North America Compressed Natural Gas Cng Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

16.32 Billion

USD

21.16 Billion

2024

2032

USD

16.32 Billion

USD

21.16 Billion

2024

2032

| 2025 –2032 | |

| USD 16.32 Billion | |

| USD 21.16 Billion | |

|

|

|

|

Segmentación del mercado de gas natural comprimido (GNC) en América del Norte por fuente (gas asociado y no asociado), kits (secuenciales y Venturi), tipo de distribución (cilindros/tanques, acumuladores, colectores compuestos y otros), uso final (vehículos ligeros, medianos y pesados): tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado de gas natural comprimido (GNC) en América del Norte

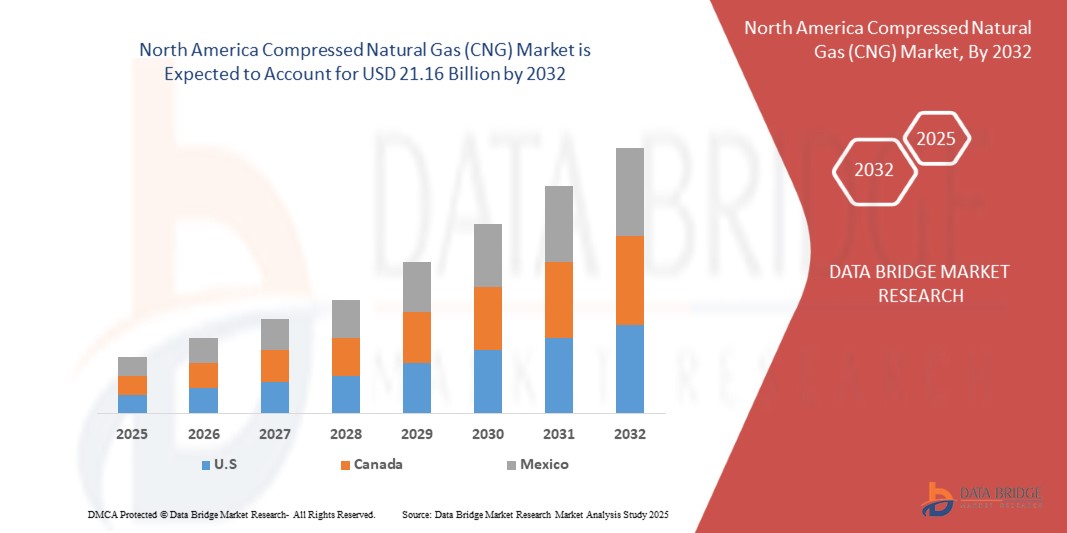

- El mercado de gas natural comprimido (GNC) de América del Norte se valoró en USD 16.320 millones en 2024 y se proyecta que alcance los USD 21.160 millones en 2032 , creciendo a una CAGR del 3,30 % durante el período de pronóstico.

- El crecimiento está siendo impulsado por la creciente demanda de combustibles de transporte más limpios, subsidios gubernamentales para vehículos a gas natural (GNV) y la expansión de la infraestructura de reabastecimiento de gas natural comprimido en los EE. UU. y Canadá.

- La creciente adopción de vehículos de gas natural comprimido basados en flotas, especialmente en logística, transporte público y servicios de transporte, está impulsando aún más la demanda.

- El apoyo regulatorio, incluidos los mandatos de vehículos de bajas emisiones y los objetivos de reducción de carbono, fortalece la defensa del gas natural comprimido frente a la gasolina y el diésel.

- Se espera que la presencia de reservas de gas natural a gran escala y las inversiones en curso en la integración de gas natural renovable (GNR) respalden significativamente el crecimiento a largo plazo.

Análisis del mercado de gas natural comprimido (GNC) en América del Norte

- El mercado de gas natural comprimido de América del Norte está experimentando una fuerte adopción debido a las ventajas económicas, ya que el combustible de gas natural comprimido es generalmente entre un 30 % y un 40 % más barato que la gasolina o el diésel en la región.

