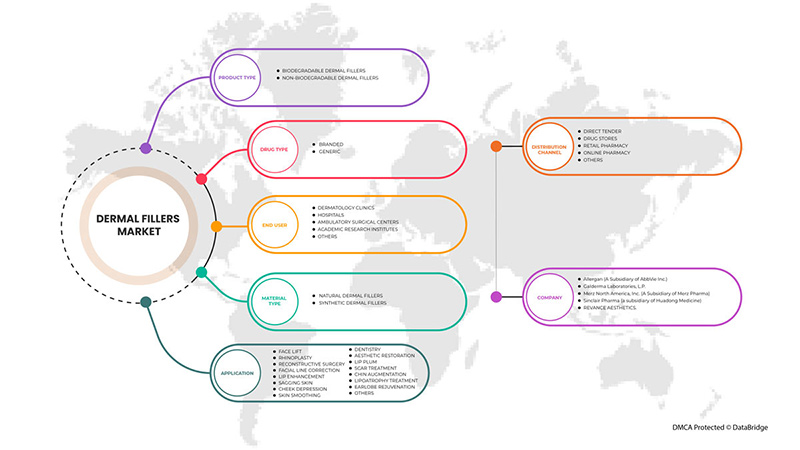

Mercado de rellenos dérmicos de América del Norte, por tipo de producto (rellenos dérmicos biodegradables, rellenos dérmicos no biodegradables), tipo de material (rellenos dérmicos naturales, rellenos dérmicos sintéticos), aplicación (lifting facial, rinoplastia, cirugía reconstructiva , corrección de líneas faciales, realce de labios, flacidez de la piel, depresión de las mejillas, suavizado de la piel, odontología, restauración estética, relleno de labios, tratamiento de cicatrices, aumento de mentón, tratamiento de lipoatrofia, rejuvenecimiento del lóbulo de la oreja y otros), tipo de fármaco (de marca, genérico), usuario final (clínicas de dermatología, centros quirúrgicos ambulatorios, hospitales, institutos de investigación académica y otros), canal de distribución (licitación directa, farmacias, farmacias minoristas, farmacias en línea y otros) - Tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de rellenos dérmicos en América del Norte

Los rellenos dérmicos son sustancias gelatinosas que se inyectan debajo de la piel para restaurar el volumen perdido, a menudo las arrugas y suavizar las líneas o mejorar los contornos faciales. El uso de rellenos dérmicos ha crecido rápidamente en los últimos años debido a las diversas ofertas para mejorar la estética y rejuvenecer las mejoras que antes solo se podían lograr con cirugías. Estos se están volviendo muy populares para los métodos de rejuvenecimiento facial. Al ser un relleno dérmico mínimamente invasivo, se muestran resultados instantáneos en las terapias cosméticas de reemplazo de volumen. Estos dispositivos brindan volumen al rostro, realzan y mejoran la calidad de la piel. Se utilizan varios métodos, como las inyecciones, para el aumento. Estos rellenos pueden dar labios más llenos y voluminosos con fines estéticos. Hay muchos tipos de rellenos dérmicos que se pueden inyectar en los labios y alrededor de la boca que mantienen el volumen de los labios de forma temporal o permanente según el tipo de producto utilizado. Algunos actores del mercado están involucrados en los productos nuevos e innovadores, y sus productos están en desarrollo. Durante los últimos años, se han desarrollado nuevos e innovadores productos de relleno dérmico para aumentar el crecimiento del mercado de rellenos dérmicos, y los actores del mercado están mejorando su cartera de productos. Muchos actores del mercado están involucrados en la fabricación de rellenos dérmicos con innovaciones que allanan el camino para el crecimiento del mercado.

