North America Collagen Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

790.67 Million

USD

1,204.26 Million

2021

2029

USD

790.67 Million

USD

1,204.26 Million

2021

2029

| 2022 –2029 | |

| USD 790.67 Million | |

| USD 1,204.26 Million | |

|

|

|

Mercado de colágeno de América del Norte por tipo de producto (gelatina, colágeno hidrolizado, colágeno nativo, péptido de colágeno, otros), tipo (tipo I, tipo II, tipo III, tipo IV), forma (polvo, líquido), fuente (bovino, avícola, porcino, marino, otros), categoría de producto (OGM, no OGM), función (textura, estabilizador, emulsionante, hallazgo, otros), aplicación (productos alimenticios, bebidas, nutracéuticos y suplementos dietéticos , cosméticos y cuidado personal, alimentos para animales, pruebas de laboratorio, otros) – Tendencias de la industria y pronóstico hasta 2029

Análisis y tamaño del mercado

El uso creciente de colágeno en las industrias alimentarias, el creciente interés en el consumo de proteínas y los nutricosméticos, la creciente aplicación en el ámbito sanitario y el creciente uso de colágeno basado en biomateriales son los factores clave que impulsan el crecimiento del mercado de colágeno en América del Norte. Además, el aumento del ingreso per cápita y la expansión de la industria de procesamiento de alimentos presentan importantes oportunidades de crecimiento para los fabricantes de colágeno.

