028 y se espera que alcance los USD 5.675,86 millones para 2028.

Las aplicaciones de dieta y nutrición son aplicaciones de software que se utilizan para realizar un seguimiento de la ingesta nutricional y gestionar las dietas para una alimentación saludable, la pérdida de peso, el mantenimiento del peso, el aumento de peso y la forma física. Las aplicaciones de dieta también tienen demanda en el ámbito sanitario para realizar un seguimiento de las sensibilidades alimentarias, las alergias y las afecciones médicas, como la diabetes, la hipertensión arterial y las enfermedades cardíacas. Estas herramientas de aplicación se ofrecen en dispositivos como teléfonos inteligentes , tabletas y PC. En los últimos años, la mayor penetración de Internet y otros servicios digitales como la computación en la nube han impulsado el mercado de la oferta de plataformas digitales. Muchos usuarios utilizan las aplicaciones de teléfonos móviles como herramientas para obtener ayuda en sus tareas diarias. La creciente conciencia sobre los trastornos de salud debidos a estilos de vida poco saludables ha provocado un aumento de las aplicaciones de dieta y nutrición.

Los principales factores que impulsan el crecimiento del mercado de aplicaciones de dieta y nutrición son la creciente atención de la población a sus hábitos alimentarios, el creciente número de entrenadores dietéticos que están creando sus aplicaciones y el avance de las tecnologías digitales, como los lectores de códigos de barras. La creciente penetración de los servicios de Internet crea oportunidades para el crecimiento del mercado. La falta de disponibilidad de información nutricional está actuando como la principal restricción para el mercado de aplicaciones de dieta y nutrición. La disponibilidad de gimnasios como alternativa es un gran desafío para el crecimiento del mercado.

Este informe de mercado de aplicaciones de dieta y nutrición proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen de analista ; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de aplicaciones de nutrición y dietas en América del Norte

Alcance y tamaño del mercado de aplicaciones de nutrición y dietas en América del Norte

El mercado de aplicaciones de dieta y nutrición de América del Norte está segmentado en función del tipo, los productos, el género, la edad, la plataforma y el usuario final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- En función del tipo, el mercado de aplicaciones de dieta y nutrición de América del Norte se segmenta en aplicaciones de seguimiento de la nutrición, aplicaciones de seguimiento de la actividad, aplicaciones de plataformas sociales, aplicaciones de apuestas y otras. En 2021, se espera que el segmento de aplicaciones de seguimiento de la nutrición domine el mercado, ya que un sistema de seguimiento de la nutrición ayuda a determinar las calorías de la persona. La persona puede realizar un seguimiento fácil de la ingesta de alimentos y equilibrar su dieta.

- En función de los productos, el mercado de aplicaciones de dieta y nutrición de América del Norte se segmenta en teléfonos inteligentes, tabletas y dispositivos portátiles. En 2021, se espera que el segmento de teléfonos inteligentes domine el mercado, ya que la región de América del Norte tiene una alta adopción de teléfonos inteligentes, que se utilizan para descargar aplicaciones de dieta y nutrición.

- En función del género, el mercado de aplicaciones de dieta y nutrición de América del Norte está segmentado en hombres y mujeres. En 2021, se espera que el segmento femenino domine el mercado, ya que las mujeres están más centradas en tener una dieta saludable. Se ha observado que las mujeres son más disciplinadas con su dieta y siguen las aplicaciones con regularidad.

