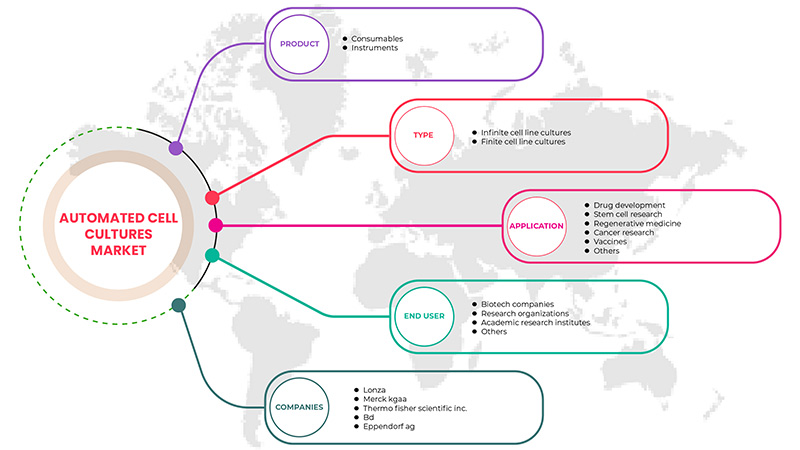

Mercado de cultivos celulares automatizados de América del Norte, por producto (consumibles, instrumentos), tipo (cultivos de líneas celulares infinitas, cultivos de líneas celulares finitas), aplicación (desarrollo de fármacos, investigación con células madre, medicina regenerativa , investigación del cáncer, vacunas , otros), usuario final (empresas de biotecnología, organizaciones de investigación, institutos de investigación académica, otros) Tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de cultivos celulares automatizados en América del Norte

El informe de mercado de cultivos celulares automatizados proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