- Las aplicaciones de servicio pesado, como autobuses, camiones de larga distancia y flotas municipales, representan los segmentos de crecimiento más prometedores.

- La competencia en el mercado se está intensificando con las compañías energéticas, los fabricantes de equipos originales (OEM) automotrices y los proveedores de GNR colaborando para ampliar la disponibilidad y confiabilidad de las soluciones de gas natural comprimido.

- Estados Unidos posee la mayor participación del 69,32% del mercado de gas natural comprimido de América del Norte, impulsado por sus vastas reservas de gas de esquisto, una infraestructura bien desarrollada y sólidas iniciativas gubernamentales para promover combustibles alternativos.

- México está emergiendo como un mercado de rápido crecimiento con una CAGR de 12.02% dentro de América del Norte, impulsado en gran medida por el impulso de su gobierno para diversificar las fuentes de combustible y reducir la dependencia de la gasolina y el diésel importados.

- El segmento de gas no asociado dominó el mercado con la mayor participación en los ingresos del 57,8 % en 2024, impulsado por su amplia disponibilidad, rentabilidad e idoneidad para aplicaciones de energía y combustible a gran escala.

Alcance del informe y segmentación del mercado de gas natural comprimido (GNC) en América del Norte

|

Atributos |

Perspectivas clave del mercado de gas natural comprimido (GNC) en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuestas de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de las cinco fuerzas de Porter y marco regulatorio. |

Tendencias del mercado de gas natural comprimido (GNC) en América del Norte

La creciente adopción de vehículos de GNC impulsada por la expansión de la infraestructura

- Una tendencia importante que configura el mercado de gas natural comprimido de América del Norte es la creciente implementación de estaciones de servicio de gas natural comprimido públicas y privadas, lo que mejora significativamente la accesibilidad y la conveniencia del gas natural comprimido como combustible para el transporte.

- Por ejemplo, en EE. UU., varias empresas energéticas se están asociando con proveedores de logística para establecer corredores de estaciones de servicio de gas natural comprimido a lo largo de las principales autopistas interestatales, lo que reduce la ansiedad de autonomía de los operadores de flotas.

- Los avances tecnológicos en cilindros de almacenamiento compuestos livianos están aumentando la capacidad de almacenamiento de combustible al mismo tiempo que mejoran el rendimiento del vehículo y reducen el peso total.

- Otra tendencia es la integración del gas natural renovable (GNR) con el gas natural comprimido convencional, lo que permite al sector del transporte reducir aún más las emisiones de gases de efecto invernadero durante su ciclo de vida.

- Los fabricantes de equipos originales (OEM) de automóviles están ampliando sus ofertas de vehículos dedicados a gas natural comprimido, mientras que los kits de modernización posventa se están volviendo cada vez más avanzados, confiables y rentables.

- La narrativa de la electrificación de la flota también está influyendo en el mercado del gas natural comprimido, con muchos gobiernos promoviendo modelos híbridos de combustible dual que combinan gas natural comprimido con transmisiones eléctricas, lo que hace que el cambio hacia la sostenibilidad sea más flexible.

- En conjunto, estos avances están impulsando la percepción del gas natural comprimido como un combustible puente en la transición de América del Norte hacia sistemas de transporte de cero emisiones netas.

Dinámica del mercado de gas natural comprimido (GNC) en América del Norte

Conductor

Apoyo gubernamental y creciente enfoque en la reducción de emisiones

- El aumento de las iniciativas gubernamentales, los subsidios y los marcos de políticas destinados a reducir la dependencia de los combustibles fósiles convencionales y minimizar la huella de carbono son un impulsor clave del mercado de gas natural comprimido de América del Norte.

- Por ejemplo, las políticas regulatorias en los EE. UU. y Canadá están ofreciendo incentivos fiscales para la adopción de gas natural comprimido, fomentando tanto la producción de OEM como las conversiones de flotas a vehículos de gas natural.

- Los vehículos a gas natural comprimido emiten entre un 20 % y un 30 % menos de gases de efecto invernadero en comparación con el diésel, lo que los hace muy atractivos para cumplir los objetivos de sostenibilidad corporativa.

