North America Automotive Level Sensor Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

356.60 Million

USD

282.60 Million

2024

2032

USD

356.60 Million

USD

282.60 Million

2024

2032

| 2025 –2032 | |

| USD 356.60 Million | |

| USD 282.60 Million | |

|

|

|

|

Segmentación del mercado de sensores de nivel automotrices de América del Norte, por tipo de producto (sensor de nivel de combustible, sensor de nivel de aceite de motor, sensor de nivel de refrigerante, sensor de nivel de líquido de frenos, sensor de nivel de líquido de dirección asistida sensor magnético y otros), tipo (capacitivo, película resistiva, ultrasónico, resistencias discretas, óptico y otros), tipo de monitoreo (monitoreo de nivel continuo y monitoreo de nivel puntual), aplicación (monitoreo de reabastecimiento de tanques y drenaje de combustible, prevención de robo de combustible y monitoreo del consumo de combustible), tipo de vehículo (vehículo de pasajeros y vehículo comercial), canal de ventas (fabricante de equipo original (OEM) y mercado de accesorios canal de distribución (en línea y fuera de línea) - Tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado de sensores de nivel automotriz en América del Norte

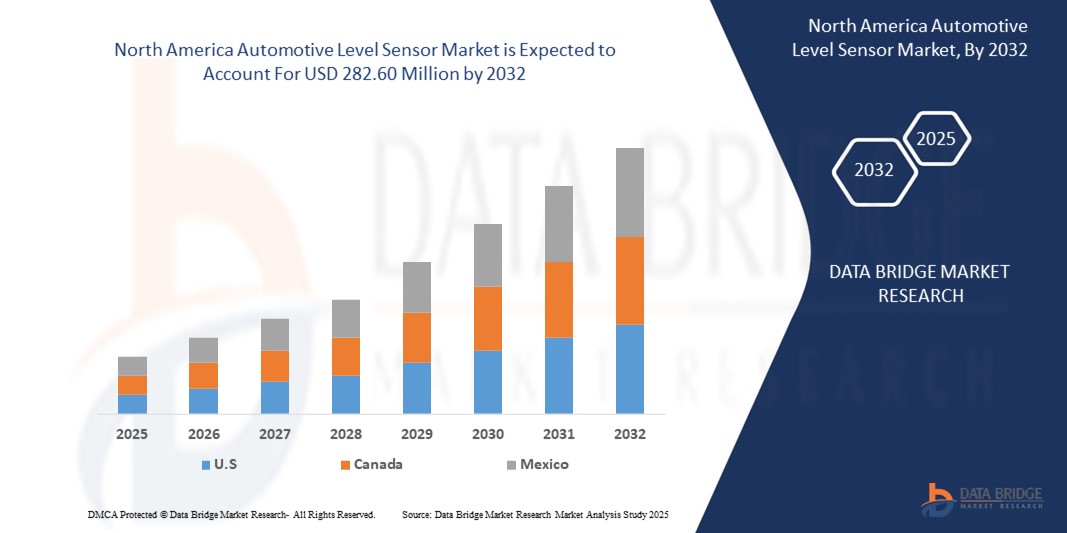

- Se espera que el mercado de sensores de nivel automotriz de América del Norte alcance los USD 356,60 millones para 2032 desde los USD 282,60 millones en 2024 , creciendo con una CAGR sustancial del 2,95 % en el período de pronóstico de 2025 a 2032.

- Los sensores de nivel para automóviles desempeñan un papel fundamental en la monitorización de diversos niveles de fluidos, como combustible, aceite de motor, refrigerante, líquido de frenos y líquido lavaparabrisas. La demanda de estos sensores está aumentando debido al aumento de la producción de vehículos, las normativas de emisiones más estrictas y las crecientes expectativas de los consumidores en cuanto a seguridad y rendimiento. En particular, la transición hacia vehículos eléctricos e híbridos está generando nuevas oportunidades, ya que estos vehículos requieren sistemas de monitorización de fluidos de alta precisión y fiabilidad.

