North America Aesthetic And Cosmetic Surgery Devices Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.62 Billion

USD

2.78 Billion

2025

2033

USD

1.62 Billion

USD

2.78 Billion

2025

2033

| 2026 –2033 | |

| USD 1.62 Billion | |

| USD 2.78 Billion | |

|

|

|

|

Segmentación del mercado de dispositivos de cirugía estética y cosmética en América del Norte, por tipo (implantes mamarios, implantes corporales e implantes personalizados), materia prima (polímeros, metales y biomateriales), usuario final (clínicas, hospitales, clínicas dermatológicas, etc.), canal de distribución (licitación directa y farmacias minoristas): tendencias y pronóstico de la industria hasta 2033.

Tamaño del mercado de dispositivos de cirugía estética y cosmética en América del Norte

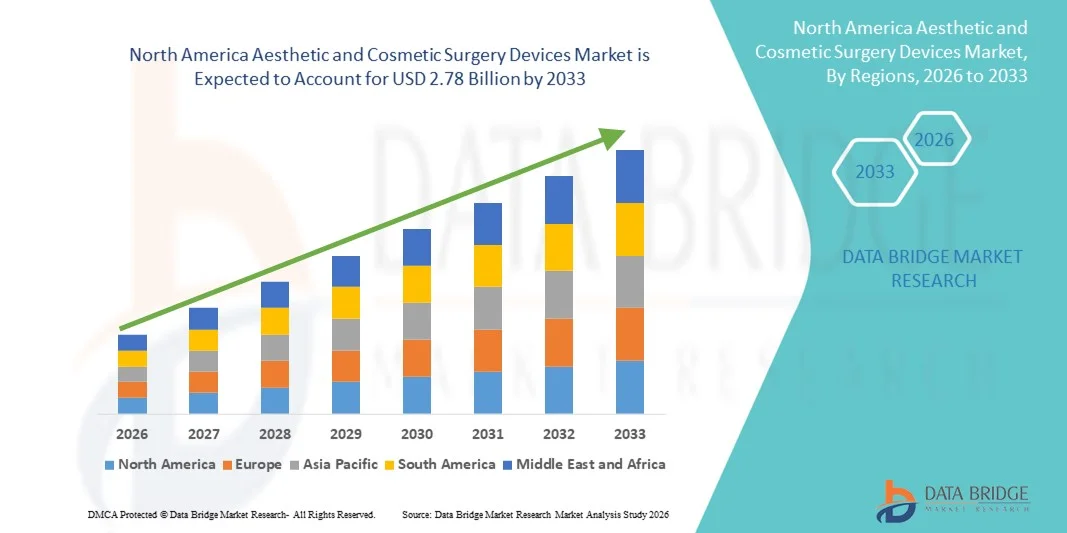

- El tamaño del mercado de dispositivos de cirugía estética y cosmética de América del Norte se valoró en USD 1.62 mil millones en 2025 y se espera que alcance los USD 2.78 mil millones para 2033 , con una CAGR del 7,0% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente adopción de procedimientos estéticos mínimamente invasivos y no invasivos, junto con los continuos avances tecnológicos en dispositivos cosméticos quirúrgicos y basados en energía en toda la región.

- Además, la creciente atención del consumidor a la apariencia física, la creciente aceptación de los procedimientos cosméticos y la fuerte demanda de soluciones seguras, eficaces y clínicamente avanzadas en spas médicos y hospitales están consolidando los dispositivos de cirugía estética y cosmética como herramientas esenciales en la atención estética moderna. Estos factores convergentes están acelerando la adopción de dispositivos, impulsando así significativamente el crecimiento del mercado.

Análisis del mercado de dispositivos de cirugía estética y cosmética en América del Norte

- Los dispositivos de cirugía estética y cosmética, incluidos los implantes mamarios, los implantes corporales y los implantes hechos a medida, son componentes cada vez más vitales de los procedimientos cosméticos y reconstructivos modernos en entornos clínicos y hospitalarios en los EE. UU. debido a su precisión, seguridad y capacidad para ofrecer resultados estéticos predecibles.

- La creciente demanda de estos dispositivos se ve impulsada principalmente por el creciente enfoque del consumidor en la apariencia, la creciente aceptación de procedimientos mínimamente invasivos y reconstructivos y los avances tecnológicos en materiales de implantes y personalización.