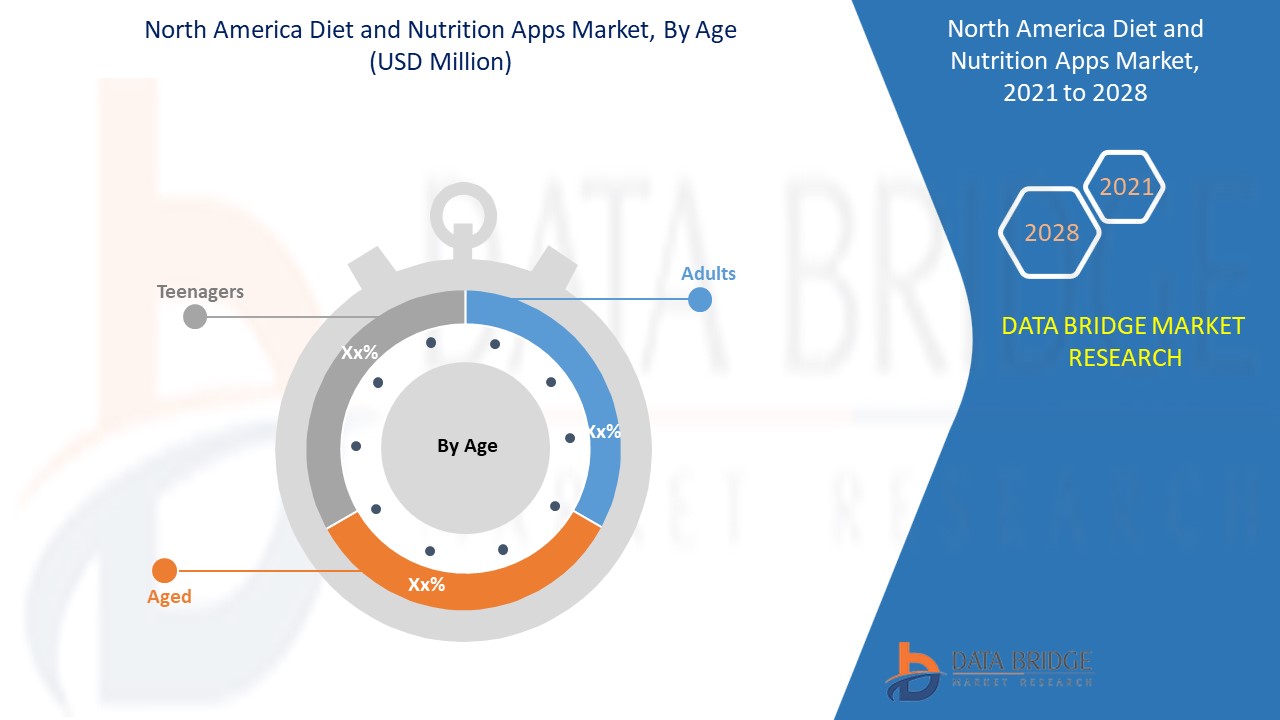

- En función de la edad, el mercado de aplicaciones de dieta y nutrición de América del Norte se segmenta en adolescentes, adultos y ancianos. En 2021, se espera que el segmento de adultos domine el mercado. La población adulta es más consciente de las aplicaciones de dieta y nutrición. Además, están más inclinados hacia las tecnologías digitales y, por lo tanto, tienen una gran cantidad de aplicaciones.

- En función de la plataforma, el mercado de aplicaciones de dieta y nutrición de América del Norte está segmentado en Android, iOS, Windows y otros. En 2021, se espera que el segmento iOS domine el mercado, ya que las aplicaciones iOS ofrecen aplicaciones de mejor calidad y la región tiene una mayor cantidad de teléfonos inteligentes iOS.

- En función del usuario final, el mercado de aplicaciones de dieta y nutrición de América del Norte se segmenta en gimnasios, entornos de atención domiciliaria, industrias de atención médica y otros. En 2021, se espera que el segmento de gimnasios domine el mercado, ya que estos actúan como la fuente clave para recomendar las aplicaciones a las personas.

Análisis a nivel de país del mercado de aplicaciones de nutrición y dietas de América del Norte

Se analiza el mercado de aplicaciones de dieta y nutrición de América del Norte y se proporciona información sobre el tamaño del mercado por país, tipo, productos, género, edad, plataforma y usuario final.

Los países cubiertos en el informe del mercado de aplicaciones de dieta y nutrición de América del Norte son EE. UU., Canadá y México.

Estados Unidos representó la mayor participación en el mercado de aplicaciones de dieta y nutrición en América del Norte debido a factores como la presencia de muchas empresas que ofrecen aplicaciones de dieta y nutrición.

La sección de países del informe sobre el mercado de aplicaciones de dieta y nutrición de América del Norte también proporciona factores de impacto individuales en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como las nuevas ventas , las ventas de reemplazo, la demografía del país, los actos regulatorios y el análisis de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se considera la presencia y disponibilidad de marcas norteamericanas y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Creciente adopción de aplicaciones de dieta y nutrición

El mercado de aplicaciones de dieta y nutrición de América del Norte también le proporciona un análisis detallado del mercado para cada país, el crecimiento de una base instalada de diferentes tipos de productos para el mercado, el impacto de la tecnología mediante curvas de línea de vida y cambios en los requisitos de productos abrasivos, escenarios regulatorios y su impacto en el mercado de aplicaciones de dieta y nutrición. Los datos están disponibles para el período histórico de 2010 a 2019.

Análisis del panorama competitivo y de la cuota de mercado de las aplicaciones de nutrición y dieta en América del Norte

El panorama competitivo del mercado de aplicaciones de nutrición y dieta de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de ensayos clínicos, el análisis de la marca, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones, la curva de supervivencia tecnológica. Los puntos de datos anteriores solo están relacionados con el enfoque de las empresas en el mercado de aplicaciones de nutrición y dieta de América del Norte.

