North America Chinese Hamster Ovary Cells Cho Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

158.66 Million

USD

293.69 Million

2024

2032

USD

158.66 Million

USD

293.69 Million

2024

2032

| 2025 –2032 | |

| USD 158.66 Million | |

| USD 293.69 Million | |

|

|

|

|

Segmentación de células de ovario de hámster chino (CHO) en América del Norte, tipo (servicios y productos), sistema (sistema de selección metabólica, sistema de selección de antibióticos y otros), aplicación (investigación médica y biológica), usuario final (empresas biofarmacéuticas, empresas de biotecnología, organizaciones de desarrollo clínico y fabricación, organizaciones de investigación clínica, institutos académicos y organizaciones de investigación, entre otros), canal de distribución (licitaciones directas, ventas minoristas y otros), país (EE. UU., Canadá, México): tendencias de la industria y pronóstico hasta 2032

Tamaño del mercado de células de ovario de hámster chino (CHO) en América del Norte

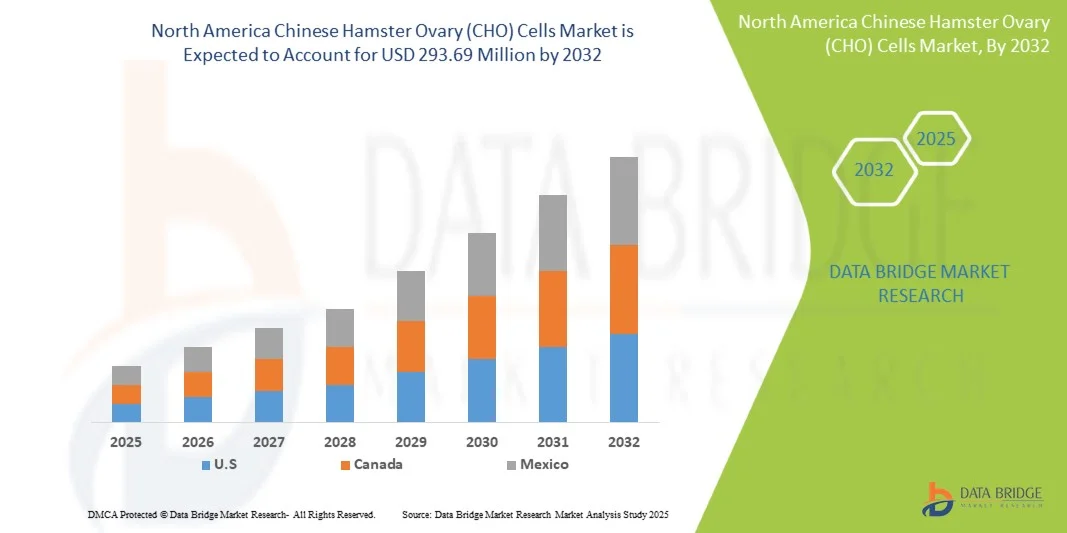

- El mercado de células de ovario de hámster chino (CHO) de América del Norte se valoró en USD 158,66 millones en 2024 y se espera que alcance los USD 293,69 millones para 2032.

- Durante el período de pronóstico de 2025 a 2032, es probable que el mercado crezca a una CAGR del 8,0 %, impulsado principalmente por el creciente uso de células CHO en el estudio genético.

- Este crecimiento está impulsado por factores como la creciente demanda de productos biológicos, los avances en la ingeniería de líneas celulares, las crecientes inversiones en investigación biotecnológica y la expansión de las aplicaciones en terapia genética.

Análisis del mercado de células de ovario de hámster chino (CHO) en Norteamérica

- Las células de ovario de hámster chino (CHO) son una línea celular de mamíferos comúnmente utilizada en biotecnología e investigación biomédica, en particular en el campo del cultivo celular y el bioprocesamiento. Estas células se han convertido en herramientas esenciales en biotecnología e investigación biomédica. Las células CHO son conocidas por su adherencia a las superficies de cultivo, su robusto crecimiento y su capacidad para expresar proteínas recombinantes.

