Mercado de cosméticos de América del Norte, por tipo de producto (cuidado de la piel, cuidado del cabello, maquillaje, fragancias y otros), naturaleza (inorgánico, orgánico), categoría (producto masivo, producto premium y producto profesional), tipo de empaque (botellas y frascos, tubos, contenedores, bombas y dispensadores, barras, latas de aerosol, bolsas, blísters y paquetes de tiras), canal de distribución (fuera de línea, en línea), aplicación (mujeres, hombres), país (EE. UU., Canadá y México), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado: mercado de cosméticos de América del Norte

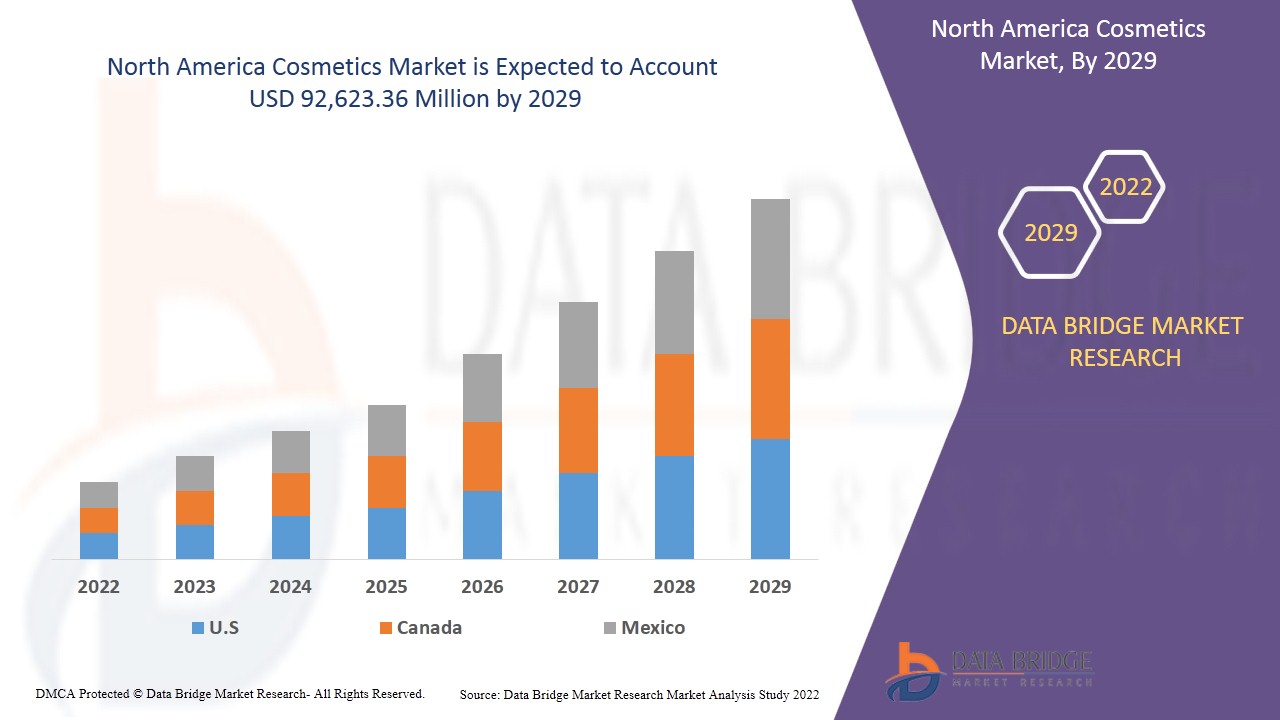

Se espera que el mercado de cosméticos de América del Norte gane un crecimiento significativo en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 5,7% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 92.623,36 millones para 2029.

Los cosméticos se utilizan para realzar la belleza y la apariencia física de un personaje. Principalmente, estos productos cosméticos se fabrican a partir de fuentes artificiales. El propósito de los productos cosméticos está destinado principalmente a la limpieza externa, perfumes , cambios de apariencia, corrección del olor corporal, protección de la piel y acondicionamiento, entre otros. Desde antitranspirantes, fragancias, maquillaje y champús, hasta jabones, protectores solares y pastas de dientes , los cosméticos y productos de cuidado personal juegan un papel esencial en todas las etapas de la vida de un consumidor.