Algunos de los principales actores que operan en el informe de aplicaciones de dieta y nutrición de América del Norte son Azumio Inc., MyFitnessPal, Inc., Noom, Inc., Lifesum Ab, FitNow, Inc., MyNetDiary Inc., Innit International SCA, The Kroger Co., mySugr GmbH, FatSecret, HappyCow, Inc., HealthifyMe Wellness Private Limited, Fitocracy, Inc., Wombat Apps LLC, Cronometer Software Inc., CareClinic, Syndigo LLC, foodvisor.io, Eat This Much Inc., Asken Inc., Leaf Group Ltd., Avatar Nutrition LLC, entre otros. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Por ejemplo,

- En octubre de 2020, CareClinic lanzó la función de planificación avanzada de la atención en su plataforma de gestión de la salud. El lanzamiento de la nueva función tiene como objetivo concienciar y educar a los canadienses sobre la importancia de la planificación. Con esto, la empresa ofreció a los usuarios todas las funciones necesarias y cruciales para gestionar su salud y prepararse para su futuro. Esto mejoró la oferta de la empresa en el mercado.

- En septiembre de 2017, Asken Inc. lanzó su aplicación en los EE. UU. con una base de datos que contiene cientos de miles de alimentos y cientos de restaurantes y marcas de alimentos nacionales. Esta medida se produjo tras la creciente demanda de aplicaciones de seguimiento de nutrientes en el mercado estadounidense. La aplicación presentó un escáner de código de barras que captura información nutricional de una gran base de datos de alimentos de todo el país después de un escaneo rápido. Después de la expansión, la aplicación colaboró con Sony Network Communications para desarrollar la tecnología de análisis de fotos de comidas impulsada por IA. Esto permitió la expansión de la empresa en el mercado norteamericano.

Las alianzas, las empresas conjuntas y otras estrategias mejoran la participación de mercado de la empresa con una mayor cobertura y presencia. La gama de productos ampliada también beneficia a la organización para mejorar su oferta en el mercado de aplicaciones de dieta y nutrición.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA DIET AND NUTRITION APPS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.9 MULTIVARIATE MODELING

2.1 TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 APPS FEATURE BASED ON THE SPECIFIC REQUIREMENTS

4.2 INFORMATION ON SCORING/RATING

4.3 NUTRIENT INFORMATION GUIDE:

4.4 REASON WHY SOME OF THE FOOD ITEMS ARE NOT RATED:

4.5 REASON WHY SAME TYPE OF FOOD CAN GET DIFFERENT RATINGS:

4.6 REASONS FOR RATING THE FOOD:

4.7 NUTRIENT PROFILING SCHEMES

4.8 APPS PROVIDING PRODUCT NUTRITION RATING/SCORING

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING PENETRATION OF DIGITAL DEVICES AND THE INTERNET

5.1.2 GROWING AWARENESS REGARDING HEALTH AND WELLNESS

5.1.3 SCIENTIFIC ADVANCES IN NUTRITION

5.1.4 INCREASING NUMBER OF LIFESTYLE-RELATED DISEASES

5.1.5 GOVERNMENT ENCOURAGEMENT FOR HEALTHY LIFESTYLES THROUGH REGULATORY LAWS

5.2 RESTRAINTS

5.2.1 NUTRIENT CODING INCONSISTENCY AS COMPARED TO THE STANDARD REFERENCE DATABASES

5.2.2 DATA COMPLIANCES BY REGIONAL GOVERNMENT ORGANIZATION RESTRICTS AND MAKES CROSS BORDER DATA TRANSFER COSTLY

5.3 OPPORTUNITIES

5.3.1 APPLICATION OF AI AND ML TECHNOLOGIES TO PROVIDE PERSONALISED DIET PLANS

5.3.2 INCREASING USE OF SMARTPHONE APPS DUE TO SURGE IN INDIVIDUALS WITH HIGHER PERSONAL INNOVATIVENESS

5.3.3 INCREASING FOCUS OF WORKING CLASS ON PROACTIVE HEALTH MONITORING

5.3.4 INTEGRATION OF APPS WITH FITNESS DEVICES FOR CONTINUOUS TRACKING OF HEALTH

5.4 CHALLENGES

5.4.1 DATA SECURITY ISSUES IN HEALTH AND FITNESS APPS

5.4.2 LACK OF AWARENESS REGARDING SPECIFIC FUNCTIONALITIES AND CAPABILITIES OF NUTRITION APPS

5.4.3 LACK OF KNOWLEDGE REGARDING THE TECHNICAL FEATURES AND PERSONALIZATION IN AN APP LEADING TO SUBSEQUENT DISENGAGEMENT

