North America Aligner Sheet Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

154.37 Million

USD

340.66 Million

2024

2032

USD

154.37 Million

USD

340.66 Million

2024

2032

| 2025 –2032 | |

| USD 154.37 Million | |

| USD 340.66 Million | |

|

|

|

Segmentación del mercado de láminas de alineadores de América del Norte, por material (poliuretano (PU), tereftalato de polietileno glicol (PETG) y otros), capa (multicapa y monocapa), usuario final (grandes fabricantes de ortodoncia, fabricantes de ortodoncia medianos y pequeños fabricantes de ortodoncia), canal de distribución (licitación directa, canal en línea y otros): tendencias de la industria y pronóstico hasta 2032

Análisis del mercado de láminas de alineación

El mercado de las láminas de alineadores está experimentando un crecimiento significativo, impulsado por los avances en la tecnología dental y la creciente demanda de productos de alineadores transparentes en todo el mundo. Estas láminas termoformables son componentes fundamentales para producir alineadores transparentes, plantillas y retenedores, que son cada vez más preferidos por sus ventajas estéticas y funcionales sobre los aparatos tradicionales. Los principales actores del mercado se están centrando en la innovación de materiales para mejorar la durabilidad, la flexibilidad y la comodidad del paciente. Los avances tecnológicos como la impresión 3D y los materiales patentados han revolucionado el proceso de fabricación, lo que permite una producción más rápida y una precisión mejorada. Por ejemplo, los materiales más delgados y duraderos como Reva de uLab Systems están estableciendo nuevos puntos de referencia en el mercado. Además, los desarrollos como las soluciones de alineadores en el mismo día, como las que ofrece LuxCreo, demuestran el potencial para aumentar la eficiencia y reducir los costos.

Tamaño del mercado de láminas de alineación

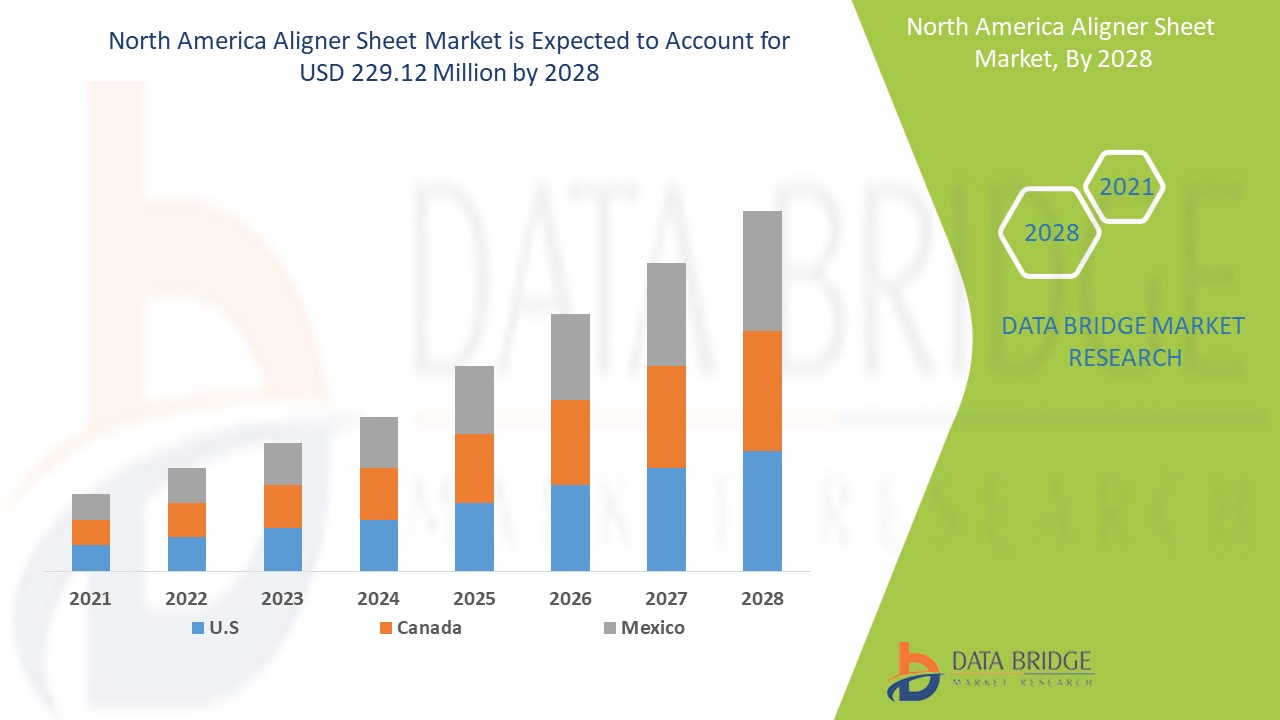

El tamaño del mercado de láminas de alineadores de América del Norte se valoró en USD 154,37 millones en 2024 y se proyecta que alcance los USD 340,66 millones para 2032, con una CAGR del 10,40% durante el período de pronóstico de 2025 a 2032. Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología del paciente, análisis de la cartera, análisis de precios y marco regulatorio.

