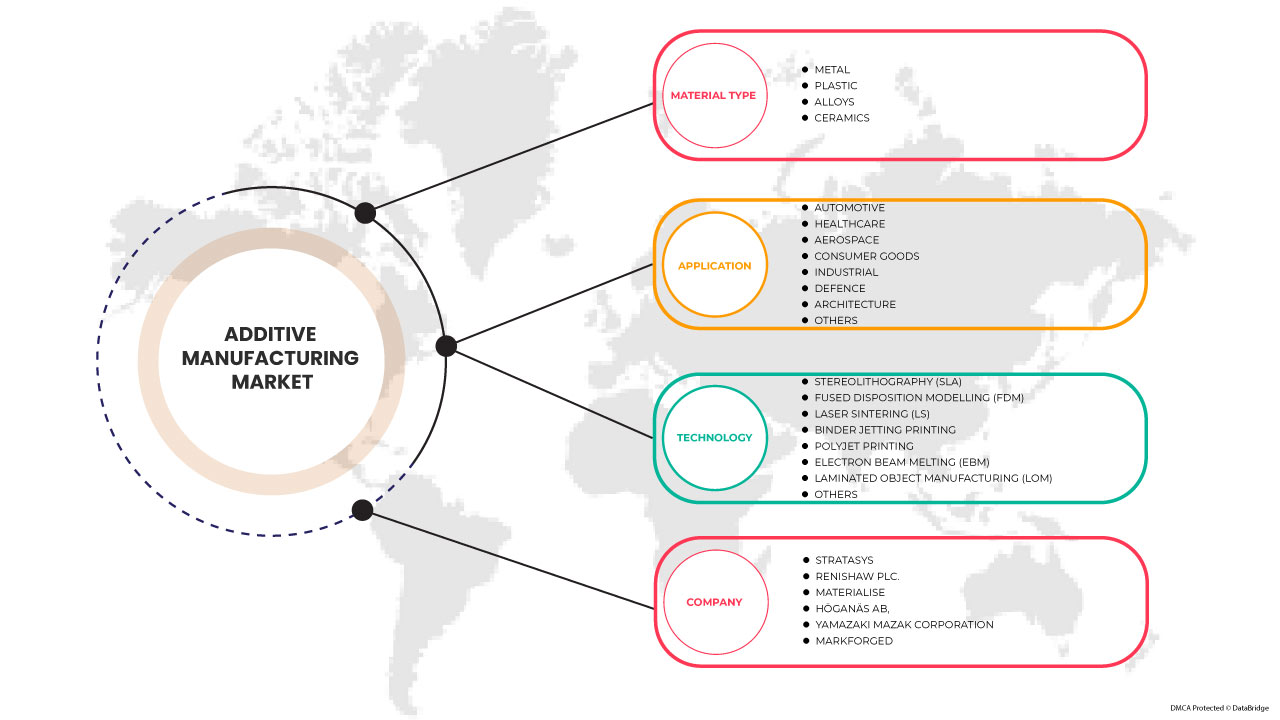

Mercado de fabricación aditiva de América del Norte, por tipo de material (metal, plástico, aleaciones y cerámica), tecnología (estereolitografía (SLA), modelado por disposición fundida (FDM), sinterización láser (LS), impresión por inyección de aglutinante, impresión Polyjet, fusión por haz de electrones (EBM), fabricación de objetos laminados (LOM) y otros), aplicación (automotriz, atención médica, aeroespacial, bienes de consumo, industrial, defensa, arquitectura y otros), tendencias del mercado y pronóstico hasta 2030.