- Estados Unidos dominó el mercado de dispositivos de cirugía estética y cosmética en América del Norte con la mayor participación en los ingresos del 87,6 % en 2025, caracterizado por un alto gasto en atención médica, una adopción generalizada de procedimientos cosméticos y una fuerte presencia de actores clave de la industria, con hospitales y clínicas que experimentaron un crecimiento sustancial en el uso de dispositivos, impulsado por innovaciones en polímeros, metales y biomateriales para implantes.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de dispositivos de cirugía estética y cosmética de América del Norte durante el período de pronóstico debido al aumento de los ingresos disponibles, la creciente conciencia de los procedimientos cosméticos y la expansión del acceso a tratamientos estéticos avanzados en clínicas y hospitales.

- El segmento de implantes mamarios/implantes mamarios dominó el mercado con una participación de mercado del 38,7 % en 2025, impulsado por su demanda establecida en cirugías cosméticas y reconstructivas y la creciente preferencia por materiales de implantes seguros y de alta calidad.

Alcance del informe y segmentación del mercado de dispositivos de cirugía estética y cosmética en América del Norte

|

Atributos |

Perspectivas clave del mercado de dispositivos de cirugía estética y cosmética en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Tendencias del mercado de dispositivos de cirugía estética y cosmética en América del Norte

Creciente adopción de procedimientos mínimamente invasivos y personalizados

- Una tendencia significativa y en aceleración en el mercado de dispositivos de cirugía estética y cosmética de América del Norte es la creciente preferencia por procedimientos de implantes mínimamente invasivos y personalizados, que mejoran los resultados del paciente y reducen el tiempo de recuperación.

- Por ejemplo, los implantes personalizados impresos en 3D para cirugía reconstructiva permiten a los cirujanos adaptar los dispositivos a la anatomía individual del paciente, mejorando el ajuste, la seguridad y los resultados estéticos.

- Los avances en materiales para implantes, como polímeros y metales biocompatibles, están permitiendo soluciones cosméticas y reconstructivas más seguras, duraderas y versátiles, impulsando la innovación en procedimientos.

- La integración de imágenes digitales y software de planificación quirúrgica permite a los médicos simular procedimientos preoperatorios, mejorando la precisión y la satisfacción del paciente.

- La creciente adopción de clínicas cosméticas ambulatorias y centros de dermatología está facilitando un acceso más sencillo a dispositivos avanzados para procedimientos electivos y reconstructivos.

- El crecimiento del turismo médico en América del Norte, en particular para tratamientos estéticos de alta calidad, está ampliando la base de pacientes para dispositivos de cirugía estética.

- Esta tendencia hacia dispositivos específicos para cada paciente, mínimamente invasivos y con tecnología habilitada está cambiando las expectativas de resultados estéticos en clínicas y hospitales.

- La demanda de dispositivos que combinan seguridad, personalización y administración mínimamente invasiva está creciendo rápidamente tanto en procedimientos cosméticos reconstructivos como electivos.

Dinámica del mercado de dispositivos de cirugía estética y cosmética en América del Norte

Conductor

Mayor atención a la apariencia y mayor aceptación de los procedimientos cosméticos

- La creciente importancia de la apariencia física entre los consumidores, combinada con la creciente aceptación de los procedimientos estéticos y reconstructivos, es un impulsor importante del crecimiento del mercado.

- Por ejemplo, la creciente influencia de las redes sociales y las tendencias impulsadas por las celebridades han llevado a una mayor demanda de aumento de senos, contorno corporal e implantes faciales en los EE. UU.

- Los avances en las tecnologías de implantes, incluidos materiales más seguros y opciones personalizables, están animando tanto a los cirujanos como a los pacientes a optar por procedimientos estéticos más complejos.

- La expansión de las clínicas ambulatorias y los centros de dermatología que ofrecen tratamientos mínimamente invasivos está haciendo que los procedimientos cosméticos sean más accesibles para una población más amplia.

- La disponibilidad de programas de capacitación y dispositivos quirúrgicos especializados permite que más profesionales realicen procedimientos avanzados, lo que impulsa aún más la adopción de dispositivos.

- El aumento de los ingresos disponibles y la disposición a invertir en estética personal están incrementando la adopción de implantes y otros dispositivos de cirugía estética en América del Norte.

- El aumento de las colaboraciones entre los fabricantes de dispositivos y los proveedores de atención médica está acelerando la adopción y la innovación en tratamientos estéticos.