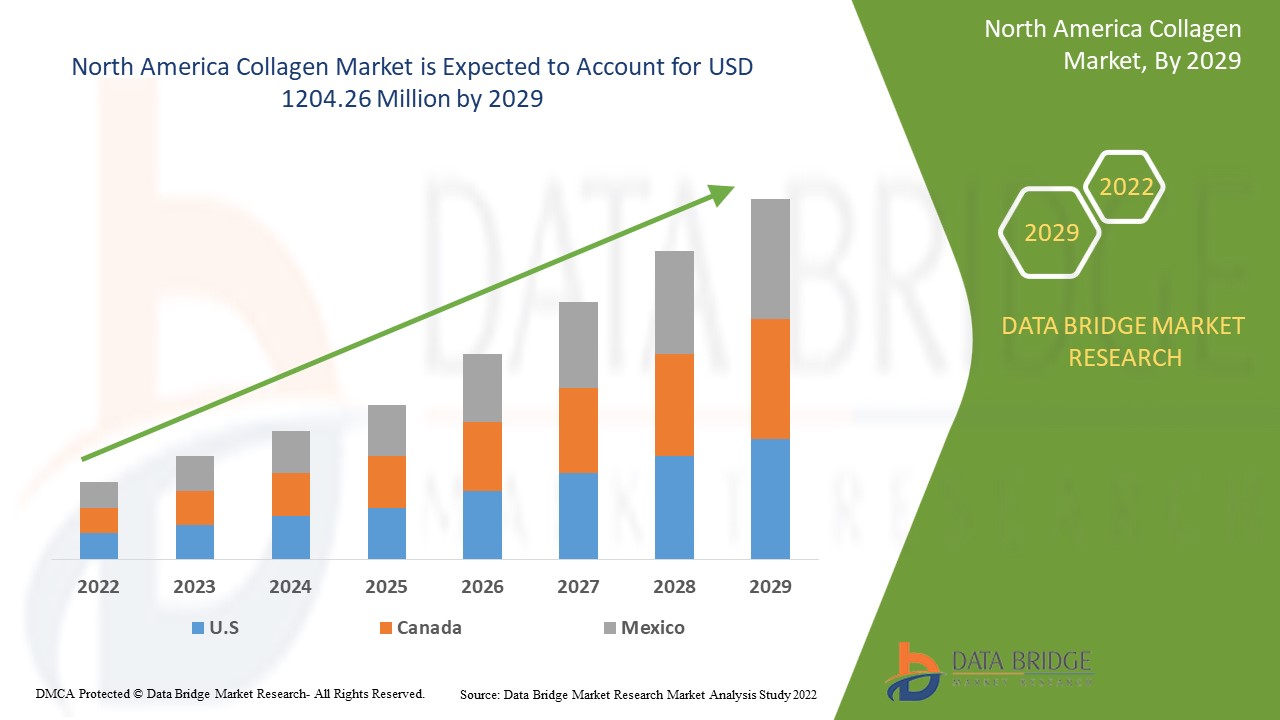

Data Bridge Market Research analiza que el mercado del colágeno se valoró en USD 790,67 millones en 2021 y se espera que alcance el valor de USD 1204,26 millones para 2029, con una CAGR del 5,4% durante el período de pronóstico de 2022 a 2029. Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado curado por el equipo de Data Bridge Market Research incluye un análisis experto en profundidad, análisis de importación/exportación, análisis de precios, análisis de consumo de producción, análisis de patentes y comportamiento del consumidor.

Alcance del informe y segmentación del mercado

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2014 - 2019) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Tipo de producto (gelatina, colágeno hidrolizado, colágeno nativo, péptido de colágeno, otros), tipo (tipo I, tipo II, tipo III, tipo IV), forma (polvo, líquido), origen (bovino, avícola, porcino, marino, otros), categoría de producto (OGM, no OGM), función (textura, estabilizador, emulsionante, hallazgo, otros), aplicación (productos alimenticios, bebidas, nutracéuticos y suplementos dietéticos, cosméticos y cuidado personal, alimentos para animales , pruebas de laboratorio, otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

Rousselot (Países Bajos), GELITA AG (Alemania), Weishardt (Francia), Tessenderlo Group NV (Bélgica), Nitta Gelatin Inc. (Japón), LAPI GELATINE Spa (Italia), ITALGELATINE SpA (Italia), Ewald-Gelatine GmbH (Alemania), REINERT GRUPPE Ingredients GmbH (Alemania), TrobasGelatine BV (Países Bajos), GELNEX (Brasil), JuncàGelatines SL (España), HolistaCollTech Ltd. (Australia), Collagen Solutions Plc (Reino Unido) y Advanced BioMatrix, Inc. (EE. UU.) |

|

Oportunidades |

|

Definición de mercado

El colágeno es una proteína estructural fibrosa insoluble que se encuentra en la matriz extracelular y en varios tejidos del cuerpo. Se sintetiza a partir de aminoácidos, glicina, hidroxiprolina y arginina. Promueve la salud cerebral, previene la pérdida ósea, alivia el dolor articular, aumenta la masa muscular, mejora el crecimiento del cabello y las uñas y mejora la fuerza y elasticidad de la piel.

Dinámica del mercado del colágeno

Conductores

- Los numerosos beneficios que ofrece el colágeno en la industria de alimentos y bebidas

El colágeno se utiliza en productos de confitería para mejorar la masticabilidad, la estabilidad de la espuma y la textura. Se utiliza como agente texturizante y estabilizador en productos lácteos. Además, actúa como agente aglutinante para los ingredientes de las barritas nutricionales y mejora la suavidad y flexibilidad de las barritas nutricionales. Como resultado de las numerosas funcionalidades que proporciona el colágeno, su uso en la industria alimentaria ha aumentado. También se utiliza para tratar la desnutrición y trastornos específicos de absorción y digestión. En términos de valor de ventas, se espera que estos factores impulsen el crecimiento del mercado del colágeno.

- Creciente aplicación del colágeno en la industria del cuidado personal

Las fibras de colágeno de la piel humana se deterioran con el tiempo, perdiendo su grosor y resistencia, lo que provoca el envejecimiento de la piel. El colágeno se utiliza en cremas cosméticas como complemento nutricional para la regeneración ósea, la regeneración del cartílago, la reconstrucción vascular y cardíaca, la sustitución de la piel y el aumento de la suavidad de la piel, entre otras cosas. El colágeno es un ingrediente que se encuentra en muchos jabones, champús, cremas faciales, lociones corporales y otros cosméticos. El colágeno hidrolizado es un componente clave en los productos para el cuidado de la piel y el cabello. En la industria del cuidado personal, el colágeno hidrolizado se combina con surfactantes y agentes de lavado activos en champús y geles de ducha.

