North America Cancer Supportive Care Products Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

13.27 Billion

USD

19.16 Billion

2024

2032

USD

13.27 Billion

USD

19.16 Billion

2024

2032

| 2025 –2032 | |

| USD 13.27 Billion | |

| USD 19.16 Billion | |

|

|

|

|

Segmentación del mercado de productos de cuidados paliativos contra el cáncer en Norteamérica por tipo de fármaco (factor estimulante de colonias de granulocitos [GCSF], agentes estimulantes de la eritropoyetina [AEE], analgésicos opioides, anticuerpos monoclonales, antiinflamatorios no esteroideos [AINE], bifosfonatos, antieméticos, antihistamínicos, etc.), tipo de medicamento (de marca y genéricos), tipo de cáncer (cáncer de pulmón, cáncer de mama, cáncer de próstata, cáncer de hígado, cáncer de vejiga, leucemia, melanoma, cáncer de ovario, etc.), usuario final (hospitales, clínicas, hospitales e instituciones académicas, etc.), canal de distribución (farmacias hospitalarias, farmacias minoristas y farmacias de preparación de compuestos), país (EE. UU., Canadá, México): tendencias y pronóstico de la industria hasta 2032.

Tamaño del mercado de productos de cuidados paliativos contra el cáncer

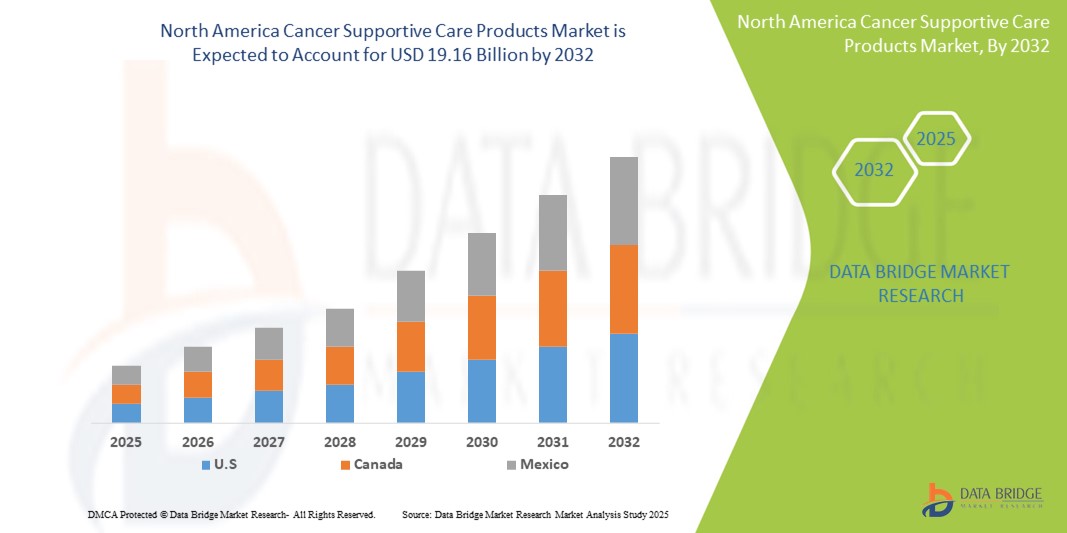

- El tamaño del mercado de productos de cuidados de apoyo para el cáncer en América del Norte se valoró en USD 13,27 mil millones en 2024 y se espera que alcance los USD 19,16 mil millones para 2032 , con una CAGR del 4,70% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente prevalencia del cáncer y la creciente demanda de terapias de apoyo efectivas en América del Norte, lo que lleva a un mayor enfoque en la calidad de vida del paciente durante el tratamiento.

- Además, la creciente concienciación entre profesionales sanitarios y pacientes sobre los beneficios de las terapias complementarias, como los antieméticos, los GCSF y los analgésicos, está consolidando los productos de apoyo como un componente fundamental de la atención oncológica integral. Estos factores convergentes están acelerando la adopción de soluciones de apoyo oncológico, impulsando así significativamente el crecimiento del mercado en la región.

