North America Colorectal Cancer Diagnostics Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1,625.27 Million

USD

3,192.46 Million

2022

2030

USD

1,625.27 Million

USD

3,192.46 Million

2022

2030

| 2023 –2030 | |

| USD 1,625.27 Million | |

| USD 3,192.46 Million | |

|

|

|

Diagnóstico de cáncer colorrectal en América del Norte, por tipo de producto (instrumentos, consumibles y accesorios), tipo de prueba (examen de heces, análisis de sangre, prueba de diagnóstico por imágenes, marcadores tumorales, biopsia y otros), estadios del cáncer (estadio 0, estadio I, estadio II, estadio III y estadio IV), tipo de cáncer (adenocarcinoma, linfoma colorrectal, tumores del estroma gastrointestinal, tumores carcinoides y otros), grupo etario (geriátrico, adultos y pediátrico), usuario final (hospitales, centros de diagnóstico, centros de investigación del cáncer, centros quirúrgicos ambulatorios, institutos académicos y otros), tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de diagnóstico de cáncer colorrectal en América del Norte

La creciente concienciación en América del Norte sobre el cáncer colorrectal ha aumentado la demanda del mercado. El aumento del gasto sanitario para mejorar los servicios sanitarios también contribuye al crecimiento del mercado. Los principales actores del mercado se centran en diversos lanzamientos y aprobaciones de servicios durante este período crucial. Además, el aumento de los procesos y técnicas de diagnóstico mejorados también contribuye a la creciente demanda de pruebas de diagnóstico del cáncer colorrectal.

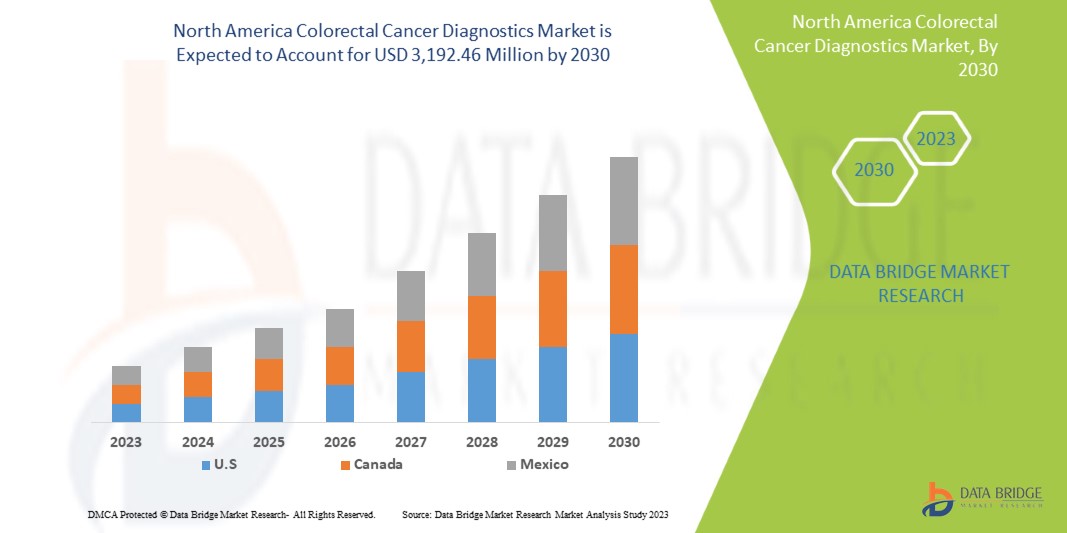

Se espera que el mercado de diagnóstico de cáncer colorrectal de América del Norte gane crecimiento de mercado en el período de pronóstico de 2023 a 2030. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 8,8% en el período de pronóstico de 2023 a 2030 y se espera que alcance los USD 3192,46 millones para 2030 desde USD 1625,27 millones en 2022.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020-2016) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por tipo de producto (instrumentos, consumibles y accesorios), tipo de prueba (examen de heces, análisis de sangre, prueba de imágenes, marcadores tumorales, biopsia y otros), estadios del cáncer (estadio 0, estadio I, estadio II, estadio III y estadio IV), tipo de cáncer (adenocarcinoma, linfoma colorrectal, tumores del estroma gastrointestinal, tumores carcinoides y otros), grupo etario (geriátrico, adultos y pediátrico), usuario final (hospitales, centros de diagnóstico, centros de investigación del cáncer, centros de cirugía ambulatoria, institutos académicos y otros). |