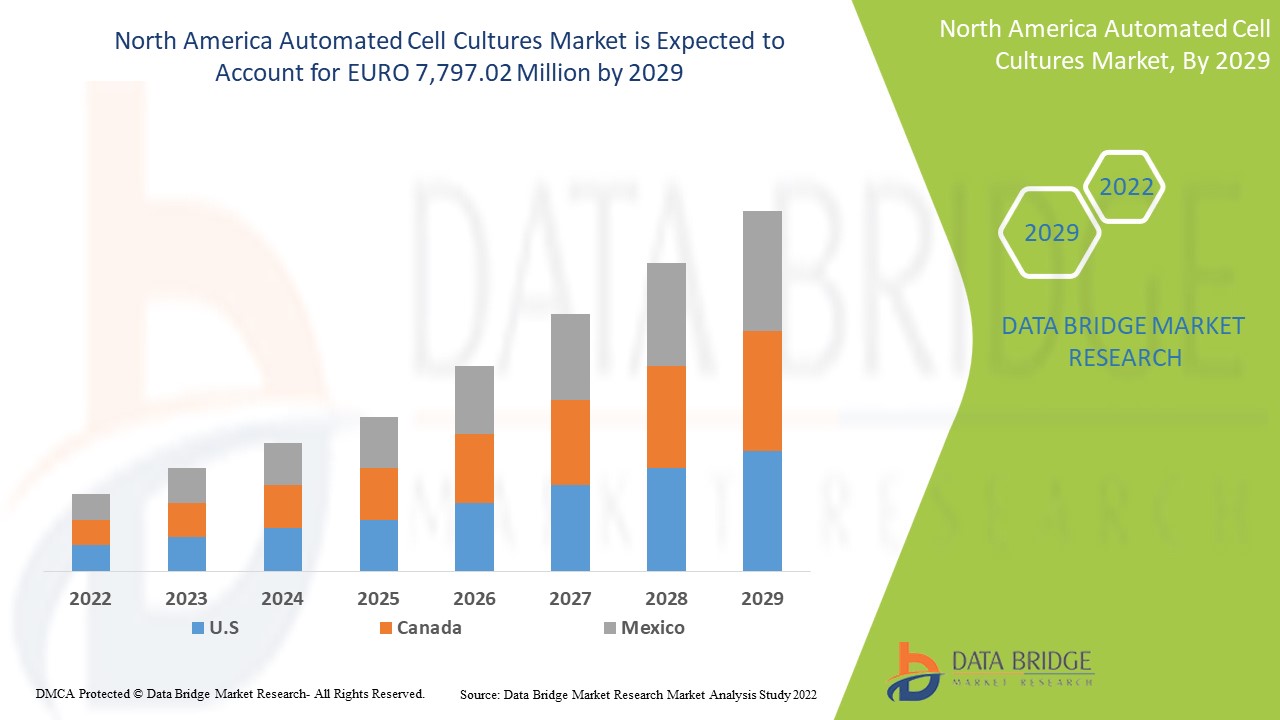

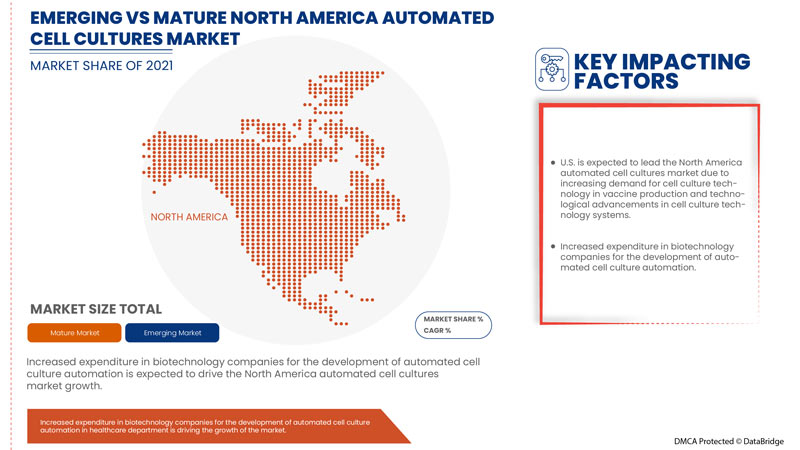

Se espera que el mercado de cultivos celulares automatizados de América del Norte gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 9,1% en el período de pronóstico de 2022 a 2029 y se espera que alcance los 7.797,02 millones de euros para 2029. La creciente demanda de tecnología de cultivo celular en la producción de vacunas y la amplia aceptación de las técnicas de cultivo celular en diversas aplicaciones son los principales impulsores que impulsaron la demanda del mercado en el período de pronóstico.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de euros, volúmenes en unidades, precios en euros |

|

Segmentos cubiertos |

Por producto (consumibles, instrumentos), tipo (cultivos de líneas celulares infinitas, cultivos de líneas celulares finitas), aplicación (desarrollo de fármacos, investigación con células madre, medicina regenerativa , investigación del cáncer, vacunas , otros), usuario final (empresas de biotecnología, organizaciones de investigación, institutos de investigación académica, otros). |

|

Países cubiertos |

Estados Unidos, Canadá, México |

|

Actores del mercado cubiertos |

Lonza, Merck KGaA, Thermo Fisher Scientific Inc., BD, Eppendorf AG y otros |

Definición del mercado de cultivos celulares automatizados en América del Norte

Los sistemas automatizados de cultivo celular son instrumentos que llevan a cabo mecánicamente los pasos necesarios para el crecimiento y mantenimiento de un cultivo celular. Útiles en cualquier laboratorio que trabaje con biología celular, señalización celular, expresión de proteínas o descubrimiento de fármacos, un sistema automatizado de cultivo celular ayuda a cultivar cultivos celulares al tiempo que ahorra tiempo de trabajo y reduce errores. Los sistemas automatizados de cultivo celular pueden ser capaces de diluir muestras, cultivar cultivos en líquido con agitación constante, sembrar cultivos o colocar cultivos en pocillos. Se espera que el aumento de la demanda de cultivos celulares en 3D , la creciente colaboración entre los actores del mercado y el aumento de las instalaciones de subcontratación proporcionen una oportunidad de crecimiento lucrativa para el mercado. Sin embargo, el alto costo de los sistemas automatizados de cultivo celular y las limitaciones asociadas con los cultivos celulares automatizados son los factores que se espera que restrinjan el crecimiento del mercado en el período de pronóstico.

Dinámica del mercado de cultivos celulares automatizados en América del Norte

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

- Conductores

Demanda creciente de tecnología de cultivo celular en la producción de vacunas

El cultivo celular es una herramienta esencial para la investigación en biología molecular y celular. Hoy en día, la mayoría de los productos biotecnológicos se basan principalmente en el cultivo masivo de líneas celulares. Los cultivos celulares tienen aplicaciones en diversas áreas y sirven como sistema modelo para numerosos esfuerzos de investigación.