Análisis y tamaño del mercado de fabricación aditiva en América del Norte

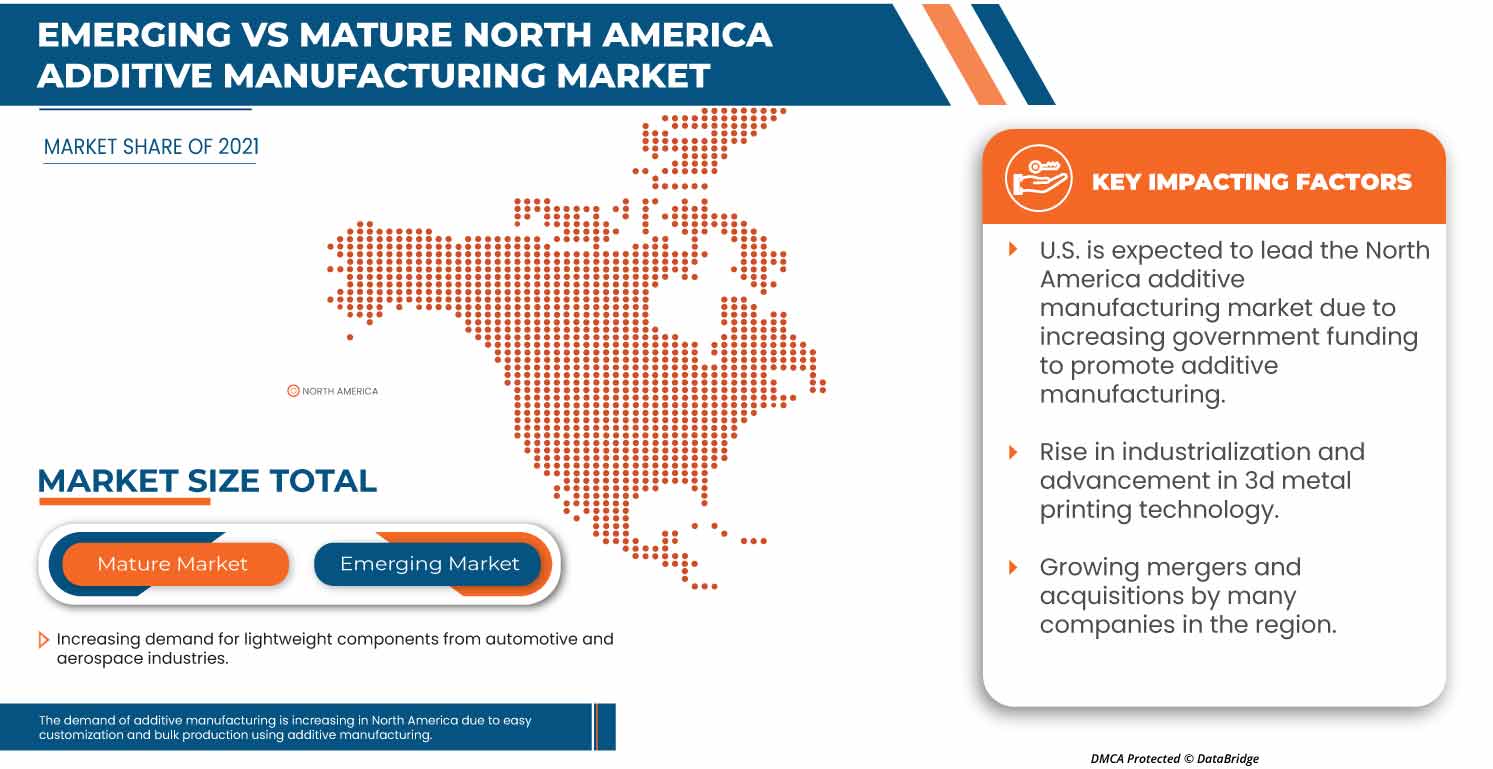

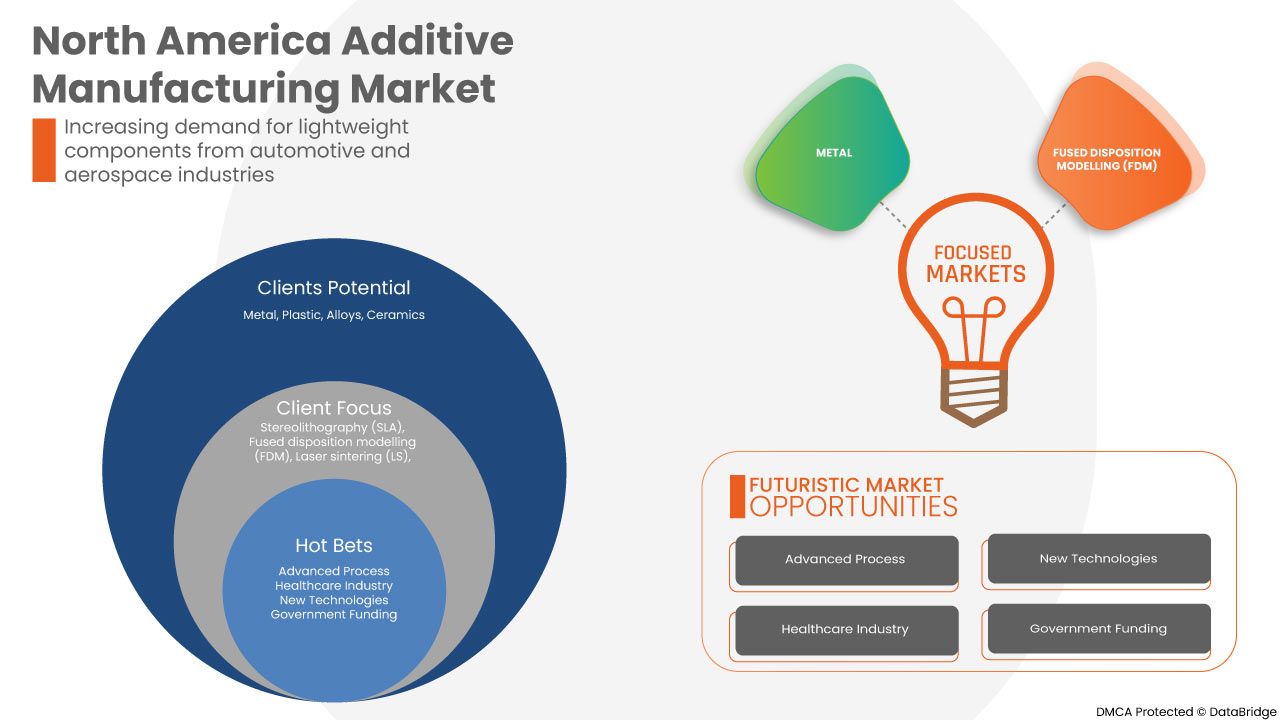

El mercado de fabricación aditiva se ocupa del diseño, la producción y la distribución de hilos, telas, prendas de vestir y prendas de vestir. La materia prima puede ser metal, plástico, aleaciones y cerámica. Las industrias de fabricación aditiva contribuyen significativamente a la economía nacional de muchos países. La creciente demanda de componentes livianos de las categorías automotriz y aeroespacial y el avance en las tecnologías de impresión 3D de metal han aumentado enormemente la demanda en el mercado de fabricación aditiva de América del Norte.

El informe del mercado de fabricación aditiva de América del Norte proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen de analista. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