- Uno de los principales usos de las células CHO es la producción de proteínas recombinantes, incluyendo anticuerpos y enzimas terapéuticas. Pueden modificarse genéticamente para expresar genes específicos de interés, y su capacidad para realizar modificaciones postraduccionales similares a las de las células humanas garantiza la calidad de los productos biofarmacéuticos. Las células CHO también son reconocidas por su estabilidad genética, lo que significa que introducen modificaciones genéticas consistentemente a lo largo de múltiples generaciones, lo que garantiza la fiabilidad y consistencia del bioprocesamiento.

- Se espera que en 2025, el segmento de servicios domine el mercado con una participación de mercado del 65,50% debido a la creciente demanda de servicios especializados relacionados con el desarrollo de líneas celulares CHO, bioprocesamiento y fabricación por contrato.

Alcance del informe y segmentación del mercado de microscopios oftálmicos

|

Atributos |

Microscopios quirúrgicos oftálmicos: perspectivas clave del mercado |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de células de ovario de hámster chino (CHO) en América del Norte

“Creciente integración de la inteligencia artificial (IA) en el desarrollo de líneas celulares”

- Una tendencia destacada en el mercado de células de ovario de hámster chino (CHO) de América del Norte es la creciente integración de la inteligencia artificial (IA) en el desarrollo de líneas celulares y la optimización de bioprocesos.

- Se están utilizando algoritmos de IA para analizar grandes conjuntos de datos, predecir condiciones de cultivo óptimas e identificar clones de alto rendimiento de manera más eficiente que los métodos tradicionales.

- Por ejemplo, los modelos de aprendizaje automático pueden procesar datos experimentales para predecir el rendimiento celular, reduciendo el tiempo y el costo asociados con los enfoques de prueba y error en la producción basada en células CHO.

- Esta tecnología permite plazos de desarrollo más rápidos, una mejor calidad del producto y una mejor escalabilidad para la fabricación de productos biológicos.

- El uso de IA está transformando la investigación y la biofabricación de células CHO, lo que genera una mayor eficiencia, menores costos de desarrollo y una ventaja competitiva para las empresas que adoptan soluciones digitales avanzadas.

Dinámica del mercado de células de ovario de hámster chino (CHO) en América del Norte

Conductor

“Aumento del uso de células CHO en el estudio genético”

- El creciente uso de células de ovario de hámster chino (CHO) en la investigación genética es un claro impulsor del mercado norteamericano de CHO. A medida que las herramientas genéticas (CRISPR, RMCE, secuenciación de ARN, multiómica unicelular) evolucionan, las células CHO ya no son simplemente huéspedes de producción; se convierten en plataformas experimentales para analizar las relaciones genotipo-fenotipo, probar estrategias de edición genética y diseñar racionalmente las características del huésped (crecimiento, productividad, glicosilación, tolerancia al estrés).

- Ese cambio expande la demanda a través de tres vectores de mercado vinculados: (1) upstream: líneas celulares CHO autorizadas y diseñadas y servicios de edición genética; (2) desarrollo de procesos: herramientas analíticas, ómicas, de gemelos digitales e inteligencia artificial necesarias para traducir los conocimientos genéticos en clones estables de alto rendimiento; y (3) fabricación: capacidad de CDMO y plataformas continuas/de un solo uso optimizadas para huéspedes genéticamente mejorados.

- En resumen, la actividad de estudios genéticos alimenta un ecosistema en expansión (software, análisis, bancos de células, reactivos, ejecuciones CDMO), lo que aumenta tanto la amplitud como la profundidad de las ofertas comerciales de CHO y, por lo tanto, incrementa el tamaño del mercado, la facturación y la importancia estratégica de las capacidades de fabricación derivadas de CHO.

- Por ejemplo, en enero de 2025, un artículo en el NIH afirmó que se había publicado un conjunto de datos de detección de knockout CRISPR no viral a escala del genoma para CHO-K1 y células recombinantes derivadas (Sci Data), lo que proporciona un recurso integral para identificar genes que afectan la aptitud celular y la producción de proteínas, evidencia de que la detección genómica funcional en CHO ahora está madura, documentada públicamente e informa directamente a los programas de ingeniería celular.

