North America Bare Metal Cloud Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

3.36 Billion

USD

30.20 Billion

2024

2032

USD

3.36 Billion

USD

30.20 Billion

2024

2032

| 2025 –2032 | |

| USD 3.36 Billion | |

| USD 30.20 Billion | |

|

|

|

|

Segmentación del mercado de la nube física en Norteamérica, por componente (servidor, servicios), por aplicación (análisis en tiempo real, tecnología publicitaria/fintech, juegos, streaming, deportes electrónicos, etc.), por tamaño de la organización (pymes y grandes empresas), por infraestructura (nube pública virtual e infraestructura clásica), por usuario final (TI y telecomunicaciones, BFSI, gobierno, fabricación, medios y entretenimiento, atención médica, comercio minorista, etc.): tendencias y pronóstico de la industria hasta 2032.

Tamaño del mercado de nube de hardware en América del Norte

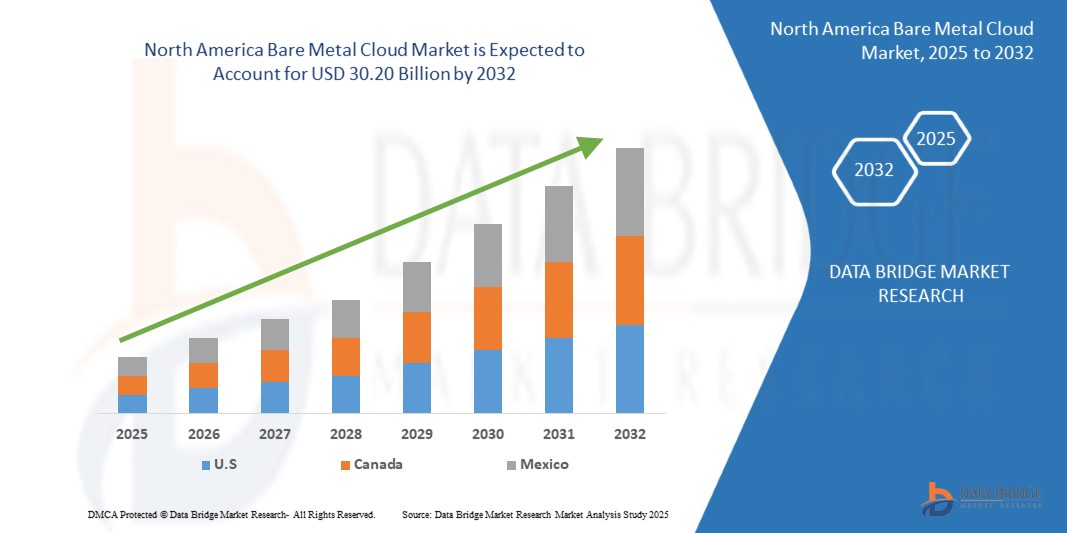

- El mercado de nube de metal desnudo de América del Norte se valoró en USD 3.36 mil millones en 2024 y se espera que alcance los USD 30.20 mil millones para 2032, con una CAGR del 32,6% durante el período de pronóstico.

- El crecimiento está impulsado por la creciente demanda de computación de alto rendimiento (HPC), cargas de trabajo de IA/ML y aplicaciones intensivas en datos, la creciente adopción en telecomunicaciones e infraestructura central 5g para procesamiento de latencia ultrabaja y el creciente cambio hacia la orquestación de contenedores nativos de la nube y la implementación de cargas de trabajo directamente en infraestructura de hardware.

- Este crecimiento está impulsado por factores como la expansión de la demanda de computación de borde, cargas de trabajo de inteligencia artificial y aprendizaje automático, una mayor implementación de arquitecturas híbridas y multicloud, y un enfoque creciente en la seguridad y el cumplimiento de los datos.

Análisis del mercado de la nube Bare Metal en América del Norte

- El mercado norteamericano de la nube Bare Metal está experimentando una rápida expansión global, impulsada por la fuerte demanda de soluciones de infraestructura en la nube de alto rendimiento, personalizables y seguras. La nube Bare Metal ofrece recursos de servidor dedicado sin sobrecarga de virtualización, lo que permite un rendimiento, una seguridad y un cumplimiento normativo superiores a los servicios de nube tradicionales. Sus aplicaciones están creciendo en sectores como TI y telecomunicaciones, finanzas, salud, videojuegos y gobierno. Sin embargo, los desafíos incluyen la gestión de la complejidad de la infraestructura, el equilibrio entre la rentabilidad y la garantía de una escalabilidad fluida.