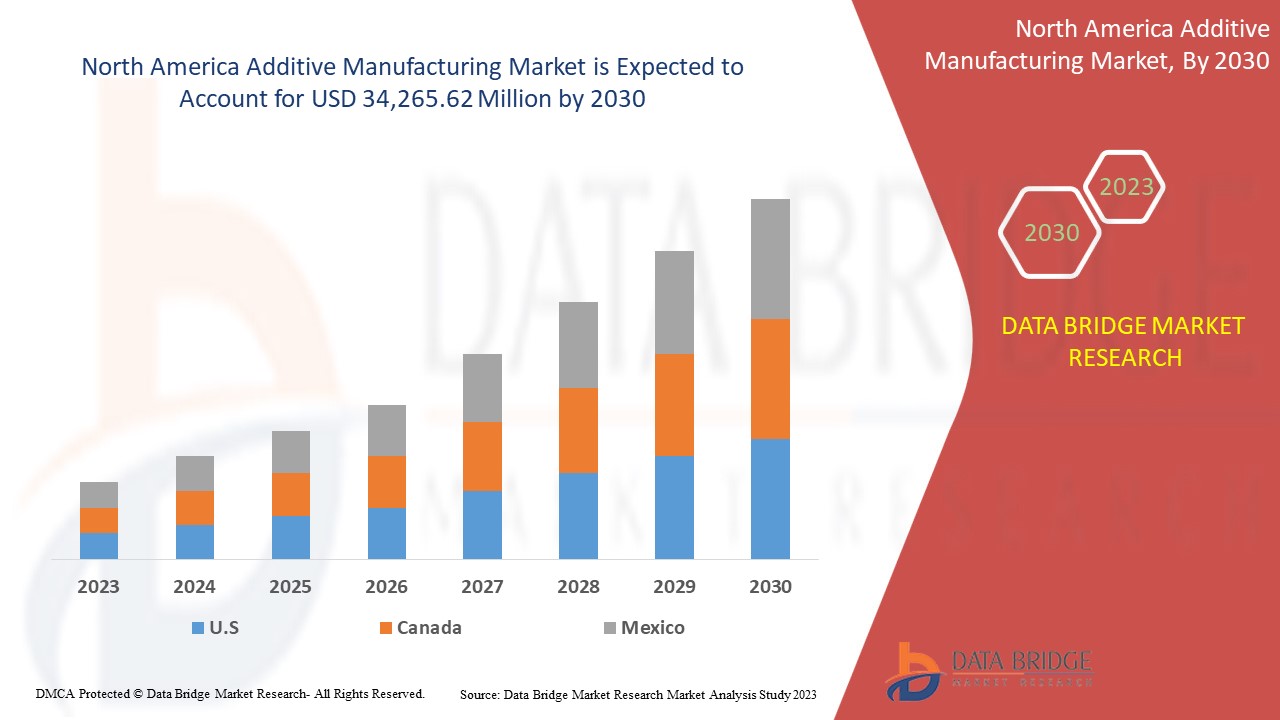

Se espera que el mercado de fabricación aditiva de América del Norte gane un crecimiento significativo en el período de pronóstico de 2023 a 2030. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 20,8% en el período de pronóstico de 2023 a 2030 y se espera que alcance los USD 34.265,62 millones para 2030. El principal factor que impulsa el crecimiento del mercado de fabricación aditiva es la creciente demanda de componentes ligeros de las industrias automotriz y aeroespacial.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020 - 2015) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por tipo de material (metal, plástico, aleaciones y cerámica), tecnología (estereolitografía (SLA), modelado por disposición fundida (FDM), sinterización láser (LS), impresión por inyección de aglutinante, impresión Polyjet, fusión por haz de electrones (EBM), fabricación de objetos laminados (LOM) y otros), aplicación (automotriz, atención médica, aeroespacial, bienes de consumo, industrial, defensa, arquitectura y otros). |

|

Países cubiertos |

Estados Unidos, Canadá y México. |

|

Actores del mercado cubiertos |

ANSYS, Inc., Höganäs AB, EOS, ARBURG GmbH + Co KG, Stratasys, Renishaw plc., YAMAZAKI MAZAK CORPORATION, Materialise, Markforged, Titomic Limited., SLM Solutions, Proto Labs, ENVISIONTEC US LLC, Ultimaker BV, American Additive Manufacturing LLC, Optomec, Inc., 3D system Inc. y ExOne. (Una subsidiaria de Desktop Metal, Inc.), entre otros. |

Definición de mercado

La fabricación aditiva (AM) es diferente del método de producción sustractivo, que consiste en extraer el material innecesario de un bloque de material. El uso de la fabricación aditiva en aplicaciones industriales suele hacer referencia a la impresión 3D. La fabricación aditiva implica la adición de material capa por capa para formar un objeto, haciendo referencia a un archivo tridimensional con la ayuda de una impresora 3D y un software de impresión 3D. Se selecciona una tecnología de fabricación aditiva adecuada del conjunto de tecnologías disponibles en función de la aplicación.

Dinámica del mercado de fabricación aditiva en América del Norte

Conductores

- Creciente demanda de componentes ligeros en las industrias automotriz y aeroespacial

El sector de la automoción y la aeronáutica exige numerosos objetivos técnicos y económicos que interactúan entre sí en cuanto a rendimiento funcional, reducción de los plazos de entrega, peso ligero, gestión de costes y entrega de componentes críticos para la seguridad. Para satisfacer la demanda y compensar el consumo de combustible y la gestión de costes, mejorar el rendimiento técnico y permitir la fabricación de una estructura más ligera, que está directamente relacionada con la mejora del rendimiento económico y técnico y que ayudará a la industria de las aerolíneas a transportar más carga útil, lo que mejorará directamente sus ingresos. Las tecnologías de fabricación aditiva, a diferencia de la fabricación tradicional convencional, utilizan la fabricación capa por capa basada en polvo o alambre y materiales típicos como el polímero plástico, que es más ligero.

- Ventajas que ofrece la fabricación aditiva en diversas industrias de usuarios finales

Industrias como la aeroespacial son algunas de las industrias que utilizan el producto de fabricación aditiva para su rendimiento, y las piezas de los aviones utilizan productos de fabricación aditiva que son livianos y pueden soportar duras condiciones ambientales debido al menor material requerido, y el proceso de formación de materiales capa por capa las industrias aeroespaciales lo utilizan como ventaja para la reducción de peso y la reducción de desechos, que son muy importantes para la fabricación de piezas aeroespaciales para las principales empresas.