6 COVID-19 IMPACT ON NORTH AMERICA DIET AND NUTRITION APPS MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 PRICE IMPACT

6.7 CONCLUSION

7 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY TYPE

7.1 OVERVIEW

7.2 NUTRITION TRACKING APP

7.2.1 CALORIE COUNTING AND DETOX

7.2.2 MEAL DATA AND HEALTHY RECIPES

7.2.3 DIET TIPS

7.2.4 WEIGHT LOSS AND GAIN DIARIES

7.3 ACTIVITY TRACKING APP

7.3.1 FOOD TRACKER

7.3.2 WATER TRACKER

7.3.3 OTHERS

7.4 SOCIAL PLATFORM APPS

7.5 WAGER APPS

7.6 OTHERS

8 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY PRODUCTS

8.1 OVERVIEW

8.2 SMARTPHONES

8.3 WEARABLE DEVICES

8.3.1 WRIST BANDS

8.3.2 SMARTWATCH

8.4 TABLETS

9 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY GENDER

9.1 OVERVIEW

9.2 WOMEN

9.3 MEN

10 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY AGE

10.1 OVERVIEW

10.2 ADULTS

10.3 TEENAGERS

10.4 AGED

11 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY PLATFORM

11.1 OVERVIEW

11.2 ANDROID

11.3 IOS

11.4 WINDOWS

11.5 OTHERS

12 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY END USER

12.1 OVERVIEW

12.2 FITNESS CENTERS

12.2.1 GYM

12.2.2 FITNESS STUDIOS

12.2.3 HEALTH CLUBS

12.2.4 OTHERS

12.3 HEALTHCARE INDUSTRIES

12.3.1 HOSPITALS

12.3.1.1 General Hospital

12.3.1.2 Physician Referral

12.3.1.3 Wayfinding

12.3.1.4 Others

12.3.2 CLINICS

12.3.3 OTHERS

12.4 HOMECARE SETTINGS

12.5 OTHERS

13 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA DIET AND NUTRITION APPS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 NOOM, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 COMPANY SHARE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 THE KROGER CO.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 MYFITNESSPAL, INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 LEAF GROUP LTD.

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 LIFESUM AB

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 ASKEN INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 AVATAR NUTRITION LLC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 AZUMIO INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 CARECLINIC

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 CRONOMETER SOFTWARE INC.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 EAT THIS MUCH INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 FATSECRET

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 FITNOW, INC

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 FITOCRACY, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 FOODVISOR.IO

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 HAPPYCOW, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 HEALTHIFYME WELLNESS PRIVATE LIMITED

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 INNIT INTERNATIONAL SCA

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 MYNETDIARY INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 MYSUGR GMBH

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 NUTRITIONIX (A SYNDIGO LLC COMPANY)

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 WOMBAT APPS LLC

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 2 NORTH AMERICA NUTRITION TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 NORTH AMERICA NUTRITION TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 4 NORTH AMERICA ACTIVITY TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028(USD MILLION)

TABLE 5 NORTH AMERICA ACTIVITY TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 6 NORTH AMERICA SOCIAL PLATFORM APPS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA WAGER APPS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA OTHERS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028(USD MILLION)

TABLE 9 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY PRODUCTS, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA SMARTPHONES IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA WEARABLE DEVICES IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028(USD MILLION)

TABLE 12 NORTH AMERICA WEARABLE DEVICES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA TABLETS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA WOMEN IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA MEN IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY AGE, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA ADULTS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028(USD MILLION)

TABLE 19 NORTH AMERICA TEENAGERS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA AGED IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY PLATFORM, 2019-2028 (USD MILLION)

TABLE 22 NORTH AMERICA ANDROID IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 23 NORTH AMERICA IOS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA WINDOWS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 27 NORTH AMERICA FITNESS CENTERS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA FITNESS CENTERS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 29 NORTH AMERICA HEALTHCARE INDUSTRIES IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA HEALTHCARE INDUSTRIES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA HOSPITALS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 32 NORTH AMERICA HOMECARE SETTINGS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 33 NORTH AMERICA OTHERS IN DIET AND NUTRITION APPS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 35 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 36 NORTH AMERICA NUTRITION TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 37 NORTH AMERICA ACTIVITY TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 38 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY PRODUCTS, 2019-2028 (USD MILLION)

TABLE 39 NORTH AMERICA WEARABLE DEVICES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 40 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 41 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY AGE, 2019-2028 (USD MILLION)

TABLE 42 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY PLATFORM, 2019-2028 (USD MILLION)