Oportunidad

Los cambios en los estilos de vida, los hábitos alimentarios, la adopción de hábitos alimentarios occidentales, el aumento de la demanda de ingredientes funcionales en los productos alimenticios y el aumento de la actividad industrial que requiere mejoras en los procesos han contribuido al crecimiento del mercado del colágeno en las economías emergentes. Las economías emergentes ofrecen excelentes oportunidades para el crecimiento del mercado. Debido al aumento del consumo en América del Norte, los actores del mercado de varios países han estado trabajando incansablemente para aumentar la producción de colágeno. Las empresas manufactureras del sector de alimentos y bebidas están utilizando un enfoque estratégico para generar oportunidades de ingresos lucrativas.

Restricciones

Las prohibiciones culturales sobre el consumo de alimentos y bebidas de origen animal pueden actuar como una restricción al crecimiento del mercado. Además, la falta de tecnologías de procesamiento en las regiones en desarrollo dificultará aún más el crecimiento del mercado.

Este informe sobre el mercado del colágeno proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado por categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado del colágeno, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto de COVID-19 en el mercado del colágeno

La pandemia de COVID-19 ha afectado significativamente a la industria de alimentos y bebidas en su conjunto. Las normas de aislamiento han provocado una falta de suministro y una interrupción en la cadena de suministro, lo que ha perjudicado a los actores nacionales del mercado. Por otro lado, existe un aumento en la demanda de productos con un alto valor nutritivo que brinden múltiples beneficios para la salud. El colágeno se encuentra comúnmente en suplementos destinados a ayudar a la población de edad avanzada. Se espera que la demanda de suplementos a base de colágeno por parte de la población que envejece mejore la salud, la inmunidad y el bienestar general. Además, a medida que aumentan las preocupaciones de salud de los consumidores como resultado de las pandemias, están prestando más atención a las etiquetas de los productos alimenticios y bebidas. Se espera que esto cree numerosas oportunidades para que los fabricantes de alimentos y bebidas aumenten su participación en el mercado.

Acontecimientos recientes

- La marca EnviroFlight de Darling Ingredients inauguró un nuevo centro corporativo y de investigación y desarrollo en Apex, Carolina del Norte, en abril de 2021. Esta nueva instalación de investigación y desarrollo permitirá un mayor enfoque en áreas de investigación específicas, como la expansión de la base de conocimientos para usos alternativos de las larvas de la mosca soldado negra (BSFL) en la salud animal, la nutrición animal, los cosméticos y el desarrollo de otros productos.

- GELITA USA inauguró su nueva unidad de péptidos de colágeno en marzo de 2021, una unidad de producción de 30.000 pies cuadrados en el extremo sureste del complejo en el área industrial de Port Neal, cerca de Sioux City, Iowa. Esta expansión está impulsada principalmente por el crecimiento de dos dígitos del mercado de péptidos de colágeno de GELITA, particularmente en los mercados de salud y belleza, que no muestra signos de disminuir en el futuro cercano.

Alcance del mercado de colágeno en América del Norte

El mercado del colágeno está segmentado en función del tipo de producto, tipo, forma, fuente, categoría de producto, función y aplicación. El crecimiento entre estos segmentos le ayudará a analizar los escasos segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de producto

- Gelatina

- Colágeno hidrolizado

- Colágeno nativo

- Péptido de colágeno

- Otros

Tipo

- Tipo 1

- Tipo 2

- Tipo 3

- Tipo 4

Forma

- Polvo

- Líquido

Fuente

- Bovino

- Ganado

- Búfalos

- Yak

- Otros

- Aves de corral

- Porcino

- Marina

- Otros

Categoría de producto

- OGM

- NO GMO

Función

- Textura

- Estabilizador

- Emulsionante

- Descubrimiento

- Otros

Solicitud

- Productos farmacéuticos

- Productos cosméticos

- Nutracéuticos

- Suplementos deportivos

- Productos alimenticios

- Bebidas

- Suplementos dietéticos

- Cosmética y cuidado personal

- Alimento para animales

- Pruebas de laboratorio

- Otros

Análisis y perspectivas regionales del mercado del colágeno

Se analiza el mercado de colágeno y se proporcionan información y tendencias del tamaño del mercado por país, tipo de producto, tipo, forma, fuente, categoría de producto, función y aplicación como se menciona anteriormente.