- Además, los avances en tecnologías de sensores, como los capacitivos, ultrasónicos y basados en MEMS, están mejorando la funcionalidad, la durabilidad y la capacidad de integración. Los fabricantes de automóviles están adoptando cada vez más soluciones de sensores inteligentes que permiten el diagnóstico y la conectividad en tiempo real, en línea con las tendencias más amplias en la digitalización automotriz y la integración del Internet de las Cosas (IoT).

Análisis del mercado de sensores de nivel para automóviles en América del Norte

- Los sensores de nivel automotrices, que monitorean los niveles de fluidos como combustible, aceite, refrigerante y líquido de frenos, se están volviendo esenciales en los vehículos modernos para garantizar un rendimiento óptimo, el cumplimiento normativo y el mantenimiento preventivo. Estos sensores desempeñan un papel fundamental en la mejora de la seguridad del vehículo, la eficiencia del motor y la concienciación del conductor en los segmentos de vehículos de pasajeros y comerciales.

- La creciente demanda de sensores de nivel para automóviles en América del Norte está impulsada por estrictas regulaciones gubernamentales sobre emisiones y eficiencia de combustible, la creciente adopción de vehículos eléctricos (VE) y la creciente integración de sistemas de diagnóstico a bordo y tecnologías avanzadas de asistencia al conductor.

- Se espera que EE. UU. domine el mercado de sensores de nivel automotriz de América del Norte con una participación de mercado del 65,12 % debido a su infraestructura automotriz bien establecida, tecnologías avanzadas de fabricación de sensores y una inversión significativamente mayor en investigación y desarrollo en comparación con otros países de la región.

- Canadá es la región de más rápido crecimiento en el mercado de sensores de nivel automotriz de América del Norte, con una CAGR del 11,23 %, respaldada por un sector automotriz estable y un creciente interés en el transporte sostenible.

- El segmento de sensores de nivel de combustible dominó el mercado con una participación del 38,6 % en 2024, principalmente debido a su papel fundamental en el monitoreo del uso de combustible y el suministro de datos precisos a los conductores y operadores de flotas.

Alcance del informe y segmentación del mercado de sensores de nivel automotriz en América del Norte

|

Métrica del informe |

Perspectivas clave del mercado de sensores de nivel para automóviles en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de sensores de nivel automotriz en América del Norte

Creciente demanda de seguridad y comodidad por parte de los consumidores

- Las crecientes expectativas de los consumidores en cuanto a mayor seguridad y comodidad son clave para impulsar el crecimiento del mercado norteamericano de sensores de nivel para automóviles. Los compradores de vehículos actuales priorizan las características de seguridad avanzadas y una experiencia de conducción fluida, que se ven reforzadas por la integración de sensores de nivel precisos y fiables.

- Los vehículos modernos están equipados con una gama de sistemas de seguridad que se basan en la monitorización del nivel de líquido. Los sensores de líquido de frenos, aceite de motor y líquido lavaparabrisas son esenciales para mantener la seguridad operativa y prevenir fallos mecánicos. Ante el aumento de las normativas de seguridad y la creciente concienciación de los consumidores, los fabricantes de automóviles están adoptando sensores de nivel de alto rendimiento para mejorar la fiabilidad del vehículo y cumplir con las normas de cumplimiento.

- La comodidad es otro factor crucial que influye en la adopción de sensores. Los sistemas avanzados de climatización, como la calefacción, la ventilación y el aire acondicionado (HVAC ), dependen de la medición precisa de los niveles de refrigerante para mantener condiciones constantes en el habitáculo. A medida que los consumidores buscan un mayor confort térmico y un funcionamiento más silencioso, la demanda de estos sensores sigue creciendo.

- Además, el aumento de las ventas de vehículos premium y de lujo contribuye a esta tendencia. Características como el monitoreo automático del líquido de transmisión, la suspensión adaptativa y los sistemas avanzados de asistencia al conductor (ADAS) requieren una detección precisa del nivel para funcionar eficazmente.