Los principales factores que impulsan el crecimiento del mercado de cosméticos de América del Norte son la creciente conciencia sobre las rutinas de cuidado de la piel, las marcas de productos innovadoras y las estrategias publicitarias. Los crecientes avances en el campo de los cosméticos sostenibles están creando oportunidades para el crecimiento del mercado. Sin embargo, la creciente conciencia sobre los efectos secundarios de los productos químicos sintéticos está actuando como una importante restricción para el crecimiento del mercado. El creciente movimiento entre los consumidores en busca de transparencia y trazabilidad de los ingredientes utilizados en los productos está actuando como un gran desafío para el crecimiento del mercado.

El informe del mercado de cosméticos de América del Norte proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen analítico; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de cosméticos en América del Norte

El mercado de cosméticos de América del Norte está segmentado en función del tipo de producto, la naturaleza, la categoría, el tipo de envase, el canal de distribución y la aplicación. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus principales áreas de aplicación y la diferencia en sus mercados objetivo.

- En función del tipo de producto, el mercado de cosméticos de América del Norte se segmenta en cuidado de la piel, cuidado del cabello, fragancias, maquillaje y otros. En 2022, se espera que el segmento del cuidado de la piel domine el mercado, ya que los consumidores se preocupan cada vez más por la salud de su piel. Las redes sociales también han desempeñado un papel importante en la publicidad de las marcas de cuidado de la piel. Además, con el aumento del crecimiento de los productos orgánicos, los consumidores tienen más confianza en la aplicación de productos naturales en su piel para obtener mejores resultados.

- En función de la naturaleza, el mercado de cosméticos de América del Norte se segmenta en productos orgánicos e inorgánicos. En 2022, se espera que el segmento inorgánico domine el mercado, ya que estos productos son muy efectivos. Los tintes para el cabello, las cremas antiacné, las cremas antiarrugas y varios otros productos se fabrican con ingredientes inorgánicos para mejorar sus resultados.

- En función de la categoría, el mercado de cosméticos de América del Norte se segmenta en productos masivos, productos premium y productos profesionales. En 2022, se espera que el segmento de productos masivos domine el mercado debido a la presencia de una amplia gama de productos, una red de distribución y precios asequibles. Los productos cosméticos se están fabricando en masa debido a la creciente demanda en el mercado.

- En función del tipo de envase, el mercado de cosméticos de América del Norte se segmenta en botellas y tarros, tubos, contenedores, bolsas, barras, bombas y dispensadores, blísters y paquetes de tiras, y latas de aerosol. En 2022, se espera que el segmento de botellas y tarros domine el mercado, ya que una gran parte de los productos suelen envasarse en un tarro o botella. Los tarros son buenos para productos que pueden no verterse bien o que un cliente puede no querer comprar en grandes cantidades, ya que los tarros vienen en una amplia gama de tamaños. Las botellas son buenas para productos líquidos que el consumidor quiere que se dispensen mediante un método determinado (bomba, pulverizador) y quiere volúmenes mayores.

- En función del canal de distribución, el mercado de cosméticos de América del Norte se segmenta en offline y online. En 2022, se espera que el segmento offline domine el mercado, ya que es una forma tradicional de canal de distribución que se centra en los establecimientos físicos, con ventas a través de supermercados, tiendas especializadas, farmacias y salones de belleza. Los clientes pueden obtener una amplia gama de opciones, sugerencias y muestras a través de estas tiendas que mejoran su toma de decisiones.

- En función de la aplicación, el mercado de cosméticos de América del Norte está segmentado en mujeres y hombres. En 2022, se espera que el segmento de mujeres domine el mercado, ya que el mercado de cosméticos está muy centrado en las mujeres y hay una amplia gama de productos disponibles para la belleza femenina. Además, con el aumento del uso de las redes sociales, la demanda de productos de belleza ha aumentado entre las mujeres.