- Los sectores de TI y telecomunicaciones son impulsores clave, ya que la nube física soporta cargas de trabajo exigentes como el procesamiento de IA/ML, el análisis de big data y el comercio de alta frecuencia. Los centros de datos adoptan cada vez más soluciones físicas para reducir la latencia y mejorar el rendimiento de las aplicaciones críticas. Mientras tanto, las empresas en transición a entornos híbridos y multicloud están aprovechando la nube física para cargas de trabajo especializadas que requieren mayor control y seguridad. Esto impulsa un mayor crecimiento del mercado.

- Se espera que EE. UU. domine y sea el país de más rápido crecimiento en el mercado de nube Bare Metal de América del Norte, debido a su sólida industria de fabricación de productos electrónicos, importantes inversiones en infraestructura de nube y rápida adopción de tecnologías emergentes como 5G, IA e IoT.

- Se espera que el segmento de servidores domine el mercado de Bare Metal Cloud de América del Norte con una participación del 71,79 % en 2025 debido a la creciente demanda de computación de alto rendimiento, infraestructura de baja latencia y una creciente dependencia de hardware dedicado para soportar cargas de trabajo intensivas en datos.

Alcance del informe y segmentación del mercado de la nube Bare Metal en América del Norte

|

Atributos |

Perspectivas clave del mercado de la nube de hardware en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de la nube Bare Metal en América del Norte

Avances en rendimiento, personalización y diversidad de aplicaciones

- Una tendencia destacada en el mercado de nube Bare Metal de América del Norte es la creciente demanda de infraestructura personalizable y de alto rendimiento para soportar cargas de trabajo que requieren baja latencia, soberanía de datos y hardware dedicado, especialmente en industrias como finanzas, atención médica y juegos.

- El mercado está experimentando un fuerte impulso en las implementaciones híbridas y multicloud, donde las empresas aprovechan Bare Metal Cloud para cargas de trabajo de alto rendimiento, manteniendo al mismo tiempo la flexibilidad nativa de la nube. Esto está impulsando el interés en el aprovisionamiento basado en API, las redes de alta velocidad y la integración con plataformas de orquestación de contenedores como Kubernetes y OpenShift.

- Por ejemplo, en 2024, Oracle Cloud Infrastructure e IBM Cloud ampliaron sus ofertas de Bare Metal en las regiones de Asia-Pacífico, lo que permitió a las empresas ejecutar aplicaciones de IA/ML y análisis sensibles a la latencia con control total del hardware. Al mismo tiempo, Equinix Metal colabora con centros de datos regionales para ofrecer una infraestructura Bare Metal localizada y optimizada para casos de uso de edge computing.

- Los principales proveedores se centran en innovaciones como la integración de silicio a medida, los módulos de seguridad mejorados (TPM 2.0) y la aceleración de GPU/FPGA para satisfacer las crecientes demandas en sectores como la conducción autónoma, la infraestructura 5G y el análisis de datos en tiempo real. Además, la integración del almacenamiento NVMe, las redes definidas por software (SDN) y las arquitecturas desagregadas está mejorando la escalabilidad y la rentabilidad.

- A medida que las empresas priorizan cada vez más la transformación digital, el cumplimiento normativo y las aplicaciones con uso intensivo de datos, crece la demanda de soluciones de nube física ágiles y energéticamente eficientes. Los participantes del mercado también están respondiendo al enfoque de la región en centros de datos ecológicos, operaciones neutras en carbono y modelos de soporte localizados, lo que fortalece su posición competitiva en un mercado global en rápida evolución.

Dinámica del mercado de la nube Bare Metal en América del Norte

Conductor

Aumento de la demanda de computación de alto rendimiento (HPC), cargas de trabajo de IA/ML y aplicaciones con uso intensivo de datos

- La creciente demanda de computación de alto rendimiento (HPC), cargas de trabajo de IA/ML y aplicaciones con uso intensivo de datos está impulsando la adopción de la nube física.

- A diferencia de los entornos virtualizados, los servidores físicos ofrecen acceso directo al hardware subyacente, lo que garantiza un rendimiento predecible, menor latencia y la capacidad de gestionar cargas de trabajo complejas, como el entrenamiento de modelos de IA, simulaciones a gran escala y análisis avanzados. Sectores como la salud y los servicios financieros, la automoción y las instituciones de investigación recurren cada vez más a la infraestructura física para soportar tareas con uso intensivo de GPU y requisitos de computación de alto rendimiento.

- Esta tendencia refleja el impulso más amplio hacia una infraestructura que pueda manejar cargas de trabajo modernas sin la sobrecarga de las capas de virtualización, al tiempo que ofrece escalabilidad y personalización alineadas con las estrategias de TI empresariales.

- A medida que los principales proveedores amplían sus ofertas de hardware optimizado para GPU y nuevos actores ingresan con clústeres dedicados, el mercado está posicionado para desempeñar un papel fundamental en el impulso de la innovación en IA, el descubrimiento científico y la transformación empresarial basada en datos.