En las industrias médicas, que están innovando rápidamente, la utilización de productos de fabricación aditiva es de gran ventaja para los médicos, los pacientes y las instituciones de investigación. A través del diseño de prototipos funcionales proporcionado por las tecnologías de fabricación aditiva, ha sido de gran ventaja crear un diseño flexible de diversas herramientas de diseño que salvan vidas necesarias para fines quirúrgicos y de estudio, herramientas utilizadas en procedimientos dentales, modelos preoperatorios para tomografías computarizadas, guías de sierra y taladro personalizadas, gabinetes e instrumentación especializada.

- Fácil personalización y producción en masa mediante fabricación aditiva

La personalización de fabricación aditiva, a diferencia de la fabricación tradicional, no agrega un costo adicional para la personalización y no requiere ningún molde o herramientas específicas para el diseño, solo necesita un diseño 3D de prototipo y puede ser creado por el propio cliente debido a la fácil personalización y la producción rápida. Existe una gran demanda, y podemos producir en masa cualquier diseño único sin obstaculizar el costo y el tiempo al hacer uso de las impresoras 3D. No solo proporciona una producción personalizada en masa, sino que también le brinda al consumidor una experiencia de compra y consumidor única donde les da la sensación de pertenencia y satisfacción del consumidor en comparación con la contraparte que no proporciona un diseño personalizado. También permite al consumidor comprar el diseño de su elección. Por ejemplo, NIKE, un fabricante de zapatos, vende sus zapatos en su sitio web con un diseño 3D donde el consumidor puede agregar su elección de color por su cuenta sin mucha vacilación. Esto agregará una ventaja a la competencia del mercado ya que, a través de este sistema, le permite al fabricante conocer a su cliente.

- Aumento de la industrialización y avance en la tecnología de impresión 3D de metales

Con el aumento de la industrialización, existe una enorme demanda de productos de impresión 3D de metales en industrias como la aeroespacial, la automotriz, la atención médica y otras industrias. Con la demanda de varios campos de piezas en la industria aeroespacial para sus motores a reacción y otras piezas estructurales para personalizar piezas en las industrias automotrices para personalizar el diseño de zapatos y otros dispositivos electrónicos, existe una demanda de un desarrollo riguroso de tecnologías de impresión 3D que funcionen de manera más eficiente y puedan producir el producto a un ritmo mucho más rápido y con mayor precisión. Por lo tanto, la demanda de avances y conveniencia de las tecnologías de fabricación aditiva conduce a un aumento en la demanda de tecnologías de impresión 3D de metales.

Oportunidades

- Avances en el sector sanitario

En el campo médico, cada paciente es único y, por lo tanto, la fabricación aditiva tiene un alto potencial para ser utilizada en aplicaciones médicas personalizadas y a medida. Los productos clínicos médicos más utilizados son los implantes personalizados y las guías de sierras para modelos médicos. En el campo dental, los productos de fabricación aditiva se utilizan en férulas, aparatos de ortodoncia, modelos dentales y guías de perforación. Sin embargo, los productos de fabricación aditiva también se utilizan para fabricar tejidos y órganos artificiales, que se pueden utilizar con fines de estudio en un instituto de investigación o entre la consulta del médico y el paciente. El desarrollo de la digitalización de imágenes médicas permite la reconstrucción de modelos 3D a partir de la anatomía de los pacientes. El flujo de trabajo típico del dispositivo médico personalizado comienza con la obtención de imágenes o la captura de la geometría de la anatomía del paciente mediante métodos de escaneo 3D computarizado. Dichos datos se pueden utilizar para imprimir modelos 3D de la anatomía de un paciente o se pueden utilizar para crear dispositivos o implantes personalizados.

- Aumentar la financiación gubernamental para promover la fabricación aditiva

La fabricación aditiva tiene un inmenso potencial para revolucionar el panorama de la producción industrial y de fabricación a través de procesos digitales, comunicación e imágenes. La fabricación aditiva es un negocio de tendencia que tiene una gran demanda en diversas industrias como la aeroespacial, la automotriz, el sector médico, la electrónica, la moda, etc. Al ver la posibilidad potencial de contribución de este sector a la economía nacional, los gobiernos de diferentes países están ideando una estrategia diferente para apoyar y promover esta industria.