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

Español F. Hoffmann-La Roche Ltd., Koninklijke Philips NV, Thermo Fisher Scientific Inc., Illumina, Inc., Quest Diagnostics Incorporated, CANON MEDICAL SYSTEMS CORPORATION, Bio-Rad Laboratories, Inc., Merck KGaA, FUJIFILM Corporation, Agilent Technologies, Inc., BD, Siemens Healthcare GmbH, Neusoft Corporation, BioFire Diagnostics, Myriad Genetics Inc., QIAGEN, Hologic, Inc., Time Medical Holding, FONAR Corp., PlexBio, MinFound Medical Systems Co., Ltd, FONAR, Corp.

|

Definición del mercado de diagnóstico de cáncer colorrectal en América del Norte

El cáncer colorrectal comienza en el colon o el recto. Según dónde comience, estos cánceres también pueden llamarse cáncer de colon o cáncer de recto. El cáncer de colon y el cáncer de recto a menudo se agrupan porque tienen muchas características en común. El cáncer colorrectal es una enfermedad en la que las células del colon o del recto crecen sin control. A veces se lo llama cáncer de colon, para abreviar. El colon es el intestino grueso. El recto es el conducto que conecta el colon con el ano.

A veces, se forman crecimientos anormales, llamados pólipos, en el colon o el recto. Con el tiempo, algunos pólipos pueden convertirse en cáncer. Las pruebas de detección pueden encontrar pólipos para que se puedan extirpar antes de que se conviertan en cáncer. Las pruebas de detección también ayudan a detectar el cáncer colorrectal en forma temprana, cuando el tratamiento funciona mejor.

Dinámica del mercado de diagnóstico del cáncer colorrectal en América del Norte

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

-

Aumento de la prevalencia del cáncer colorrectal

El cáncer colorrectal a veces se denomina cáncer de colon, un término que combina el cáncer de colon y el cáncer rectal, que comienza en el recto. El cáncer de colon afecta típicamente a adultos mayores, aunque puede aparecer a cualquier edad. Suele comenzar como pequeños grupos de células no cancerosas (benignas) llamadas pólipos que se forman dentro del colon. Con el tiempo, algunos de estos pólipos pueden convertirse en cánceres de colon.

En 2022, según la publicación de la Sociedad Estadounidense del Cáncer (ACS), el número de cánceres colorrectales en los Estados Unidos para 2023 fue de 106,970 casos nuevos de cáncer de colon, 46,050 casos nuevos de cáncer de recto y, en general, el riesgo de por vida de desarrollar cáncer colorrectal es de aproximadamente 1 en 23 para los hombres y 1 en 26 para las mujeres.

-

Aumento del número de pacientes con diverticulitis y colitis ulcerosa.

La diverticulitis es la inflamación de los divertículos, que son pequeñas bolsas que se forman en el revestimiento del colon. La colitis ulcerosa (CU) es una enfermedad inflamatoria intestinal (EII) en la que las personas desarrollan inflamación y úlceras en el revestimiento del intestino grueso. Las opciones de tratamiento incluyen antibióticos, una dieta líquida clara temporal, analgésicos y cirugía para extirpar parte del colon solo en algunos casos.

En junio de 2022, según la información proporcionada por el Centro Nacional de Información Biotecnológica (NCBI), la colitis ulcerosa tiene una incidencia de 9 a 20 casos por cada 100.000 personas al año. Su prevalencia es de 156 a 291 casos por cada 100.000 personas al año. La colitis ulcerosa tiene un patrón de incidencia bimodal. El pico de aparición principal se produce entre los 15 y los 30 años. Un segundo pico de incidencia más pequeño se produce entre los 50 y los 70 años.

Oportunidad

-

Aumento del gasto sanitario para el diagnóstico y tratamiento del cáncer

El gasto en atención sanitaria ha aumentado en todo el mundo a medida que aumenta el ingreso disponible de las personas en varios países. Además, los organismos gubernamentales y las organizaciones de atención sanitaria están tomando la iniciativa de acelerar el gasto sanitario para satisfacer las necesidades de la población. El aumento del gasto sanitario ayuda simultáneamente a los centros sanitarios a mejorar sus instalaciones de tratamiento para el diagnóstico del cáncer colorrectal, ya que el trastorno ha tenido una alta prevalencia en los últimos años.