Restricción/Desafío

Ecosistema de proveedores limitado y estandarización

- El ecosistema limitado de proveedores y la falta de estandarización plantean desafíos importantes para el mercado global de Bare Metal Cloud de América del Norte. Con relativamente pocos proveedores y estándares técnicos fragmentados, los proveedores enfrentan dificultades para lograr la interoperabilidad y la escalabilidad, lo que a menudo resulta en mayores costos de integración y ciclos de adopción más lentos.

- Esto plantea desafíos como la dependencia de un proveedor, una menor capacidad de negociación y una capacidad limitada para innovar, ya que cada proveedor opera con marcos propietarios que no son fácilmente compatibles con otros. Sectores como la salud, los servicios financieros, las telecomunicaciones y la infraestructura de TI gubernamental —que requieren un cumplimiento estricto, computación de alto rendimiento e intercambio de datos transfronterizo— se ven particularmente afectados, ya que la ausencia de estándares unificados complica las adquisiciones, aumenta los costos operativos y obstaculiza la adopción de infraestructuras bare metal en estos sectores.

- Si bien herramientas emergentes como Kubernetes ofrecen un alivio parcial, su adopción en entornos de hardware aún es desigual, lo que subraya la necesidad de estándares abiertos más sólidos y la diversificación de proveedores. Hasta que se aborden estos problemas, el mercado norteamericano de la nube de hardware seguirá enfrentándose a barreras que ralentizan la escalabilidad y una adopción empresarial más amplia.

Alcance del mercado de la nube de hardware en América del Norte

El mercado está segmentado en función del componente, la aplicación, el tamaño de la organización, la infraestructura y el usuario final.

• Por componente

Según sus componentes, el mercado norteamericano de la nube física se segmenta en servidores y servicios. En 2025, se prevé que el segmento de servidores domine el mercado con una cuota de mercado del 71,79 %, impulsado por la creciente demanda de computación de alto rendimiento, infraestructura de baja latencia y la creciente dependencia de hardware dedicado para soportar cargas de trabajo con uso intensivo de datos.

Se espera que el segmento de servidores experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 33,0 %, entre 2025 y 2032, impulsada por la creciente demanda de computación de alto rendimiento, la creciente adopción de aplicaciones nativas de la nube y la creciente necesidad de una infraestructura escalable para respaldar la IA, el análisis de big data y la computación en el borde en diversas industrias. Las organizaciones confían en los servicios gestionados para reducir la complejidad operativa, mejorar la seguridad y optimizar el rendimiento de la nube. La escalabilidad, la rentabilidad y la experiencia que ofrecen los proveedores de servicios convierten a este segmento en el componente dominante del mercado norteamericano de la nube Bare Metal.

• Por aplicación

Según la aplicación, el mercado norteamericano de la nube Bare Metal se segmenta en análisis en tiempo real, tecnología publicitaria/fintech, videojuegos, streaming, esports y otros. En 2025, se prevé que el segmento de análisis en tiempo real domine el mercado con una cuota de mercado del 30,56 %, gracias a la creciente adopción de aplicaciones de IA, big data e IoT que requieren un procesamiento rápido, una latencia mínima y una infraestructura segura.

Se espera que el segmento de Analítica en Tiempo Real experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 34,2 %, entre 2025 y 2032. Este auge se debe a la creciente demanda de información instantánea entre las organizaciones para facilitar una toma de decisiones rápida e informada. Ante la creciente competencia de las empresas, la capacidad de analizar datos en tiempo real se ha vuelto crucial para lograr eficiencia y agilidad operativa. La analítica en tiempo real permite a las organizaciones monitorizar tendencias, detectar anomalías y responder de forma proactiva a las condiciones dinámicas del mercado. Además, desempeña un papel fundamental en la personalización de las experiencias de los clientes, ofreciendo interacciones oportunas y relevantes. A medida que la transformación digital se acelera en todos los sectores, se prevé un aumento significativo en la adopción de herramientas de procesamiento de datos en tiempo real.

• Por tamaño de la organización

Según el tamaño de la organización, el mercado norteamericano de la nube física se segmenta en pymes y grandes empresas. En 2025, se prevé que el segmento de pymes domine el mercado con una cuota de mercado del 59,38 %, gracias a la adopción rentable de la nube física, que ofrece escalabilidad, flexibilidad e infraestructura de TI segura sin grandes inversiones.

Se prevé que el segmento de las pymes experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 33,2 %, entre 2025 y 2032, impulsada por el aumento de las iniciativas de transformación digital entre las pequeñas y medianas empresas que buscan soluciones en la nube rentables, escalables y flexibles. Las pymes adoptan cada vez más soluciones basadas en la nube debido a su rentabilidad, escalabilidad y flexibilidad, lo que les permite competir de forma más eficaz con empresas de mayor tamaño. Las tecnologías en la nube ofrecen a las pymes acceso a herramientas avanzadas sin necesidad de realizar grandes inversiones iniciales en infraestructura. Además, el auge del teletrabajo y el comercio electrónico impulsa aún más a las pymes a adoptar plataformas digitales. Como resultado, se prevé un crecimiento sostenido y significativo de la adopción de la nube en este segmento.