Restricciones/Desafíos

- Altos costos de los equipos, maquinarias y falta de profesionales calificados

Los beneficios que aporta la fabricación aditiva han abierto amplios horizontes para la creación de absolutamente cualquier forma y componente 3D. Pero no todas las empresas tienen la capacidad de integrar de forma asequible este tipo de actividad en sus procesos de negocio. Algunas de las causas más habituales que frenan el futuro de la fabricación aditiva son el elevado coste de los equipos y la falta de profesionales en esta industria.

El precio medio de los equipos de fabricación aditiva oscila entre 300.000 y 1,5 millones de dólares. El coste de los consumibles industriales varía entre 100 y 150 dólares por pieza. Aunque el precio final depende del material elegido, como el plástico, que se considera la opción más económica entre todos los materiales disponibles. El tiempo necesario también es bastante elevado, ya que se tarda más de una hora en imprimir un objeto de 40 cm.

- Falta de eficiencia del software

La fabricación aditiva mediante el proceso de fusión de lecho de polvo por láser (PBF) permite crear formas complejas e intrincadas junto con estructuras orgánicas que antes eran demasiado caras o complejas de fabricar mediante operaciones de fabricación tradicionales. Por ejemplo, las libertades de diseño logradas mediante la PBF por láser se podrían aprovechar para fabricar componentes livianos con el fin de construir las estructuras de celosía más intrincadas para un uso más eficiente del material. Sin embargo, la PBF por láser tiene sus desventajas. Incluye piezas de paredes delgadas y alta relación de aspecto que pueden fallar durante la construcción, estructuras de soporte difíciles de quitar, efectos de capas en la rugosidad de la superficie y diferentes configuraciones de parámetros de proceso, como configuraciones de láser para superficies con la piel hacia arriba o hacia abajo.

Desarrollo reciente

- En febrero, SLM Solutions lanzó SLM.Quality, una solución de software de control de calidad que permite a los clientes realizar evaluaciones de trabajos de fabricación, calificaciones de procesos y certificaciones de piezas de forma más eficiente. Ya sea para la producción de piezas individuales o en serie, las soluciones SLM. Quality pueden ayudar a los clientes industriales durante el proceso de calificación, mejorando la trazabilidad y la documentación de los datos clave del proceso. Este desarrollo ayudará a la empresa a atraer más clientes.

- En febrero, SLM Solutions y Assembrix anunciaron conjuntamente la integración exitosa del software VMS de Assembrix con las máquinas de SLM Solutions en todo el mundo. Esta nueva asociación satisfará la creciente demanda de los fabricantes de equipos originales (OEM) de una fabricación aditiva distribuida y segura y permitirá la creación de un ecosistema de fabricación aditiva internacional y confiable.

Alcance del mercado de fabricación aditiva en América del Norte

El mercado de fabricación aditiva de América del Norte se clasifica en función del tipo de material, la tecnología y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas a fin de identificar las principales aplicaciones del mercado.

Tipo de material

- Rieles

- Plástica

- Aleaciones

- Cerámica

Según el tipo de material, el mercado de fabricación aditiva de América del Norte se clasifica en cinco segmentos: metales, plásticos, aleaciones y cerámicas.

Tecnologías

- Estereolitografía (SLA)

- Modelado de disposición fundida (FDM)

- Sinterización por láser (LS)

- Impresión por inyección de aglutinante

- Impresión Polyjet

- Fusión por haz de electrones (EBM)

- Fabricación de objetos laminados (LOM)

- Otros

Sobre la base de la tecnología, el mercado de fabricación aditiva de América del Norte se clasifica en ocho segmentos: estereolitografía (SLA), modelado por disposición fundida (FDM), sinterización láser (LS), impresión por inyección de aglutinante, impresión Polyjet, fusión por haz de electrones (EBM), fabricación de objetos laminados (LOM) y otros.

Solicitud

- Automotor

- Cuidado de la salud

- Aeroespacial

- Bienes de consumo

- Industrial

- Defensa

- Arquitectura

- Otros

Sobre la base de la aplicación, el mercado de fabricación aditiva de América del Norte se clasifica en ocho segmentos: atención médica, aeroespacial, bienes de consumo, industrial, defensa, arquitectura y otros.