- A medida que continúa la innovación automotriz, los sensores de nivel siguen siendo fundamentales para garantizar el rendimiento, la seguridad y una experiencia de conducción superior.

Dinámica del mercado de sensores de nivel automotriz en América del Norte

Conductores

Aumento de la producción de vehículos y la demanda de sistemas avanzados de asistencia al conductor (ADAS)

- El mercado norteamericano de sensores de nivel para automóviles está experimentando un crecimiento significativo, impulsado por el aumento de la producción de vehículos y la creciente integración de los sistemas avanzados de asistencia al conductor (ADAS) en los automóviles modernos. Los fabricantes de automóviles incorporan cada vez más sensores sofisticados para mejorar la seguridad, el rendimiento y la comodidad de los vehículos.

- Por ejemplo, en marzo de 2024, TE Connectivity amplió su gama de sensores automotrices con sensores de nivel de fluidos de última generación, diseñados para una mayor durabilidad y precisión en entornos vehiculares hostiles. Innovaciones como estas respaldan la demanda de sensores de alto rendimiento en diversas aplicaciones, como la detección de niveles de combustible, aceite y refrigerante.

- Las regulaciones de eficiencia de combustible y los estándares de emisiones en EE. UU. y Canadá también están impulsando a los fabricantes de equipos originales (OEM) a adoptar sensores de nivel para optimizar la gestión del motor y los fluidos, lo que impulsa aún más la demanda. La transición hacia los vehículos eléctricos (VE) es otro factor clave, ya que estos requieren un monitoreo preciso de los niveles de refrigerante de la batería y del líquido de frenos.

- Los consumidores priorizan cada vez más la seguridad y la comodidad, y muchos vehículos exigentes están equipados con tecnologías ADAS. Estos sistemas dependen de la información precisa de los sensores, incluidos los sensores de nivel, para funcionar correctamente, lo que los hace cruciales para el diseño de vehículos modernos.

- Además, el aumento del desarrollo de vehículos autónomos y de las tecnologías de automóviles conectados está incrementando la necesidad de datos precisos y en tiempo real sobre los niveles de fluidos del vehículo, lo que impulsa la adopción de soluciones avanzadas de detección de nivel en todo el sector automotriz en América del Norte.

Restricción/Desafío

Limitaciones de precisión de los sensores y restricciones de costos en la integración de vehículos

- A pesar de su sólido crecimiento, el mercado norteamericano de sensores de nivel para automóviles enfrenta desafíos relacionados con la precisión y los costos de integración. Factores ambientales como temperaturas extremas, vibraciones y exposición a sustancias químicas pueden afectar la confiabilidad del sensor y generar lecturas inexactas, especialmente en vehículos antiguos o muy usados.

- Un rendimiento inconsistente de los sensores puede provocar falsas alertas o fallos del sistema, lo que podría socavar la confianza del consumidor en los sistemas avanzados de los vehículos. Para solucionar estos problemas se requiere una inversión continua en la durabilidad de los sensores y tecnologías de calibración.

- Además, el coste de incorporar sensores de nivel de alta precisión puede ser considerable, especialmente para vehículos económicos o de gama media. Los fabricantes de equipos originales (OEM) deben encontrar el equilibrio entre las ventajas de las funcionalidades adicionales y la asequibilidad para garantizar su adopción generalizada.

- Por ejemplo, mientras que las marcas de automóviles de lujo han adoptado sistemas avanzados de detección de niveles como estándar, los fabricantes de automóviles tradicionales pueden limitar dichas características a niveles de equipamiento más altos para gestionar los costos generales de producción.

- Para superar estas barreras, los actores de la industria deben centrarse en mejorar la robustez y la rentabilidad de los sensores. La colaboración entre fabricantes de sensores y fabricantes de equipos originales (OEM), junto con los avances tecnológicos en miniaturización y ciencia de materiales, será esencial para abordar las preocupaciones sobre rendimiento y costes e impulsar la futura expansión del mercado.

