North America Biodegradable Film Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

3.24 Billion

USD

4.76 Billion

2025

2033

USD

3.24 Billion

USD

4.76 Billion

2025

2033

| 2026 –2033 | |

| USD 3.24 Billion | |

| USD 4.76 Billion | |

|

|

|

|

Segmentación del mercado de películas biodegradables en Norteamérica: por tipo (PLA, mezclas de almidón, poliéster biodegradable, PHA, a base de soja, a base de celulosa, a base de lignina, etc.), tipo de producto (oxobiodegradable e hidrobiodegradable), tipo de cultivo (frutas y verduras, cereales y oleaginosas, flores y plantas, etc.), aplicación (envasado de alimentos, agricultura y horticultura, productos cosméticos y de cuidado personal, envases industriales, etc.): tendencias y pronóstico de la industria hasta 2033.

Tamaño del mercado de películas biodegradables en América del Norte

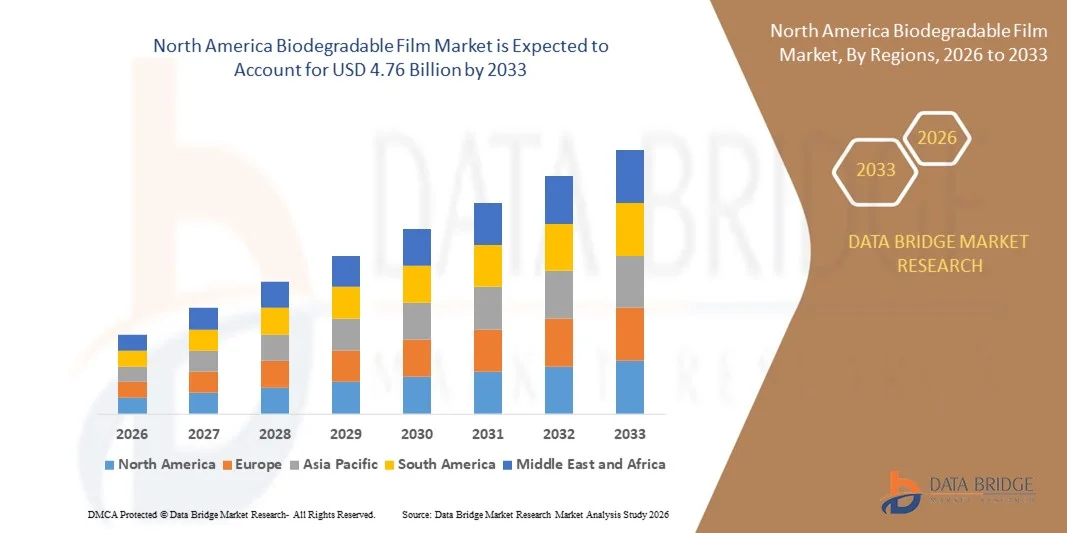

- El tamaño del mercado de películas biodegradables de América del Norte se valoró en USD 3.24 mil millones en 2025 y se espera que alcance los USD 4.76 mil millones para 2033 , con una CAGR del 4,90 % durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de soluciones de envasado sostenibles en aplicaciones de alimentos, agricultura y bienes de consumo.

- La creciente presión regulatoria para reducir los plásticos de un solo uso y promover materiales ecológicos está acelerando significativamente su adopción.

Análisis del mercado de películas biodegradables en América del Norte

- El mercado está experimentando un fuerte impulso a medida que las industrias cambian hacia prácticas de economía circular y priorizan los materiales compostables y de origen biológico para cumplir con los objetivos de sostenibilidad.

- Además, la innovación continua en materias primas y técnicas de procesamiento está mejorando la paridad de rendimiento con las películas plásticas convencionales, mejorando la competitividad de costos y la viabilidad del mercado a largo plazo.

- Estados Unidos dominó el mercado de películas biodegradables con la mayor participación en los ingresos en 2025, impulsado por la creciente demanda de soluciones de envasado sostenibles en las industrias de alimentos, agricultura y bienes de consumo.