Análisis y perspectivas regionales del mercado de fabricación aditiva de América del Norte

El mercado de fabricación aditiva de América del Norte está segmentado según el tipo de material, la tecnología y las aplicaciones.

Los países del mercado de fabricación aditiva de América del Norte son EE. UU., Canadá y México, siendo EE. UU. el mercado líder en la región.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos afrontados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de fabricación aditiva en América del Norte

El panorama competitivo del mercado de fabricación aditiva de América del Norte proporciona detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la profundidad de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de fabricación aditiva de América del Norte.

Algunos de los participantes destacados que operan en el mercado de fabricación aditiva de América del Norte son SLM Solutions, Proto Labs, Stratasys, Renishaw plc., Materialise, Titomic Limited., Höganäs AB, YAMAZAKI MAZAK CORPORATION, Markforged, Ultimaker BV, Optomec, Inc., ExOne. (Una subsidiaria de Desktop Metal, Inc.), American Additive Manufacturing LLC, ANSYS, Inc., ARBURG GmbH + Co KG, ENVISIONTEC US LLC, EOS y 3D Systems, Inc., entre otros .

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA ADDITIVE MANUFACTURING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES:

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 PRODUCTION CONSUMPTION ANALYSIS

4.3 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.4 SUPPLY CHAIN ANALYSIS

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR LIGHTWEIGHT COMPONENTS FROM THE AUTOMOTIVE AND AEROSPACE INDUSTRIES

6.1.2 ADVANTAGES OFFERED BY ADDITIVE MANUFACTURING IN VARIOUS END-USER INDUSTRIES

6.1.3 EASY CUSTOMIZATION AND BULK PRODUCTION USING ADDITIVE MANUFACTURING

6.1.4 RISE IN INDUSTRIALIZATION AND ADVANCEMENT IN 3D METAL PRINTING TECHNOLOGY

6.2 RESTRAINTS

6.2.1 HIGH COSTS OF EQUIPMENT, MACHINERY AND LACK OF SKILLED PROFESSIONAL

6.2.2 LACK OF SOFTWARE EFFICIENCY

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENT IN THE HEALTHCARE SECTOR

6.3.2 INCREASING GOVERNMENT FUNDING TO PROMOTE ADDITIVE MANUFACTURING

6.4 CHALLENGES

6.4.1 ISSUES RELATED TO MATERIAL AVAILABILITY, DEVELOPMENT, VALIDATION, AND STANDARDIZATION

6.4.2 MISCONCEPTIONS AMONG SMALL AND MEDIUM-SCALE MANUFACTURERS ABOUT THE PROTOTYPING PROCESS

7 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE

7.1 OVERVIEW

7.2 METAL

7.2.1 METAL, BY MATERIAL TYPE

7.2.1.1 STEEL

7.2.1.2 ALUMINUM (ALUMIDE)

7.2.1.3 TITANIUM

7.2.1.4 SILVER

7.2.1.5 GOLD

7.2.1.6 OTHERS

7.3 PLASTIC

7.3.1 PLASTIC, BY MATERIAL TYPE

7.3.1.1 ACRYLONITRILE BUTADIENE STYRENE

7.3.1.2 POLYLACTIC ACID (PLA)

7.3.1.3 NYLON

7.3.1.4 PHOTOPOLYMERS

7.3.1.5 OTHERS

7.3.2 OTHERS, BY MATERIAL TYPE

7.3.2.1 POLYPROPYLENE

7.3.2.2 HIGH DENSITY POLYETHYLENE

7.3.2.3 POLYCARBONATE

7.3.2.4 POLYVINYL ALCOHOL

7.4 ALLOYS

7.4.1 ALLOYS, BY MATERIAL TYPE

7.4.1.1 TOOL STEELS AND MARAGING STEELS

7.4.1.2 COMMERCIALLY PURE TITANIUM AND ALLOYS

7.4.1.3 ALUMINUM ALLOYS

7.4.1.4 NICKEL-BASED ALLOYS

7.4.1.5 COBALT-CHROMIUM ALLOYS

7.4.1.6 COPPER-BASED ALLOYS

7.5 CERAMICS

7.5.1 CERAMICS, BY MATERIAL TYPE

7.5.1.1 GLASS

7.5.1.2 SILICA

7.5.1.3 QUARTZ

7.5.1.4 OTHERS

8 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 STEREOLITHOGRAPHY (SLA)

