North America Data Center Cooling Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

18.25 Billion

USD

56.62 Billion

2024

2032

USD

18.25 Billion

USD

56.62 Billion

2024

2032

| 2025 –2032 | |

| USD 18.25 Billion | |

| USD 56.62 Billion | |

|

|

|

|

Segmentación del mercado de refrigeración de centros de datos de América del Norte, por tipo (centro de datos empresarial, centro de datos de borde), soluciones (aire acondicionado, unidades de enfriamiento, torres de enfriamiento, sistema economizador, sistema de enfriamiento líquido, aire acondicionado de sala de computadoras (CRAC) y manejador de aire de sala de computadoras (CRAH), unidades de control, otros), servicio (consultoría y capacitación, instalación e implementación, mantenimiento y soporte), tipo de enfriamiento (refrigeración basada en sala, enfriamiento basado en rack, enfriamiento basado en filas), tamaño de la organización (tamaño de organización grande, organización pequeña y mediana) - Tendencias de la industria y pronóstico hasta 2032.

Análisis del mercado de refrigeración de centros de datos

En los últimos años, los operadores de centros de datos están utilizando ampliamente la refrigeración de centros de datos debido a sus numerosas características, como la rentabilidad, la eficiencia energética y el respeto por el medio ambiente. Se está observando un aumento en el uso de redes 4G LTE debido al aumento en el número de centros de datos. Un aumento en el número de instalaciones de centros de datos está favoreciendo el rápido crecimiento de la refrigeración de centros de datos en todo el mundo. Además, el cambio en curso hacia los servicios en la nube está generando una demanda de tecnología de refrigeración respetuosa con el medio ambiente que impulsará la demanda de refrigeración de centros de datos.