- La creciente conciencia de los procedimientos no quirúrgicos y complementarios, como el injerto de grasa o la ingeniería de tejidos, está impulsando la demanda de dispositivos complementarios en las clínicas estéticas.

Restricción/Desafío

Altos costos y obstáculos para el cumplimiento normativo

- El alto costo de los implantes avanzados, los dispositivos personalizados y los procedimientos quirúrgicos asociados representa una restricción importante para una adopción más amplia en el mercado entre los consumidores sensibles a los precios.

- Por ejemplo, los implantes mamarios de primera calidad o los implantes corporales hechos a medida pueden ser prohibitivamente caros para pacientes sin cobertura de seguro suficiente o ingresos disponibles.

- Las estrictas aprobaciones regulatorias y los requisitos de cumplimiento de la FDA para la seguridad y eficacia de los dispositivos pueden retrasar los lanzamientos de productos y aumentar los costos de desarrollo.

- Los desafíos para garantizar la biocompatibilidad, la seguridad a largo plazo y la precisión quirúrgica limitan la rápida adopción de materiales más nuevos e implantes personalizados.

- Si bien los precios están disminuyendo gradualmente para algunos dispositivos estándar, la prima percibida para los implantes de alta tecnología puede obstaculizar su adopción en clínicas más pequeñas o en segmentos de pacientes menos pudientes.

- Superar estos desafíos mediante la optimización de costos, la orientación regulatoria y la educación del paciente será vital para el crecimiento sostenido del mercado en América del Norte.

- La conciencia limitada entre los pacientes y algunos proveedores de atención médica sobre los dispositivos más nuevos y mínimamente invasivos puede ralentizar las tasas de adopción en ciertas regiones.

- Los riesgos de complicaciones posquirúrgicas o retiradas de dispositivos debido a defectos materiales pueden afectar la confianza del mercado y frenar el crecimiento.

Mercado de dispositivos de cirugía estética y cosmética en América del Norte

El mercado está segmentado según el tipo, la materia prima, el usuario final y el canal de distribución.

- Por tipo

Según el tipo, el mercado norteamericano se segmenta en implantes mamarios, implantes corporales e implantes a medida. El segmento de implantes mamarios dominó el mercado con la mayor participación en ingresos, un 38,7 %, en 2025, impulsado por la alta demanda de cirugías estéticas y reconstructivas de mama. Estos implantes son ampliamente preferidos debido a su perfil de seguridad establecido, su disponibilidad en diversos tamaños y formas, y su compatibilidad con técnicas quirúrgicas avanzadas. Es probable que tanto cirujanos como pacientes prefieran los implantes mamarios tanto para la mejora estética como para la reconstrucción postmastectomía, lo que garantiza una demanda constante en el mercado. El segmento también se beneficia de las continuas innovaciones de productos, incluyendo implantes de gel texturizado y de alta cohesión, que mejoran la seguridad y la satisfacción del paciente. Las campañas de marketing y la influencia de las redes sociales impulsan aún más el interés del consumidor, especialmente en EE. UU., donde la conciencia cosmética es alta. El dominio del segmento se ve reforzado por la sólida presencia de fabricantes líderes que ofrecen implantes con aprobación regulatoria y un amplio respaldo clínico.

Se prevé que el segmento de implantes a medida experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente preferencia por soluciones personalizadas adaptadas a la anatomía de cada paciente. Estos implantes son especialmente solicitados en procedimientos reconstructivos tras traumatismos, defectos congénitos o cirugías oncológicas. Los avances en la impresión 3D y las tecnologías de imagen digital permiten una planificación preoperatoria precisa, lo que resulta en mejores resultados estéticos y funcionales. La capacidad de crear implantes específicos para cada paciente aumenta la confianza del cirujano y la satisfacción del paciente, lo que impulsa su adopción. La creciente concienciación entre los profesionales sanitarios sobre los beneficios de los implantes a medida, sumada a las crecientes inversiones en investigación y desarrollo, está impulsando aún más la expansión del mercado. La creciente disponibilidad de materiales biocompatibles para implantes a medida también respalda esta tendencia.

