North America Automated Liquid Handling Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

574.94 Million

USD

1,096.11 Million

2025

2033

USD

574.94 Million

USD

1,096.11 Million

2025

2033

| 2026 –2033 | |

| USD 574.94 Million | |

| USD 1,096.11 Million | |

|

|

|

|

Segmentación del mercado de manipulación automatizada de líquidos en Norteamérica: por producto (estaciones de trabajo automatizadas, reactivos y consumibles, entre otros), tipo (sistemas automatizados y semiautomatizados de manipulación de líquidos), procedimiento (configuración de PCR, replicación de placas, dilución seriada, cribado de alto rendimiento, reformateo de placas, cultivo celular, amplificación del genoma completo, impresión de matrices, entre otros), modalidad (puntas desechables y fijas), aplicación (genómica, descubrimiento de fármacos, diagnóstico clínico, proteómica, entre otros), usuario final (biotecnología, industrias farmacéuticas, institutos de investigación, hospitales, laboratorios de diagnóstico, instituciones académicas, entre otros), canal de distribución (licitación directa, venta minorista y distribuidor externo): tendencias y pronóstico del sector hasta 2033.

Tamaño del mercado de manejo automatizado de líquidos en América del Norte

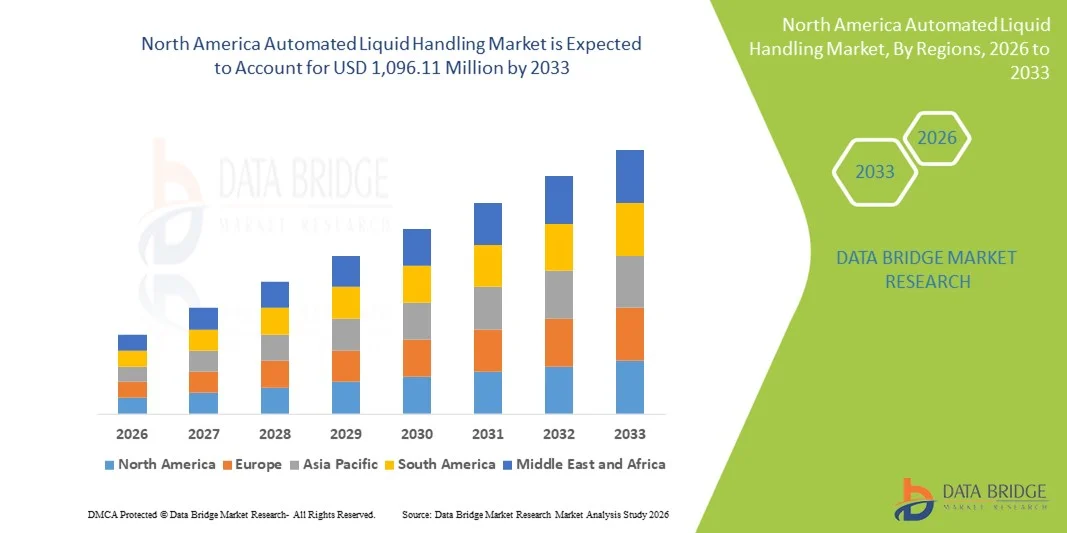

- El tamaño del mercado de manejo automatizado de líquidos de América del Norte se valoró en USD 574,94 millones en 2025 y se espera que alcance los USD 1.096,11 millones para 2033 , con una CAGR del 8,4% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente adopción de sistemas automatizados de manipulación de líquidos en biotecnología, I+D farmacéutica, diagnóstico clínico e investigación genómica. Los flujos de trabajo de alto rendimiento, los requisitos de precisión y la necesidad de reducir los errores manuales impulsan la inversión en tecnologías avanzadas de manipulación de líquidos en laboratorios de Estados Unidos y Canadá.

- Además, la creciente demanda de consumidores e instituciones de una automatización de laboratorio eficiente, fiable e integrada, que incluya estaciones de trabajo y consumibles automatizados, está consolidando las soluciones automatizadas de manipulación de líquidos como herramientas esenciales para los flujos de trabajo modernos en las ciencias de la vida. Estos factores convergentes están acelerando la adopción de manipuladores de líquidos automatizados, impulsando así significativamente el crecimiento del mercado en la región.