- La creciente asequibilidad del gas natural en comparación con los combustibles derivados del petróleo está mejorando aún más la competitividad de los costos, alentando a los operadores de logística, transporte público y flotas privadas a realizar la transición hacia vehículos propulsados por gas natural comprimido.

- La expansión de la infraestructura, junto con sólidas alianzas entre proveedores de servicios públicos, operadores de flotas e innovadores tecnológicos, está acelerando la adopción en múltiples categorías de vehículos.

Restricción/Desafío

Brechas de infraestructura y altos costos iniciales de conversión

- A pesar de la rápida expansión, la limitada infraestructura de abastecimiento de gas natural comprimido en ciertas regiones de América del Norte sigue siendo una barrera importante que restringe la adopción a larga distancia fuera de los conglomerados urbanos o industriales.

- El alto costo inicial de los vehículos a gas natural comprimido y los kits de modernización en comparación con los vehículos convencionales genera dudas entre los consumidores individuales y los operadores de flotas pequeñas.

- Los desafíos constantes en torno al mantenimiento del sistema de almacenamiento, el reemplazo de cilindros y las normas de seguridad aumentan los gastos operativos, en particular en las flotas comerciales.

- Los incentivos gubernamentales inconsistentes en los estados y provincias conducen a una adopción fragmentada del mercado, con algunas áreas experimentando una penetración más rápida mientras que otras se quedan atrás.

- La competencia de alternativas emergentes, como los vehículos eléctricos y los vehículos de pilas de combustible de hidrógeno, también es un desafío, ya que las empresas sopesan las inversiones a largo plazo en gas natural comprimido frente a otras tecnologías de combustibles limpios.

- Para superar estos obstáculos se requiere el desarrollo de infraestructura estratégica, estandarización tecnológica e incentivos financieros, que desempeñarán un papel fundamental para sostener el impulso del mercado.

Alcance del mercado de gas natural comprimido (GNC) en América del Norte

El mercado está segmentado según la fuente, el kit, el tipo de distribución y el usuario final.

• Por fuente

Según la fuente de origen, el mercado se segmenta en gas asociado y gas no asociado. El segmento de gas no asociado dominó el mercado con la mayor participación en los ingresos, un 57,8%, en 2024, gracias a su amplia disponibilidad, rentabilidad e idoneidad para aplicaciones energéticas y de combustibles a gran escala. El gas no asociado, extraído independientemente del petróleo crudo, ofrece una cadena de suministro fiable para satisfacer la creciente demanda energética, a la vez que apoya las estrategias de descarbonización. Su escalabilidad lo convierte en la opción preferida para usos industriales y automotrices.

Se proyecta que el segmento de gas asociado experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, a medida que los avances en las tecnologías de recuperación de gas mejoran la eficiencia y reducen las pérdidas por quema. Con un enfoque creciente en la sostenibilidad y las medidas regulatorias para minimizar los residuos, se espera que el uso de gas asociado se expanda rápidamente. Esta tendencia posiciona al gas asociado como una fuente emergente para cumplir con los objetivos globales de transición energética.

• Por Kits

En cuanto a los kits, el mercado se segmenta en kits secuenciales y kits Venturi. El segmento de kits secuenciales representó la mayor cuota de ingresos, con un 61,3 %, en 2024, gracias a su mayor eficiencia, precisión en la inyección de combustible y reducción de emisiones en comparación con los sistemas tradicionales. Los kits secuenciales se utilizan cada vez más en vehículos ligeros y medianos gracias a su capacidad para ofrecer mejor kilometraje, mejor rendimiento y cumplimiento de las estrictas normas de emisiones. Su uso generalizado en los mercados desarrollados y emergentes consolida su dominio.

Se prevé que el segmento de kits Venturi experimente el mayor crecimiento entre 2025 y 2032, gracias a su menor coste de instalación y a su idoneidad para modelos de vehículos más antiguos en mercados con precios sensibles. Los kits Venturi, aunque menos sofisticados, siguen siendo atractivos para operadores de flotas y consumidores que buscan soluciones económicas de conversión de combustible. Su creciente adopción en las economías en desarrollo garantiza su expansión constante a pesar del predominio de los kits secuenciales.