- Por materia prima

On the basis of raw material, the market is segmented into polymers, metals, and biomaterials. The polymers segment dominated the market in 2025 due to their biocompatibility, lightweight nature, and versatility in aesthetic and reconstructive applications. Polymers are widely used in breast implants, body implants, and various custom devices, offering durability and minimal risk of adverse reactions. Their ease of molding and adaptability to patient-specific shapes makes them ideal for both standard and custom implant solutions. Surgeons favor polymer-based devices for their long-term stability and compatibility with advanced surgical techniques. In addition, regulatory approvals and clinical data supporting polymer implants increase their acceptance among practitioners. The availability of high-quality, FDA-approved polymer materials also strengthens their market position.

The biomaterials segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing demand for implants that mimic natural tissue properties and improve integration with human tissue. Biomaterials, including collagen-based or hydroxyapatite-enhanced composites, are gaining traction in both reconstructive and cosmetic surgeries. Their ability to reduce post-surgical complications and enhance healing makes them highly attractive for hospitals and specialized clinics. Rising research in tissue engineering and regenerative medicine supports the expansion of biomaterial applications. Surgeons increasingly prefer biomaterials for advanced, minimally invasive procedures where biocompatibility and aesthetic outcomes are critical.

- By End User

On the basis of end user, the market is segmented into clinics, hospitals, dermatology clinics, and others. The clinics segment dominated the market with the largest revenue share in 2025, driven by the high number of outpatient procedures and the growing popularity of minimally invasive aesthetic surgeries. Clinics provide convenient access for elective procedures, shorter recovery periods, and specialized care, attracting a wide patient base. They are often equipped with advanced implant technologies and staffed by trained cosmetic surgeons, ensuring high-quality procedural outcomes. The prevalence of dermatology and aesthetic clinics in urban areas further reinforces this segment’s dominance. Patient preference for personalized care and streamlined treatment processes continues to drive demand. Marketing campaigns and social media awareness programs by clinics also contribute to consistent growth.

The hospitals segment is expected to witness the fastest growth from 2026 to 2033, fueled by the rising demand for reconstructive surgeries and more complex aesthetic procedures requiring advanced infrastructure. Hospitals provide comprehensive surgical care, access to high-end imaging, and post-operative support, making them the preferred choice for high-risk or multi-stage procedures. Increasing collaboration between hospitals and device manufacturers ensures the availability of the latest implants and materials. Rising insurance coverage for reconstructive procedures also supports hospital adoption. Growth in medical tourism targeting high-quality hospital care further accelerates this segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail pharmacies. The direct tender segment dominated the market in 2025, driven by procurement through hospitals, clinics, and large healthcare institutions. This channel allows bulk purchasing of implants and surgical devices, ensuring consistent supply and cost efficiencies for healthcare providers. Direct tender contracts often include long-term support and warranty services from manufacturers, enhancing trust and reliability. Hospitals and major clinics prefer this channel due to regulatory compliance and inventory management convenience. Manufacturers also benefit from predictable revenue streams and easier market penetration through direct tender agreements.

The retail pharmacies segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing consumer awareness and the rise of minimally invasive procedures that can be facilitated through outpatient care and home-use devices. Retail pharmacies provide convenient access for adjunctive products and support services related to aesthetic procedures. Growing partnerships between device manufacturers and pharmacy chains facilitate distribution of smaller or non-implant devices directly to clinics or patients. The trend of self-managed pre- and post-operative care also supports the growth of this channel. Increasing adoption of e-commerce for healthcare products further accelerates expansion in the retail pharmacy segment.

North America Aesthetic and Cosmetic Surgery Devices Market Regional Analysis

- The U.S. dominated the North America aesthetic and cosmetic surgery devices market with the largest revenue share of 87.6% in 2025, characterized by high healthcare spending, widespread adoption of cosmetic procedures, and a strong presence of key industry players, with hospitals and clinics experiencing substantial growth in device usage, driven by innovations in polymers, metals, and biomaterials for implants

- Patients and practitioners in the region highly value the precision, safety, and customization offered by advanced implants and minimally invasive devices, which enhance aesthetic outcomes and reduce recovery times

- This widespread adoption is further supported by high healthcare spending, a large pool of skilled cosmetic surgeons, and increasing investments in advanced clinics and hospitals, establishing aesthetic and cosmetic surgery devices as essential tools for both elective and reconstructive procedures

The U.S. Aesthetic and Cosmetic Surgery Devices Market Insight

The U.S. aesthetic and cosmetic surgery devices market captured the largest revenue share of 87.6% in 2025 within North America, fueled by rising consumer awareness of aesthetic procedures and the growing demand for minimally invasive and reconstructive surgeries. Patients are increasingly prioritizing personalized and safe implant solutions, including breast implants, body implants, and custom-made devices. The expansion of specialized clinics and dermatology centers, combined with hospitals equipped with advanced surgical technologies, further propels the market. Moreover, innovations in biocompatible polymers, metals, and biomaterials are significantly contributing to improved patient outcomes. Strong healthcare infrastructure, high disposable incomes, and increasing social media influence also play key roles in sustaining market growth.