Análisis del mercado de manejo automatizado de líquidos en América del Norte

- Los sistemas automatizados de manipulación de líquidos, que permiten la manipulación precisa y de alto rendimiento de líquidos en los laboratorios, son componentes cada vez más vitales de los flujos de trabajo modernos de las ciencias de la vida, tanto en entornos de investigación como clínicos, debido a su precisión, eficiencia e integración perfecta con las plataformas de automatización de laboratorio.

- La creciente demanda de sistemas automatizados de manipulación de líquidos se ve impulsada principalmente por la creciente adopción de tecnologías de automatización de laboratorio, la necesidad de reducir los errores manuales y los crecientes requisitos de rendimiento en procedimientos como la configuración de PCR, la detección de alto rendimiento, la dilución en serie y la replicación de placas.

- Estados Unidos dominó el mercado de manejo automatizado de líquidos con la mayor participación en los ingresos del 90% en 2025, caracterizado por una fuerte inversión en I+D, la adopción temprana de tecnologías de laboratorio avanzadas y una presencia significativa de actores clave de la industria, con un crecimiento sustancial observado en las industrias biotecnológica y farmacéutica, institutos de investigación y laboratorios de diagnóstico, impulsados por innovaciones en estaciones de trabajo de manejo automatizado de líquidos, sistemas robóticos y consumibles.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de manejo automatizado de líquidos de América del Norte durante el período de pronóstico debido al aumento de la investigación biotecnológica y farmacéutica, el creciente apoyo del gobierno para la automatización de laboratorios y la creciente demanda de flujos de trabajo de laboratorio precisos y de alto rendimiento.

- Las estaciones de trabajo automatizadas de manipulación de líquidos dominaron el mercado estadounidense con una participación de mercado del 45 % en 2025, impulsadas por su precisión, flexibilidad y capacidad para respaldar una amplia gama de procedimientos en genómica, descubrimiento de fármacos, diagnóstico clínico y aplicaciones de proteómica.

Alcance del informe y segmentación del mercado de manejo automatizado de líquidos en América del Norte

|

Atributos |

Perspectivas clave del mercado de manejo automatizado de líquidos en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Tendencias del mercado de manejo automatizado de líquidos en América del Norte

Integración de IA y robótica para mejorar la eficiencia del laboratorio

- Una tendencia significativa y en aceleración en el mercado de manipulación automatizada de líquidos de América del Norte es la integración de la robótica impulsada por IA con estaciones de trabajo automatizadas, lo que mejora la precisión, el rendimiento y la eficiencia operativa en los flujos de trabajo de laboratorio.

- Por ejemplo, la plataforma STARlet de Hamilton Robotics integra pipeteo asistido por IA y manejo robótico para reducir la intervención manual y optimizar los tiempos de procesamiento de muestras.

- La integración de IA permite funciones como la detección predictiva de errores, la optimización del flujo de trabajo adaptativo y la programación inteligente de experimentos de alto rendimiento, lo que mejora la reproducibilidad y reduce el error humano.

- La combinación perfecta de robótica con sistemas de gestión de información de laboratorio (LIMS) permite un control centralizado sobre múltiples flujos de trabajo, lo que posibilita el seguimiento automatizado de muestras, la recopilación de datos y la generación de informes a través de una única interfaz.

- Esta tendencia hacia sistemas de manipulación de líquidos más inteligentes e interconectados está cambiando las expectativas de automatización de laboratorio, con empresas como Tecan desarrollando plataformas mejoradas con IA capaces de manipulación de líquidos adaptativa, análisis integrados y toma de decisiones automatizada.

- La demanda de sistemas automatizados de manipulación de líquidos con IA e integración robótica está creciendo rápidamente en los laboratorios de biotecnología, farmacéuticos y clínicos, a medida que las instituciones priorizan la eficiencia, la confiabilidad y la precisión en el procesamiento de muestras.

- El monitoreo remoto y la conectividad habilitada para la nube están cada vez más integrados, lo que permite a los laboratorios rastrear experimentos y métricas de rendimiento en tiempo real, respaldando flujos de trabajo de investigación descentralizados y colaborativos.

Dinámica del mercado de manejo automatizado de líquidos en América del Norte

Conductor

Creciente necesidad de procesamiento de muestras preciso y de alto rendimiento

- La creciente necesidad de un cribado de alto rendimiento y precisión en los flujos de trabajo de investigación, junto con la creciente adopción de tecnologías de automatización de laboratorio, es un impulsor clave del crecimiento del mercado.