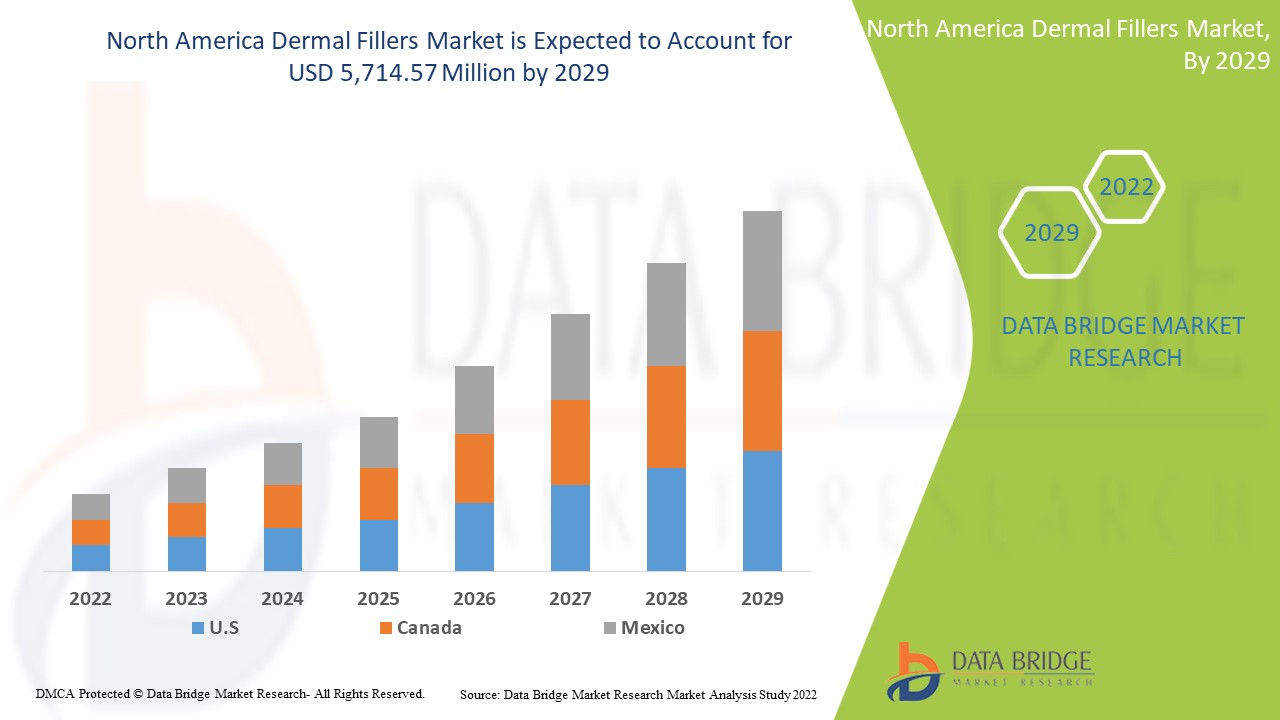

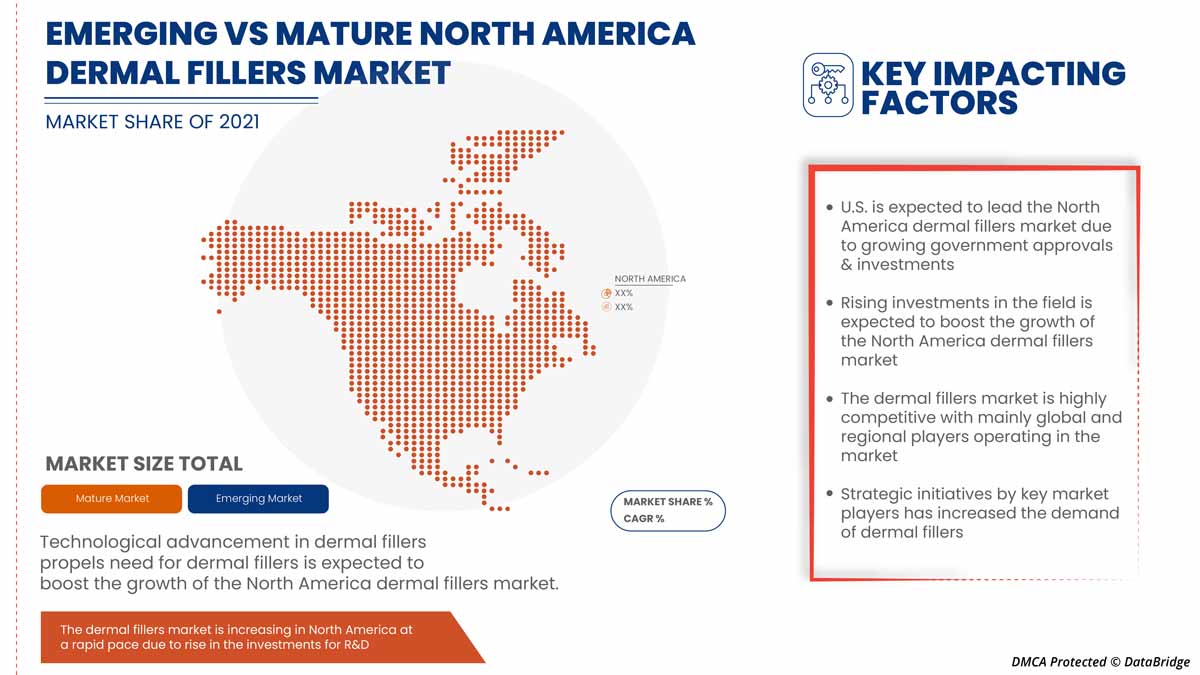

Data Bridge Market Research analiza que se espera que el mercado de rellenos dérmicos alcance un valor de USD 5.714,57 millones para 2029, con una CAGR del 11,4% durante el período de pronóstico 2022-2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Año histórico |

2020 (Personalizable para 2019-2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Por tipo de producto (rellenos dérmicos biodegradables, rellenos dérmicos no biodegradables), tipo de material (rellenos dérmicos naturales, rellenos dérmicos sintéticos), aplicación (lifting facial, rinoplastia, cirugía reconstructiva, corrección de líneas faciales, realce de labios, flacidez de la piel, depresión de pómulos, alisado de la piel, odontología, restauración estética, relleno de labios, tratamiento de cicatrices, aumento de mentón, tratamiento de lipoatrofia, rejuvenecimiento del lóbulo de la oreja y otros), tipo de medicamento (de marca, genérico), usuario final (clínicas de dermatología, centros quirúrgicos ambulatorios, hospitales, institutos de investigación académica y otros), canal de distribución (licitación directa, farmacias, farmacias minoristas, farmacias en línea y otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México en América del Norte |

|

Actores del mercado cubiertos |

Allergan (una subsidiaria de Abbvie, Inc.), Prollenium Medical Technologies, Suneva Medical, Revance Therapeutics, Inc., FillMed Laboratories, Anika Therapeutics, Inc, Ipsen Pharma, BIOXIS Pharmaceuticals, Zimmer Aesthetic, Zhejiang Jingjia Medical Technology Co. Ltd., Medytox, Contura International ltd., Shanghai Reyoungel Medical Technology Company Limited, Humedix (una subsidiaria de HUONS GLOBAL), Galderma Laboratories, LP, Merz North America, Inc. (una subsidiaria de Merz Pharma), Croma-Pharma GmbH, Sinclair Pharma (una subsidiaria de Huadong Medicine Co., Ltd.), Teoxane, BioPlus Co., Ltd., Amalian, Givaudan, Mesoestetic, Sosum Global, DSM, IBSA Nordic ApS, entre otros. |

Definición de mercado

Los rellenos dérmicos son sustancias diseñadas para ser inyectadas en la piel para agregar volumen y plenitud. Las sustancias utilizadas en los rellenos dérmicos incluyen hidroxiapatita de calcio (un compuesto similar a un mineral que se encuentra en los huesos), ácido hialurónico , polialquilimida, ácido poliláctico, microesferas de polimetilmetacrilato (PMMA). Los rellenos dérmicos se pueden clasificar en función de varios criterios, que incluyen la dermis profunda, la profundidad de la implantación (a nivel superficial medio y superior, y subcutáneo); la longevidad de la corrección (temporal y permanente); la alergenicidad, la composición del agente (aloinjertos, semi/totalmente sintéticos, xenoinjertos o autólogos); y el comportamiento estimulante (procesos fisiológicos de proliferación de tejido endógeno) frente a los rellenos de reemplazo (efecto de reemplazo de espacio).