Además, las iniciativas estratégicas que adopten los actores clave del mercado proporcionarán integridad estructural y oportunidades futuras para el mercado de diagnóstico de cáncer colorrectal en el período de pronóstico de 2023 a 2030.

Restricción/Desafío

- Mayores problemas de costes, seguridad y conveniencia

El cáncer colorrectal es mortal y el proceso de diagnóstico de este tipo de cáncer también presenta problemas de seguridad. Además, no es rentable. Uno de los trastornos médicos más costosos de tratar en América del Norte es el cáncer. Los pacientes con cáncer pueden ser hospitalizados y recibir una variedad de terapias, como cirugía, radioterapia y varias terapias sistémicas. Las primas de seguro médico para pacientes con cáncer son ahora más caras que en el pasado. Además, sus costos de copago, deducible y coaseguro están aumentando.

Impacto posterior al COVID-19 en el mercado de diagnóstico del cáncer colorrectal

La COVID-19 ha afectado positivamente al mercado. Los confinamientos y el aislamiento durante las pandemias complican el manejo de las enfermedades y la adherencia a la medicación. Por ello, el uso de diversos medicamentos de tratamiento ha aumentado ampliamente entre la población mundial. Por tanto, la pandemia ha afectado positivamente a este mercado.

Acontecimientos recientes

- En agosto de 2022, Bio-Rad Laboratories Inc. completó la adquisición de Curiosity Diagnostics, un desarrollador con sede en Polonia de soluciones tecnológicas innovadoras para los mercados de diagnóstico médico y atención médica. Esto ha ayudado a la empresa a aumentar su cartera de productos y su presencia en el mercado de América del Norte.

- En enero de 2022, QIAGEN anunció nuevas incorporaciones al creciente número de aplicaciones de QIAcuity, su plataforma de PCR digital ultrasensible (dPCR) que ha establecido nuevos estándares al utilizar las denominadas nanoplacas para procesar muestras en dos horas en lugar de las cinco horas que requieren otros sistemas. Esto ha ayudado a la empresa a ampliar su cartera de productos en el mercado y a aumentar sus ingresos generales.

Alcance del mercado de diagnóstico de cáncer colorrectal en América del Norte

El mercado de diagnóstico de cáncer colorrectal de América del Norte está segmentado por tipo de producto, tipo de prueba, tipo de cáncer, estadios del cáncer, grupo de edad y usuario final. El crecimiento entre estos segmentos le ayudará a analizar segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de producto

- Instrumentos

- Consumibles y accesorios

Según el tipo de producto, el mercado de diagnóstico de cáncer colorrectal de América del Norte está segmentado en instrumentos, consumibles y accesorios.

Tipo de prueba

- Prueba de imagen

- Examen de heces

- Marcadores tumorales

- Biopsia

- Análisis de sangre

- Otros

Según el tipo de prueba, el mercado de diagnóstico de cáncer colorrectal de América del Norte está segmentado en examen de heces, prueba de imágenes, biopsia, análisis de sangre, marcadores tumorales y otros.

Tipo de cáncer

- Adenocarcinoma

- Linfoma colorrectal

- Tumores del estroma gastrointestinal

- Tumores carcinoides

- Otros

Según el tipo de cáncer, el mercado de diagnóstico de cáncer colorrectal de América del Norte está segmentado en adenocarcinoma, linfoma colorrectal, tumores del estroma gastrointestinal, tumores carcinoides y otros.

Etapas del cáncer

- Etapa 0

- Etapa I

- Etapa ii

- Estadio iii

- Estadio IV

Sobre la base de las etapas del cáncer, el mercado de diagnóstico de cáncer colorrectal de América del Norte está segmentado en etapa 0, etapa I, etapa II, etapa III y etapa IV.

Grupo de edad

- Geriátrico

- Adultos

- Pediátrico

Según el grupo de edad, el mercado de diagnóstico de cáncer colorrectal de América del Norte está segmentado en geriátrico, adultos y pediátrico.

Usuario final

- Hospitales

- Centros de diagnóstico

- Centros de investigación del cáncer,

- Centros de cirugía ambulatoria,

- Institutos académicos

- Otros

Sobre la base de los usuarios finales, el mercado de diagnóstico de cáncer colorrectal de América del Norte está segmentado en hospitales, centros de diagnóstico, centros de investigación del cáncer, centros quirúrgicos ambulatorios, institutos académicos y otros.