- Por ejemplo, en marzo de 2025, Beckman Coulter anunció actualizaciones de su Biomek i-Series para respaldar flujos de trabajo genómicos de alto rendimiento, con el objetivo de reducir los errores manuales y aumentar la eficiencia del laboratorio.

- A medida que los laboratorios de investigación y diagnóstico expanden sus operaciones, los sistemas automatizados de manejo de líquidos ofrecen reproducibilidad, menor error humano y tiempos de procesamiento más rápidos, lo que proporciona una clara ventaja sobre el pipeteo manual.

- La creciente popularidad de las soluciones automatizadas en el descubrimiento de fármacos, la genómica y el diagnóstico clínico está haciendo que estos sistemas sean parte integral de las operaciones de laboratorio modernas.

- Características como la configuración automatizada de PCR, la replicación de placas, las diluciones en serie y la integración con LIMS facilitan la operación manos libres y agilizan flujos de trabajo complejos, lo que impulsa la adopción en laboratorios de biotecnología, farmacéuticos y de diagnóstico.

- Por ejemplo, los crecientes requisitos regulatorios para procesos de laboratorio estandarizados y rastreables están impulsando a los laboratorios a adoptar sistemas automatizados de manejo de líquidos para garantizar el cumplimiento y la integridad de los datos.

- La integración con plataformas multiómicas y herramientas de detección de alto contenido brinda una oportunidad única para acelerar estudios de investigación complejos, particularmente en medicina personalizada y genómica.

- Por ejemplo, los manipuladores de líquidos asistidos por IA pueden adaptar los protocolos en tiempo real a las variaciones en el volumen o la concentración de la muestra, lo que reduce el desperdicio de reactivos y mejora la eficiencia experimental.

Restricción/Desafío

Altos costos y complejidad de mantenimiento

- El costo inicial relativamente alto de los sistemas avanzados de manejo automatizado de líquidos, junto con los requisitos de mantenimiento continuo, plantea un desafío importante para su adopción generalizada, en particular para los laboratorios más pequeños.

- Por ejemplo, las empresas biotecnológicas emergentes en sus primeras etapas pueden dudar en invertir en estaciones de trabajo totalmente automatizadas debido a limitaciones presupuestarias, a pesar de las posibles ganancias de eficiencia a largo plazo.

- La configuración compleja del sistema, la calibración y la necesidad de personal capacitado pueden retrasar la implementación, limitando la accesibilidad para algunos institutos de investigación o laboratorios de diagnóstico.

- Si bien existen sistemas de nivel básico y soluciones modulares, las plataformas premium con robótica integrada, IA y consumibles siguen siendo caras, lo que hace que el costo sea una barrera para las instituciones sensibles a los precios.

- Abordar estos desafíos mediante soluciones modulares y rentables, capacitación de usuarios y soporte de servicio será fundamental para ampliar la penetración del mercado y sostener el crecimiento en América del Norte.

- Por ejemplo, la necesidad de actualizaciones periódicas de software y mantenimiento preventivo puede sobrecargar a los equipos internos de TI y de gestión de laboratorio, lo que aumenta la complejidad operativa.

- La interoperabilidad limitada entre los sistemas de manipulación de líquidos de diferentes proveedores puede obstaculizar la estandarización del flujo de trabajo y la integración con la infraestructura de automatización de laboratorio existente.

- Por ejemplo, los laboratorios pequeños y medianos pueden enfrentar desafíos al integrar nuevas plataformas de manejo de líquidos con brazos robóticos, LIMS o software de análisis existentes, lo que ralentiza la adopción.

Alcance del mercado de manejo automatizado de líquidos en América del Norte

El mercado está segmentado en función del producto, tipo, procedimiento, modalidad, aplicación, usuario final y canal de distribución.