Análisis del mercado de productos de apoyo para el cáncer

- Los productos de cuidados de apoyo para el cáncer, que incluyen terapias como antieméticos, agentes estimulantes de la eritropoyetina, GCSF y soluciones para el manejo del dolor, son componentes cada vez más vitales de los protocolos integrales de tratamiento oncológico tanto en entornos hospitalarios como ambulatorios debido a su función en minimizar los efectos secundarios relacionados con el tratamiento, mejorar la calidad de vida del paciente y garantizar la adherencia al tratamiento.

- La creciente demanda de productos de cuidados de apoyo para el cáncer se ve impulsada principalmente por la creciente incidencia del cáncer en América del Norte, el énfasis cada vez mayor en la atención basada en el valor y una mayor conciencia entre los profesionales de la salud sobre la importancia del manejo de los síntomas junto con el tratamiento primario del cáncer.

- Norteamérica domina el mercado de productos de cuidados paliativos para el cáncer, con la mayor participación en los ingresos en 2025, impulsada por las altas tasas de prevalencia del cáncer, una infraestructura sanitaria avanzada, marcos de reembolso favorables y la sólida presencia de compañías farmacéuticas líderes. Estados Unidos, en particular, está experimentando un crecimiento sustancial en la adopción de medicamentos de cuidados paliativos, especialmente en instituciones académicas y centros oncológicos especializados, gracias a los continuos avances clínicos y las innovaciones de productos destinadas a reducir la toxicidad relacionada con el tratamiento.

- Canadá y México también están contribuyendo al crecimiento del mercado regional, apoyados por programas nacionales de atención del cáncer, la expansión de los servicios oncológicos y el creciente acceso de los pacientes a biosimilares y terapias de apoyo genéricas.

- Se espera que el segmento del factor estimulante de colonias de granulocitos (GCSF) domine el mercado de América del Norte en 2025, debido a su papel fundamental en el manejo de la neutropenia inducida por quimioterapia, el alto volumen de prescripciones y la eficacia clínica establecida en la prevención de infecciones durante los ciclos de tratamiento.

Alcance del informe y segmentación del mercado de productos de cuidados paliativos contra el cáncer

|

Atributos |

Perspectivas clave del mercado de productos de cuidados paliativos contra el cáncer |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de productos de cuidados paliativos contra el cáncer

Atención personalizada de apoyo mediante terapias avanzadas e integración digital .

- Una tendencia significativa y en auge en el mercado norteamericano de productos de cuidados paliativos para el cáncer es la creciente adopción de formulaciones terapéuticas avanzadas y su integración con herramientas de salud digital, que mejoran la monitorización, la adherencia y el manejo de los síntomas del paciente durante todo el tratamiento. Esta evolución está mejorando significativamente la calidad general de la atención y los resultados de los pacientes.

- Por ejemplo, la innovadora formulación de antieméticos de liberación prolongada de Heron Therapeutics, como Aponvie, proporciona un control prolongado de las náuseas y vómitos inducidos por la quimioterapia (NVIQ), lo que reduce la necesidad de administrar dosis frecuentes. De igual manera, el dispositivo portátil Neulasta Onpro de Amgen administra GCSF automáticamente al día siguiente de la quimioterapia, lo que mejora la adherencia al tratamiento y reduce las visitas al hospital.

- La integración con plataformas de salud digital permite la monitorización de síntomas en tiempo real, ajustes personalizados de dosis y alertas inteligentes para los profesionales sanitarios. Por ejemplo, algunas clínicas oncológicas en EE. UU. utilizan plataformas de resultados informados por los pacientes para rastrear los efectos secundarios y modificar proactivamente los tratamientos de apoyo. Estas soluciones permiten una intervención más temprana y una mayor seguridad del paciente.

- La coordinación fluida de los medicamentos de apoyo con las historias clínicas electrónicas (HCE) y las herramientas digitales específicas para oncología facilita una planificación más integral del tratamiento. Mediante plataformas integradas, los oncólogos pueden administrar medicamentos antieméticos, analgésicos y factores de crecimiento junto con las terapias primarias, garantizando un enfoque de atención coordinado y centrado en el paciente.

- Esta tendencia hacia la atención de apoyo personalizada y tecnológica está transformando las expectativas en oncología. Como resultado, compañías farmacéuticas y biotecnológicas como Pfizer y Helsinn Healthcare se están centrando en terapias de apoyo de nueva generación que combinan la eficacia clínica con innovaciones en la administración, como inyectables de acción prolongada, formulaciones subcutáneas y dispositivos de administración inocuos para el paciente.