• Por Infraestructura

En cuanto a la infraestructura, el mercado norteamericano de nube virtual se segmenta en nube pública virtual e infraestructura clásica. En 2025, se prevé que el segmento de nube pública virtual domine el mercado con una cuota de mercado del 65,25 %, impulsado por la agilidad, la facilidad de implementación y el uso generalizado en estrategias híbridas y multicloud en diferentes sectores.

Se espera que el segmento de la nube pública virtual registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 33,2 %, entre 2025 y 2032, debido a la creciente demanda de recursos informáticos flexibles y bajo demanda que ofrezcan escalabilidad y rentabilidad. Este crecimiento se debe principalmente a la creciente demanda de recursos informáticos flexibles y bajo demanda que permitan a las empresas escalar sus operaciones de forma eficiente. Las organizaciones recurren cada vez más a entornos de nube pública virtual para reducir la inversión y mejorar la agilidad operativa. El modelo de pago por uso ofrece rentabilidad, especialmente para startups y empresas que gestionan cargas de trabajo dinámicas. Además, los avances en seguridad y cumplimiento normativo en la nube están haciendo que la adopción de la nube pública sea más viable en diversos sectores.

• Por el usuario final

En función del usuario final, el mercado norteamericano de la nube Bare Metal se segmenta en TI y telecomunicaciones, BFSI, gobierno, manufactura, medios y entretenimiento, salud, comercio minorista y otros. En 2025, se espera que el segmento de TI y telecomunicaciones domine el mercado con una participación del 22,94 %, gracias a las crecientes iniciativas de transformación digital, la adopción de redes 5G y la creciente demanda de infraestructura confiable y de alta capacidad para gestionar el tráfico masivo de datos.

Se espera que el segmento de TI y telecomunicaciones experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 34,0 %, entre 2025 y 2032, impulsada por la creciente adopción de aplicaciones nativas de la nube, la implementación de redes 5G y la creciente demanda de soluciones de procesamiento y almacenamiento de datos de alta velocidad. Un factor clave de este crecimiento es la creciente adopción de aplicaciones nativas de la nube, que ofrecen mayor flexibilidad, escalabilidad y una implementación más rápida. La implementación de redes 5G también desempeña un papel crucial, permitiendo una transmisión de datos más rápida y dando soporte a servicios de última generación. Además, la creciente demanda de procesamiento de datos de alta velocidad y soluciones de almacenamiento eficientes está impulsando a las empresas de TI y telecomunicaciones a realizar importantes inversiones en infraestructura en la nube.

Análisis regional del mercado de la nube Bare Metal en Norteamérica

- Se espera que EE. UU. domine el mercado de nube Bare Metal de América del Norte con la mayor participación en los ingresos del 83,42 % en 2025, impulsado por la rápida adopción de la infraestructura de la nube por parte de las empresas y la creciente demanda de computación de alto rendimiento en sectores como finanzas, atención médica y servicios de TI.

- La fuerte demanda de computación de borde, cargas de trabajo de IA y soluciones de soberanía de datos está impulsando el crecimiento, junto con importantes inversiones en infraestructura 5G e iniciativas de transformación digital.

- Países como México, Estados Unidos y Canadá son líderes debido a sus ecosistemas de TI avanzados, la presencia de importantes proveedores de servicios en la nube y la innovación continua en tecnologías de la nube.

- La infraestructura madura del centro de datos de la región, junto con la creciente adopción de estrategias híbridas y de múltiples nubes, acelera aún más la adopción de Bare Metal Cloud.

Perspectiva del mercado de la nube Bare Metal en Canadá y América del Norte

Se espera que el mercado canadiense de la nube de hardware en Norteamérica alcance una participación significativa del 11,53 % en 2025, impulsado por su avanzada infraestructura de TI y la sólida presencia de grandes empresas en sectores como el automotriz, el electrónico y el financiero. El enfoque del país en la transformación digital y las iniciativas de la Industria 4.0 está acelerando la demanda de soluciones de infraestructura en la nube de alto rendimiento, seguras y personalizables. Las organizaciones están adoptando cada vez más servicios de nube de hardware para soportar cargas de trabajo de IA, análisis de big data y computación en el borde que requieren hardware dedicado y baja latencia. Las políticas gubernamentales que fomentan la innovación y la soberanía de los datos están impulsando aún más el crecimiento del mercado. Además, el sólido ecosistema canadiense de proveedores de tecnología y centros de datos proporciona un entorno favorable para expandir la adopción de la nube de hardware, especialmente en industrias de misión crítica y reguladas.