Los rellenos dérmicos temporales, como el ácido hialurónico y el colágeno, son biodegradables y duran entre 4 y 9 meses. Los posibles efectos secundarios y la insatisfacción también son de corta duración. Por lo tanto, los rellenos temporales siempre se utilizan como primera línea de tratamiento para guardar los rellenos de larga duración para futuras visitas del paciente.

Los rellenos permanentes se utilizan fundamentalmente para modificar las líneas y surcos profundos de la piel, que se encuentran más allá de las arrugas faciales normales. Se consideran una excelente opción para el rejuvenecimiento facial, especialmente en la lipodistrofia por VIH. El polimetilmetacrilato (PMMA) es el más utilizado por sus efectos seguros, efectivos y duraderos.

Dinámica del mercado de rellenos dérmicos

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- Aumento de la prevalencia de procedimientos mínimamente invasivos

El uso de procedimientos mínimamente invasivos ha cambiado en comparación con los métodos tradicionales de cirugía estética y cosmética, incluidos el láser y otros dispositivos basados en energía. Para el uso de procedimientos quirúrgicos o no quirúrgicos, se han desarrollado instrumentos especialmente diseñados para procedimientos mínimamente utilizados. Estos dispositivos antienvejecimiento ayudan a reducir los efectos visuales del envejecimiento de la piel revitalizando y tensando la piel, lo que le da un aspecto más joven.

La cirugía mínimamente invasiva es un procedimiento que se lleva a cabo con la ayuda de un telescopio e instrumentos quirúrgicos especialmente equipados. Se enfoca en las irregularidades faciales, incluidas las arrugas y las líneas finas, y disminuye el volumen, el contorno y la grasa no deseada. Estos procedimientos no tienen prácticamente ningún riesgo de efectos adversos graves, ya que no permiten cortes o cortes mínimos con un menor tiempo de recuperación, lo que aumenta la demanda del uso de procedimientos mínimamente invasivos. Los tratamientos mínimamente invasivos basados en energía para el tensado de la piel, la reducción de arrugas, el contorno del rostro y el rejuvenecimiento de la piel tienen una gran demanda en el mundo. Otras razones que impulsan la demanda de estos procedimientos son el aumento del envejecimiento de las personas y la creciente necesidad de instalaciones sanitarias, lo que puede dar lugar a una disminución de la carga en las instalaciones sanitarias.

Con el aumento de los avances tecnológicos y las comunicaciones, las personas son más conscientes de los dispositivos y procedimientos estéticos que se realizan bien en el campo de la atención médica, lo que repercute positivamente en la adopción de procedimientos mínimamente invasivos en la próxima era. Por lo tanto, se espera que la creciente prevalencia de los procedimientos mínimamente invasivos impulse el crecimiento del mercado de rellenos dérmicos.

- Aumento de la población geriátrica

La población geriátrica está aumentando para vivir más tiempo y se informa que tiene cada vez más problemas de envejecimiento de la piel. La velocidad del envejecimiento de la población está aumentando exponencialmente en el mundo, mientras que los países europeos tienen ciertas características culturales, sociales y económicas en común con aspiraciones similares. A medida que las personas comienzan a envejecer, aumenta su apariencia para parecer más jóvenes, lo que en última instancia genera interés en la utilización de procedimientos estéticos.

La creciente mejora en la prestación de servicios de atención sanitaria y su situación en los países de Oriente Medio entre el porcentaje de personas mayores se ha traducido en mejores resultados para los pacientes.

Oportunidades

- Aumentar las actividades de financiación de la investigación estética

La cirugía plástica, la eliminación del vello no deseado, el estiramiento de la piel, los tratamientos antienvejecimiento, la eliminación del exceso de grasa, el contorno corporal y otros procedimientos cosméticos que se realizan mediante procedimientos mínimamente invasivos se incluyen en el ámbito de los dispositivos médicos estéticos que se utilizan para mejorar la apariencia, embellecer y mejorar otras partes del cuerpo. Varias fundaciones y organizaciones gubernamentales están invirtiendo grandes cantidades en investigación estética.