- La demanda de productos de atención de apoyo que se alineen con el manejo personalizado del cáncer y las herramientas de monitoreo digital está creciendo rápidamente en hospitales, clínicas especializadas y entornos de atención domiciliaria en América del Norte, a medida que los proveedores y los pacientes priorizan cada vez más la calidad de vida y la adherencia al tratamiento.

Dinámica del mercado de productos de apoyo para el cáncer

Conductor

Aumento de la prevalencia del cáncer y demanda de terapias de apoyo integradas

- La creciente incidencia del cáncer en Estados Unidos, Canadá y México, junto con el énfasis cada vez mayor en mejorar la calidad de vida de los pacientes durante y después del tratamiento, es un importante impulsor de la demanda en el mercado de productos de cuidados de apoyo para el cáncer en América del Norte.

- Por ejemplo, en marzo de 2024, Amgen amplió el acceso a su kit Neulasta Onpro en más centros oncológicos ambulatorios de EE. UU., reforzando así su compromiso de mejorar el manejo de la neutropenia y reducir las visitas hospitalarias. Se espera que estas iniciativas de las principales compañías impulsen significativamente el crecimiento del sector de cuidados paliativos para el cáncer en la región.

- A medida que los regímenes de tratamiento del cáncer se vuelven más agresivos y complejos, aumenta la necesidad de terapias de apoyo eficaces, como GCSF, antieméticos y analgésicos, para mitigar efectos secundarios como náuseas, fatiga, anemia e infecciones. Estos productos ofrecen un apoyo clínico esencial que permite a los pacientes tolerar mejor y completar sus protocolos de tratamiento.

- Además, existe una creciente demanda de atención oncológica integrada, donde la medicación de apoyo se administra en consonancia con las terapias primarias mediante modelos de atención coordinada. Los hospitales y las clínicas especializadas están adoptando cada vez más estrategias de tratamiento que incluyen atención de apoyo preventiva y sintomática como parte de los protocolos estándar.

- El creciente enfoque en la atención ambulatoria, la comodidad del paciente y las opciones de administración domiciliaria, gracias a innovaciones como los inyectables de acción prolongada y los dispositivos portátiles de administración de fármacos, también está impulsando su adopción. La creciente disponibilidad de formulaciones de marca y genéricas en farmacias hospitalarias y minoristas impulsa aún más la expansión del mercado en Norteamérica.

Restricción/Desafío

“ Alto costo y reembolso limitado para terapias de apoyo ”

- Uno de los principales desafíos que restringen el crecimiento del mercado de productos de apoyo para el cáncer en América del Norte es el alto costo asociado con muchas terapias de apoyo, en particular los productos biológicos como los GCSF y los anticuerpos monoclonales, que pueden aumentar significativamente la carga financiera general del tratamiento del cáncer.

- Por ejemplo, los pacientes sometidos a quimioterapia pueden requerir intervenciones de apoyo a largo plazo para controlar la anemia, la neutropenia y las náuseas, y el costo acumulativo de estas terapias complementarias puede ser sustancial, especialmente para aquellos que no tienen una cobertura de seguro integral.

- Además, las políticas de reembolso limitadas para ciertos medicamentos de apoyo —especialmente los fármacos de marca más recientes o los de uso no autorizado— pueden restringir el acceso a estos medicamentos entre pacientes de bajos ingresos o con seguro insuficiente. Las aseguradoras suelen priorizar las terapias oncológicas esenciales, lo que deja a los fármacos de apoyo sujetos a autorizaciones previas o límites de cobertura.

- Para abordar este desafío se necesita una inclusión más amplia de la atención de apoyo dentro de los modelos de reembolso del tratamiento del cáncer, así como iniciativas políticas para mejorar la asequibilidad y el acceso a través de estrategias de precios basadas en el valor y programas de asistencia al paciente.

- Además, incluso con la creciente disponibilidad de genéricos, persisten disparidades en el acceso a atención oncológica de calidad en partes de comunidades rurales o marginadas de Estados Unidos y México, donde la infraestructura oncológica y el acceso a especialistas son limitados.

- Superar estas barreras mediante una mayor cobertura, reformas de precios e iniciativas de apoyo específicas será esencial para garantizar un acceso equitativo y constante a la atención de apoyo en toda América del Norte.