Perspectiva del mercado de nube de hardware desnudo en América del Norte y EE. UU.

El mercado estadounidense de nube física en Norteamérica representó la mayor participación en el mercado norteamericano, con un 83,42%, en 2025, gracias a sus sólidas políticas de transformación digital y al rápido crecimiento en la implementación de centros de datos a gran escala. El énfasis del gobierno en la autosuficiencia tecnológica y las inversiones en infraestructura nacional de nube están impulsando la adopción acelerada de soluciones físicas. La demanda está aumentando en sectores como finanzas, manufactura, comercio electrónico y gobierno, donde los entornos de nube dedicados, de alto rendimiento y seguros son fundamentales. La infraestructura física también está ganando terreno en apoyo de los ecosistemas en expansión de IA, 5G y edge computing de EE. UU., ofreciendo soluciones sensibles a la latencia y personalizables para el procesamiento de datos en tiempo real. Además, iniciativas como "Eastern Data, Western Computing" están redefiniendo la estrategia nacional de nube al optimizar centros de datos infrautilizados y redistribuir la capacidad de cómputo entre regiones. El creciente liderazgo de EE. UU. en manufactura inteligente y tecnologías nativas de la nube continúa posicionándolo como un actor central en el mercado regional de nube física en Norteamérica.

Perspectiva del mercado de nube Bare Metal en América del Norte, México

El mercado de nube Bare Metal en México y Norteamérica se perfila como uno de los de mayor crecimiento en la región, impulsado por el aumento de las inversiones en infraestructura digital, empresas nativas de la nube y regulaciones de localización de datos. La adopción de la nube Bare Metal se está expandiendo en sectores como BFSI, salud, manufactura y telecomunicaciones, donde las cargas de trabajo críticas requieren una infraestructura de servidores dedicada y de baja latencia. La apuesta del Banco de la Reserva de México por el almacenamiento de datos localizado y el creciente número de centros de datos nacionales impulsan la transición hacia implementaciones de nube de un solo inquilino. Además, el floreciente ecosistema de startups de México y la creciente demanda de análisis en tiempo real están creando nuevas oportunidades para soluciones de nube Bare Metal adaptadas a las necesidades de rendimiento y cumplimiento normativo.

Los principales líderes del mercado que operan en el mercado son:

- HorizonIQ (EE. UU.)

- Google LLC (EE. UU.)

- Equinix Inc. (EE. UU.)

- Amazon Web Services, Inc. (EE. UU.)

- IBM Corporation (EE. UU.)

- Zenlayer, Inc. (EE. UU.)

- PhoenixNAP (EE. UU.)

- Oracle Corporation (EE. UU.)

- Lumen Technologies (EE. UU.)

- Atlantic.Net (EE. UU.)

- Scaleway SAS (Francia)

- Limestone Networks, Inc. (EE. UU.)

- BigStep Technologies Pvt. Ltd. (India)

- Alibaba Cloud (China)

- Hivelocity, Inc. (EE. UU.)

- Servidores Cherry (Lituania)

- OVH SAS (Francia)

- Liquid Web, LLC (EE. UU.)

- Joyent (Estados Unidos)

- Fasthosts Internet Limited (Reino Unido)

- VULTR (EE. UU.)

- Microsoft (EE. UU.)

- Samsung SDS (Corea del Sur)

Últimos avances en el mercado de la nube Bare Metal en América del Norte

- En febrero de 2025, Liquid Web, LLC expandió su nube Bare Metal con el lanzamiento de centros de datos en San José, Ashburn, Sídney y Londres, mejorando así el rendimiento global. También introdujo redes privadas cifradas interregionales, ofreciendo una conectividad segura, conforme y sin interrupciones en todos los planes de alojamiento Bare Metal.

- En febrero de 2025, AWS reveló sus planes de invertir más de 100 000 millones de dólares este año en infraestructura específica para IA, superando ampliamente a sus competidores y consolidando su liderazgo en la expansión global de infraestructura de IA y nube. AWS también anunció una inversión de 13 000 millones de dólares en centros de datos australianos hasta 2029, incluyendo tres parques solares, para reforzar su capacidad de cómputo de IA y sus operaciones en energías renovables.

- En 2025, Alphabet (la empresa matriz de Google) comprometió aproximadamente 75 000 millones de dólares en inversiones de capital, principalmente para ampliar la infraestructura de redes, servidores y centros de datos centrados en IA. Además, Google Cloud cerró un acuerdo récord de 10 000 millones de dólares a seis años con Meta para cubrir las necesidades de infraestructura de IA, uno de sus mayores acuerdos en la nube.

