North America Automotive Magnet Wire Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.21 Billion

USD

1.67 Billion

2024

2032

USD

1.21 Billion

USD

1.67 Billion

2024

2032

| 2025 –2032 | |

| USD 1.21 Billion | |

| USD 1.67 Billion | |

|

|

|

|

Segmentación del mercado de alambre magnético automotriz en América del Norte, por tipo (alambre de cobre y alambre de aluminio), tipo de producto (alambre esmaltado y alambre conductor recubierto), forma (alambre magnético redondo, alambre magnético redondo adherible, alambre magnético rectangular y alambre magnético cuadrado), tipo de aislamiento (poliamida-imida [PAI], poliimidas [PI], polieterimida [PEI], poliéter éter cetona [PEEK] y otros), tipo de enfoque tecnológico (tecnología de neodimio, tecnología de samario cobalto, tecnología de ferrita y otras tecnologías magnéticas), tipo de marco de integración (imán blando, imán duro e imán semirrígido), aplicación (motores, transformadores, inductores, frenos, arnés de batería, arnés de alternador de arranque, fuente de alimentación de EDS, cables de batería, cables de alimentación de alta tensión, LVDS/HDS, coaxial, ventanas, bloqueo de puertas, asientos, estabilidad y otros dispositivos eléctricos), canal de distribución (ventas directas e indirectas), usuario final (industria automotriz, industria de sensores, industria de actuadores, iluminación) Industria, Pasajeros, Vehículos, Energía, Electrodomésticos, Transformadores, Señalización y Suministro, Datos y Otros) - Tendencias y Pronósticos de la Industria hasta 2032

Tamaño del mercado de alambre magnético para automoción

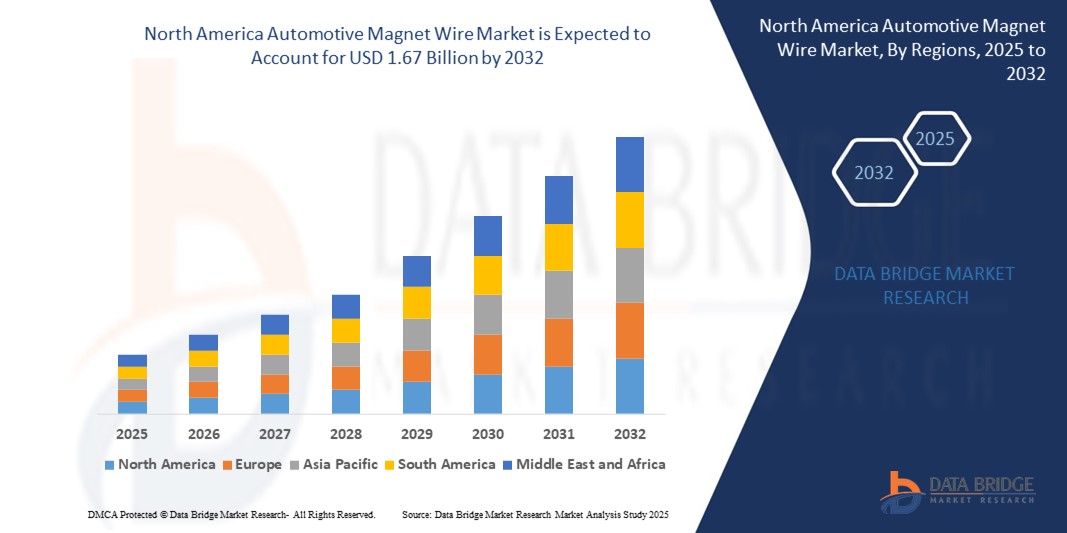

- El tamaño del mercado de alambre magnético automotriz de América del Norte se valoró en USD 1.21 mil millones en 2024 y se espera que alcance los USD 1.67 mil millones para 2032 , con una CAGR del 4,1% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente producción de vehículos eléctricos e híbridos, que requieren motores y sistemas de energía de alta eficiencia, lo que impulsa la demanda de alambres magnéticos automotrices avanzados con conductividad superior, resistencia térmica y durabilidad.

- Además, el enfoque creciente en la electrificación de los vehículos, las estrictas regulaciones sobre emisiones y la creciente integración de componentes electrónicos en los sistemas de propulsión, ADAS y de información y entretenimiento están acelerando significativamente la necesidad de cables magnéticos de alto rendimiento en las arquitecturas automotrices modernas.