Análisis y perspectivas regionales del mercado de diagnóstico de cáncer colorrectal en América del Norte

Se analiza el mercado de diagnóstico de cáncer colorrectal y se proporcionan información y tendencias del tamaño del mercado por país, tipo de producto, tipo de prueba, tipo de cáncer, estadios del cáncer, grupo de edad y usuario final, como se menciona anteriormente.

Los países cubiertos en este informe de mercado son Estados Unidos, Canadá y México.

Estados Unidos domina el mercado de diagnóstico de cáncer colorrectal en América del Norte en términos de participación de mercado e ingresos y seguirá fortaleciendo su dominio durante el período de pronóstico. Esto se debe a la alta prevalencia de cáncer colorrectal en la región y al rápido desarrollo de la investigación que está impulsando el mercado.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en las regulaciones del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos, como las ventas nuevas y de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación, son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas de América del Norte y los desafíos que enfrentan debido a la alta competencia de las marcas locales y nacionales y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los diagnósticos de cáncer colorrectal

El panorama competitivo del mercado de diagnóstico de cáncer colorrectal proporciona detalles de los competidores. Los detalles incluyen una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores solo están relacionados con el enfoque de las empresas en el mercado de diagnóstico de cáncer colorrectal.

Algunos de los principales actores que operan en el mercado de diagnóstico de cáncer colorrectal son F. Hoffmann-La Roche Ltd, Koninklijke Philips NV, Thermo Fisher Scientific Inc., Illumina, Inc., Quest Diagnostics Incorporated, CANON MEDICAL SYSTEMS CORPORATION., Bio-Rad Laboratories, Inc., Merck KGaA, FUJIFILM Corporation, Agilent Technologies, Inc., BD, Siemens Healthcare GmbH, Neusoft Corporation, BioFire Diagnostics, Myriad Genetics Inc., QIAGEN, Hologic, Inc., Time Medical Holding., FONAR Corp., PlexBio, MinFound Medical Systems Co., Ltd, FONAR, Corp.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 INDUSTRY INSIGHTS:

6 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, REGULATIONS

6.1 REGULATORY SCENARIO IN THE U.S

6.2 REGULATORY SCENARIO IN AUSTRALIA

6.3 REGULATORY SCENARIO IN JAPAN

6.4 REGULATORY SCENARIO IN CHINA

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING PREVALENCE OF COLORECTAL CANCER