Los países cubiertos en el informe del mercado de colágeno son Estados Unidos, Canadá y México.

Se espera que Estados Unidos domine el mercado debido a la creciente aceptación del colágeno en una variedad de aplicaciones como suplementos dietéticos. Además, Canadá es dominante debido a la creciente industria alimentaria del país, que utiliza ampliamente el colágeno como ingrediente alimentario.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y la cuota de mercado del colágeno

El panorama competitivo del mercado del colágeno proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento del producto, la amplitud y la variedad del producto, el dominio de la aplicación. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado del colágeno.

Algunos de los principales actores que operan en el mercado del colágeno son:

- Rousselot (Países Bajos)

- GELITA AG (Alemania)

- Weishardt (Francia)

- Tessenderlo Group NV (Bélgica)

- Nitta Gelatin Inc. (Japón)

- Gelatina Lapi Spa (Italia)

- ITALGELATINE SpA (Italia)

- Ewald-Gelatine GmbH (Alemania)

- REINERT GRUPPE Ingredients GmbH (Alemania)

- TrobasGelatine BV (Países Bajos)

- GELNEX (Brasil)

- JuncàGelatines SL (España)

- HolistaCollTech Ltd. (Australia)

- Collagen Solutions Plc (Reino Unido)

- Advanced BioMatrix, Inc. (Estados Unidos)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA COLLAGEN MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION METHOD COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT EXPORT ANALYSIS

4.2 NORTH AMERICA COLLAGEN MARKET: LIST OF SUBSTITUTES

4.3 NORTH AMERICA COLLAGEN MARKET: MARKETING STRATEGIES

4.3.1 LAUNCHING NEW INNOVATIVE PRODUCTS

4.3.2 PROMOTION OF THEIR PRODUCTS BY EMPHASIZING DIFFERENT APPLICATIONS

4.3.3 A VAST NETWORK OF DISTRIBUTION

4.3.4 LAUNCHING CLEAN, SUSTAINABLE AND ORGANIC PRODUCTS FOR HEALTH-CONSCIOUS CONSUMERS

4.3.5 POPULARITY OF PLANT-BASED MEAT ALTERNATIVE

4.4 NORTH AMERICA COLLAGEN MARKET: PATENT ANALYSIS

4.4.1 DBMR ANALYSIS

4.4.2 COUNTRY-LEVEL ANALYSIS

4.4.3 YEARWISE ANALYSIS

4.4.4 PATENT ANALYSIS BY COMPANY

4.5 NORTH AMERICA COLLAGEN MARKET: PRODUCTION & CONSUMPTION PATTERN

4.6 NORTH AMERICA COLLAGEN MARKET: RAW MATERIAL PRICING ANALYSIS

5 REGULATORY FRAMEWORK

6 IMPACT OF COVID-19 IMPACT ON THE NORTH AMERICA COLLAGEN MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA COLLAGEN MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE NORTH AMERICA COLLAGEN MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING USAGE OF COLLAGEN PRODUCTS IN THE COSMETIC INDUSTRY