- En abril de 2025, un artículo publicado en el NIH afirmó que un metaanálisis de los transcriptomas de CHO ("Genes fantásticos...") fue aceptado/publicado en PMC (acceso abierto) después de una revisión a principios de 2025; el artículo integra datos de ARN-seq y epigenéticos de cientos de muestras de CHO y destaca la necesidad de ingeniería genética dirigida para controlar los programas de expresión; esto es evidencia directa de que los estudios genómicos/epigenómicos de CHO están definiendo objetivos de ingeniería para la mejora de líneas celulares industriales.

- El creciente uso de células CHO en estudios genéticos no sólo refuerza su dominio como sistema de expresión estándar de oro para productos biológicos, sino que también amplía su papel como plataformas experimentales para la genómica funcional, las pruebas regulatorias y la ingeniería celular.

Oportunidad

“Desarrollo continuo de tecnologías de cultivo celular”

- Los avances continuos en las tecnologías de cultivo celular están creando un conjunto de oportunidades únicas para el mercado de células de ovario de hámster chino (CHO) de América del Norte.

- Las mejoras en el diseño de biorreactores y los procesos de perfusión, junto con la ingeniería de líneas celulares de precisión, herramientas de integración específicas del sitio y la optimización de procesos impulsada por aprendizaje automático, están aumentando de manera constante la productividad, la estabilidad y la calidad del producto de los CHO, al tiempo que reducen los costos por lote.

- Por ejemplo, en junio de 2021, la Organización Mundial de la Salud informó que estaba apoyando a un consorcio sudafricano para establecer el primer centro de transferencia de tecnología de vacunas de ARNm contra la COVID-19 para desarrollar capacidad de fabricación regional y compartir conocimientos para la producción de productos biológicos avanzados.

- En abril de 2022, Medicines Patent Pool informó que la Organización Mundial de la Salud y el MPP habían anunciado que 15 fabricantes recibirían capacitación del programa de transferencia de tecnología de ARNm de la OMS, lo que demuestra un esfuerzo público continuo y de varios años para difundir la capacidad de fabricación avanzada de vacunas y productos biológicos.

- Los casos seleccionados muestran colectivamente que el desarrollo continuo de las tecnologías de cultivo celular ya no se limita a laboratorios aislados o hojas de ruta de proveedores, sino que se está acelerando activamente mediante esfuerzos públicos coordinados, actualizaciones regulatorias e innovaciones técnicas revisadas por pares.

Restricción/Desafío

El alto costo de la producción de células CHO como restricción del mercado

- Los altos costos de capital y operativos asociados con la producción de productos biológicos basados en células CHO representan una restricción importante en el mercado de células CHO de América del Norte.

- Las grandes inversiones iniciales en capacidad de biorreactores, salas blancas, sistemas de un solo uso o infraestructura de acero inoxidable y equipos especializados de purificación posterior, combinadas con materias primas costosas (medios, resinas de cromatografía), mano de obra calificada, cumplimiento normativo complejo y plazos de validación prolongados, aumentan el costo total de propiedad para los fabricantes y los CDMO.

- Estas presiones de costos incrementan el tiempo de comercialización, comprimen los márgenes, desalientan a los desarrolladores más pequeños a fabricar internamente y pueden desacelerar la adopción en regiones de menores ingresos; en conjunto, restringen la demanda de nuevas líneas celulares, consumibles y contratos de servicios vinculados a las plataformas CHO.

- Por ejemplo, en julio de 2025, la Oficina del Subsecretario de Planificación y Evaluación (HHS-ASPE) del Departamento de Salud y Servicios Humanos de los EE. UU. publicó un informe informativo en el que se señalaba que el gasto en productos biológicos había aumentado considerablemente y que la complejidad y el perfil de costos de los productos biológicos (desarrollo y fabricación) son impulsores materiales del aumento de los gastos en medicamentos, lo que subraya la restricción económica que plantean los costos de fabricación de productos biológicos/CHO.