Alcance del mercado de productos de cuidados paliativos contra el cáncer

El mercado está segmentado según el tipo de medicamento, tipo (de marca y genéricos), tipo de cáncer, usuario final y canal de distribución.

Por tipo de fármaco

Según el tipo de fármaco, el mercado norteamericano de productos de apoyo para el tratamiento del cáncer se segmenta en factores estimulantes de colonias de granulocitos (G-CSF), agentes estimulantes de la eritropoyetina (AEE), analgésicos opioides, anticuerpos monoclonales, antiinflamatorios no esteroideos (AINE), bifosfonatos, antieméticos, antihistamínicos y otros. El segmento de los G-CSF dominará la mayor cuota de mercado en 2025, impulsado por su papel crucial en la reducción del riesgo de infección durante la neutropenia inducida por quimioterapia. La alta frecuencia de los ciclos de quimioterapia y la eficacia clínica de los G-CSF para minimizar las interrupciones del tratamiento siguen respaldando su uso generalizado en las consultas oncológicas.

Se prevé que el segmento de los antieméticos experimente la tasa de crecimiento más rápida entre 2025 y 2032, impulsado por el creciente interés en mejorar la calidad de vida de los pacientes durante el tratamiento oncológico. Estos fármacos desempeñan un papel fundamental en el manejo de las náuseas y los vómitos inducidos por la quimioterapia (NVIQ), un efecto secundario común y molesto. Las crecientes aprobaciones de nuevas formulaciones, junto con la expansión de su uso en distintos tipos de cáncer y regímenes de tratamiento, están contribuyendo al rápido crecimiento del segmento en América del Norte.

Por canal de distribución

Según el canal de distribución, el mercado norteamericano de productos de cuidados paliativos para el cáncer se segmenta en farmacias hospitalarias, farmacias minoristas y farmacias de preparación magistral. El segmento de farmacias hospitalarias obtuvo la mayor cuota de mercado en 2025, impulsado por el alto volumen de tratamientos oncológicos administrados en entornos hospitalarios y la disponibilidad inmediata de medicamentos de cuidados paliativos para pacientes hospitalizados. La centralización de las compras hospitalarias garantiza un suministro constante y la supervisión clínica, lo que favorece la adherencia y la seguridad del paciente.

Se prevé que el segmento de farmacias minoristas experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por la creciente tendencia hacia el tratamiento ambulatorio del cáncer y el mayor acceso a medicamentos de apoyo a través de farmacias comunitarias. La comodidad, la mayor cobertura de seguros y la preferencia de los pacientes por la distribución local impulsan la adopción. Las cadenas minoristas también están invirtiendo en programas de apoyo dirigidos por farmacéuticos para ayudar a los pacientes con cáncer a gestionar los efectos secundarios, lo que contribuye al crecimiento del segmento en Norteamérica.

Por vía de administración

Según la vía de administración, el mercado norteamericano de productos de cuidados paliativos para el cáncer se segmenta en oral, parenteral y otros. El segmento oral registró la mayor cuota de mercado en 2025, impulsado por la preferencia de los pacientes por métodos de tratamiento no invasivos y la comodidad de la administración domiciliaria. Los fármacos orales de cuidados paliativos, como antieméticos, analgésicos y estimulantes de la eritropoyesis, permiten un mejor cumplimiento terapéutico y reducen la necesidad de visitas clínicas frecuentes, lo que los convierte en una opción ampliamente adoptada en toda la región.

Se prevé que el segmento parenteral presente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, gracias a su rápida acción terapéutica y a la necesidad de ciertos tratamientos de apoyo como los G-CSF y los anticuerpos monoclonales. La administración parenteral se prefiere en entornos de cuidados intensivos y para pacientes sometidos a quimioterapia intensiva, donde la administración inmediata y controlada de fármacos es esencial para el manejo de las complicaciones relacionadas con el tratamiento.

Por tipo de cáncer

Según el tipo de cáncer, el mercado norteamericano de productos de cuidados paliativos para el cáncer se segmenta en cáncer de pulmón, cáncer de mama, cáncer de próstata, cáncer de hígado, cáncer de vejiga, leucemia, melanoma, cáncer de ovario y otros tipos de cáncer. El segmento de cáncer de mama representó la mayor cuota de mercado en 2024, impulsado por la alta incidencia de cáncer de mama en mujeres de EE. UU. y Canadá, así como por la necesidad de terapias de apoyo integrales, como antieméticos, factores estimulantes de colonias y analgésicos, para abordar las complicaciones relacionadas con el tratamiento. La sólida presencia de campañas de concienciación y programas de detección temprana también ha contribuido a una mayor aceptación del tratamiento, impulsando la demanda de cuidados paliativos.