7.1.2 SUBSTANTIAL DEMAND FOR THE COLLAGEN PRODUCTS AS FOOD STABILIZER

7.1.3 RISING COLLAGEN AS INGREDIENTS IN SUPPLEMENTS FOR SPORTS ATHLETES

7.1.4 GROWTH IN THE USE OF COLLAGEN PROTEINS IN THE MEDICAL AND PHARMACEUTICAL INDUSTRY

7.1.5 GROWTH OF FISHING INDUSTRY TO USE FISH AS A RAW MATERIAL FOR GELATIN PRODUCTION

7.2 RESTRAINTS

7.2.1 INCREASING STRINGENT REGULATIONS REGARDING THE USE OF FOOD ADDITIVES

7.2.2 REGULATIONS OVER THE IMPORTS OF RAW MATERIAL FOR THE PRODUCTION OF GELATIN AND COLLAGEN PRODUCTS IN EUROPEAN UNION

7.2.3 RISK OF DISEASE TRANSFER FROM ANIMAL SOURCES

7.2.4 REGULATIONS UPON THE SLAUGHTERING OF FARM AND POULTRY ANIMALS

7.3 OPPORTUNITIES

7.3.1 RISING COLLAGEN APPLICATION AS BIOMATERIALS IN THE LABORATORIES

7.3.2 RECENT TECHNOLOGICAL ADVANCEMENTS, INCLUDING THE FORMATION OF COLLAGEN-BASED PELLET AS GENE DELIVERY CARRIER

7.3.3 RISING COLLAGEN AS INGREDIENTS IN SUPPLEMENTS FOR SPORTS ATHLETES

7.4 CHALLENGES

7.4.1 LACK OF ADVANCED PROCESSING TECHNOLOGIES FOR COLLAGEN EXTRACTION

7.4.2 HIGH PROCESSING COSTS IN THE COLLAGEN INDUSTRY

7.4.3 COMPLICATED GMO CERTIFICATION PROCESS FOR COLLAGEN PRODUCTS LABELLING

8 NORTH AMERICA COLLAGEN MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 GELATIN

8.3 HYDROLYZED COLLAGEN

8.4 NATIVE COLLAGEN

8.5 COLLAGEN PEPTIDE

8.6 OTHERS

9 NORTH AMERICA COLLAGEN MARKET, BY TYPE

9.1 OVERVIEW

9.2 TYPE I

9.3 TYPE II

9.4 TYPE III

9.5 TYPE IV

10 NORTH AMERICA COLLAGEN MARKET, BY FORM

10.1 OVERVIEW

10.2 POWDER

10.3 LIQUID

11 NORTH AMERICA COLLAGEN MARKET, BY SOURCE

11.1 OVERVIEW

11.2 BOVINE

11.3 POULTRY

11.4 PORCINE

11.5 MARINE

11.6 OTHERS

12 NORTH AMERICA COLLAGEN MARKET, BY PRODUCT CATEGORY

12.1 OVERVIEW

12.2 GMO

12.3 NON-GMO

13 NORTH AMERICA COLLAGEN MARKET, BY FUNCTION

13.1 OVERVIEW

13.2 TEXTURE

13.3 STABILIZER

13.4 EMULSIFIER

13.5 FINDING

13.6 OTHERS

14 NORTH AMERICA COLLAGEN MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 FOOD PRODUCTS

14.3 BEVERAGES

14.4 NUTRACEUTICALS AND DIETARY SUPPLEMENTS

14.5 COSMETICS AND PERSONAL CARE

14.6 ANIMAL FEED

14.7 LABORATORY TESTS

14.8 OTHERS

15 NORTH AMERICA COLLAGEN MARKET, BY REGION

15.1 NORTH AMERICA

16 NORTH AMERICA COLLAGEN MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 GELITA AG

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCT PORTFOLIO

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 RECENT DEVELOPMENTS

18.2 ROUSSELOT

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCT PORTFOLIO

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 RECENT DEVELOPMENTS

18.3 DSM

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 ASHLAND

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 WEISHARDT

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 RECENT DEVELOPMENTS

18.6 AMICOGEN

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 ITALGELATINE S.P.A.

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 ADVANCED BIOMATRIX, INC.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 COBIOSA

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 COLLAGEN SOLUTIONS PLC

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 CONNOILS LLC

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 ET-CHEM

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 EWALD-GELATINE GMBH

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 GELNEX

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 HOLISTA COLLTECH

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 JELLAGEN

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 JUNCÀ GELATINES SL

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 KENNEY & ROSS LIMITED MARINE GELATIN

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 LAPI GELATINE S.P.A.