Análisis del mercado de alambre magnético para automoción

- Los cables magnéticos automotrices son conductores aislados especializados que se utilizan en componentes de vehículos como motores eléctricos, alternadores, transformadores y actuadores para permitir una transmisión de potencia eficiente, función electromagnética y resistencia al calor en entornos exigentes.

- La creciente demanda de movilidad eléctrica, sistemas de motores miniaturizados de alta potencia y electrónica mejorada en los vehículos está impulsando la adopción de cables magnéticos con tecnologías de aislamiento avanzadas, propiedades de bobinado precisas y estabilidad térmica mejorada, particularmente en vehículos eléctricos y modelos híbridos.

- Estados Unidos dominó el mercado de alambre magnético automotriz con una participación del 23,73 % en 2024, debido a su sólido ecosistema de producción de vehículos eléctricos, capacidades avanzadas de I+D automotriz y una cadena de suministro bien establecida para componentes de vehículos eléctricos y motores de alta eficiencia.

- Se espera que Canadá sea la región de más rápido crecimiento en el mercado de alambre magnético automotriz durante el período de pronóstico debido a las políticas nacionales de vehículos eléctricos, el aumento de la producción nacional de vehículos eléctricos y el crecimiento del sector de fabricación de piezas automotrices del país.

- El segmento de alambre magnético redondo dominó el mercado con una cuota de mercado del 76,8 % en 2024, gracias a su facilidad de bobinado, su rentabilidad y su amplia compatibilidad con diseños estándar de motores y bobinas. Los alambres redondos se utilizan ampliamente en diversos sistemas automotrices gracias a su adaptabilidad a diferentes tipos de aislamiento y a su escalabilidad de producción.

Alcance del informe y segmentación del mercado de alambre magnético automotriz

|

Atributos |

Análisis clave del mercado del alambre magnético para automoción |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis en profundidad de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle. |

Tendencias del mercado de alambre magnético para automoción

“Creciente énfasis en los materiales sostenibles”

- La sostenibilidad ha pasado de ser una iniciativa de nicho a un motor de mercado clave en la industria del alambre magneto automotriz. Los fabricantes están invirtiendo en materiales y métodos de procesamiento de última generación que reducen las emisiones durante su vida útil, reducen los subproductos peligrosos y se alinean con los principios de la economía circular. Se hace hincapié en las afirmaciones "verdes" y también en mejoras mensurables de la huella de carbono en toda la cadena de suministro automotriz.

- Por ejemplo, Essex Furukawa y Superior Essex han introducido alambres magnetos con recubrimientos de esmalte vegetal sin solventes que eliminan las emisiones de compuestos orgánicos volátiles (COV) que se producen tradicionalmente durante el aislamiento de cables. Sus líneas de productos sostenibles han marcado nuevos hitos en la industria y son solicitadas por fabricantes de automóviles con conciencia ecológica para su uso en bobinados de motores eléctricos.

- La adopción de soluciones de reciclaje de cobre de circuito cerrado se está acelerando, lo que ayuda a los fabricantes a reducir el impacto ambiental y a proteger sus operaciones de la volatilidad de los precios de las materias primas. El aislamiento biodegradable se encuentra en fase de I+D en las principales empresas, lo que refleja la creciente anticipación a las futuras regulaciones sobre residuos electrónicos.

- Los fabricantes de automóviles ahora incluyen explícitamente criterios de sostenibilidad en la selección de proveedores, lo que lleva a los proveedores a obtener certificaciones de abastecimiento responsable, trazabilidad y transparencia de emisiones, lo que crea una ventaja competitiva para las empresas proactivas.

- El mercado también está viendo una mayor colaboración entre fabricantes de cables, productores químicos y fabricantes de equipos originales (OEM) de automóviles en proyectos conjuntos diseñados para aumentar aún más la eficiencia del aislamiento y reducir la responsabilidad ambiental.

- Estos esfuerzos, incluidas iniciativas internacionales de alto perfil, están ayudando a establecer nuevos estándares globales para el alambre magneto, brindando a las empresas líderes beneficios pioneros y una imagen pública positiva ante las partes interesadas preocupadas por el medio ambiente.