7.1.2 RISE IN THE NUMBER OF PATIENTS SUFFERING FROM DIVERTICULITIS AND ULCERATIVE COLITIS.

7.1.3 RISING PREFERENCE FOR PREVENTIVE HEALTH CHECK-UPS

7.2 RESTRAINTS

7.2.1 STRINGENT REGULATORY POLICIES

7.2.2 HIGH COST FOR THE COLORECTAL CANCER TREATMENTS.

7.3 OPPORTUNITIES

7.3.1 RISE IN HEALTHCARE EXPENDITURE FOR CANCER DIAGNOSIS AND TREATMENT

7.3.2 GOVERNMENT INITIATIVES TOWARD CANCER DIAGNOSTICS

7.3.3 STRATEGIC INITIATIVES BY MARKET PLAYERS

7.4 CHALLENGES

7.4.1 INCREASED COST, SAFETY, AND CONVENIENCE ISSUES

7.4.2 LACK OF SKILLED AND CERTIFIED PROFESSIONALS

8 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 INSTRUMENTS

8.2.1 PATHOLOGY-BASED INSTRUMENTS

8.2.1.1 PCR INSTRUMENTS

8.2.1.2 SLIDE STAINING SYSTEMS

8.2.1.3 TISSUE PROCESSING SYSTEMS

8.2.1.4 CELL PROCESSORS

8.2.1.5 OTHER PATHOLOGY-BASED INSTRUMENTS

8.2.2 IMAGING INSTRUMENTS

8.2.2.1 ULTRASOUND SYSTEMS

8.2.2.2 CT SYSTEMS

8.2.2.3 MRI SYSTEMS

8.2.2.4 OTHERS

8.2.3 BIOPSY INSTRUMENTS

8.2.4 OTHERS

8.3 CONSUMABLES & ACCESSORIES

8.3.1 KITS

8.3.1.1 PCR KITS

8.3.1.2 DNA POLYMERASE KITS

8.3.1.3 NUCLEIC ACID ISOLATION KITS

8.3.1.4 OTHERS

8.3.2 REAGENTS

8.3.2.1 ASSAYS

8.3.2.2 BUFFERS

8.3.2.3 PRIMERS

8.3.2.4 OTHERS

8.3.3 OTHER CONSUMABLES

9 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE

9.1 OVERVIEW

9.2 STOOL EXAMINATION

9.3 BLOOD TEST

9.3.1 COMPLETE BLOOD COUNT (CBC)

9.3.2 TUMOR MARKER TEST

9.3.3 LIVER ENZYME BLOOD TEST

9.4 IMAGING TEST

9.4.1 COMPUTED TOMOGRAPHY (CT) SCAN

9.4.2 MRI

9.4.3 ULTRASOUND

9.4.4 POSITION EMISSION TOMOGRAPHY (PET)

9.4.5 OTHERS

9.5 TUMOR MARKERS

9.5.1 CARCINOEMBRYONIC ANTIGEN (CEA)

9.5.2 CA19-9 BIOMARKER TEST

9.5.3 CA 50 MARKER TEST

9.5.4 OTHERS

9.6 BIOPSY

9.7 OTHERS

10 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY CANCER STAGES

10.1 OVERVIEW

10.2 STAGE III

10.3 STAGE IV

10.4 STAGE II

10.5 STAGE I

10.6 STAGE 0

11 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY AGE GROUP

11.1 OVERVIEW

11.2 GERIATRIC

11.3 ADULTS

11.4 PEDIATRIC

12 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY CANCER TYPE

12.1 OVERVIEW

12.2 ADENOCARCINOMA

12.3 COLORECTAL LYMPHOMA

12.4 GASTROINTESTINAL STROMAL TUMORS

12.5 CARCINOID TUMORS

12.6 OTHERS

13 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY END USER

13.1 OVERVIEW

13.2 HOSPITALS

13.3 DIAGNOSTIC CENTERS

13.4 CANCER RESEARCH CENTERS

13.5 AMBULATORY SURGICAL CENTERS

13.6 ACADEMIC INSTITUTES

13.7 OTHERS

14 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 F. HOFFMANN- LA ROCHE LTD

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 KONINKLIJKE PHILIPS N.V.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 THERMO FISHER SCIENTIFIC INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 ILLUMINA, INC.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 QUEST DIAGNOSTICS INCORPORATED

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 ABBOTT

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 AGILENT TECHNOLOGIES, INC.

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 BD

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 BEIJING O&D BIOTECH CO., LTD.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 BIOFIRE DIAGNOSTICS

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 BIO-RAD LABORATORIES, INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 CANON MEDICAL SYSTEMS CORPORATION.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 FONAR CORP.

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 FUJIFILM CORPORATION

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 GE HEALTHCARE.

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENT

17.16 HOLOGIC, INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENT

17.17 MEDONICA CO. LTD

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 MERCK KGAA

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENT

17.19 MINFOUND MEDICAL SYSTEMS CO., LTD

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 MYRIAD GENETICS, INC.

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENT

17.21 NEUSOFT CORPORATION

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENT

17.22 PLEXBIO

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 QIAGEN

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 SIEMENS HEALTHCARE GMBH

17.24.1 COMPANY SNAPSHOT

17.24.2 REVENUE ANALYSIS

17.24.3 1.2.3 PRODUCT PORTFOLIO

17.24.4 RECENT DEVELOPMENT

17.25 STERNMED GMBH

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 TIME MEDICAL HOLDING.