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 NIPPI COLLAGEN NA INC.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 NORLAND PRODUCTS INC.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 PB LEINER (A PART OF TESSENDERLO GROUP)

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS

18.23 SMPNUTRA

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 TITAN BIOTECH

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENT

18.25 VITAL PROTEINS LLC

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF PRODUCT: 3503 GELATIN …HS CODE: 3503 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PRODUCT: 3503 GELATIN …HS CODE: 3503 (USD THOUSAND)

TABLE 3 IMPORT DATA OF PRODUCT: 3504 PEPTONES AND THEIR DERIVATIVES; OTHER PROTEIN SUBSTANCES AND THEIR DERIVATIVES, N.E.S.; HIDE…HS CODE: 3504 (USD THOUSAND)

TABLE 4 EXPORT DATA OF 3504 PEPTONES AND THEIR DERIVATIVES; OTHER PROTEIN SUBSTANCES AND THEIR DERIVATIVES, N.E.S.; HIDE…HS CODE: 3504 (USD THOUSAND)

TABLE 5 COLLAGEN RAW MATERIAL PRICE ANALYSIS IN 2020 (PER KGS)

TABLE 6 PERCENTAGE OF COLLAGEN YIELD FROM DIFFERENT SOURCES

TABLE 7 FOUR COMMON TYPES OF COLLAGEN AND THEIR RESPECTIVE LOCATION

Lista de figuras

FIGURE 1 NORTH AMERICA COLLAGEN MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA COLLAGEN MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA COLLAGEN MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA COLLAGEN MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA COLLAGEN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA COLLAGEN MARKET: THE PRODUCT TYPE LIFELINE CURVE

FIGURE 7 NORTH AMERICA COLLAGEN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 NORTH AMERICA COLLAGEN MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA COLLAGEN MARKET: SEGMENTATION

FIGURE 13 ASIA PACIFIC IS EXPECTED TO DOMINATE THE NORTH AMERICA COLLAGEN MARKET, AND EUROPE IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 GROWTH IN THE USE OF COLLAGEN PROTEINS IN THE MEDICAL AND PHARMACEUTICAL INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA COLLAGEN MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 15 COLLAGEN DEVICES IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA COLLAGEN MARKET IN 2021 & 2028

FIGURE 16 PATENT REGISTERED FOR COLLAGEN BY COUNTRY (2016 - 2021)

FIGURE 17 PATENT REGISTERED YEAR (2016 - 2021)

FIGURE 18 CONCENTRATION OF EACH AMINO ACID IN HYDROLYSED COLLAGEN (IN %)

FIGURE 19 NORTH AMERICA COLLAGEN MARKET BY PRODUCTION (USD MILLION)

FIGURE 20 CONSUMPTION OF COLLAGEN BY REGION (USD MILLION)

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA COLLAGEN MARKET

FIGURE 22 ESTIMATED PRODUCTION OF COSMETICS IN THAILAND (2017-2020) (USD BILLION)

FIGURE 23 PERCENTAGE OF SPORTS NUTRITION NEW PRODUCT LAUNCHES TRACKED WITH COLLAGEN NORTH AMERICALY (2012-2016)

FIGURE 24 NORTH AMERICA COLLAGEN MARKET: BY PRODUCT TYPE, 2020

FIGURE 25 NORTH AMERICA COLLAGEN MARKET: BY TYPE, 2020

FIGURE 26 NORTH AMERICA COLLAGEN MARKET: BY FORM, 2020

FIGURE 27 NORTH AMERICA COLLAGEN MARKET: BY SOURCE, 2020

FIGURE 28 NORTH AMERICA COLLAGEN MARKET: BY PRODUCT CATEGORY, 2020

FIGURE 29 NORTH AMERICA COLLAGEN MARKET: BY FUNCTION, 2020

FIGURE 30 NORTH AMERICA COLLAGEN MARKET: BY APPLICATION, 2020

FIGURE 31 NORTH AMERICA COLLAGEN MARKET: SNAPSHOT, 2020

FIGURE 32 NORTH AMERICA COLLAGEN MARKET: BY COUNTRY, 2020

FIGURE 33 NORTH AMERICA COLLAGEN MARKET: BY COUNTRY, 2020

FIGURE 34 NORTH AMERICA COLLAGEN MARKET: BY COUNTRY, 2020

FIGURE 35 NORTH AMERICA COLLAGEN MARKET: BY PRODUCT TYPE, 2020

FIGURE 36 NORTH AMERICA COLLAGEN MARKET: COMPANY SHARE 2020 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.