Análisis a nivel de país del mercado de cosméticos de América del Norte

Se analiza el mercado de cosméticos de América del Norte y se proporciona información sobre el tamaño del mercado por país, tipo de producto, naturaleza, categoría, tipo de empaque, canal de distribución y aplicación.

Los países cubiertos en el informe del mercado de cosméticos de América del Norte son EE. UU., Canadá y México.

Estados Unidos representó la mayor participación en el mercado de cosméticos de América del Norte debido a factores como la presencia de un gran número de empresas proveedoras de cosméticos.

La sección de países del informe sobre el mercado de cosméticos de América del Norte también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como las nuevas ventas, las ventas de reemplazo, la demografía del país, las leyes regulatorias y el análisis de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se considera la presencia y disponibilidad de marcas de América del Norte y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

La creciente adopción de cosméticos impulsará el crecimiento del mercado

El mercado de cosméticos de América del Norte también le ofrece un análisis detallado del mercado de cada país: crecimiento de la base instalada de diferentes tipos de productos para el mercado de cosméticos de América del Norte, impacto de la tecnología mediante curvas de línea de vida y cambios en los requisitos de productos abrasivos, escenarios regulatorios y su impacto en el mercado de cosméticos. Los datos están disponibles para el período histórico de 2012 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de los cosméticos en América del Norte

El panorama competitivo del mercado de cosméticos de América del Norte proporciona detalles por competidor. Los detalles incluidos son la descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de ensayos clínicos, el análisis de la marca, las aprobaciones de productos, las patentes, la amplitud y la variedad de productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de cosméticos de América del Norte.

Algunos de los principales actores que operan en el informe del mercado de cosméticos de América del Norte son Procter & Gamble, L'Oreal SA, The Estee Lauder Companies Inc., Coty Inc., Shiseido Company, Limited, Colgate-Palmolive Company, Kao Corporation, Beiersdorf Group, Unilever, Amorepacific, Johnson & Johnson Services, Inc., Revlon, Inc., LMVH, Oriflame Cosmetics Global SA, Espa, Henkel AG & Co. KGaA, Mary Kay, Natura&Co, CHANEL, KOSÉ Corporation, entre otros. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Por ejemplo,

- En septiembre de 2021, Unilever lanzó Positive Beauty Growth Platform, una nueva iniciativa que tiene como objetivo asociarse con empresas en expansión y nuevas empresas para impulsar la innovación y el crecimiento de la marca. La plataforma tiene como objetivo invitar a nuevas empresas en expansión y nuevas empresas a través de una serie de concursos de presentación de proyectos. La empresa, a través de esta plataforma, pretende aprovechar el enfoque disruptivo de las nuevas empresas para preparar sus marcas para el futuro y dar forma a la industria de la belleza.

- En noviembre de 2021, The Estée Lauder Companies Inc. anunció la asociación con Florida A&M University para un nuevo programa de desarrollo y talentos con el fin de formar la próxima generación de líderes negros en belleza en el sector minorista de viajes. Este desarrollo estuvo en línea con el compromiso de la empresa con la equidad racial. Esto le permitió crear un programa exclusivo de pasantías y becas con Florida A&M University.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA COSMETICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELING