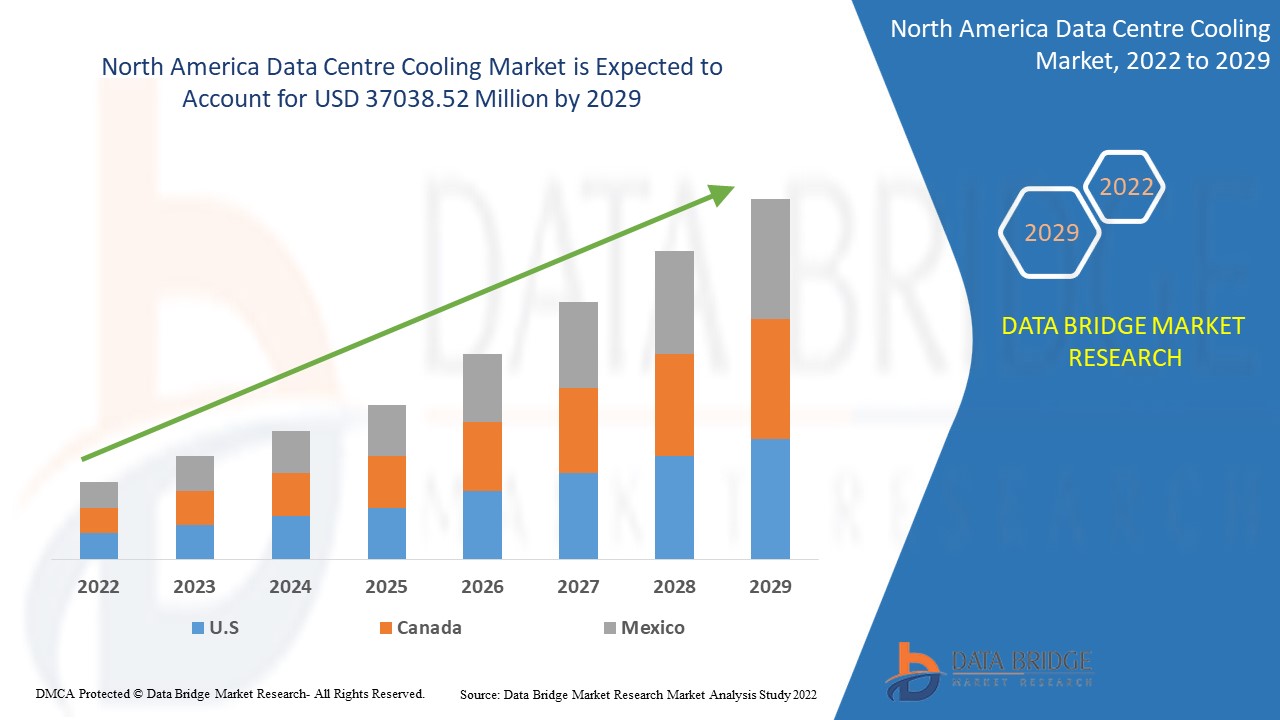

Tamaño del mercado de refrigeración de centros de datos de América del Norte

El tamaño del mercado de enfriamiento de centros de datos de América del Norte se valoró en USD 18,25 mil millones en 2024 y se proyecta que alcance los USD 56,62 mil millones para 2032, con una CAGR del 15,20% durante el período de pronóstico de 2025 a 2032.

Alcance del informe y segmentación del mercado

|

Atributos |

Información clave sobre el mercado de refrigeración de centros de datos |

|

Segmentación |

|

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores clave del mercado |

Schneider Electric (Francia), Vertiv Group Corp. (EE. UU.), STULZ GMBH (Alemania), Eaton (EE. UU.), FUJITSU (Japón), Rittal GmbH & Co. KG (Alemania), Daikin Applied (EE. UU.), Black Box Corporation (EE. UU.), ALFA LAVAL (Suecia), Nortek Air Solutions, LLC (EE. UU.), Airedale Air Conditioning (Reino Unido), 3M (EE. UU.), Coolcentric (EE. UU.), Delta Power Solutions (India) y EcoCooling (Reino Unido) |

|

Oportunidades de mercado |

|

Definición del mercado de refrigeración de centros de datos

La refrigeración de un centro de datos se define como los procesos, equipos, herramientas y técnicas colectivas que ayudan a garantizar una temperatura de funcionamiento perfecta en las instalaciones de un centro de datos. Los operadores de centros de datos utilizan soluciones de refrigeración para mantener la temperatura en los centros de datos dentro de un límite permisible. Los centros de datos funcionan de manera eficiente las 24 horas del día, los 7 días de la semana, para procesar grandes cantidades de datos.

Mercado de refrigeración de centros de datos

Conductores

- Innovaciones tecnológicas

La digitalización de los registros médicos de los clientes en forma de registros médicos electrónicos conduce a un incremento de los datos. La modernización de los sistemas operativos heredados y las innovaciones más recientes en equipos médicos, como las mejoras en los sistemas de respuesta a los pacientes, la gestión del personal y otras, generan una multitud de datos que aumentan la demanda de centros de datos. Se espera que esta necesidad y demanda de centros de datos impulse la demanda de refrigeración de centros de datos e impulse la tasa de crecimiento del mercado.

- Aumentan las iniciativas favorables de las autoridades gubernamentales

Las iniciativas favorables de las autoridades gubernamentales de todo el mundo destinadas a promover la proliferación de la nube están impulsando la demanda de centros de datos y, en consecuencia, creando vías para el mercado de refrigeración de centros de datos. Por ejemplo, los Emiratos Árabes Unidos (EAU) financiaron numerosos proyectos relacionados con la computación en la nube, como Smart Dubai o Smart Abu Dhabi. Estos proyectos tenían como objetivo generar una rápida transformación digital entre las empresas y, al mismo tiempo, favorecer el crecimiento económico del país. Estas iniciativas de diferentes gobiernos impulsarán la demanda de centros de datos a nivel mundial, lo que hará florecer la necesidad de soluciones de refrigeración.

Oportunidades

- Mayores inversiones asociadas a la digitalización

La creciente digitalización está ayudando a crear el impacto más significativo y, por lo tanto, a realizar grandes inversiones en tecnología sanitaria. Por ejemplo, TVM Capital Healthcare, en julio de 2020, aumentó un segundo fondo de capital de crecimiento concentrado en la inversión en el Golfo. Este nuevo fondo se centrará principalmente en el CCG, pero también en Arabia Saudita principalmente. La empresa buscará invertir en todos los ámbitos de la atención sanitaria, excepto en los hospitales generales. Esto ha aumentado aún más la generación de registros de datos de los pacientes, lo que aumentó la demanda de tecnologías de refrigeración de centros de datos en esta región.