Tendencias del mercado de láminas de alineación

“ Desarrollo de materiales ultrafinos y de alto rendimiento”

El mercado de las láminas de alineadores está siendo testigo de una tendencia creciente hacia el desarrollo de materiales ultradelgados y de alto rendimiento que mejoran la comodidad del paciente y la eficiencia del tratamiento. Este cambio está impulsado por la creciente demanda de alineadores transparentes que sean discretos y efectivos. Los actores clave de la industria están aprovechando tecnologías avanzadas como los materiales de termoformado patentados y la impresión 3D para mantenerse competitivos. Por ejemplo, el material Reva de uLab Systems, presentado en 2024, es un 17 % más delgado que las opciones tradicionales y, al mismo tiempo, ofrece una retención de fuerza superior, lo que lo convierte en un producto destacado en el mercado. Esta innovación resalta el enfoque en mejorar la durabilidad, la flexibilidad y la precisión de las láminas de alineadores para cumplir con las expectativas de los consumidores. Además, la creciente adopción de soluciones de producción de alineadores en el mismo día, como los alineadores impresos en 3D de LuxCreo, subraya el énfasis de la industria en la eficiencia y la rentabilidad. A medida que continúan los avances en los materiales y los procesos de fabricación, el mercado de las láminas de alineadores está posicionado para un crecimiento sólido y la innovación.

Alcance del informe y segmentación del mercado de láminas de alineación

|

Atributos |

Información clave sobre el mercado de las láminas de alineación |

|

Segmentos cubiertos |

|

|

Países cubiertos |

EE. UU., Canadá y México en América del Norte, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de América del Sur como parte de América del Sur |

|

Actores clave del mercado |

Bay Materials, LLC (EE. UU.), Dentsply Sirona (EE. UU.), Tru-Tain (EE. UU.), Align Technology, Inc. (EE. UU.), Dreve Group (Alemania), Vedia Solutions (EE. UU.), Ormco Corporation (EE. UU.), Great Lakes Dental Technologies (EE. UU.), Orthodontic Supply & Equipment Company (EE. UU.), American Orthodontics (EE. UU.) y Good Fit Technologies (EE. UU.) |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Definición del mercado de láminas de alineación

Una lámina de alineadores es un material termoformable especializado que se utiliza en la producción de alineadores transparentes, retenedores dentales y plantillas. Estas láminas están diseñadas para brindar la flexibilidad, durabilidad y transparencia necesarias para las aplicaciones de ortodoncia. Desempeñan un papel crucial en la prestación de un tratamiento de ortodoncia eficaz al mantener una retención de fuerza constante y, al mismo tiempo, ser estéticamente discretas.

Dinámica del mercado de láminas de alineación

Conductores

- Demanda creciente de soluciones de ortodoncia estética

La creciente demanda de soluciones de ortodoncia estética es un factor importante en el mercado de las láminas de alineadores. A medida que más pacientes buscan alternativas discretas y cómodas a los aparatos metálicos tradicionales, los alineadores transparentes han ganado una popularidad significativa. A diferencia de los aparatos tradicionales, los alineadores transparentes son transparentes, extraíbles y personalizados para adaptarse a los dientes del paciente, lo que los convierte en una opción atractiva tanto para adolescentes como para adultos. Este cambio en las preferencias está generando una mayor necesidad de láminas de alineadores de alta calidad que ofrezcan flexibilidad, durabilidad y una excelente retención de la fuerza. Por ejemplo, el material Reva de uLab Systems, que es un 17 % más fino que los materiales de alineadores tradicionales, satisface esta demanda al ofrecer una comodidad y una eficacia superiores. A medida que más consumidores priorizan las soluciones estéticas que no interfieren en su vida diaria, la demanda de láminas de alineadores avanzadas sigue creciendo, lo que impulsa aún más la expansión del mercado. Esta tendencia subraya cómo la evolución de las preferencias de los pacientes está dando forma al desarrollo y la producción de materiales de alineadores transparentes.