El aumento de la financiación gubernamental para la investigación basada en células está impulsando significativamente el crecimiento del mercado. Además, las técnicas de cultivo celular se están utilizando ampliamente como una alternativa a las estrategias actuales basadas en huevos para desarrollar vacunas basadas en células. El cultivo celular tiene aplicaciones potenciales en el desarrollo de vacunas virales con un mayor riesgo de enfermedades transmisibles y pandemias. Por lo tanto, la tecnología de cultivo celular se está utilizando ampliamente en el desarrollo de vacunas autorizadas en los EE. UU., como las vacunas contra la rubéola, la viruela, la varicela, la hepatitis, el rotavirus y la polio.

Avances tecnológicos en sistemas de tecnología de cultivo celular

A medida que aumenta la demanda de tecnologías avanzadas de cultivo celular en la producción de vacunas, la investigación del cáncer y la virología, entre otros, se están produciendo ciertos avances tecnológicos en el cultivo celular automatizado.

Por lo tanto, los actores del mercado que operan en el mercado adoptan diversos avances tecnológicos en equipos de cultivo celular para impulsar su negocio en varias dimensiones y generar crecimiento del mercado. Este factor podría impulsar el crecimiento del mercado de cultivos celulares automatizados en América del Norte .

- Restricción

Alto costo de los sistemas automatizados de cultivo celular

El costo del producto es el mayor obstáculo para el mercado, ya que se espera que disminuya la demanda debido a su alto costo. En el caso de los sistemas automatizados de cultivo celular, el precio también es alto y, por debajo del ejemplo dado, se mostrará el precio del producto.

Los instrumentos y productos relacionados con consumibles, como contadores de células, reactivos, tampones y otros, tienen precios elevados, lo que demuestra que el costo de los cultivos celulares automatizados es el factor principal que se espera que restrinja el mercado de cultivos celulares automatizados de América del Norte en el período pronosticado.

- Oportunidad

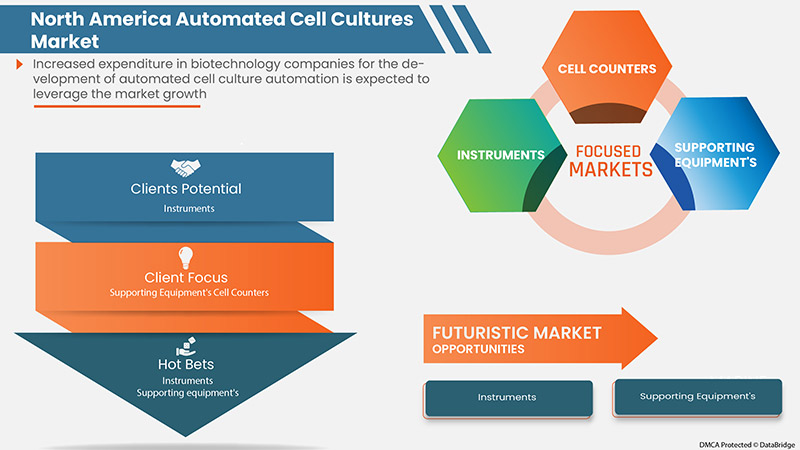

Lanzamientos de nuevos productos y desarrollos tecnológicos

Las empresas farmacéuticas y biotecnológicas están trabajando para desarrollar y lanzar nuevos productos y tecnologías que permitan avanzar en el cultivo celular automatizado y hacer que los métodos de tratamiento y diagnóstico sean más accesibles. Esto también ha aumentado la demanda de un mercado de cultivo celular automatizado para cultivos celulares en 3D. El desarrollo de nuevos biorreactores, plataformas y software ha propiciado un avance en el mercado de cultivo celular automatizado y su crecimiento.

Los nuevos productos y tecnologías que se han lanzado y desarrollado crean buenas oportunidades para el mercado de cultivos celulares automatizados de América del Norte. Las nuevas plataformas con tecnologías avanzadas actúan como un paso más hacia el avance del mercado.

- Desafío

Desarrollo y mantenimiento de la experiencia

La contratación y retención de personal capacitado y calificado, el desarrollo del personal, los presupuestos de capital para la compra de equipos, la gestión del presupuesto operativo, la infraestructura de las instalaciones y la gestión del cambio son aspectos que requieren una atención adecuada para el crecimiento y el éxito de cualquier mercado. No satisfacer las necesidades en cualquiera de estas áreas puede generar una debilidad grave que, si no se corrige, puede comprometer la credibilidad de un laboratorio y crear una situación que será difícil de corregir en el corto plazo.