Además, el requisito de un enfoque de enfriamiento modular del centro de datos y el surgimiento de la tecnología de enfriamiento líquido aumentan las oportunidades beneficiosas para los principales actores del mercado durante el período de pronóstico de 2025 a 2032.

Restricciones

- Problemas asociados con la refrigeración del centro de datos

Se espera que el requisito de infraestructura especializada y los altos costos de inversión obstaculicen el crecimiento del mercado de refrigeración de centros de datos. Además, los problemas con la refrigeración durante los cortes de energía y la reducción de las emisiones de carbono actuarán como el mayor desafío para el crecimiento del mercado de refrigeración de centros de datos durante el período de pronóstico de 2025 a 2032.

Este informe sobre el mercado de refrigeración de centros de datos proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado por categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de refrigeración de centros de datos, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Alcance del mercado de refrigeración de centros de datos

El mercado de refrigeración de centros de datos está segmentado en función del tipo, las soluciones, el servicio, el tipo de refrigeración y el tamaño de la organización. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Centro de datos empresarial

- Centro de datos de borde

Soluciones

- Aire acondicionado

- Unidades de enfriamiento

- Torres de enfriamiento

- Sistema economizador

- Sistema de refrigeración líquida

- Aire acondicionado de la sala de ordenadores (CRAC)

- Unidades de control del manipulador de aire de la sala de ordenadores (CRAH)

- Otros

Servicio

- Consultoría y Capacitación

- Instalación y despliegue

- Mantenimiento y soporte

Tipo de enfriamiento

- Refrigeración basada en la habitación

- Refrigeración basada en bastidor

- Refrigeración basada en filas

Tamaño de la organización

- Organización grande

- Pequeña y mediana organización

Análisis regional del mercado de refrigeración de centros de datos

Se analiza el mercado de enfriamiento del centro de datos y se proporcionan información y tendencias del tamaño del mercado por país, tipo, soluciones, tipo de enfriamiento, servicio y tamaño de la organización como se menciona anteriormente.

Los países cubiertos en el informe del mercado de refrigeración del centro de datos son Estados Unidos, Canadá y México.

Estados Unidos domina el mercado de refrigeración de centros de datos gracias a la infraestructura de apoyo y a una sólida oferta de productos por parte de los proveedores de soluciones. El mercado de refrigeración de centros de datos de América del Norte se está expandiendo como resultado de la mayor adopción de la tecnología IoT por parte de las empresas, lo que impulsa la demanda de un mayor almacenamiento de datos y el respaldo de soluciones sólidas de conectividad de red, lo que impulsa el crecimiento del mercado.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado de refrigeración de centros de datos

El panorama competitivo del mercado de refrigeración de centros de datos proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de refrigeración de centros de datos.

Los líderes del mercado de refrigeración de centros de datos que operan en el mercado son:

- Schneider Electric (Francia)

- Vertiv Group Corp. (Estados Unidos)

- STULZ GMBH (Alemania)

- Eaton (Estados Unidos)

- FUJITSU (Japón)

- Rittal GmbH & Co. KG (Alemania)

- Daikin Applied (Estados Unidos)

- Corporación Black Box (Estados Unidos)

- ALFA LAVAL (Suecia)

- Nortek Air Solutions, LLC (Estados Unidos)

- Aire acondicionado Airedale (Reino Unido)

- 3M (Estados Unidos)

- Coolcentric (Estados Unidos)

- Soluciones energéticas Delta (India)

- EcoCooling (Reino Unido)

Últimos avances en el mercado de refrigeración de centros de datos

- Vertiv Holdings Co. lanzará el Vertiv VRC-S en septiembre de 2020. La tecnología consiste en un rack integrado con equipos de soporte de infraestructura. El producto incorpora una unidad de distribución de energía para rack (rPDU), un sistema de enfriamiento de rack autónomo Vertiv VRC y una unidad de distribución de energía para rack (rPDU) y encierra un rack de TI de tamaño estándar.

- En julio de 2020, Asetek colaborará con Hewlett Packard Enterprise (HPE). La colaboración tiene como objetivo ofrecer soluciones de refrigeración líquida de primera calidad para centros de datos en sistemas HPE Apollo. Estos sistemas son sistemas de alto rendimiento y optimizados en densidad destinados a satisfacer los requisitos de inteligencia artificial (IA) y computación de alto rendimiento (HPC).

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.