- En marzo de 2024, la Comisión Europea publicó material de políticas e investigación (análisis del Centro Común de Investigación/DG R&I) en el que se señala que la biotecnología y la biofabricación requieren equipos altamente especializados y una fuerza laboral multidisciplinaria calificada, factores que aumentan los costos unitarios de fabricación y presentan barreras para ampliar la producción en toda la UE.

- A pesar de ser el estándar de oro para la producción de proteínas terapéuticas y anticuerpos monoclonales, la fabricación a partir de células CHO sigue estando significativamente limitada por su elevada estructura de costos. Los requisitos de infraestructura, que requieren un alto capital, las costosas materias primas, la necesidad de mano de obra especializada y los rigurosos procesos de cumplimiento normativo, elevan los gastos generales de producción, lo que limita la participación de empresas más pequeñas y dificulta su acceso a los mercados emergentes.

Mercado de células de ovario de hámster chino (CHO) en América del Norte

El mercado está segmentado según el tipo, sistema, aplicación, usuario final y canal de distribución.

- Por tipo

Según el tipo, el mercado se segmenta en servicios, productos y otros. En 2025, se espera que el segmento de servicios domine el mercado con un 66,50% y sea el de mayor crecimiento, con una tasa de crecimiento anual compuesta (TCAC) del 8,3%. Este crecimiento se puede atribuir a la creciente dependencia de las organizaciones de investigación por contrato (CRO) y las organizaciones de desarrollo y fabricación por contrato (CDMO) para el desarrollo de líneas celulares especializadas, la optimización de procesos y la biofabricación a gran escala. Además, la creciente complejidad de la producción de productos biológicos, los altos costos asociados con las instalaciones internas y la creciente demanda de soluciones personalizadas están animando a las empresas farmacéuticas y biotecnológicas a externalizar más servicios. Estos factores, en conjunto, impulsan la expansión del segmento de servicios, mejorando su cuota de mercado y su potencial de crecimiento durante el período de pronóstico.

- Por sistema

Según el sistema, el mercado se segmenta en Sistemas de Selección Metabólica, Sistemas de Selección de Antibióticos y Otros. En 2025, se espera que el segmento de Sistemas de Selección Metabólica domine el mercado con un 58,17% y sea el de mayor crecimiento, con una tasa de crecimiento anual compuesta (TCAC) del 8,3%. Este crecimiento se debe principalmente a la creciente adopción de sistemas de selección metabólica para la producción estable y de alto rendimiento de proteínas recombinantes, ya que eliminan la necesidad de marcadores de resistencia a antibióticos, reducen las preocupaciones regulatorias y mejoran la eficiencia del cultivo. Además, la creciente preferencia por técnicas de desarrollo de líneas celulares más seguras, rentables y escalables en la fabricación de productos biológicos y biosimilares impulsa aún más la expansión de este segmento.

- Por aplicación

Según la aplicación, el mercado se segmenta en productos biológicos e investigación médica. En 2025, se espera que el segmento de productos biológicos domine el mercado con un 71,48 % y sea el de mayor crecimiento, con una tasa de crecimiento anual compuesta (TCAC) del 8,2 %. Este crecimiento se atribuye principalmente a la creciente demanda de proteínas terapéuticas, anticuerpos monoclonales y vacunas, junto con la creciente prevalencia de enfermedades crónicas y autoinmunes. Además, los avances en las tecnologías de bioprocesamiento, la expansión de las inversiones en I+D biofarmacéutica y la creciente adopción de células de ovario de hámster chino (CHO) para la producción de productos biológicos escalables y de alta calidad impulsan aún más el dominio y la rápida expansión del segmento de productos biológicos en el mercado.