- En 2025, Samsung SDS informó un crecimiento interanual del 20 % en su negocio de nube, impulsado por la expansión de los servicios de nube pública, HPC y servicios administrados, incluidos proyectos de IA generativa, en su Samsung Cloud Platform (SCP).

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER FIVE FORCES

4.2 TECHNOLOGICAL TRENDS

4.2.1 RISE IN AI/ML WORKLOADS DRIVING BARE METAL ADOPTION

4.2.2 RISE OF EDGE COMPUTING AND DISTRIBUTED INFRASTRUCTURE

4.2.3 AUTOMATION & ORCHESTRATION VIA INFRASTRUCTURE AS CODE (IAC)

4.2.4 ENHANCED SECURITY VIA HARDWARE ROOT OF TRUST AND TPM INTEGRATION

4.3 COMPANY COMPARITIVE ANALYSIS

4.4 KEY STRATEGIC DECISION

4.4.1 INFRASTRUCTURE INVESTMENT — EDGE VS. CORE DEPLOYMENT STRATEGY

4.4.2 SERVICE DIFFERENTIATION THROUGH ECOSYSTEM INTEGRATION

4.4.3 PRICING MODEL AND RESOURCE MONETIZATION STRATEGY

4.4.4 COMPLIANCE & DATA SOVEREIGNTY ROADMAP

4.4.5 CONCLUSION

4.5 REGULATORY STANDARDS

4.5.1 DATA PRIVACY & SOVEREIGNTY

4.5.2 SECURITY & RISK MANAGEMENT STANDARDS

4.5.3 INTEROPERABILITY, PORTABILITY & POLICIES

4.5.4 PROCUREMENT, ANTITRUST & MARKET STRUCTURE

4.6 PATENT ANALYSIS

4.6.1 PATENT ANALYSIS – NORTH AMERICA BARE METAL CLOUD MARKET

4.7 PRICING ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SURGING DEMAND FOR HIGH-PERFORMANCE COMPUTING (HPC), AI/ML WORKLOADS, AND DATA-INTENSIVE APPLICATIONS

5.1.2 INCREASING ADOPTION IN TELECOM AND 5G CORE INFRASTRUCTURE FOR ULTRA-LOW LATENCY PROCESSING

5.1.3 GROWING SHIFT TOWARD CLOUD-NATIVE CONTAINER ORCHESTRATION AND DEPLOYMENT OF WORKLOADS DIRECTLY ON BARE METAL INFRASTRUCTURE

5.1.4 EXPANDING USE IN GAMING, MEDIA RENDERING, AND ADTECH PLATFORMS REQUIRING DIRECT HARDWARE ACCESS

5.2 RESTRAINTS

5.2.1 SKILL GAP AND LACK OF STANDARDIZED AUTOMATION TOOLS FOR BARE METAL DEPLOYMENTS

5.2.2 HARDWARE DEPENDENCY LEADING TO LONGER UPGRADE CYCLES AND VENDOR LOCK-IN RISKS

5.3 OPPORTUNITY-

5.3.1 RISING DEMAND FOR HIGH-PERFORMANCE INFRASTRUCTURE TO SUPPORT AI AND MACHINE LEARNING

5.3.2 ACCELERATED ADOPTION OF IOT, SMART DEVICES, AND 5G DRIVING EDGE AND CORE COMPUTE NEEDS

5.3.3 INCREASING ADOPTION AMONG SMES DUE TO COST-EFFICIENT AND SCALABLE DEPLOYMENT MODELS

5.4 CHALLENGES-

5.4.1 LIMITED VENDOR ECOSYSTEM & STANDARDIZATION

5.4.2 HIGH INFRASTRUCTURE & OPERATIONAL COSTS

6 NORTH AMERICA BARE METAL CLOUD MARKET, BY COMPONENT.

6.1 OVERVIEW

6.2 SERVER

6.3 SERVICES

7 NORTH AMERICA BARE METAL CLOUD MARKET, BY APPLICATION.

7.1 OVERVIEW

7.2 REAL TIME ANALYTICS

7.3 ADTECH/FINTECH

7.4 GAMING

7.5 STREAMING

7.6 ESPORTS

7.7 OTHERS

8 NORTH AMERICA BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE.

8.1 OVERVIEW

8.2 SMES

8.3 LARGE ENTERPRISES

9 NORTH AMERICA BARE METAL CLOUD MARKET, BY INFRASTRUCTURE

9.1 OVERVIEW

9.2 VIRTUAL PUBLIC CLOUD

9.3 CLASSIC INFRASTRUCTURE

10 NORTH AMERICA BARE METAL CLOUD MARKET, BY END USER.

10.1 OVERVIEW

10.2 IT & TELECOM

10.3 BFSI

10.4 GOVERNMENT

10.5 MANUFACTURING

10.6 MEDIA & ENTERTAINMENT

10.7 HEALTHCARE

10.8 RETAIL

10.9 OTHERS

11 NORTH AMERICA BARE METAL CLOUD MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA BARE METAL CLOUD MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 ATLANTIC.NET