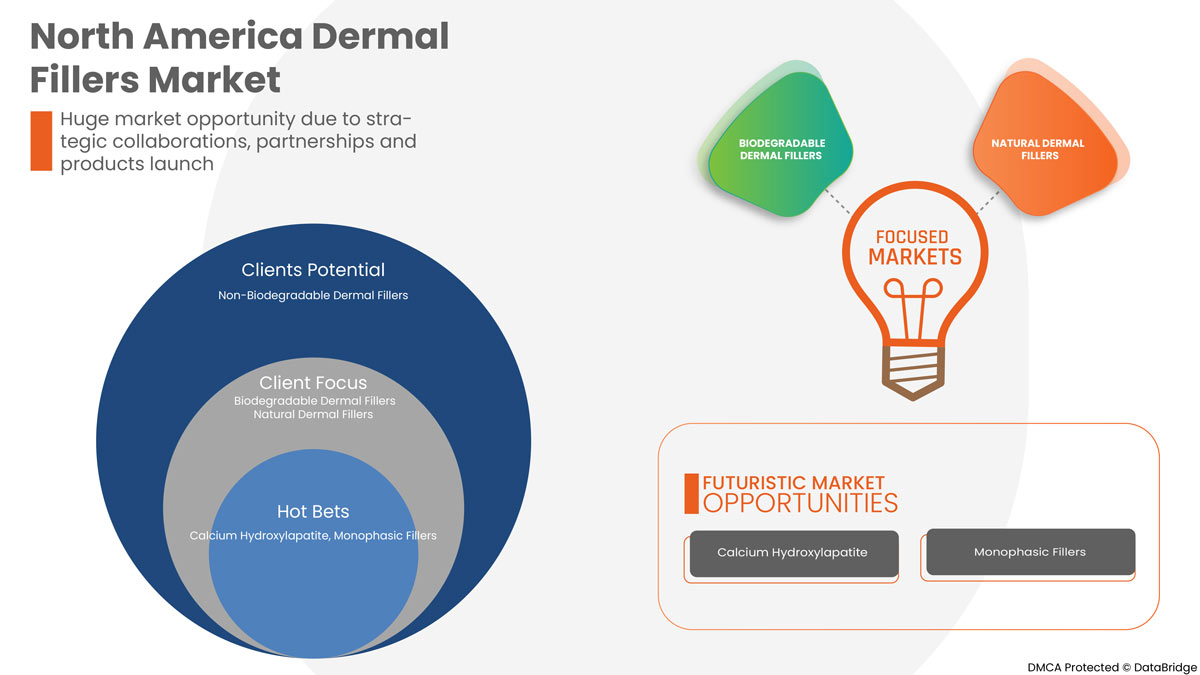

- Avances en los nuevos rellenos dérmicos

Los rellenos dérmicos se presentan en forma de sustancias gelatinosas que se inyectan debajo de la piel para restaurar el volumen perdido, suavizar las arrugas y alisar las líneas. También se utilizan para mejorar los contornos faciales; cada año, más de un millón de personas prefieren este popular tratamiento de transformación facial para restaurar las arrugas y la apariencia de las líneas faciales. Los rellenos dérmicos son una forma de tratamiento eficaz para lucir más joven sin tiempo de recuperación ni cirugía. Los medicamentos de relleno dérmico se inyectan en la piel, lo que ayuda a rellenar las arrugas faciales. Hay diferentes tipos de medicamentos de relleno dérmico disponibles, los tipos más comunes son la hidroxiapatita de calcio, el ácido hialurónico, la polialquilimida, el ácido poliláctico y otros. El avance en las marcas de rellenos dérmicos ayudará a impulsar la demanda del mercado.

Restricciones/Desafíos

- Alto costo de los procedimientos estéticos

El costo siempre es un factor a considerar en el procedimiento electivo. El costo del relleno dérmico depende del tipo de relleno y la cantidad que se utiliza en el tratamiento. Además, el costo del tratamiento se basa en las calificaciones y la experiencia de la persona que realiza el tratamiento con rellenos dérmicos. El tratamiento cosmético con rellenos dérmicos es un procedimiento ambulatorio seguro y es un tratamiento muy popular para restaurar el volumen perdido y tratar algunos signos del envejecimiento, pero se espera que el alto costo de los procedimientos obstaculice la demanda del mercado.

- Falta de profesionales cualificados

Los procedimientos de tratamiento estético son de diferentes tipos: tecnología basada en láser, tecnología basada en energía y luz pulsada intensa, entre otras. Todas estas técnicas requieren habilidades interpersonales calificadas para llevar a cabo un tratamiento eficaz.

Además, el rápido avance tecnológico en este campo también genera una falta de profesionales capacitados, lo que plantea un gran desafío a la hora de manipular dispositivos y realizar procedimientos quirúrgicos.

Acontecimientos recientes

- En abril de 2022, Sinclair Pharma anunció que la empresa había recibido la marca CE europea para Perfectha Lidocaine en el tratamiento de corrección de arrugas, contorno facial y restauración del volumen. Este certificado CE da como resultado el lanzamiento de Perfectha Lidocaine en el Reino Unido y en todos los principales mercados europeos.

Segmentación del mercado de rellenos dérmicos

El mercado de rellenos dérmicos está segmentado en función del tipo de producto, tipo de material, aplicación, tipo de fármaco, usuario final y canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus principales áreas de aplicación y la diferencia en sus mercados objetivo.

Por tipo de producto

- Rellenos dérmicos biodegradables

- Rellenos dérmicos no biodegradables

Según el tipo de producto, el mercado de rellenos dérmicos se segmenta en rellenos dérmicos biodegradables y rellenos dérmicos no biodegradables.

Por tipo de material

- Rellenos dérmicos naturales

- Rellenos dérmicos sintéticos

Según el tipo de material, el mercado está segmentado en rellenos dérmicos naturales y rellenos dérmicos sintéticos.

Por aplicación

- Estiramiento facial

- Rinoplastia

- Cirugía reconstructiva

- Corrección de líneas faciales

- Aumento de labios

- Piel flácida

- Depresión de la mejilla

- Suavizado de la piel

- Odontología

- Restauración estética

- Labios color ciruela

- Tratamiento de cicatrices

- Aumento de mentón

- Tratamiento de la lipoatrofia

- Rejuvenecimiento del lóbulo de la oreja

- Otros

Sobre la base de la aplicación, el mercado está segmentado en estiramiento facial, rinoplastia, cirugía reconstructiva, corrección de líneas faciales, aumento de labios, flacidez de la piel, depresión de las mejillas, suavizado de la piel, odontología, restauración estética, tratamiento de cicatrices, aumento de mentón, tratamiento de lipoatrofia, rejuvenecimiento del lóbulo de la oreja y otros.

Por tipo de fármaco

- De marca

- Genérico

Según el tipo de medicamento, el mercado se segmenta en de marca y genéricos.

Por el usuario final

- Clínicas de Dermatología

- Hospitales

- Centros de cirugía ambulatoria

- Institutos de investigación académica

- Otros

Según el usuario final, el mercado está segmentado en clínicas de dermatología, centros quirúrgicos ambulatorios, hospitales, institutos de investigación académica y otros.

Por canal de distribución

- Licitación directa

- Farmacias

- Farmacia minorista

- Farmacia en línea

- Otros

Sobre la base del canal de distribución, el mercado está segmentado en licitación directa, farmacias, farmacias minoristas, farmacias en línea y otros.

Análisis y perspectivas regionales del mercado de rellenos dérmicos

Se analiza el mercado de rellenos dérmicos y se proporcionan información y tendencias del tamaño del mercado por país, por tipo de producto, por tipo de material, por aplicación, por tipo de fármaco, por usuario final y por canal de distribución como se menciona anteriormente.

Los países cubiertos en el informe del mercado de rellenos dérmicos son Estados Unidos, Canadá y México en América del Norte.

Se espera que Estados Unidos domine el mercado debido al uso exponencial de la cirugía mínimamente invasiva para tratamientos de la piel en el país.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas arriba y aguas abajo, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los rellenos dérmicos

El panorama competitivo del mercado de rellenos dérmicos proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de rellenos dérmicos.