- Se espera que Canadá sea testigo de la mayor tasa de crecimiento anual compuesta (CAGR) en el mercado de películas biodegradables de América del Norte debido al aumento de las iniciativas de sostenibilidad, la creciente adopción de películas biodegradables en envases y agricultura, políticas gubernamentales de apoyo y un enfoque creciente en la reducción de desechos plásticos en todas las industrias.

- El segmento de mezclas de almidón mantuvo la mayor cuota de mercado en 2025 gracias a su rentabilidad, amplia disponibilidad de materia prima y equilibradas propiedades de biodegradabilidad. Las películas de mezcla de almidón se utilizan ampliamente en aplicaciones de envasado y agrícolas gracias a su flexibilidad, facilidad de procesamiento y compatibilidad con las tecnologías de fabricación de películas existentes.

Alcance del informe y segmentación del mercado de películas biodegradables en América del Norte

|

Atributos |

Perspectivas clave del mercado de películas biodegradables en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de películas biodegradables en América del Norte

Aumento de la adopción de envases sostenibles en películas biodegradables

- La creciente tendencia hacia soluciones de envasado sostenibles está transformando el mercado de películas biodegradables, impulsando la sustitución de las películas de plástico convencionales por alternativas ecológicas. Estas películas ayudan a reducir el impacto ambiental, a la vez que respaldan los objetivos de compostabilidad y reciclabilidad en diversas aplicaciones de envasado. Su adopción también está alineada con los objetivos de sostenibilidad corporativa y las iniciativas de economía circular en las cadenas de valor del envasado.

- La creciente demanda de envases respetuosos con el medio ambiente en los sectores de la alimentación, la agricultura y los bienes de consumo está acelerando la adopción de películas biodegradables. Las empresas integran cada vez más estos materiales para cumplir con sus compromisos de sostenibilidad y responder a las normas más estrictas de reducción de plástico. Este cambio también ayuda a las marcas a mejorar su credibilidad ambiental y a cumplir con las directrices de envasado en constante evolución.

- Las mejoras en la formulación de materiales y las tecnologías de procesamiento están optimizando el rendimiento funcional de las películas biodegradables. Su mayor resistencia, flexibilidad y propiedades de barrera están expandiendo su uso en diversos formatos de envasado sin comprometer la protección del producto. Estos avances están impulsando una mayor aceptación en aplicaciones de envasado primario y secundario.

- Por ejemplo, varios fabricantes de alimentos y bienes de consumo han informado de reducciones en la generación de residuos plásticos tras la transición a soluciones de envasado con película biodegradable. Esta transición ha contribuido a los objetivos de sostenibilidad, a la vez que mantiene la eficiencia del envasado y la seguridad del producto. También ha ayudado a las empresas a reducir su dependencia de los plásticos de origen fósil.

- Si bien la adopción impulsada por la sostenibilidad está fortaleciendo el crecimiento del mercado, el impacto a largo plazo depende de la innovación continua de materiales, la fabricación escalable y la optimización de costos. Garantizar una calidad constante y un suministro confiable sigue siendo esencial para asegurar una mayor aceptación comercial en todos los sectores.

Dinámica del mercado de películas biodegradables en América del Norte

Conductor

Aumento de las regulaciones ambientales y mayor preferencia de los consumidores por envases ecológicos

- El endurecimiento de las regulaciones ambientales sobre los plásticos de un solo uso está impulsando a las industrias a priorizar las películas biodegradables como alternativa viable. Los marcos regulatorios destinados a reducir la contaminación plástica están acelerando las inversiones en tecnologías de películas de origen biológico y compostables. Estas medidas están creando un entorno favorable para la adopción de envases sostenibles.

- Los consumidores son cada vez más conscientes del impacto ambiental de los residuos de envases, lo que impulsa a las marcas a adoptar soluciones de film biodegradable. Este cambio anima a los fabricantes a rediseñar sus estrategias de envasado en torno a materiales sostenibles. La creciente preferencia por productos ecológicos está impulsando la demanda en los sectores minorista y de restauración.

- Las iniciativas de apoyo de los organismos reguladores y las organizaciones del sector están fortaleciendo el impulso del mercado. Los programas de certificación, los estándares de sostenibilidad y las iniciativas de concienciación están ayudando a acelerar la adopción en todos los sectores de consumo final. Estos esfuerzos también están mejorando la transparencia y la confianza en las afirmaciones sobre envases biodegradables.