Canada Aesthetic and Cosmetic Surgery Devices Market Insight

The Canada aesthetic and cosmetic surgery devices market is expected to grow at a noteworthy CAGR during the forecast period, driven by rising disposable incomes, increasing awareness of cosmetic procedures, and growing medical tourism for aesthetic treatments. The adoption of minimally invasive and customized implants, coupled with the expansion of specialized aesthetic clinics, is enhancing accessibility to advanced procedures. Canadian consumers value high-quality, safe, and technologically advanced devices for reconstructive and elective surgeries. The presence of regulatory-compliant, FDA-approved implants and devices further encourages market uptake. Growing investments by manufacturers and healthcare providers in training and infrastructure are expected to accelerate market growth.

Mexico Aesthetic and Cosmetic Surgery Devices Market Insight

The Mexico aesthetic and cosmetic surgery devices market is expected to grow at a significant CAGR during the forecast period, driven by increasing awareness of cosmetic and reconstructive procedures and rising disposable incomes. Patients in Mexico are increasingly opting for minimally invasive treatments and personalized implants, including breast implants, body implants, and custom-made devices. The expansion of aesthetic clinics, dermatology centers, and hospital-based surgical units is enhancing access to advanced procedures. Moreover, the growth of medical tourism, particularly from the U.S. and Canada, is boosting demand for high-quality, cost-effective devices. Government initiatives to improve healthcare infrastructure and regulatory approvals for safe, high-quality implants further support market growth. Social media influence and a growing culture of aesthetic awareness are also key factors propelling adoption across the country.

North America Aesthetic and Cosmetic Surgery Devices Market Share

The North America Aesthetic and Cosmetic Surgery Devices industry is primarily led by well-established companies, including:

- Cutera, Inc. (U.S.)

- Tiger Aesthetics Medical, LLC (U.S.)

- Implantech (U.S.)

- Cynosure LLC (U.S.)

- Apyx Medical Corporation (U.S.)

- AbbVie Inc. (U.S.)

- CANDELA CORPORATION (U.S.)

- BTL Industries, Inc. (U.S.)

- Alma Lasers Ltd. (Israel)

- Lumenis Ltd. (Israel)

- Viora (U.S.)

- AirXpanders, Inc. (U.S.)

- Cartessa Aesthetics (U.S.)

- Aesthetic Management Partners (U.S.)

- Zimmer Biomet (U.S.)

- Solta Medical (U.S.)

- Viora Ltd. (U.S.)

- Cereplas (U.S.)

- PMT Corporation (U.S.)

What are the Recent Developments in North America Aesthetic and Cosmetic Surgery Devices Market?

- In October 2025, Apyx Medical submitted a new 510(k) to expand the AYON system’s indications to include power liposuction, aiming to broaden its procedural applications and further establish AYON as a comprehensive aesthetic surgical platform

- In May 2025, Apyx Medical Corporation received FDA 510(k) clearance for its AYON Body Contouring System, the first all‑in‑one platform combining fat removal, tissue contraction and electrosurgical capabilities for comprehensive aesthetic body sculpting marking a significant product advancement in surgical aesthetic technology

- In January 2025, Apyx Medical submitted its 510(k) premarket notification to the U.S. FDA for the AYON Body Contouring System, signaling regulatory progress for a novel comprehensive body contouring device integrating multiple surgical modalities

- In March 2024, Hugel America, Inc. received FDA approval for Letybo (letibotulinumtoxinA‑wlbg), a new neurotoxin injectable for treating moderate‑to‑severe glabellar (frown) lines in adults, positioning it as a competitive alternative in the aesthetic neuromodulator space

- En abril de 2023, la pieza de mano Renuvion APR de Apyx Medical recibió la autorización 510(k) de la FDA para la coagulación de tejidos blandos después de la liposucción, lo que mejora las capacidades del dispositivo en procedimientos complementarios de estiramiento de la piel, un avance en la tecnología estética quirúrgica y no invasiva.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.