2.1 PRODUCT TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CONSUMER TRENDS AND PREFERENCES

4.2 FACTORS AFFECTING BUYING DECISION

4.3 CONSUMER PRODUCT ADOPTION

4.4 PORTERS FIVE FORCES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING AWARENESS REGARDING SKIN CARE ROUTINE

5.1.2 INNOVATIVE PRODUCT BRANDING AND ADVERTISING STRATEGIES IS FUELLING DEMAND FOR COSMETICS

5.1.3 AVAILABILITY OF CUSTOMIZED BEAUTY & SKINCARE PRODUCTS

5.1.4 CHANGING LIFESTYLE AND INCREASING URBAN POPULATION

5.1.5 SURGE IN E-COMMERCE TO FUEL DEMAND IN COSMETICS PRODUCTS

5.2 RESTRAINTS

5.2.1 AWARENESS REGARDING SIDE EFFECTS DUE TO THE USE OF SYNTHETIC CHEMICALS

5.2.2 INCREASING TRENDS IN PRODUCT RECALLS

5.3 OPPORTUNITIES

5.3.1 INCREASING DEVELOPMENTS IN SUSTAINABLE COSMETICS

5.3.2 INCREASING DEMAND FOR VEGAN BEAUTY PRODUCTS

5.3.3 TECHNOLOGICAL INTEGRATION FOR OFFERING PERSONALISED BEAUTY EXPERIENCE

5.3.4 INCREASING DEMAND FOR COSMETICS AMONG AGING POPULATION

5.4 CHALLENGES

5.4.1 INCREASING MOVEMENT ACROSS CONSUMERS FOR TRANSPARENCY AND TRACEABILITY OF INGREDIENTS USED IN PRODUCTS

5.4.2 ISSUES IN PRODUCT DELIVERY LIFECYCLE ACROSS SUPPLY CHAINS

6 COVID-19 IMPACT ON THE NORTH AMERICA COSMETICS MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 PRICE IMPACT

6.7 CONCLUSION

7 NORTH AMERICA COSMETICS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SKIN CARE

7.2.1 MASKS

7.2.2 MOISTURIZERS

7.2.3 BODY LOTIONS

7.2.4 TONERS

7.2.5 CLEANSING CREAM

7.2.6 FACIAL REMOVER

7.2.7 SUNSCREENS

7.2.8 BODY WASH

7.2.9 NIGHT SERUM

7.2.10 DAY CREAM

7.2.11 HAND & FOOT CREAMS

7.2.12 OTHERS

7.3 HAIR CARE

7.3.1 SHAMPOO

7.3.2 CONDITIONERS

7.3.3 HAIR COLOR

7.3.3.1 BY TYPE

7.3.3.1.1 HAIR DYES AND COLORS

7.3.3.1.2 HAIR BLEACHES

7.3.3.1.3 HAIR TINTS

7.3.3.1.4 OTHERS

7.3.3.2 BY HAIR TYPE

7.3.3.2.1 NORMAL

7.3.3.2.2 OILY

7.3.3.2.3 DRY

7.3.4 SERUMS

7.3.5 OIL

7.3.6 SPRAYS

7.3.7 OTHERS

7.4 MAKE UP

7.4.1 LIPSTICK

7.4.2 EYE SHADOW

7.4.3 MASCARA

7.4.4 FOUNDATION

7.4.5 BRONZER

7.4.6 BLUSH

7.4.7 OTHERS

7.5 FRAGRANCES

7.6 OTHERS

8 NORTH AMERICA COSMETICS MARKET, BY NATURE

8.1 OVERVIEW

8.2 INORGANIC

8.3 ORGANIC

9 NORTH AMERICA COSMETICS MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 MASS PRODUCT

9.3 PREMIUM PRODUCT

9.4 PROFESSIONAL PRODUCT

10 NORTH AMERICA COSMETICS MARKET, BY PACKAGING TYPE

10.1 OVERVIEW

10.2 BOTTLES AND JARS

10.3 TUBES

10.4 CONTAINERS

10.5 PUMPS & DISPENSERS

10.6 STICKS

10.7 AEROSOL CANS

10.8 POUCHES

10.9 BLISTERS & STRIP PACKS

11 NORTH AMERICA COSMETICS MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 OFFLINE

11.2.1 COSMETICS STORES

11.2.2 PHARMACIES

11.2.3 SPECIALITY STORES

11.2.4 SUPERMARKETS/HYPERMARKETS

11.2.5 SALONS

11.2.6 OTHERS

11.3 ONLINE

12 NORTH AMERICA COSMETICS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 WOMEN

12.2.1 SKIN CARE

12.2.2 HAIR CARE

12.2.3 MAKE UP

12.2.4 FRAGRANCES

12.2.5 OTHERS

12.3 MEN

12.3.1 SKIN CARE

12.3.2 HAIR CARE

12.3.3 FRAGRANCES

12.3.4 MAKE UP

12.3.5 OTHERS

13 NORTH AMERICA COSMETICS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA COSMETICS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 L’ORÉAL S.A.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 UNILEVER

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 THE ESTÉE LAUDER COMPANIES INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 PROCTER & GAMBLE

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 LVMH

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 AMOREPACIFIC

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 BEIERSDORF GROUP

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 CHANEL

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 COLGATE-PALMOLIVE COMPANY

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 COTY INC.