- Por el usuario final

Sobre la base del usuario final, el mercado está segmentado en Compañías Biofarmacéuticas, Compañías Biotecnológicas, Organizaciones de Desarrollo Clínico y Fabricación, Organizaciones de Investigación Clínica, Institutos Académicos y Organizaciones de Investigación, y Otros. En 2025, se espera que el segmento de Compañías Biofarmacéuticas domine el mercado con un 43,07%. Este dominio está impulsado por el creciente enfoque de las compañías biofarmacéuticas en el desarrollo de productos biológicos, anticuerpos monoclonales y terapias génicas, que dependen en gran medida de líneas celulares avanzadas como las células CHO para la producción de proteínas de alto rendimiento y alta calidad. Además, el aumento de las inversiones en I+D, la expansión de las líneas de productos biológicos y la necesidad de procesos de producción escalables y rentables refuerzan aún más la posición de liderazgo de las compañías biofarmacéuticas en el mercado.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en licitaciones directas, ventas minoristas y otros. En 2025, se espera que el segmento de licitaciones directas domine el mercado con un 55,46%, y que las ventas minoristas sean el segmento de mayor crecimiento, con una tasa de crecimiento anual compuesta (TCAC) del 7,8%. El predominio de las licitaciones directas se debe a las compras a granel por parte de grandes organizaciones biofarmacéuticas y de investigación que buscan rentabilidad, un suministro fiable y contratos a largo plazo. Por otro lado, el rápido crecimiento de las ventas minoristas se ve impulsado por la creciente accesibilidad de los productos de investigación a laboratorios e institutos académicos más pequeños, la creciente demanda de kits listos para usar y la expansión de las plataformas de comercio electrónico para suministros científicos, lo que facilita la disponibilidad de los productos para diversos usuarios finales.

Análisis regional del mercado de células de ovario de hámster chino (CHO) en América del Norte

América del Norte es la región dominante en las células de ovario de hámster chino (CHO)

- Estados Unidos tiene la mayor participación en el mercado de células CHO de América del Norte, impulsado por una industria biofarmacéutica bien establecida, una infraestructura de atención médica avanzada y la fuerte presencia de empresas farmacéuticas y biotecnológicas líderes.

- Estados Unidos, en particular, contribuye significativamente al dominio regional debido al alto gasto en I+D, la creciente demanda de productos biológicos y el uso extensivo de células CHO en la producción de proteínas terapéuticas como los anticuerpos monoclonales.

- El apoyo gubernamental al desarrollo de productos biológicos, sumado a marcos regulatorios sólidos y políticas de reembolso favorables, impulsa aún más el crecimiento del mercado. Además, las colaboraciones estratégicas, los avances tecnológicos en el desarrollo de líneas celulares y el aumento de las aprobaciones de la FDA para productos derivados de células CHO continúan impulsando la expansión del mercado en toda la región .

Perspectiva del mercado de células CHO de EE. UU.

- El mercado de células CHO de EE. UU. representó la mayor participación en los ingresos del mercado de células CHO de América del Norte en 2025, atribuido a la industria biofarmacéutica bien establecida del país, las importantes inversiones en I+D, la presencia de importantes empresas biotecnológicas y farmacéuticas, la infraestructura avanzada de fabricación de productos biológicos y el fuerte apoyo del gobierno a la innovación en el desarrollo de líneas celulares y la producción de productos biológicos.

Perspectiva del mercado de células CHO de Canadá

- Se espera que el mercado de células CHO de Canadá registre una CAGR significativa en América del Norte entre 2025 y 2032, impulsado por las crecientes inversiones en investigación biofarmacéutica, la creciente adopción de tecnologías avanzadas de líneas celulares, la expansión de las instalaciones de producción de productos biológicos y biosimilares y las iniciativas gubernamentales de apoyo que promueven la biotecnología y la innovación en las ciencias de la vida.

Cuota de mercado de células de ovario de hámster chino (CHO) en América del Norte

El panorama competitivo del mercado ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia en Norteamérica, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los principales líderes del mercado que operan en el mercado son:

- Thermo Fisher Scientific Inc. (EE. UU.)

- AcceGen (EE. UU.)

- RayBiotech Life, Inc. (EE. UU.)

- Cytion (Alemania)

- BPS Bioscience, Inc. (EE. UU.)

- GenTarget Inc. (EE. UU.)

- Merck KGaA (Alemania)

- Promega Corporation (EE. UU.)

- Abeomics (EE. UU.)

- Applied Biological Materials Inc. (Canadá)

- ATCC (EE.UU.)