Se proyecta que el segmento de cáncer de pulmón experimentará la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por el aumento de la prevalencia, los diagnósticos en etapa avanzada y el creciente uso de quimioterapia agresiva y terapias dirigidas, que requieren cuidados paliativos complementarios. Un mayor enfoque en la investigación y los marcos de reembolso de los tratamientos paliativos contribuyen a ampliar el acceso a los medicamentos paliativos para los pacientes con cáncer de pulmón en toda Norteamérica.

Análisis regional del mercado de productos de apoyo para el cáncer

- Estados Unidos domina el mercado de productos de cuidados de apoyo para el cáncer en América del Norte con la mayor participación en los ingresos en 2024, impulsado por una alta prevalencia de cáncer, el aumento de las tasas de tratamiento y la infraestructura de atención médica bien establecida que respalda las terapias de apoyo avanzadas.

- Los pacientes y los proveedores de atención médica de la región priorizan la atención de apoyo integral para controlar los efectos secundarios asociados con la quimioterapia, la radioterapia y los tratamientos dirigidos contra el cáncer, lo que genera una fuerte demanda de productos como antieméticos, factores estimulantes de colonias y medicamentos para el manejo del dolor.

- Este uso generalizado está respaldado además por políticas de reembolso sólidas, altos niveles de concientización y la disponibilidad de nuevos productos biológicos y biosimilares, lo que posiciona la atención de apoyo del cáncer como un componente esencial de los regímenes de tratamiento oncológico en hospitales, clínicas y centros especializados.

Perspectiva del mercado de productos de cuidados paliativos contra el cáncer en EE. UU.

El mercado estadounidense de productos de cuidados paliativos para el cáncer captó la mayor participación en los ingresos, con aproximadamente el 85%, en Norteamérica en 2024, impulsado por la avanzada infraestructura sanitaria del país y la alta incidencia de diagnósticos de cáncer. Pacientes y profesionales sanitarios priorizan cada vez más el manejo integral de los efectos secundarios del tratamiento oncológico, lo que impulsa la demanda de terapias de apoyo como factores estimulantes de colonias de granulocitos (GCSF), antieméticos y analgésicos opioides. La creciente adopción de productos biológicos y biosimilares innovadores, junto con sólidos marcos de reembolso y campañas de concienciación, impulsa aún más el crecimiento del mercado. Además, la creciente población de pacientes oncológicos y la creciente inversión en investigación oncológica contribuyen significativamente a la expansión sostenida del mercado en EE. UU.

Análisis del mercado de productos de apoyo para el cáncer en Canadá

Se espera que el mercado canadiense de productos de cuidados paliativos para el cáncer crezca de forma constante durante el período de pronóstico, impulsado por el aumento de la incidencia de cáncer y el incremento de las inversiones en infraestructura sanitaria. Las iniciativas gubernamentales para mejorar los resultados de los pacientes con cáncer, junto con el acceso generalizado a terapias avanzadas como los factores estimulantes de colonias de granulocitos y los analgésicos opioides, impulsan la expansión del mercado. La creciente concienciación sobre las terapias de cuidados paliativos y el mayor enfoque en los cuidados paliativos están impulsando su adopción en hospitales y clínicas especializadas. Los sólidos marcos de reembolso de la atención médica del país y la creciente demanda de tratamientos de apoyo personalizados contribuyen aún más al crecimiento del mercado tanto en zonas urbanas como rurales.

Análisis del mercado de productos de apoyo para el cáncer en México

Se proyecta que el mercado mexicano de productos de cuidados paliativos para el cáncer crezca a una tasa de crecimiento anual compuesta (TCAC) significativa durante el período de pronóstico, impulsado por el aumento de la prevalencia del cáncer y la mejora del acceso a la atención médica en todo el país. Las iniciativas gubernamentales dirigidas a ampliar los servicios oncológicos y mejorar los cuidados paliativos están acelerando su adopción en el mercado. La creciente disponibilidad de medicamentos genéricos para cuidados paliativos, sumada a la creciente conciencia sobre el manejo de los síntomas y efectos secundarios relacionados con el cáncer, está impulsando la demanda en hospitales, clínicas y centros especializados. Además, se espera que el aumento de las inversiones en infraestructura sanitaria y las alianzas público-privadas fortalezcan la trayectoria de crecimiento del mercado en México.