- Por producto

Según el producto, el mercado se segmenta en estaciones de trabajo automatizadas para el manejo de líquidos, reactivos y consumibles, entre otros. El segmento de estaciones de trabajo automatizadas para el manejo de líquidos dominó el mercado con la mayor participación en los ingresos, con un 45 % en 2025, impulsado por su alta precisión, flexibilidad y capacidad para automatizar flujos de trabajo complejos de laboratorio. Estas estaciones de trabajo se adoptan ampliamente en genómica, descubrimiento de fármacos y diagnóstico clínico debido a su compatibilidad con el cribado de alto rendimiento, la configuración de PCR y los procesos de dilución en serie. Los laboratorios prefieren las estaciones de trabajo porque reducen los errores manuales, aumentan la eficiencia y se integran perfectamente con los sistemas de gestión de información de laboratorio (LIMS). Las innovaciones continuas, como el pipeteo asistido por IA y el manejo robótico de muestras, refuerzan aún más su dominio. La creciente demanda de resultados reproducibles y escalabilidad, tanto en laboratorios académicos como comerciales, refuerza la preferencia por las estaciones de trabajo automatizadas. Además, el auge de las plataformas de automatización de laboratorio centralizadas que pueden gestionar múltiples procedimientos simultáneamente ha impulsado la adopción de estos sistemas.

Se prevé que el segmento de Reactivos y Consumibles experimente el mayor crecimiento entre 2026 y 2033, impulsado por el aumento del uso de consumibles en experimentos de alto rendimiento, la creciente demanda de kits prevalidados y la necesidad de reactivos estandarizados. Consumibles como puntas de pipeta, placas y tubos son fundamentales para la consistencia del flujo de trabajo, lo que impulsa las compras recurrentes. La expansión de la investigación en genómica, proteómica y diagnóstico clínico genera una demanda constante de reactivos y consumibles, lo que impulsa su crecimiento. La creciente concienciación sobre el control de calidad y la prevención de la contaminación impulsa aún más la demanda de consumibles especializados.

- Por tipo

Según el tipo, el mercado se segmenta en sistemas automatizados de manejo de líquidos y sistemas semiautomatizados de manejo de líquidos. El segmento de sistemas automatizados de manejo de líquidos dominó el mercado en 2025, representando la mayor participación en los ingresos debido a su capacidad para gestionar flujos de trabajo complejos y de gran volumen con mínima intervención humana. Estos sistemas son los preferidos para procedimientos críticos como la configuración de PCR, el cribado de alto rendimiento y la amplificación del genoma completo, donde la precisión y la repetibilidad son esenciales. Los laboratorios se benefician de plazos de entrega más rápidos, menores tasas de error y una integración fluida con plataformas LIMS y robóticas. Las continuas mejoras en software, la integración de IA y la optimización del flujo de trabajo han fortalecido su adopción. Las grandes empresas farmacéuticas y biotecnológicas recurren cada vez más a sistemas totalmente automatizados para el descubrimiento de fármacos a gran escala y la investigación genómica, consolidando aún más su liderazgo en el mercado.

Se prevé que el segmento de Manejo Semiautomatizado de Líquidos experimente el mayor crecimiento entre 2026 y 2033, impulsado por laboratorios pequeños y medianos que buscan soluciones de automatización rentables. Los sistemas semiautomatizados ofrecen mayor eficiencia que el pipeteo manual sin la elevada inversión que requieren las plataformas totalmente automatizadas. Su flexibilidad, interfaz intuitiva y modularidad permiten la adopción gradual de flujos de trabajo automatizados. Los institutos de investigación y los laboratorios académicos prefieren los sistemas semiautomatizados por su versatilidad experimental, lo que hace que este segmento sea muy atractivo durante el período de pronóstico.

- Por procedimiento

Según el procedimiento, el mercado se segmenta en configuración de PCR, replicación de placas, dilución seriada, cribado de alto rendimiento, reformateo de placas, cultivo celular, amplificación del genoma completo, impresión de matrices, entre otros. El segmento de cribado de alto rendimiento dominó el mercado en 2025 debido a su papel crucial en el descubrimiento de fármacos, la genómica y la investigación proteómica. Los manipuladores de líquidos automatizados aceleran el procesamiento de muestras a gran escala, garantizando la reproducibilidad y la eficiencia. Las compañías farmacéuticas dependen en gran medida del cribado de alto rendimiento para analizar miles de compuestos rápidamente, lo que impulsa la adopción de sistemas automatizados. La integración con robótica e IA mejora aún más la precisión del cribado y reduce la variabilidad experimental. Los laboratorios priorizan la automatización para aplicaciones de alto rendimiento con el fin de reducir los costos laborales y minimizar el error humano. La demanda de desarrollo acelerado de fármacos e investigación de precisión continúa reforzando el dominio de este segmento.