Dinámica del mercado del alambre magnético para automoción

Conductor

“Aumento de la demanda de vehículos eléctricos e híbridos”

- La creciente transición hacia los vehículos eléctricos (VE) y los vehículos eléctricos híbridos (VEH) está transformando radicalmente el mercado del alambre magneto para automoción, ya que estos vehículos requieren mayores cantidades y calidades de alambre magneto para sus motores eléctricos, sistemas de baterías y componentes auxiliares electrificados. La demanda es especialmente alta para alambre con mayor resistencia térmica, conductividad eléctrica y durabilidad para garantizar la eficiencia y la longevidad del vehículo.

- Por ejemplo, Essex Furukawa suministra alambre de bobinado de alta tensión (HVWW) especializado a los modelos emblemáticos de vehículos eléctricos de Tesla y Ford, lo que respalda las funciones principales de propulsión y carga con un aislamiento avanzado y un rendimiento térmico superior. Sus productos de alambre magneto ejemplifican los altos estándares técnicos y las colaboraciones que caracterizan al sector.

- Los principales fabricantes están aumentando su capacidad, modernizando procesos e invirtiendo fuertemente en I+D para nuevos materiales de aislamiento y tecnologías de bobinado mejoradas, anticipándose tanto a los crecientes requisitos de volumen como a las demandas de calidad cada vez más estrictas de los OEM.

- Las políticas y el impulso de los consumidores hacia la descarbonización, incluidos los mandatos gubernamentales sobre emisiones y los lucrativos incentivos ecológicos en los EE. UU., la UE, China y otros países, están inflando aún más la demanda de alambre magnético a medida que los fabricantes de automóviles aceleran los lanzamientos de nuevos vehículos eléctricos.

- La estrecha colaboración entre los productores de cables y los fabricantes de automóviles se ha convertido en la norma, con el desarrollo conjunto de cables magnéticos específicos para cada aplicación, diseñados para cumplir con arquitecturas de tren motriz, clasificaciones de voltaje y entornos operativos únicos en vehículos de próxima generación.

Restricción/Desafío

Las interrupciones en la cadena de suministro del cobre plantean riesgos

- El cobre, principal material conductor del alambre magneto, enfrenta un riesgo constante en la cadena de suministro debido a las interrupciones en las minas a nivel mundial, la limitada escalabilidad de la producción y la compleja logística. La volatilidad de los precios del cobre impacta directamente los costos de insumos para los productores de alambre magneto y puede amenazar la continuidad de la producción de los fabricantes de automóviles, especialmente durante los periodos de auge del sector.

- Por ejemplo, las interrupciones en el suministro de cobre a lo largo de 2024 provocaron desafíos operativos y financieros para empresas como Furukawa Electric y Prysmian Group, obligándolas a intensificar el uso de cobre reciclado, obtener contratos de abastecimiento alternativos y reevaluar sus estrategias de gestión de riesgos. Estas perturbaciones en el suministro repercuten en el sector automotriz y han obligado a reevaluar las estrategias a largo plazo en materia de materias primas.

- A medida que aumentan los costos de los insumos, algunos productores han incrementado la adopción del alambre magneto de aluminio para aplicaciones específicas. Sin embargo, el aluminio suele requerir modificaciones de diseño debido a su menor conductividad eléctrica en comparación con el cobre, lo que puede limitar su uso en aplicaciones compactas o de alto rendimiento y subraya la importancia continua del cobre.

- La volatilidad del mercado complica la planificación del inventario y la producción tanto para los proveedores como para los fabricantes de equipos originales (OEM), lo que puede causar retrasos en los lanzamientos de vehículos, limitaciones de suministro y compresión de márgenes en toda la cadena de valor.

- Con el aumento de la producción de vehículos eléctricos y la intensificación de la competencia por el cobre en múltiples industrias (incluidas la energía, la infraestructura y la electrónica), la estabilidad del suministro y la gestión de precios siguen estando entre los desafíos de mayor prioridad que enfrenta el mercado de alambre magnético para automóviles.

Alcance del mercado del alambre magnético para automoción

El mercado está segmentado según tipo, tipo de producto, forma, tipo de aislamiento, tipo de enfoque tecnológico, tipo de marco de integración, aplicación, canal de distribución y usuario final.

- Por tipo

Según el tipo, el mercado de alambre magneto automotriz se segmenta en alambre de cobre y alambre de aluminio. El segmento de alambre de cobre dominó la mayor cuota de mercado en 2024, gracias a su superior conductividad eléctrica, alta resistencia térmica y resistencia mecánica, lo que lo convierte en la opción preferida para aplicaciones automotrices críticas como motores y alternadores. Los alambres magneto de cobre garantizan un rendimiento estable bajo tensiones térmicas y mecánicas exigentes, lo cual es crucial para la fiabilidad y la eficiencia de vehículos eléctricos y de combustión interna.