• Por tipo de distribución

Según el tipo de distribución, el mercado se segmenta en cilindros/tanques, acumuladores, colectores compuestos y otros. El segmento de cilindros/tanques dominó el mercado con la mayor participación en los ingresos, con un 49,5 % en 2024, gracias a su infraestructura consolidada, sus certificaciones de seguridad y su amplio uso en vehículos ligeros y pesados. Su durabilidad y compatibilidad con las estaciones de servicio existentes los convierten en la opción estándar para el almacenamiento y la distribución de gas.

Se proyecta que el segmento de colectores compuestos registre la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, gracias a su ligereza, sus características de seguridad mejoradas y su capacidad para almacenar mayores volúmenes de gas a presiones optimizadas. Con un enfoque creciente en la reducción del peso de los vehículos y la eficiencia del combustible, los colectores compuestos se perfilan como la solución de próxima generación para los sistemas de distribución de gas automotriz. Su rápida adopción en flotas de vehículos avanzados consolida su trayectoria de crecimiento.

• Por uso final

Según el uso final, el mercado se segmenta en vehículos ligeros, medianos y pesados. El segmento de vehículos ligeros tuvo la mayor participación de mercado, con un 54,1 %, en 2024, impulsado por la creciente demanda de soluciones de movilidad personal y comercial rentables y ecológicas. La urbanización, el crecimiento de los servicios de transporte compartido y la preferencia de los consumidores por alternativas de combustible asequibles refuerzan aún más el dominio de este segmento.

Se prevé que el segmento de vehículos pesados experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, a medida que la logística, el transporte de mercancías y el transporte de larga distancia adoptan cada vez más sistemas basados en gas para reducir los costes operativos y la huella de carbono. Con normas de emisiones más estrictas y una creciente infraestructura para el reabastecimiento de combustibles alternativos, las flotas de vehículos pesados están adoptando rápidamente el gas, lo que convierte a este segmento en un motor vital para el crecimiento futuro.

Análisis regional del mercado de gas natural comprimido (GNC) en América del Norte

- Estados Unidos posee la mayor participación del 69,32% del mercado de gas natural comprimido de América del Norte, impulsado por sus vastas reservas de gas de esquisto, una infraestructura bien desarrollada y sólidas iniciativas gubernamentales para promover combustibles alternativos.

- El país está siendo testigo de una importante adopción de gas natural comprimido en las flotas de transporte público y comercial, particularmente en las regiones metropolitanas donde las regulaciones de emisiones son estrictas.

- Además, los avances tecnológicos en kits secuenciales y colectores compuestos están mejorando la eficiencia y la adopción de vehículos. Empresas importantes como Clean Energy Fuels, Trillium y proyectos respaldados por empresas de servicios públicos impulsan aún más el crecimiento.

Perspectivas del mercado de gas natural comprimido (GNC) de Canadá

El mercado canadiense de gas natural comprimido (GNC) se encuentra en constante expansión, impulsado por su enfoque en el transporte sostenible y los compromisos climáticos. Si bien la infraestructura no es tan extensa como en EE. UU., iniciativas gubernamentales promueven el uso de GNC en autobuses, flotas municipales y logística. El aumento de los costos del combustible y el comercio transfronterizo con EE. UU. también incentivan a los operadores de flotas a adoptar el GNC como una solución rentable. La demanda de vehículos medianos y pesados propulsados por GNC es particularmente alta en centros urbanos como Toronto y Vancouver, donde las normas de emisiones son más estrictas.