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 ESPA

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 HENKEL AG & CO. KGAA

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 JOHNSON & JOHNSON SERVICES, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 KAO CORPORATION

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 KOSÉ CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 MARY KAY

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 NATURA &CO

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 ORIFLAME COSMETICS NORTH AMERICA SA

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 REVLON, INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 SHISEIDO COMPANY, LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA SKIN CARE IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA HAIR CARE IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA MAKE UP IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA FRAGRANCES IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA OTHERS IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA INORGANIC IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ORGANIC IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA MASS PRODUCT IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA PREMIUM PRODUCT IN COSMETICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 18 NORTH AMERICA PROFESSIONAL PRODUCT IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA BOTTLES AND JARS IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA TUBES IN COSMETICS MARKET, BY REGION,2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA CONTAINERS IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA PUMPS & DISPENSERS IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA STICKS IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA AEROSOL CANS IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA POUCHES IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA BLISTERS AND STRIP PACKS IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA OFFLINE IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA ONLINE IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA COSMETICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA WOMEN IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA MEN IN COSMETICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA COSMETICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA COSMETICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.S. COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.S. SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.S. HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.S. HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.S. HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.S. MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.S. COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 59 U.S. COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 60 U.S. COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.S. COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 62 U.S. OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.S. COSMETICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 U.S. WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.S. MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 CANADA COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 67 CANADA SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 CANADA HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CANADA HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 CANADA HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 71 CANADA MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 CANADA COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 73 CANADA COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 74 CANADA COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 75 CANADA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 CANADA OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 CANADA COSMETICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 CANADA WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 79 CANADA MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 80 MEXICO COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 81 MEXICO SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 MEXICO HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 MEXICO HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 MEXICO HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 85 MEXICO MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 MEXICO COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 87 MEXICO COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 88 MEXICO COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 89 MEXICO COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 90 MEXICO OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 MEXICO COSMETICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 MEXICO WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 MEXICO MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA COSMETICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA COSMETICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA COSMETICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA COSMETICS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA COSMETICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA COSMETICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA COSMETICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA COSMETICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA COSMETICS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA COSMETICS MARKET: SEGMENTATION

FIGURE 11 SURGE IN E-COMMERCE TO FUEL DEMANDS IN COSMETICS PRODUCTS IS EXPECTED TO DRIVE THE NORTH AMERICA COSMETICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SKIN CARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA COSMETICS MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE NORTH AMERICA COSMETICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA COSMETICS MARKET

FIGURE 15 NORTH AMERICA COSMETICS MARKET, BY PRODUCT TYPE, 2021

FIGURE 16 NORTH AMERICA COSMETICS MARKET, BY NATURE, 2021

FIGURE 17 NORTH AMERICA COSMETICS MARKET, BY CATEGORY, 2021

FIGURE 18 NORTH AMERICA COSMETICS MARKET, BY PACKAGING TYPE, 2021

FIGURE 19 NORTH AMERICA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 20 NORTH AMERICA COSMETICS MARKET, BY APPLICATION, 2021

FIGURE 21 NORTH AMERICA COSMETICS MARKET: SNAPSHOT (2021)

FIGURE 22 NORTH AMERICA COSMETICS MARKET: BY COUNTRY (2021)

FIGURE 23 NORTH AMERICA COSMETICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 NORTH AMERICA COSMETICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 NORTH AMERICA COSMETICS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 26 NORTH AMERICA COSMETICS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.