Probar y mantener el nivel de experiencia en los laboratorios de pruebas es una tarea difícil y requiere mucha experiencia, a la que a veces no se puede acceder, lo que dificulta el proceso de desarrollo de una determinada empresa. Por lo tanto, se prevé que el crecimiento del mercado de cultivos celulares automatizados de América del Norte sea un desafío en el período previsto.

Acontecimientos recientes

- En agosto de 2021, Advanced Instruments, un fabricante líder de instrumentos analíticos y servicios para bioprocesamiento, anunció la ejecución de un acuerdo definitivo para adquirir Solentim, un líder de confianza de América del Norte en soluciones para el aislamiento y caracterización de clones unicelulares de alto valor en aplicaciones de desarrollo de líneas celulares (CLD). La adquisición amplía las posiciones de ambas empresas en los flujos de trabajo de bioprocesamiento para terapias avanzadas.

- En julio de 2021, BD lanzó bdbiosciences.com, un mercado digital actualizado para citometría de flujo. El nuevo sitio web ofrece una experiencia de compra en línea mejorada para los usuarios de citometría de flujo y sus equipos de compras.

Alcance del mercado de cultivos celulares automatizados en América del Norte

El mercado de cultivos celulares automatizados de América del Norte está segmentado en Producto, Tipo, Aplicación y Usuario final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

Mercado de cultivos celulares automatizados en América del Norte, por producto

- Consumibles

- Instrumentos

Sobre la base del producto, el mercado de cultivos celulares automatizados de América del Norte está segmentado en consumibles e instrumentos.

Mercado de cultivos celulares automatizados en América del Norte, por tipo

- Cultivos de líneas celulares infinitas

- Cultivos de líneas celulares finitas

Según el tipo, el mercado de cultivos celulares automatizados de América del Norte se segmenta en cultivos de líneas celulares infinitas y cultivos de líneas celulares finitas.

Mercado de cultivos celulares automatizados en América del Norte, por aplicación

- Desarrollo de fármacos

- Investigación con células madre

- Medicina regenerativa

- Investigación sobre el cáncer

- Vacunas

- Otro

Sobre la base de la aplicación, el mercado de cultivos celulares automatizados de América del Norte está segmentado en desarrollo de fármacos, investigación con células madre, medicina regenerativa, investigación del cáncer, vacunas y otros.

Mercado de cultivos celulares automatizados en América del Norte, por usuario final

- Empresas de biotecnología

- Organizaciones de investigación

- Institutos de investigación académica

- Otro

Sobre la base del usuario final, el mercado de cultivos celulares automatizados de América del Norte está segmentado en empresas de biotecnología, organizaciones de investigación, institutos de investigación académica y otros.

Análisis y perspectivas regionales del mercado de cultivos celulares automatizados en América del Norte

Se analiza el mercado de cultivos celulares automatizados de América del Norte y se proporciona información sobre el tamaño del mercado por producto, tipo, aplicación y usuario final.

Los países cubiertos en este informe de mercado son Estados Unidos, Canadá y México.

En 2022, se espera que el mercado de cultivos celulares automatizados de América del Norte crezca debido al aumento de las aplicaciones en la investigación de células madre, la producción de vacunas, la producción de medicamentos regenerativos y el descubrimiento de fármacos.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas de América del Norte y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de cultivos celulares automatizados en América del Norte

El panorama competitivo del mercado de cultivos celulares automatizados de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en I+D, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y amplitud de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en el mercado de cultivos celulares automatizados de América del Norte.

Los actores clave del mercado de cultivos celulares automatizados de América del Norte son Lonza, Merck KGaA, Thermo Fisher Scientific Inc., BD, Eppendorf AG, Advanced Instruments, Benchmark scientific, Inc., BioSpherix, Ltd., Biotron Healthcare, Bulldog Bio, Cell Culture Company, LLC, CellGenix GmbH, ChemoMetec, Corning Incorporated, Cytiva (subsidiaria de Danahar Corporation), FUJIFILM Holdings America Corporation, Hemilton Company, Hitachi, Ltd., Kawasaki Heavy Industries, ltd., HiMedia Laboratories, NanoEntek America, Inc., Nexcelom Bioscience LLC., PromoCell GmbH, RWD Life Science Co., LTD, Sartorius AG, Scientica Instrumentation, Inc., SHIBUYA CORPORATION, Sphere Fluidics Limited, Tecan Trading AG, Thrive Bioscience, Inc. y otros.