Se prevé que el segmento de preparación de PCR experimente el mayor crecimiento entre 2026 y 2033, impulsado por el auge de la genómica, el diagnóstico y la medicina personalizada. La automatización en la preparación de PCR reduce los errores de pipeteo, garantiza la manipulación uniforme de las muestras y facilita el procesamiento de alto rendimiento. Los laboratorios académicos, clínicos y farmacéuticos recurren cada vez más a la preparación automatizada de PCR para satisfacer la creciente demanda de pruebas. La adopción de las pruebas de COVID-19 y el diagnóstico molecular en hospitales y laboratorios de diagnóstico ha acelerado aún más la necesidad de flujos de trabajo de PCR automatizados.

- Por modalidad

Según la modalidad, el mercado se segmenta en puntas desechables y puntas fijas. El segmento de puntas desechables dominó el mercado en 2025 debido a su papel en la prevención de la contaminación cruzada, el mantenimiento de la integridad de las muestras y la garantía de resultados reproducibles en flujos de trabajo críticos de laboratorio. Las puntas desechables se utilizan ampliamente en genómica, diagnóstico clínico y descubrimiento de fármacos para cumplir con los estándares de calidad y seguridad. También son compatibles con plataformas automatizadas de manipulación de líquidos con detección de puntas integrada y calibración de volumen. Los laboratorios priorizan cada vez más los consumibles desechables para reducir el riesgo de contaminación en procedimientos sensibles y de alto rendimiento. La introducción continua de puntas preesterilizadas y con filtro ha impulsado aún más su adopción en EE. UU.

Se prevé que el segmento de puntas fijas experimente el mayor crecimiento entre 2026 y 2033, impulsado por su rentabilidad, reutilización e integración con sistemas semiautomatizados. Las puntas fijas están ganando terreno en laboratorios académicos y de investigación, donde la optimización presupuestaria y los requisitos de rendimiento moderados son cruciales. La creciente demanda de prácticas ambientalmente sostenibles también fomenta la adopción de puntas fijas reutilizables en los flujos de trabajo rutinarios. Su robustez y durabilidad las hacen ideales para experimentos repetitivos. Se espera que la creciente concienciación sobre la eficiencia operativa impulse la expansión de este segmento.

- Por aplicación

Según su aplicación, el mercado se segmenta en genómica, descubrimiento de fármacos, diagnóstico clínico, proteómica, entre otros. El segmento de descubrimiento de fármacos dominó el mercado en 2025 gracias al uso generalizado de la manipulación automatizada de líquidos en el cribado de compuestos, la preparación de placas de ensayo y la realización de experimentos de alto rendimiento. Las empresas farmacéuticas recurren a la automatización para acelerar los plazos de I+D, reducir errores y mejorar la reproducibilidad. La integración con IA y plataformas robóticas mejora la eficiencia y la precisión de los datos en las pruebas de compuestos. El enfoque en un desarrollo de fármacos más rápido y la medicina de precisión ha impulsado aún más su adopción. La inversión continua en I+D y la colaboración con empresas biotecnológicas refuerzan la demanda de la manipulación automatizada de líquidos en el descubrimiento de fármacos.

Se prevé que el segmento de genómica experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente demanda de secuenciación, diagnósticos basados en PCR y aplicaciones de medicina personalizada. La automatización en genómica reduce los errores manuales, acelera el procesamiento de muestras y facilita flujos de trabajo complejos como la amplificación del genoma completo y la impresión de matrices. El aumento de la financiación para la investigación genómica y las iniciativas gubernamentales para expandir el diagnóstico molecular han impulsado aún más su adopción. La creciente demanda de terapias personalizadas fortalece aún más este segmento. La integración con IA y plataformas robóticas mejora la eficiencia y la estandarización del flujo de trabajo.

- Por el usuario final

En función del usuario final, el mercado se segmenta en industrias biotecnológicas y farmacéuticas, institutos de investigación, hospitales y laboratorios de diagnóstico, instituciones académicas, entre otros. El segmento de las industrias biotecnológicas y farmacéuticas dominó el mercado en 2025 debido a la gran dependencia de la manipulación automatizada de líquidos para el desarrollo de fármacos, el cribado de alto rendimiento y los procesos de laboratorio reproducibles. Las operaciones de I+D a gran escala en estas industrias priorizan la velocidad, la precisión y la escalabilidad, lo que hace esenciales los sistemas totalmente automatizados. La integración de la IA y la robótica impulsa aún más su adopción en los laboratorios farmacéuticos y biotecnológicos. Las inversiones continuas en medicina de precisión e investigación de alto rendimiento refuerzan el liderazgo de este segmento.