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA INSTRUMENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA INSTRUMENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA PATHOLOGY-BASED INSTRUMENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA IMAGING INSTRUMENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA CONSUMABLES & ACCESSORIES IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA CONSUMABLES AND ACCESSORIES IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA KITS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA REAGENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA STOOL EXAMINATION IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA BLOOD TEST IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA BLOOD TEST IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA IMAGING TEST IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA IMAGING TEST IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA TUMOR MARKERS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA TUMOR MARKERS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA BIOPSY IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA OTHERS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY CANCER STAGES, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA STAGE III IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA STAGE IV IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA STAGE II IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA STAGE I IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA STAGE 0 IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA GERIATRIC IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA ADULTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA PEDIATRIC IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA ADENOCARCINOMA IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA COLORECTAL LYMPHOMA IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA GASTROINTESTINAL STROMAL TUMORS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA CARCINOID TUMORS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA HOSPITALS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA DIAGNOSTIC CENTERS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA CANCER RESEARCH CENTERS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA ACADEMIC INSTITUTES IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA OTHERS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA INSTRUMENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA PATHOLOGY-BASED INSTRUMENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA IMAGING INSTRUMENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA CONSUMABLES & ACCESSORIES IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA KITS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA REAGENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA BLOOD TEST IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA IMAGING TEST IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA TUMOR MARKERS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY CANCER STAGES, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 59 U.S. COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 60 U.S. INSTRUMENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 61 U.S. PATHOLOGY-BASED INSTRUMENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 62 U.S. IMAGING INSTRUMENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 63 U.S. CONSUMABLES & ACCESSORIES IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 64 U.S. KITS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 65 U.S. REAGENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 66 U.S. COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 67 U.S. BLOOD TEST IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 68 U.S. IMAGING TEST IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 69 U.S. TUMOR MARKERS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 70 U.S. COLORECTAL CANCER DIAGNOSTICS MARKET, BY CANCER STAGES, 2021-2030 (USD MILLION)

TABLE 71 U.S. COLORECTAL CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 72 U.S. COLORECTAL CANCER DIAGNOSTICS MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 73 U.S. COLORECTAL CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 74 CANADA COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 75 CANADA INSTRUMENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 76 CANADA PATHOLOGY-BASED INSTRUMENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 77 CANADA IMAGING INSTRUMENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 78 CANADA CONSUMABLES & ACCESSORIES IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 79 CANADA KITS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 80 CANADA REAGENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 81 CANADA COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 82 CANADA BLOOD TEST IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 83 CANADA IMAGING TEST IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 84 CANADA TUMOR MARKERS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 85 CANADA COLORECTAL CANCER DIAGNOSTICS MARKET, BY CANCER STAGES, 2021-2030 (USD MILLION)

TABLE 86 CANADA COLORECTAL CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 87 CANADA COLORECTAL CANCER DIAGNOSTICS MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 88 CANADA COLORECTAL CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 89 MEXICO COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 90 MEXICO INSTRUMENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 91 MEXICO PATHOLOGY-BASED INSTRUMENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 92 MEXICO IMAGING INSTRUMENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 93 MEXICO CONSUMABLES & ACCESSORIES IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 94 MEXICO KITS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 95 MEXICO REAGENTS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 96 MEXICO COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 97 MEXICO BLOOD TEST IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 98 MEXICO IMAGING TEST IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 99 MEXICO TUMOR MARKERS IN COLORECTAL CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 100 MEXICO COLORECTAL CANCER DIAGNOSTICS MARKET, BY CANCER STAGES, 2021-2030 (USD MILLION)

TABLE 101 MEXICO COLORECTAL CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 102 MEXICO COLORECTAL CANCER DIAGNOSTICS MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 103 MEXICO COLORECTAL CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 11 THE INCREASE IN THE AWARENESS ABOUT COLORECTAL CANCER IS EXPECTED TO DRIVE THE NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET GROWTH IN THE FORECAST PERIOD

FIGURE 12 THE INSTRUMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET

FIGURE 14 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2022

FIGURE 15 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY TEST TYPE, 2022

FIGURE 19 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY TEST TYPE, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY TEST TYPE, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY CANCER STAGES, 2022

FIGURE 23 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY CANCER STAGES, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY CANCER STAGES, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY CANCER STAGES, LIFELINE CURVE

FIGURE 26 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY AGE GROUP, 2022

FIGURE 27 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY AGE GROUP, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY AGE GROUP, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 30 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, 2022

FIGURE 31 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, LIFELINE CURVE

FIGURE 34 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY END USER, 2022

FIGURE 35 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 36 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 37 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 38 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: SNAPSHOT (2022)

FIGURE 39 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022)

FIGURE 40 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 41 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 42 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: PRODUCT TYPE (2023-2030)

FIGURE 43 NORTH AMERICA COLORECTAL CANCER DIAGNOSTICS MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.