Metodología de investigación: mercado de cultivos celulares automatizados en América del Norte

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen la cuadrícula de posicionamiento de proveedores, el análisis de la línea de tiempo del mercado, la descripción general y la guía del mercado, la cuadrícula de posicionamiento de la empresa, el análisis de la participación de mercado de la empresa, los estándares de medición, América del Norte frente a la región y el análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 REGULATORY FRAMEWORK FOR NORTH AMERICA AUTOMATED CELL CULTURES MARKET

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR CELL CULTURE TECHNOLOGY IN VACCINE PRODUCTION

6.1.2 TECHNOLOGICAL ADVANCEMENTS IN CELL CULTURE TECHNOLOGY SYSTEMS

6.1.3 WIDE ACCEPTANCE OF CELL CULTURE TECHNIQUES IN VARIOUS APPLICATIONS

6.1.4 GROWING BIOTECHNOLOGY SECTOR, ALONG WITH RISING HEALTHCARE EXPENDITURE

6.1.5 ADVANTAGES OF AUTOMATED CELL CULTURE SYSTEMS OVER MANUAL METHODS

6.2 RESTRAINTS

6.2.1 HIGH COST OF AUTOMATED CELL CULTURE SYSTEMS

6.2.2 LIMITATIONS ASSOCIATED WITH AUTOMATED CELL CULTURES

6.2.3 MAINTENANCE AND UPDATING OF EQUIPMENT

6.2.4 LACK OF SKILLED AND CERTIFIED PROFESSIONALS

6.3 OPPORTUNITIES

6.3.1 NEW PRODUCT LAUNCHES AND TECHNOLOGY DEVELOPMENTS

6.3.2 INCREASING COLLABORATION AMONG MARKET PLAYERS

6.3.3 INCREASING OUTSOURCING FACILITIES

6.3.4 INCREASE IN DEMAND FOR 3D CELL CULTURE

6.4 CHALLENGES

6.4.1 DEVELOPMENT AND MAINTENANCE OF EXPERTISE

6.4.2 LACK OF INFRASTRUCTURE FOR CELL-BASED RESEARCH IN EMERGING ECONOMIES

7 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 CONSUMABLES

7.2.1 MEDIA

7.2.1.1 SERUM FREE MEDIA

7.2.1.2 CLASSICAL MEDIA & SALTS

7.2.1.3 STEM CELL CULTURE MEDIA

7.2.1.4 SPECIALTY MEDIA

7.2.2 BUFFERS AND SUPPLEMENTS

7.2.2.1 PLASMA

7.2.2.2 SERA

7.2.2.3 FETAL BOVINE SERA

7.2.2.4 ADULT BOVINE SERA

7.2.2.5 OTHERS ANIMAL SERA

7.2.3 REAGENTS

7.2.3.1 SUPPLEMENTS & GROWTH FACTORS

7.2.3.2 BUFFERS & CHEMICALS

7.2.3.3 CELL DISASSOCIATION REAGENTS

7.2.3.4 BALANCED SALT SOLUTIONS

7.2.3.5 ATTACHMENT & MATRIX FACTORS

7.2.3.6 ANTIBIOTICS/ANTIMYCOTICS

7.2.3.7 CONTAMINATION DETECTION KITS

7.2.3.8 CRYOPROTECTIVE REAGENTS

7.2.3.9 OTHERS CELL CULTURE REAGENTS

7.2.4 ACCESSORIES

7.3 INSTRUMENTS

7.3.1 SUPPORTING EQUIPMENTS

7.3.1.1 CELL COUNTERS

7.3.1.2 IMAGE BASED CELL COUNTERS

7.3.1.3 FLOW CYTOMETERS

7.3.1.4 COULTER COUNTERS

7.3.1.5 CELL EXPANSION

7.3.1.6 LIQUID HANDLERS

7.3.1.7 OTHERS

7.3.2 BIOREACTORS

7.3.2.1 SINGLE USE BIOREACTORS

7.3.2.2 CONVENTIONAL BIOREACTORS

7.3.2.3 OTHERS

7.3.3 STORAGE EQUIPMENTS

7.3.3.1 REFRIGERATORS & FREEZERS

7.3.3.2 CRYOSTORAGE SYSTEMS

7.3.3.3 OTHERS

8 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY TYPE

8.1 OVERVIEW

8.2 INFINITE CELL LINE CULTURES

8.3 FINITE CELL LINE CULTURES

9 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 DRUG DEVELOPMENT

9.3 STEM CELL RESEARCH

9.3.1 EMBRYONIC STEM CELLS

9.3.2 TISSUE-SPECIFIC STEM CELLS

9.3.3 MESENCHYMAL STEM CELLS

9.3.4 INDUCED PLURIPOTENT STEM CELLS

9.4 REGENERATIVE MEDICINE

9.4.1 STEM CELL THERAPY

9.4.2 PLATELET-RICH PLASMA THERAPY (OR PRP INJECTIONS)

9.4.3 TISSUE ENGINEERING

9.4.4 AMNIOTIC-MEMBRANE DERIVED STEM CELLS

9.5 CANCER RESEARCH

9.6 VACCINES

9.7 OTHERS

10 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY END USER

10.1 OVERVIEW

10.2 BIOTECH COMPANIES

10.3 RESEARCH ORGANIZATIONS

10.4 ACADEMIC RESEARCH INSTITUTES

10.5 OTHERS