Se prevé que el segmento de Institutos de Investigación experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente adopción de sistemas automatizados en laboratorios académicos y financiados por el gobierno. Los institutos de investigación implementan cada vez más la automatización para acelerar los estudios de genómica, proteómica y biología molecular, minimizando al mismo tiempo la intervención manual. El crecimiento también se ve respaldado por el aumento de las colaboraciones con empresas de biotecnología y las subvenciones para la modernización de laboratorios. El creciente enfoque en experimentos de biología molecular de alto rendimiento impulsa aún más el crecimiento del segmento.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en licitación directa, ventas minoristas y distribuidores externos. El segmento de licitación directa dominó el mercado en 2025, representando la mayor participación en los ingresos, ya que los principales laboratorios y compañías farmacéuticas prefieren comprar directamente a los fabricantes para garantizar el cumplimiento normativo, la garantía y el servicio posventa. La adquisición directa también permite la personalización de los sistemas automatizados de manejo de líquidos para satisfacer las necesidades específicas del flujo de trabajo. Este enfoque fortalece las relaciones a largo plazo con los proveedores, garantizando el soporte técnico y las actualizaciones periódicas del sistema. Las compras al por mayor para redes multilaboratorio o entornos institucionales refuerzan aún más el dominio de las ventas por licitación directa.

Se prevé que el segmento de distribuidores externos experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente demanda de laboratorios más pequeños, instituciones académicas y hospitales que buscan opciones de compra flexibles. Los distribuidores externos ofrecen acceso rentable a sistemas de automatización, consumibles y servicios de mantenimiento, lo que impulsa la expansión del mercado más allá de los laboratorios a gran escala. Los contratos de servicio flexibles y las ofertas combinadas fomentan la adopción. La creciente demanda de automatización para laboratorios remotos y de menor tamaño impulsa la expansión de los distribuidores.

Análisis regional del mercado de manejo automatizado de líquidos en América del Norte

- Estados Unidos dominó el mercado de manejo automatizado de líquidos con la mayor participación en los ingresos del 90% en 2025, caracterizado por una fuerte inversión en I+D, una adopción temprana de tecnologías de laboratorio avanzadas y una presencia significativa de actores clave de la industria.

- Los laboratorios de la región valoran mucho la precisión, eficiencia y reproducibilidad que ofrecen los sistemas automatizados de manejo de líquidos, que minimizan los errores manuales y aceleran procedimientos complejos como la configuración de PCR, la detección de alto rendimiento y los ensayos de descubrimiento de fármacos.

- Esta adopción generalizada está respaldada además por una sólida infraestructura de I+D, una alta inversión en automatización de laboratorio y la presencia de importantes actores de la industria, lo que establece los sistemas automatizados de manejo de líquidos como una solución crítica tanto para los laboratorios académicos como comerciales en todo Estados Unidos.

Perspectiva del mercado de manipulación automatizada de líquidos en EE. UU.

El mercado estadounidense de manejo automatizado de líquidos captó la mayor participación en los ingresos, con un 90%, en Norteamérica en 2025, impulsado por la sólida presencia de laboratorios de biotecnología, farmacéuticos y de investigación clínica. Los laboratorios priorizan cada vez más los flujos de trabajo de alto rendimiento, precisos y reproducibles para aplicaciones como la configuración de PCR, el descubrimiento de fármacos y la investigación genómica. La creciente demanda de estaciones de trabajo totalmente automatizadas, integración robótica y sistemas de manejo de líquidos con IA impulsa aún más el mercado. Además, las inversiones gubernamentales y privadas en I+D en ciencias de la vida, junto con la adopción de la automatización de laboratorios para el cumplimiento normativo y la eficiencia, están impulsando la expansión del mercado. Estados Unidos continúa liderando gracias a su avanzada infraestructura de investigación, la adopción temprana de tecnología y las operaciones de laboratorios comerciales a gran escala.