Se prevé que el segmento de alambre de aluminio experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente demanda de soluciones ligeras para vehículos eléctricos. La menor densidad del aluminio y sus ventajas de coste frente al cobre están impulsando a los fabricantes de equipos originales (OEM) a adoptarlo en aplicaciones donde la reducción de peso y la optimización de costes son clave, especialmente en arneses de cables y bobinados secundarios de gran volumen.

- Por tipo de producto

Según el tipo de producto, el mercado se clasifica en alambre esmaltado y alambre conductor revestido. El segmento de alambre esmaltado representó la mayor participación en los ingresos en 2024, gracias a su capa de aislamiento compacta, alta resistencia térmica y excelente rigidez dieléctrica, esenciales para entornos con limitaciones de espacio y altas temperaturas en componentes automotrices. Su uso generalizado en motores de tracción, sistemas de dirección asistida y ventiladores de HVAC aumenta su demanda.

Se proyecta que el segmento de cables conductores cubiertos registre la tasa de crecimiento más rápida durante el período de pronóstico debido a la creciente adopción en aplicaciones de servicio pesado que requieren resistencia a la abrasión mecánica y aislamiento térmico, especialmente en vehículos comerciales y arquitecturas híbridas.

- Por forma

Según su forma, el mercado se segmenta en alambre magnético redondo, alambre magnético redondo adherible, alambre magnético rectangular y alambre magnético cuadrado. En 2024, el segmento de alambre magnético redondo lideró el mercado con una participación del 76,8% gracias a su facilidad de bobinado, rentabilidad y amplia compatibilidad con diseños estándar de motores y bobinas. Los alambres redondos se utilizan ampliamente en diversos sistemas automotrices gracias a su adaptabilidad a diferentes tipos de aislamiento y escalabilidad de producción.

El segmento de alambre magneto rectangular está en camino de experimentar el mayor crecimiento, principalmente debido al aumento de aplicaciones en motores de alta eficiencia, donde un empaquetamiento de bobinas más compacto y una reducción de los entrehierros mejoran la densidad energética y el rendimiento del motor. Su creciente uso en motores de alto rendimiento para vehículos eléctricos (VE) es un factor clave que impulsa esta demanda.

- Por tipo de aislamiento

La segmentación por tipo de aislamiento incluye poliamida-imida (PAI), poliimidas (PI), polieterimida (PEI), poliéter éter cetona (PEEK) y otros. El segmento de poliamida-imida (PAI) dominó el mercado en 2024, gracias a su excelente clasificación térmica (hasta 240 °C), alta durabilidad mecánica y resistencia química superior, lo que lo hace adecuado para entornos automotrices hostiles.

Se prevé que el segmento de poliéter éter cetona (PEEK) exhiba la CAGR más alta debido a sus excepcionales propiedades térmicas y eléctricas, su naturaleza liviana y su adopción emergente en aplicaciones específicas de vehículos eléctricos donde se requieren tanto miniaturización como alta estabilidad térmica.

- Por tipo de enfoque tecnológico

Según el tipo de enfoque tecnológico, el mercado se segmenta en tecnología de neodimio, tecnología de samario-cobalto, tecnología de ferrita y otras tecnologías magnéticas. El segmento de tecnología de neodimio lideró el mercado en 2024 gracias a su superior densidad de energía magnética, crucial para los motores eléctricos compactos y de alta eficiencia de los vehículos eléctricos modernos y los sistemas híbridos.

Se espera que el segmento de tecnología de ferrita crezca al ritmo más rápido, en particular debido a aplicaciones sensibles a los costos en motores de baja potencia, actuadores y sistemas auxiliares donde la resistencia a la desmagnetización y la asequibilidad superan la compacidad.

- Por tipo de marco de integración

En términos de integración, el mercado incluye imanes blandos, duros e semiduros. El segmento de imanes duros representó la mayor cuota de mercado en 2024, impulsado por el creciente uso de motores de imanes permanentes en sistemas de propulsión eléctrica que requieren alta coercitividad y remanencia.