Algunos de los principales actores que operan en el mercado son Allergan (una subsidiaria de Abbvie, Inc.), Prollenium Medical Technologies, Suneva Medical, Revance Therapeutics, Inc., FillMed Laboratories, Anika Therapeutics, Inc, Ipsen Pharma, BIOXIS Pharmaceuticals, Zimmer Aesthetic, Zhejiang Jingjia Medical Technology Co. Ltd., Medytox, Contura International ltd., Shanghai Reyoungel Medical Technology Company Limited, Humedix (una subsidiaria de HUONS GLOBAL), Galderma Laboratories, LP, Merz North America, Inc. (una subsidiaria de Merz Pharma), Croma-Pharma GmbH, Sinclair Pharma (una subsidiaria de Huadong Medicine Co., Ltd.), Teoxane, BioPlus Co., Ltd., Amalian, Givaudan, Mesoestetic, Sosum Global, DSM, IBSA Nordic ApS, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA DERMAL FILLERS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCTS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 EPIDEMIOLOGY PROCEDURES PER COUNTRY

5 REGULATIONS OF NORTH AMERICA DERMAL FILLERS MARKET

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF MINIMALLY INVASIVE PROCEDURES

6.1.2 INCREASING GERIATRIC POPULATION

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN DERMAL FILLERS

6.1.4 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.2 RESTRAINTS

6.2.1 HIGH COST OF AESTHETIC PROCEDURES

6.2.2 ESCALATING PRODUCT RECALL

6.2.3 FDA GUIDELINES FOR ADVANCED DERMAL FILLER INJECTORS

6.3 OPPORTUNITIES

6.3.1 INCREASING HEALTHCARE EXPENDITURE

6.3.2 INCREASING FUNDING ACTIVITIES FOR AESTHETIC RESEARCH

6.3.3 ADVANCEMENT IN THE NEW DERMAL FILLERS

6.3.4 INCREASING COMPENSATION AND ACCIDENTAL CLAIMS FOR DERMAL FILLER

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS

6.4.2 AVAILABILITY OF ALTERNATIVES

7 NORTH AMERICA DERMAL FILLERS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 BIODEGRADABLE DERMAL FILLERS

7.2.1 TEMPORARY BIODEGRADABLE

7.2.2 SEMI-PERMANENT BIODEGRADABLE

7.3 NON-BIODEGRADABLE DERMAL FILLERS

8 NORTH AMERICA DERMAL FILLERS MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 NATURAL DERMAL FILLERS

8.2.1 HYALURONIC ACID

8.2.1.1 BY TYPE

8.2.1.1.1 MONOPHASIC FILLERS

8.2.1.2 BY TYPE

8.2.1.2.1 MONODENSIFIED

8.2.1.2.2 POLYDENSIFIED

8.2.1.2.3 BIPHASIC FILLERS

8.2.1.3 BY MATERIAL TYPE

8.2.1.3.1 SINGLE-PHASE

8.2.1.3.2 DUPLEX-PHASE

8.2.1.4 BY APPLICATION

8.2.1.4.1 FACE LIFT

8.2.1.4.2 RHINOPLASTY

8.2.1.4.3 RECONSTRUCTIVE SURGERY

8.2.1.4.4 FACIAL LINE CORRECTION

8.2.1.4.5 LIP ENHANCEMENT

8.2.1.4.6 SAGGING SKIN

8.2.1.4.7 CHEEK DEPRESSION

8.2.1.4.8 SKIN SMOOTHING

8.2.1.4.9 DENTISTRY

8.2.1.4.10 AESTHETIC RESTORATION

8.2.1.4.11 SCAR TREATMENT

8.2.1.4.12 CHIN AUGMENTATION

8.2.1.4.13 LIPOATROPHY TREATMENT

8.2.1.4.14 EARLOBE REJUVENATION

8.2.1.4.15 OTHERS

8.2.2 FAT

8.2.2.1 BY APPLICATION

8.2.2.1.1 FACE LIFT

8.2.2.1.2 RHINOPLASTY

8.2.2.1.3 RECONSTRUCTIVE SURGERY

8.2.2.1.4 FACIAL LINE CORRECTION

8.2.2.1.5 LIP ENHANCEMENT

8.2.2.1.6 SAGGING SKIN

8.2.2.1.7 CHEEK DEPRESSION

8.2.2.1.8 SKIN SMOOTHING

8.2.2.1.9 DENTISTRY

8.2.2.1.10 AESTHETIC RESTORATION

8.2.2.1.11 SCAR TREATMENT

8.2.2.1.12 CHIN AUGMENTATION

8.2.2.1.13 LIPOATROPHY TREATMENT

8.2.2.1.14 EARLOBE REJUVENATION

8.2.2.1.15 OTHERS

8.2.3 COLLAGEN

8.2.3.1 BY APPLICATION

8.2.3.1.1 FACE LIFT

8.2.3.1.2 RHINOPLASTY

8.2.3.1.3 RECONSTRUCTIVE SURGERY

8.2.3.1.4 FACIAL LINE CORRECTION

8.2.3.1.5 LIP ENHANCEMENT

8.2.3.1.6 SAGGING SKIN

8.2.3.1.7 CHEEK DEPRESSION

8.2.3.1.8 SKIN SMOOTHING

8.2.3.1.9 DENTISTRY

8.2.3.1.10 AESTHETIC RESTORATION

8.2.3.1.11 SCAR TREATMENT

8.2.3.1.12 CHIN AUGMENTATION

8.2.3.1.13 LIPOATROPHY TREATMENT

8.2.3.1.14 EARLOBE REJUVENATION

8.2.3.1.15 OTHERS

8.2.4 OTHERS