8.3 FUSED DISPOSITION MODELLING (FDM)

8.4 LASER SINTERING (LS)

8.4.1 LASER SINTERING (LS), BY TECHNOLOGY

8.4.1.1 SELECTIVE LASER MELTING (SLM)

8.4.1.2 SELECTIVE LASER SINTERING (SLS)

8.4.1.3 DIRECT METAL LASER SINTERING

8.5 BINDER JETTING PRINTING

8.6 POLYJET PRINTING

8.7 ELECTRON BEAM MELTING (EBM)

8.8 LAMINATED OBJECT MANUFACTURING (LOM)

8.9 OTHERS

9 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 AUTOMOTIVE

9.3 HEALTHCARE

9.4 AEROSPACE

9.5 CONSUMER GOODS

9.6 INDUSTRIAL

9.7 DEFENCE

9.8 ARCHITECTURE

9.9 OTHERS

10 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.2 CERTIFICATION

11.3 ACHIEVEMENT

11.4 LAUNCH

11.5 MERGER

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 ANSYS, INC

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATES

13.2 HÖGANÄS AB

13.2.1 COMPANY SNAPSHOT

13.2.2 COMPANY SHARE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATE

13.3 EOS

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 ARBURG GMBH + CO KG

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATE

13.5 STRATASYS

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT UPDATES

13.6 AMERICAN ADDITIVE MANUFACTURING LLC

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATE

13.7 ENVISIONTEC US LLC

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATE

13.8 EXONE. (A SUBSIDIARY OF DESKTOP METAL, INC.)

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATES

13.9 MATERIALISE

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT UPDATES

13.1 MARKFORGED

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT UPDATES

13.11 OPTOMEC, INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATE

13.12 PROTO LABS

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 ANNUAL REPORTS, AND SEC FILINGRECENT UPDATES

13.13 RENISHAW PLC.

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT UPDATES

13.14 SLM SOLUTIONS

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT UPDATES

13.15 TITOMIC LIMITED.

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT UPDATES

13.16 ULTIMAKER BV

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT UPDATE

13.17 YAMAZAKI MAZAK CORPORATION

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT UPDATES

13.18 3D SYSTEM, INC.

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA METAL IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA STEREOLITHOGRAPHY (SLA) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA FUSED DISPOSITION MODELLING (FDM) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA BINDER JETTING PRINTING IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA POLYJET PRINTING IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA ELECTRON BEAM MELTING (EBM) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA LAMINATED OBJECT MANUFACTURING (LOM) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA AUTOMOTIVE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA HEALTHCARE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA AEROSPACE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA CONSUMER GOODS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA INDUSTRIAL IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA DEFENCE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA ARCHITECTURE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 U.S. ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 42 U.S. METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 43 U.S. PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 44 U.S. OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 45 U.S. ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 46 U.S. CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 47 U.S. ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 48 U.S. LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 49 U.S. ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 50 CANADA ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 51 CANADA METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 52 CANADA PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 53 CANADA OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 54 CANADA ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 55 CANADA CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 56 CANADA ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 57 CANADA LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 58 CANADA ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 59 MEXICO ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 60 MEXICO METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 61 MEXICO PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 62 MEXICO OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 63 MEXICO ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 64 MEXICO CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 65 MEXICO ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 66 MEXICO LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 67 MEXICO ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA ADDITIVE MANUFACTURING MARKET

FIGURE 2 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: SEGMENTATION

FIGURE 14 INCREASING DEMAND FOR LIGHTWEIGHT COMPONENTS FROM THE AUTOMOTIVE AND AEROSPACE INDUSTRIES IS EXPECTED TO DRIVE THE NORTH AMERICA ADDITIVE MANUFACTURING MARKET IN THE FORECAST PERIOD

FIGURE 15 THE METAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ADDITIVE MANUFACTURING MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ADDITIVE MANUFACTURING MARKET

FIGURE 17 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: BY MATERIAL TYPE, 2022

FIGURE 18 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: BY TECHNOLOGY, 2022

FIGURE 19 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: BY APPLICATION, 2022

FIGURE 20 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: BY COUNTRY (2022)

FIGURE 22 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: BY MATERIAL TYPE (2023-2030)

FIGURE 25 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.