Alcance del mercado de sensores de nivel automotriz en América del Norte

El mercado está segmentado según el tipo de producto, tipo, tipo de monitoreo, aplicación, tipo de vehículo, canal de ventas y canal de distribución.

- Por tipo de producto

Según el tipo de producto, el mercado de sensores de nivel de combustible se segmenta en: sensor de nivel de combustible, sensor de nivel de aceite de motor, sensor de nivel de refrigerante, sensor de nivel de líquido de frenos, sensor de nivel de líquido de dirección asistida, sensor magnético, entre otros. El segmento de sensores de nivel de combustible dominó el mercado con una participación del 38,6 % en 2024, principalmente debido a su papel crucial en la monitorización del consumo de combustible y la provisión de datos precisos a conductores y operadores de flotas. La creciente importancia de la eficiencia de los vehículos y el cumplimiento de las normativas sobre emisiones ha impulsado su demanda tanto en vehículos de pasajeros como comerciales.

Se proyecta que el segmento de sensores de nivel de aceite del motor crecerá a la CAGR más rápida del 20,9 % entre 2025 y 2032, impulsado por la creciente demanda de soluciones de mantenimiento preventivo e integración de sistemas de monitoreo de aceite en vehículos conectados y eléctricos para garantizar la longevidad y confiabilidad del motor.

- Por tipo

Según el tipo, el mercado se segmenta en sensores capacitivos, de película resistiva, ultrasónicos, de resistencias discretas, ópticos, entre otros. El segmento capacitivo representó la mayor cuota de mercado, con un 41,2%, en 2024, gracias a su alta precisión, mayor vida útil y compatibilidad con los sistemas digitales modernos. Los sensores capacitivos se utilizan ampliamente en vehículos de pasajeros y comerciales gracias a su adaptabilidad a diferentes tipos de combustible.

Mientras tanto, se espera que el segmento ultrasónico experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 22,1 %, entre 2025 y 2032. Esta tecnología permite la medición sin contacto, lo que la hace ideal para aplicaciones avanzadas como los sistemas de gestión térmica de vehículos eléctricos y la gestión de flotas telemática. La creciente adopción de sensores de precisión en vehículos autónomos impulsa aún más este crecimiento.

- Por tipo de monitoreo

Según el tipo de monitoreo, el mercado se segmenta en monitoreo continuo de nivel y monitoreo de nivel puntual. El segmento de monitoreo continuo de nivel dominó el mercado con una participación del 57.8% en 2024, gracias a su capacidad para proporcionar un seguimiento preciso y en tiempo real de combustible y fluidos. Este segmento es crucial en los sectores de logística y flotas, donde la eficiencia y el monitoreo del robo de combustible son prioritarios.

Se anticipa que el segmento de monitoreo de nivel de puntos registrará la CAGR más rápida del 19,4% durante 2025-2032, impulsada por su menor costo, diseño más simple y creciente demanda de vehículos más pequeños y modelos económicos, particularmente en mercados emergentes donde la asequibilidad es un factor clave.

- Por aplicación

Según la aplicación, el mercado se segmenta en monitoreo de reabastecimiento de tanques y vaciado de combustible, prevención de robo de combustible y monitoreo del consumo de combustible. El segmento de monitoreo del consumo de combustible dominó el mercado con una participación del 45.6% en 2024, ya que la precisión de los datos de consumo es vital tanto para particulares como para operadores de flotas para reducir costos operativos y cumplir con las normas de emisiones.

Se espera que el segmento de prevención de robo de combustible crezca a la CAGR más rápida del 21,3 % entre 2025 y 2032, impulsado por el aumento de los precios del combustible, el aumento del tamaño de las flotas y la demanda de las empresas de logística de tecnologías antirrobo avanzadas integradas con plataformas telemáticas e IoT.