- Sartorius AG (Alemania)

- Lonza (Suiza)

- Revvity Discovery Limited (EE. UU.)

- Cytiva (EE. UU.)

- GTP Bioways (Francia)

- Curia North America, Inc. (EE. UU.)

- Abbott (EE. UU.)

Últimos avances en células de ovario de hámster chino (CHO) en América del Norte

- En febrero de 2022, Sartorius adquirió el negocio de Novasep y añadió una oferta complementaria a su portafolio de cromatografía. El portafolio adquirido incluye sistemas de cromatografía especialmente diseñados para biomoléculas pequeñas como oligonucleótidos, péptidos e insulina, así como sistemas innovadores para la producción continua de biofármacos.

- En julio de 2023, Lonza lanzó TheraPRO CHO Media System, un nuevo medio de cultivo celular que simplifica los procesos y optimiza la productividad y la calidad de las proteínas al utilizar líneas celulares GS-CHO. La startup apoya a empresas farmacéuticas y biotecnológicas que producen proteínas terapéuticas para mejorar aún más la calidad de sus productos. TheraPRO CHO Media System ofrece un rendimiento eficiente, logrando altas concentraciones de células viables y títulos de proteínas superiores a 5 g/L durante un período de cultivo de 15 días. Esto representa más del doble del título de proteínas que se puede producir con soluciones comerciales. Este lanzamiento ha ayudado a la empresa a ampliar su cartera de productos en el mercado.

- En octubre de 2022, Thermo Fisher Scientific Inc. colaboró con ProBioGen para desarrollar una plataforma mejorada: el kit de desarrollo de líneas celulares Gibco Freedom ExpiCHO-S. Este kit permite generar líneas celulares aptas para el desarrollo clínico sin necesidad de células, vectores ni experiencia previa en el campo. ProBioGen contribuyó significativamente al rendimiento del kit Freedom ExpiCHO-S aprovechando su sólida experiencia en el desarrollo de líneas celulares y procesos. La nueva serie utiliza la línea celular ExpiCHO-S de Thermo Fisher, ampliando así la cartera de productos de la compañía para el desarrollo de líneas celulares CHO.

- En julio de 2023, Merck anunció la expansión de sus instalaciones en Lenexa, Kansas, EE. UU., añadiendo 9100 metros cuadrados de espacio de laboratorio y capacidad de producción para la elaboración de medios de cultivo celular. Esta expansión convierte a Lenexa en la planta de cultivo celular en polvo seco más grande de la compañía y en un centro de excelencia en Norteamérica. La inversión en la región refleja la estrategia de la compañía de expandir y diversificar su cadena de suministro para satisfacer la demanda actual y futura de plataformas de cultivo celular.

- En noviembre de 2022, la ATCC, la principal organización mundial de regulación y estandarización de materiales biológicos, anunció una nueva línea de células reporteras de luciferasa CAR-T Target para apoyar el descubrimiento en inmunooncología (IO) y el desarrollo de nuevas inmunoterapias. Estos modelos presentan una alta expresión endógena de antígenos diana del receptor de antígeno quimérico (CAR-T) relevantes, como HER2, CD19 y CD20. Estas nuevas herramientas de IO incluyen líneas celulares de cánceres hematológicos y tumores sólidos que expresan un reportero de luciferasa. Esto ayudó a la empresa a ampliar su cartera de productos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTER'S FIVE FORCES ANALYSIS

4.3 PATENT ANALYSIS – NORTH AMERICA CHO CELLS MARKET

4.3.1 PATENT QUALITY AND STRENGTH

4.3.2 PATENT FAMILIES

4.3.3 LICENSING AND COLLABORATIONS

4.3.4 COMPETITIVE LANDSCAPE

4.3.5 IP STRATEGY AND MANAGEMENT

4.3.6 OTHER OBSERVATIONS

4.4 INDUSTRY INSIGHTS

4.4.1 MICRO AND MACRO ECONOMIC FACTORS

4.4.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.4.3 KEY PRICING STRATEGIES

4.5 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.5.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.5.1.1 JOINT VENTURES