Se proyecta que el segmento de imanes blandos se expandirá a la tasa de crecimiento más alta, respaldado por su creciente uso en núcleos de transformadores y aplicaciones de sensores donde la alta permeabilidad y la baja coercitividad son esenciales para un rendimiento energéticamente eficiente.

- Por aplicación

Según su aplicación, el mercado se segmenta en motores, transformadores, inductores, frenos, arneses de batería, arneses de alternador de arranque, fuente de alimentación EDS, cables de batería, cables de alimentación de alta tensión, LVDS/HDS, cable coaxial, elevalunas, cierre de puertas, asientos, control de estabilidad y otros dispositivos eléctricos. El segmento de motores dominó el mercado en 2024 debido a la creciente electrificación de transmisiones y sistemas auxiliares que requieren cables magnetos para una entrega óptima de par y potencia.

Se prevé que el segmento de arneses de batería sea testigo del crecimiento más rápido, impulsado por la expansión de la producción de vehículos eléctricos, que exige soluciones de cableado complejas y de alta capacidad para una transmisión de energía segura y eficiente entre los paquetes de baterías y las unidades de potencia.

- Por canal de distribución

Según el canal de distribución, el mercado se divide en ventas directas e indirectas. El segmento de ventas directas representó la mayor participación en 2024, gracias a la preferencia de los fabricantes de equipos originales (OEM) por relaciones a largo plazo con los proveedores, garantizando la calidad, la personalización y el control de costos.

Se prevé que el segmento de ventas indirectas crezca más rápidamente debido a la creciente participación de distribuidores externos y proveedores de repuestos que atienden los mercados de reemplazo y reparación, especialmente en las economías en desarrollo.

- Por el usuario final

En cuanto al usuario final, el mercado incluye la industria automotriz, la industria de sensores, la industria de actuadores, la industria de iluminación, los vehículos de pasajeros, la energía, los electrodomésticos, los transformadores, la señalización y el suministro, los datos, entre otros. La industria automotriz lideró los ingresos del segmento en 2024, debido a la creciente demanda de motores de alta eficiencia para vehículos eléctricos (VE), sistemas de climatización (HVAC) y vehículos con sistemas ADAS.

Se proyecta que la industria de sensores registrará el crecimiento más rápido hasta 2032 debido al papel cada vez mayor de los sensores activados magnéticamente en los vehículos modernos para monitoreo en tiempo real, automatización de seguridad y diagnóstico de rendimiento.

Análisis regional del mercado de alambre magnético para automoción

- Estados Unidos dominó el mercado de alambre magnético automotriz con la mayor participación en los ingresos del 23,73 % en 2024, impulsado por su sólido ecosistema de producción de vehículos eléctricos, capacidades avanzadas de I+D automotriz y una cadena de suministro bien establecida para componentes de vehículos eléctricos y motores de alta eficiencia.

- El país alberga a varios fabricantes de automóviles y proveedores de primer nivel líderes que invierten fuertemente en el desarrollo de alambres magnetos compactos y térmicamente estables para su uso en motores de tracción, electrónica de potencia y sistemas avanzados de asistencia al conductor (ADAS). La presencia de importantes desarrolladores de tecnología de aislamiento y empresas de ciencia de materiales impulsa la rápida innovación y personalización en el diseño de alambres magnetos.

- El mercado estadounidense se ve reforzado por los favorables incentivos federales que promueven la fabricación de vehículos eléctricos, junto con la creciente demanda de vehículos ligeros y energéticamente eficientes. Las continuas inversiones en plantas de producción locales, junto con las crecientes colaboraciones entre fabricantes de automóviles y fabricantes de alambre, están consolidando el dominio del país en el sector del alambre magnético para la industria automotriz en Norteamérica.

Análisis del mercado canadiense de alambre magnético para automóviles

Se proyecta que Canadá registrará la tasa de crecimiento anual compuesta (TCAC) más rápida en el mercado norteamericano de alambres magnéticos para automóviles entre 2025 y 2032, gracias a las políticas nacionales para vehículos eléctricos, el aumento de la producción nacional de vehículos eléctricos y el crecimiento del sector de fabricación de autopartes del país. Provincias clave como Ontario y Quebec están experimentando una inversión significativa en el ensamblaje de motores y componentes, lo que impulsa la demanda de alambres magnéticos de alto rendimiento con propiedades térmicas y mecánicas mejoradas.