Perspectiva del mercado de gas natural comprimido (GNC) en México

México se perfila como un mercado de rápido crecimiento con una tasa de crecimiento anual compuesta (TCAC) del 12.02% en Norteamérica, impulsado principalmente por la iniciativa de su gobierno para diversificar las fuentes de combustible y reducir la dependencia de la gasolina y el diésel importados. La disponibilidad de gas natural comprimido (GNC) asequible, sumada a la creciente inversión en infraestructura de abastecimiento, está fomentando su adopción en taxis, autobuses y flotas de reparto. Los kits secuenciales están ganando terreno en el transporte urbano, mientras que los vehículos pesados se están adaptando gradualmente gracias a las ventajas en costos. La posición estratégica de México como centro logístico en Latinoamérica impulsa aún más la demanda de GNC como combustible alternativo sostenible y económico.

La industria del gas natural comprimido de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Clean Energy Fuels Corp. (EE. UU.)

- Cummins Inc. (EE. UU.)

- Agilidad hexagonal (EE. UU.)

- Westport Fuel Systems Inc. (Canadá)

- Compañía de vehículos de gas natural (EE. UU.)

- Quantum Fuel Systems LLC (EE. UU.)

- NGV Global Group (EE. UU.)

- Chart Industries, Inc. (EE. UU.)

- Cilindros de gas Luxfer (EE. UU.)

Últimos avances en el mercado de gas natural comprimido (GNC) en América del Norte

- En febrero de 2025, Clean Energy Fuels (US) anunció la apertura de 25 nuevas estaciones de servicio de GNC en California y Texas, con el objetivo de apoyar a las flotas de camiones pesados en transición hacia el diésel. Esta expansión fortalece el liderazgo de la compañía en transporte sostenible y apoya las iniciativas de descarbonización a nivel estatal.

- En noviembre de 2024, Trillium Energy Solutions (EE. UU.) se asoció con Love's Travel Stops para implementar una infraestructura avanzada de repostaje de GNC en corredores de carga clave. La iniciativa se centra en facilitar que las empresas de transporte de larga distancia accedan a un suministro confiable de GNC, mejorando la rentabilidad y reduciendo las emisiones en la logística interestatal.

- En septiembre de 2024, FortisBC (Canadá) lanzó un programa de conversión de flotas de autobuses municipales en Columbia Británica, con la introducción de kits secuenciales de GNC de alta capacidad. Esta medida forma parte de la estrategia más amplia de Canadá para cumplir con el Estándar de Combustible Limpio y se espera que reduzca las emisiones de la flota en más del 25 % anual.

- En junio de 2024, Hexagon Agility (EE. UU./Canadá) presentó sus tanques de GNC ligeros de nueva generación, fabricados con materiales compuestos, para vehículos medianos y pesados. Esta nueva tecnología mejora la eficiencia del almacenamiento de combustible, reduce el peso del vehículo y aumenta la autonomía, lo que hace que la adopción del GNC sea más atractiva para los operadores logísticos.

- En abril de 2024, GAIL Global (división México) anunció su inversión en el desarrollo de 50 nuevas estaciones de GNC en las principales áreas metropolitanas, incluyendo la Ciudad de México y Monterrey. El proyecto apoya la transición de México hacia combustibles más limpios y mejora la accesibilidad para vehículos comerciales y de pasajeros.

- En diciembre de 2023, Chesapeake Utilities Corporation (EE. UU.) amplió su distribución de GNC a través de su filial Marlin Gas Services, introduciendo unidades móviles de abastecimiento de GNC en zonas rurales y desatendidas. Este desarrollo mejora la accesibilidad y garantiza un suministro fiable donde la infraestructura permanente es limitada.

- En octubre de 2023, Enbridge Gas (Canadá) se asoció con Cummins para impulsar la adopción del GNC en flotas de camiones de larga distancia. La colaboración incluye el suministro de motores y kits de GNC mejorados, dirigidos a flotas que buscan cumplir con las normas de emisiones más estrictas de Ontario y Quebec.

- En agosto de 2023, Naturgy México implementó un programa de subsidios para flotas de taxis y vehículos compartidos que se migraran a kits secuenciales de GNC. El programa de incentivos ya ha acelerado su adopción en el transporte urbano, especialmente en la Ciudad de México, donde la demanda de soluciones de movilidad limpias y rentables está en aumento.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.