8.3 SYNTHETIC DERMAL FILLERS

8.3.1 POLY-L-LACTIC ACID

8.3.1.1 BY APPLICATION

8.3.1.1.1 FACE LIFT

8.3.1.1.2 RHINOPLASTY

8.3.1.1.3 RECONSTRUCTIVE SURGERY

8.3.1.1.4 FACIAL LINE CORRECTION

8.3.1.1.5 LIP ENHANCEMENT

8.3.1.1.6 SAGGING SKIN

8.3.1.1.7 CHEEK DEPRESSION

8.3.1.1.8 SKIN SMOOTHING

8.3.1.1.9 DENTISTRY

8.3.1.1.10 AESTHETIC RESTORATION

8.3.1.1.11 SCAR TREATMENT

8.3.1.1.12 CHIN AUGMENTATION

8.3.1.1.13 LIPOATROPHY TREATMENT

8.3.1.1.14 EARLOBE REJUVENATION

8.3.1.1.15 OTHERS

8.3.2 CALCIUM HYDROXYLAPATITE

8.3.2.1 BY APPLICATION

8.3.2.1.1 FACE LIFT

8.3.2.1.2 RHINOPLASTY

8.3.2.1.3 RECONSTRUCTIVE SURGERY

8.3.2.1.4 FACIAL LINE CORRECTION

8.3.2.1.5 LIP ENHANCEMENT

8.3.2.1.6 SAGGING SKIN

8.3.2.1.7 CHEEK DEPRESSION

8.3.2.1.8 SKIN SMOOTHING

8.3.2.1.9 DENTISTRY

8.3.2.1.10 AESTHETIC RESTORATION

8.3.2.1.11 SCAR TREATMENT

8.3.2.1.12 CHIN AUGMENTATION

8.3.2.1.13 LIPOATROPHY TREATMENT

8.3.2.1.14 EARLOBE REJUVENATION

8.3.2.1.15 OTHERS

8.3.3 POLYMETHYL-METHACRYLATE MICROSPHERES (PMMA)

8.3.3.1 BY APPLICATION

8.3.3.1.1 FACE LIFT

8.3.3.1.2 RHINOPLASTY

8.3.3.1.3 RECONSTRUCTIVE SURGERY

8.3.3.1.4 FACIAL LINE CORRECTION

8.3.3.1.5 LIP ENHANCEMENT

8.3.3.1.6 SAGGING SKIN

8.3.3.1.7 CHEEK DEPRESSION

8.3.3.1.8 SKIN SMOOTHING

8.3.3.1.9 DENTISTRY

8.3.3.1.10 AESTHETIC RESTORATION

8.3.3.1.11 SCAR TREATMENT

8.3.3.1.12 CHIN AUGMENTATION

8.3.3.1.13 LIPOATROPHY TREATMENT

8.3.3.1.14 EARLOBE REJUVENATION

8.3.3.1.15 OTHERS

8.3.4 POLYALKYLIMIDE

8.3.4.1 BY APPLICATION

8.3.4.1.1 FACE LIFT

8.3.4.1.2 RHINOPLASTY

8.3.4.1.3 RECONSTRUCTIVE SURGERY

8.3.4.1.4 FACIAL LINE CORRECTION

8.3.4.1.5 LIP ENHANCEMENT

8.3.4.1.6 SAGGING SKIN

8.3.4.1.7 CHEEK DEPRESSION

8.3.4.1.8 SKIN SMOOTHING

8.3.4.1.9 DENTISTRY

8.3.4.1.10 AESTHETIC RESTORATION

8.3.4.1.11 SCAR TREATMENT

8.3.4.1.12 CHIN AUGMENTATION

8.3.4.1.13 LIPOATROPHY TREATMENT

8.3.4.1.14 EARLOBE REJUVENATION

8.3.4.1.15 OTHERS

8.3.5 OTHERS

9 NORTH AMERICA DERMAL FILLERS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 FACE LIFT

9.2.1 DEEP PLANE/SMAS FACE

9.2.2 MINI FACE LIFT

9.2.3 MID-FACE LIFT

9.2.4 JAW LINE

9.2.5 CUTANEOUS LIFT

9.2.6 TEMPORAL OR BROW LIFT

9.2.7 LIQUID FACE LIFT

9.2.8 OTHERS

9.2.8.1 JUVEDERM

9.2.8.2 RESTYLANE

9.2.8.3 SCULPTRA

9.2.8.4 DYSPORT

9.2.8.5 OTHERS

9.3 RHINOPLASTY

9.3.1 JUVEDERM

9.3.1.1 JUVEDERM XC

9.3.1.2 JUVEDERM ULTRA XC

9.3.1.3 JUVEDERM VOLUMA

9.3.1.4 JUVEDERM VOLBELLA

9.3.1.5 JUVEDERM VOLLURE XC

9.3.2 RESTYLANE

9.3.2.1 RESTYLANE SILK

9.3.2.2 RESTYLANE LYFT

9.3.2.3 RESTYLANE REFYNE

9.3.2.4 RESTYLANE DEFYNE

9.3.2.5 RESTYLANE-L

9.3.3 OTHERS

9.4 RECONSTRUCTIVE SURGERY

9.4.1 JUVEDERM

9.4.2 RESTYLANE

9.4.3 OTHERS

9.5 FACIAL LINE CORRECTION

9.5.1 DYNAMIC WRINKLES

9.5.2 STATIC WRINKLES

9.5.3 WRINKLE FOLDS

9.5.3.1 FOREHEAD LINES

9.5.3.2 WORRY LINES

9.5.3.3 BUNNIES

9.5.3.4 CROW’S FEET

9.5.3.5 LAUGH LINES

9.5.3.6 LIP LINES

9.5.3.7 MARIONETTE LINES

9.5.3.8 OTHERS

9.5.3.8.1 JUVEDERM

9.5.3.8.2 RESTYLANE

9.5.3.8.3 RADIESSE

9.5.3.8.4 BELOTERO

9.5.3.8.5 OTHERS

9.6 LIP ENHANCEMENT

9.6.1 JUVEDERM

9.6.1.1 JUVÉDERM XC

9.6.1.2 JUVÉDERM ULTRA XC

9.6.1.3 JUVÉDERM VOLUMA

9.6.1.4 JUVÉDERM VOLBELLA

9.6.1.5 JUVÉDERM VOLLURE XC

9.6.2 RESTYLANE

9.6.2.1 RESTYLANE SILK

9.6.2.2 RESTYLANE LYFT

9.6.2.3 RESTYLANE REFYNE

9.6.2.4 RESTYLANE DEFYNE

9.6.2.5 RESTYLANE-L

9.6.3 BELOTERO BALANCE

9.6.4 REVANESSE VERSA

9.6.5 HYLAFORM

9.6.6 PREVELLE SILK

9.6.7 OTHERS

9.7 SAGGING SKIN

9.7.1 JUVEDERM

9.7.2 RESTYLANE

9.7.3 BELOTERO

9.7.4 OTHERS

9.8 CHEEK DEPRESSION

9.8.1 JUVEDERM VOLUMA

9.8.2 RESTYLANE-LYFT

9.8.3 SCULPTRA

9.8.4 RADIESSE

9.8.5 OTHERS

9.9 SKIN SMOOTHENING

9.9.1 RESTYLANE

9.9.2 BELOTERO