- Por tipo de vehículo

Según el tipo de vehículo, el mercado se segmenta en vehículos de pasajeros y vehículos comerciales. El segmento de vehículos de pasajeros tuvo la mayor cuota de mercado, con un 62,4 %, en 2024, impulsado por el aumento de las ventas mundiales de automóviles, la preferencia de los consumidores por una mayor seguridad y la integración de sistemas de monitorización inteligentes en vehículos de gama media y alta.

Se proyecta que el segmento de vehículos comerciales crecerá a la CAGR más rápida del 20,1 % entre 2025 y 2032, respaldado por la creciente adopción de soluciones de gestión de flotas, las necesidades de eficiencia en el transporte de larga distancia y los estándares de emisiones más estrictos que requieren un monitoreo preciso de los niveles de combustible y fluidos.

- Por canal de venta

Según el canal de venta, el mercado se segmenta en fabricantes de equipos originales (OEM) y posventa. El segmento OEM dominó el mercado con una cuota de mercado del 68,7 % en 2024, debido a la fuerte preferencia de los fabricantes de automóviles por integrar sensores avanzados de nivel de combustible durante la fabricación de vehículos para garantizar el cumplimiento de las normativas globales de seguridad y emisiones.

Se proyecta que el segmento de posventa registre la CAGR más rápida del 18,8 % entre 2025 y 2032, a medida que los vehículos más antiguos se equipan con sensores modernos y la conciencia del consumidor sobre el mantenimiento preventivo continúa aumentando.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en online y offline. El segmento offline tuvo la mayor cuota de mercado, con un 72,5%, en 2024, gracias a la sólida presencia de distribuidores de autopartes, centros de servicio físicos y la confianza de los consumidores en comprar a través de redes de concesionarios consolidadas.

Se anticipa que el segmento en línea crecerá a la CAGR más rápida del 23,4 % durante 2025-2032, impulsado por la expansión de las plataformas de comercio electrónico, la creciente demanda de entrega a domicilio de componentes automotrices y la creciente adopción digital entre los consumidores minoristas y los operadores de flotas.

Análisis regional del mercado de sensores de nivel automotriz en América del Norte

- Se espera que EE. UU. domine el mercado de sensores de nivel automotriz de América del Norte con una participación de mercado del 65,12 % debido a su infraestructura automotriz bien establecida, tecnologías avanzadas de fabricación de sensores y una inversión significativamente mayor en investigación y desarrollo en comparación con otros países de la región.

- La fuerte presencia de los principales fabricantes de automóviles, la creciente producción de vehículos eléctricos e híbridos y la adopción temprana de sistemas avanzados de seguridad en los vehículos contribuyen aún más a la rápida expansión del mercado estadounidense.

- La presencia de fabricantes líderes de equipos originales (OEM) y de sensores, junto con la atención a los estrictos estándares de seguridad y emisiones, impulsa la demanda de sensores de nivel de alta precisión. El apoyo regulatorio y la innovación en tecnologías para vehículos conectados amplían aún más el potencial del mercado.

Perspectivas del mercado de Canadá

Canadá es la región de mayor crecimiento en el mercado norteamericano de sensores de nivel para automóviles, con una tasa de crecimiento anual compuesta (TCAC) del 11,23 %, impulsada por un sector automotriz estable y un creciente interés en el transporte sostenible. Las iniciativas gubernamentales que promueven la adopción de vehículos eléctricos, junto con las colaboraciones entre empresas tecnológicas y fabricantes de automóviles, están impulsando la demanda de sistemas de monitorización de fluidos. Sin embargo, el crecimiento del mercado es ligeramente inferior al de EE. UU. debido a menores volúmenes de producción y una actividad moderada de I+D.

Perspectiva del mercado de México

México es un importante centro de manufactura para la industria automotriz norteamericana. Con una sólida base de plantas de ensamblaje de automóviles y bajos costos de producción, el país está experimentando una mayor integración de tecnologías avanzadas de sensores, especialmente en vehículos exportados a Estados Unidos y otras regiones. Sin embargo, desafíos como la variabilidad regulatoria y la dependencia de proveedores externos de tecnología podrían afectar el ritmo de adopción de tecnologías en sistemas de sensores.