11 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 COMPANY PROFILE

13.1 LONZA

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.1.6 SWOT ANALYSIS

13.2 MERCK KGAA

13.2.1 COMPANY SNAPSHOT

13.2.2 RECENT FINANCIALS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.2.6 SWOT ANALYSIS

13.3 THERMO FISHER SCIENTIFIC INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 RECENT FINANCIALS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.3.6 SWOT ANALYSIS

13.4 BD

13.4.1 COMPANY SNAPSHOT

13.4.2 RECENT FINANCIALS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.4.6 SWOT ANALYSIS

13.5 EPPENDORF AG

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.5.6 SWOT ANALYSIS

13.6 ADVANCED INSTRUMENTS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 BENCHMARK SCIENTIFIC INC.

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 BIOSPHERIX LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 BIOTRON HEALTHCARE

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 BULLDOG-BIO, INC.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.11 CELL CULTURE COMPANY, LLC

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 CELLGENIX GMBH

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 CHEMOMETEC

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 CORNING INCORPORATED

13.14.1 COMPANY SNAPSHOT

13.14.2 RECENT FINANCIALS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 CYTIVA (SUBSIDIARY OF DANAHER CORPORATION)

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 FUJIFILM HOLDINGS AMERICA CORPORATION

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 HAMILTON COMPANY

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

13.18 HITACHI, LTD.

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 KAWASAKI HEAVY INDUSTRIES, LTD.

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 HIMEDIA LABORATORIES

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

13.21 NANOENTEK AMERICA INC. (A SUBSIDIARY OF NANOENTEK)

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENTS

13.22 NEXCELOM BIOSCIENCE LLC.

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENTS

13.23 PROMOCELL GMBH

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCT PORTFOLIO

13.23.3 RECENT DEVELOPMENTS

13.24 RWD LIFE SCIENCE CO LTD.

13.24.1 COMPANY SNAPSHOT

13.24.2 PRODUCT PORTFOLIO

13.24.3 RECENT DEVELOPMENTS

13.25 SARTORIUS AG

13.25.1 COMPANY SNAPSHOT

13.25.2 REVENUE ANALYSIS

13.25.3 PRODUCT PORTFOLIO

13.25.4 RECENT DEVELOPMENTS

13.26 SCIENTICA INSTRUMENTATION, INC.

13.26.1 COMPANY SNAPSHOT

13.26.2 PRODUCT PORTFOLIO

13.26.3 RECENT DEVELOPMENTS

13.27 SHIBUYA CORPORATION

13.27.1 COMPANY SNAPSHOT

13.27.2 RECENT FINANCIALS

13.27.3 PRODUCT PORTFOLIO

13.27.4 RECENT DEVELOPMENTS

13.28 SPHERE FLUIDICS LIMITED

13.28.1 COMPANY SNAPSHOT

13.28.2 PRODUCT PORTFOLIO

13.28.3 RECENT DEVELOPMENTS

13.29 TECAN TRADING AG

13.29.1 COMPANY SNAPSHOT

13.29.2 RECENT FINANCIALS

13.29.3 PRODUCT PORTFOLIO

13.29.4 RECENT DEVELOPMENT

13.3 THRIVE BIOSCIENCE, INC.

13.30.1 COMPANY SNAPSHOT

13.30.2 PRODUCT PORTFOLIO

13.30.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 2 NORTH AMERICA CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 3 NORTH AMERICA CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 4 NORTH AMERICA MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 5 NORTH AMERICA BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 6 NORTH AMERICA REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCTS, 2020-2029 (EURO MILLION)