Cuota de mercado de productos de cuidados paliativos contra el cáncer

La industria de productos de cuidados paliativos contra el cáncer está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Amgen Inc. (EE. UU.)

- Janssen Pharmaceuticals, Inc. (una subsidiaria de Johnson & Johnson Services, Inc.) (EE. UU.)

- Pfizer Inc. (EE. UU.)

- APR (EE. UU.)

- Novartis AG (Suiza)

- F. Hoffmann-La Roche Ltd. (Suiza)

- Acacia Pharma Group Plc. (Reino Unido)

- Baxter (Estados Unidos)

- Bayer AG (Alemania)

- Helsinn Healthcare SA (Suiza)

- Heron Therapeutics, Inc. (EE. UU.)

- Kyowa Kirin Co., Ltd. (Japón)

- Acrotech Biopharma (EE. UU.)

- Spectrum Pharmaceuticals, Inc. (EE. UU.)

- Oxford Pharmascience Ltd (Reino Unido)

- Merck Sharp & Dohme Corp. (Una subsidiaria de Merck & Co., Inc.) (EE. UU.)

- Teva (una subsidiaria de Teva Pharmaceutical Industries Ltd.) (Israel)

- Tersera Therapeutics LLC (EE. UU.)

- Mylan NV (EE. UU./Países Bajos: Mylan tenía originalmente su sede en EE. UU. y ahora forma parte de Viatris, cuya sede central está en EE. UU.)

- Sun Pharmaceutical Industries Ltd. (India)

- Laboratorios del Dr. Reddy (India)

- Fresenius Kabi (Alemania)

- Tolmar Inc. (EE. UU.)

- AbbVie Inc. (EE. UU.)

- Sanofi (Francia)

Últimos avances en el mercado de productos de apoyo para el cáncer en América del Norte

- En abril de 2025 , la alemana Merck anunció la adquisición de la biotecnológica estadounidense SpringWorks Therapeutics por 3.900 millones de dólares. Esta estrategia busca reforzar la cartera de oncología de Merck, especialmente en tumores raros, y se espera que aumente la presencia de la compañía en el mercado estadounidense.

- En marzo de 2024 , AstraZeneca acordó adquirir la empresa canadiense Fusion Pharmaceuticals por 2.400 millones de dólares. Fusion se especializa en radioconjugados, un tratamiento oncológico de última generación que ataca las células cancerosas con isótopos radiactivos, minimizando el daño a las células sanas. Esta adquisición fortalecerá la cartera de productos oncológicos de AstraZeneca y ampliará su presencia en Canadá.

- En septiembre de 2023 , Cardinal Health anunció su plan de adquirir Integrated Oncology Network por 1.120 millones de dólares. Esta adquisición forma parte de la estrategia de Cardinal Health para expandirse al sector de la atención oncológica, fusionando su unidad especializada en cáncer, Navista, con la extensa red de Integrated Oncology Network, que incluye más de 100 proveedores de atención médica en 10 estados y más de 50 centros de práctica.

- En noviembre de 2023 , AbbVie anunció un acuerdo para adquirir ImmunoGen, incluyendo su terapia estrella contra el cáncer ELAHERE® (mirvetuximab soravtansina-gynx), por aproximadamente 10.100 millones de dólares. Se espera que esta adquisición amplíe la cartera de AbbVie para tumores sólidos y fortalezca su posición en el mercado oncológico.

- En diciembre de 2022 , la Administración de Alimentos y Medicamentos de EE. UU. (FDA) aprobó el atezolizumab (Tecentriq), un fármaco de inmunoterapia desarrollado por F. Hoffmann-La Roche Ltd., para el tratamiento del sarcoma alveolar de partes blandas (SAPB) en adultos y niños de 2 años o más si la enfermedad ha metastatizado o es inoperable. Esta aprobación marcó un avance significativo en los tratamientos de apoyo contra el cáncer.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.