TABLE 43 NORTH AMERICA DIET AND NUTRITION APPS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 44 NORTH AMERICA FITNESS CENTERS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 45 NORTH AMERICA HEALTHCARE INDUSTRIES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 46 NORTH AMERICA HOSPITALS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 47 U.S. DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 48 U.S. NUTRITION TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 49 U.S. ACTIVITY TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 50 U.S. DIET AND NUTRITION APPS MARKET, BY PRODUCTS, 2019-2028 (USD MILLION)

TABLE 51 U.S. WEARABLE DEVICES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 52 U.S. DIET AND NUTRITION APPS MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 53 U.S. DIET AND NUTRITION APPS MARKET, BY AGE, 2019-2028 (USD MILLION)

TABLE 54 U.S. DIET AND NUTRITION APPS MARKET, BY PLATFORM, 2019-2028 (USD MILLION)

TABLE 55 U.S. DIET AND NUTRITION APPS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 56 U.S. FITNESS CENTERS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 57 U.S. HEALTHCARE INDUSTRIES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 58 U.S. HOSPITALS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 59 CANADA DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 60 CANADA NUTRITION TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 61 CANADA ACTIVITY TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 62 CANADA DIET AND NUTRITION APPS MARKET, BY PRODUCTS, 2019-2028 (USD MILLION)

TABLE 63 CANADA WEARABLE DEVICES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 64 CANADA DIET AND NUTRITION APPS MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 65 CANADA DIET AND NUTRITION APPS MARKET, BY AGE, 2019-2028 (USD MILLION)

TABLE 66 CANADA DIET AND NUTRITION APPS MARKET, BY PLATFORM, 2019-2028 (USD MILLION)

TABLE 67 CANADA DIET AND NUTRITION APPS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 68 CANADA FITNESS CENTERS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 69 CANADA HEALTHCARE INDUSTRIES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 70 CANADA HOSPITALS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 71 MEXICO DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 72 MEXICO NUTRITION TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 73 MEXICO ACTIVITY TRACKING APP IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 74 MEXICO DIET AND NUTRITION APPS MARKET, BY PRODUCTS, 2019-2028 (USD MILLION)

TABLE 75 MEXICO WEARABLE DEVICES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 76 MEXICO DIET AND NUTRITION APPS MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 77 MEXICO DIET AND NUTRITION APPS MARKET, BY AGE, 2019-2028 (USD MILLION)

TABLE 78 MEXICO DIET AND NUTRITION APPS MARKET, BY PLATFORM, 2019-2028 (USD MILLION)

TABLE 79 MEXICO DIET AND NUTRITION APPS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 80 MEXICO FITNESS CENTERS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 81 MEXICO HEALTHCARE INDUSTRIES IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 82 MEXICO HOSPITALS IN DIET AND NUTRITION APPS MARKET, BY TYPE, 2019-2028 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA DIET AND NUTRITION APPS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA DIET AND NUTRITION APPS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA DIET AND NUTRITION APPS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA DIET AND NUTRITION APPS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA DIET AND NUTRITION APPS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA DIET AND NUTRITION APPS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA DIET AND NUTRITION APPS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA DIET AND NUTRITION APPS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA DIET AND NUTRITION APPS MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA DIET AND NUTRITION APPS MARKET: SEGMENTATION

FIGURE 11 GROWING AWARENESS REGARDING HEALTH AND WELLNESS IS EXPECTED TO DRIVE THE NORTH AMERICA DIET AND NUTRITION APPS MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 NUTRITION TRACKING APP SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA DIET AND NUTRITION APPS MARKET IN 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA DIET AND NUTRITION APPS MARKET

FIGURE 14 INCREASE IN THE INTERNET USERS WORLDWIDE, FROM 2010 TO 2021

FIGURE 15 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY TYPE, 2020

FIGURE 16 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY PRODUCTS, 2020

FIGURE 17 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY GENDER, 2020

FIGURE 18 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY AGE, 2020

FIGURE 19 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY PLATFORM, 2020

FIGURE 20 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY END USER, 2020

FIGURE 21 NORTH AMERICA DIET AND NUTRITION APPS MARKET: SNAPSHOT (2020)

FIGURE 22 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY COUNTRY (2020)

FIGURE 23 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY COUNTRY (2021 & 2028)

FIGURE 24 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY COUNTRY (2020 & 2028)

FIGURE 25 NORTH AMERICA DIET AND NUTRITION APPS MARKET: BY TYPE (2021-2028)

FIGURE 26 NORTH AMERICA DIET AND NUTRITION APPS MARKET: COMPANY SHARE 2020 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.