9.9.3 BELLAFIL

9.9.4 OTHERS

9.1 DENTISTRY

9.10.1 JUVEDERM

9.10.2 RESTYLANE

9.10.3 RADIESSE

9.10.4 OTHERS

9.11 AESTHETIC RESTORATION

9.11.1 JUVEDERM

9.11.1.1 JUVEDERM ULTRA XC

9.11.1.2 JUVEDERM VOLLURE XC

9.11.1.3 JUVEDERM VOLBELLA XC

9.11.2 RESTYLANE

9.11.2.1 RESTYLANE-L

9.11.2.2 RESTYLANE SILK

9.11.2.3 RESTYLANE REFYNE AND DEFYNE

9.11.2.4 RESTYLANE LYFT

9.12 REVANESSE VERSA

9.13 SCULPTRA

9.14 RHA

9.14.1 RHA 2

9.14.2 RHA 3

9.14.3 RHA 4

9.15 BELLAFIL

9.16 BELOTERO BALANCE

9.17 OTHERS

9.18 LIP PLUM

9.18.1 RESTYLANE

9.18.2 BELOTERO

9.18.3 OTHERS

9.19 SCAR TREATMENT

9.19.1 JUVEDERM

9.19.2 RESTYLANE

9.19.3 RADIESSE

9.19.4 BELOTERO

9.19.5 PERLANE

9.19.6 OTHERS

9.19.6.1 KELOID SCARS

9.19.6.2 CONTRACTURE SCARS

9.19.6.3 HYPERTROPHIC SCARS

9.19.6.4 ACNE SCARS

9.19.6.5 OTHERS

9.2 CHIN AUGMENTATION

9.20.1 JUVEDERM VOLUMA XC

9.20.2 RESTYLANE

9.20.3 OTHERS

9.21 LIPOATROPHY TREATMENT

9.21.1 SCULPTRA

9.21.2 OTHERS

9.22 EARLOBE REJUVENATION

9.22.1 JUVEDERM

9.22.2 RESTYLANE

9.22.3 SCULPTRA

9.22.4 BELOTERO

9.22.5 ELLANSE

9.22.6 OTHERS

9.23 OTHERS

10 NORTH AMERICA DERMAL FILLERS MARKET, BY DRUG TYPE

10.1 OVERVIEW

10.2 BRANDED

10.2.1 JUVEDERM

10.2.1.1 JUVÉDERM XC

10.2.1.2 JUVÉDERM ULTRA XC

10.2.1.3 JUVÉDERM ULTRA PLUS XC

10.2.1.4 JUVÉDERM VOLBELLA

10.2.1.5 JUVÉDERM VOLUMA

10.2.1.6 JUVÉDERM VOLLURE

10.2.2 RESTYLANE

10.2.2.1 RESTYLANE-L

10.2.2.2 RESTYLANE REFYNE

10.2.2.3 RESTYLANE DEFYNE

10.2.2.4 RESTYLANE LYFT

10.2.2.5 RESTYLANE SILK

10.2.2.6 RESTYLANE KYSSE

10.2.2.7 RESTYLANE CONTOUR

10.2.3 RADIESSE

10.2.4 SCULPTRA

10.2.5 ELLANSE

10.2.5.1 ELLANSE-S

10.2.5.2 ELLANSE-M

10.2.5.3 ELLANSE-L

10.2.5.4 ELLANSE-E

10.2.6 BELLAFILL

10.2.7 AQUAMID

10.2.8 OTHERS

10.3 GENERIC

11 NORTH AMERICA DERMAL FILLERS MARKET, BY END USER

11.1 OVERVIEW

11.2 DERMATOLOGY CLINICS

11.3 HOSPITALS

11.4 AMBULATORY SURGICAL CENTERS

11.5 ACADEMIC RESEARCH INSTITUTES

11.6 OTHERS

12 NORTH AMERICA DERMAL FILLERS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 DRUG STORES

12.4 RETAIL PHARMACY

12.5 ONLINE PHARMACY

12.6 OTHERS

13 NORTH AMERICA DERMAL FILLERS MARKET, BY GEOGRAPHY

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA DERMA FILLERS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ALLERGAN (A SUBSIDIARY OF ABBVIE INC.)

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 GALDERMA LABORATORIES, L.P

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 MERZ NORTH AMERICA, INC (A SUBSIDIARY OF MERZ PHARMA)

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 SINCLAIR PHARMA (A SUBSIDIARY OF HUADONG MEDICINE)

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 REVANCE THERAPEUTICS, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 AMALIAN

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ANIKA THERAPEUTICS, INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 BIOPLUS CO., LTD.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 BIOXIS PHARMACEUTICALS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CONTURA INTERNATIONAL LTD.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 CROMA-PHARMA GMBH

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 DSM

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 FILLMED

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 GIVAUDAN

16.14.1 COMPANY SNAPSHOT

16.14.2 RECENT FINANCIALS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 HUMEDIX (A SUBSIDIARY OF HUONS NORTH AMERICA)

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 IBSA FARMACEUTICI ITALIA SRL (A SUBSIDIARY OF IBSA INSTITUT BIOCHIMIQUE SA)

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 IPSEN PHARMA.