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT DEVELOPMENT

14.2 MICROSOFT.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 AMAZON WEB SERVICES, INC

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 GOOGLE LLC

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 SAMSUNG SDS

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 RACKSPACE TECHNOLOGY

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 COMPANY SHARE ANALYSIS

14.6.4 SOLUTIONS PORTFOLIO

14.6.5 RECENT DEVELOPMENT

14.7 ALIBABA CLOUD

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 BIGSTEP TECHNOLOGIES PVT. LTD.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 CHERRY SERVERS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 EQUINIX INC

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 FASTHOSTS INTERNET LIMITED.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 HORIZONIQ

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 HIVELOCITY, INC

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 IBM

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 JOYENT

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 LUMEN TECHNOLOGIES

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT/NEWS

14.17 LIMESTONE NETWORKS, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 LIQUID WEB, LLC

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 ORACLE

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 OVH SAS.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENT

14.21 PHOENIXNAP

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 SCALEWAY SAS

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

14.23 VULTR

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENT

14.24 ZENLAYER, INC.

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

Lista de Tablas

TABLE 1 NORTH AMERICA BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 2 NORTH AMERICA SERVER IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA SERVICES IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA BARE METAL CLOUD MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA REAL TIME ANALYTICS IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA ADTECH/FINTECH IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA GAMING IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA STREAMING IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA ESPORTS IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA OTHERS IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA SMES IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA LARGE ENTERPRISES IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA BARE METAL CLOUD MARKET, BY INFRASTRUCTURE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA VIRTUAL PUBLIC CLOUD IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA CLASSIC INFRASTRUCTURE IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA BARE METAL CLOUD MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA IT & TELECOM IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA IT & TELECOM IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA BFSI IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA BFSI IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA SERVICE IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA GOVERNMENT IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA GOVERNMENT IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA MANUFACTURING IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA MANUFACTURING IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA MEDIA & ENTERTAINMENT IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA MEDIA & ENTERTAINMENT IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA HEALTHCARE IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA HEALTHCARE IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA RETAIL IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA RETAIL IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 OTHERS IN BARE METAL CLOUD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA OTHERS IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA BARE METAL CLOUD MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA BARE METAL CLOUD MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA BARE METAL CLOUD MARKET, BY INFRASTRUCTURE, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA BARE METAL CLOUD MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA IT & TELECOM IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA BFSI IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA GOVERNMENT IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 NORTH AMERICA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 NORTH AMERICA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA MANUFACTURING IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 83 NORTH AMERICA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 NORTH AMERICA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 NORTH AMERICA MEDIA & ENTERTAINMENT IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 87 NORTH AMERICA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 NORTH AMERICA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 NORTH AMERICA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 NORTH AMERICA HEALTHCARE IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 91 NORTH AMERICA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 NORTH AMERICA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 NORTH AMERICA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 NORTH AMERICA RETAIL IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 95 NORTH AMERICA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 NORTH AMERICA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 NORTH AMERICA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 NORTH AMERICA OTHERS IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 99 NORTH AMERICA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 NORTH AMERICA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 U.S. BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 103 U.S. SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 U.S. SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 U.S. PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 U.S. BARE METAL CLOUD MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 107 U.S. BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 108 U.S. BARE METAL CLOUD MARKET, BY INFRASTRUCTURE, 2018-2032 (USD THOUSAND)

TABLE 109 U.S. BARE METAL CLOUD MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 110 U.S. IT & TELECOM IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 111 U.S. SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 U.S. SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 U.S. PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 U.S. BFSI IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 115 U.S. SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 U.S. SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 U.S. PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 U.S. GOVERNMENT IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 119 U.S. SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 U.S. SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 U.S. PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 U.S. MANUFACTURING IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 123 U.S. SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 U.S. SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 U.S. PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 U.S. MEDIA & ENTERTAINMENT IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 127 U.S. SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 U.S. SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 U.S. PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 U.S. HEALTHCARE IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 131 U.S. SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 U.S. SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 U.S. PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 U.S. RETAIL IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 135 U.S. SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 U.S. SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 U.S. PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 U.S. OTHERS IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 139 U.S. SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.S. SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 U.S. PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 CANADA BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 143 CANADA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 CANADA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 CANADA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 CANADA BARE METAL CLOUD MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 147 CANADA BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 148 CANADA BARE METAL CLOUD MARKET, BY INFRASTRUCTURE, 2018-2032 (USD THOUSAND)