TABLE 7 NORTH AMERICA INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 8 NORTH AMERICA INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 9 NORTH AMERICA SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 10 NORTH AMERICA BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 11 NORTH AMERICA STORAGE EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 12 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 13 NORTH AMERICA INFINITE CELL LINE CULTURES IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 14 NORTH AMERICA FINITE CELL LINE CULTURES IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 15 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 16 NORTH AMERICA DRUG DEVELOPMENT IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 17 NORTH AMERICA STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 18 NORTH AMERICA STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 19 NORTH AMERICA REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 20 NORTH AMERICA REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 21 NORTH AMERICA CANCER RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 22 NORTH AMERICA VACCINES IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 23 NORTH AMERICA OTHERS IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 24 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 25 NORTH AMERICA BIOTECH COMPANIES IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 26 NORTH AMERICA RESEARCH ORGANIZATIONS IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 27 NORTH AMERICA ACADEMIC RESEARCH INSTITUTES IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 28 NORTH AMERICA OTHERS IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 29 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY COUNTRY, 2020-2029 (EURO MILLION)

TABLE 30 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 31 NORTH AMERICA CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 32 NORTH AMERICA MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 33 NORTH AMERICA BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 34 NORTH AMERICA REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 35 NORTH AMERICA INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 36 NORTH AMERICA SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 37 NORTH AMERICA BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 38 NORTH AMERICA STORAGE EQUIPMENT IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 39 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 40 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 41 NORTH AMERICA STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 42 NORTH AMERICA REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 43 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 44 U.S. AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 45 U.S. CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 46 U.S. MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 47 U.S. BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 48 U.S. REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 49 U.S. INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 50 U.S. SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 51 U.S. BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 52 U.S. STORAGE EQUIPMENT IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 53 U.S. AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 54 U.S. AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 55 U.S. STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 56 U.S. REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 57 U.S. AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 58 CANADA AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 59 CANADA CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 60 CANADA MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 61 CANADA BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 62 CANADA REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 63 CANADA INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 64 CANADA SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 65 CANADA BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 66 CANADA STORAGE EQUIPMENT IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 67 CANADA AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 68 CANADA AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 69 CANADA STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 70 CANADA REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 71 CANADA AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 72 MEXICO AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 73 MEXICO CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 74 MEXICO MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 75 MEXICO BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 76 MEXICO REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 77 MEXICO INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 78 MEXICO SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 79 MEXICO BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 80 MEXICO STORAGE EQUIPMENT IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 81 MEXICO AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 82 MEXICO AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 83 MEXICO STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 84 MEXICO REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 85 MEXICO AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: SEGMENTATION

FIGURE 11 WIDE ACCEPTANCE OF CELL CULTURE TECHNIQUES IN VARIOUS APPLICATIONS AND THE GROWING BIOTECHNOLOGY SECTOR ARE EXPECTED TO DRIVE THE NORTH AMERICA AUTOMATED CELL CULTURES MARKET IN THE FORECAST PERIOD

FIGURE 12 CONSUMABLES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AUTOMATED CELL CULTURES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA AUTOMATED CELL CULTURES MARKET

FIGURE 14 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY PRODUCT, 2021

FIGURE 15 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY PRODUCT, 2022-2029 (EURO MILLION)

FIGURE 16 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 18 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY TYPE, 2021

FIGURE 19 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY TYPE, 2022-2029 (EURO MILLION)

FIGURE 20 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY APPLICATION, 2021

FIGURE 23 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY APPLICATION, 2022-2029 (EURO MILLION)

FIGURE 24 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY END USER, 2021

FIGURE 27 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY END USER, 2022-2029 (EURO MILLION)

FIGURE 28 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA AUTOMATED CELL CULTURES MARKET : SNAPSHOT (2021)

FIGURE 31 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY COUNTRY (2021)

FIGURE 32 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 NORTH AMERICA AUTOMATED CELL CULTURES MARKET : BY PRODUCT (2022-2029)

FIGURE 35 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.