4.5.1.2 MERGERS AND ACQUISITIONS

4.5.1.3 LICENSING AND PARTNERSHIP

4.5.1.4 TECHNOLOGY COLLABORATIONS

4.5.1.5 STRATEGIC DIVESTMENTS

4.5.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.5.3 STAGE OF DEVELOPMENT

4.5.4 TIMELINES AND MILESTONES

4.5.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.5.6 RISK ASSESSMENT AND MITIGATION

4.5.7 FUTURE OUTLOOK

4.6 OPPORTUNITY MAP

4.7 PRICING ANALYSIS – NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET

4.8 RAW MATERIAL COVERAGE

4.9 VALUE CHAIN ANALYSIS

4.1 CONSUMER BUYING BEHAVIOUR

4.11 TECHNOLOGICAL ADVANCEMENTS

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE

5.2 OUTLOOK — LOCAL PRODUCTION VS. IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND MARKET POSITION

5.5 INDUSTRY PARTICIPANTS

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE AND LOCAL PARTNERSHIPS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATORY FRAMEWORK – NORTH AMERICA CHO CELLS MARKET

6.1 NORTH AMERICA

6.2 EUROPE

6.3 ASIA-PACIFIC

6.4 SOUTH AMERICA

6.5 MIDDLE EAST & AFRICA

7 MARKET OVERVIEW

7.1 DRIVER

7.1.1 RISING USE OF CHO CELLS IN THE GENETIC STUDY

7.1.2 GROWING DEMAND FOR BIOPHARMACEUTICALS

7.1.3 RISING INVESTMENTS IN BIOTECHNOLOGY R&D

7.1.4 RISING DEMAND FOR MONOCLONAL ANTIBODIES

7.2 RESTRAINT

7.2.1 HIGH COST OF CHO CELL–BASED PRODUCTION AS A MARKET RESTRAINT

7.2.2 STRICT REGULATORY REQUIREMENTS FOR CHO CELL-BASED PRODUCTION

7.3 OPPORTUNITY

7.3.1 CONTINUOUS DEVELOPMENT OF CELL-CULTURE TECHNOLOGIES

7.3.2 RISING NUMBER OF APPLICATIONS OF CHO CELLS

7.3.3 ADVANCES IN CELL-LINE ENGINEERING & SYNTHETIC BIOLOGY

7.4 CHALLENGES

7.4.1 TIME-CONSUMING AND INCONSISTENCY IN CHO CELL LINE DEVELOPMENT PROCESS

7.4.2 CONTAMINATION RISK OF CHO CELL CULTURES

8 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE

8.1 OVERVIEW

8.2 SERVICES

8.3 PRODUCT

8.3.1 CHO-K1

8.3.1.1 CHO-K1 ATCC

8.3.1.2 CHO-K1 ECACC

8.3.1.3 Others

8.3.2 CHO-DG44

8.3.3 CHO-S

8.3.4 CHO-DXB11

8.3.5 OTHERS

9 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM

9.1 OVERVIEW

9.2 METABOLIC SELECTION SYSTEM

9.3 ANTIBIOTIC SELECTION SYSTEM

9.4 OTHERS

10 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BIOLOGICS

10.2.1 MONOCLONAL ANTIBODIES

10.2.2 FC-FUSION PROTIEN

10.2.3 ENZYMES

10.2.4 HORMONES

10.2.5 CYTOKINES

10.2.6 CLOTTING FACTORS

10.2.7 OTHERS

10.3 MEDICAL RESEARCH

11 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER

11.1 OVERVIEW

11.2 BIOPHARMACEUTICAL COMPANIES

11.2.1 MEDIUM

11.2.2 SMALL

11.3 CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS

11.3.1 MEDIUM

11.3.2 SMALL

11.4 BIOTECHNOLOGY COMPANIES

11.4.1 MEDIUM

11.4.2 SMALL

11.5 ACADEMIC INSTITUTES AND RESEARCH ORGANIZATIONS

11.6 CLINICAL RESEARCH ORGANIZATIONS

11.6.1 MEDIUM

11.6.2 SMALL

11.7 OTHERS

12 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDERS

12.3 RETAIL SALES

12.4 OTHERS

13 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 SARTORIUS AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 LONZA