TABLE 149 CANADA BARE METAL CLOUD MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 150 CANADA IT & TELECOM IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 151 CANADA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 CANADA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 CANADA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 CANADA BFSI IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 155 CANADA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 CANADA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 CANADA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 CANADA GOVERNMENT IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 159 CANADA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 CANADA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 CANADA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 CANADA MANUFACTURING IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 163 CANADA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 CANADA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 CANADA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 CANADA MEDIA & ENTERTAINMENT IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 167 CANADA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 CANADA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 CANADA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 CANADA HEALTHCARE IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 171 CANADA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 CANADA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 CANADA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 CANADA RETAIL IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 175 CANADA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 CANADA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 CANADA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 CANADA OTHERS IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 179 CANADA SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 CANADA SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 CANADA PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 MEXICO BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 183 MEXICO SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 MEXICO SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 MEXICO PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 MEXICO BARE METAL CLOUD MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 187 MEXICO BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 188 MEXICO BARE METAL CLOUD MARKET, BY INFRASTRUCTURE, 2018-2032 (USD THOUSAND)

TABLE 189 MEXICO BARE METAL CLOUD MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 190 MEXICO IT & TELECOM IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 191 MEXICO SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 MEXICO SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 MEXICO PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 MEXICO BFSI IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 195 MEXICO SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 MEXICO SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 MEXICO PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 MEXICO GOVERNMENT IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 199 MEXICO SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 MEXICO SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 MEXICO PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 MEXICO MANUFACTURING IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 203 MEXICO SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 MEXICO SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 MEXICO PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 MEXICO MEDIA & ENTERTAINMENT IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 207 MEXICO SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 MEXICO SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 MEXICO PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 MEXICO HEALTHCARE IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 211 MEXICO SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 MEXICO SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 MEXICO PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 MEXICO RETAIL IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 215 MEXICO SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 MEXICO SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 MEXICO PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 MEXICO OTHERS IN BARE METAL CLOUD MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 219 MEXICO SERVER IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 MEXICO SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 MEXICO PROFESSIONAL SERVICES IN BARE METAL CLOUD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

Lista de figuras

FIGURE 1 NORTH AMERICA BARE METAL CLOUD MARKET

FIGURE 2 NORTH AMERICA BARE METAL CLOUD MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BARE METAL CLOUD MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BARE METAL CLOUD MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BARE METAL CLOUD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BARE METAL CLOUD MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA BARE METAL CLOUD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA BARE METAL CLOUD MARKET FOR BARE METAL CLOUD TREATMENT: DBMR MARKET POSITION GRID MANUFACTURER

FIGURE 9 NORTH AMERICA BARE METAL CLOUD MARKET FOR BARE METAL CLOUD TREATMENT: DBMR MARKET POSITION GRID DISTRIBUTOR

FIGURE 10 NORTH AMERICA BARE METAL CLOUD MARKET FOR BARE METAL CLOUD TREATMENT: MARKET END USER COVERAGE GRID MANUFACTURER

FIGURE 11 NORTH AMERICA BARE METAL CLOUD MARKET FOR BARE METAL CLOUD TREATMENT: MARKET END USER COVERAGE GRID MANUFACTURER

FIGURE 12 NORTH AMERICA BARE METAL CLOUD MARKET: SEGMENTATION

FIGURE 13 EXECUTIVE SUMMARY

FIGURE 14 NINE SEGMENTS COMPRISE THE NORTH AMERICA BARE METAL CLOUD MARKET, BY OFFERING

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 SURGING DEMAND FOR HIGH-PERFORMANCE COMPUTING (HPC), AI/ML WORKLOADS, AND DATA-INTENSIVE APPLICATIONS IS DRIVING ADOPTION IS EXPECTED TO DRIVE THE NORTH AMERICA BARE METAL CLOUD MARKET FOR BARE METAL CLOUD TREATMENT IN THE FORECAST PERIOD

FIGURE 17 THE INJECTION REGIMEN SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BARE METAL CLOUD MARKET FOR BARE METAL CLOUD TREATMENT IN 2025 AND 2032

FIGURE 18 NORTH AMERICA BARE METAL CLOUD MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA BARE METAL CLOUD MARKET

FIGURE 20 NORTH AMERICA BARE METAL CLOUD MARKET, BY COMPONENT, 2025

FIGURE 21 NORTH AMERICA BARE METAL CLOUD MARKET, BY APPLICATION, 2025

FIGURE 22 NORTH AMERICA BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2025

FIGURE 23 NORTH AMERICA BARE METAL CLOUD MARKET, BY INFRASTRUCTURE, 2025

FIGURE 24 NORTH AMERICA BARE METAL CLOUD MARKET, BY END USER, 2025

FIGURE 25 NORTH AMERICA BARE METAL CLOUD MARKET: SNAPSHOT (2024)

FIGURE 26 NORTH AMERICA BARE METAL CLOUD MARKET: COMPANY SHARE 2024 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.