Análisis del mercado de alambre magnético automotriz en México

Se prevé que México experimente un crecimiento sostenido en el mercado de alambre magneto automotriz entre 2025 y 2032, impulsado por su creciente papel como centro regional de fabricación para los fabricantes de automóviles norteamericanos. El auge de las plantas de producción de arneses de cables y motores eléctricos, especialmente en los estados del norte, y las favorables relaciones comerciales con Estados Unidos están impulsando la demanda de alambre magneto en el país. Las inversiones en parques industriales automotrices y el mejor acceso a materiales avanzados y tecnologías de aislamiento impulsan aún más la expansión del mercado.

Cuota de mercado del alambre magnético para automóviles

La industria del alambre magnético para automóviles está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- ACEBSA (España)

- Cividale SpA (Italia)

- Craig Wire Products LLC (EE. UU.)

- Device Technologies, Inc. (EE. UU.)

- Ederfil Becker (Alemania)

- ELEKTRISOLA (Alemania)

- Fujikura Ltd. (Japón)

- Furukawa Electric Co., Ltd. (Japón)

- Hitachi Metals, Ltd. (Japón)

- LS Cable & System Ltd. (Corea del Sur)

- Ewwa (Alemania)

- MWS Wire Industries, Inc. (EE. UU.)

- Ningbo Jintian Copper (Grupo) Co., Ltd. (China)

- Rea (Italia)

- Sam Dong (Corea del Sur)

- Sumitomo Electric Industries, Ltd. (Japón)

- Superior Essex Inc. (EE. UU.)

- Synflex Elektro GmbH (Alemania)

- TaYa Electric Wire & Cable Co., Ltd. (Taiwán)

- Tongling Jingda Special Magnet Wire Co., Ltd. (China)

- Wenzhou Jogo Imp & Exp Co., Ltd. (China)

Últimos avances en el mercado de alambre magnético para automóviles en América del Norte

- En junio de 2024, Sumitomo Electric adquirió una participación mayoritaria en el fabricante alemán de cables Südkabel para impulsar dos importantes proyectos de HVDC con Amprion, impulsando así la transición energética de Alemania. Esta adquisición refuerza la presencia y la capacidad de producción de Sumitomo Electric en Europa, especialmente en cables de alta tensión. Al aprovechar esta experiencia, la empresa puede fortalecer indirectamente su producción de alambre magneto para automoción, crucial en los sistemas de vehículos eléctricos, respondiendo a la creciente demanda de energía sostenible y soluciones para la automoción.

- En enero de 2024, Hitachi Metals cambió su nombre a Proterial, Ltd. tras su adquisición por Bain Capital y propone sus imanes de ferrita NMF 15 como una posible alternativa a los imanes de neodimio en los motores de tracción de vehículos eléctricos (VE), con el objetivo de reducir la dependencia de tierras raras. Este desarrollo posiciona a Proterial para ofrecer soluciones más sostenibles para motores de VE mediante la integración de sus imanes de ferrita, lo que podría reducir los riesgos y costos de los recursos, a la vez que amplía su oferta de productos en el mercado del alambre magnético para automoción.

- En mayo de 2023, Essex Furukawa anunció una inversión de 60 millones de dólares para establecer una nueva planta de fabricación dedicada a la producción de alambre magneto para vehículos eléctricos e híbridos. Se espera que esta expansión estratégica fortalezca significativamente la capacidad de producción de la empresa y su posición en el segmento automotriz, permitiéndole satisfacer la creciente demanda de alambre magneto impulsada por la adopción global de vehículos eléctricos.

- En febrero de 2022, el Grupo LWW consolidó sus operaciones de alambre magneto bajo la nueva marca Dahren, integrando Dahrentrad AB, Dahren Poland y LWW Slaska. Esta unificación de marcas busca mejorar la eficiencia operativa y ampliar su oferta de productos en todas las categorías de alambre para bobinado. Esta operación mejorará la competitividad del grupo y su capacidad de servicio para aplicaciones de automoción en toda Europa.

- En octubre de 2020, Furukawa Electric Co. Ltd. y Superior Essex Holding Corp. formaron Essex Furukawa Magnet Wire LLC, una empresa conjunta global que combina sus negocios de alambre magnético pesado y tubos de poliimida. Esta colaboración ha fortalecido su presencia en el mercado global y sus capacidades tecnológicas, lo que ha permitido una cadena de suministro más integrada para satisfacer las crecientes necesidades de los fabricantes de vehículos eléctricos y los proveedores de componentes de todo el mundo.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.