- Creciente conciencia sobre la ortodoncia

La creciente conciencia sobre la ortodoncia es un importante impulsor del mercado para la industria de las láminas de alineadores, especialmente en los mercados emergentes donde hay un enfoque cada vez mayor en la salud bucal y la odontología cosmética . A medida que se extiende la conciencia sobre los beneficios del tratamiento de ortodoncia, más personas buscan soluciones de ortodoncia como los alineadores transparentes para mejorar su sonrisa y su salud dental en general. En países como India y Brasil, el aumento de los ingresos disponibles y la influencia de las redes sociales están acelerando esta tendencia, y los alineadores transparentes están ganando popularidad debido a su atractivo estético y conveniencia. Por ejemplo, la reciente expansión de Angelalign Technology en el mercado estadounidense destaca la creciente demanda de alineadores transparentes como una solución eficaz para los problemas dentales. A medida que más consumidores se informan sobre las ventajas del tratamiento de ortodoncia, como una mayor confianza y una salud bucal a largo plazo, la adopción de alineadores transparentes continúa aumentando, lo que impulsa la demanda de láminas de alineadores de alta calidad en estos mercados de rápido crecimiento.

Oportunidades

- Aumento del gasto sanitario en América del Norte

El aumento del gasto sanitario en América del Norte presenta una importante oportunidad de mercado para la industria de las láminas de alineadores. A medida que el gasto sanitario sigue aumentando, tanto los particulares como los proveedores de servicios sanitarios buscan soluciones de ortodoncia más avanzadas, eficaces y accesibles. La creciente inversión en infraestructura sanitaria, combinada con unos ingresos disponibles más elevados, está impulsando a más personas a invertir en tratamientos de ortodoncia, incluidos los alineadores transparentes. Por ejemplo, el éxito de Align Technology en América del Norte se debe en parte a la fuerte financiación sanitaria de la región, que respalda una creciente demanda de tratamientos dentales estéticos. Este aumento del gasto sanitario también facilita la introducción de tecnologías y materiales de vanguardia, lo que permite a las empresas desarrollar láminas de alineadores mejoradas que ofrecen mayor comodidad, durabilidad y precisión. A medida que los consumidores norteamericanos tienen un mayor acceso a los tratamientos dentales y están más dispuestos a invertir en su salud bucal, esta tendencia presenta una valiosa oportunidad para que las empresas del mercado de las láminas de alineadores aprovechen la creciente demanda de la región de productos de alineadores transparentes de alta calidad.

- Aumento de la renta disponible

El aumento de los ingresos disponibles es una oportunidad de mercado clave para la industria de las láminas de alineadores, ya que permite que más consumidores puedan permitirse tratamientos de ortodoncia avanzados, como los alineadores transparentes. Con el aumento del poder adquisitivo, especialmente en las economías emergentes, más personas buscan soluciones dentales que ofrezcan tanto atractivo estético como beneficios funcionales. Por ejemplo, en países como la India y los mercados del sudeste asiático, la creciente clase media se está inclinando más a invertir en tratamientos de ortodoncia de alta calidad, incluidos los alineadores transparentes, como resultado de su asequibilidad y conveniencia. A medida que los ingresos disponibles continúan aumentando, especialmente en regiones con economías en rápido desarrollo, se espera que la demanda de procedimientos dentales cosméticos y correctivos se expanda. Los fabricantes de láminas de alineadores pueden aprovechar este mercado en crecimiento ofreciendo productos asequibles e innovadores que atiendan a un grupo demográfico más amplio, posicionándose así para capitalizar el creciente interés de los consumidores en los alineadores transparentes como una solución accesible y a largo plazo.

Restricciones/Desafíos

- Cuestiones de reglamentación y cumplimiento

Los problemas de cumplimiento normativo y regulatorio presentan desafíos importantes en el mercado de las láminas de alineadores, ya que los fabricantes deben sortear complejos procesos de aprobación para garantizar que sus productos cumplan con los estándares de seguridad y calidad en varias regiones. En mercados como el de EE. UU., los alineadores deben cumplir con las regulaciones de la FDA, que requieren pruebas y documentación exhaustivas antes de la aprobación, lo que genera demoras y costos adicionales. De manera similar, en la UE, los fabricantes de alineadores deben adherirse al Reglamento de Dispositivos Médicos (MDR), que impone estrictos requisitos de evidencia clínica y vigilancia posterior a la comercialización. Por ejemplo, Align Technology, un actor importante en el mercado, se ha enfrentado a obstáculos regulatorios en ciertas regiones, lo que ha retrasado el lanzamiento de nuevos productos. Estas regulaciones aumentan el tiempo y el costo involucrados en la comercialización de productos y representan una barrera para las empresas más pequeñas o los nuevos participantes que intentan cumplir con diferentes estándares en múltiples jurisdicciones. Como resultado, sortear estos desafíos regulatorios se convierte en una restricción clave del mercado, lo que obstaculiza el ritmo de innovación y crecimiento en el sector de las láminas de alineadores.