Análisis del mercado canadiense de manipulación automatizada de líquidos

Se espera que el mercado canadiense de manejo automatizado de líquidos crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida de Norteamérica durante el período de pronóstico, impulsado por el aumento de las inversiones en biotecnología e investigación farmacéutica. El aumento de la financiación gubernamental para la automatización de laboratorios, la expansión de las instalaciones de investigación académica y el creciente enfoque en flujos de trabajo de alto rendimiento en biología molecular y genómica están impulsando su adopción. La demanda de sistemas de manejo de líquidos semiautomatizados y modulares es especialmente alta entre los institutos de investigación y hospitales más pequeños. Los laboratorios canadienses están implementando cada vez más la automatización para mejorar la productividad, la reproducibilidad y la eficiencia, a la vez que reducen los errores manuales. La creciente colaboración entre los institutos de investigación nacionales y las empresas globales de ciencias de la vida está acelerando aún más el crecimiento del mercado.

Análisis del mercado de manejo automatizado de líquidos en México

El mercado mexicano de manejo automatizado de líquidos está experimentando un crecimiento gradual, impulsado por la expansión de los sectores farmacéutico y biotecnológico y la creciente adopción de la automatización de laboratorios en la investigación clínica y académica. La creciente inversión en infraestructura sanitaria, las crecientes iniciativas gubernamentales para la modernización de la investigación y las alianzas con empresas internacionales del sector de las ciencias de la vida están impulsando su adopción. Los laboratorios mexicanos utilizan cada vez más sistemas automatizados de manejo de líquidos para la configuración de PCR, el cribado de alto rendimiento y los flujos de trabajo de descubrimiento de fármacos, con el fin de mejorar la precisión y la eficiencia. La demanda de soluciones rentables, modulares y semiautomatizadas es especialmente alta en hospitales e institutos de investigación más pequeños. Se prevé que el mercado crezca de forma constante a medida que aumenta la concienciación sobre los beneficios de la automatización, la reproducibilidad y la eficiencia del flujo de trabajo en todo el país.

Cuota de mercado de manejo automatizado de líquidos en América del Norte

La industria de manejo automatizado de líquidos de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Compañía Hamilton (EE. UU.)

- Thermo Fisher Scientific Inc. (EE. UU.)

- Agilent Technologies, Inc. (EE. UU.)

- Sartorius AG (EE. UU.)

- Beckman Coulter (Estados Unidos)

- Bio Rad Laboratories, Inc. (EE. UU.)

- Hudson Lab Automation (EE. UU.)

- Opentrons Labworks Inc. (EE. UU.)

- Aurora Biomed, Inc. (Canadá)

- Gilson, Inc. (EE. UU.)

- BioTek Instruments, Inc. (EE. UU.)

- Brandtech Scientific (EE. UU.)

- Drummond Scientific Company (EE. UU.)

- HighRes Biosolutions (EE. UU.)

- Tomtec Automation (EE. UU.)

- Mettler Toledo Rainin (EE. UU.)

- Analytik Jena (EE. UU.)

- Corning Incorporated (EE. UU.)

- PerkinElmer, Inc. (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado de manejo automatizado de líquidos en América del Norte?

- En octubre de 2025, Pillar Biosciences anunció una solución automatizada de preparación de bibliotecas NGS en la plataforma Hamilton Microlab STAR diseñada para acelerar la investigación en neoplasias mieloproliferativas y otras aplicaciones genómicas.

- En julio de 2025, Hamilton anunció una asociación estratégica entre Covaris y Hamilton para potenciar los laboratorios con Sonication STAR, mejorando los flujos de trabajo automatizados al combinar la automatización del manejo de líquidos de Hamilton con tecnología de sonicación avanzada.

- En enero de 2025, Tecan presentó oficialmente Veya™, una plataforma automatizada de manejo de líquidos de última generación que integra automatización mejorada por IA, análisis en tiempo real y flujos de trabajo prediseñados destinados a simplificar procesos de laboratorio complejos y aumentar la productividad en los laboratorios de investigación y clínicos.

- En junio de 2024, Thermo Fisher Scientific presentó el procesador Thermo Scientific™ KingFisher™ PlasmidPro Maxi, un sistema de purificación de ADN plasmídico a gran escala totalmente automatizado que reduce significativamente el tiempo de intervención y acelera los flujos de trabajo en biología molecular e investigación terapéutica.

- En mayo de 2023, Hamilton Company firmó un acuerdo estratégico de comercialización conjunta con Biosero, Inc. para integrar el software de control y programación Green Button Go® de Biosero con las plataformas automatizadas de manipulación de líquidos de Hamilton, con el objetivo de agilizar las operaciones de laboratorio y mejorar la eficiencia del flujo de trabajo.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.