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 THERMO FISHER SCIENTIFIC INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 CYTIVA

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 MERCK KGAA

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ABEOMICS

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ACCEGEN

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 APPLIED BIOLOGICAL MATERIALS INC. (ABM)

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 ATCC

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 BPS BIOSCIENCE, INC.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 CYTION

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 CURIA GLOBAL, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 SERVICE PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 GENTARGET INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 GTP BIOWAYS

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 PROMEGA CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 RAYBIOTECH LIFE, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 REVVITY DISCOVERY LIMITED.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 NORTH AMERICA SERVICES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA METABOLIC SELECTION SYSTEM IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA ANTIBIOTIC SELECTION SYSTEM IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA OTHERS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA MEDICAL RESEARCH IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA CHINESE HAMSTER OVARY CELLS CHO MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA ACADEMIC INSTITUTES AND RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA OTHERS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA DIRECT TENDERS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA RETAIL SALES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA OTHERS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 42 U.S. CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 U.S. PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 U.S. CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 U.S. CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 46 U.S. CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 U.S. BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 U.S. CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 49 U.S. BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 U.S. CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 U.S. BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 U.S. CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 U.S. CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 54 CANADA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 CANADA PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 CANADA CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 CANADA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 58 CANADA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 59 CANADA BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 CANADA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 61 CANADA BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 CANADA CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 CANADA BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 CANADA CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 CANADA CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 66 MEXICO CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 MEXICO PRODUCT IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 MEXICO CHO-K1 IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 MEXICO CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 70 MEXICO CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 71 MEXICO BIOLOGICS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 MEXICO CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 73 MEXICO BIOPHARMACEUTICAL COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 MEXICO CLINICAL DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 MEXICO BIOTECHNOLOGY COMPANIES IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 MEXICO CLINICAL RESEARCH ORGANIZATIONS IN CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 MEXICO CHINESE HAMSTER OVARY (CHO) CELLS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

Lista de figuras

FIGURE 1 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EXECUTIVE SUMMARY: NORTH AMERICA CHINESE HAMSTER OVARY CELLS CHO MARKET

FIGURE 11 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: SEGMENTATION

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 TWO SEGMENTS COMPRISE THE NORTH AMERICA CHINESE HAMSTER OVARY CELLS CHO MARKET, BY TYPE

FIGURE 14 RISING DEMAND FOR BIOLOGICS AND THERAPEUTIC PROTEINS EXPECTED TO DRIVE THE NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET GROWTH IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET IN THE FORECAST PERIOD OF 2025 & 2032

FIGURE 16 NUMBER OF PATENTS PER COUNTRY OR REGION

FIGURE 17 NUMBER OF PATENTS PER APPLICANTS

FIGURE 18 NUMBER OF PATENTS PER YEAR.

FIGURE 19 DROC ANALYSIS

FIGURE 20 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY TYPE, 2024

FIGURE 21 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 22 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY TYPE, CAGR (2025- 2032)

FIGURE 23 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 24 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY SYSTEM, 2024

FIGURE 25 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY SYSTEM, 2025 TO 2032 (USD THOUSAND)

FIGURE 26 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY SYSTEM, CAGR (2025- 2032)

FIGURE 27 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY SYSTEM, LIFELINE CURVE

FIGURE 28 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY APPLICATION, 2024

FIGURE 29 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY APPLICATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 30 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY APPLICATION, CAGR (2025- 2032)

FIGURE 31 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 32 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY END USER, 2024

FIGURE 33 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY END USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 34 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY END USER, CAGR (2025- 2032)

FIGURE 35 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY END USER, LIFELINE CURVE

FIGURE 36 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 37 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 38 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025- 2032)

FIGURE 39 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 40 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: SNAPSHOT (2022)

FIGURE 41 NORTH AMERICA CHINESE HAMSTER OVARY (CHO) CELLS MARKET: COMPANY SHARE 2024 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.