- Por ejemplo, la implementación de políticas de reducción de plástico ha generado un aumento notable en la demanda de películas biodegradables para el envasado de alimentos y aplicaciones agrícolas. Las empresas están respondiendo ampliando su capacidad de producción e invirtiendo en innovación de materiales sostenibles. Esta tendencia contribuye a una expansión constante del mercado.

- Si bien la presión regulatoria y la concienciación del consumidor impulsan el mercado, mantener una calidad constante del material y el cumplimiento de las normas de compostabilidad sigue siendo crucial. Gestionar los costos de producción y la estabilidad del suministro también es esencial para garantizar un crecimiento sostenido y una adopción a largo plazo.

Restricción/Desafío

Mayores costos de producción y limitaciones de rendimiento en comparación con las películas plásticas convencionales

- El mayor costo de producción de las películas biodegradables en comparación con las películas plásticas convencionales sigue siendo un desafío clave para el crecimiento del mercado. Las materias primas de origen biológico y los requisitos de procesamiento especializado suelen incrementar los gastos generales de fabricación. Esta brecha de costos puede limitar la adopción entre los usuarios finales sensibles al precio.

- En ciertas aplicaciones, las películas biodegradables presentan limitaciones de rendimiento, como una menor resistencia a la humedad o una menor durabilidad mecánica. Estos desafíos restringen su uso en entornos de envasado de alta demanda que requieren una mayor vida útil. Las desventajas en el rendimiento pueden retrasar la sustitución de las películas de plástico tradicionales.

- La adopción en el mercado se ve aún más limitada por la limitada infraestructura de procesamiento al final de su vida útil. Los sistemas inadecuados de compostaje y segregación de residuos pueden reducir los beneficios ambientales prácticos de las películas biodegradables. Esta brecha afecta la confianza de fabricantes y propietarios de marcas.

- Por ejemplo, los actores de la industria han señalado las limitaciones de costos y las compensaciones en el rendimiento como importantes obstáculos para la sustitución a gran escala. Estas limitaciones suelen retrasar las decisiones de inversión y restringir la penetración en los segmentos de envases para el mercado masivo. Superar estos problemas sigue siendo una prioridad para los desarrolladores de tecnología.

- Si bien las tecnologías de materiales siguen avanzando, es fundamental abordar la competitividad en costos y la consistencia del rendimiento. La alineación con los sistemas de gestión de residuos y las normas de eliminación también es crucial para aprovechar al máximo el potencial del mercado de películas biodegradables.

Alcance del mercado de películas biodegradables en América del Norte

El mercado está segmentado según el tipo, tipo de producto, tipo de cultivo y aplicación.

- Por tipo

Según el tipo, el mercado norteamericano de películas biodegradables se segmenta en PLA, mezclas de almidón, poliéster biodegradable, PHA, a base de soja, a base de celulosa, a base de lignina, entre otros. El segmento de mezclas de almidón mantuvo la mayor cuota de mercado en 2025 gracias a su rentabilidad, amplia disponibilidad de materia prima y equilibradas propiedades de biodegradabilidad. Las películas de mezcla de almidón se utilizan ampliamente en aplicaciones de envasado y agrícolas gracias a su flexibilidad, facilidad de procesamiento y compatibilidad con las tecnologías de fabricación de películas existentes.

Se prevé que el segmento de PLA experimente su mayor crecimiento entre 2026 y 2033 debido a la creciente demanda de materiales de origen biológico y compostables. Las películas de PLA ofrecen buena transparencia y resistencia, lo que las hace adecuadas para el envasado de alimentos y bienes de consumo, a la vez que cumplen con los objetivos de sostenibilidad y cumplimiento normativo.

- Por tipo de producto

Según el tipo de producto, el mercado norteamericano de películas biodegradables se segmenta en oxobiodegradables e hidrobiodegradables. El segmento hidrobiodegradable representó la mayor participación en los ingresos en 2025 debido a su capacidad de descomponerse naturalmente mediante la actividad microbiana sin dejar residuos microplásticos. Estas películas son ampliamente preferidas en aplicaciones que requieren biodegradabilidad y compostabilidad genuinas.