Cuota de mercado de sensores de nivel para automóviles en América del Norte

Los líderes del mercado de sensores de nivel automotriz de América del Norte que operan en el mercado son:

- Continental AG (Alemania)

- Littelfuse, Inc. (EE. UU.)

- Bosch Rexroth Sp. Z OO (Polonia)

- Elobau Gmbh & Co. KG.C (Alemania),

- Pricol Limited (India)

- Bourns Inc (EE. UU.)

- Guangdong Zhengyang Sensing Technology Co., Ltd. (China)

- Misensor Tech Co., Ltd. (China)

- Omnicomm (Estonia), Soway Tech Limited (China)

- Spark Minda (India)

- Standex Electronics, Inc. (EE. UU.)

- Technoton (República Checa)

- Wema UK (Reino Unido)

Últimos avances en el mercado de sensores de nivel automotriz en América del Norte

- En julio de 2023, TE Connectivity, líder mundial en soluciones de sensores y conectividad, presentó una nueva línea de sensores de nivel de fluido diseñados específicamente para vehículos eléctricos e híbridos en el mercado norteamericano. Estos sensores están diseñados para monitorear los niveles de refrigerante de la batería y líquido de frenos con alta precisión, ofreciendo una gestión térmica mejorada para vehículos eléctricos. Este lanzamiento refleja el compromiso de TE de apoyar la transición de la región hacia la movilidad eléctrica, proporcionando tecnologías de sensores robustas y listas para usar en vehículos que satisfacen las necesidades cambiantes de los fabricantes de equipos originales (OEM) y los proveedores de primer nivel.

- En mayo de 2023, Sensata Technologies anunció una alianza estratégica con un fabricante de equipos originales (OEM) automotriz líder en Norteamérica para suministrar sensores de nivel de aceite de última generación para las próximas plataformas de vehículos. Los sensores cuentan con diagnósticos avanzados y capacidades de salida digital, en línea con la tendencia de la industria hacia sistemas de vehículos inteligentes. Esta colaboración destaca el enfoque de Sensata en ofrecer soluciones de sensores de alta confiabilidad que mejoran el rendimiento del motor, amplían los intervalos de mantenimiento y permiten la monitorización en tiempo real dentro de las arquitecturas de vehículos conectados.

- En abril de 2023, Continental AG amplió su planta de fabricación en Michigan para aumentar la capacidad de producción de sensores capacitivos de nivel de fluido. La inversión busca satisfacer la creciente demanda de los fabricantes de automóviles estadounidenses que buscan soluciones de detección avanzadas para sistemas de combustible y refrigerante. La expansión también respalda la estrategia de Continental de localizar la producción de sensores y mejorar la resiliencia de la cadena de suministro en Norteamérica.

- En febrero de 2023, Texas Instruments (TI) lanzó una nueva plataforma de circuitos integrados (CI) optimizada para sistemas de detección de nivel de líquidos en automóviles. Este CI permite el desarrollo de sensores de nivel compactos y energéticamente eficientes que admiten sistemas ADAS y funciones de vehículos autónomos. La innovación de TI permite a los fabricantes de primer nivel desarrollar sensores con mayor precisión y tiempos de respuesta más rápidos, lo que contribuye a una mayor seguridad y un mejor diagnóstico de los sistemas en los vehículos modernos.

- En enero de 2023, Amphenol Advanced Sensors anunció una colaboración con una startup estadounidense de vehículos eléctricos para el desarrollo conjunto de sensores inalámbricos de nivel de refrigerante. La solución está diseñada para funcionar de forma fiable en entornos de alto voltaje, a la vez que ofrece transmisión de datos en tiempo real a los sistemas de gestión del vehículo. Esta colaboración demuestra el compromiso de Amphenol con el desarrollo de soluciones pioneras adaptadas a los vehículos eléctricos y promueve una mayor adopción de las tecnologías de detección inalámbrica en el sector automotriz norteamericano.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.