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 MEDYTROX

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 MESOESTETIC

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 PROLLENIUM MEDICAL TECHNOLOGIES

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SHANGHAI REYOUNGEL MEDICAL TECHNOLOGY COMPANY LIMITED

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 SOSUM NORTH AMERICA

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 SUNEVA MEDICAL

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 TEOXANE SA

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 ZHEJIANG JINGJIA MEDICAL TECHNOLOGY CO., LTD

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 ZIMMER AESTHETICS

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 COST OF DERMAL FILLERS

TABLE 2 COST OF PROCEDURE

TABLE 3 ASAPS PROCEDURE FACTS

TABLE 4 COMPENSATION COST FOR DERMAL FILLERS

TABLE 5 NORTH AMERICA DERMAL FILLERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA DERMAL FILLERS MARKET, BY PRODUCT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 7 NORTH AMERICA BIODEGRADABLE DERMAL FILLERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA BIODEGRADABLE DERMAL FILLERS IN DERMAL FILLERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA BIODEGRADABLE DERMAL FILLERS IN DERMAL FILLERS MARKET, BY PRODUCT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 10 NORTH AMERICA NON-BIODEGRADABLE DERMAL FILLERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA DERMAL FILLERS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA NATURAL DERMAL FILLERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA NATURAL DERMAL FILLERS IN DERMAL FILLERS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA HYALURONIC ACID IN DERMAL FILLERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA MONOPHASIC FILLERS IN DERMAL FILLERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA HYALURONIC ACID IN DERMAL FILLERS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA HYALURONIC ACID IN DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA FAT IN DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA COLLAGEN IN DERMAL FILLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SYNTHETIC DERMAL FILLERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SYNTHETIC DERMAL FILLERS IN DERMAL FILLERS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA POLY-L-LACTIC ACID IN DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA CALCIUM HYDROXYLAPATITE IN DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA POLYMETHYL-METHACRYLATE MICROSPHERES (PMMA) IN DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA POLYALKYLIMIDE IN DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA FACE LIFT IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA FACE LIFT IN DERMAL FILLERS MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 29 NORTH AMERICA FACE LIFT IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA RHINOPLASTY IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA RHINOPLASTY IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA JUVEDERM IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA RESTYLANE IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA RECONSTRUCTIVE SURGERY IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA RECONSTRUCTIVE SURGERY IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA FACIAL LINE CORRECTION IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA FACIAL LINE CORRECTION IN DERMAL FILLERS MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 38 NORTH AMERICA FACIAL LINE CORRECTION IN DERMAL FILLERS MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 39 NORTH AMERICA FACIAL LINE CORRECTION IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA LIP ENHANCEMENT IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA LIP ENHANCEMENT IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA JUVEDERM IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA RESTYLANE IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA SAGGING SKIN IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA SAGGING SKIN IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA CHEEK DEPRESSION IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA CHEEK DEPRESSION IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA SKIN SMOOTHENING IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA SKIN SMOOTHENING IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA DENTISTRY IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA DENTISTRY IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA AESTHETIC RESTORATION IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA AESTHETIC RESTORATION IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA JUVEDERM IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA RESTYLANE IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA RHA IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA LIP PLUM IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA LIP PLUM IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA SCAR TREATMENT IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA SCAR TREATMENT IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA SCAR TREATMENT IN DERMAL FILLERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA CHIN AUGMENTATION IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA CHIN AUGMENTATION IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA LIPOATROPHY TREATMENT IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA LIPOATROPHY TREATMENT IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA EARLOBE REJUVENTION IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA EARLOBE REJUVENTION IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA OTHERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA DERMAL FILLERS MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA BRANDED IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA BRANDED IN DERMAL FILLERS MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA JUVEDERM IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA RESTYLANE IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA ELLANSE IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA GENERIC IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA DERMAL FILLERS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA DERMATOLOGY CLINICS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA HOSPITALS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA ACADEMIC RESEARCH INSTITUTES IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA OTHERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA DERMAL FILLERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA DIRECT TENDER IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA DRUG STORES IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA RETAIL PHARMACY IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA ONLINE PHARMACY IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA OTHERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA DERMAL FILLERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA DERMAL FILLERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA DERMAL FILLERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA DERMAL FILLERS MARKET : NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA DERMAL FILLERS MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA DERMAL FILLERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA DERMAL FILLERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA DERMAL FILLERS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA DERMAL FILLERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA DERMAL FILLERS MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR ANTI-AGING DRUGS, AND GROWING POPULARITY OF NON-SURGICAL OR MINIMALLY INVASIVE AESTHETICS PROCEDURES ARE EXPECTED TO DRIVE THE NORTH AMERICA DERMAL FILLERS MARKET IN THE FORECAST PERIOD 2022 TO 2029

FIGURE 12 BIODEGRADABLE DERMAL FILLER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA DERMAL FILLERS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA DERMAL FILLERS MARKET

FIGURE 14 NORTH AMERICA DERMAL FILLERS MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 NORTH AMERICA DERMAL FILLERS MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA DERMAL FILLERS MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA DERMAL FILLERS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA DERMAL FILLERS MARKET: BY MATERIAL TYPE, 2021

FIGURE 19 NORTH AMERICA DERMAL FILLERS MARKET, BY MATERIAL TYPE, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA DERMAL FILLERS MARKET: BY MATERIAL TYPE, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA DERMAL FILLERS MARKET: BY MATERIAL TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA DERMAL FILLERS MARKET : BY APPLICATION, 2021

FIGURE 23 NORTH AMERICA DERMAL FILLERS MARKET : BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA DERMAL FILLERS MARKET : BY APPLICATION, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA DERMAL FILLERS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA DERMAL FILLERS MARKET: BY DRUG TYPE, 2021

FIGURE 27 NORTH AMERICA DERMAL FILLERS MARKET, BY DRUG TYPE, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA DERMAL FILLERS MARKET: BY DRUG TYPE, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA DERMAL FILLERS MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 30 NORTH AMERICA DERMAL FILLERS MARKET: BY END USER, 2021

FIGURE 31 NORTH AMERICA DERMAL FILLERS MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA DERMAL FILLERS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA DERMAL FILLERS MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 NORTH AMERICA DERMAL FILLERS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 35 NORTH AMERICA DERMAL FILLERS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA DERMAL FILLERS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 NORTH AMERICA DERMAL FILLERS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 NORTH AMERICA DERMAL FILLERS MARKET: SNAPSHOT (2021)

FIGURE 39 NORTH AMERICA DERMAL FILLERS MARKET: BY COUNTRY (2021)

FIGURE 40 NORTH AMERICA DERMAL FILLERS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 NORTH AMERICA DERMAL FILLERS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 42 NORTH AMERICA DERMAL FILLERS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 43 NORTH AMERICA DERMA FILLERS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.