Se prevé que el segmento oxobiodegradable experimente el mayor crecimiento entre 2026 y 2033, gracias a su menor coste de producción y su similitud con las películas plásticas convencionales. Sin embargo, el crecimiento se mantiene moderado debido al creciente escrutinio sobre la eficiencia de degradación y el impacto ambiental.

- Por tipo de cultivo

Según el tipo de cultivo, el mercado norteamericano de películas biodegradables se segmenta en frutas y verduras, cereales y oleaginosas, flores y plantas, entre otros. El segmento de frutas y verduras dominó el mercado en 2025 gracias al amplio uso de películas biodegradables para acolchado y embalaje, que mejoran la calidad de la producción y reducen los residuos plásticos. Estas películas favorecen la retención de humedad y la salud del suelo, a la vez que minimizan las pérdidas poscosecha.

Se prevé un crecimiento notable en el segmento de flores y plantas entre 2026 y 2033 gracias a la creciente adopción de películas biodegradables en viveros y paisajismo. Estas películas ayudan a mejorar los ciclos de crecimiento de las plantas y a reducir los costos de mano de obra asociados con su eliminación.

- Por aplicación

En cuanto a su aplicación, el mercado norteamericano de películas biodegradables se segmenta en envases para alimentos, agricultura y horticultura, productos cosméticos y de cuidado personal, envases industriales, entre otros. El segmento de envases para alimentos mantuvo la mayor cuota de mercado en 2025, impulsado por la fuerte demanda de soluciones de envasado sostenibles y el creciente énfasis en la reducción de residuos plásticos. Las películas biodegradables se utilizan cada vez más para productos frescos, productos de panadería y alimentos listos para consumir.

Se prevé que el sector de la agricultura y la horticultura experimente el mayor crecimiento entre 2026 y 2033 durante el período de pronóstico, debido a la creciente adopción de acolchados biodegradables y películas para invernaderos. Estas películas promueven prácticas agrícolas sostenibles y ayudan a reducir la contaminación del suelo a largo plazo causada por los plásticos convencionales.

Análisis regional del mercado de películas biodegradables en América del Norte

- Estados Unidos dominó el mercado de películas biodegradables con la mayor participación en los ingresos en 2025, impulsado por la creciente demanda de soluciones de envasado sostenibles en las industrias de alimentos, agricultura y bienes de consumo.

- Las empresas del país están adoptando cada vez más películas biodegradables para cumplir con los objetivos de sostenibilidad corporativa y responder a la creciente demanda de los consumidores de productos ambientalmente responsables.

- Esta sólida posición en el mercado está respaldada por avances tecnológicos, una alta capacidad de innovación y un uso cada vez mayor de materiales biodegradables tanto en envases flexibles como en aplicaciones agrícolas.

Perspectivas del mercado canadiense de películas biodegradables

Se prevé que el mercado canadiense de películas biodegradables experimente su mayor crecimiento entre 2026 y 2033, impulsado por la creciente concienciación sobre la reducción de residuos plásticos y la creciente adopción de alternativas de envasado sostenibles. Fabricantes y marcas están realizando una transición activa hacia películas biodegradables para cumplir con las normas ambientales y mejorar sus credenciales de sostenibilidad. El creciente interés en los envases ecológicos para alimentos y productos agrícolas, junto con las iniciativas de sostenibilidad que apoyan la sostenibilidad y la innovación en materiales de origen biológico, contribuye a la rápida expansión del mercado.

Cuota de mercado de películas biodegradables en América del Norte

La industria de películas biodegradables de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

• NatureWorks LLC (EE. UU.)

• Danimer Scientific (EE. UU .)

• Cortec Corporation (EE

. UU.) • Biome Technologies (EE. UU.)

• Eastman Chemical Company (EE. UU.)

• Teknor Apex Company (EE. UU.)

• Novolex (EE. UU.)

• Arkema Inc. (EE. UU.)

• Green Dot Bioplastics (EE. UU.)

• Cedar Grove Packaging (Canadá)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.