- Preocupaciones sobre la eficacia posterior al tratamiento

Las preocupaciones sobre la eficacia posterior al tratamiento son un desafío importante en el mercado de las láminas de alineadores, ya que el éxito a largo plazo de los tratamientos con alineadores a menudo depende del cumplimiento del paciente y del mantenimiento adicional. Después de completar el proceso de alineación inicial, los pacientes pueden necesitar usar retenedores para evitar que sus dientes se muevan hacia atrás, un paso que no todos los pacientes siguen de manera constante. No mantener la alineación después del tratamiento puede provocar una recaída, lo que socava la efectividad percibida de los alineadores. Por ejemplo, un estudio del American Journal of Orthodontics and Dentofacial Orthopedics descubrió que un porcentaje significativo de pacientes que completaron el tratamiento con alineadores sin el uso adecuado de retenedores experimentaron algún grado de recaída. Esto genera inquietudes sobre la efectividad general de los tratamientos con alineadores a largo plazo, lo que afecta la satisfacción del cliente y el crecimiento del mercado. Los fabricantes se enfrentan al desafío de garantizar no solo el éxito de la alineación inicial, sino también la retención posterior al tratamiento, lo que agrega complejidad a las ofertas de productos y aumenta la necesidad de educación del paciente y atención de seguimiento.

Este informe de mercado proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Alcance del mercado de las láminas de alineación

El mercado está segmentado en función del material, la capa, el usuario final y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Material

- Poliuretano (PU)

- Tereftalato de polietileno glicol (PETG)

- Otros

Capa

- Multicapa

- De una sola capa

Usuario final

- Grandes fabricantes de ortodoncia

- Fabricantes de ortodoncia mediana

- Pequeños fabricantes de ortodoncia

Canal de distribución

- Licitación directa

- Canal en línea

- Otros

Análisis regional del mercado de láminas de alineación

Se analiza el mercado y se proporcionan información y tendencias del tamaño del mercado por país, tipo de producto, modalidad y usuario final como se menciona anteriormente.

Estados Unidos domina el mercado de materiales para láminas de alineación debido a su gran base de consumidores y a su robusta economía respaldada por un elevado PIB. También es líder mundial en gasto de los hogares, lo que impulsa la demanda de productos innovadores. Además, los amplios acuerdos comerciales del país con múltiples naciones facilitan la expansión y la accesibilidad del mercado. La presencia de importantes actores de la industria y los continuos avances tecnológicos consolidan aún más a Estados Unidos como el mercado más grande e influyente en este sector.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas arriba y aguas abajo, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado de las láminas de alineación

El panorama competitivo del mercado proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Los líderes del mercado de láminas de alineación que operan en el mercado son:

- Bay Materials, LLC (Estados Unidos)

- Dentsply Sirona (Estados Unidos)

- Tru-Tain (Estados Unidos)

- Align Technology, Inc. (Estados Unidos)

- Grupo Dreve (Alemania)

- Soluciones Vedia (Estados Unidos)

- Corporación Ormco (Estados Unidos)

- Great Lakes Dental Technologies (Estados Unidos)

- Empresa de suministros y equipos de ortodoncia (EE. UU.)

- Ortodoncia Americana (EE.UU.)

- Good Fit Technologies (Estados Unidos)

Últimos avances en el mercado de láminas de alineación

- En septiembre de 2024, uLab Systems lanzó Reva, un innovador material termoformado diseñado para productos de alineadores transparentes. Reva es un 17 % más delgado que los materiales de los principales competidores, lo que lo convierte en el material para alineadores más delgado del mercado. Ofrece una retención de fuerza superior y ahora está disponible para todos los productos de alineadores, plantillas y retenedores uSmile fabricados en las instalaciones de uLab en Memphis, Tennessee.

- En julio de 2023, Angelalign Technology Inc. introdujo sus alineadores transparentes hechos a medida en el mercado estadounidense. Como líder mundial en tecnología dental con alineadores transparentes con más de un millón de sonrisas tratadas, la empresa está ampliando su presencia y experiencia en los EE. UU.

- En abril de 2023, LuxCreo, especialista en impresión 3D para aparatos dentales, presentó una solución integral aprobada por la FDA Clase II 510(k) para ortodoncistas y dentistas. Esta innovación permite la producción en el mismo día de alineadores transparentes, eliminando las etapas tradicionales de modelado y termoformado. Los alineadores se pueden entregar a los pacientes dentro de las dos horas posteriores a una exploración oral, lo que reduce significativamente los gastos de mano de obra y capital.

- En agosto de 2020, Dentagrafix, en colaboración con NBALAB, presentó láminas de plástico con temática de la NBA para alineadores y retenedores de ortodoncia. Estas láminas termoformables que cumplen con las normas de la FDA presentan logotipos y diseños con licencia de equipos de la NBA como Boston Celtics, Brooklyn Nets, Golden State Warriors, Houston Rockets, Los Angeles Clippers, Los Angeles Lakers, Milwaukee Bucks, New York Knicks y Philadelphia 76ers.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.